Key Insights

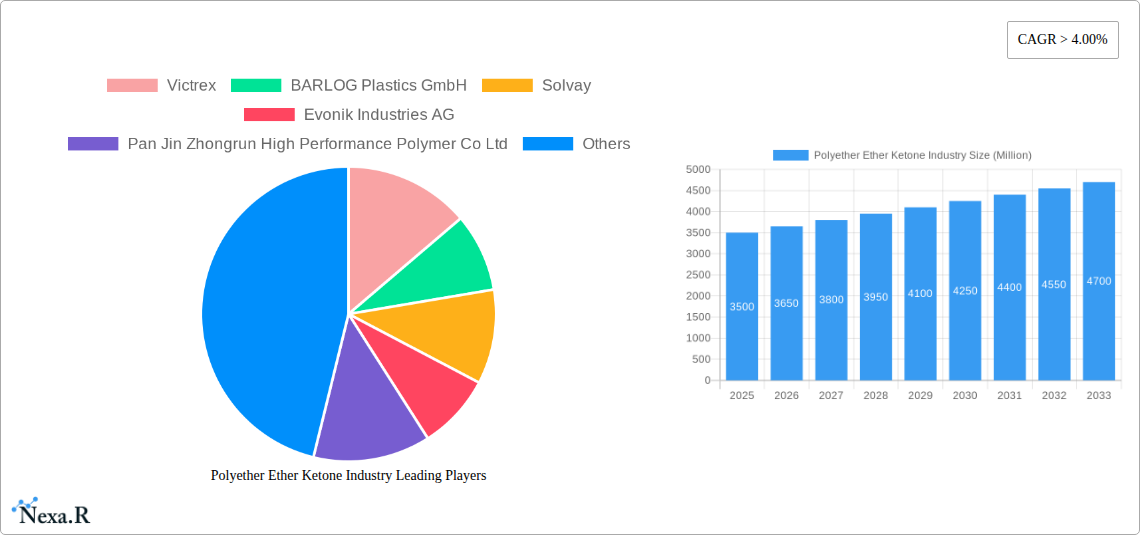

The Polyether Ether Ketone (PEEK) market is poised for robust growth, projected to reach an estimated XX million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This expansion is primarily fueled by the increasing demand for high-performance polymers across critical industries. The aerospace sector, in particular, is a significant driver, leveraging PEEK's exceptional strength-to-weight ratio, thermal stability, and chemical resistance for lightweight components, thereby enhancing fuel efficiency and performance. Similarly, the automotive industry is increasingly adopting PEEK for under-the-hood applications, electric vehicle components, and interior parts where durability and resistance to extreme temperatures and fluids are paramount. The electrical and electronics sector benefits from PEEK's excellent dielectric properties and flame retardancy, making it ideal for connectors, insulators, and housings. Furthermore, the industrial and machinery segment is recognizing PEEK's superior wear resistance and mechanical properties for gears, bearings, and seals in demanding environments.

Polyether Ether Ketone Industry Market Size (In Billion)

Despite this positive trajectory, the PEEK market faces certain restraints. The high cost of raw materials and complex manufacturing processes contribute to a premium price point, which can limit adoption in cost-sensitive applications. Additionally, the availability of alternative high-performance polymers, although often with less comprehensive property profiles, presents a competitive challenge. Nonetheless, ongoing research and development focused on improving manufacturing efficiencies and exploring novel PEEK composites are expected to mitigate these restraints. Key regions demonstrating significant market activity include Asia Pacific, driven by burgeoning manufacturing bases in China and India, and North America, owing to its advanced aerospace and automotive industries. Europe also represents a substantial market, supported by stringent regulatory requirements for high-performance materials in various sectors. The competitive landscape is characterized by established global players and emerging regional manufacturers, all striving to innovate and capture market share.

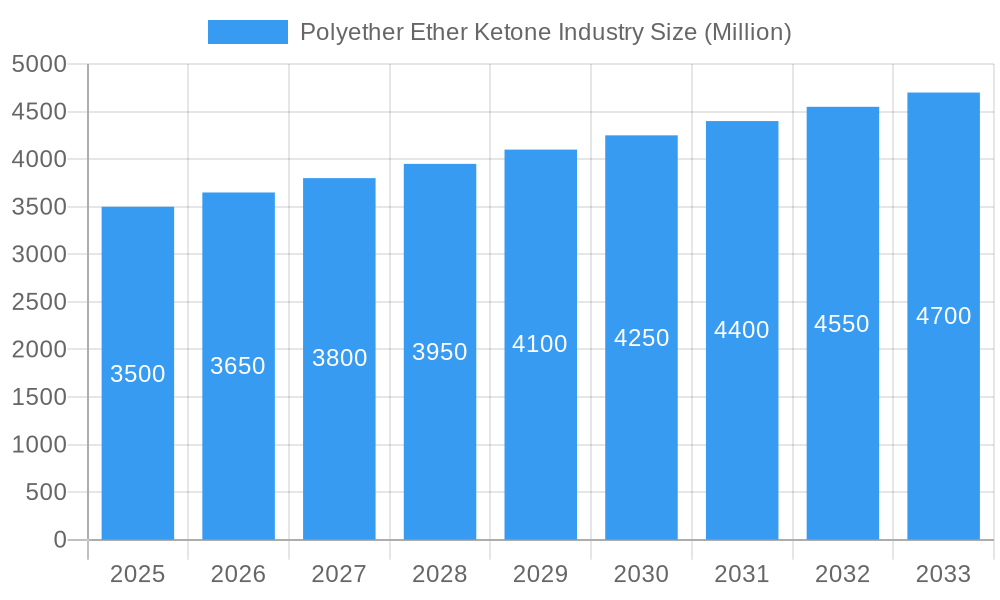

Polyether Ether Ketone Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Polyether Ether Ketone (PEEK) industry, examining its market dynamics, growth trends, regional dominance, product landscape, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers crucial insights for stakeholders seeking to understand and capitalize on the evolving PEEK market. All values are presented in Million units.

Polyether Ether Ketone Industry Market Dynamics & Structure

The Polyether Ether Ketone (PEEK) industry is characterized by a moderate market concentration, with key players like Victrex PLC and Solvay holding significant market shares. Technological innovation is a primary driver, fueled by advancements in polymer science and the increasing demand for high-performance materials in critical applications. Regulatory frameworks, particularly concerning material safety and sustainability, are also shaping market development. Competitive product substitutes, such as other high-performance polymers and advanced ceramics, present ongoing challenges, necessitating continuous product differentiation and performance enhancement. End-user demographics are shifting towards sectors demanding superior mechanical strength, chemical resistance, and thermal stability, including aerospace, automotive (especially e-mobility), and medical devices. Merger and acquisition (M&A) trends, while not as prevalent as in some other industries, are strategically focused on expanding production capacity, enhancing technological capabilities, and gaining market access. The industry's future growth hinges on addressing these dynamics effectively.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Driven by material science advancements and application-specific requirements.

- Regulatory Frameworks: Focus on safety, biocompatibility, and environmental standards.

- Competitive Substitutes: Other high-performance polymers, composites, and advanced ceramics.

- End-User Demographics: Growing demand from aerospace, automotive, medical, and industrial sectors.

- M&A Trends: Strategic acquisitions for capacity expansion and market penetration.

Polyether Ether Ketone Industry Growth Trends & Insights

The Polyether Ether Ketone (PEEK) market is poised for significant expansion, driven by its exceptional material properties and increasing adoption across diverse high-value applications. This growth is further augmented by advancements in material processing and a growing emphasis on lightweight, durable, and chemically resistant components. The estimated market size for PEEK is projected to reach $X,XXX million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025–2033. This robust growth trajectory is influenced by several key trends. Firstly, the automotive sector, particularly the burgeoning electric vehicle (EV) market, is a major catalyst, demanding PEEK for its high-temperature resistance and electrical insulation properties in components like battery systems, power electronics, and thermal management. The aerospace industry continues to be a consistent driver, leveraging PEEK's lightweight nature and exceptional strength for structural components, interior parts, and engine systems, contributing to fuel efficiency and enhanced performance. The medical industry's demand for biocompatible and sterilizable PEEK for implants, surgical instruments, and drug delivery systems is also a significant growth avenue, representing a high-value segment within the overall market. Furthermore, technological disruptions, such as advancements in additive manufacturing (3D printing) of PEEK, are opening up new design possibilities and enabling the creation of complex geometries, thereby expanding its application scope and accelerating adoption. Consumer behavior is increasingly favoring products that offer longevity, reliability, and superior performance, which aligns perfectly with the inherent advantages of PEEK. The integration of PEEK into consumer electronics, where miniaturization and heat dissipation are critical, also presents a growing opportunity. Market penetration is expected to deepen as awareness of PEEK's benefits grows and its cost-effectiveness for specific high-performance applications becomes more apparent. The continuous development of new PEEK grades with tailored properties for specific end-use requirements will further fuel market penetration and drive overall market size evolution.

Dominant Regions, Countries, or Segments in Polyether Ether Ketone Industry

The Polyether Ether Ketone (PEEK) market's dominance is significantly influenced by the interplay of advanced industrial infrastructure, robust research and development capabilities, and the presence of key end-user industries. Among the end-user segments, Automotive is emerging as a leading driver of market growth. This ascendancy is directly linked to the global transition towards electric mobility and the increasing demand for lightweight, high-performance materials that can withstand the demanding operational conditions of EVs.

Automotive Segment Dominance

The automotive industry's embrace of PEEK is propelled by several key factors:

- Electric Vehicle (EV) Revolution: The surging demand for EVs necessitates materials that offer superior thermal management, electrical insulation, and chemical resistance. PEEK's ability to withstand high temperatures and harsh automotive fluids makes it ideal for battery components, power electronics, motor housings, and charging infrastructure. The estimated market share of PEEK in the automotive sector is projected to be XX% by 2025, a figure expected to grow substantially.

- Lightweighting Initiatives: To improve fuel efficiency in internal combustion engine vehicles and extend the range of EVs, manufacturers are actively seeking to reduce vehicle weight. PEEK, with its high strength-to-weight ratio, offers a viable alternative to heavier metal components in areas like engine parts, transmission systems, and structural elements.

- Durability and Reliability: PEEK's exceptional wear resistance and mechanical strength ensure the longevity and reliability of automotive components, reducing maintenance needs and enhancing overall vehicle performance.

- Technological Advancements: Innovations in PEEK grades specifically designed for automotive applications, such as those for brake systems and e-mobility pump components, are further accelerating its adoption. Solvay's introduction of KetaSpire PEEK, KT-850 SCF 30 in July 2022 exemplifies this trend, targeting precision brake systems and e-mobility pump components.

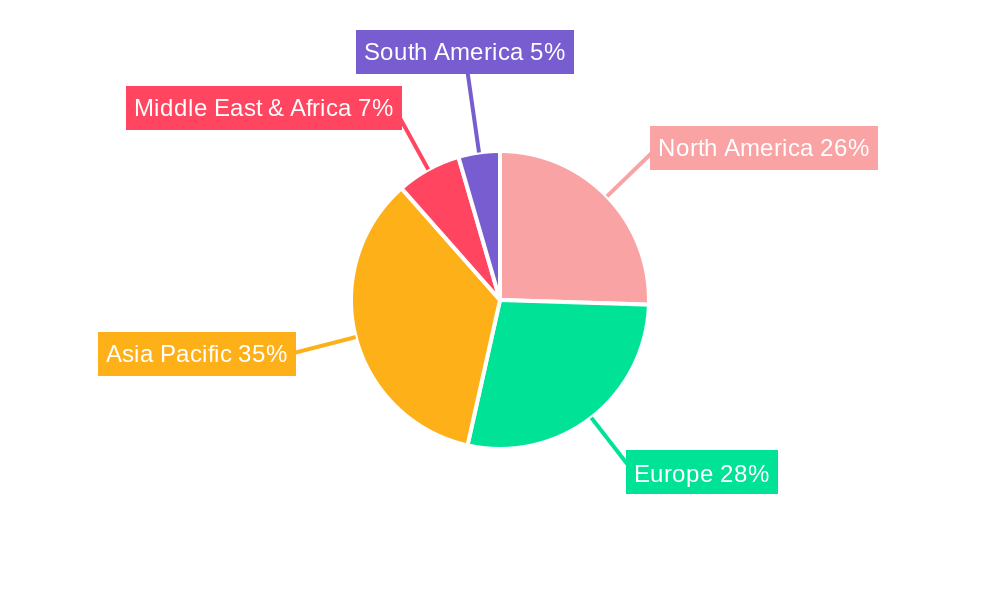

Regional Dominance

Geographically, North America and Europe are leading regions in PEEK consumption, primarily due to their well-established automotive and aerospace industries, coupled with strong R&D investments. However, Asia Pacific is rapidly emerging as a significant growth hub, driven by the burgeoning automotive manufacturing sector, particularly in China, and increasing investments in advanced manufacturing technologies and medical devices. The region's growing disposable income and increasing demand for high-performance vehicles are also contributing factors.

Polyether Ether Ketone Industry Regional Market Share

Other Significant Segments

While automotive is at the forefront, other segments also play a crucial role:

- Aerospace: Continues to be a significant consumer of PEEK due to its critical properties for aircraft components, including structural elements, interiors, and engine parts.

- Electrical and Electronics: PEEK's excellent electrical insulation properties and high-temperature resistance make it suitable for connectors, insulators, and semiconductor manufacturing equipment.

- Industrial and Machinery: PEEK's chemical inertness and mechanical strength are leveraged in pumps, seals, bearings, and other demanding industrial applications.

- Other End-user Industries: This includes the medical sector, which relies on PEEK's biocompatibility for implants and surgical instruments, and the oil and gas industry for downhole equipment.

The interplay of these segments and regions, driven by technological advancements and evolving industry demands, will continue to shape the global PEEK market landscape.

Polyether Ether Ketone Industry Product Landscape

The Polyether Ether Ketone (PEEK) product landscape is defined by continuous innovation aimed at enhancing its already impressive performance characteristics. Manufacturers are developing specialized grades of PEEK to cater to specific application requirements, offering improved mechanical strength, chemical resistance, wear resistance, and thermal stability. Innovations include reinforced PEEK composites, such as carbon fiber-filled or glass fiber-filled variants, which significantly boost stiffness and tensile strength, making them suitable for structural applications in aerospace and automotive. Furthermore, advancements in PEEK formulations for additive manufacturing are enabling the 3D printing of complex, high-performance parts with exceptional accuracy and speed. The introduction of grades with enhanced biocompatibility and sterilizability, like Victrex PLC's PEEK-OPTIMA polymer designed for medical device additive manufacturing, underscores the industry's focus on critical sectors. These product developments directly translate into unique selling propositions, allowing PEEK to displace traditional materials like metals and thermosets in demanding environments.

Key Drivers, Barriers & Challenges in Polyether Ether Ketone Industry

The Polyether Ether Ketone (PEEK) industry is propelled by several key drivers, primarily stemming from the increasing demand for high-performance materials across critical sectors.

Key Drivers:

- Technological Advancements: Continuous improvements in PEEK synthesis, processing, and formulation enable new applications and enhanced performance.

- Growth in Key End-User Industries: The expanding aerospace, automotive (especially electric vehicles), medical, and industrial machinery sectors are significant demand generators.

- Demand for Lightweighting and High Strength: PEEK's superior strength-to-weight ratio is crucial for fuel efficiency and performance enhancements.

- Superior Chemical and Thermal Resistance: These properties make PEEK ideal for harsh environments and high-temperature applications.

- Biocompatibility and Sterilizability: Essential for growth in the medical device and implantable applications.

Barriers & Challenges:

- High Material Cost: PEEK remains a premium material, which can limit its adoption in cost-sensitive applications. The estimated production cost per kilogram of virgin PEEK is around $XX-$XX.

- Processing Complexity: While improving, processing PEEK often requires specialized equipment and expertise due to its high melting point.

- Competition from Other High-Performance Polymers: Other advanced polymers and materials offer similar properties, creating competitive pressure.

- Supply Chain Volatility: Global geopolitical factors and raw material availability can impact supply chain stability and pricing.

- Regulatory Hurdles for New Applications: Gaining approvals for new medical or aerospace applications can be a lengthy and rigorous process.

Emerging Opportunities in Polyether Ether Ketone Industry

Emerging opportunities in the Polyether Ether Ketone (PEEK) industry lie in the burgeoning sectors of additive manufacturing (3D printing) and e-mobility. The development of specialized PEEK filaments and powders is enabling the cost-effective production of complex, customized parts for prototyping and end-use applications across various industries. In e-mobility, the demand for high-performance polymers in battery components, power electronics, and charging infrastructure presents a significant untapped market. Furthermore, the increasing focus on sustainable materials and the circular economy could spur opportunities for PEEK in applications requiring extreme durability and longevity, thereby reducing the need for frequent replacements.

Growth Accelerators in the Polyether Ether Ketone Industry Industry

Several factors are acting as significant growth accelerators for the Polyether Ether Ketone (PEEK) industry. The ongoing advancements in additive manufacturing (3D printing) are a major catalyst, enabling the creation of intricate, customized PEEK components that were previously impossible to manufacture. This opens new avenues for innovation in rapid prototyping and the production of specialized parts for industries like aerospace and medical. Furthermore, the accelerated adoption of electric vehicles (EVs) is creating substantial demand for PEEK due to its exceptional thermal and electrical properties, essential for battery systems, power electronics, and thermal management solutions. Strategic partnerships between PEEK manufacturers and key end-users, focusing on co-development of tailored materials for emerging applications, are also bolstering growth. Finally, the continuous expansion of medical applications, driven by PEEK's biocompatibility and mechanical performance for implants and surgical devices, remains a strong growth engine.

Key Players Shaping the Polyether Ether Ketone Industry Market

- Victrex PLC

- BARLOG Plastics GmbH

- Solvay

- Evonik Industries AG

- Pan Jin Zhongrun High Performance Polymer Co Ltd

- Zhejiang Pengfulong Technology Co Ltd

- Zibo Bainaisi Chemical Co Lt

- Jilin Joinature Polymer Co Ltd

- Polyplastics-Evonik Corporation

- Shandong Haoran Special Plastic Co Ltd

Notable Milestones in Polyether Ether Ketone Industry Sector

- March 2023: Victrex PLC introduced a new type of implantable PEEK-OPTIMA polymer specifically designed for the manufacturing processes of medical device additives, such as fused deposition modeling (FDM) and fused filament fabrication (FFF). This innovation is poised to significantly impact the medical device additive manufacturing sector.

- February 2023: Victrex PLC revealed plans to invest in the expansion of its medical division, Invibio Biomaterial Solutions, including the establishment of a new product development facility in Leeds, United Kingdom. This strategic investment underscores Victrex's commitment to advancing biomaterial solutions and increasing its capacity in the high-demand medical PEEK market.

- July 2022: Solvay introduced a new grade of KetaSpire PEEK, KT-850 SCF 30, designed for the precision brake system and e-mobility pump components. This product launch highlights Solvay's focus on developing specialized PEEK grades for the evolving automotive sector, particularly for electric and hybrid vehicles.

In-Depth Polyether Ether Ketone Industry Market Outlook

The Polyether Ether Ketone (PEEK) industry is projected to experience robust growth, driven by its indispensable role in high-performance applications. The expansion of additive manufacturing technologies will continue to unlock new design possibilities and accelerate the adoption of PEEK in intricate component manufacturing. The transition towards electric vehicles presents a massive opportunity, with PEEK's superior thermal management and electrical insulation properties being critical for battery packs, power electronics, and charging infrastructure. The medical sector's sustained demand for biocompatible and sterilizable materials for implants and surgical instruments will remain a significant contributor. Strategic collaborations, focused R&D on novel PEEK grades, and expanding production capacities are key to capitalizing on these growth accelerators, ensuring PEEK's continued dominance in demanding material applications.

Polyether Ether Ketone Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Electrical and Electronics

- 1.4. Industrial and Machinery

- 1.5. Other End-user Industries

Polyether Ether Ketone Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polyether Ether Ketone Industry Regional Market Share

Geographic Coverage of Polyether Ether Ketone Industry

Polyether Ether Ketone Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Growing Demand from the Poultry Industry; Increased Intake of Human Nutritional Supplements; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Outbreak of Animal Diseases; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Electrical and Electronics

- 5.1.4. Industrial and Machinery

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Electrical and Electronics

- 6.1.4. Industrial and Machinery

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Electrical and Electronics

- 7.1.4. Industrial and Machinery

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Electrical and Electronics

- 8.1.4. Industrial and Machinery

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Electrical and Electronics

- 9.1.4. Industrial and Machinery

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Polyether Ether Ketone Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Electrical and Electronics

- 10.1.4. Industrial and Machinery

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Victrex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BARLOG Plastics GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evonik Industries AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pan Jin Zhongrun High Performance Polymer Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zhejiang Pengfulong Technology Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zibo Bainaisi Chemical Co Lt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jilin Joinature Polymer Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Polyplastics-Evonik Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shandong Haoran Special Plastic Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Victrex

List of Figures

- Figure 1: Global Polyether Ether Ketone Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Polyether Ether Ketone Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 3: North America Polyether Ether Ketone Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Polyether Ether Ketone Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Polyether Ether Ketone Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Polyether Ether Ketone Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 7: South America Polyether Ether Ketone Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America Polyether Ether Ketone Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Polyether Ether Ketone Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polyether Ether Ketone Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 11: Europe Polyether Ether Ketone Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Polyether Ether Ketone Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Polyether Ether Ketone Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Polyether Ether Ketone Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa Polyether Ether Ketone Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa Polyether Ether Ketone Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Polyether Ether Ketone Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polyether Ether Ketone Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific Polyether Ether Ketone Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific Polyether Ether Ketone Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Polyether Ether Ketone Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 2: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 9: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 25: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Polyether Ether Ketone Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 33: Global Polyether Ether Ketone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Polyether Ether Ketone Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyether Ether Ketone Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Polyether Ether Ketone Industry?

Key companies in the market include Victrex, BARLOG Plastics GmbH, Solvay, Evonik Industries AG, Pan Jin Zhongrun High Performance Polymer Co Ltd, Zhejiang Pengfulong Technology Co Ltd, Zibo Bainaisi Chemical Co Lt, Jilin Joinature Polymer Co Ltd, Polyplastics-Evonik Corporation, Shandong Haoran Special Plastic Co Ltd.

3. What are the main segments of the Polyether Ether Ketone Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Growing Demand from the Poultry Industry; Increased Intake of Human Nutritional Supplements; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Outbreak of Animal Diseases; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2023: Victrex PLC introduced a new type of implantable PEEK-OPTIMA polymer that is specifically designed for use in the manufacturing processes of medical device additives, such as fused deposition modeling (FDM) and fused filament fabrication (FFF).February 2023: Victrex PLC revealed its plans to invest in the expansion of its medical division, Invibio Biomaterial Solutions, which includes establishing a new product development facility in Leeds, United Kingdom.July 2022: Solvay introduced a new grade of KetaSpire PEEK, KT-850 SCF 30, designed for the precision brake system and e-mobility pump components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyether Ether Ketone Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyether Ether Ketone Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyether Ether Ketone Industry?

To stay informed about further developments, trends, and reports in the Polyether Ether Ketone Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence