Key Insights

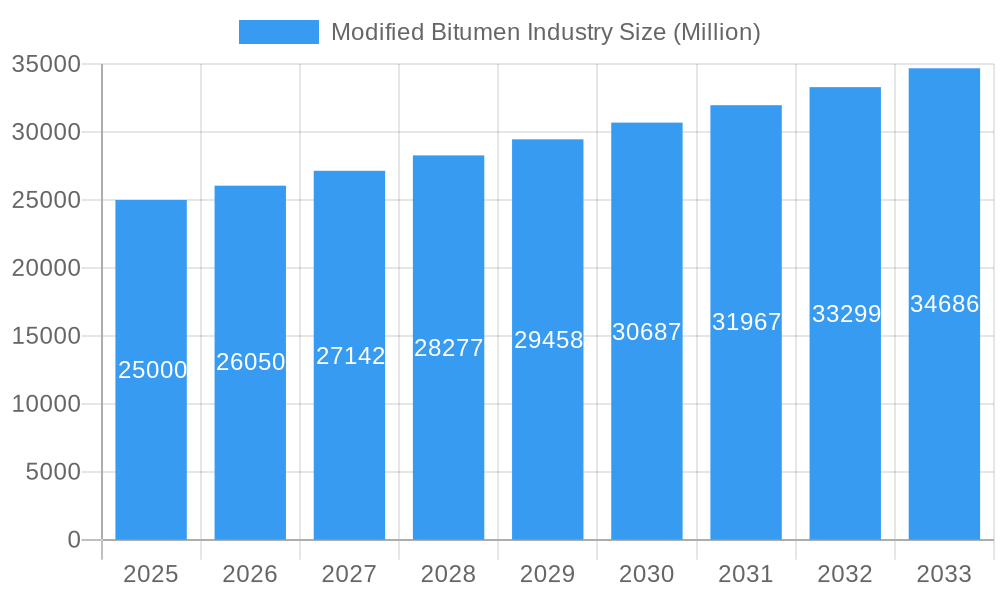

The global Modified Bitumen market is poised for robust expansion, projected to reach a significant market size of approximately USD 25,000 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) exceeding 4.00% throughout the forecast period of 2025-2033. This growth is fundamentally driven by the escalating demand for enhanced asphalt performance in infrastructure development, particularly in road construction and roofing applications. The superior properties of modified bitumen, such as improved elasticity, durability, and resistance to temperature fluctuations, make it an indispensable material for constructing long-lasting and resilient infrastructure. Key market drivers include increasing government investments in infrastructure projects globally, the need for sustainable and environmentally friendly construction materials, and the rising adoption of advanced application techniques like the hot asphalt method, which offers efficiency and quality. The market's trajectory is further bolstered by emerging economies with substantial infrastructure development initiatives, creating significant opportunities for market players.

Modified Bitumen Industry Market Size (In Billion)

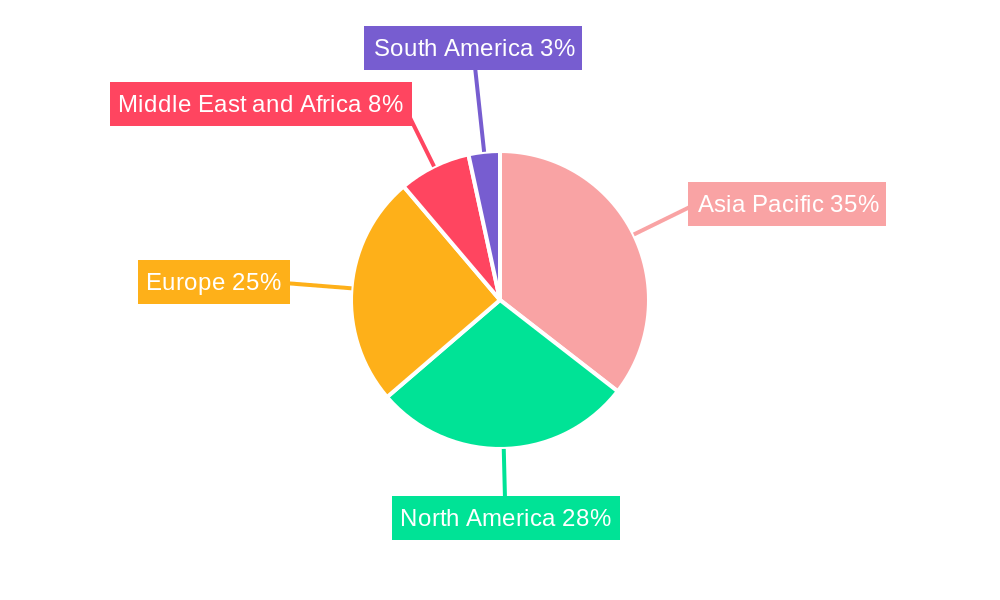

The market is segmented by modifier type, with Styrene-Butadiene-Styrene (SBS) and Atactic Polypropylene (APP) holding dominant positions due to their well-established performance benefits in bitumen modification. The Crumb Rubber segment is also gaining traction as a sustainable alternative, repurposing waste tires into valuable construction materials. Application methods are largely dominated by the Hot Asphalt Method due to its widespread use and efficiency, though Cold Asphalt and Torch Applied methods cater to specific roofing and piping needs. Geographically, the Asia Pacific region, led by China and India, is expected to be a major growth engine due to rapid urbanization and substantial infrastructure spending. North America and Europe continue to represent mature yet significant markets, driven by ongoing road maintenance and repair activities, as well as stringent regulations favoring high-performance roofing solutions. Restraints such as fluctuating raw material prices and the availability of conventional bitumen may pose challenges, but the overarching demand for enhanced performance and longevity in infrastructure is expected to outweigh these limitations, ensuring sustained market growth.

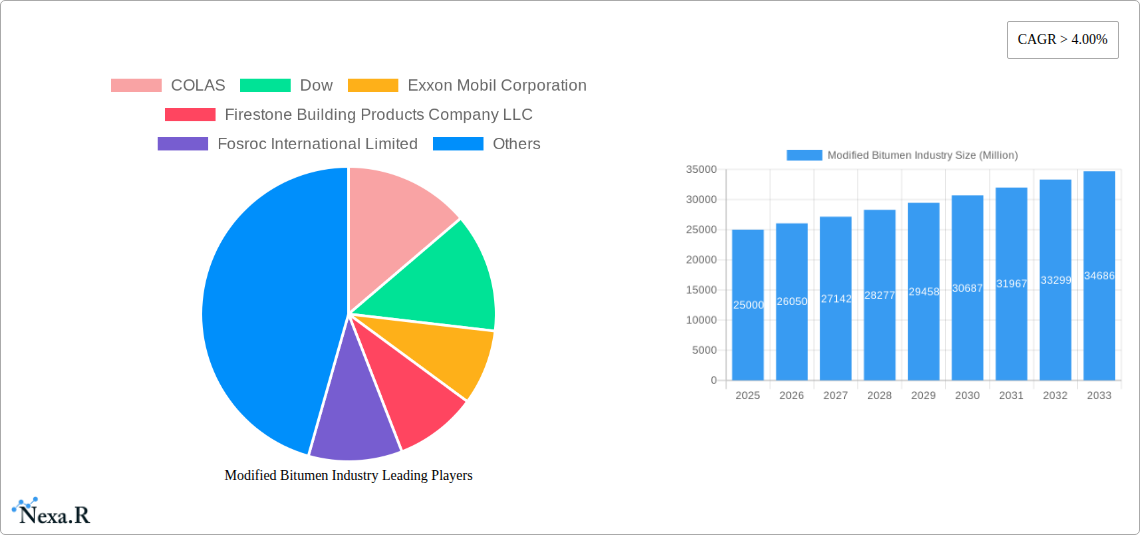

Modified Bitumen Industry Company Market Share

Modified Bitumen Market Report: Global Insights, Growth Trajectories, and Key Player Analysis (2019-2033)

This comprehensive report offers an in-depth analysis of the global Modified Bitumen Industry, a critical sector powering infrastructure and construction worldwide. Leveraging extensive historical data from 2019-2024 and robust forecasts for 2025-2033, with a base year of 2025, this report delivers actionable insights for industry stakeholders. We dissect market dynamics, growth trends, regional dominance, product landscapes, and the strategic positioning of key players. Our analysis encompasses the nuanced parent and child market structures, providing a granular understanding of opportunities and challenges. All quantitative values are presented in Million units for clarity and comparability.

Modified Bitumen Industry Market Dynamics & Structure

The global Modified Bitumen Industry is characterized by a moderately consolidated market structure, with a few major players holding significant market share, while a substantial number of smaller, regional companies cater to niche demands. Technological innovation is a primary driver, spurred by the increasing demand for durable, flexible, and sustainable construction materials. Stringent regulatory frameworks, particularly concerning environmental impact and performance standards, are shaping product development and adoption. Competitive product substitutes, such as polymer-modified asphalt and advanced concrete technologies, exert pressure, necessitating continuous product enhancement. End-user demographics are evolving, with a growing emphasis on long-term cost-effectiveness and reduced maintenance, particularly in large-scale infrastructure projects. Mergers and acquisitions (M&A) are a strategic tool for market expansion and technological consolidation, with recent years witnessing several significant deals aimed at enhancing product portfolios and geographic reach.

- Market Concentration: Moderate, with a mix of global leaders and regional specialists.

- Technological Innovation Drivers: Demand for enhanced durability, flexibility, and environmental performance.

- Regulatory Frameworks: Focus on performance standards, safety, and sustainability.

- Competitive Product Substitutes: Advanced concrete, polymer-modified asphalt.

- End-User Demographics: Growing preference for long-term value and reduced lifecycle costs.

- M&A Trends: Strategic acquisitions for market share expansion and technological integration.

Modified Bitumen Industry Growth Trends & Insights

The global Modified Bitumen Industry is poised for significant expansion, driven by a confluence of factors including robust infrastructure development initiatives worldwide and the increasing recognition of modified bitumen’s superior performance characteristics compared to traditional bitumen. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). Adoption rates for modified bitumen are steadily climbing as governments and private developers prioritize projects that require enhanced durability, resistance to extreme weather conditions, and extended service life. Technological disruptions, such as advancements in modifier types and application techniques, are further propelling market growth. For instance, the development of more efficient and environmentally friendly modifiers, coupled with innovative hot asphalt and cold asphalt application methods, is making modified bitumen a more attractive and versatile material. Consumer behavior is shifting towards a greater appreciation for the long-term economic benefits and reduced environmental footprint offered by modified bitumen solutions. This includes lower lifecycle costs due to less frequent repairs and replacements, and a reduced demand for raw materials over time. The market penetration is expected to deepen across both established and emerging economies, as the need for resilient and sustainable infrastructure becomes paramount.

- Market Size Evolution: Projected to grow at a CAGR of approximately 5.5% during the forecast period.

- Adoption Rates: Steadily increasing due to demand for durability and performance.

- Technological Disruptions: Innovations in modifiers and application methods enhance versatility.

- Consumer Behavior Shifts: Growing preference for long-term economic and environmental benefits.

- Market Penetration: Deepening across both developed and developing regions.

- Key Metrics: Historical market size estimated at $12,500 Million in 2024, with a forecast to reach $19,800 Million by 2033.

Dominant Regions, Countries, or Segments in Modified Bitumen Industry

The Asia-Pacific region stands as the dominant force in the global Modified Bitumen Industry, driven by extensive infrastructure development and rapid urbanization across key economies like China, India, and Southeast Asian nations. Within the Modifier Type segment, Styrene-Butadiene-Styrene (SBS) is a leading modifier, accounting for an estimated 45% market share, due to its superior elasticity, flexibility, and resistance to temperature fluctuations, making it ideal for a wide range of applications. Following closely is Atactic Polypropylene (APP), holding around 30% of the market, known for its UV resistance and higher softening point, making it suitable for roofing and waterproofing applications. Crumb Rubber, derived from recycled tires, is gaining traction due to its sustainability benefits and noise reduction properties, capturing approximately 15% market share.

In terms of Application Method, the Hot Asphalt Method remains the predominant application technique, representing an estimated 70% of the market share. This method is favored for its efficiency in large-scale road construction projects. The Torch Applied Method holds a significant share in the roofing and piping segment, estimated at 20%, offering a durable and waterproof solution. The Cold Asphalt Method is growing in niche applications, particularly for repairs and smaller projects, accounting for about 10%.

For Application, Road Construction is the largest segment, consuming over 60% of the modified bitumen produced. This is directly linked to global investments in improving transportation networks and maintaining existing road infrastructure. Roofing and Piping applications constitute the second-largest segment, accounting for approximately 35%, driven by the construction of residential, commercial, and industrial buildings. Other applications, including waterproofing membranes and industrial coatings, represent the remaining 5%. The dominance of Asia-Pacific is propelled by substantial government spending on infrastructure, coupled with a burgeoning construction sector driven by population growth and economic expansion. Economic policies promoting infrastructure upgrades, coupled with a large labor force and increasing adoption of advanced materials, further cement its leading position.

- Dominant Region: Asia-Pacific.

- Leading Modifier Type: Styrene-Butadiene-Styrene (SBS) (estimated 45% market share).

- Second Leading Modifier Type: Atactic Polypropylene (APP) (estimated 30% market share).

- Growing Modifier Type: Crumb Rubber (estimated 15% market share).

- Dominant Application Method: Hot Asphalt Method (estimated 70% market share).

- Significant Application Method: Torch Applied Method (estimated 20% market share).

- Largest Application Segment: Road Construction (over 60% market share).

- Second Largest Application Segment: Roofing and Piping (approximately 35% market share).

- Key Drivers for Asia-Pacific: Infrastructure investment, urbanization, economic growth, supportive government policies.

Modified Bitumen Industry Product Landscape

The Modified Bitumen Industry is marked by continuous product innovation, with manufacturers actively developing advanced formulations to enhance performance metrics such as elasticity, durability, and resistance to extreme temperatures. Key product innovations include advanced polymer-modified bitumens (PMBs) that offer superior flexibility at low temperatures and improved resistance to rutting at high temperatures. Unique selling propositions often revolve around specialized grades for specific applications, such as highly elastic SBS-modified bitumen for bridge decks or UV-resistant APP-modified bitumen for exposed roofing membranes. Technological advancements are also focused on improving the sustainability of modified bitumen, with a growing emphasis on incorporating recycled materials and developing bitumen with a lower carbon footprint.

Key Drivers, Barriers & Challenges in Modified Bitumen Industry

Key Drivers: The modified bitumen industry is propelled by several critical drivers. Foremost is the escalating global demand for durable and resilient infrastructure, especially in road construction and building sectors, necessitating materials that offer extended service life and reduced maintenance. Technological advancements in polymer modification are yielding enhanced performance characteristics like superior flexibility, elasticity, and temperature resistance, making modified bitumen a preferred choice over traditional bitumen. Supportive government initiatives and increasing investments in infrastructure development projects worldwide act as significant catalysts. Furthermore, the growing emphasis on sustainability and the circular economy is driving the adoption of modified bitumen incorporating recycled materials, such as crumb rubber.

Barriers & Challenges: Despite its promising growth, the industry faces several challenges. Volatility in raw material prices, particularly crude oil, directly impacts the cost of bitumen and modifiers, posing pricing and profitability challenges. Stringent environmental regulations concerning emissions during production and application can increase operational costs and necessitate the adoption of advanced, albeit more expensive, technologies. High initial investment costs for specialized application equipment and training can be a barrier for smaller contractors. Intense competition from alternative materials like asphalt concrete and advanced waterproofing solutions also requires continuous innovation and competitive pricing strategies. Supply chain disruptions, as observed in recent global events, can affect the availability and timely delivery of raw materials and finished products.

Emerging Opportunities in Modified Bitumen Industry

Emerging opportunities within the Modified Bitumen Industry lie in the development of advanced, eco-friendly modified bitumen solutions. There is a growing demand for bitumen with enhanced thermal insulation properties for energy-efficient buildings and roads. Untapped markets in developing regions with rapidly growing infrastructure needs present significant expansion potential. Innovative applications, such as its use in sound barriers for highways and in specialized industrial coatings, offer avenues for market diversification. Evolving consumer preferences for sustainable construction materials are creating opportunities for bitumen products that utilize a higher percentage of recycled content or have a reduced carbon footprint throughout their lifecycle.

Growth Accelerators in the Modified Bitumen Industry Industry

Several catalysts are accelerating the growth of the Modified Bitumen Industry. Technological breakthroughs in creating advanced polymer modifiers that offer superior and tailored performance characteristics are a major growth accelerator. Strategic partnerships between bitumen suppliers, modifier manufacturers, and construction companies are fostering innovation and streamlining product development and market penetration. Market expansion strategies focusing on emerging economies with significant infrastructure development needs are also driving growth. Furthermore, the increasing focus on lifecycle cost analysis by infrastructure developers is highlighting the long-term economic benefits of using modified bitumen, thereby encouraging its widespread adoption.

Key Players Shaping the Modified Bitumen Industry Market

- COLAS

- Dow

- Exxon Mobil Corporation

- Firestone Building Products Company LLC

- Fosroc International Limited

- GAF

- Gazprom Neft PJSC

- Hincol

- Breedon Group plc

- Nynas AB

- ORLEN Asfalt Sp z o o

- Repsol

- Rosneft Deutschland GmbH

- Royal Dutch Shell PLC

- Saint-Gobain Weber

- Sika AG

- SOPREMA S A S

- Texsa Systems slu

- Total

Notable Milestones in Modified Bitumen Industry Sector

- 2020: Introduction of new bio-based polymer modifiers enhancing sustainability.

- 2021: Significant advancements in cold application technologies for modified bitumen.

- 2022: Increased adoption of crumb rubber modified bitumen (CRMB) driven by environmental regulations.

- 2023: Major infrastructure projects worldwide prioritizing high-performance modified bitumen for longevity.

- 2024: Launch of enhanced UV-resistant APP modified bitumen for superior roofing applications.

In-Depth Modified Bitumen Industry Market Outlook

The future of the Modified Bitumen Industry is exceptionally promising, fueled by ongoing global investments in sustainable and resilient infrastructure. Growth accelerators such as continuous innovation in polymer technology, the increasing integration of recycled materials, and strategic collaborations across the value chain will continue to drive market expansion. Strategic focus on emerging markets and the development of specialized bitumen grades for niche applications will unlock new revenue streams. The industry is poised to witness substantial growth as modified bitumen solidifies its position as a critical material for durable construction, meeting the evolving demands for performance, longevity, and environmental responsibility.

Modified Bitumen Industry Segmentation

-

1. Modifier Type

- 1.1. Styrene-Butadiene-Styrene (SBS)

- 1.2. Atactic Polypropylene (APP)

- 1.3. Crumb Rubber

- 1.4. Natural Rubber

- 1.5. Other Modifier Types

-

2. Application Method

- 2.1. Hot Asphalt Method

- 2.2. Cold Asphalt Method

- 2.3. Torch Applied Method

-

3. Application

- 3.1. Road Construction

- 3.2. Roofing and Piping

- 3.3. Other Applications

Modified Bitumen Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Modified Bitumen Industry Regional Market Share

Geographic Coverage of Modified Bitumen Industry

Modified Bitumen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Road Construction and Repair Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Road Construction and Repair Activities; Other Drivers

- 3.4. Market Trends

- 3.4.1. Hot Asphalt Method to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modifier Type

- 5.1.1. Styrene-Butadiene-Styrene (SBS)

- 5.1.2. Atactic Polypropylene (APP)

- 5.1.3. Crumb Rubber

- 5.1.4. Natural Rubber

- 5.1.5. Other Modifier Types

- 5.2. Market Analysis, Insights and Forecast - by Application Method

- 5.2.1. Hot Asphalt Method

- 5.2.2. Cold Asphalt Method

- 5.2.3. Torch Applied Method

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Road Construction

- 5.3.2. Roofing and Piping

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Modifier Type

- 6. Asia Pacific Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Modifier Type

- 6.1.1. Styrene-Butadiene-Styrene (SBS)

- 6.1.2. Atactic Polypropylene (APP)

- 6.1.3. Crumb Rubber

- 6.1.4. Natural Rubber

- 6.1.5. Other Modifier Types

- 6.2. Market Analysis, Insights and Forecast - by Application Method

- 6.2.1. Hot Asphalt Method

- 6.2.2. Cold Asphalt Method

- 6.2.3. Torch Applied Method

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Road Construction

- 6.3.2. Roofing and Piping

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Modifier Type

- 7. North America Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Modifier Type

- 7.1.1. Styrene-Butadiene-Styrene (SBS)

- 7.1.2. Atactic Polypropylene (APP)

- 7.1.3. Crumb Rubber

- 7.1.4. Natural Rubber

- 7.1.5. Other Modifier Types

- 7.2. Market Analysis, Insights and Forecast - by Application Method

- 7.2.1. Hot Asphalt Method

- 7.2.2. Cold Asphalt Method

- 7.2.3. Torch Applied Method

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Road Construction

- 7.3.2. Roofing and Piping

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Modifier Type

- 8. Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Modifier Type

- 8.1.1. Styrene-Butadiene-Styrene (SBS)

- 8.1.2. Atactic Polypropylene (APP)

- 8.1.3. Crumb Rubber

- 8.1.4. Natural Rubber

- 8.1.5. Other Modifier Types

- 8.2. Market Analysis, Insights and Forecast - by Application Method

- 8.2.1. Hot Asphalt Method

- 8.2.2. Cold Asphalt Method

- 8.2.3. Torch Applied Method

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Road Construction

- 8.3.2. Roofing and Piping

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Modifier Type

- 9. South America Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Modifier Type

- 9.1.1. Styrene-Butadiene-Styrene (SBS)

- 9.1.2. Atactic Polypropylene (APP)

- 9.1.3. Crumb Rubber

- 9.1.4. Natural Rubber

- 9.1.5. Other Modifier Types

- 9.2. Market Analysis, Insights and Forecast - by Application Method

- 9.2.1. Hot Asphalt Method

- 9.2.2. Cold Asphalt Method

- 9.2.3. Torch Applied Method

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Road Construction

- 9.3.2. Roofing and Piping

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Modifier Type

- 10. Middle East and Africa Modified Bitumen Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Modifier Type

- 10.1.1. Styrene-Butadiene-Styrene (SBS)

- 10.1.2. Atactic Polypropylene (APP)

- 10.1.3. Crumb Rubber

- 10.1.4. Natural Rubber

- 10.1.5. Other Modifier Types

- 10.2. Market Analysis, Insights and Forecast - by Application Method

- 10.2.1. Hot Asphalt Method

- 10.2.2. Cold Asphalt Method

- 10.2.3. Torch Applied Method

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Road Construction

- 10.3.2. Roofing and Piping

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Modifier Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 COLAS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dow

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Exxon Mobil Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Firestone Building Products Company LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fosroc International Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GAF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gazprom Neft PJSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hincol

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Breedon Group plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nynas AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ORLEN Asfalt Sp z o o

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Repsol

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rosneft Deutschland GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Royal Dutch Shell PLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Saint-Gobain Weber

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sika AG

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SOPREMA S A S

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Texsa Systems slu

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Total*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 COLAS

List of Figures

- Figure 1: Global Modified Bitumen Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Modified Bitumen Industry Revenue (undefined), by Modifier Type 2025 & 2033

- Figure 3: Asia Pacific Modified Bitumen Industry Revenue Share (%), by Modifier Type 2025 & 2033

- Figure 4: Asia Pacific Modified Bitumen Industry Revenue (undefined), by Application Method 2025 & 2033

- Figure 5: Asia Pacific Modified Bitumen Industry Revenue Share (%), by Application Method 2025 & 2033

- Figure 6: Asia Pacific Modified Bitumen Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Asia Pacific Modified Bitumen Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Modified Bitumen Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific Modified Bitumen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Modified Bitumen Industry Revenue (undefined), by Modifier Type 2025 & 2033

- Figure 11: North America Modified Bitumen Industry Revenue Share (%), by Modifier Type 2025 & 2033

- Figure 12: North America Modified Bitumen Industry Revenue (undefined), by Application Method 2025 & 2033

- Figure 13: North America Modified Bitumen Industry Revenue Share (%), by Application Method 2025 & 2033

- Figure 14: North America Modified Bitumen Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: North America Modified Bitumen Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Modified Bitumen Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America Modified Bitumen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Modified Bitumen Industry Revenue (undefined), by Modifier Type 2025 & 2033

- Figure 19: Europe Modified Bitumen Industry Revenue Share (%), by Modifier Type 2025 & 2033

- Figure 20: Europe Modified Bitumen Industry Revenue (undefined), by Application Method 2025 & 2033

- Figure 21: Europe Modified Bitumen Industry Revenue Share (%), by Application Method 2025 & 2033

- Figure 22: Europe Modified Bitumen Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe Modified Bitumen Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Modified Bitumen Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Modified Bitumen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Modified Bitumen Industry Revenue (undefined), by Modifier Type 2025 & 2033

- Figure 27: South America Modified Bitumen Industry Revenue Share (%), by Modifier Type 2025 & 2033

- Figure 28: South America Modified Bitumen Industry Revenue (undefined), by Application Method 2025 & 2033

- Figure 29: South America Modified Bitumen Industry Revenue Share (%), by Application Method 2025 & 2033

- Figure 30: South America Modified Bitumen Industry Revenue (undefined), by Application 2025 & 2033

- Figure 31: South America Modified Bitumen Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Modified Bitumen Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Modified Bitumen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Modified Bitumen Industry Revenue (undefined), by Modifier Type 2025 & 2033

- Figure 35: Middle East and Africa Modified Bitumen Industry Revenue Share (%), by Modifier Type 2025 & 2033

- Figure 36: Middle East and Africa Modified Bitumen Industry Revenue (undefined), by Application Method 2025 & 2033

- Figure 37: Middle East and Africa Modified Bitumen Industry Revenue Share (%), by Application Method 2025 & 2033

- Figure 38: Middle East and Africa Modified Bitumen Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: Middle East and Africa Modified Bitumen Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Modified Bitumen Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Modified Bitumen Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 2: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 3: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Modified Bitumen Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 6: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 7: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Modified Bitumen Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 15: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 16: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Modified Bitumen Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: United States Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Canada Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 22: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 23: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Modified Bitumen Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: France Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 31: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 32: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Modified Bitumen Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Argentina Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Modified Bitumen Industry Revenue undefined Forecast, by Modifier Type 2020 & 2033

- Table 38: Global Modified Bitumen Industry Revenue undefined Forecast, by Application Method 2020 & 2033

- Table 39: Global Modified Bitumen Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Modified Bitumen Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Africa Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Modified Bitumen Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modified Bitumen Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Modified Bitumen Industry?

Key companies in the market include COLAS, Dow, Exxon Mobil Corporation, Firestone Building Products Company LLC, Fosroc International Limited, GAF, Gazprom Neft PJSC, Hincol, Breedon Group plc, Nynas AB, ORLEN Asfalt Sp z o o, Repsol, Rosneft Deutschland GmbH, Royal Dutch Shell PLC, Saint-Gobain Weber, Sika AG, SOPREMA S A S, Texsa Systems slu, Total*List Not Exhaustive.

3. What are the main segments of the Modified Bitumen Industry?

The market segments include Modifier Type, Application Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Road Construction and Repair Activities; Other Drivers.

6. What are the notable trends driving market growth?

Hot Asphalt Method to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Road Construction and Repair Activities; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Modified Bitumen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Modified Bitumen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Modified Bitumen Industry?

To stay informed about further developments, trends, and reports in the Modified Bitumen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence