Key Insights

The Middle East engineering plastics market is forecast to experience significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 2.8%. The market size is estimated at 22.2 billion in the base year 2024. This growth is primarily propelled by robust demand from key sectors including automotive, aerospace, and electrical & electronics. The region's economic diversification initiatives, coupled with substantial investments in infrastructure and advanced manufacturing, are fostering the adoption of high-performance engineering plastics. These materials are crucial for developing lighter, stronger, and more fuel-efficient vehicles, enhancing the performance of electronic components, and enabling innovative construction solutions. The expanding packaging sector's demand for sustainable and advanced alternatives further contributes to market growth. The prevalence of specialized resins such as Fluoropolymers (PTFE, PVDF, ETFE), Polycarbonates (PC), and Polyether Ether Ketones (PEEK) highlights the market's shift towards applications requiring superior thermal, chemical, and mechanical properties.

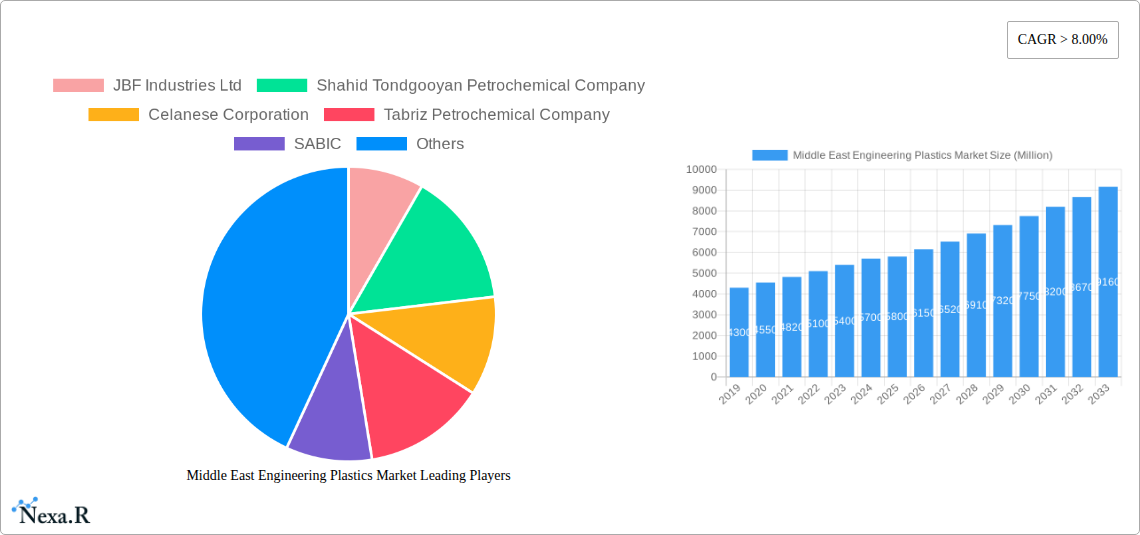

Middle East Engineering Plastics Market Market Size (In Billion)

The Middle East engineering plastics market features a diverse array of resin types and applications, with Fluoropolymers and Polycarbonates being significant market contributors. The automotive sector's increasing use of lightweight, durable plastic components for improved fuel efficiency and safety, alongside the aerospace industry's requirement for high-performance materials that withstand extreme conditions, are key growth drivers. The electrical and electronics segment benefits from the insulating and heat-resistant characteristics of these advanced plastics. While facing potential restraints from fluctuating raw material prices and the availability of cost-effective alternatives, proactive government initiatives to boost local manufacturing and the presence of major petrochemical players are expected to mitigate these challenges. The forecast period anticipates sustained demand, underscoring the region's growing importance in the global engineering plastics landscape.

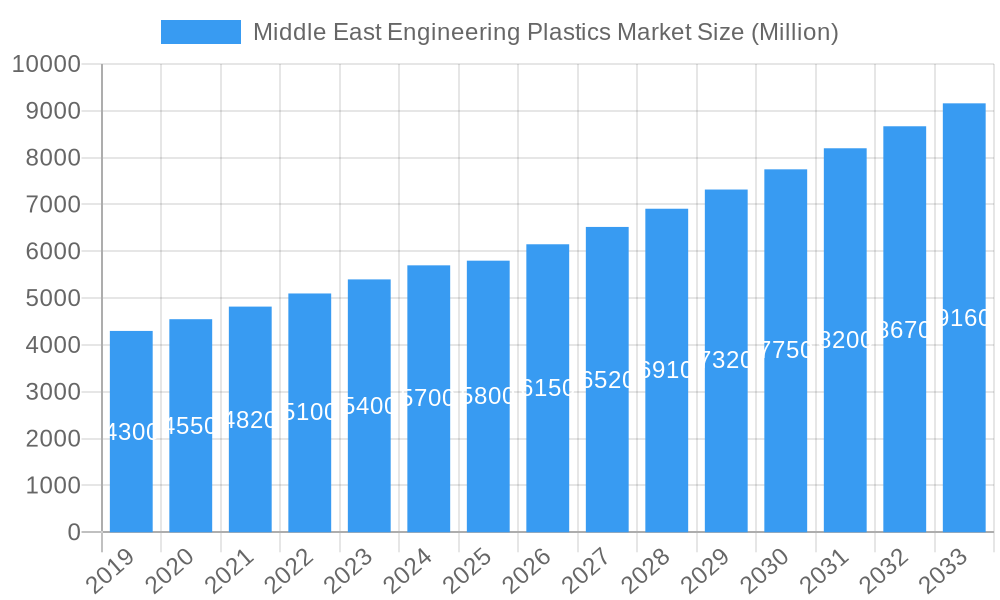

Middle East Engineering Plastics Market Company Market Share

This comprehensive market analysis provides critical insights into the Middle East Engineering Plastics Market, detailing growth trends, key segments, and competitive landscapes for strategic decision-making. Explore the evolving demand for high-performance plastics across the automotive, aerospace, building & construction, and electrical & electronics industries. The report offers granular market segmentation by resin type (Fluoropolymers, Polycarbonate, Polyamide, Polyethylene Terephthalate, ABS/SAN) and end-user industries, identifying key market opportunities.

The Middle East engineering plastics market is projected for substantial growth, driven by industrialization, infrastructure development, and a growing focus on lightweight materials. This analysis projects market evolution from 2019 to 2033, with a base year estimate of 2025. Gain critical intelligence on leading companies and their strategic initiatives within the burgeoning Middle East polymer industry.

Middle East Engineering Plastics Market Market Dynamics & Structure

The Middle East engineering plastics market exhibits a moderately concentrated structure, with dominant players like SABIC and Celanese Corporation leveraging significant production capacities and extensive distribution networks. Technological innovation is a key driver, with ongoing advancements in material science leading to the development of enhanced high-performance polymers with superior thermal, mechanical, and chemical resistance. Regulatory frameworks, particularly those promoting sustainability and stricter environmental standards, are influencing product development and material selection. Competitive product substitutes, such as advanced composites and certain metals, present a constant challenge, pushing engineering plastic manufacturers to emphasize their unique value propositions like lightweighting and cost-effectiveness. End-user demographics are increasingly sophisticated, demanding customized solutions for specialized applications across sectors like automotive and electronics. Mergers and acquisitions (M&A) trends are shaping the competitive landscape, with companies seeking to expand their product portfolios and geographical reach. For instance, the acquisition of DuPont's Mobility & Materials business by Celanese Corporation in November 2022 significantly bolstered its engineered thermoplastics offerings.

- Market Concentration: Dominated by a few key players with substantial market share, but with emerging regional producers gaining traction.

- Technological Innovation: Driven by the pursuit of lighter, stronger, and more sustainable engineering plastic solutions.

- Regulatory Impact: Growing emphasis on recyclability, reduced emissions, and compliance with international standards.

- Product Substitutes: Constant innovation required to compete with advanced composites and metals.

- End-User Demand: Shifting towards tailored solutions for demanding applications in automotive, aerospace, and electronics.

- M&A Activity: Strategic consolidations aimed at portfolio expansion and market penetration.

Middle East Engineering Plastics Market Growth Trends & Insights

The Middle East engineering plastics market is poised for robust expansion, projected to grow at a significant Compound Annual Growth Rate (CAGR) over the forecast period. This growth is underpinned by escalating demand from key industries such as automotive, where the drive for lightweighting and fuel efficiency is paramount, and building and construction, benefiting from mega-projects and increased urbanization. Furthermore, the burgeoning electrical and electronics sector, driven by the proliferation of smart devices and advanced manufacturing, is a substantial contributor to the market's upward trajectory. Adoption rates for advanced engineering plastics like Polycarbonate (PC), Polyamide (PA), and specialized Fluoropolymers are steadily increasing as manufacturers recognize their superior performance characteristics. Technological disruptions, including advancements in compounding, additive manufacturing (3D printing) with engineering plastics, and the development of bio-based or recycled engineering plastics, are reshaping product development and market penetration strategies. Consumer behavior shifts, particularly a greater awareness of sustainability and a demand for durable, high-performance products, are also influencing purchasing decisions and driving the adoption of innovative material solutions.

The market size of the Middle East engineering plastics market is estimated to have reached approximately $X,XXX million units in the base year 2025, with projections indicating a substantial increase to $Y,YYY million units by 2033. The adoption rate of engineering plastics in the automotive sector, for example, is anticipated to see a CAGR of Z.ZZ% over the forecast period, reflecting the industry's commitment to electrification and enhanced safety features, which necessitate advanced polymer solutions for components. Technological advancements in polymerization processes are enabling the production of engineering plastics with tailored properties, leading to wider applications in industries previously dominated by metals. This includes enhanced scratch resistance for automotive exteriors, improved thermal stability for electronic components, and greater chemical resistance for industrial machinery.

The consumer behavior shift towards products with longer lifespans and reduced environmental impact is also a significant catalyst. This is driving demand for high-quality, durable engineering plastics that can withstand harsh conditions and offer superior performance over conventional materials. For instance, the increasing popularity of electric vehicles (EVs) creates new opportunities for specialized engineering plastics in battery components, charging infrastructure, and lightweight structural elements. The Middle East engineering plastics market is therefore not just growing, but evolving, driven by innovation, changing industrial demands, and a conscious move towards more sustainable and high-performance material solutions. The interplay between these factors is creating a fertile ground for significant market penetration and sustained growth.

Dominant Regions, Countries, or Segments in Middle East Engineering Plastics Market

The Middle East engineering plastics market is largely dominated by countries with robust industrial bases and significant investment in infrastructure development. Saudi Arabia and the United Arab Emirates consistently emerge as leading markets, driven by their strategic economic diversification initiatives, large-scale construction projects, and established petrochemical industries. These nations benefit from substantial domestic production capabilities and a strong focus on attracting foreign investment in advanced manufacturing sectors.

Within the End User Industry segmentation, the Automotive sector stands out as a primary growth engine. The region's increasing automotive production, coupled with a growing demand for lighter, safer, and more fuel-efficient vehicles, particularly EVs, is propelling the adoption of advanced engineering plastics. The Building and Construction segment also exhibits significant dominance, fueled by ongoing mega-projects, urban development, and the demand for durable, weather-resistant, and aesthetically pleasing materials. The Electrical and Electronics sector is another key contributor, with the rise of smart cities, consumer electronics, and telecommunications infrastructure creating substantial demand for high-performance plastics with excellent insulating and thermal properties.

In terms of Resin Type, Polycarbonate (PC) and Polyamide (PA) are among the most dominant. PC's excellent impact strength, optical clarity, and heat resistance make it ideal for automotive glazing, electronic housings, and construction applications. PA, known for its mechanical strength, wear resistance, and chemical stability, finds extensive use in automotive under-the-hood components, industrial machinery, and consumer goods. Polyethylene Terephthalate (PET) is also a significant contributor, primarily driven by the packaging industry's demand for lightweight and recyclable materials.

Key drivers for this regional dominance include favorable government policies promoting industrial growth, substantial investments in petrochemical infrastructure, and a strategic geographical location facilitating trade and logistics. The presence of major petrochemical producers like SABIC and their integrated value chains provides a competitive advantage in terms of raw material availability and cost. Furthermore, the region's increasing focus on technological adoption and the development of specialized applications within these dominant segments are expected to sustain their leading positions in the foreseeable future. For instance, Saudi Arabia's Vision 2030 initiatives are fostering significant growth in the automotive and advanced manufacturing sectors, directly translating into increased demand for engineering plastics.

- Dominant Countries: Saudi Arabia, United Arab Emirates, with growing contributions from Qatar and Kuwait.

- Key End-User Industries: Automotive, Building and Construction, Electrical and Electronics, Packaging, and Industrial and Machinery.

- Leading Resin Types: Polycarbonate (PC), Polyamide (PA) (including PA 6 and PA 66), Polyethylene Terephthalate (PET), and Styrene Copolymers (ABS and SAN).

- Primary Growth Drivers: Industrial diversification, infrastructure development, government support, and technological adoption.

Middle East Engineering Plastics Market Product Landscape

The Middle East engineering plastics market is characterized by a dynamic product landscape driven by continuous innovation in material science. Manufacturers are focusing on developing engineering plastics with enhanced properties, including superior thermal stability, improved mechanical strength, increased chemical resistance, and flame retardancy. Key product innovations include advanced grades of Polycarbonate (PC) for high-impact applications, specialized Polyamide (PA) formulations for demanding automotive and industrial uses, and high-performance Fluoropolymers like PVDF and PTFE for corrosive environments and high-temperature applications. The application of these materials extends across diverse sectors, from lightweight automotive components and durable building materials to sophisticated electronic housings and robust industrial machinery parts. Unique selling propositions often lie in customized formulations, superior processing characteristics, and adherence to stringent industry-specific standards.

Key Drivers, Barriers & Challenges in Middle East Engineering Plastics Market

Key Drivers:

The Middle East engineering plastics market is propelled by several key drivers. Significant government initiatives aimed at economic diversification and industrial growth, such as Saudi Arabia's Vision 2030, are fueling demand across key sectors like automotive and construction. The escalating need for lightweight materials in the automotive industry to improve fuel efficiency and support the transition to electric vehicles is a major catalyst. Furthermore, burgeoning infrastructure development and urban expansion projects across the region necessitate high-performance and durable construction materials. Technological advancements in polymer science leading to improved material properties and new applications also play a crucial role in market expansion.

Barriers & Challenges:

Despite the robust growth potential, the market faces several barriers and challenges. Fluctuations in the price of raw materials, which are often petrochemical derivatives, can impact profitability and pricing strategies. Intense competition from established global players and the emergence of regional competitors with competitive pricing can also pose a challenge. Supply chain disruptions, geopolitical uncertainties, and trade policies can affect the availability and cost of raw materials and finished products. Regulatory hurdles related to environmental compliance and product safety standards, although driving innovation, can also increase operational costs. Additionally, the capital-intensive nature of engineering plastics manufacturing requires substantial investment, which can be a barrier for new entrants. The limited availability of skilled labor for specialized manufacturing processes in certain sub-regions also presents a challenge.

Emerging Opportunities in Middle East Engineering Plastics Market

Emerging opportunities in the Middle East engineering plastics market are manifold, driven by evolving technological landscapes and shifting consumer preferences. The rapid growth of the electric vehicle (EV) sector presents a significant avenue, with demand for specialized engineering plastics in battery components, charging infrastructure, and lightweight structural parts. The expansion of the renewable energy sector, particularly solar power, creates opportunities for durable and weather-resistant plastics in panel components and mounting systems. Furthermore, the increasing adoption of additive manufacturing (3D printing) with engineering plastics for prototyping and specialized part production opens new market segments. Growing consumer demand for sustainable products is fostering opportunities in bio-based and recycled engineering plastics, aligning with the region's sustainability goals. The development of smart infrastructure and advanced healthcare devices also represents a growing demand for high-performance, custom-engineered polymer solutions.

Growth Accelerators in the Middle East Engineering Plastics Market Industry

Several factors are acting as significant growth accelerators for the Middle East engineering plastics market. The aggressive pursuit of economic diversification strategies by regional governments, such as Saudi Arabia's Vision 2030 and the UAE's Operation 300bn, is a primary catalyst, fostering investment in downstream industries that heavily rely on engineering plastics. Strategic partnerships and joint ventures between international technology providers and local manufacturers are accelerating the transfer of advanced processing techniques and material innovations. The increasing focus on localization of manufacturing and value chains is further boosting domestic production and consumption. The development of specialized industrial zones and R&D hubs dedicated to materials science is also fostering innovation and accelerating the adoption of new engineering plastic solutions. Furthermore, a growing commitment to sustainability and circular economy principles is driving the development and adoption of recycled and bio-based engineering plastics, opening new market segments.

Key Players Shaping the Middle East Engineering Plastics Market Market

- JBF Industries Ltd

- Shahid Tondgooyan Petrochemical Company

- Celanese Corporation

- Tabriz Petrochemical Company

- SABIC

- PCC

- IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- Alfa S A B de C V

- Rabigh Refining and Petrochemical Company (Petro Rabigh)

- Saudi Methacrylates Company (SAMAC)

- Sipchem Company

- Ghaed Basir Petrochemical Products Company (GBPC)

Notable Milestones in Middle East Engineering Plastics Market Sector

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.

- June 2022: Alpek acquired OCTAL, which increased Alpek's PET resin capacity by 576,000 tons, helping it meet customers' increased demand.

- March 2022: Celanese Corporation announced the completion of the restructuring of Korea Engineering Plastics Co. (KEP), a joint venture owned 50% by Celanese and 50% by Mitsubishi Gas Chemical Company Inc. With the completion, Celanese had access to approximately 70KTA of POM production in Asia and corresponding global marketing rights.

In-Depth Middle East Engineering Plastics Market Market Outlook

The Middle East engineering plastics market is set for a period of sustained and dynamic growth, driven by an confluence of strategic initiatives and technological advancements. The region's commitment to diversifying its economy beyond oil and gas is translating into significant investments in manufacturing, construction, and automotive sectors, all of which are major consumers of engineering plastics. Key growth accelerators include the increasing adoption of lightweight materials in the automotive industry, spurred by the global push towards electrification and sustainability. Furthermore, ongoing mega-infrastructure projects and rapid urbanization are creating substantial demand in the building and construction segment. Technological innovations, such as the development of advanced polymer composites and the expanding use of 3D printing with engineering plastics, are opening up new application frontiers. The market's outlook is further bolstered by the proactive strategies of key players to expand their product portfolios and production capacities, alongside a growing regional emphasis on sustainability and the circular economy. This forward-looking approach positions the Middle East engineering plastics market for significant future potential and strategic opportunities in emerging applications.

Middle East Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Middle East Engineering Plastics Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Engineering Plastics Market Regional Market Share

Geographic Coverage of Middle East Engineering Plastics Market

Middle East Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Automotive Industry; Expanding Electronics and Electrical Sector

- 3.3. Market Restrains

- 3.3.1. Engineering plastics can be more expensive than traditional materials

- 3.4. Market Trends

- 3.4.1. Increased demand for customized engineering plastics that cater to specific application needs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Engineering Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JBF Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shahid Tondgooyan Petrochemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Celanese Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tabriz Petrochemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SABIC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PCC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alfa S A B de C V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rabigh Refining and Petrochemical Company (Petro Rabigh)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Methacrylates Company (SAMAC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sipchem Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ghaed Basir Petrochemical Products Company (GBPC)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 JBF Industries Ltd

List of Figures

- Figure 1: Middle East Engineering Plastics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Engineering Plastics Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Engineering Plastics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Middle East Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2020 & 2033

- Table 3: Middle East Engineering Plastics Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 4: Middle East Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 5: Middle East Engineering Plastics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East Engineering Plastics Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Middle East Engineering Plastics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Middle East Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2020 & 2033

- Table 9: Middle East Engineering Plastics Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 10: Middle East Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: Middle East Engineering Plastics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Middle East Engineering Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East Engineering Plastics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East Engineering Plastics Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Engineering Plastics Market?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Middle East Engineering Plastics Market?

Key companies in the market include JBF Industries Ltd, Shahid Tondgooyan Petrochemical Company, Celanese Corporation, Tabriz Petrochemical Company, SABIC, PCC, IVL Dhunseri Petrochem Industries Private Limited (IDPIPL), Alfa S A B de C V, Rabigh Refining and Petrochemical Company (Petro Rabigh), Saudi Methacrylates Company (SAMAC), Sipchem Company, Ghaed Basir Petrochemical Products Company (GBPC).

3. What are the main segments of the Middle East Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Automotive Industry; Expanding Electronics and Electrical Sector.

6. What are the notable trends driving market growth?

Increased demand for customized engineering plastics that cater to specific application needs.

7. Are there any restraints impacting market growth?

Engineering plastics can be more expensive than traditional materials.

8. Can you provide examples of recent developments in the market?

November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.June 2022: Alpek acquired OCTAL, which increased Alpek's PET resin capacity by 576,000 tons, helping it meet customers' increased demand.March 2022: Celanese Corporation announced the completion of the restructuring of Korea Engineering Plastics Co. (KEP), a joint venture owned 50% by Celanese and 50% by Mitsubishi Gas Chemical Company Inc. With the completion, Celanese had access to approximately 70KTA of POM production in Asia and corresponding global marketing rights.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Middle East Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence