Key Insights

The Middle East and Africa (MEA) repair and rehabilitation market is poised for substantial expansion. Key growth drivers include accelerating urbanization, the aging of existing infrastructure, and a strategic shift towards asset maintenance over costly new construction. Government initiatives focused on sustainable infrastructure development and substantial investments in large-scale regional projects, particularly in transportation, industrial, and commercial sectors, are further bolstering market growth. The widespread adoption of advanced repair and rehabilitation techniques, such as injection grouting and fiber wrapping, is a significant contributor. Specific segments like injection grouting materials and fiber wrapping systems are anticipated to outperform due to their efficacy in structural reinforcement and lifespan extension. The market exhibits a fragmented structure with prominent global players and assertive regional competitors vying for market share through innovation, strategic alliances, and consolidation.

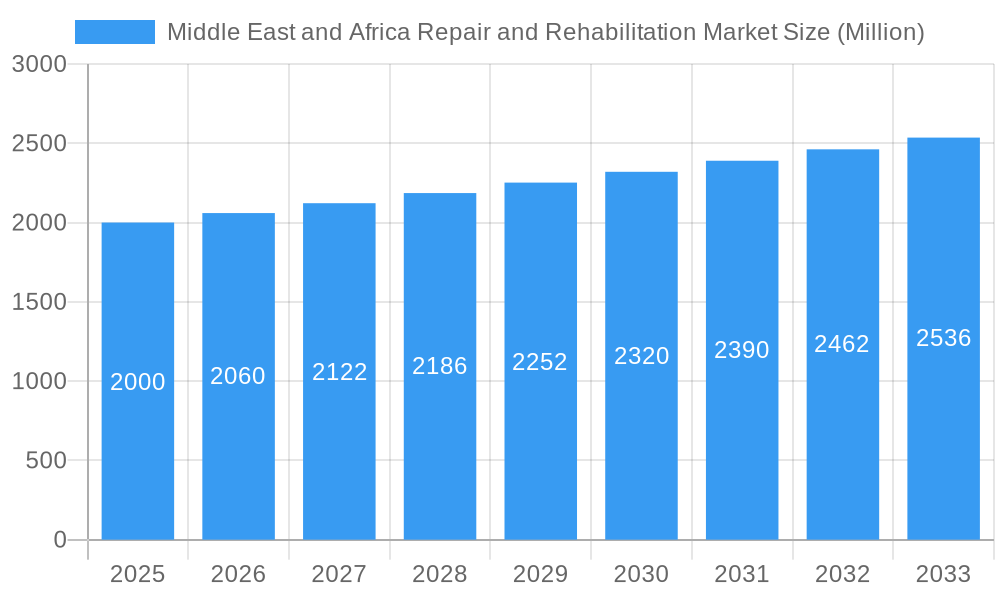

Middle East and Africa Repair and Rehabilitation Market Market Size (In Billion)

Challenges to market expansion include economic volatility in select MEA nations, potential fluctuations in material costs, and a scarcity of skilled labor. Addressing these impediments necessitates targeted investments in workforce development and the implementation of efficient project management methodologies. Furthermore, continuous advancements in materials science and construction technologies demand agile adaptation from market participants. The growing emphasis on sustainable and eco-friendly repair materials is also set to influence future market trajectories. With a projected Compound Annual Growth Rate (CAGR) of 6%, and a current market size of $7.22 billion in the base year 2024, the MEA repair and rehabilitation market demonstrates a robust outlook, expected to reach significant value by 2033. This growth will be intrinsically linked to the sustained expansion of the construction industry and ongoing governmental infrastructure investments.

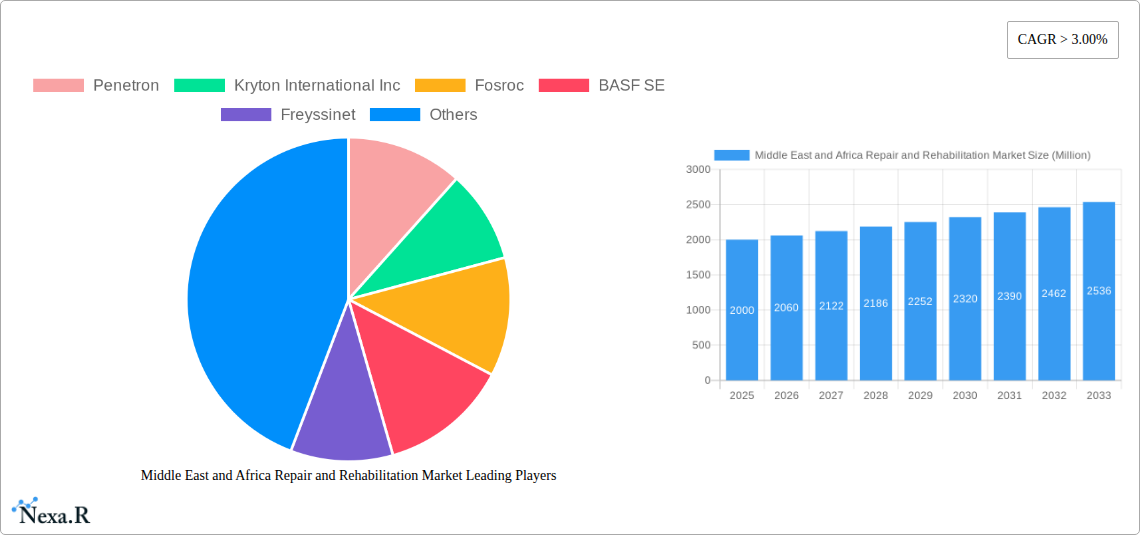

Middle East and Africa Repair and Rehabilitation Market Company Market Share

Middle East & Africa Repair and Rehabilitation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Repair and Rehabilitation Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, utilizing 2025 as the base year. The market is segmented by product type (Injection Grouting Materials, Modified Mortars, Fiber Wrapping Systems, Rebar Protectors, Micro-concrete Mortars, Other Product Types) and sector (Commercial, Industrial, Infrastructure, Residential). Key players analyzed include Penetron, Kryton International Inc, Fosroc, BASF SE, Freyssinet, Al Geemi Contracting LLC, Structural Group Inc, Sika AG, MAPEI SpA, Saint Gobain, Colas South Africa (Pty) Ltd, CICO Group, and Hilti Corporation. The market size is presented in million units.

Middle East and Africa Repair and Rehabilitation Market Dynamics & Structure

The Middle East and Africa Repair and Rehabilitation Market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, particularly in materials science and construction techniques, is a key driver, alongside stringent regulatory frameworks focusing on infrastructure safety and sustainability. The market witnesses continuous development of competitive product substitutes, pushing for improved performance and cost-effectiveness. End-user demographics, primarily driven by urbanization and infrastructure development, significantly influence market growth. M&A activity is moderate, with strategic acquisitions aiming to expand geographic reach and product portfolios.

- Market Concentration: xx% held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable, high-performance materials and digital construction technologies.

- Regulatory Landscape: Increasing emphasis on building codes and safety standards.

- Competitive Substitutes: Growth of eco-friendly and high-strength alternatives impacting market share.

- End-User Demographics: Rapid urbanization and infrastructure projects driving demand in key regions.

- M&A Activity: xx deals recorded between 2019-2024, with a focus on regional expansion and technology acquisition.

Middle East and Africa Repair and Rehabilitation Market Growth Trends & Insights

The Middle East and Africa Repair and Rehabilitation Market exhibits robust growth, driven by factors such as increasing infrastructure investment, aging infrastructure requiring refurbishment, and the growing adoption of advanced repair technologies. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, like the integration of 3D printing and robotics in repair operations, are accelerating adoption rates. Shifting consumer behavior towards sustainable and durable solutions is further fueling market expansion. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Middle East and Africa Repair and Rehabilitation Market

The Infrastructure sector dominates the market, driven by large-scale projects and government initiatives. Within product types, Injection Grouting Materials and Modified Mortars hold the largest market share due to their versatility and cost-effectiveness. The UAE and Saudi Arabia lead the regional market due to significant investment in infrastructure development. Nigeria and South Africa represent key growth markets due to their expanding economies and aging infrastructure.

- Key Drivers:

- Massive infrastructure investments in the Middle East.

- Aging infrastructure needing urgent repair and rehabilitation in Africa.

- Stringent building codes and regulations.

- Rising awareness of sustainable construction practices.

- Dominant Regions:

- Middle East: UAE, Saudi Arabia (High infrastructure spending, government initiatives).

- Africa: Nigeria, South Africa (Growing economies, aging infrastructure, rising construction activities).

- Dominant Segments:

- Product Type: Injection Grouting Materials and Modified Mortars (High demand, cost-effectiveness).

- Sector: Infrastructure (Large-scale projects, government funding).

Middle East and Africa Repair and Rehabilitation Market Product Landscape

The market showcases continuous innovation in materials science, resulting in high-performance, durable, and sustainable repair solutions. New products offer improved strength, longevity, and ease of application. Technological advancements include self-healing concrete, smart sensors for structural health monitoring, and advanced fiber-reinforced polymers for strengthening aging structures. These innovations contribute to enhanced efficiency, reduced maintenance costs, and improved infrastructure lifespan.

Key Drivers, Barriers & Challenges in Middle East and Africa Repair and Rehabilitation Market

Key Drivers: Increasing urbanization, aging infrastructure, government investments in infrastructure development, rising awareness of sustainable construction practices, and technological advancements in repair materials and techniques.

Key Challenges: Fluctuations in raw material prices, skilled labor shortages, stringent regulatory compliance requirements, and intense competition among existing players. Supply chain disruptions caused by geopolitical instability can significantly impact project timelines and costs.

Emerging Opportunities in Middle East and Africa Repair and Rehabilitation Market

Emerging opportunities lie in the adoption of innovative repair techniques, the use of sustainable and eco-friendly materials, and expanding into untapped markets within both regions. The development of smart infrastructure solutions and the integration of digital technologies in repair and rehabilitation projects presents significant growth potential.

Growth Accelerators in the Middle East and Africa Repair and Rehabilitation Market Industry

Technological breakthroughs in material science, strategic partnerships between construction companies and material suppliers, and expansion into emerging markets within the Middle East and Africa are key accelerators for long-term growth. Government initiatives focusing on infrastructure development and sustainable construction further stimulate market expansion.

Key Players Shaping the Middle East and Africa Repair and Rehabilitation Market Market

- Penetron

- Kryton International Inc

- Fosroc

- BASF SE

- Freyssinet

- Al Geemi Contracting LLC

- Structural Group Inc

- Sika AG

- MAPEI SpA

- Saint Gobain

- Colas South Africa (Pty) Ltd

- CICO Group

- Hilti Corporation

Notable Milestones in Middle East and Africa Repair and Rehabilitation Market Sector

- November 2022: Cortec Corporation launched MCI-2040 High Performance Vertical/Overhead Repair Mortar, enhancing concrete repair longevity.

- June 2021: Tecnimont SpA secured a USD 1.5 billion contract for the Port Harcourt Refinery rehabilitation in Nigeria.

In-Depth Middle East and Africa Repair and Rehabilitation Market Market Outlook

The Middle East and Africa Repair and Rehabilitation Market is poised for significant growth, driven by continued infrastructure development, technological advancements, and increasing focus on sustainable construction. Strategic partnerships and expansion into untapped markets offer lucrative opportunities for market players. The long-term outlook remains positive, with considerable potential for market expansion and innovation.

Middle East and Africa Repair and Rehabilitation Market Segmentation

-

1. Product Type

- 1.1. Injection Grouting Materials

- 1.2. Modified Mortars

- 1.3. Fiber Wrapping Systems

- 1.4. Rebar Protectors

- 1.5. Micro-concrete Mortars

- 1.6. Other Product Types

-

2. Sector

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Infrastructure

- 2.4. Residential

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

Middle East and Africa Repair and Rehabilitation Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

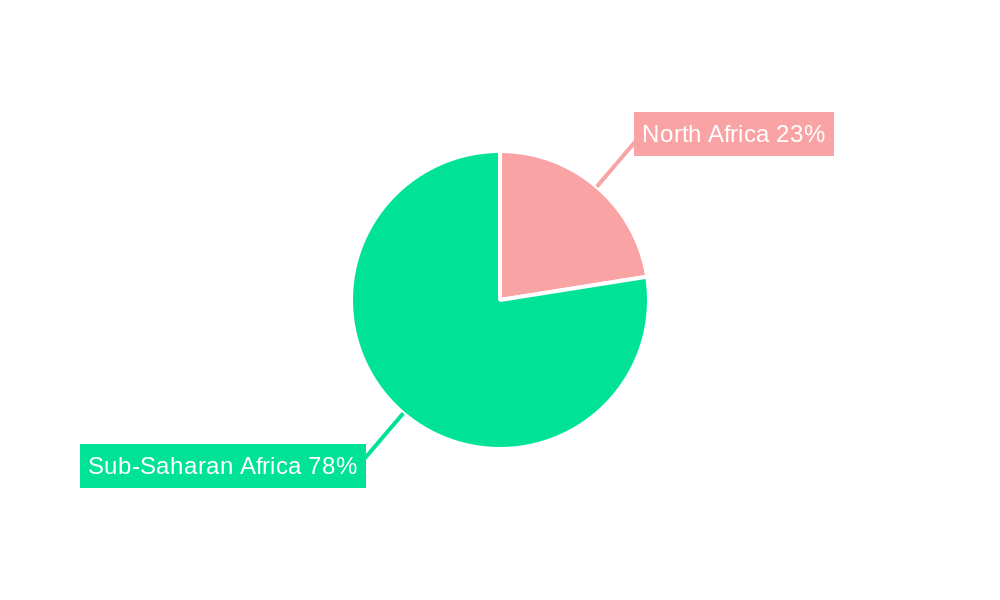

Middle East and Africa Repair and Rehabilitation Market Regional Market Share

Geographic Coverage of Middle East and Africa Repair and Rehabilitation Market

Middle East and Africa Repair and Rehabilitation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rehabilitation Projects Aimed at Preparing the Infrastructure for Climate Change; Rising Number of Government Initiated Projects in View of Social and Economic Development

- 3.3. Market Restrains

- 3.3.1. High Initial Investment and Engineering Challenges

- 3.4. Market Trends

- 3.4.1. Rising Infrastructure Repair and Rehabilitation Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Injection Grouting Materials

- 5.1.2. Modified Mortars

- 5.1.3. Fiber Wrapping Systems

- 5.1.4. Rebar Protectors

- 5.1.5. Micro-concrete Mortars

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Infrastructure

- 5.2.4. Residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Injection Grouting Materials

- 6.1.2. Modified Mortars

- 6.1.3. Fiber Wrapping Systems

- 6.1.4. Rebar Protectors

- 6.1.5. Micro-concrete Mortars

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Commercial

- 6.2.2. Industrial

- 6.2.3. Infrastructure

- 6.2.4. Residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle East and Africa Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Injection Grouting Materials

- 7.1.2. Modified Mortars

- 7.1.3. Fiber Wrapping Systems

- 7.1.4. Rebar Protectors

- 7.1.5. Micro-concrete Mortars

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Commercial

- 7.2.2. Industrial

- 7.2.3. Infrastructure

- 7.2.4. Residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa Middle East and Africa Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Injection Grouting Materials

- 8.1.2. Modified Mortars

- 8.1.3. Fiber Wrapping Systems

- 8.1.4. Rebar Protectors

- 8.1.5. Micro-concrete Mortars

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Commercial

- 8.2.2. Industrial

- 8.2.3. Infrastructure

- 8.2.4. Residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East and Africa Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Injection Grouting Materials

- 9.1.2. Modified Mortars

- 9.1.3. Fiber Wrapping Systems

- 9.1.4. Rebar Protectors

- 9.1.5. Micro-concrete Mortars

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Sector

- 9.2.1. Commercial

- 9.2.2. Industrial

- 9.2.3. Infrastructure

- 9.2.4. Residential

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Penetron

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kryton International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fosroc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BASF SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Freyssinet

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Al Geemi Contracting LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Structural Group Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sika AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MAPEI SpA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Saint Gobain

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Colas South Africa (Pty) Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 CICO Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Hilti Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Penetron

List of Figures

- Figure 1: Middle East and Africa Repair and Rehabilitation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Repair and Rehabilitation Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Sector 2020 & 2033

- Table 5: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Product Type 2020 & 2033

- Table 11: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 12: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Sector 2020 & 2033

- Table 13: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Product Type 2020 & 2033

- Table 19: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 20: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Sector 2020 & 2033

- Table 21: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Product Type 2020 & 2033

- Table 27: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 28: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Sector 2020 & 2033

- Table 29: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Product Type 2020 & 2033

- Table 35: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 36: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Sector 2020 & 2033

- Table 37: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Repair and Rehabilitation Market Volume N Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Repair and Rehabilitation Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Middle East and Africa Repair and Rehabilitation Market?

Key companies in the market include Penetron, Kryton International Inc, Fosroc, BASF SE, Freyssinet, Al Geemi Contracting LLC, Structural Group Inc , Sika AG, MAPEI SpA, Saint Gobain, Colas South Africa (Pty) Ltd, CICO Group, Hilti Corporation.

3. What are the main segments of the Middle East and Africa Repair and Rehabilitation Market?

The market segments include Product Type, Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Rehabilitation Projects Aimed at Preparing the Infrastructure for Climate Change; Rising Number of Government Initiated Projects in View of Social and Economic Development.

6. What are the notable trends driving market growth?

Rising Infrastructure Repair and Rehabilitation Across the Region.

7. Are there any restraints impacting market growth?

High Initial Investment and Engineering Challenges.

8. Can you provide examples of recent developments in the market?

November 2022: Cortec Corporation announced the launch of its new and improved MCI-2040 High Performance Vertical/Overhead Repair Mortar, under its MCI Technology. The new product will help concrete repairs last longer through its corrosion-inhibition properties and by reducing the risk of the insidious ring-anode effect.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in N.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Repair and Rehabilitation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Repair and Rehabilitation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Repair and Rehabilitation Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Repair and Rehabilitation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence