Key Insights

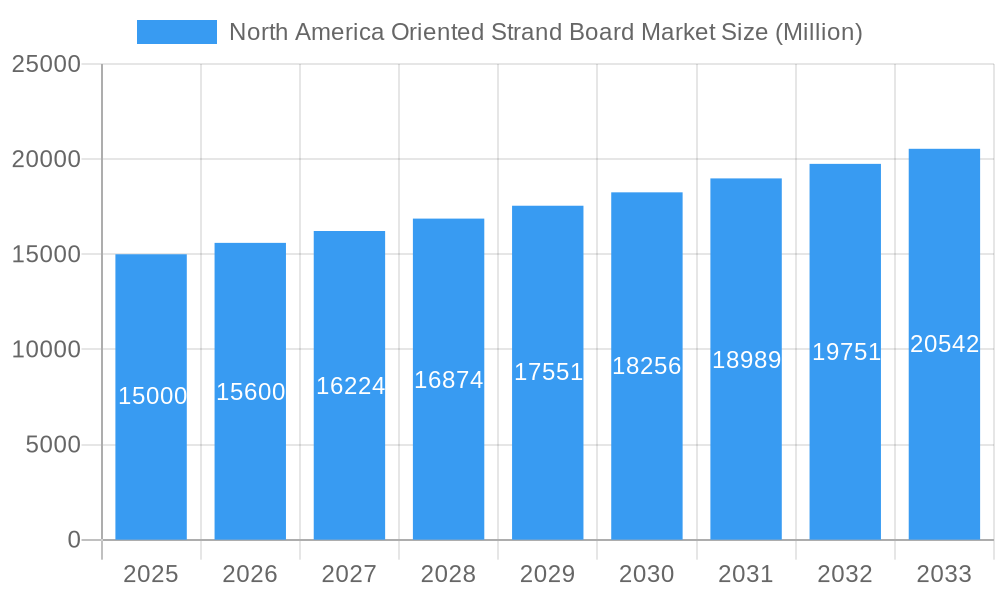

The North American Oriented Strand Board (OSB) market is experiencing robust growth, fueled by a CAGR exceeding 4% from 2019 to 2033. This expansion is driven primarily by the burgeoning construction sector, particularly residential building, which remains a significant consumer of OSB for sheathing, roofing, and flooring applications. Increased demand for affordable housing and ongoing infrastructure development projects further contribute to market expansion. While fluctuations in lumber prices and raw material availability pose challenges, technological advancements in OSB manufacturing, leading to improved product quality and efficiency, are mitigating these constraints. The market is segmented based on product type (e.g., thickness, grade), end-use (residential, commercial, industrial), and geographic region. Major players like Egger Group, Georgia-Pacific, and Weyerhaeuser, amongst others, hold significant market share, competing based on product differentiation, pricing strategies, and distribution networks. The market is expected to witness continued growth, driven by ongoing construction activity and the increasing preference for OSB due to its cost-effectiveness and performance characteristics.

North America Oriented Strand Board Market Market Size (In Billion)

The forecast period (2025-2033) projects continued growth, albeit potentially at a slightly moderated pace compared to the historical period. This moderation could stem from factors such as economic cycles influencing construction activity and potential shifts in material preferences. However, long-term prospects remain positive given the ongoing need for housing and infrastructure development across North America. The competitive landscape is likely to remain dynamic, with existing players consolidating their positions and new entrants potentially emerging through innovation and strategic partnerships. Analysis suggests that the increasing adoption of sustainable forestry practices and the development of environmentally friendly OSB products will further shape market trends in the coming years. Market players will need to adapt to these evolving dynamics by focusing on innovation, supply chain management, and environmentally conscious production processes.

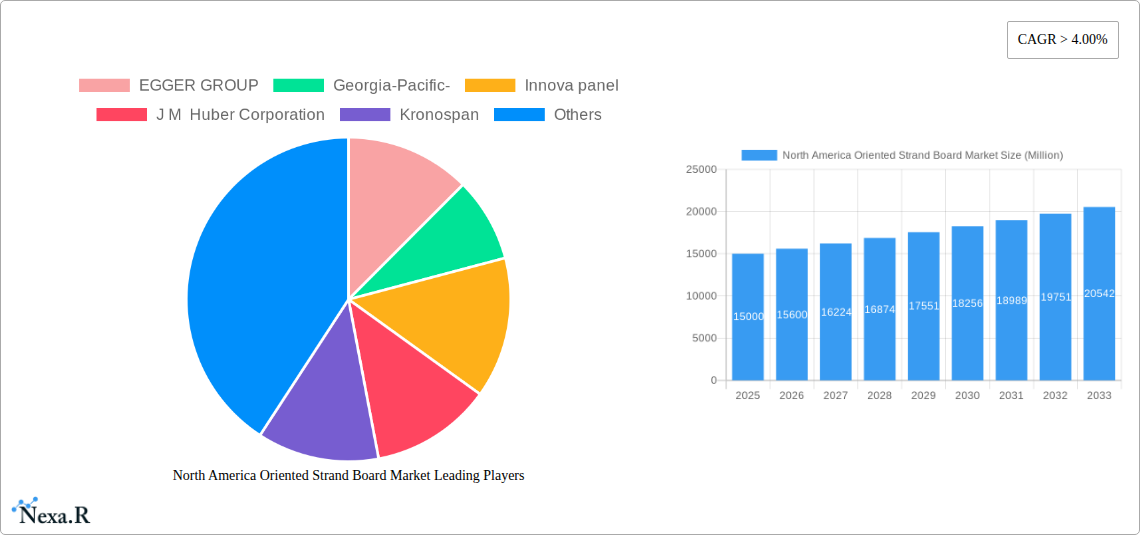

North America Oriented Strand Board Market Company Market Share

North America Oriented Strand Board (OSB) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Oriented Strand Board (OSB) market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market valued at xx Million units in 2025. The parent market is the North American building materials market, while the child market comprises residential and commercial construction segments.

North America Oriented Strand Board Market Dynamics & Structure

This section analyzes the North American OSB market's competitive landscape, technological advancements, regulatory environment, and market forces. The market is characterized by a moderate level of concentration, with key players like EGGER GROUP, Georgia-Pacific, Innova panel, J M Huber Corporation, Kronospan, Louisiana-Pacific Corporation, Mans Lumber & Millwork, RoyOMartin, SWISS KRONO, West Fraser, and Weyerhaeuser Co. holding significant market share (exact percentages determined through proprietary data analysis).

- Market Concentration: xx% of the market is held by the top 5 players.

- Technological Innovation: Focus on improving OSB strength, durability, and sustainability through material innovations and manufacturing processes. Innovation barriers include high R&D costs and stringent environmental regulations.

- Regulatory Framework: Building codes and environmental standards influence OSB production and usage.

- Competitive Substitutes: Plywood, engineered wood products, and other construction materials compete with OSB.

- End-User Demographics: Residential and commercial construction drive demand. Growth in housing starts positively correlates with OSB demand.

- M&A Trends: The past five years witnessed xx M&A deals, primarily focused on expanding production capacity and geographical reach (specific deal details within the full report).

North America Oriented Strand Board Market Growth Trends & Insights

The North American OSB market experienced significant growth during the historical period (2019-2024), driven primarily by robust construction activity. The market size reached xx Million units in 2024, exhibiting a CAGR of xx% during this period. Factors such as increased investment in infrastructure projects, growing residential construction, and rising demand for sustainable building materials contributed to this growth. The forecast period (2025-2033) anticipates continued expansion, with a projected CAGR of xx%, reaching xx Million units by 2033. Technological advancements in OSB manufacturing, such as improved bonding techniques and the use of recycled materials, are expected to further drive market growth. Consumer behavior shifts towards sustainable and cost-effective building materials also contribute to increased OSB adoption. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

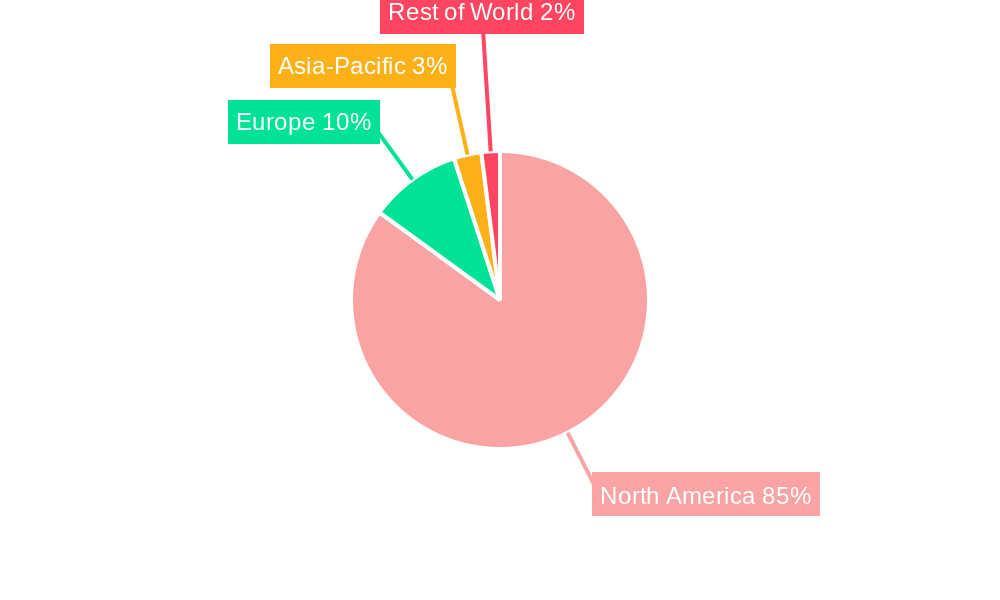

Dominant Regions, Countries, or Segments in North America Oriented Strand Board Market

The Southern and Western regions of the United States are the most dominant markets within North America due to concentrated residential and commercial construction activity and favorable economic climates in those areas. The Canadian market, while smaller, displays steady growth.

- Key Drivers:

- Strong housing market in the South and West.

- Increased infrastructure investments.

- Favorable government policies promoting construction.

- Growing demand for eco-friendly building materials.

- Dominance Factors: High construction activity, availability of raw materials, and strong economic conditions contribute to the dominance of these regions. Market share for the US South is estimated at xx% in 2025, while the US West holds approximately xx%. Canada accounts for approximately xx% of the total market share. Growth potential is projected to be highest in the rapidly developing urban areas within these regions.

North America Oriented Strand Board Market Product Landscape

The OSB market offers a range of products varying in thickness, density, and performance characteristics, catering to diverse applications in construction. Recent product innovations focus on improving strength, moisture resistance, and sustainability. These include OSB panels with enhanced bonding properties and the use of recycled wood fibers. These advancements cater to stricter building codes and increased demand for eco-friendly construction materials. Performance metrics like tensile strength, shear strength, and modulus of elasticity are key differentiators within the market.

Key Drivers, Barriers & Challenges in North America Oriented Strand Board Market

Key Drivers:

- Robust housing market and infrastructure development.

- Growing demand for cost-effective and sustainable building materials.

- Technological advancements leading to improved OSB properties.

Challenges and Restraints:

- Fluctuations in raw material prices (wood chips) can impact OSB pricing and profitability.

- Stringent environmental regulations may increase production costs.

- Competition from other building materials (plywood, etc.) can limit market share growth. The competitive intensity is estimated to increase by xx% by 2033.

Emerging Opportunities in North America Oriented Strand Board Market

- Expansion into prefabricated construction and modular building systems.

- Development of high-performance OSB panels for specialized applications.

- Increased use of recycled wood fibers to enhance sustainability.

- Growing demand for OSB in non-traditional applications (e.g., furniture).

Growth Accelerators in the North America Oriented Strand Board Market Industry

Technological advancements, strategic partnerships between OSB manufacturers and construction companies, and expansion into new geographical markets, particularly within the rapidly growing urban areas of the south and west are key factors accelerating the long-term growth of the North American OSB market. Furthermore, government incentives and subsidies for sustainable building materials are also positively impacting the market.

Key Players Shaping the North America Oriented Strand Board Market Market

- EGGER GROUP

- Georgia-Pacific

- Innova panel

- J M Huber Corporation

- Kronospan

- Louisiana-Pacific Corporation

- Mans Lumber & Millwork

- RoyOMartin

- SWISS KRONO

- West Fraser

- Weyerhaeuser Co

- *List Not Exhaustive

Notable Milestones in North America Oriented Strand Board Market Sector

- August 2021: RoyOMartin announced a USD 211 million investment in a new OSB plant in Texas, expanding regional supply.

- October 2022: Martco LLC announced a second OSB production facility in Corrigan, Texas, driven by high regional demand.

In-Depth North America Oriented Strand Board Market Outlook

The North American OSB market is poised for continued growth, driven by several factors, including a robust housing market, increased infrastructure spending, and the growing adoption of sustainable building practices. Strategic partnerships, investments in advanced manufacturing technologies, and the development of innovative OSB products will further shape the market's trajectory. The market presents significant opportunities for companies focused on sustainability, technological advancements, and effective supply chain management. The long-term growth potential is substantial, with projections indicating significant market expansion throughout the forecast period.

North America Oriented Strand Board Market Segmentation

-

1. Grade

- 1.1. OSB/1

- 1.2. OSB/2

- 1.3. OSB/3

- 1.4. OSB/4

-

2. End-user Industry

- 2.1. Furniture

- 2.2. Construction

- 2.3. Packaging

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Oriented Strand Board Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oriented Strand Board Market Regional Market Share

Geographic Coverage of North America Oriented Strand Board Market

North America Oriented Strand Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapidly expanding construction industry; Rise in imports and export

- 3.2.2 leading to increased packaging

- 3.3. Market Restrains

- 3.3.1 Rapidly expanding construction industry; Rise in imports and export

- 3.3.2 leading to increased packaging

- 3.4. Market Trends

- 3.4.1. Rising Demand for Oriented Strand Board (OSB) from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. OSB/1

- 5.1.2. OSB/2

- 5.1.3. OSB/3

- 5.1.4. OSB/4

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Furniture

- 5.2.2. Construction

- 5.2.3. Packaging

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. United States North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. OSB/1

- 6.1.2. OSB/2

- 6.1.3. OSB/3

- 6.1.4. OSB/4

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Furniture

- 6.2.2. Construction

- 6.2.3. Packaging

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Canada North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. OSB/1

- 7.1.2. OSB/2

- 7.1.3. OSB/3

- 7.1.4. OSB/4

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Furniture

- 7.2.2. Construction

- 7.2.3. Packaging

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Mexico North America Oriented Strand Board Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. OSB/1

- 8.1.2. OSB/2

- 8.1.3. OSB/3

- 8.1.4. OSB/4

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Furniture

- 8.2.2. Construction

- 8.2.3. Packaging

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EGGER GROUP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Georgia-Pacific-

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Innova panel

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 J M Huber Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kronospan

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Louisiana-Pacific Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Mans Lumber & Millwork

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 RoyOMartin

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 SWISS KRONO

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 West Fraser

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Weyerhaeuser Co *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 EGGER GROUP

List of Figures

- Figure 1: Global North America Oriented Strand Board Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 3: United States North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: United States North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: United States North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: United States North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: United States North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United States North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 11: Canada North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 12: Canada North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 13: Canada North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Canada North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Canada North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Canada North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Oriented Strand Board Market Revenue (Million), by Grade 2025 & 2033

- Figure 19: Mexico North America Oriented Strand Board Market Revenue Share (%), by Grade 2025 & 2033

- Figure 20: Mexico North America Oriented Strand Board Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 21: Mexico North America Oriented Strand Board Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Mexico North America Oriented Strand Board Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Mexico North America Oriented Strand Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Oriented Strand Board Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Mexico North America Oriented Strand Board Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global North America Oriented Strand Board Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 6: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 10: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global North America Oriented Strand Board Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 14: Global North America Oriented Strand Board Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global North America Oriented Strand Board Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global North America Oriented Strand Board Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oriented Strand Board Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Oriented Strand Board Market?

Key companies in the market include EGGER GROUP, Georgia-Pacific-, Innova panel, J M Huber Corporation, Kronospan, Louisiana-Pacific Corporation, Mans Lumber & Millwork, RoyOMartin, SWISS KRONO, West Fraser, Weyerhaeuser Co *List Not Exhaustive.

3. What are the main segments of the North America Oriented Strand Board Market?

The market segments include Grade, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly expanding construction industry; Rise in imports and export. leading to increased packaging.

6. What are the notable trends driving market growth?

Rising Demand for Oriented Strand Board (OSB) from the Construction Industry.

7. Are there any restraints impacting market growth?

Rapidly expanding construction industry; Rise in imports and export. leading to increased packaging.

8. Can you provide examples of recent developments in the market?

October 2022: Martco LLC revealed that Corrigan OSB LLC, its Texas subsidiary, would build a second-oriented strand board (OSB) production facility near its present, state-of-the-art OSB factory in Corrigan, Texas. This expansion will meet the region's demand for Oriented strand boards (OSB).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oriented Strand Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oriented Strand Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oriented Strand Board Market?

To stay informed about further developments, trends, and reports in the North America Oriented Strand Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence