Key Insights

The pyrolysis gas industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% through 2033. This expansion is fueled by several key drivers. The increasing demand for ethylene and propylene, fundamental building blocks in the plastics and petrochemical industries, is a significant factor. Furthermore, the growing adoption of sustainable and circular economy practices is boosting the utilization of pyrolysis gas as a valuable feedstock derived from waste plastic recycling. Technological advancements, leading to improved efficiency and reduced production costs in pyrolysis processes, further contribute to market growth. However, the market faces some restraints, including the high capital investment required for pyrolysis plant construction and the fluctuating prices of crude oil, which can affect the competitiveness of pyrolysis-derived products. The industry is segmented by application (e.g., chemical production, energy generation), by feedstock type (e.g., plastics, biomass), and by geographic region. Key players such as KOYO KAIUN Co Ltd, Axens, Chevron Phillips Chemical Company, Dow, Exxon Mobil Corporation, and others are actively shaping the market through innovation and strategic partnerships, expanding their production capacities, and exploring new applications.

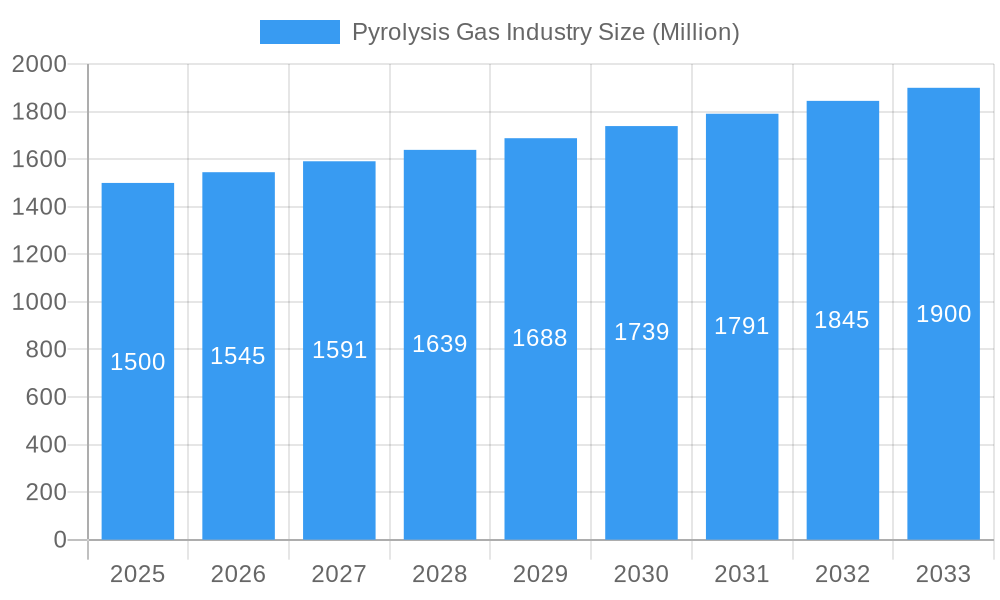

Pyrolysis Gas Industry Market Size (In Billion)

The forecast period of 2025-2033 indicates continued growth, primarily driven by the expanding global demand for petrochemicals and the increasing focus on sustainable waste management solutions. The competitive landscape is characterized by both established petrochemical companies and specialized pyrolysis technology providers, leading to a dynamic market with ongoing innovation and consolidation. Regional variations in growth will depend on factors such as government policies promoting renewable energy and waste recycling, the availability of suitable feedstock, and the level of industrial development. Continuous advancements in pyrolysis technologies, including the development of more efficient and versatile reactor designs and the integration of advanced process control systems, are likely to further accelerate market expansion in the coming years. The overall outlook for the pyrolysis gas industry remains positive, presenting significant opportunities for both established players and new entrants.

Pyrolysis Gas Industry Company Market Share

Pyrolysis Gas Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Pyrolysis Gas industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report illuminates the market dynamics, growth trends, and future potential of this crucial sector. The report values are presented in Million units.

Pyrolysis Gas Industry Market Dynamics & Structure

The global pyrolysis gas market, projected to reach xx Million by 2025, is characterized by a moderately concentrated structure. Leading entities such as Exxon Mobil Corporation, SABIC, and Shell currently command a substantial portion of the market share. A primary impetus for growth stems from relentless technological innovation, specifically aimed at augmenting process efficiency and minimizing environmental emissions. The evolving regulatory landscape, with an increasing emphasis on stringent environmental standards, is a significant factor shaping market trajectories and compelling industry participants to embrace more sustainable operational practices. The market also experiences competitive pressure from readily available alternative gas sources, which can influence growth. The primary end-user segments remain the petrochemical and plastics industries. Mergers and acquisitions (M&A) have shown a moderate trend in recent years, with xx recorded transactions between 2019 and 2024, largely concentrated on bolstering production capacities and integrating advanced technological capabilities.

- Market Concentration: The market exhibits moderate concentration, with the top 5 players anticipated to hold approximately xx% of the market share by 2025.

- Technological Innovation: Key innovation efforts are focused on enhancing energy efficiency, substantially reducing emissions, and pioneering the development of next-generation pyrolysis technologies.

- Regulatory Landscape: Increasingly stringent environmental regulations are a powerful catalyst, accelerating the adoption of cleaner and more sustainable pyrolysis technologies.

- Competitive Substitutes: The presence of alternative gas sources presents a notable competitive challenge, potentially impacting the overall market growth trajectory.

- End-User Demographics: The demand is predominantly driven by the robust requirements of the petrochemical and plastics sectors.

- M&A Trends: M&A activity has been moderate, with a strategic emphasis on expanding production capabilities and integrating advanced technologies.

Pyrolysis Gas Industry Growth Trends & Insights

The pyrolysis gas market demonstrates consistent growth, driven by increasing demand from the downstream petrochemical industry and expanding production capacities. The market size experienced a CAGR of xx% during the historical period (2019-2024), reaching xx Million in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. Technological advancements, particularly in the development of more efficient and sustainable pyrolysis processes, are accelerating market adoption rates. Consumer behavior is largely influenced by price fluctuations and environmental concerns, with a growing preference for sustainable production methods. Market penetration in developing economies is expected to increase significantly, driven by industrialization and infrastructure development.

Dominant Regions, Countries, or Segments in Pyrolysis Gas Industry

The Asia-Pacific region is currently the dominant market for pyrolysis gas, owing to its robust petrochemical industry, rapid economic growth, and substantial investments in infrastructure development. China and India are key growth drivers within this region. North America also holds a significant market share due to its established petrochemical infrastructure and technological advancements.

- Key Drivers in Asia-Pacific: Rapid industrialization, increasing demand from the petrochemical sector, and government support for infrastructure development.

- Key Drivers in North America: Established petrochemical infrastructure, technological advancements, and focus on sustainable practices.

- Market Share: Asia-Pacific holds approximately xx% of the global market share in 2025, while North America holds approximately xx%.

- Growth Potential: Significant growth potential in developing economies, driven by rising energy demand and industrialization.

Pyrolysis Gas Industry Product Landscape

The pyrolysis gas market encompasses a diverse array of products, each possessing distinct compositions and purity levels, meticulously engineered to align with specific applications within the petrochemical sector. Recent advancements are predominantly geared towards elevating gas quality, maximizing product yields, and curtailing energy consumption throughout the pyrolysis process. State-of-the-art pyrolysis technologies, including microwave-assisted pyrolysis and catalytic pyrolysis, are instrumental in boosting product efficiency and significantly mitigating environmental impact. Differentiating factors and unique selling propositions often revolve around achieving exceptional purity, ensuring unwavering product consistency, and demonstrating a demonstrably reduced environmental footprint.

Key Drivers, Barriers & Challenges in Pyrolysis Gas Industry

Key Drivers:

- Increasing demand from the petrochemical industry.

- Technological advancements leading to improved efficiency and reduced costs.

- Government support and incentives for sustainable energy solutions.

Key Challenges:

- Fluctuations in feedstock prices.

- Stringent environmental regulations and compliance costs.

- Competition from alternative gas sources.

- Supply chain disruptions impacting production and distribution.

Emerging Opportunities in Pyrolysis Gas Industry

Emerging opportunities include the expansion into untapped markets, particularly in developing economies with burgeoning petrochemical industries. Innovative applications of pyrolysis gas in specialty chemicals and biofuels offer significant growth potential. The growing demand for sustainable and environmentally friendly alternatives is driving opportunities for green pyrolysis technologies.

Growth Accelerators in the Pyrolysis Gas Industry

Sustained long-term growth is poised to be significantly influenced by transformative technological breakthroughs in pyrolysis processes, leading to enhanced efficiency and improved cost-effectiveness. The establishment of strategic alliances and collaborative partnerships between pyrolysis gas manufacturers and downstream petrochemical entities is anticipated to optimize supply chain operations and foster increased demand. Furthermore, the strategic expansion into nascent geographical markets and the diversification of applications will serve as potent catalysts for accelerated market expansion.

Key Players Shaping the Pyrolysis Gas Industry Market

- KOYO KAIUN Co Ltd

- Axens

- Chevron Phillips Chemical Company

- Dow

- Exxon Mobil Corporation

- Haldia Petrochemicals Limited

- HIP-Petrohemija

- Jam Petrochemical Company

- ONGC Petro additions Limited

- Ras Laffan Olefins Company Limited

- SABIC

- Shell

- Sud Chemie India Pvt Ltd *List Not Exhaustive

Notable Milestones in Pyrolysis Gas Industry Sector

- 2020: Introduction of a groundbreaking, highly efficient pyrolysis technology by Company Name.

- 2022: A strategic merger between two prominent market players, leading to a significant consolidation of market share and an expansion of production capacity.

- 2023: Substantial capital investment allocated towards the development of a new, advanced pyrolysis gas production facility in the Region.

In-Depth Pyrolysis Gas Industry Market Outlook

The future trajectory of the pyrolysis gas market appears exceptionally promising, marked by significant growth potential. This optimism is underpinned by the persistent and robust demand emanating from the petrochemical industry, coupled with continuous advancements in pyrolysis technologies and an escalating global emphasis on sustainability. Strategic collaborations, dedicated investments in research and development initiatives, and the strategic penetration of new markets will be paramount for companies aspiring to effectively leverage the opportunities presented within this dynamic industrial landscape. The market is strategically positioned for substantial expansion, driven by the ongoing global transition towards sustainable energy solutions and the ever-increasing demand for petrochemical derivatives worldwide.

Pyrolysis Gas Industry Segmentation

-

1. Type

- 1.1. Raw Pyrolysis Gasoline

- 1.2. Hydrogenated Pyrolysis Gasoline

-

2. Application

- 2.1. Benzene Processing

- 2.2. Aromatic Extraction

- 2.3. Feedstock of BTX Plant

- 2.4. Motor Fuels

- 2.5. Others

Pyrolysis Gas Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Pyrolysis Gas Industry Regional Market Share

Geographic Coverage of Pyrolysis Gas Industry

Pyrolysis Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand of Pyrolysis Gas from Benzene Processing; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand of Pyrolysis Gas from Benzene Processing; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand of Pyrolysis Gas from Benzene Processing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Raw Pyrolysis Gasoline

- 5.1.2. Hydrogenated Pyrolysis Gasoline

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Benzene Processing

- 5.2.2. Aromatic Extraction

- 5.2.3. Feedstock of BTX Plant

- 5.2.4. Motor Fuels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Raw Pyrolysis Gasoline

- 6.1.2. Hydrogenated Pyrolysis Gasoline

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Benzene Processing

- 6.2.2. Aromatic Extraction

- 6.2.3. Feedstock of BTX Plant

- 6.2.4. Motor Fuels

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Raw Pyrolysis Gasoline

- 7.1.2. Hydrogenated Pyrolysis Gasoline

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Benzene Processing

- 7.2.2. Aromatic Extraction

- 7.2.3. Feedstock of BTX Plant

- 7.2.4. Motor Fuels

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Raw Pyrolysis Gasoline

- 8.1.2. Hydrogenated Pyrolysis Gasoline

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Benzene Processing

- 8.2.2. Aromatic Extraction

- 8.2.3. Feedstock of BTX Plant

- 8.2.4. Motor Fuels

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Raw Pyrolysis Gasoline

- 9.1.2. Hydrogenated Pyrolysis Gasoline

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Benzene Processing

- 9.2.2. Aromatic Extraction

- 9.2.3. Feedstock of BTX Plant

- 9.2.4. Motor Fuels

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Pyrolysis Gas Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Raw Pyrolysis Gasoline

- 10.1.2. Hydrogenated Pyrolysis Gasoline

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Benzene Processing

- 10.2.2. Aromatic Extraction

- 10.2.3. Feedstock of BTX Plant

- 10.2.4. Motor Fuels

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 KOYO KAIUN Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Axens

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Phillips Chemical Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dow

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Exxon Mobil Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Haldia Petrochemicals Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HIP-Petrohemija

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jam Petrochemical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ONGC Petro additions Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ras Laffan Olefins Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SABIC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shell

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sud Chemie India Pvt Ltd*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 KOYO KAIUN Co Ltd

List of Figures

- Figure 1: Global Pyrolysis Gas Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Pyrolysis Gas Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Pyrolysis Gas Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Pyrolysis Gas Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Pyrolysis Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Pyrolysis Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Pyrolysis Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Pyrolysis Gas Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Pyrolysis Gas Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Pyrolysis Gas Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Pyrolysis Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Pyrolysis Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Pyrolysis Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Pyrolysis Gas Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Pyrolysis Gas Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Pyrolysis Gas Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Pyrolysis Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Pyrolysis Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Pyrolysis Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Pyrolysis Gas Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Pyrolysis Gas Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Pyrolysis Gas Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Pyrolysis Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Pyrolysis Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Pyrolysis Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pyrolysis Gas Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Pyrolysis Gas Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Pyrolysis Gas Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Pyrolysis Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Pyrolysis Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Pyrolysis Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Pyrolysis Gas Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Pyrolysis Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Pyrolysis Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Pyrolysis Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Pyrolysis Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Pyrolysis Gas Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Pyrolysis Gas Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Pyrolysis Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Pyrolysis Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pyrolysis Gas Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Pyrolysis Gas Industry?

Key companies in the market include KOYO KAIUN Co Ltd, Axens, Chevron Phillips Chemical Company, Dow, Exxon Mobil Corporation, Haldia Petrochemicals Limited, HIP-Petrohemija, Jam Petrochemical Company, ONGC Petro additions Limited, Ras Laffan Olefins Company Limited, SABIC, Shell, Sud Chemie India Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the Pyrolysis Gas Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand of Pyrolysis Gas from Benzene Processing; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand of Pyrolysis Gas from Benzene Processing.

7. Are there any restraints impacting market growth?

; Growing Demand of Pyrolysis Gas from Benzene Processing; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pyrolysis Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pyrolysis Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pyrolysis Gas Industry?

To stay informed about further developments, trends, and reports in the Pyrolysis Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence