Key Insights

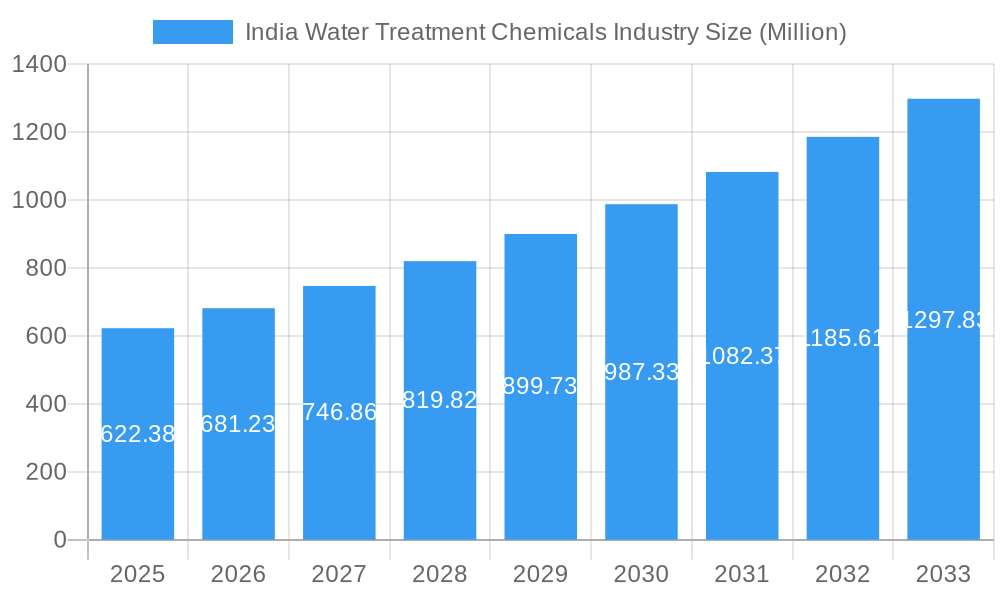

The India water treatment chemicals market, valued at $622.38 million in 2025, is projected to experience robust growth, exceeding a 9% CAGR from 2025 to 2033. This expansion is driven by several factors. Firstly, increasing industrialization and urbanization lead to a higher demand for clean water across various sectors, including manufacturing, power generation, and municipal water supplies. Secondly, stringent government regulations aimed at improving water quality are compelling businesses to invest in advanced water treatment technologies and chemicals. Thirdly, rising awareness about waterborne diseases and the need for safe drinking water is boosting consumer demand for effective water purification solutions. The market is segmented based on chemical type (coagulants, flocculants, disinfectants, etc.), application (municipal, industrial, etc.), and region. Key players like Dow, Ecolab (Nalco), and Solvay are actively shaping the market through technological innovation and strategic partnerships. However, challenges remain, including price volatility of raw materials and the need for sustainable and environmentally friendly water treatment solutions. The market's future growth trajectory hinges on continued infrastructure development, technological advancements in water treatment, and sustained government support for water conservation initiatives. Competition is intense, with both multinational corporations and domestic players vying for market share. The focus on sustainable solutions and cost-effective technologies will play a crucial role in determining future market leaders.

India Water Treatment Chemicals Industry Market Size (In Million)

The projected growth signifies significant opportunities for investors and businesses operating within this sector. The increasing adoption of advanced oxidation processes (AOPs) and membrane filtration technologies necessitates a parallel growth in the demand for specialized chemicals. Furthermore, the rising adoption of smart water management systems and the increasing focus on water reuse and recycling will further fuel market expansion. The market's success hinges on the ability of companies to innovate, adapt to evolving regulatory landscapes, and meet the growing demand for sustainable and effective water treatment solutions in a cost-effective manner. This necessitates investments in R&D and strategic partnerships to ensure long-term competitiveness and market leadership in this expanding sector.

India Water Treatment Chemicals Industry Company Market Share

India Water Treatment Chemicals Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India water treatment chemicals industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking a granular understanding of this dynamic market. The total market size in 2025 is estimated at xx Million.

India Water Treatment Chemicals Industry Market Dynamics & Structure

The Indian water treatment chemicals industry presents a dynamic and evolving market landscape shaped by a complex interplay of competitive forces, technological advancements, regulatory pressures, and prevailing market trends. The market structure is characterized by a moderate level of concentration, with a mix of established multinational corporations and agile domestic players actively vying for market dominance. This competitive arena fosters innovation, particularly in areas such as membrane technology, AI-driven process optimization, and cutting-edge advanced oxidation processes. Stringent environmental regulations, increasingly enforced by the government, are a key driver in the widespread adoption of eco-friendly and sustainable water treatment chemicals, pushing the industry towards a greener future.

Market Structure:

- Market Concentration: A moderately concentrated market, with the top 5 players estimated to hold approximately [Insert Percentage]% market share in 2025. This concentration is expected to [Increase/Decrease/Remain Stable] in the coming years due to [Explain reason, e.g., mergers and acquisitions, entry of new players, etc.].

- Technological Innovation: The industry is experiencing rapid technological innovation, with a strong focus on membrane filtration techniques, AI-powered process optimization for enhanced efficiency and cost reduction, and the development of sustainable chemical formulations that minimize environmental impact.

- Regulatory Framework: The Indian government's increasingly stringent effluent discharge standards are a significant driver of demand for advanced water treatment solutions. Compliance with these regulations necessitates the adoption of more sophisticated and effective treatment technologies.

- Competitive Substitutes: While direct substitutes are limited, alternative water treatment technologies, such as advanced wastewater recycling and desalination, pose indirect competitive pressure.

- End-User Demographics: The industrial sector, encompassing manufacturing, power generation, and pharmaceuticals, represents the dominant end-user segment. However, the municipal and residential sectors are also experiencing growth in demand for water treatment solutions.

- M&A Trends: Consolidation within the industry is accelerating, with [Insert Number] mergers and acquisitions recorded between 2019 and 2024. These activities reflect strategic expansion plans and the acquisition of valuable technologies by larger players aiming to strengthen their market position.

India Water Treatment Chemicals Industry Growth Trends & Insights

The Indian water treatment chemicals market exhibits robust and sustained growth, fueled by a confluence of factors. These include the rapid pace of industrialization and urbanization, increasing water scarcity across various regions, and the aforementioned stringent environmental regulations. The market size experienced a Compound Annual Growth Rate (CAGR) of [Insert Percentage]% during the historical period (2019-2024) and is projected to maintain a CAGR of [Insert Percentage]% during the forecast period (2025-2033). This growth trajectory is further accelerated by technological advancements, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into water treatment plants, which allow for real-time monitoring, optimization, and predictive maintenance. Furthermore, a growing awareness among consumers regarding environmental sustainability is shaping market demand towards eco-friendly solutions. The market penetration of advanced treatment technologies is gradually increasing, particularly within the industrial sector, as businesses prioritize operational efficiency and environmental responsibility.

Dominant Regions, Countries, or Segments in India Water Treatment Chemicals Industry

The industrial segment dominates the Indian water treatment chemicals market, driven by increasing industrial activity and stringent effluent discharge norms. Maharashtra, Gujarat, and Tamil Nadu are the leading states, owing to their high industrial concentration and robust infrastructure. Rapid urbanization and growing population in these regions are fueling demand for efficient and sustainable water treatment solutions.

Key Drivers:

- Industrial Growth: Significant industrial activity across various sectors, driving demand for water treatment chemicals.

- Stringent Regulations: Strict environmental norms mandate the adoption of advanced water treatment technologies.

- Government Initiatives: Government policies promoting water conservation and industrial wastewater treatment.

- Infrastructure Development: Investments in water treatment infrastructure are accelerating market growth.

- Technological Advancements: The increasing adoption of advanced water treatment technologies, coupled with the rising adoption of AI and IoT are driving the growth.

India Water Treatment Chemicals Industry Product Landscape

The Indian water treatment chemicals market boasts a diverse product portfolio, encompassing a wide range of essential chemicals. These include coagulants, flocculants, disinfectants, scale inhibitors, and corrosion inhibitors. A significant trend is the focus on developing eco-friendly, high-performance chemicals designed to enhance treatment efficacy while minimizing environmental impact. Companies are increasingly specializing in the development of customized chemical solutions tailored to specific industrial applications, such as pharmaceuticals, food and beverage processing, and power generation. This trend reflects a market shift towards technologically advanced products offering superior performance, efficiency, and environmental sustainability.

Key Drivers, Barriers & Challenges in India Water Treatment Chemicals Industry

Key Drivers:

- Rapid industrialization and urbanization.

- Growing water scarcity and increasing water pollution.

- Stringent environmental regulations and government initiatives.

- Technological advancements in water treatment.

Challenges and Restraints:

- Fluctuating raw material prices and supply chain disruptions.

- Intense competition and price pressures.

- Regulatory complexities and compliance costs.

- Lack of awareness and adoption of advanced technologies in certain regions. This is estimated to impact the market growth by xx Million in 2033.

Emerging Opportunities in India Water Treatment Chemicals Industry

- Growing demand for sustainable and eco-friendly water treatment solutions.

- Increasing adoption of advanced oxidation processes and membrane filtration technologies.

- Expansion into untapped markets, such as rural areas and smaller towns.

- Development of customized solutions for specific industrial applications.

Growth Accelerators in the India Water Treatment Chemicals Industry

Technological breakthroughs in water treatment, strategic partnerships among industry players, and aggressive market expansion strategies are key growth accelerators for the Indian water treatment chemicals industry. The increasing adoption of AI and IoT for optimizing water treatment processes further drives industry growth. Focus on sustainable and eco-friendly solutions is expected to propel market expansion in the coming years.

Key Players Shaping the India Water Treatment Chemicals Market

- Chembond Chemicals Limited

- Chemtex Speciality Limited

- Dow

- Ecolab (Nalco)

- ION EXCHANGE

- Lonza

- Nouryon

- SicagenChem

- SNF

- Solenis

- Solvay

- Thermax Limited

- VASU CHEMICALS LLP *List Not Exhaustive

Notable Milestones in India Water Treatment Chemicals Industry Sector

- February 2024: Thermax Group acquires 51% stake in TSA Process Equipments, expanding its high-purity water treatment offerings.

- October 2023: WABAG Group partners with Pani Energy Inc. to integrate AI for optimized water treatment plant operations.

- September 2022: Toray Industries Inc. establishes a research center in Chennai to enhance water treatment membrane technology.

In-Depth India Water Treatment Chemicals Industry Market Outlook

The Indian water treatment chemicals market is poised for substantial and continued growth, driven by the sustained expansion of the industrial sector, rapid urbanization, and a heightened focus on water resource sustainability. Strategic collaborations, ongoing technological innovation, and supportive government initiatives are poised to further accelerate market expansion. This presents promising opportunities for both existing industry players and new entrants seeking to capitalize on this dynamic market. The future growth is expected to be particularly strong in [Mention specific segments or regions with high growth potential], driven by [Explain the reasons].

India Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing (including Petrochemicals)

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Pulp and Paper

- 2.7. Other End-user Industries

India Water Treatment Chemicals Industry Segmentation By Geography

- 1. India

India Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of India Water Treatment Chemicals Industry

India Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Corrosion and Scale Inhibitors Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing (including Petrochemicals)

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Pulp and Paper

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chembond Chemicals Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemtex Speciality Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecolab (Nalco)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ION EXCHANGE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nouryon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SicagenChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SNF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Solenis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solvay

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thermax Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VASU CHEMICALS LLP*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Chembond Chemicals Limited

List of Figures

- Figure 1: India Water Treatment Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: India Water Treatment Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Water Treatment Chemicals Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: India Water Treatment Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Water Treatment Chemicals Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water Treatment Chemicals Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Water Treatment Chemicals Industry?

Key companies in the market include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, VASU CHEMICALS LLP*List Not Exhaustive.

3. What are the main segments of the India Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 622.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Corrosion and Scale Inhibitors Segment.

7. Are there any restraints impacting market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the India Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence