Key Insights

The global natural fatty acids market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by increasing demand across diverse sectors, primarily fueled by the burgeoning cosmetics and personal care industry's preference for natural and sustainable ingredients. The rising awareness of the health and environmental impacts of synthetic alternatives is further bolstering market growth. Growth is also observed in the household, soap and detergent, and lubricants segments, reflecting the versatility of natural fatty acids in various applications. While the market faces restraints such as price volatility of raw materials and stringent regulatory compliance, the continued innovation in extraction and processing techniques is mitigating these challenges. Specific product types like stearic acid and oleic acid are experiencing significant traction due to their wide-ranging applications and established market presence. Geographically, the Asia-Pacific region, particularly China and India, holds a dominant market share, driven by expanding manufacturing sectors and increasing consumer spending. North America and Europe also represent substantial markets, characterized by mature industries and high consumer demand for natural and sustainable products.

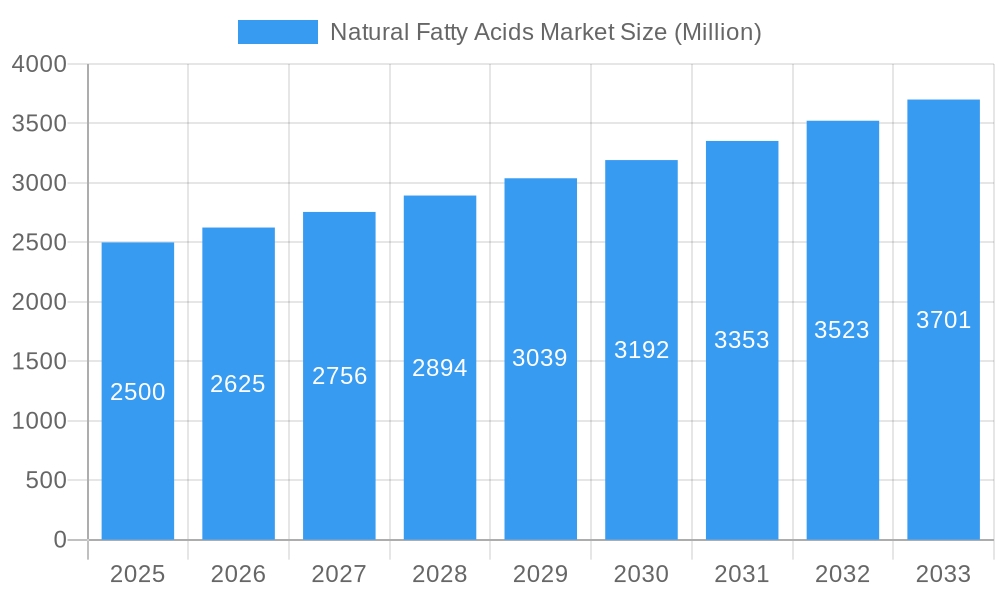

Natural Fatty Acids Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established multinational corporations and regional players. Key players are strategically investing in research and development to enhance product quality and expand their product portfolios. Acquisitions and mergers are also anticipated to play a role in shaping market dynamics. The market’s future trajectory hinges on several factors, including the development of sustainable sourcing practices, technological advancements in fatty acid extraction, and the growing global emphasis on environmentally friendly alternatives. Further growth is anticipated as consumers become increasingly conscious of the ingredients they use and prioritize naturally-derived options. The continued expansion of the global population and the consequent rise in demand for consumer goods will also serve as a significant driver of future market growth.

Natural Fatty Acids Market Company Market Share

Natural Fatty Acids Market: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Natural Fatty Acids market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The parent market is the broader Oleochemicals Market while the child markets include Stearic Acid Market, Oleic Acid Market, and others. The market is projected to reach xx Million by 2033.

Natural Fatty Acids Market Dynamics & Structure

The Natural Fatty Acids market is characterized by a moderately concentrated structure with several major players holding significant market share. Technological innovation, particularly in bio-based fatty acid production, is a key driver. Stringent regulatory frameworks concerning sustainability and environmental impact influence market dynamics. Competitive pressure from synthetic fatty acids necessitates continuous product improvement and cost optimization. End-user demographics, specifically growing demand from the cosmetics and personal care sector, fuel market expansion. M&A activity has been moderate, with a few strategic acquisitions aiming to enhance market reach and product portfolios.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Focus on bio-based production and sustainable sourcing is driving innovation.

- Regulatory Framework: Growing emphasis on sustainability and eco-friendly products shapes regulations.

- Competitive Substitutes: Synthetic fatty acids pose a significant competitive challenge.

- End-User Demographics: The cosmetics, personal care, and bio-based industries are key growth drivers.

- M&A Trends: Moderate M&A activity focuses on expanding product lines and geographic reach; xx major deals were recorded between 2019-2024.

Natural Fatty Acids Market Growth Trends & Insights

The Natural Fatty Acids market has demonstrated robust and consistent growth throughout the historical period (2019-2024), propelled by a surge in demand from a diverse array of end-use industries. The market size is currently estimated at **[Insert 2025 Market Size Here - e.g., $500 Million]** in 2025 and is strategically projected to achieve a Compound Annual Growth Rate (CAGR) of **[Insert CAGR Here - e.g., 6.5%]** during the forecast period (2025-2033). This upward trajectory is underpinned by several pivotal factors: an accelerating consumer preference for natural, ethically sourced, and sustainable products; the continuous expansion of applications across a multitude of sectors; and significant technological advancements that are enhancing production efficiency and elevating product quality. Adoption rates are particularly pronounced within the cosmetics and personal care sectors, which represent a primary growth engine. Concurrently, the oilfield and rubber & plastics industries are exhibiting considerable growth potential, signaling diversification in demand. Technological innovations, especially in the realm of bio-based production methodologies, are acting as powerful catalysts, further accelerating market expansion. The profound shift in consumer behavior towards environmentally conscious choices is a substantial contributor to this overarching trend. While market penetration remains highest in well-established developed regions, there is a steady and promising increase in adoption rates within developing economies, indicating a global expansion of the market's reach.

Dominant Regions, Countries, or Segments in Natural Fatty Acids Market

North America currently holds the largest market share in the Natural Fatty Acids market, followed by Europe and Asia Pacific. Within applications, the cosmetics and personal care segment demonstrates the highest growth potential, driven by increasing demand for natural ingredients in beauty products. The stearic acid type dominates the market due to its wide range of applications.

- Key Drivers: Growing consumer awareness of natural ingredients, stringent regulations on synthetic chemicals, and increasing demand for eco-friendly products are key drivers.

- Dominance Factors: North America’s dominance stems from established industries, high consumer spending, and early adoption of natural ingredients. Asia Pacific shows high growth potential due to increasing disposable income and expanding consumer base.

- Growth Potential: The cosmetics and personal care sector, along with the expanding bio-based chemical industry, displays significant growth potential.

Natural Fatty Acids Market Product Landscape

The Natural Fatty Acids market offers a diverse range of products, including stearic acid, oleic acid, and other specialized fatty acids, each tailored to specific applications. Recent innovations focus on enhancing product purity, improving performance characteristics, and developing sustainable production methods. Unique selling propositions often center around sustainability certifications, superior quality, and customized formulations for specific end-use industries. Technological advancements are mainly focused on optimizing extraction processes and reducing environmental impact.

Key Drivers, Barriers & Challenges in Natural Fatty Acids Market

Key Drivers: The Natural Fatty Acids market is propelled by a confluence of powerful drivers. Foremost among these is the escalating consumer demand for natural and sustainably produced products, a trend that resonates across various demographics and geographies. Complementing this is the ever-expanding spectrum of applications for natural fatty acids in diverse industries, from food and pharmaceuticals to personal care and industrial manufacturing. Furthermore, continuous technological advancements, particularly in efficient and eco-friendly bio-based production methods, are not only improving output but also reducing costs, thereby making natural fatty acids more competitive. The increasing integration of these ingredients into everyday consumer goods and specialized industrial processes is directly fueling market growth and widening its adoption base.

Challenges & Restraints: Despite the optimistic growth outlook, the Natural Fatty Acids market faces a set of formidable challenges and restraints. Significant price volatility in the raw materials, which are often agricultural commodities, can impact profitability and market predictability. Stringent regulatory compliance requirements, particularly concerning purity standards and sourcing ethics, can add to operational complexities and costs. The market also grapples with intense competition from readily available and often cheaper synthetic alternatives, which can sway price-sensitive consumers and industries. Supply chain disruptions, whether due to geopolitical events, climate change affecting agricultural yields, or logistical hurdles, can significantly impact production schedules and timely delivery. Moreover, for certain advanced bio-based production methods, limitations in achieving true industrial-scale efficiency and consistency in product quality can act as a brake on rapid market expansion. The ongoing quest for uniform product quality across different sources and processing methods remains a critical challenge for manufacturers.

Emerging Opportunities in Natural Fatty Acids Market

The Natural Fatty Acids market is ripe with emerging opportunities, particularly in geographies and applications that are currently underserved. Untapped markets, especially in developing economies, present a significant avenue for growth. As disposable incomes rise and awareness of health and environmental benefits increases, consumers in these regions are increasingly seeking natural and sustainable alternatives. Innovative applications in high-growth sectors such as bioplastics, where natural fatty acids can serve as building blocks, and biofuels, offering a renewable energy source, represent substantial long-term growth potential. The development of specialized industrial chemicals derived from natural fatty acids, catering to niche but growing demands, also offers promising avenues. Furthermore, the continuous evolution of consumer preferences, with a growing emphasis on transparency, ethical sourcing, and the "clean label" movement, consistently creates new market opportunities for manufacturers who can effectively meet these demands with high-quality, traceable, and sustainably produced natural fatty acids.

Growth Accelerators in the Natural Fatty Acids Market Industry

Technological breakthroughs in bio-based production, offering sustainable and cost-effective alternatives, are crucial growth catalysts. Strategic partnerships between producers and end-use industries foster innovation and market penetration. Market expansion strategies targeting emerging economies and niche applications are further accelerating growth. The ongoing shift towards sustainable and eco-friendly products presents a long-term growth opportunity for this market.

Key Players Shaping the Natural Fatty Acids Market Market

- Kraton Performance Polymers Inc

- Yueyang Ch-Cheng Oleochemicals Co Ltd

- Ashland Inc

- Akzo Nobel NV

- Croda Industrial Chemicals

- BASF SE

- SABIC

- Eastman Chemical Company

- Chemithon Corporation

- Chemol Company Inc

- LG Chemicals

- Faci SpA

- Baerlocher GmbH

- Behn-Meyer Holding AG

- Zibo Fenbao Chemical Co Ltd

- Pacific Oleochemicals Sdn Bhd

Notable Milestones in Natural Fatty Acids Market Sector

- November 2022: Sinarmas Cepsa Pte Ltd (SCPL) and its parent companies unveiled ambitious plans for the expansion of their bio-based chemical production facilities. This strategic move signals a substantial investment in the sector and has the potential to significantly increase the overall supply of bio-based chemicals, including natural fatty acids, thereby influencing market dynamics and availability.

- August 2022: Kraton Chemical LLC made a strategic move to expand its distribution network across Australia and New Zealand. This expansion is designed to enhance market access for their product portfolio, which includes natural fatty acids and their derivatives, potentially leading to increased sales volumes and a stronger presence in these key markets.

- [Insert New Milestone Here - e.g., January 2024]: [Brief description of a new, relevant milestone, such as a significant product launch, a new research breakthrough in sustainable sourcing, or a strategic partnership focused on expanding applications.]

In-Depth Natural Fatty Acids Market Market Outlook

The Natural Fatty Acids market is poised for continued robust growth, driven by the aforementioned factors. Strategic investments in sustainable production technologies and expansion into new markets will be key to maximizing future potential. Companies that successfully adapt to evolving consumer preferences and regulatory landscapes will be best positioned to capture significant market share. The long-term outlook remains positive, with significant opportunities for growth and innovation within this vital sector.

Natural Fatty Acids Market Segmentation

-

1. Type

- 1.1. Stearic Acid

- 1.2. Distilled Fatty Acid

- 1.3. C8 Caprylic Fatty Acid

- 1.4. Tall Oil Fatty Acid

- 1.5. Oleic Acid

-

2. Application

- 2.1. Household, Cosmetics, and Personal Care

- 2.2. Soap and Detergent

- 2.3. Oilfield

- 2.4. Rubber and Plastic

- 2.5. Lubricants

- 2.6. Other End-user Industries

Natural Fatty Acids Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Natural Fatty Acids Market Regional Market Share

Geographic Coverage of Natural Fatty Acids Market

Natural Fatty Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Glycerin to Manufacture Propylene Glycol and Epichlorohydrin; Government Regulations Promoting the Use of Eco-friendly Products; Broader Use of C18s in Oilfield and Drilling Applications; Increasing Demand from the Cosmetics and Personal Care Market

- 3.3. Market Restrains

- 3.3.1. Fluctuating Supply and Prices of Feed Stock Materials

- 3.4. Market Trends

- 3.4.1 Household

- 3.4.2 Cosmetics

- 3.4.3 and Personal Care Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stearic Acid

- 5.1.2. Distilled Fatty Acid

- 5.1.3. C8 Caprylic Fatty Acid

- 5.1.4. Tall Oil Fatty Acid

- 5.1.5. Oleic Acid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Household, Cosmetics, and Personal Care

- 5.2.2. Soap and Detergent

- 5.2.3. Oilfield

- 5.2.4. Rubber and Plastic

- 5.2.5. Lubricants

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stearic Acid

- 6.1.2. Distilled Fatty Acid

- 6.1.3. C8 Caprylic Fatty Acid

- 6.1.4. Tall Oil Fatty Acid

- 6.1.5. Oleic Acid

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Household, Cosmetics, and Personal Care

- 6.2.2. Soap and Detergent

- 6.2.3. Oilfield

- 6.2.4. Rubber and Plastic

- 6.2.5. Lubricants

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stearic Acid

- 7.1.2. Distilled Fatty Acid

- 7.1.3. C8 Caprylic Fatty Acid

- 7.1.4. Tall Oil Fatty Acid

- 7.1.5. Oleic Acid

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Household, Cosmetics, and Personal Care

- 7.2.2. Soap and Detergent

- 7.2.3. Oilfield

- 7.2.4. Rubber and Plastic

- 7.2.5. Lubricants

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stearic Acid

- 8.1.2. Distilled Fatty Acid

- 8.1.3. C8 Caprylic Fatty Acid

- 8.1.4. Tall Oil Fatty Acid

- 8.1.5. Oleic Acid

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Household, Cosmetics, and Personal Care

- 8.2.2. Soap and Detergent

- 8.2.3. Oilfield

- 8.2.4. Rubber and Plastic

- 8.2.5. Lubricants

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stearic Acid

- 9.1.2. Distilled Fatty Acid

- 9.1.3. C8 Caprylic Fatty Acid

- 9.1.4. Tall Oil Fatty Acid

- 9.1.5. Oleic Acid

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Household, Cosmetics, and Personal Care

- 9.2.2. Soap and Detergent

- 9.2.3. Oilfield

- 9.2.4. Rubber and Plastic

- 9.2.5. Lubricants

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Natural Fatty Acids Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Stearic Acid

- 10.1.2. Distilled Fatty Acid

- 10.1.3. C8 Caprylic Fatty Acid

- 10.1.4. Tall Oil Fatty Acid

- 10.1.5. Oleic Acid

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Household, Cosmetics, and Personal Care

- 10.2.2. Soap and Detergent

- 10.2.3. Oilfield

- 10.2.4. Rubber and Plastic

- 10.2.5. Lubricants

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kraton Performance Polymers Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yueyang Ch-Cheng Oleochemicals Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ashland Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Akzo Nobel NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Croda Industrial Chemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SABIC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eastman Chemical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chemithon Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chemol Company Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LG Chemicals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Faci SpA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Baerlocher GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Behn-Meyer Holding AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zibo Fenbao Chemical Co Ltd*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pacific Oleochemicals Sdn Bhd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Kraton Performance Polymers Inc

List of Figures

- Figure 1: Global Natural Fatty Acids Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Natural Fatty Acids Market Volume Breakdown (liter , %) by Region 2025 & 2033

- Figure 3: Asia Pacific Natural Fatty Acids Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Natural Fatty Acids Market Volume (liter ), by Type 2025 & 2033

- Figure 5: Asia Pacific Natural Fatty Acids Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Natural Fatty Acids Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Natural Fatty Acids Market Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Natural Fatty Acids Market Volume (liter ), by Application 2025 & 2033

- Figure 9: Asia Pacific Natural Fatty Acids Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Natural Fatty Acids Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Natural Fatty Acids Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Natural Fatty Acids Market Volume (liter ), by Country 2025 & 2033

- Figure 13: Asia Pacific Natural Fatty Acids Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Natural Fatty Acids Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Natural Fatty Acids Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Natural Fatty Acids Market Volume (liter ), by Type 2025 & 2033

- Figure 17: North America Natural Fatty Acids Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Natural Fatty Acids Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Natural Fatty Acids Market Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Natural Fatty Acids Market Volume (liter ), by Application 2025 & 2033

- Figure 21: North America Natural Fatty Acids Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Natural Fatty Acids Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Natural Fatty Acids Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Natural Fatty Acids Market Volume (liter ), by Country 2025 & 2033

- Figure 25: North America Natural Fatty Acids Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Natural Fatty Acids Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Natural Fatty Acids Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Natural Fatty Acids Market Volume (liter ), by Type 2025 & 2033

- Figure 29: Europe Natural Fatty Acids Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Natural Fatty Acids Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Natural Fatty Acids Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Natural Fatty Acids Market Volume (liter ), by Application 2025 & 2033

- Figure 33: Europe Natural Fatty Acids Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Natural Fatty Acids Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Natural Fatty Acids Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Natural Fatty Acids Market Volume (liter ), by Country 2025 & 2033

- Figure 37: Europe Natural Fatty Acids Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Natural Fatty Acids Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Natural Fatty Acids Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Natural Fatty Acids Market Volume (liter ), by Type 2025 & 2033

- Figure 41: South America Natural Fatty Acids Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Natural Fatty Acids Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Natural Fatty Acids Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Natural Fatty Acids Market Volume (liter ), by Application 2025 & 2033

- Figure 45: South America Natural Fatty Acids Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Natural Fatty Acids Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Natural Fatty Acids Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Natural Fatty Acids Market Volume (liter ), by Country 2025 & 2033

- Figure 49: South America Natural Fatty Acids Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Natural Fatty Acids Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Natural Fatty Acids Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Natural Fatty Acids Market Volume (liter ), by Type 2025 & 2033

- Figure 53: Middle East and Africa Natural Fatty Acids Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Natural Fatty Acids Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Natural Fatty Acids Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Natural Fatty Acids Market Volume (liter ), by Application 2025 & 2033

- Figure 57: Middle East and Africa Natural Fatty Acids Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Natural Fatty Acids Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Natural Fatty Acids Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Natural Fatty Acids Market Volume (liter ), by Country 2025 & 2033

- Figure 61: Middle East and Africa Natural Fatty Acids Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Natural Fatty Acids Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 3: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 5: Global Natural Fatty Acids Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Natural Fatty Acids Market Volume liter Forecast, by Region 2020 & 2033

- Table 7: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 9: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 11: Global Natural Fatty Acids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Natural Fatty Acids Market Volume liter Forecast, by Country 2020 & 2033

- Table 13: China Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 15: India Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 17: Japan Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 19: South Korea Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 23: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 25: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 27: Global Natural Fatty Acids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Natural Fatty Acids Market Volume liter Forecast, by Country 2020 & 2033

- Table 29: United States Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 31: Canada Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 33: Mexico Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 35: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 37: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 39: Global Natural Fatty Acids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Natural Fatty Acids Market Volume liter Forecast, by Country 2020 & 2033

- Table 41: Germany Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 45: France Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 47: Italy Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 51: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 53: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 55: Global Natural Fatty Acids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Natural Fatty Acids Market Volume liter Forecast, by Country 2020 & 2033

- Table 57: Brazil Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 59: Argentina Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 63: Global Natural Fatty Acids Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Natural Fatty Acids Market Volume liter Forecast, by Type 2020 & 2033

- Table 65: Global Natural Fatty Acids Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Natural Fatty Acids Market Volume liter Forecast, by Application 2020 & 2033

- Table 67: Global Natural Fatty Acids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Natural Fatty Acids Market Volume liter Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 71: South Africa Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Natural Fatty Acids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Natural Fatty Acids Market Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Fatty Acids Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Natural Fatty Acids Market?

Key companies in the market include Kraton Performance Polymers Inc, Yueyang Ch-Cheng Oleochemicals Co Ltd, Ashland Inc, Akzo Nobel NV, Croda Industrial Chemicals, BASF SE, SABIC, Eastman Chemical Company, Chemithon Corporation, Chemol Company Inc, LG Chemicals, Faci SpA, Baerlocher GmbH, Behn-Meyer Holding AG, Zibo Fenbao Chemical Co Ltd*List Not Exhaustive, Pacific Oleochemicals Sdn Bhd.

3. What are the main segments of the Natural Fatty Acids Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Glycerin to Manufacture Propylene Glycol and Epichlorohydrin; Government Regulations Promoting the Use of Eco-friendly Products; Broader Use of C18s in Oilfield and Drilling Applications; Increasing Demand from the Cosmetics and Personal Care Market.

6. What are the notable trends driving market growth?

Household. Cosmetics. and Personal Care Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

Fluctuating Supply and Prices of Feed Stock Materials.

8. Can you provide examples of recent developments in the market?

November 2022: Sinarmas Cepsa Pte Ltd (SCPL) and its parent companies, the chemicals business of CEPSA and agribusiness Golden Agri-Resources (GAR), signed a Memorandum of Understanding to expand the production of bio-based chemicals at SCPL's site in Lubuk Gaung, Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Natural Fatty Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Natural Fatty Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Natural Fatty Acids Market?

To stay informed about further developments, trends, and reports in the Natural Fatty Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence