Key Insights

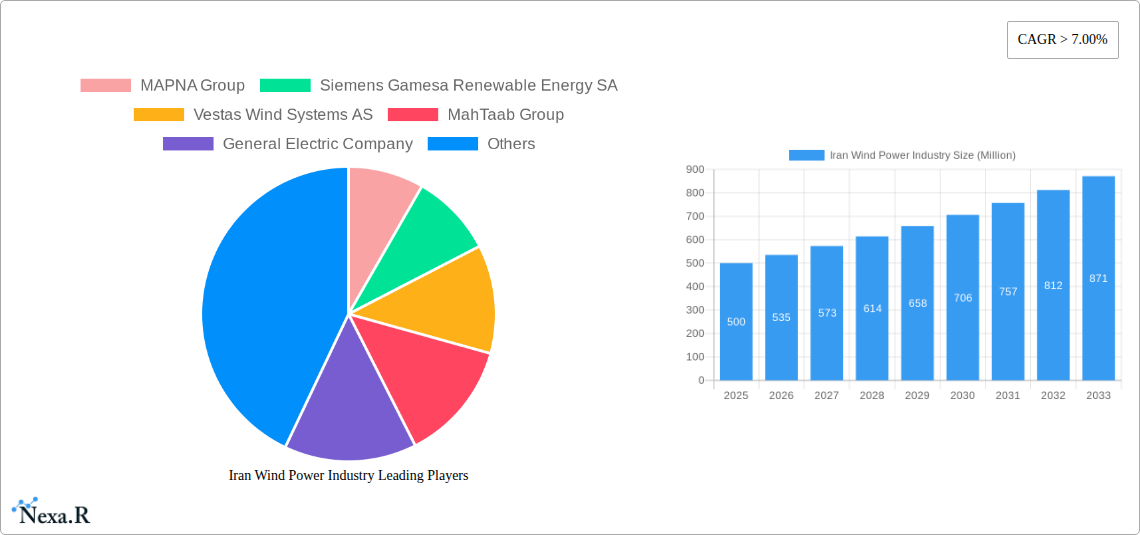

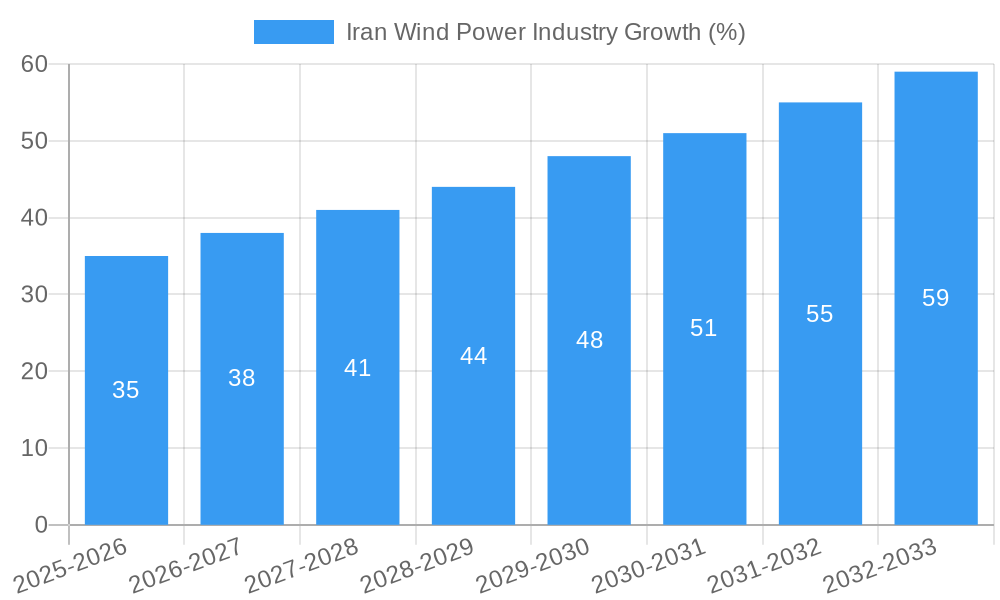

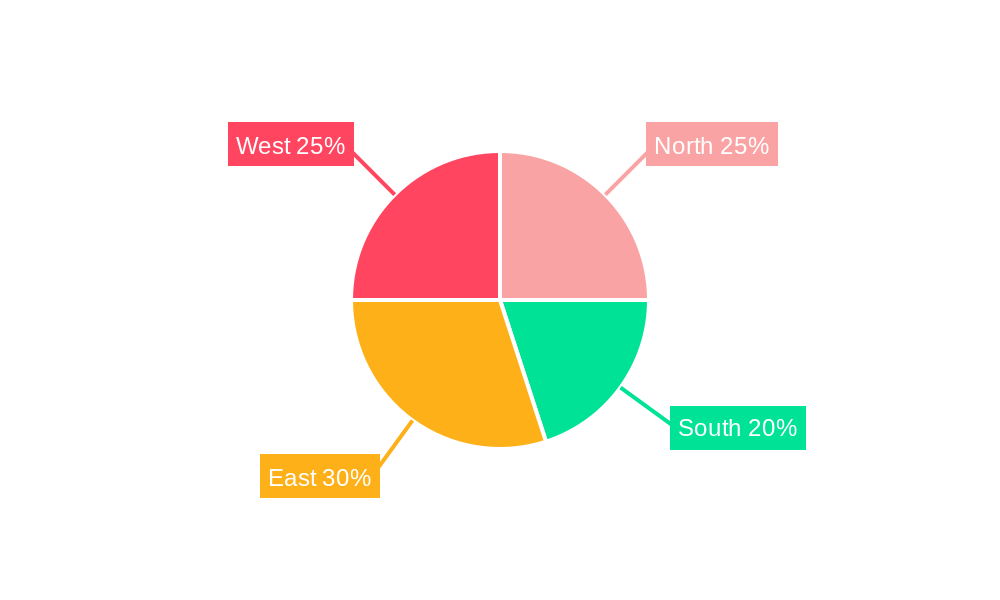

The Iranian wind power industry is poised for significant growth, driven by the country's ambitious renewable energy targets and the need to diversify its energy mix away from fossil fuels. With a Compound Annual Growth Rate (CAGR) exceeding 7% from 2019 to 2033, the market, currently estimated at approximately $X million (in 2025, a reasonable estimate given a 7%+ CAGR and a market size 'XX' indicated as a placeholder which, in the absence of a real value, needs interpretation and may indicate a smaller market size to start with ), is projected to reach a substantial size by 2033. Key drivers include government incentives promoting renewable energy adoption, increasing electricity demand, and a growing awareness of climate change. Technological advancements leading to more efficient and cost-effective wind turbines are also contributing to market expansion. However, challenges remain, including the need for improved grid infrastructure to accommodate intermittent renewable energy sources and potential regulatory hurdles. The market is segmented by application (residential, industrial & utilities, commercial) and fuel type (natural gas, coal, oil, other fuel types), with the industrial and utilities sector expected to dominate due to high energy consumption. Leading players like MAPNA Group, Siemens Gamesa, Vestas, MahTaab Group, and General Electric are actively involved, showcasing the market's attractiveness to both domestic and international investors. Regional variations within Iran (North, South, East, West) exist due to differing wind resources and infrastructure development, but all regions are expected to contribute to the overall market growth.

The segmentation of the Iranian wind power market provides a nuanced understanding of its dynamics. The residential segment, though smaller compared to industrial and commercial applications, presents opportunities for decentralized generation and energy independence. The industrial & utilities segment holds significant potential given the large energy requirements of various industrial processes. The commercial sector, including office buildings and shopping malls, is increasingly adopting wind power to reduce operating costs and demonstrate environmental responsibility. The fuel type segmentation highlights a shift away from traditional fossil fuels towards clean energy. While natural gas, coal, and oil currently play a dominant role in the overall energy sector, the wind power market is effectively replacing a portion of that demand, and other fuel types may encompass emerging technologies in energy storage and renewable energy integration. This dynamic interplay between established energy sources and emerging renewable technologies is central to the long-term trajectory of the Iranian wind power industry.

Iran Wind Power Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Iranian wind power industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Renewable Energy) and child market (Wind Power), this report is an essential resource for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. All market values are presented in millions of units.

Iran Wind Power Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Iranian wind power sector. The market is characterized by a moderate level of concentration, with key players like MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, and General Electric Company vying for market share. Technological innovation is driven by the need for increased efficiency and cost reduction, though sanctions and limited access to international technologies pose significant barriers.

- Market Concentration: xx% of the market is controlled by the top 5 players (estimated).

- Technological Innovation: Focus on improving turbine technology, grid integration solutions, and reducing manufacturing costs.

- Regulatory Framework: Government policies and incentives play a crucial role, with recent price increases aimed at stimulating private sector investment.

- Competitive Substitutes: Solar power and other renewable energy sources compete for investment.

- End-User Demographics: Primarily focused on industrial and utility segments, with growing residential and commercial adoption.

- M&A Trends: Limited M&A activity observed in recent years due to economic and political factors; xx number of deals recorded between 2019-2024.

Iran Wind Power Industry Growth Trends & Insights

The Iranian wind power market is expected to experience significant growth during the forecast period, driven by increasing energy demand, government support for renewable energy, and falling technology costs. While historical growth was constrained by sanctions and political instability, recent policy changes signal a shift towards greater private sector participation and investment. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Market penetration is expected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, such as advancements in turbine design and energy storage, will further accelerate market expansion. Consumer behavior is shifting towards greater acceptance of renewable energy sources, driven by environmental concerns and rising energy prices.

Dominant Regions, Countries, or Segments in Iran Wind Power Industry

The industrial and utility segments dominate the Iranian wind power market, accounting for the largest share of installed capacity. This is primarily due to the high energy demands of these sectors and the economic benefits of renewable energy adoption. Specific regions with favorable wind resources and existing infrastructure are experiencing faster growth.

- Key Drivers:

- Government incentives and guaranteed purchase prices.

- Increasing energy demand from industrial and utility sectors.

- Growing awareness of environmental concerns.

- Availability of land suitable for wind farms.

- Dominant Segments: Industrial & Utilities (xx% market share), followed by Commercial (xx%) and Residential (xx%).

- Geographic Dominance: Provinces with high wind speeds and suitable land availability are witnessing the highest growth rates.

Iran Wind Power Industry Product Landscape

The Iranian wind power market features a range of wind turbine technologies, primarily focusing on onshore wind farms. Recent advancements have centered on improving turbine efficiency, reducing operating costs, and enhancing grid integration capabilities. Manufacturers are also focusing on developing customized solutions tailored to the specific requirements of the Iranian market, addressing factors such as environmental conditions and grid stability.

Key Drivers, Barriers & Challenges in Iran Wind Power Industry

Key Drivers:

- Government support through policy changes and financial incentives.

- Growing energy demand and reliance on fossil fuels.

- Environmental concerns and the need for sustainable energy solutions.

Challenges & Restraints:

- Sanctions and limited access to international technology and financing.

- Grid infrastructure limitations and integration challenges.

- Political and economic instability affecting investment decisions.

- High initial capital costs associated with wind farm development.

Emerging Opportunities in Iran Wind Power Industry

Significant opportunities exist for expanding wind power capacity in underserved regions, developing innovative financing models, and integrating energy storage solutions. The increasing adoption of hybrid renewable energy systems, combining wind and solar power, presents another promising area for growth. The government's focus on encouraging private sector participation opens avenues for new entrants and partnerships.

Growth Accelerators in the Iran Wind Power Industry

Technological advancements in turbine design, improved grid integration technologies, and declining manufacturing costs will fuel long-term growth. Strategic partnerships between domestic and international companies can provide access to advanced technologies and financial resources. Expanding into new geographical areas with high wind potential will unlock further market expansion.

Key Players Shaping the Iran Wind Power Industry Market

- MAPNA Group

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- MahTaab Group

- General Electric Company

Notable Milestones in Iran Wind Power Industry Sector

- November 2022: Iranian government increases guaranteed purchase prices for solar and wind power by 20-60%, boosting private investment.

- January 2022: Ministry of Energy and SATBA sign MoU to add 10 GW of renewable energy capacity within four years.

In-Depth Iran Wind Power Industry Market Outlook

The Iranian wind power market is poised for substantial growth, driven by supportive government policies, rising energy demand, and technological advancements. Strategic investments in infrastructure development, technological innovation, and collaboration between domestic and international players will be critical for realizing the full market potential. The long-term outlook remains positive, with significant opportunities for both domestic and international companies to participate in this rapidly expanding sector.

Iran Wind Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Wind Power Industry Segmentation By Geography

- 1. Iran

Iran Wind Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 MAPNA Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siemens Gamesa Renewable Energy SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vestas Wind Systems AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MahTaab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Electric Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Wind Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Wind Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: North Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: North Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: South Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: East Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: East Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: West Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: West Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 27: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Wind Power Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Iran Wind Power Industry?

Key companies in the market include MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, General Electric Company.

3. What are the main segments of the Iran Wind Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

In November 2022, the Iranian government increased private companies' guaranteed purchase prices for solar and wind power generated by 20-60% compared to 2021. Iran's Ministry of Energy announced a new directive to raise tariffs (for private sector producers) to encourage investment. The Ministry's new portal cited the press release issued by the state-run Renewable Energy and Energy Efficiency Organization (SATBA). The Ministry also noted that the latest prices for generating electricity from small-scale solar power stations (with less than 20-kilowatt capacity) have risen by 20% per kilowatt, reaching 6 cents/kWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Wind Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Wind Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Wind Power Industry?

To stay informed about further developments, trends, and reports in the Iran Wind Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence