Key Insights

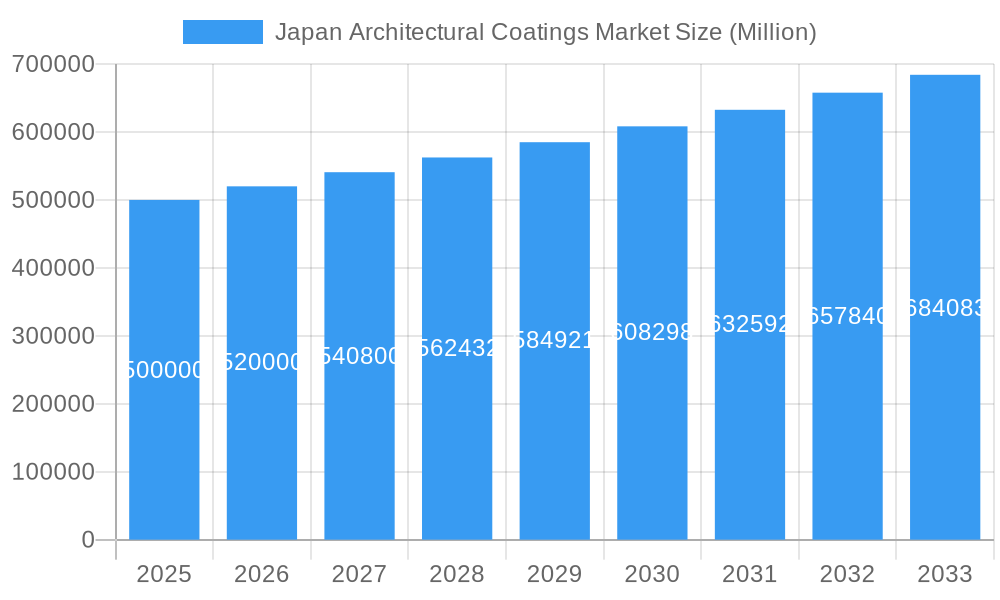

The Japan Architectural Coatings market, estimated at $1.8 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.2% from 2025 to 2033. This growth is propelled by substantial government investments in infrastructure and urban renewal across key regions, alongside an increasing preference for aesthetically appealing and energy-efficient buildings. The adoption of premium coatings with enhanced properties, such as heat reflection and superior durability, is on the rise. Furthermore, environmental consciousness and stringent regulations are driving the widespread adoption of eco-friendly waterborne coatings. The residential sector anticipates significant expansion, fueled by increased construction and renovation activities. In terms of technology, waterborne coatings are increasingly favored over solventborne alternatives due to their lower VOC emissions and sustainability benefits. Leading companies like AkzoNobel, Jotun, and Nippon Paint Holdings are actively pursuing product innovation and geographic expansion to capitalize on market dynamics. Competitive strategies are increasingly focused on value-added services and tailored solutions.

Japan Architectural Coatings Market Market Size (In Billion)

Potential market restraints include volatility in raw material prices, particularly for key resins, and economic downturns that could affect construction volumes. Ensuring consistent quality across various subcontractors and projects remains a challenge, necessitating enhanced quality control and training. Despite these obstacles, the Japan Architectural Coatings market exhibits a positive long-term outlook, supported by ongoing infrastructure development, a growing middle class, and a definitive shift towards sustainable building practices. Niche segments, such as specialized coatings for high-performance structures, represent significant growth avenues.

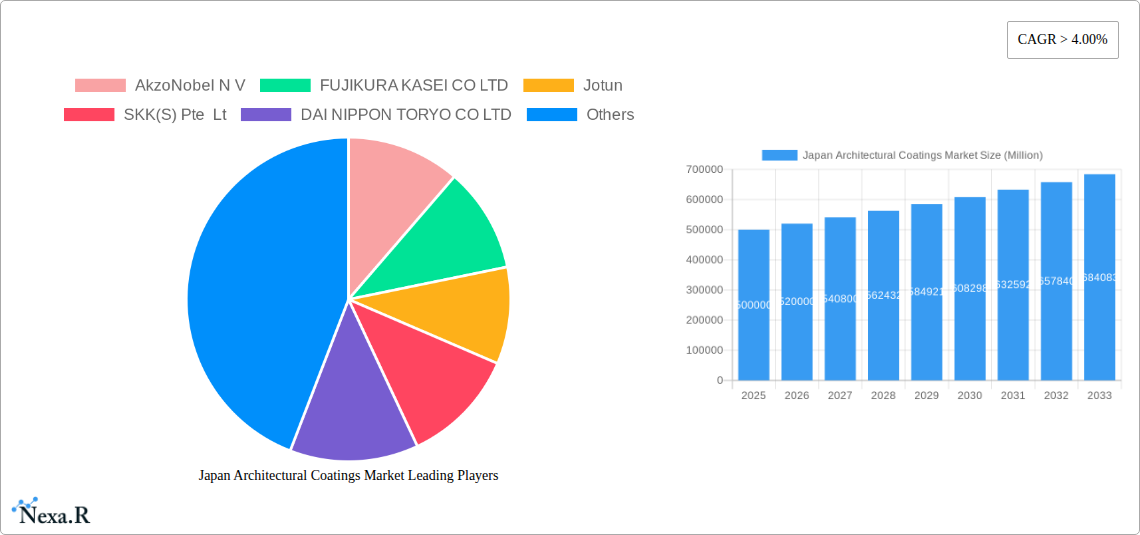

Japan Architectural Coatings Market Company Market Share

Japan Architectural Coatings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Architectural Coatings Market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, dominant segments, and key players shaping this dynamic sector. The market size is projected to reach xx Million by 2033.

Japan Architectural Coatings Market Dynamics & Structure

The Japan Architectural Coatings market is characterized by a moderately concentrated landscape, with major players holding significant market share. Technological innovation, particularly in sustainable and high-performance coatings, is a crucial driver, alongside stringent environmental regulations promoting waterborne and low-VOC options. The market faces competition from substitute materials like cladding and alternative finishes. Demographic shifts, particularly an aging population and evolving construction trends, significantly influence end-user demand. The M&A activity in the sector remains moderate, with a focus on strategic acquisitions to expand product portfolios and geographic reach. In 2024, xx M&A deals were recorded, resulting in a xx% market share shift.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on waterborne, high-performance, and eco-friendly coatings. Innovation barriers include high R&D costs and regulatory compliance.

- Regulatory Framework: Stringent environmental regulations driving the adoption of sustainable coatings.

- Competitive Substitutes: Cladding, stone veneer, and other exterior finishes pose competition.

- End-User Demographics: Aging population and changing construction trends are key demographic factors.

- M&A Trends: Moderate activity, primarily strategic acquisitions for portfolio diversification and market expansion.

Japan Architectural Coatings Market Growth Trends & Insights

The Japan Architectural Coatings market experienced steady growth during the historical period (2019-2024), driven by infrastructure development and rising construction activity. The market size reached xx Million in 2024. However, growth rates are expected to moderate slightly in the forecast period (2025-2033), primarily due to macroeconomic factors and fluctuating construction spending. Technological advancements, such as anti-viral and anti-bacterial coatings, are expected to drive market expansion. Consumer preference for aesthetically pleasing and durable coatings is also a contributing factor. The projected CAGR for the forecast period is xx%. Market penetration for waterborne coatings is expected to increase to xx% by 2033.

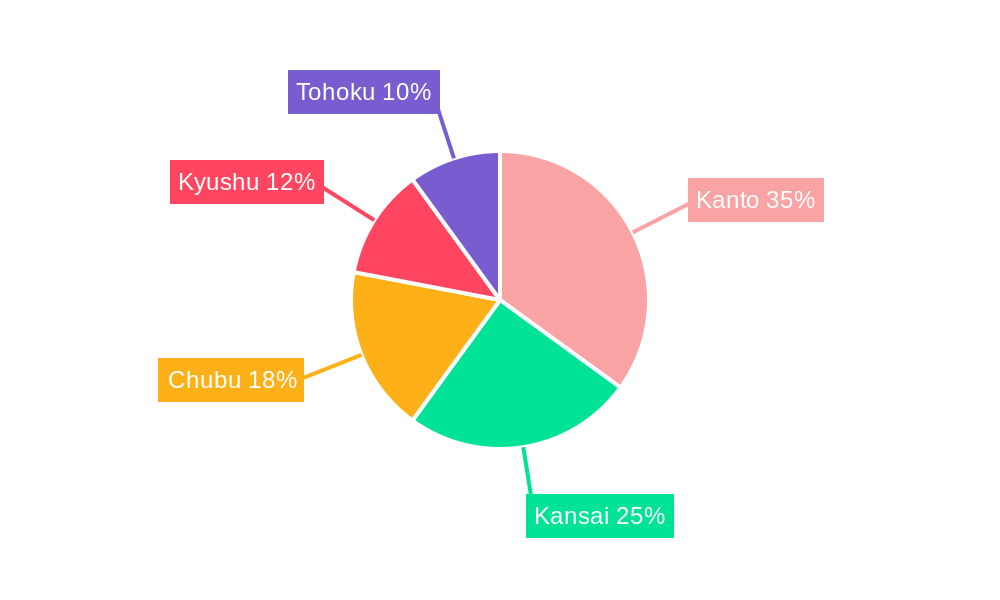

Dominant Regions, Countries, or Segments in Japan Architectural Coatings Market

The residential segment currently holds the largest market share, driven by increasing housing construction and renovation activities. However, the commercial segment is projected to exhibit faster growth in the forecast period due to ongoing infrastructure projects and investments in commercial real estate. Within technology, waterborne coatings are gaining significant traction, fueled by environmental concerns and regulatory mandates. Acrylic resins dominate the market due to their versatility and cost-effectiveness. Tokyo and Osaka are the leading regions, benefitting from robust construction activities and higher disposable income.

- Sub End User: Residential segment dominates, with Commercial segment exhibiting higher growth potential.

- Technology: Waterborne coatings are experiencing rapid growth due to environmental regulations and performance advantages.

- Resin: Acrylic resins dominate due to cost-effectiveness and versatility.

- Key Regional Drivers: Tokyo and Osaka benefit from robust construction and high disposable income.

Japan Architectural Coatings Market Product Landscape

The market offers a diverse range of products, including solventborne and waterborne coatings, catering to various applications and end-user needs. Recent innovations focus on enhanced durability, improved aesthetics, and eco-friendly formulations. Anti-viral and anti-bacterial coatings are gaining popularity, driven by heightened health consciousness. Products are differentiated based on performance characteristics, such as UV resistance, stain resistance, and ease of application. Key selling propositions include long-lasting protection, ease of maintenance, and aesthetically pleasing finishes.

Key Drivers, Barriers & Challenges in Japan Architectural Coatings Market

Key Drivers:

- Increasing construction activity, particularly in residential and commercial sectors.

- Growing demand for high-performance and aesthetically pleasing coatings.

- Stringent environmental regulations promoting eco-friendly formulations.

- Technological advancements leading to innovative product offerings (e.g., anti-viral paints).

Key Challenges:

- Fluctuations in raw material prices impacting production costs.

- Intense competition among established and emerging players.

- Stringent regulatory compliance requirements for new product approvals.

- Potential supply chain disruptions impacting availability of raw materials.

Emerging Opportunities in Japan Architectural Coatings Market

- Expanding into niche markets, such as specialized coatings for historical buildings or high-rise structures.

- Developing sustainable and eco-friendly coatings with enhanced performance characteristics.

- Leveraging digital technologies to improve customer experience and product development.

- Focusing on value-added services, such as color consultation and application support.

Growth Accelerators in the Japan Architectural Coatings Market Industry

Strategic partnerships between coating manufacturers and construction companies can significantly accelerate market growth by facilitating product adoption and creating synergistic opportunities. Investments in R&D for innovative and sustainable coatings are essential for driving technological advancements. Expanding into emerging markets and developing tailored products for specific applications are also key growth drivers. Government initiatives promoting sustainable construction practices further encourage market growth.

Key Players Shaping the Japan Architectural Coatings Market Market

- AkzoNobel N V

- FUJIKURA KASEI CO LTD

- Jotun

- SKK(S) Pte Lt

- DAI NIPPON TORYO CO LTD

- Nippon Paint Holdings Co Ltd

- AGC Cortec Co Ltd

- BASF SE

- Chuo Paint Co Ltd

- AS PAINT CO LTD

- Kansai Paint Co Ltd

Notable Milestones in Japan Architectural Coatings Market Sector

- December 2020: Nippe Home Products Co., Ltd. launched 'PROTECTON Interior Wall VK-200 for DIY', an anti-viral and anti-bacterial water-based paint.

- February 2022: Nippon Paint launched two new anti-viral water-based paint products for architectural use.

- May 2022: Kansai Paint Co., Ltd. announced the launch of "Dyna Axel," a topcoat paint for exterior walls.

In-Depth Japan Architectural Coatings Market Market Outlook

The future of the Japan Architectural Coatings market appears promising, driven by sustained infrastructure development, growing consumer demand for high-performance coatings, and the ongoing shift towards sustainable building practices. Strategic investments in R&D, focus on eco-friendly formulations, and strategic partnerships will be crucial for sustained growth. The market is expected to witness the emergence of new technologies and innovative product offerings, further shaping its trajectory. Opportunities exist for players who can effectively address the challenges posed by fluctuating raw material prices and stringent regulatory compliance.

Japan Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Japan Architectural Coatings Market Segmentation By Geography

- 1. Japan

Japan Architectural Coatings Market Regional Market Share

Geographic Coverage of Japan Architectural Coatings Market

Japan Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure and Industrialization in Russia; Increasing demand from Japan's Oil and gas industry

- 3.3. Market Restrains

- 3.3.1. The Fluctuations in the prices of raw materials

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FUJIKURA KASEI CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SKK(S) Pte Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAI NIPPON TORYO CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Paint Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGC Cortec Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chuo Paint Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AS PAINT CO LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kansai Paint Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: Japan Architectural Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 2: Japan Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Japan Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 4: Japan Architectural Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Japan Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 6: Japan Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Japan Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 8: Japan Architectural Coatings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Architectural Coatings Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Japan Architectural Coatings Market?

Key companies in the market include AkzoNobel N V, FUJIKURA KASEI CO LTD, Jotun, SKK(S) Pte Lt, DAI NIPPON TORYO CO LTD, Nippon Paint Holdings Co Ltd, AGC Cortec Co Ltd, BASF SE, Chuo Paint Co Ltd, AS PAINT CO LTD, Kansai Paint Co Ltd.

3. What are the main segments of the Japan Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure and Industrialization in Russia; Increasing demand from Japan's Oil and gas industry.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

The Fluctuations in the prices of raw materials.

8. Can you provide examples of recent developments in the market?

May 2022: Kansai Paint Co., Ltd. has announced that it will start selling "Dyna Axel", a topcoat paint for exterior walls that protects and looks great on exterior walls.February 2022: Nippon Paint launched two new anti-viral water-based paint products for Architectural use. This new product has been added to the lineup of PROTECTON, an anti-viral and anti-bacterial brand for floors and interior walls.December 2020: Nippe Home Products Co., Ltd., a group company of Nippon Paint Holdings Co., Ltd, which handles paints for DIY and home use, launched a new product 'PROTECTON Interior Wall VK-200 for DIY', an indoor use anti-viral and anti-bacterial water-based paint using a visible light-responsive photocatalyst in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Japan Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence