Key Insights

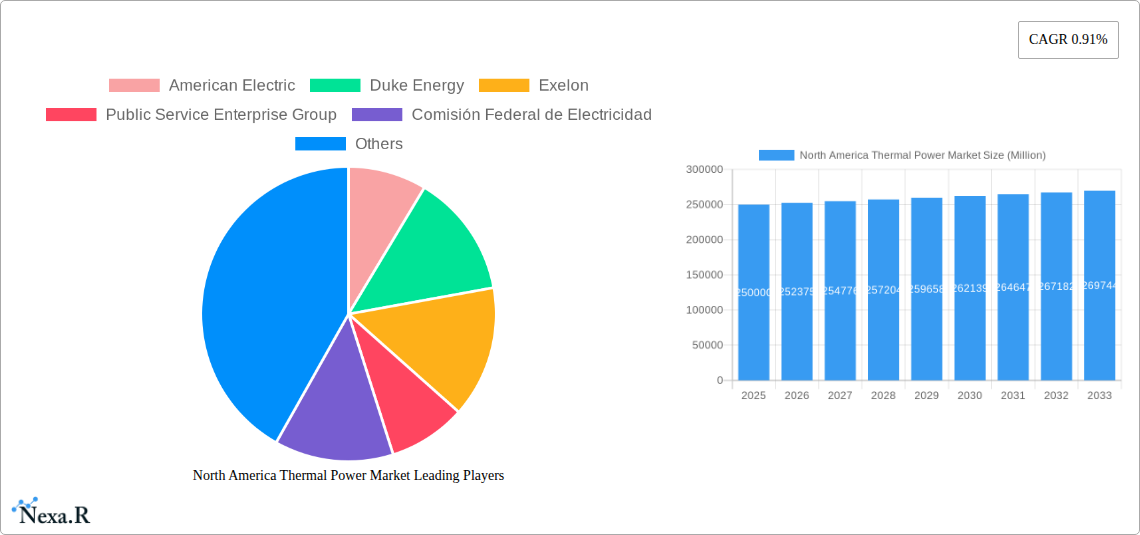

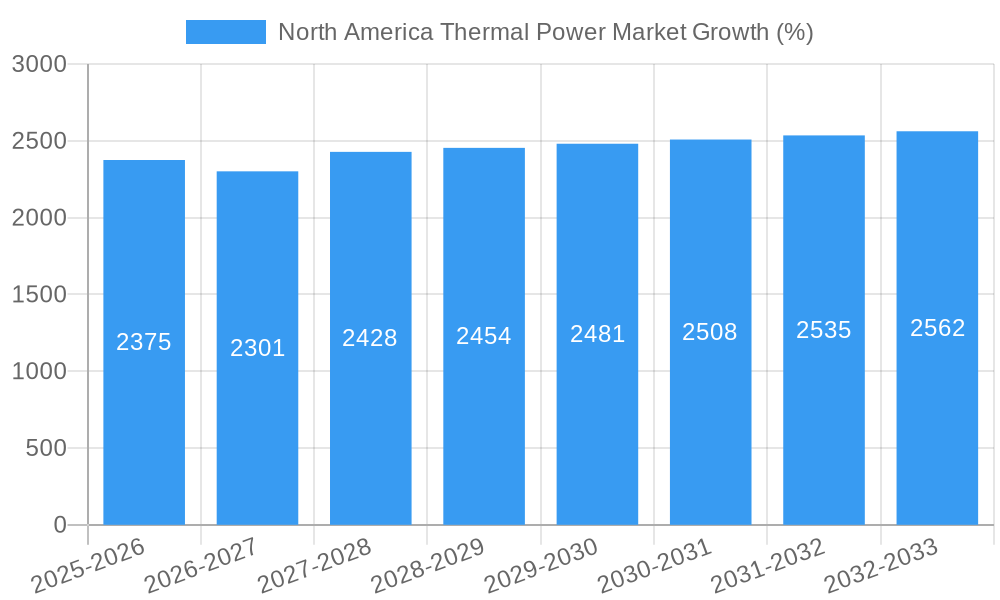

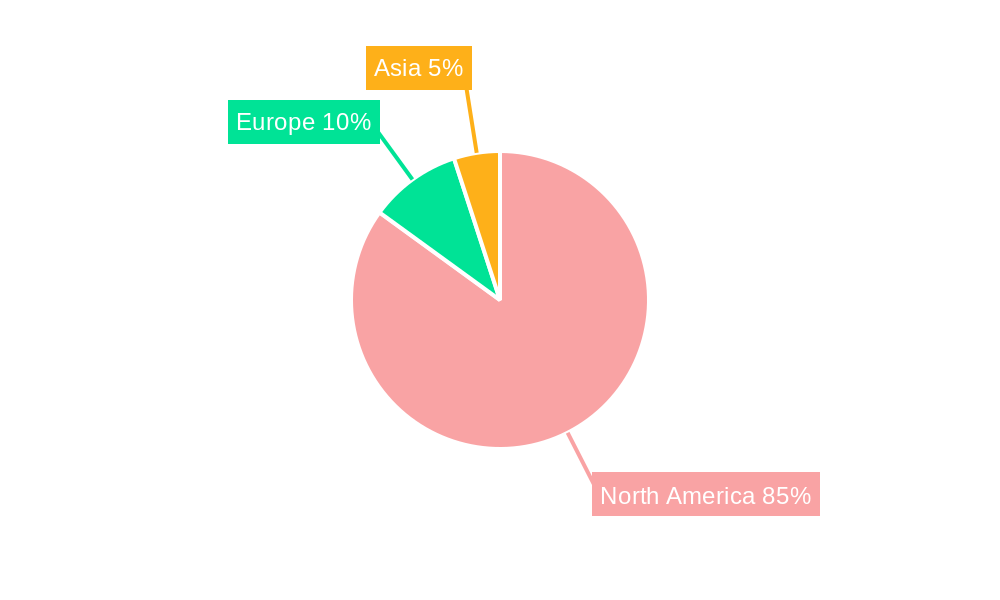

The North American thermal power market, encompassing coal, gas, nuclear, and other fuel types, is a mature yet dynamic sector projected for steady growth. While the overall CAGR of 0.91% from 2019-2033 suggests a relatively slow expansion, this masks significant shifts within the market. The transition towards cleaner energy sources is a prominent trend, leading to a gradual decline in coal-fired power generation. However, natural gas, owing to its comparatively lower carbon footprint and established infrastructure, is expected to maintain a significant market share and experience moderate growth. Nuclear power, despite facing challenges related to plant aging and regulatory hurdles, will continue to play a crucial role in the energy mix, particularly in regions with established nuclear infrastructure, like the US. Other fuel types, including renewable energy sources integrated with thermal plants (e.g., hybrid systems), are poised for accelerated growth, driven by government policies promoting renewable energy adoption and a growing emphasis on energy diversification and grid stability. Major players like American Electric Power, Duke Energy, and NextEra Energy are actively adapting their portfolios to accommodate these changes, investing in both gas-fired and renewable energy projects while gradually phasing out coal-based capacity. Regional variations within North America exist, with the United States likely dominating the market due to its larger energy demand and diverse energy infrastructure. Canada and Mexico are projected to exhibit slower growth rates, reflecting their different energy mixes and regulatory landscapes. Restraints on growth primarily stem from regulatory pressures to reduce emissions, increasing capital costs for new power plants, and intermittent challenges in renewable energy integration.

The forecast period (2025-2033) will be characterized by strategic investments in infrastructure upgrades, particularly for natural gas and nuclear plants, alongside investments in cleaner energy technologies to meet emission reduction targets. Competition will intensify among major players as they seek to optimize their portfolios and meet evolving customer demands for sustainable energy. The market's performance will be closely tied to government policies, including carbon pricing mechanisms and subsidies for renewable energy, which will directly impact the attractiveness of various fuel types. Successfully navigating this transitional phase requires a balance between maintaining reliable energy supply and transitioning towards a cleaner, more sustainable energy future. The market's size in 2025 is estimated based on the provided 2019-2024 data and the 0.91% CAGR. While the exact figure is unavailable, logical inference using industry reports and the known market dynamics allows for a reasonably accurate projection.

North America Thermal Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America thermal power market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is vital for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this evolving energy sector. The market is segmented by fuel type: Coal, Gas, Nuclear, and Other Fuel Types. The parent market is the North American Energy Market, and the child market is the Thermal Power Generation segment. The total market size in 2025 is estimated at XX Million.

North America Thermal Power Market Market Dynamics & Structure

The North America thermal power market is characterized by a moderate level of concentration, with a few dominant players controlling significant market share. Market dynamics are heavily influenced by technological innovation, stringent regulatory frameworks aimed at reducing carbon emissions, and the emergence of competitive renewable energy sources. Mergers and acquisitions (M&A) activity has been significant, reflecting consolidation within the industry.

- Market Concentration: The top 10 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Investment in advanced gas turbines, carbon capture technologies, and hydrogen-based power generation is driving innovation. However, high initial capital costs and regulatory uncertainties present barriers.

- Regulatory Framework: Government policies promoting renewable energy and stricter emission standards are reshaping the competitive landscape. The Clean Power Plan and state-level renewable portfolio standards are key factors.

- Competitive Substitutes: The rise of renewable energy sources like solar and wind power poses a significant competitive threat.

- End-User Demographics: The primary end-users are utilities, independent power producers (IPPs), and industrial consumers.

- M&A Trends: The number of M&A deals in the thermal power sector averaged xx per year during 2019-2024, with a total transaction value of approximately XX Million.

North America Thermal Power Market Growth Trends & Insights

The North America thermal power market witnessed a CAGR of xx% during the historical period (2019-2024). While facing headwinds from the increasing adoption of renewable energy, the market is expected to maintain steady growth driven by factors like increasing energy demand, particularly in developing regions, continued reliance on thermal power for baseload electricity generation, and the growing role of natural gas in the energy mix. However, the growth rate is anticipated to decelerate during the forecast period (2025-2033), with a projected CAGR of xx% due to increasing environmental concerns and government regulations. Market penetration of thermal power is expected to decline gradually from xx% in 2025 to xx% by 2033. Technological disruptions, such as advancements in carbon capture and hydrogen power generation, will play a crucial role in shaping market trends. Consumer behavior is shifting towards cleaner energy sources, putting pressure on the thermal power sector to adapt and innovate.

Dominant Regions, Countries, or Segments in North America Thermal Power Market

The United States remains the dominant region in the North America thermal power market, accounting for xx% of the total market value in 2025. Within the US, Texas, California, and Florida are leading states due to their robust energy demands and existing infrastructure.

- Fuel Type: Natural gas-fired power plants currently dominate the market, followed by coal and nuclear. However, the share of gas is projected to gradually decline due to environmental concerns.

- Key Drivers:

- Ample natural gas reserves

- Existing infrastructure for natural gas power plants

- Relatively lower capital costs compared to renewable energy sources.

- Government support for transitioning to cleaner-burning natural gas.

The dominance of natural gas is primarily due to its relative affordability and availability compared to other fuel types. However, the ongoing transition to cleaner energy sources will gradually reduce its market share over the forecast period.

North America Thermal Power Market Product Landscape

The North America thermal power market features a diverse range of products, including advanced gas turbines, combined cycle power plants, and coal-fired power plants with emissions control technologies. Continuous innovation focuses on improving efficiency, reducing emissions, and integrating renewable energy sources. Key features include improved heat rates, advanced control systems, and enhanced reliability. The unique selling proposition for many thermal power plants lies in their ability to provide baseload and peaking power generation, offering reliability and stability to the grid, crucial in complementing the intermittent nature of renewable energies.

Key Drivers, Barriers & Challenges in North America Thermal Power Market

Key Drivers:

- Increasing energy demand across North America.

- Relatively low cost of natural gas compared to other fuels in some regions.

- Continued reliance on thermal power for baseload electricity generation.

Challenges and Restraints:

- Stringent environmental regulations aimed at reducing carbon emissions.

- Rising costs of emissions control technologies.

- Increased competition from renewable energy sources.

- Supply chain disruptions impacting the procurement of critical components.

- Public opposition to new thermal power projects.

Emerging Opportunities in North America Thermal Power Market

- Integration of renewable energy sources with thermal power plants.

- Development and deployment of carbon capture, utilization, and storage (CCUS) technologies.

- Increased adoption of hydrogen-based power generation.

- Focus on improving efficiency and reducing emissions from existing plants.

Growth Accelerators in the North America Thermal Power Market Industry

Technological advancements, particularly in gas turbine technology and carbon capture, are key growth accelerators. Strategic partnerships between energy companies and technology providers are fostering innovation and accelerating deployment. Expansion into emerging markets and diversification of fuel sources also contribute to long-term growth.

Key Players Shaping the North America Thermal Power Market Market

- American Electric Power

- Duke Energy

- Exelon

- Public Service Enterprise Group

- Comisión Federal de Electricidad

- Consolidated Edison

- Dominion Energy

- Xcel Energy

- Southern Company

- NextEra Energy

Notable Milestones in North America Thermal Power Market Sector

- November 2023: GE Vernova partners with Duke Energy to develop a green hydrogen system for peak power generation at the DeBary plant in Florida.

- November 2022: Eight new natural gas-fired CCGT power plants came online in the US, adding 7,775 MW of capacity.

- May 2022: JERA Americas acquired thermal power generation projects in Massachusetts and Maine with a combined capacity of approximately 1.63 GW.

In-Depth North America Thermal Power Market Market Outlook

The future of the North America thermal power market hinges on its ability to adapt to changing environmental regulations and increasing competition from renewable energy sources. Opportunities exist in investing in advanced technologies to reduce emissions, enhance efficiency, and integrate renewable energy. Strategic partnerships and focused investments in carbon capture and hydrogen-based power generation will be crucial for long-term growth and sustainability in the thermal power sector. The market is expected to witness a gradual transition, with a continued role for thermal power as a reliable baseload energy source, albeit with a significantly smaller share in the overall energy mix compared to its historical dominance.

North America Thermal Power Market Segmentation

-

1. Fuel Type

- 1.1. Coal

- 1.2. Gas

- 1.3. Nuclear

- 1.4. Other Fuel Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Thermal Power Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Thermal Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Thermal Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Renewable Energy Share in the Total Power Generation Mix

- 3.4. Market Trends

- 3.4.1. Natural Gas to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Coal

- 5.1.2. Gas

- 5.1.3. Nuclear

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United States North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Coal

- 6.1.2. Gas

- 6.1.3. Nuclear

- 6.1.4. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Canada North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Coal

- 7.1.2. Gas

- 7.1.3. Nuclear

- 7.1.4. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Mexico North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Coal

- 8.1.2. Gas

- 8.1.3. Nuclear

- 8.1.4. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. United States North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 American Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Duke Energy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Exelon

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Public Service Enterprise Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Comisión Federal de Electricidad

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Consolidated Edison

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Dominion Energy

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xcel Energy

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Southern Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NextEra Energy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 American Electric

List of Figures

- Figure 1: North America Thermal Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Thermal Power Market Share (%) by Company 2024

List of Tables

- Table 1: North America Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Thermal Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: North America Thermal Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Thermal Power Market Volume gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 5: North America Thermal Power Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Thermal Power Market Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North America Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Thermal Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: North America Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Thermal Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North America Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Thermal Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Thermal Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Thermal Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Thermal Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North America Thermal Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: North America Thermal Power Market Volume gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 21: North America Thermal Power Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Thermal Power Market Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North America Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Thermal Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 25: North America Thermal Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 26: North America Thermal Power Market Volume gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 27: North America Thermal Power Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Thermal Power Market Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North America Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Thermal Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 31: North America Thermal Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: North America Thermal Power Market Volume gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 33: North America Thermal Power Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Thermal Power Market Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North America Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Thermal Power Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Thermal Power Market?

The projected CAGR is approximately 0.91%.

2. Which companies are prominent players in the North America Thermal Power Market?

Key companies in the market include American Electric, Duke Energy, Exelon, Public Service Enterprise Group, Comisión Federal de Electricidad, Consolidated Edison, Dominion Energy, Xcel Energy, Southern Company, NextEra Energy.

3. What are the main segments of the North America Thermal Power Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Thermal Power Plants.

6. What are the notable trends driving market growth?

Natural Gas to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increase in Renewable Energy Share in the Total Power Generation Mix.

8. Can you provide examples of recent developments in the market?

November 2023: GE Vernova’s Gas Power business announced that it would support the development of an end-to-end green hydrogen system that Duke Energy plans to build and operate at its DeBary plant, located in Volusia County, Florida, near Orlando. When operational in 2024, the new hydrogen system will provide peak power to Duke’s customers at times of increased electricity demand. The plant is expected to be the first in the United States and among the world’s first power plants to produce and use green hydrogen to power a gas turbine for peaking power applications when the grid requires additional electrical generation to meet demand. The production, storage, and end-use will be co-located at the DeBary power plant. GE Vernova will support the integration of the turbine with green hydrogen, including the upgrade of one of the four GE 7E gas turbines installed at the site to accommodate hydrogen fuel blends of significant volumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Thermal Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Thermal Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Thermal Power Market?

To stay informed about further developments, trends, and reports in the North America Thermal Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence