Key Insights

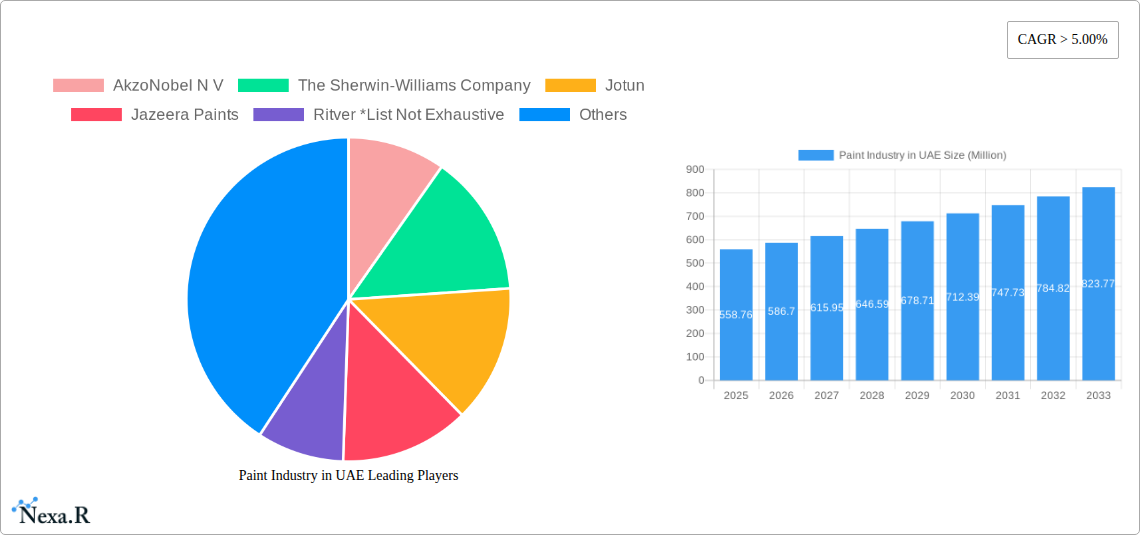

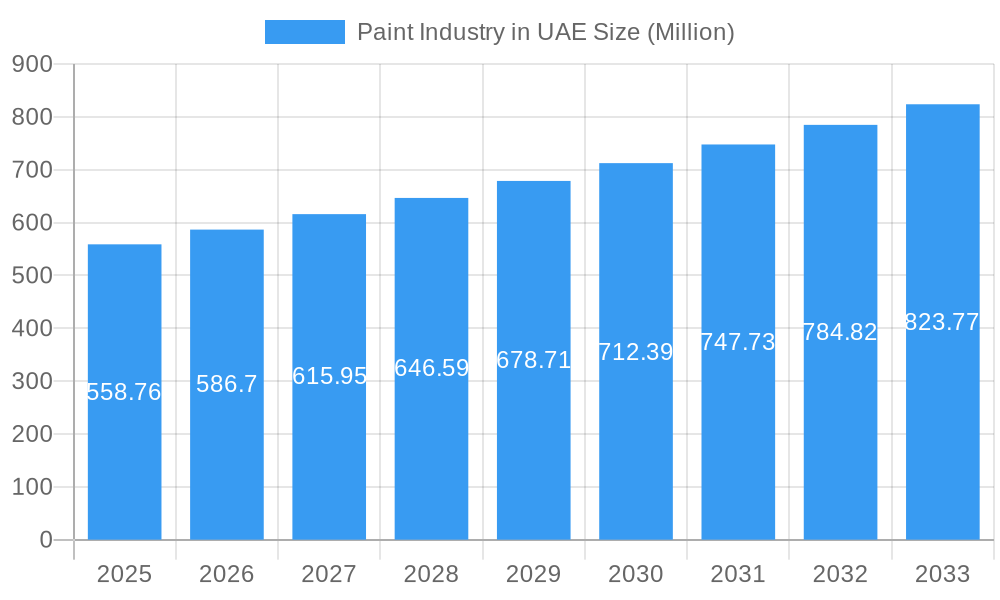

The United Arab Emirates (UAE) paint industry is poised for robust growth, projected to reach a substantial market size of approximately USD 558.76 million by 2025. Driven by a burgeoning construction sector, significant infrastructure development projects, and increasing demand for decorative and protective coatings across residential, commercial, and industrial applications, the market is expected to witness a Compound Annual Growth Rate (CAGR) exceeding 5.00% from 2025 through 2033. Key growth drivers include government initiatives focused on urban beautification and the expansion of tourism and hospitality sectors, which necessitate continuous maintenance and new construction requiring high-quality paints. Furthermore, a growing emphasis on sustainable and eco-friendly building materials is spurring the adoption of water-borne paints, aligning with the UAE's commitment to environmental preservation.

Paint Industry in UAE Market Size (In Million)

The market's expansion is further supported by the diverse range of resin types and technologies available, catering to a wide spectrum of performance requirements. While acrylic and epoxy resins dominate due to their durability and versatility, alkyd and polyurethane paints are also finding significant application. The industry is characterized by intense competition among both global players like AkzoNobel N.V. and The Sherwin-Williams Company, and strong regional manufacturers such as Jotun and Jazeera Paints. Emerging trends include the increasing demand for specialized coatings offering enhanced functionalities like anti-bacterial properties, fire resistance, and improved weatherability, particularly in the face of the region's challenging climate. While the overall outlook is positive, potential restraints such as fluctuating raw material prices and stringent environmental regulations could influence market dynamics, necessitating strategic adaptation from industry stakeholders.

Paint Industry in UAE Company Market Share

Comprehensive Report: Paint Industry in UAE - Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report provides a critical analysis of the Paint Industry in UAE, encompassing market dynamics, growth trajectories, segmentation, product landscape, key players, and future outlook. Covering the Study Period of 2019–2033, with Base Year and Estimated Year at 2025, and a Forecast Period of 2025–2033, this report delves into the historical performance from 2019–2024. We present all values in Million units, offering precise quantitative insights for industry professionals. This report is meticulously researched and requires no further modification.

Paint Industry in UAE Market Dynamics & Structure

The UAE paint industry is characterized by a moderately concentrated market, driven by substantial demand from the construction and infrastructure sectors. Key players like AkzoNobel N.V., The Sherwin-Williams Company, Jotun, and Jazeera Paints exert significant influence. Technological innovation, particularly the shift towards water-borne paints for environmental compliance and enhanced performance, is a major driver. Regulatory frameworks, such as VOC emission standards, are shaping product development and market entry strategies. Competitive product substitutes include wall coverings and advanced surface treatments, though paints remain dominant for their versatility and aesthetic appeal. End-user demographics are diverse, with a strong emphasis on the Residential and Commercial segments, fueled by ongoing urbanization and a growing population. Mergers and Acquisitions (M&A) are less prevalent but can significantly alter market shares.

- Market Concentration: Moderate, with a few dominant global and regional players.

- Technological Innovation Drivers: Environmental regulations, demand for durable and aesthetically pleasing finishes, and advancements in resin technology.

- Regulatory Frameworks: Strict adherence to VOC emission standards and product safety regulations.

- Competitive Product Substitutes: Wallpapers, decorative panels, and specialized coatings.

- End-User Demographics: Primarily driven by new construction, renovation, and infrastructure projects in both residential and commercial sectors.

- M&A Trends: Limited but impactful transactions can occur to gain market access or technological capabilities.

Paint Industry in UAE Growth Trends & Insights

The UAE paint market is projected for robust growth, propelled by a consistently expanding construction sector and significant government investments in infrastructure development. Historical data from 2019-2024 indicates a steady upward trend, with the market size anticipated to reach approximately USD 3,250 Million by 2025. The adoption rate of advanced paint technologies, particularly low-VOC and eco-friendly formulations, is accelerating as both consumers and developers prioritize sustainability and indoor air quality. Technological disruptions, such as the development of self-cleaning paints and anti-microbial coatings, are emerging, offering enhanced functionality and value propositions. Consumer behavior is shifting towards premium products that offer durability, aesthetic appeal, and specialized properties, reflecting an increasing disposable income and a desire for high-quality living and working spaces. The CAGR for the forecast period (2025-2033) is estimated at a healthy XX%, signifying sustained expansion. Market penetration for decorative paints remains high, while industrial and protective coatings are witnessing increased demand due to large-scale infrastructure and oil & gas projects.

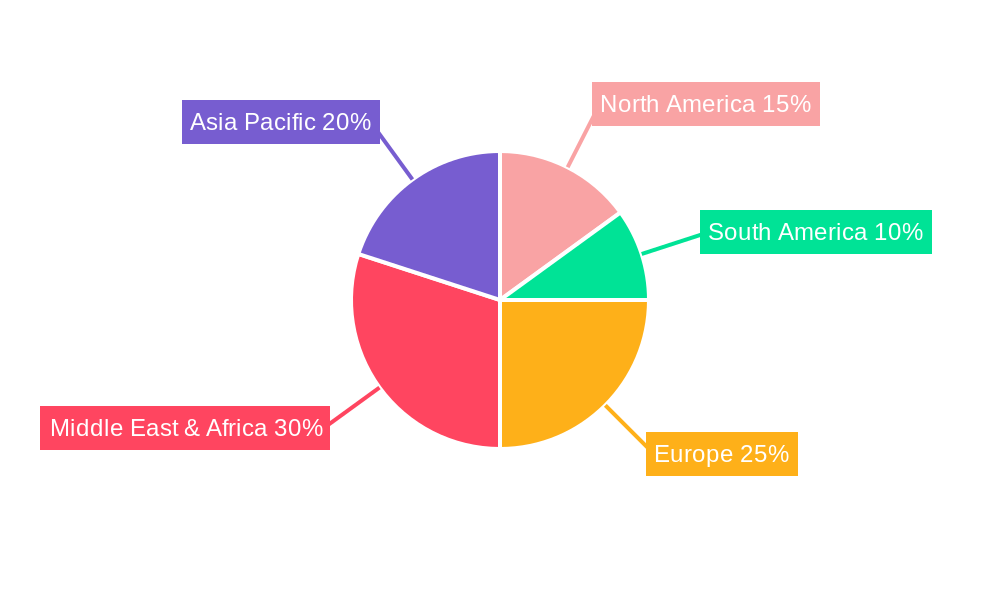

Dominant Regions, Countries, or Segments in Paint Industry in UAE

The UAE paint industry exhibits dominance across specific segments driven by distinct economic and developmental factors. Within the Resin Type segmentation, Acrylic paints are leading, accounting for approximately 45% of the market share in 2025. This is attributed to their versatility, durability, and cost-effectiveness, making them ideal for a wide range of applications, particularly in the Residential and Commercial end-user segments. The Technology segment sees a strong preference for Water-borne paints, estimated to hold around 60% market share in 2025, driven by stringent environmental regulations and a growing consumer preference for low-VOC products. Solvent-borne paints still retain a significant share, particularly in industrial applications requiring higher performance and faster drying times.

The End-User segmentation reveals the Residential sector as the largest consumer, driven by ongoing urbanization, population growth, and extensive renovation activities. This segment is projected to account for approximately 40% of the market by 2025. The Commercial segment, encompassing offices, retail spaces, and hospitality, follows closely with an estimated 35% market share, fueled by new project developments and the refurbishment of existing establishments. The Industry segment, including protective coatings for infrastructure, oil & gas, and manufacturing, represents the remaining share and is crucial for large-scale projects.

Key drivers for dominance include government initiatives promoting sustainable construction, significant investments in real estate development, and the presence of major international and regional paint manufacturers. Dubai and Abu Dhabi, as major economic hubs, represent the largest provincial markets.

- Resin Type Dominance: Acrylic paints lead due to their widespread applicability and performance.

- Technology Dominance: Water-borne paints are favored for environmental compliance and growing consumer demand.

- End-User Dominance: Residential construction and renovation activities are the primary growth engines.

- Geographical Dominance: Dubai and Abu Dhabi are the largest consuming emirates.

- Growth Potential: Industrial coatings segment shows significant potential with ongoing infrastructure projects.

Paint Industry in UAE Product Landscape

The UAE paint market is dynamic, with a constant influx of product innovations aimed at enhancing performance, sustainability, and aesthetics. Companies are focusing on developing advanced formulations such as high-durability exterior paints with superior weather resistance and UV protection, exemplified by Jotun's ‘Jotashield’ range. Interior paints are increasingly incorporating antimicrobial properties and low-VOC emissions for improved indoor air quality. Specialty coatings, including fire-retardant paints and heat-reflective coatings, are gaining traction, particularly for industrial and commercial applications. The performance metrics that differentiate products include adhesion, scratch resistance, color retention, and ease of application. Technological advancements in pigment dispersion and binder technologies are enabling richer colors and improved finish quality.

Key Drivers, Barriers & Challenges in Paint Industry in UAE

Key Drivers:

The UAE paint industry is propelled by several key drivers. The burgeoning construction and infrastructure development sector, fueled by government initiatives and foreign investment, is a primary catalyst. Growing demand for aesthetic and protective coatings in the Residential and Commercial segments, driven by population growth and urbanization, further bolsters the market. The increasing awareness and adoption of sustainable and eco-friendly water-borne paints due to stringent environmental regulations and corporate social responsibility are also significant drivers. Technological advancements leading to improved product performance and functionality, alongside a rising disposable income, contribute to the demand for premium paints.

Barriers & Challenges:

Despite the growth, the industry faces several barriers and challenges. Volatility in raw material prices, particularly crude oil derivatives used in solvent-borne paints and resins, can impact profit margins. Intense competition from both global giants and local manufacturers can lead to price wars and pressure on profitability. Stringent regulatory compliance regarding VOC emissions and product safety requires continuous investment in research and development. Economic slowdowns or unforeseen geopolitical events can impact construction activity, consequently affecting paint demand. Supply chain disruptions and logistics complexities in sourcing raw materials and distributing finished goods also pose challenges. The high initial cost of some advanced technologies can also be a barrier to widespread adoption.

Emerging Opportunities in Paint Industry in UAE

Emerging opportunities in the UAE paint industry lie in several key areas. The growing trend towards sustainable and green building practices presents a significant avenue for eco-friendly paints, including low-VOC and recyclable formulations. The increasing demand for specialized coatings, such as anti-microbial paints for healthcare facilities, high-performance coatings for the oil and gas sector, and heat-reflective coatings for energy efficiency, offers lucrative niche markets. The expansion of the hospitality and tourism sector will drive demand for decorative and durable interior and exterior finishes. Furthermore, the development of smart paints with integrated functionalities like self-cleaning or color-changing properties represents a future growth frontier. The increasing focus on home renovation and interior design among affluent consumers also opens up opportunities for premium and designer paint collections.

Growth Accelerators in the Paint Industry in UAE Industry

Several growth accelerators are shaping the long-term trajectory of the UAE paint industry. Strategic partnerships between paint manufacturers and real estate developers, construction companies, and architectural firms can foster innovation and ensure market penetration. The continuous investment in research and development by key players, focusing on product enhancement and the creation of novel functionalities, will drive market expansion. Government initiatives aimed at promoting sustainable construction and enhancing the built environment will further fuel demand for advanced and eco-friendly paint solutions. Expansion into untapped markets within the region and the development of innovative application techniques that reduce labor costs and improve efficiency will also act as significant growth catalysts. The increasing focus on digitalization in the construction sector presents opportunities for online sales channels and digital marketing strategies to reach a wider customer base.

Key Players Shaping the Paint Industry in UAE Market

- AkzoNobel N.V.

- The Sherwin-Williams Company

- Jotun

- Jazeera Paints

- Ritver

- NATIONAL PAINTS FACTORIES CO LTD

- Caparol Paints

- Hempel A/S

- Terraco Holdings Ltd

- Gulf Paints

- Al Gurg Paints LLC (Oasis Paints)

Notable Milestones in Paint Industry in UAE Sector

- October 2023: National Paints Factories Co. Ltd. extended its sponsorship of Sharjah Football Club for the 8th year, reinforcing brand visibility and community engagement.

- June 2023: Jotun Paints UAE introduced two new products to its ‘Jotashield’ range of premium exterior paints. These paints are formulated for enhanced durability and dust resistance, crucial for protecting buildings in the UAE's harsh climate.

- November 2022: Jotun Paints UAE opened its second inspiration shop in Dubai in collaboration with Gemini Building Materials Ltd. This expansion offers an extensive range of interior and exterior paint products, enhancing customer accessibility and product experience in Dubai.

In-Depth Paint Industry in UAE Market Outlook

The UAE paint industry is poised for sustained growth, driven by a combination of robust construction activity, increasing consumer demand for quality and aesthetics, and a growing emphasis on sustainability. The market's future potential is significantly linked to the successful adoption of innovative product categories and technological advancements. Strategic opportunities lie in catering to the evolving needs of the Residential, Commercial, and Industrial segments with specialized and high-performance coatings. The continued shift towards water-borne paints and the development of eco-friendly solutions will be paramount. The industry's ability to navigate raw material price fluctuations and supply chain challenges while capitalizing on emerging trends like smart paints and enhanced functionalities will determine its accelerated growth trajectory. The proactive approach of key players in product development and market expansion will solidify the UAE's position as a key market in the global paints and coatings landscape.

Paint Industry in UAE Segmentation

-

1. Resin Type

- 1.1. Arcylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Other Resin Types (Urethanes, Etc.)

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Paint Industry in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Paint Industry in UAE Regional Market Share

Geographic Coverage of Paint Industry in UAE

Paint Industry in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential Construction Activities; Growing Commercial Construction Sector

- 3.3. Market Restrains

- 3.3.1. Environmental Impact and Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Residential and Commercial Construction in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Arcylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Other Resin Types (Urethanes, Etc.)

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North America Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Arcylic

- 6.1.2. Alkyd

- 6.1.3. Polyurethane

- 6.1.4. Epoxy

- 6.1.5. Other Resin Types (Urethanes, Etc.)

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-borne

- 6.2.2. Solvent-borne

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. South America Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Arcylic

- 7.1.2. Alkyd

- 7.1.3. Polyurethane

- 7.1.4. Epoxy

- 7.1.5. Other Resin Types (Urethanes, Etc.)

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-borne

- 7.2.2. Solvent-borne

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Arcylic

- 8.1.2. Alkyd

- 8.1.3. Polyurethane

- 8.1.4. Epoxy

- 8.1.5. Other Resin Types (Urethanes, Etc.)

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-borne

- 8.2.2. Solvent-borne

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Middle East & Africa Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Arcylic

- 9.1.2. Alkyd

- 9.1.3. Polyurethane

- 9.1.4. Epoxy

- 9.1.5. Other Resin Types (Urethanes, Etc.)

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water-borne

- 9.2.2. Solvent-borne

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Asia Pacific Paint Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Arcylic

- 10.1.2. Alkyd

- 10.1.3. Polyurethane

- 10.1.4. Epoxy

- 10.1.5. Other Resin Types (Urethanes, Etc.)

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water-borne

- 10.2.2. Solvent-borne

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AkzoNobel N V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Sherwin-Williams Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jotun

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jazeera Paints

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ritver *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NATIONAL PAINTS FACTORIES CO LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Caparol Paints

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hempel A/S

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terraco Holdings Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf Paints

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Al Gurg Paints LLC (Oasis Paints)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 AkzoNobel N V

List of Figures

- Figure 1: Global Paint Industry in UAE Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Paint Industry in UAE Volume Breakdown (litre, %) by Region 2025 & 2033

- Figure 3: North America Paint Industry in UAE Revenue (Million), by Resin Type 2025 & 2033

- Figure 4: North America Paint Industry in UAE Volume (litre), by Resin Type 2025 & 2033

- Figure 5: North America Paint Industry in UAE Revenue Share (%), by Resin Type 2025 & 2033

- Figure 6: North America Paint Industry in UAE Volume Share (%), by Resin Type 2025 & 2033

- Figure 7: North America Paint Industry in UAE Revenue (Million), by Technology 2025 & 2033

- Figure 8: North America Paint Industry in UAE Volume (litre), by Technology 2025 & 2033

- Figure 9: North America Paint Industry in UAE Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Paint Industry in UAE Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Paint Industry in UAE Revenue (Million), by End-User 2025 & 2033

- Figure 12: North America Paint Industry in UAE Volume (litre), by End-User 2025 & 2033

- Figure 13: North America Paint Industry in UAE Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Paint Industry in UAE Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Paint Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Paint Industry in UAE Volume (litre), by Country 2025 & 2033

- Figure 17: North America Paint Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Paint Industry in UAE Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Paint Industry in UAE Revenue (Million), by Resin Type 2025 & 2033

- Figure 20: South America Paint Industry in UAE Volume (litre), by Resin Type 2025 & 2033

- Figure 21: South America Paint Industry in UAE Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: South America Paint Industry in UAE Volume Share (%), by Resin Type 2025 & 2033

- Figure 23: South America Paint Industry in UAE Revenue (Million), by Technology 2025 & 2033

- Figure 24: South America Paint Industry in UAE Volume (litre), by Technology 2025 & 2033

- Figure 25: South America Paint Industry in UAE Revenue Share (%), by Technology 2025 & 2033

- Figure 26: South America Paint Industry in UAE Volume Share (%), by Technology 2025 & 2033

- Figure 27: South America Paint Industry in UAE Revenue (Million), by End-User 2025 & 2033

- Figure 28: South America Paint Industry in UAE Volume (litre), by End-User 2025 & 2033

- Figure 29: South America Paint Industry in UAE Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Paint Industry in UAE Volume Share (%), by End-User 2025 & 2033

- Figure 31: South America Paint Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Paint Industry in UAE Volume (litre), by Country 2025 & 2033

- Figure 33: South America Paint Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Paint Industry in UAE Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Paint Industry in UAE Revenue (Million), by Resin Type 2025 & 2033

- Figure 36: Europe Paint Industry in UAE Volume (litre), by Resin Type 2025 & 2033

- Figure 37: Europe Paint Industry in UAE Revenue Share (%), by Resin Type 2025 & 2033

- Figure 38: Europe Paint Industry in UAE Volume Share (%), by Resin Type 2025 & 2033

- Figure 39: Europe Paint Industry in UAE Revenue (Million), by Technology 2025 & 2033

- Figure 40: Europe Paint Industry in UAE Volume (litre), by Technology 2025 & 2033

- Figure 41: Europe Paint Industry in UAE Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Europe Paint Industry in UAE Volume Share (%), by Technology 2025 & 2033

- Figure 43: Europe Paint Industry in UAE Revenue (Million), by End-User 2025 & 2033

- Figure 44: Europe Paint Industry in UAE Volume (litre), by End-User 2025 & 2033

- Figure 45: Europe Paint Industry in UAE Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Europe Paint Industry in UAE Volume Share (%), by End-User 2025 & 2033

- Figure 47: Europe Paint Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Paint Industry in UAE Volume (litre), by Country 2025 & 2033

- Figure 49: Europe Paint Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Paint Industry in UAE Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Paint Industry in UAE Revenue (Million), by Resin Type 2025 & 2033

- Figure 52: Middle East & Africa Paint Industry in UAE Volume (litre), by Resin Type 2025 & 2033

- Figure 53: Middle East & Africa Paint Industry in UAE Revenue Share (%), by Resin Type 2025 & 2033

- Figure 54: Middle East & Africa Paint Industry in UAE Volume Share (%), by Resin Type 2025 & 2033

- Figure 55: Middle East & Africa Paint Industry in UAE Revenue (Million), by Technology 2025 & 2033

- Figure 56: Middle East & Africa Paint Industry in UAE Volume (litre), by Technology 2025 & 2033

- Figure 57: Middle East & Africa Paint Industry in UAE Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Middle East & Africa Paint Industry in UAE Volume Share (%), by Technology 2025 & 2033

- Figure 59: Middle East & Africa Paint Industry in UAE Revenue (Million), by End-User 2025 & 2033

- Figure 60: Middle East & Africa Paint Industry in UAE Volume (litre), by End-User 2025 & 2033

- Figure 61: Middle East & Africa Paint Industry in UAE Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Middle East & Africa Paint Industry in UAE Volume Share (%), by End-User 2025 & 2033

- Figure 63: Middle East & Africa Paint Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa Paint Industry in UAE Volume (litre), by Country 2025 & 2033

- Figure 65: Middle East & Africa Paint Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Paint Industry in UAE Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Paint Industry in UAE Revenue (Million), by Resin Type 2025 & 2033

- Figure 68: Asia Pacific Paint Industry in UAE Volume (litre), by Resin Type 2025 & 2033

- Figure 69: Asia Pacific Paint Industry in UAE Revenue Share (%), by Resin Type 2025 & 2033

- Figure 70: Asia Pacific Paint Industry in UAE Volume Share (%), by Resin Type 2025 & 2033

- Figure 71: Asia Pacific Paint Industry in UAE Revenue (Million), by Technology 2025 & 2033

- Figure 72: Asia Pacific Paint Industry in UAE Volume (litre), by Technology 2025 & 2033

- Figure 73: Asia Pacific Paint Industry in UAE Revenue Share (%), by Technology 2025 & 2033

- Figure 74: Asia Pacific Paint Industry in UAE Volume Share (%), by Technology 2025 & 2033

- Figure 75: Asia Pacific Paint Industry in UAE Revenue (Million), by End-User 2025 & 2033

- Figure 76: Asia Pacific Paint Industry in UAE Volume (litre), by End-User 2025 & 2033

- Figure 77: Asia Pacific Paint Industry in UAE Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Asia Pacific Paint Industry in UAE Volume Share (%), by End-User 2025 & 2033

- Figure 79: Asia Pacific Paint Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific Paint Industry in UAE Volume (litre), by Country 2025 & 2033

- Figure 81: Asia Pacific Paint Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Paint Industry in UAE Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 3: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 5: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 7: Global Paint Industry in UAE Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Paint Industry in UAE Volume litre Forecast, by Region 2020 & 2033

- Table 9: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 10: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 11: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 13: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 15: Global Paint Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Paint Industry in UAE Volume litre Forecast, by Country 2020 & 2033

- Table 17: United States Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 19: Canada Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 21: Mexico Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 23: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 24: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 25: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 27: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 29: Global Paint Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Paint Industry in UAE Volume litre Forecast, by Country 2020 & 2033

- Table 31: Brazil Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 33: Argentina Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 37: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 38: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 39: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 41: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 43: Global Paint Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Paint Industry in UAE Volume litre Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 47: Germany Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 49: France Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 51: Italy Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 53: Spain Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 55: Russia Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 57: Benelux Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 59: Nordics Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 63: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 64: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 65: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 66: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 67: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 68: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 69: Global Paint Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Paint Industry in UAE Volume litre Forecast, by Country 2020 & 2033

- Table 71: Turkey Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 73: Israel Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 75: GCC Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 77: North Africa Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 79: South Africa Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 83: Global Paint Industry in UAE Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 84: Global Paint Industry in UAE Volume litre Forecast, by Resin Type 2020 & 2033

- Table 85: Global Paint Industry in UAE Revenue Million Forecast, by Technology 2020 & 2033

- Table 86: Global Paint Industry in UAE Volume litre Forecast, by Technology 2020 & 2033

- Table 87: Global Paint Industry in UAE Revenue Million Forecast, by End-User 2020 & 2033

- Table 88: Global Paint Industry in UAE Volume litre Forecast, by End-User 2020 & 2033

- Table 89: Global Paint Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global Paint Industry in UAE Volume litre Forecast, by Country 2020 & 2033

- Table 91: China Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 93: India Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 95: Japan Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 97: South Korea Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 101: Oceania Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Paint Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Paint Industry in UAE Volume (litre) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paint Industry in UAE?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Paint Industry in UAE?

Key companies in the market include AkzoNobel N V, The Sherwin-Williams Company, Jotun, Jazeera Paints, Ritver *List Not Exhaustive, NATIONAL PAINTS FACTORIES CO LTD, Caparol Paints, Hempel A/S, Terraco Holdings Ltd, Gulf Paints, Al Gurg Paints LLC (Oasis Paints).

3. What are the main segments of the Paint Industry in UAE?

The market segments include Resin Type, Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 558.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential Construction Activities; Growing Commercial Construction Sector.

6. What are the notable trends driving market growth?

Increasing Residential and Commercial Construction in the Country.

7. Are there any restraints impacting market growth?

Environmental Impact and Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2023: National Paints Factories Co. Ltd. extended its sponsorship of Sharjah Football Club for the 8th year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in litre.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paint Industry in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paint Industry in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paint Industry in UAE?

To stay informed about further developments, trends, and reports in the Paint Industry in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence