Key Insights

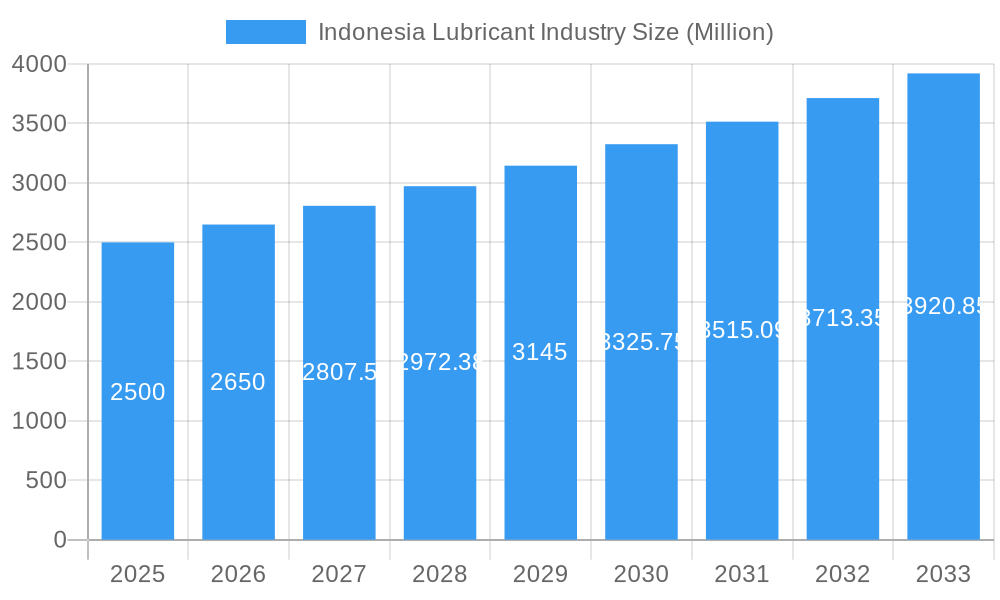

The Indonesian lubricant market is poised for substantial expansion, driven by key economic and industrial trends. The market, valued at an estimated $3.1 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.92% from 2025 to 2033. This upward trajectory is propelled by the burgeoning automotive sector, particularly motorcycles and passenger vehicles, alongside accelerating industrialization and infrastructure development across Indonesia. Government-led economic growth initiatives and enhancements to transportation networks are further stimulating lubricant demand. However, market dynamics are also influenced by volatile crude oil prices, intensified competition from domestic and international suppliers, potential economic slowdowns, and a growing preference for sustainable lubricant solutions.

Indonesia Lubricant Industry Market Size (In Billion)

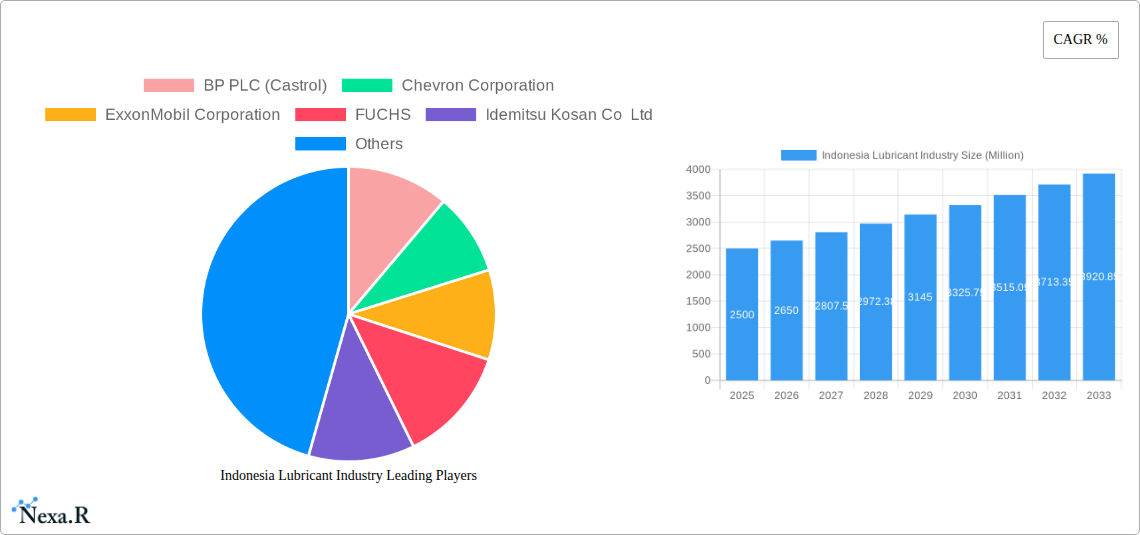

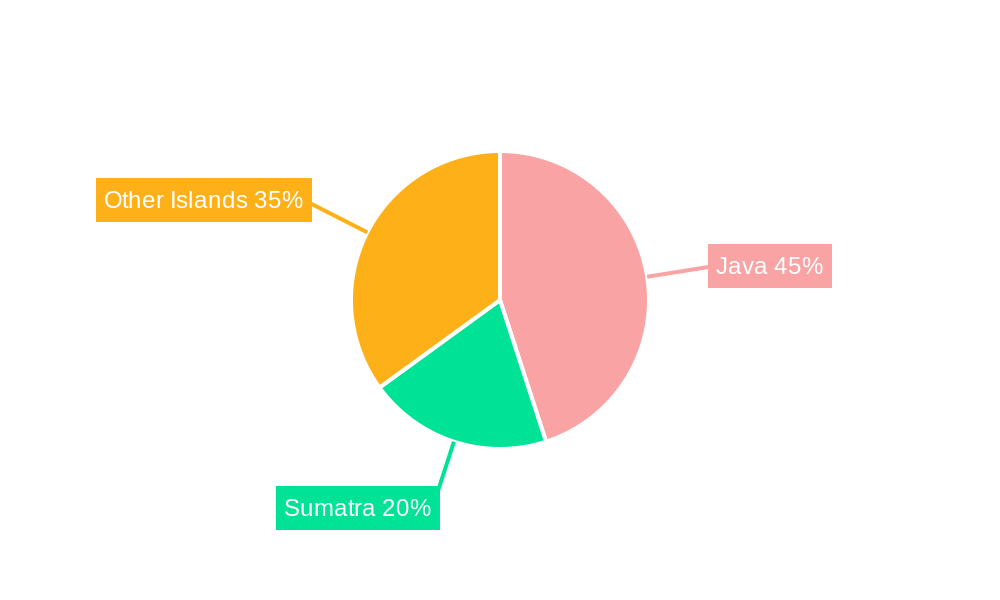

The lubricant market is segmented into automotive (including passenger car motor oil and heavy-duty diesel engine oil), industrial, and marine categories, each exhibiting distinct growth patterns driven by sector-specific advancements. Leading global companies such as BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, and Shell, alongside prominent local entities like PT Pertamina, are actively engaged in a competitive landscape characterized by brand building, technological innovation in high-performance and eco-friendly lubricants, and strategic alliances. Understanding both global and local market dynamics is essential for effective business strategy. Regional market distribution within Indonesia is shaped by population density, economic activity, and industrial concentration, with Java and Sumatra expected to lead market share. Future growth prospects are contingent upon sustained economic expansion, advancements in lubricant technology focused on efficiency and environmental responsibility, and a supportive business environment fostered by the government. Thorough analysis of these factors is critical for all market participants.

Indonesia Lubricant Industry Company Market Share

Indonesia Lubricant Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia lubricant industry, offering invaluable insights for industry professionals, investors, and strategic planners. We delve into market dynamics, growth trends, key players, and future opportunities within this rapidly evolving sector. The report covers the historical period (2019-2024), base year (2025), and forecasts until 2033. Expect detailed analysis of parent markets (e.g., automotive, industrial) and child markets (e.g., passenger car motor oil, industrial gear oil) within the Indonesian context. Market values are presented in million units.

Indonesia Lubricant Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market consolidation within the Indonesian lubricant industry. We examine market concentration, identifying the market share held by key players like PT Pertamina, Royal Dutch Shell PLC, Chevron Corporation, and others. The impact of technological innovations, such as the development of bio-lubricants and enhanced performance fluids, is thoroughly assessed. Furthermore, we examine the influence of government regulations, the presence of substitute products, and the demographics of end-users. The analysis also includes an overview of recent mergers and acquisitions (M&A) activity, quantifying deal volumes and assessing their implications for market structure.

- Market Concentration: PT Pertamina holds xx% market share, followed by Shell (xx%), Chevron (xx%), and others. The market is characterized by [Describe concentration: e.g., high/moderate/low concentration].

- Technological Innovation: Key drivers include the demand for energy-efficient lubricants and environmentally friendly formulations. Barriers include high R&D costs and the need for localized adaptation.

- Regulatory Framework: [Describe relevant Indonesian regulations and their impact on the market].

- Competitive Substitutes: [Discuss substitute products and their market penetration].

- End-User Demographics: [Analyze the demographics of end-users across various segments].

- M&A Trends: [Quantify M&A activity (e.g., number of deals, total value) during the study period].

Indonesia Lubricant Industry Growth Trends & Insights

This section presents a detailed analysis of the Indonesia lubricant market's historical and projected growth. Using proprietary data and industry expertise, we analyze market size evolution, adoption rates of new lubricant technologies, and shifts in consumer preferences. Key performance indicators (KPIs) such as the Compound Annual Growth Rate (CAGR) and market penetration rates are provided to offer a comprehensive understanding of the market's trajectory. Factors influencing growth, such as economic expansion, infrastructural development, and evolving vehicle ownership patterns, are meticulously explored. The analysis also considers the impact of technological disruptions, such as the rise of electric vehicles and their implications for lubricant demand.

[Insert 600-word analysis based on XXX data source, including CAGR, market penetration rates, and detailed explanation of growth factors].

Dominant Regions, Countries, or Segments in Indonesia Lubricant Industry

This section identifies the leading geographical regions or market segments driving the growth of the Indonesian lubricant industry. Factors contributing to the dominance of specific regions, such as favorable economic policies, robust infrastructure development, and high industrial activity, are highlighted. A detailed analysis of market share and growth potential for each dominant region and segment is presented, providing a clear picture of the market's geographical and sectoral distribution.

- Key Drivers:

- Economic Growth: [Explain the relationship between economic growth and lubricant demand].

- Infrastructure Development: [Discuss the role of infrastructure in driving lubricant consumption].

- Industrialization: [Analyze the contribution of various industrial sectors to lubricant demand]. [Insert 600-word analysis, including market share and growth potential data for leading regions/segments, supported by bullet points and paragraphs].

Indonesia Lubricant Industry Product Landscape

The Indonesian lubricant market offers a diverse range of products catering to various applications. This section details the key product innovations, highlighting their unique selling propositions and technological advancements. We analyze the performance metrics of different lubricant types, focusing on their efficiency, durability, and environmental impact. The analysis considers the specific applications of these products, from automotive and industrial machinery to marine and aerospace sectors.

[Insert 100-150 word paragraph detailing product innovations, applications, and performance metrics].

Key Drivers, Barriers & Challenges in Indonesia Lubricant Industry

This section identifies the key factors propelling the growth of the Indonesian lubricant industry, focusing on technological advancements, economic conditions, and supportive government policies. Conversely, we analyze the challenges and restraints impacting market expansion, such as supply chain disruptions, regulatory hurdles, and intense competition. The analysis quantifies the impact of these factors wherever possible.

Key Drivers:

- [List and explain key drivers, e.g., increasing vehicle ownership, industrial growth, government infrastructure projects].

Key Challenges and Restraints:

- [List and explain key challenges, e.g., fluctuating crude oil prices, environmental regulations, intense competition from international players, supply chain vulnerability].

Emerging Opportunities in Indonesia Lubricant Industry

This section highlights the promising opportunities emerging within the Indonesian lubricant industry. We identify untapped market segments, innovative applications, and evolving consumer preferences that present potential avenues for growth.

[Insert 150 words on emerging opportunities, such as bio-lubricants, specialized lubricants for new technologies, expansion into underserved regions].

Growth Accelerators in the Indonesia Lubricant Industry

This section discusses the key catalysts poised to drive long-term growth in the Indonesian lubricant market. We focus on technological advancements, strategic partnerships, and market expansion strategies that are expected to significantly shape the future of the industry.

[Insert 150-word paragraph on growth accelerators, e.g., technological innovation, strategic collaborations, market expansion].

Key Players Shaping the Indonesia Lubricant Industry Market

- BP PLC (Castrol)

- Chevron Corporation

- ExxonMobil Corporation

- FUCHS

- Idemitsu Kosan Co Ltd

- PT Pertamina

- PT Wiraswasta Gemilang Indonesia (Evalube)

- Royal Dutch Shell PLC

- Top

- TotalEnergies

Notable Milestones in Indonesia Lubricant Industry Sector

- January 2022: ExxonMobil Corporation reorganized into three business lines: Upstream, Product Solutions, and Low Carbon Solutions. This restructuring may impact its lubricant business strategy.

- March 2022: ExxonMobil appointed Jay Hooley as lead managing director. This leadership change could influence future market strategies.

- May 2022: TotalEnergies and NEXUS Automotive extended their strategic partnership for five years, expanding TotalEnergies' presence in the N! community (EUR 7.2 billion in 2015 to nearly EUR 35 billion by 2021). This signifies a significant expansion in the automotive aftermarket.

In-Depth Indonesia Lubricant Industry Market Outlook

The Indonesian lubricant industry is poised for substantial growth over the forecast period (2025-2033), driven by sustained economic expansion, infrastructure development, and increasing vehicle ownership. Strategic partnerships, technological advancements in lubricant formulations, and the exploration of new market segments will further accelerate growth. The market presents significant opportunities for both established players and new entrants to capitalize on the expanding demand for high-performance and environmentally friendly lubricants. The industry's future will be characterized by innovation, sustainability, and increased competition.

Indonesia Lubricant Industry Segmentation

-

1. End User

- 1.1. Automotive

- 1.2. Heavy Equipment

- 1.3. Metallurgy & Metalworking

- 1.4. Power Generation

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Metalworking Fluids

- 2.5. Transmission & Gear Oils

- 2.6. Other Product Types

Indonesia Lubricant Industry Segmentation By Geography

- 1. Indonesia

Indonesia Lubricant Industry Regional Market Share

Geographic Coverage of Indonesia Lubricant Industry

Indonesia Lubricant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Lubricant Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Automotive

- 5.1.2. Heavy Equipment

- 5.1.3. Metallurgy & Metalworking

- 5.1.4. Power Generation

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Metalworking Fluids

- 5.2.5. Transmission & Gear Oils

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUCHS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Idemitsu Kosan Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Pertamina

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Wiraswasta Gemilang Indonesia (Evalube)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Top

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Indonesia Lubricant Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Lubricant Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Lubricant Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Indonesia Lubricant Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Indonesia Lubricant Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Indonesia Lubricant Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Indonesia Lubricant Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Indonesia Lubricant Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Lubricant Industry?

The projected CAGR is approximately 3.92%.

2. Which companies are prominent players in the Indonesia Lubricant Industry?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, FUCHS, Idemitsu Kosan Co Ltd, PT Pertamina, PT Wiraswasta Gemilang Indonesia (Evalube), Royal Dutch Shell PLC, Top, TotalEnergie.

3. What are the main segments of the Indonesia Lubricant Industry?

The market segments include End User, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By End User : Automotive.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: TotalEnergies, NEXUS Automotive Extend Strategic Partnership for a period of five years. As part of this partnership, TotalEnergies Lubricants will be expanding its presence in the burgeoning N! community, which has seen rapid growth in sales from EUR 7.2 billion in 2015 to nearly EUR 35 billion by the end of 2021.March 2022: ExxonMobil Corporation company has appointed Jay Hooley as lead managing director of the company.January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Lubricant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Lubricant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Lubricant Industry?

To stay informed about further developments, trends, and reports in the Indonesia Lubricant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence