Key Insights

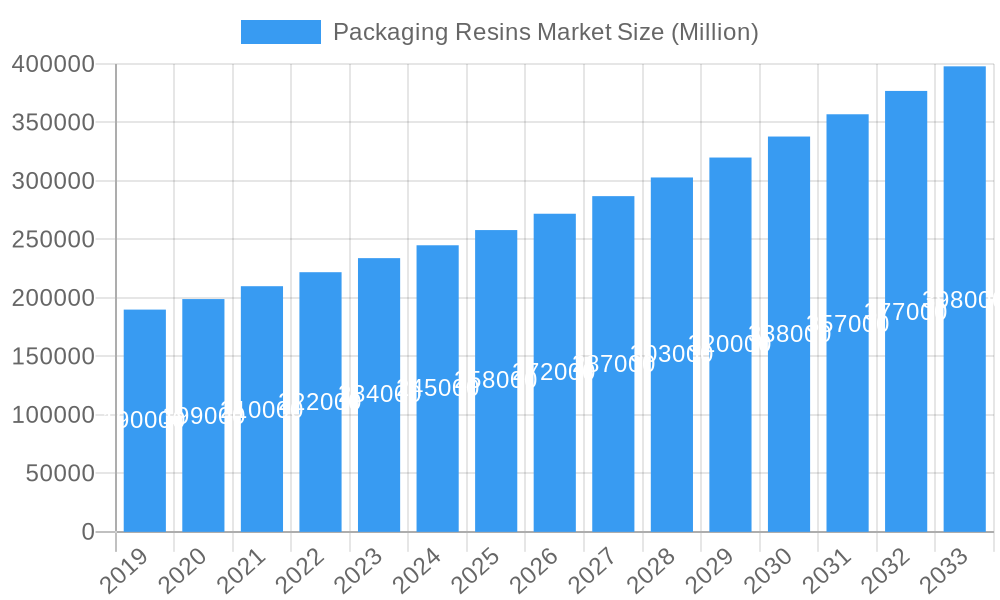

The global Packaging Resins Market is poised for robust expansion, projected to reach an estimated USD 250,000 million in 2025, with a significant Compound Annual Growth Rate (CAGR) exceeding 5.00% through 2033. This growth is primarily fueled by the escalating global demand for packaged goods, driven by a burgeoning middle class, urbanization, and evolving consumer lifestyles. The Food and Beverage sector continues to be the dominant application segment, accounting for a substantial market share due to the inherent need for protective, shelf-stable, and convenient packaging solutions. Additionally, the Consumer Goods and Cosmetics and Personal Care industries are witnessing consistent growth, further stimulating the demand for innovative and aesthetically pleasing packaging materials. Key resin types such as High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), and Polypropylene (PP) are expected to maintain their leading positions due to their versatile properties, cost-effectiveness, and recyclability. The market's trajectory is also influenced by increasing environmental consciousness, leading to a greater emphasis on sustainable and recyclable packaging solutions, which in turn is fostering innovation in bio-based and recycled resins.

Packaging Resins Market Market Size (In Billion)

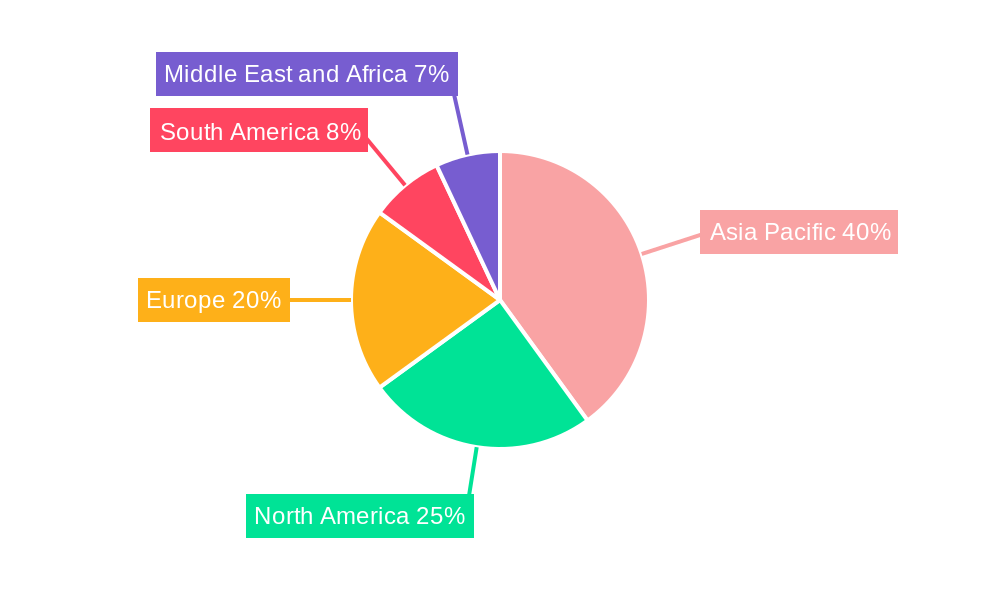

The market dynamics are shaped by several key drivers, including advancements in packaging technology, the growing e-commerce sector requiring specialized and durable packaging, and the increasing adoption of rigid and flexible packaging formats across various industries. However, restraints such as fluctuating raw material prices, particularly for petrochemical-based resins, and stringent regulatory landscapes concerning plastic waste and recyclability, pose challenges. The Asia Pacific region is anticipated to emerge as the largest and fastest-growing market, driven by its massive consumer base, rapid industrialization, and increasing disposable incomes, particularly in economies like China and India. North America and Europe, while mature markets, are characterized by a strong focus on sustainability, innovation, and the adoption of high-performance resins. Companies like Dow, Exxon Mobil Corporation, Lyondellbasell Industries Holdings BV, and SABIC are at the forefront of this market, investing heavily in research and development to introduce novel resin solutions and expand their production capacities to meet the escalating global demand.

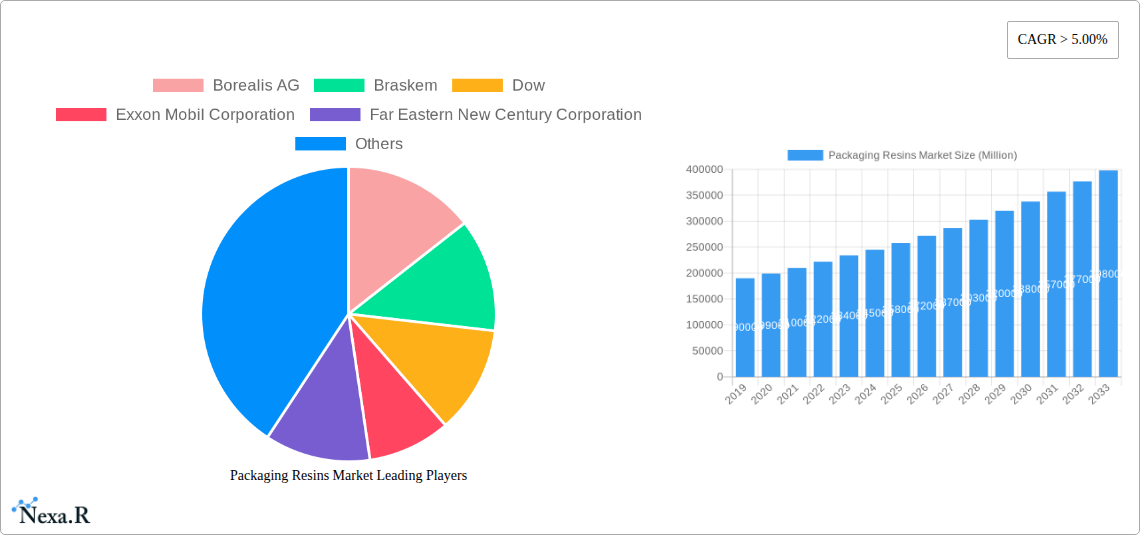

Packaging Resins Market Company Market Share

Packaging Resins Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report offers a detailed examination of the global packaging resins market, a critical sector for numerous industries including food and beverage packaging, consumer goods, cosmetics and personal care, and healthcare. Analyzing market dynamics from 2019 to 2033, with a base year of 2025, this report provides invaluable insights into growth trends, regional dominance, key players, and future opportunities. It meticulously dissects the market by resin type (High-density Polyethylene, Low-density Polyethylene, Polyethylene Terephthalate, Polypropylene, Polystyrene, Polyvinyl Chloride, Other Resin Types) and application, offering a granular perspective on market segmentation and demand drivers. Discover the strategic moves and innovations shaping this multi-billion dollar industry.

Packaging Resins Market Dynamics & Structure

The packaging resins market exhibits a moderately concentrated structure, characterized by the presence of several global giants and a growing number of regional players. Technological innovation remains a key driver, particularly in the development of sustainable packaging solutions, advanced barrier properties, and lightweighting technologies. Regulatory frameworks, such as Extended Producer Responsibility (EPR) schemes and bans on single-use plastics, are increasingly influencing material choices and driving demand for recycled packaging resins and bioplastics. Competitive product substitutes, including glass, metal, and paperboard, continue to pose a challenge, though advancements in resin technology are mitigating some of these pressures. End-user demographics, with a growing global population and rising disposable incomes in emerging economies, are a significant tailwind. Mergers and acquisitions (M&A) are prevalent as companies seek to expand their geographical reach, diversify their product portfolios, and enhance their sustainability credentials. For instance, the packaging resins market has witnessed significant consolidation, with the value of M&A deals in the last five years estimated to be in the range of USD 5,000-7,000 Million. Innovation barriers primarily revolve around the cost of developing and implementing new sustainable technologies and the challenges of achieving circularity at scale.

- Market Concentration: Moderately concentrated with a mix of large multinational corporations and regional manufacturers.

- Technological Innovation: Driven by sustainability, lightweighting, and improved barrier properties.

- Regulatory Frameworks: Increasing impact of environmental regulations, promoting recycled content and biodegradable options.

- Competitive Substitutes: Ongoing competition from glass, metal, and paperboard packaging.

- End-User Demographics: Growing demand fueled by population growth and increasing consumer spending.

- M&A Trends: Strategic acquisitions and joint ventures to gain market share and technological capabilities.

- Innovation Barriers: High R&D costs and scalability challenges for novel sustainable solutions.

Packaging Resins Market Growth Trends & Insights

The global packaging resins market is poised for robust growth, projected to expand from an estimated market size of USD 165,500 Million in 2025 to USD 210,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.0%. This growth is underpinned by a confluence of factors, including the sustained demand from key end-use industries and the increasing adoption of advanced packaging materials. The market's evolution is being significantly shaped by technological disruptions such as the development of high-performance resins that offer enhanced durability, shelf-life extension, and improved aesthetics for packaged goods. Consumer behavior shifts, characterized by a growing preference for convenience, premiumization, and, crucially, sustainable packaging, are also acting as powerful catalysts. The increasing awareness of environmental issues has led to a heightened demand for recyclable packaging resins, biodegradable plastics, and products with higher recycled content. This is driving innovation in polyethylene terephthalate (PET) for beverage bottles and food containers, as well as polypropylene (PP) for its versatility in various applications. The adoption rates for these advanced and sustainable resins are steadily increasing, penetration reaching approximately 70% in developed markets for applications prioritizing recyclability and environmental impact. Market penetration for specialized resins, such as those with enhanced barrier properties for extended shelf life in the food and beverage sector, is also on an upward trajectory, contributing to the overall market size evolution. Furthermore, the shift towards e-commerce has amplified the need for resilient and protective packaging, further bolstering demand for specific resin types. The interplay between these trends—evolving consumer preferences, technological advancements, and the drive for sustainability—will continue to define the growth trajectory of the packaging resins market.

Dominant Regions, Countries, or Segments in Packaging Resins Market

The packaging resins market is experiencing robust growth, with the Asia-Pacific region emerging as the dominant force, driven by a confluence of economic prosperity, rapid industrialization, and a burgeoning middle-class population. This region's dominance is further amplified by substantial investments in manufacturing infrastructure and a proactive stance on adopting advanced packaging technologies. Within this region, China stands out as a pivotal market, contributing significantly to global demand for packaging resins. The country's massive consumer base, coupled with its position as a global manufacturing hub, fuels an insatiable appetite for packaging solutions across all major applications, from food and beverage to consumer goods and healthcare.

Among the resin types, Polyethylene (PE), encompassing High-density Polyethylene (HDPE) and Low-density Polyethylene (LDPE), consistently commands the largest market share. This is attributed to their cost-effectiveness, versatility, and widespread use in flexible packaging, films, bottles, and containers. Polyethylene Terephthalate (PET) is another significant segment, particularly dominant in the food and beverage and cosmetics and personal care industries, owing to its excellent clarity, barrier properties, and recyclability. Polypropylene (PP) is also a strong performer, widely employed in rigid packaging, films, and closures due to its good chemical resistance and heat tolerance.

In terms of applications, the Food and Beverage sector represents the largest and most dynamic segment within the packaging resins market. The ever-increasing global demand for packaged foods and beverages, driven by population growth and changing lifestyles, makes this application area the primary growth engine. The segment's significant market share, estimated at over 40% of the total packaging resins market, is underpinned by the need for safe, hygienic, and shelf-stable packaging solutions.

- Dominant Region: Asia-Pacific

- Key Country: China

- Drivers: Rapid industrialization, large consumer base, economic growth, significant manufacturing output.

- Dominant Resin Type: Polyethylene (HDPE & LDPE)

- Drivers: Versatility, cost-effectiveness, wide application in flexible and rigid packaging.

- Key Growing Resin Type: Polyethylene Terephthalate (PET)

- Drivers: High demand in food & beverage and cosmetics, excellent clarity and barrier properties, recyclability.

- Dominant Application: Food and Beverage

- Drivers: Essential for product preservation and safety, increasing demand for convenience and processed foods, substantial market share (estimated >40%).

- Other Key Applications: Consumer Goods, Cosmetics and Personal Care, Healthcare.

- Economic Policies: Supportive government policies promoting manufacturing and domestic consumption in emerging economies.

- Infrastructure Development: Expansion of logistics and supply chains facilitating wider distribution of packaged goods.

Packaging Resins Market Product Landscape

The packaging resins market is characterized by continuous product innovation, aimed at enhancing performance, sustainability, and cost-effectiveness. Manufacturers are actively developing resins with improved barrier properties to extend product shelf life, such as advanced polyethylene terephthalate (PET) grades for carbonated beverages and barrier layers in multi-layer films. Lightweighting initiatives are leading to the creation of thinner yet stronger resins, reducing material consumption and transportation costs. The growing emphasis on sustainability has spurred the development of bio-based and biodegradable resins, offering environmentally friendly alternatives to traditional petroleum-based plastics. Furthermore, specialized resin formulations are emerging to meet the unique demands of specific applications, including those requiring enhanced chemical resistance for industrial packaging or improved transparency and aesthetics for cosmetic packaging.

Key Drivers, Barriers & Challenges in Packaging Resins Market

The packaging resins market is propelled by several key drivers. Growing global population and increasing disposable incomes, particularly in emerging economies, are fueling demand for packaged goods across all sectors. The convenience-driven lifestyles of modern consumers necessitate effective and safe packaging solutions. Technological advancements leading to the development of higher-performance, lightweight, and sustainable resins are also significant growth accelerators. Environmental consciousness among consumers and regulatory pressures are driving the demand for recycled packaging resins and biodegradable alternatives, creating new market opportunities.

Key challenges in the packaging resins market include volatility in raw material prices, particularly crude oil and natural gas, which directly impact production costs. Stringent environmental regulations and the growing consumer backlash against plastic waste necessitate significant investment in research and development for sustainable alternatives, which can be costly to implement. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can also hinder market growth. The competitive landscape is intense, with established players and emerging companies vying for market share. Furthermore, the development and widespread adoption of truly circular economy solutions for plastics remain a significant hurdle.

Emerging Opportunities in Packaging Resins Market

Emerging opportunities in the packaging resins market are primarily centered around the burgeoning demand for sustainable packaging solutions. This includes the expansion of the recycled packaging resins market, driven by both regulatory mandates and consumer preference for products with recycled content. The development and commercialization of novel biodegradable and compostable packaging resins present a significant untapped market, especially for single-use applications. Furthermore, advancements in smart packaging technologies, incorporating features like traceability and spoilage indication, offer new avenues for value creation. The increasing penetration of e-commerce also creates opportunities for specialized packaging resins that offer enhanced protection and durability for shipping. Innovations in mono-material packaging solutions, designed for easier recycling, are also gaining traction.

Growth Accelerators in the Packaging Resins Market Industry

Several factors are accelerating growth within the packaging resins market. The ongoing shift towards a circular economy is a major catalyst, driving innovation in recyclable packaging materials and increasing the use of recycled resins. Strategic partnerships and joint ventures between resin manufacturers, packaging converters, and waste management companies are crucial for developing integrated solutions and expanding the supply of recycled feedstocks. The growing demand for lightweight and high-performance packaging materials that reduce product spoilage and transportation emissions is another significant accelerator. Furthermore, expanding production capacities in high-growth regions, coupled with investments in advanced manufacturing technologies, are supporting the market's expansion.

Key Players Shaping the Packaging Resins Market Market

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- INEOS

- Lyondellbasell Industries Holdings BV

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC

- China Petrochemical Corporation

- Total

Notable Milestones in Packaging Resins Market Sector

- October 2020: LyondellBasell and Sasol announced a definitive agreement to form a 50/50 joint venture, with LyondellBasell acquiring 50% of Sasol's ethane cracker and polyethylene plants for USD 2 billion, expected to operate as Louisiana Integrated PolyEthylene JV LLC.

- September 2020: INEOS Olefins & Polymers partnered with Saica Natur for a supply agreement of recycled LDPE and LLDPE, supporting the demand for sustainable flexible packaging.

- March 2020: LyondellBasell signed definitive agreements to expand in China through a 50:50 joint venture with Liaoning Bora Enterprise Group (Bora), building on a Memorandum of Understanding signed in September 2019.

In-Depth Packaging Resins Market Market Outlook

The future outlook for the packaging resins market is exceptionally promising, driven by an unwavering demand for effective and increasingly sustainable packaging solutions. Growth accelerators such as the circular economy transition, continuous technological advancements in high-performance and lightweight resins, and strategic market expansions by key players will shape this trajectory. The market's potential is further amplified by the increasing adoption of recycled packaging resins and the burgeoning demand for biodegradable and compostable alternatives. Strategic investments in research and development, coupled with collaborations aimed at enhancing recycling infrastructure and developing innovative applications, will be pivotal in unlocking the full market potential. The market is anticipated to witness significant growth, driven by evolving consumer preferences and stringent environmental mandates, ensuring its continued relevance and expansion in the global economy.

Packaging Resins Market Segmentation

-

1. Resin Type

- 1.1. High-density Polyethylene

- 1.2. Low-density Polyethylene

- 1.3. Polyethylene Terephthalate

- 1.4. Polypropylene

- 1.5. Polystyrene

- 1.6. Polyvinyl Chloride

- 1.7. Other Resin Types

-

2. Application

- 2.1. Food and Beverage

- 2.2. Consumer Goods

- 2.3. Cosmetics and Personal Care

- 2.4. Healthcare

- 2.5. Industrial

- 2.6. Other Applications

Packaging Resins Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Packaging Resins Market Regional Market Share

Geographic Coverage of Packaging Resins Market

Packaging Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Increased Shelf-life of Products; Growing E-commerce Industry

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Increased Shelf-life of Products; Growing E-commerce Industry

- 3.4. Market Trends

- 3.4.1. Food and Beverage Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. High-density Polyethylene

- 5.1.2. Low-density Polyethylene

- 5.1.3. Polyethylene Terephthalate

- 5.1.4. Polypropylene

- 5.1.5. Polystyrene

- 5.1.6. Polyvinyl Chloride

- 5.1.7. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Consumer Goods

- 5.2.3. Cosmetics and Personal Care

- 5.2.4. Healthcare

- 5.2.5. Industrial

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. High-density Polyethylene

- 6.1.2. Low-density Polyethylene

- 6.1.3. Polyethylene Terephthalate

- 6.1.4. Polypropylene

- 6.1.5. Polystyrene

- 6.1.6. Polyvinyl Chloride

- 6.1.7. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Consumer Goods

- 6.2.3. Cosmetics and Personal Care

- 6.2.4. Healthcare

- 6.2.5. Industrial

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. High-density Polyethylene

- 7.1.2. Low-density Polyethylene

- 7.1.3. Polyethylene Terephthalate

- 7.1.4. Polypropylene

- 7.1.5. Polystyrene

- 7.1.6. Polyvinyl Chloride

- 7.1.7. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Consumer Goods

- 7.2.3. Cosmetics and Personal Care

- 7.2.4. Healthcare

- 7.2.5. Industrial

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. High-density Polyethylene

- 8.1.2. Low-density Polyethylene

- 8.1.3. Polyethylene Terephthalate

- 8.1.4. Polypropylene

- 8.1.5. Polystyrene

- 8.1.6. Polyvinyl Chloride

- 8.1.7. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Consumer Goods

- 8.2.3. Cosmetics and Personal Care

- 8.2.4. Healthcare

- 8.2.5. Industrial

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. South America Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. High-density Polyethylene

- 9.1.2. Low-density Polyethylene

- 9.1.3. Polyethylene Terephthalate

- 9.1.4. Polypropylene

- 9.1.5. Polystyrene

- 9.1.6. Polyvinyl Chloride

- 9.1.7. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Consumer Goods

- 9.2.3. Cosmetics and Personal Care

- 9.2.4. Healthcare

- 9.2.5. Industrial

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Middle East and Africa Packaging Resins Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. High-density Polyethylene

- 10.1.2. Low-density Polyethylene

- 10.1.3. Polyethylene Terephthalate

- 10.1.4. Polypropylene

- 10.1.5. Polystyrene

- 10.1.6. Polyvinyl Chloride

- 10.1.7. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Consumer Goods

- 10.2.3. Cosmetics and Personal Care

- 10.2.4. Healthcare

- 10.2.5. Industrial

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Borealis AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Braskem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dow

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Far Eastern New Century Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indorama Ventures Public Company Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INEOS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lyondellbasell Industries Holdings BV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PetroChina Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Reliance Industries Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SABIC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 China Petrochemical Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Total*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Borealis AG

List of Figures

- Figure 1: Global Packaging Resins Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Packaging Resins Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 3: Asia Pacific Packaging Resins Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Packaging Resins Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Packaging Resins Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Packaging Resins Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Packaging Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Packaging Resins Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 9: North America Packaging Resins Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 10: North America Packaging Resins Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Packaging Resins Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Packaging Resins Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Packaging Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Packaging Resins Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 15: Europe Packaging Resins Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 16: Europe Packaging Resins Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Packaging Resins Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Packaging Resins Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Packaging Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Packaging Resins Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 21: South America Packaging Resins Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: South America Packaging Resins Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Packaging Resins Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Packaging Resins Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Packaging Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Packaging Resins Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 27: Middle East and Africa Packaging Resins Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East and Africa Packaging Resins Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Packaging Resins Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Packaging Resins Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Packaging Resins Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Packaging Resins Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 5: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Packaging Resins Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 13: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Packaging Resins Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 19: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Packaging Resins Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 27: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Packaging Resins Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Packaging Resins Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 33: Global Packaging Resins Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Packaging Resins Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Packaging Resins Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Resins Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Packaging Resins Market?

Key companies in the market include Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, INEOS, Lyondellbasell Industries Holdings BV, PetroChina Company Limited, Reliance Industries Limited, SABIC, China Petrochemical Corporation, Total*List Not Exhaustive.

3. What are the main segments of the Packaging Resins Market?

The market segments include Resin Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Increased Shelf-life of Products; Growing E-commerce Industry.

6. What are the notable trends driving market growth?

Food and Beverage Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Increased Shelf-life of Products; Growing E-commerce Industry.

8. Can you provide examples of recent developments in the market?

In October 2020, LyondellBasell and Sasol announced that they entered a definitive agreement to form a 50/50 joint venture, through which LyondellBasell is likely to acquire 50% of Sasol's 1.5 MM ton ethane cracker, 0.9 MM ton low and linear low-density polyethylene plants, and associated infrastructure for a total consideration of USD 2 billion. The venture is expected to operate under the name Louisiana Integrated PolyEthylene JV LLC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging Resins Market?

To stay informed about further developments, trends, and reports in the Packaging Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence