Key Insights

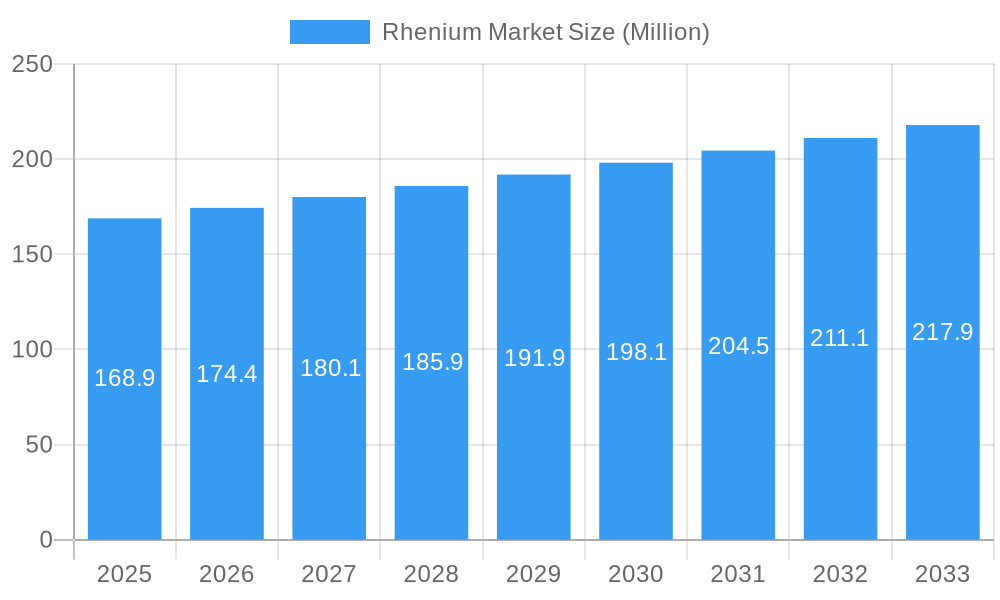

The global Rhenium Market is poised for steady growth, projected to reach approximately $168.9 million by 2025, with a compound annual growth rate (CAGR) of 3.3% expected to carry it through 2033. This expansion is underpinned by the critical role of rhenium in high-performance applications, primarily superalloys used in the aerospace and industrial gas turbine sectors. The increasing demand for fuel-efficient aircraft and advanced power generation systems directly fuels the need for rhenium's exceptional high-temperature strength and resistance to oxidation and corrosion. While the automotive sector represents a smaller but growing segment, its focus on high-performance engines and catalytic converters also contributes to market dynamics. The catalyst application, particularly in petroleum refining for producing high-octane gasoline, remains a significant driver, benefiting from the ongoing need for cleaner fuels and efficient refining processes. Emerging applications within healthcare, though currently niche, present potential avenues for future growth as research into rhenium's unique properties continues.

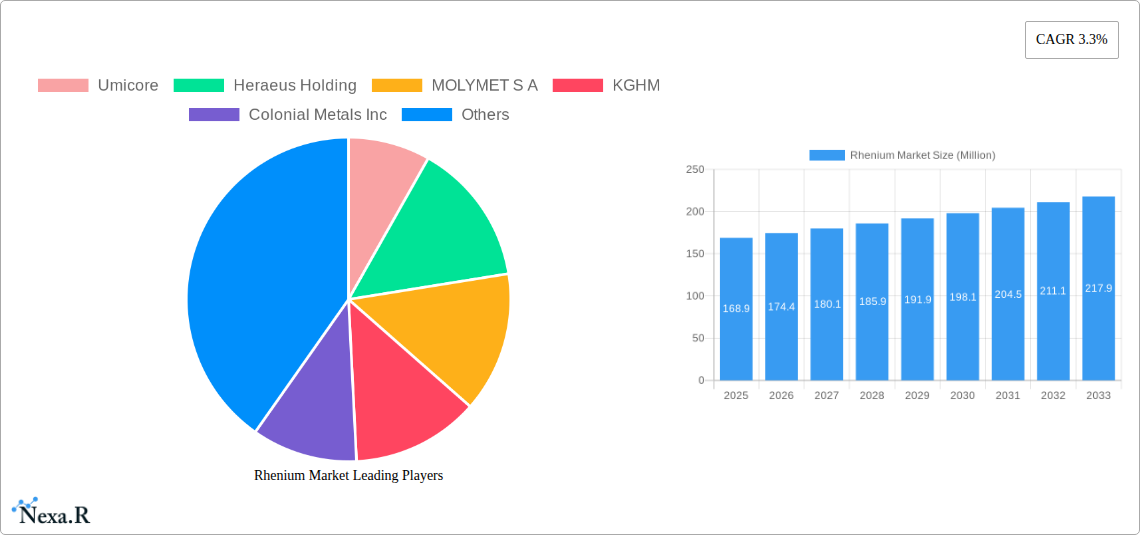

Rhenium Market Market Size (In Million)

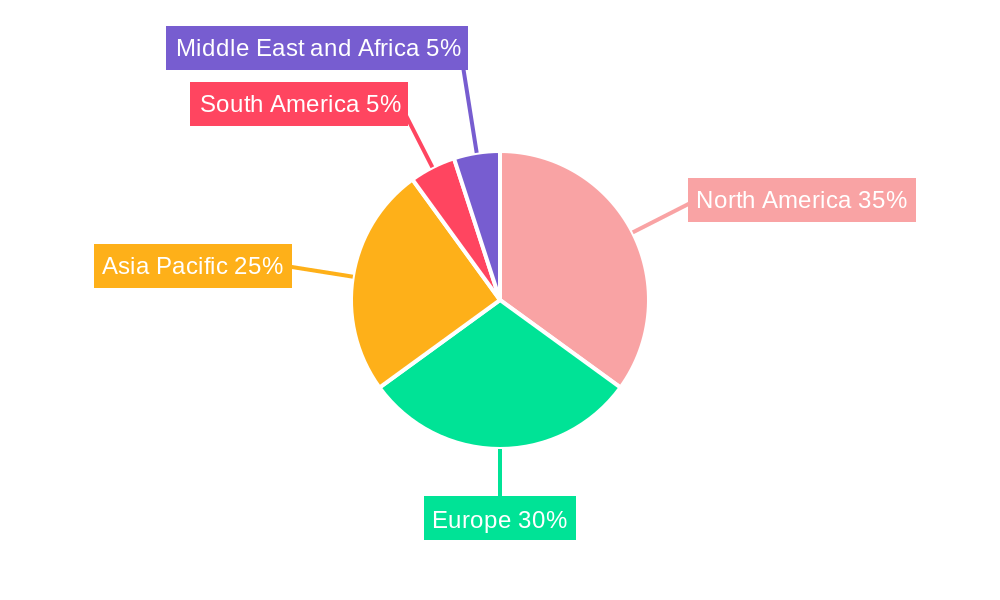

The market faces certain headwinds, primarily related to the concentrated supply of rhenium, which is largely a byproduct of molybdenum and copper mining. This inherent supply constraint, coupled with geopolitical factors and the complex extraction and refining processes, can lead to price volatility and supply chain disruptions. Emerging recycling technologies for rhenium from spent catalysts and superalloys are gaining traction and could play a crucial role in mitigating supply concerns and enhancing market sustainability. Geographically, North America and Europe have historically dominated the market due to the presence of major aerospace and industrial gas turbine manufacturers. However, the Asia Pacific region, particularly China and India, is exhibiting robust growth, driven by expanding domestic aviation industries, increasing investments in power generation, and a burgeoning automotive sector. The development of advanced mining and refining capabilities within these regions, coupled with supportive government initiatives, is expected to shift market share dynamics in the coming years.

Rhenium Market Company Market Share

Here's a SEO-optimized report description for the Rhenium Market, designed for maximum visibility and industry engagement:

Rhenium Market Size, Share, Trends, Growth & Forecast 2019-2033: Superalloys, Catalysts, Aerospace, Industrial Gas Turbines Analysis

This comprehensive Rhenium Market report delves into the intricate dynamics, evolving trends, and future outlook of this critical specialty metal. Covering the period from 2019 to 2033, with a deep dive into the Base Year (2025) and Forecast Period (2025–2033), this study provides unparalleled insights for industry stakeholders. Analyze the global Rhenium market size, rhenium market share, and rhenium market growth across key applications including Superalloys, Catalysts, and Other Applications. Understand the pivotal role of rhenium in driving advancements within the Aerospace, Industrial Gas Turbines, Automotive, Healthcare, and Other End-user Industries.

The report meticulously examines market concentration, technological innovation drivers, and the impact of evolving regulatory frameworks. We dissect competitive product substitutes and analyze end-user demographics, alongside key Mergers & Acquisitions (M&A) trends. Quantitative insights, such as estimated market share percentages and M&A deal volumes, are presented alongside qualitative factors, including innovation barriers, offering a 360-degree market view.

Gain a profound understanding of market evolution, adoption rates, and technological disruptions. This report quantifies rhenium market growth trends and forecasts rhenium market CAGR with specific metrics and market penetration data. Explore the dominant regions, countries, and segments, highlighting key drivers like economic policies and infrastructure development. The rhenium market product landscape section details product innovations, unique selling propositions, and technological advancements.

Crucially, this report identifies the key drivers, barriers & challenges in the Rhenium Market, including technological, economic, and policy-driven factors, alongside supply chain issues and competitive pressures. We uncover emerging opportunities in the Rhenium Market and discuss the growth accelerators in the Rhenium Market industry, focusing on technological breakthroughs and strategic partnerships.

This report features an extensive analysis of the Key Players Shaping the Rhenium Market, including Umicore, Heraeus Holding, MOLYMET S A, KGHM, Colonial Metals Inc, Höganäs AB, American Elements, NEO, H Cross Company, Buss & Buss Spezialmetalle GmbH, Rhenium Alloys Inc. Explore Notable Milestones in the Rhenium Market Sector, from product launches to strategic mergers, and gain an In-Depth Rhenium Market Outlook on future market potential and strategic opportunities. All values are presented in Million units for clear quantitative analysis.

Rhenium Market Market Dynamics & Structure

The rhenium market is characterized by a moderate to high level of concentration, with a few key players dominating global supply and demand. Technological innovation is a primary driver, particularly in the development of advanced superalloys for high-temperature applications and enhanced catalytic processes. Regulatory frameworks, especially concerning environmental standards and the sourcing of rare metals, play a significant role in shaping market entry and operational practices. Competitive product substitutes are limited due to rhenium's unique properties, but advancements in material science are continuously explored. End-user demographics are heavily skewed towards high-performance industries, with aerospace and industrial gas turbines constituting the largest consumer base. Mergers and acquisitions (M&A) trends are influenced by the need for supply chain security and vertical integration, often driven by the strategic importance of rhenium in critical technologies.

- Market Concentration: Dominated by a select group of global producers and refiners.

- Technological Innovation: Driven by demand for higher-performing superalloys and more efficient catalysts.

- Regulatory Frameworks: Increasingly stringent environmental and sourcing regulations impacting operations.

- Competitive Product Substitutes: Limited due to unique rhenium properties, but continuous research into alternatives.

- End-User Demographics: Heavily reliant on Aerospace and Industrial Gas Turbines sectors.

- M&A Trends: Focused on securing supply chains and integrating downstream applications.

- Innovation Barriers: High capital investment for exploration and refining, coupled with geopolitical risks.

- Estimated M&A Deal Volume (2024-2025): xx Million units.

- Estimated Market Share of Top 3 Players (2025): xx%.

Rhenium Market Growth Trends & Insights

The rhenium market is poised for significant growth, fueled by sustained demand from its core applications and the emergence of new technological frontiers. The market size evolution is projected to witness a steady upward trajectory throughout the forecast period, driven by consistent adoption rates in aerospace engine manufacturing and industrial gas turbine production. Technological disruptions, such as advancements in additive manufacturing for high-temperature components and novel catalytic processes in petrochemical refining, are expected to further boost demand. Consumer behavior shifts, while less direct in this industrial market, are influenced by a growing emphasis on efficiency, performance, and sustainability across end-user industries. For instance, the drive for more fuel-efficient aircraft and power generation turbines directly translates to increased demand for high-performance nickel-based superalloys containing rhenium.

The market penetration of rhenium in specialized applications continues to expand as its unique properties—high melting point, excellent resistance to corrosion and creep—become increasingly indispensable. The rhenium market CAGR is anticipated to be robust, reflecting the critical nature of this metal in enabling advanced technologies. The base year of 2025 marks a significant point in this growth trajectory, with estimations pointing towards continued expansion driven by global infrastructure projects and a rebound in air travel, both of which directly impact the aerospace and industrial gas turbine sectors. Further insights into market dynamics reveal a growing interest in rhenium's potential applications within the healthcare sector, particularly in medical imaging and targeted drug delivery systems, though these are still nascent compared to established uses. The interplay between technological innovation and the increasing performance demands of key industries will undoubtedly shape the rhenium market growth trends for the foreseeable future.

- Market Size Evolution: Consistent upward trajectory driven by core applications and new technological frontiers.

- Adoption Rates: Sustained high adoption in aerospace and industrial gas turbines.

- Technological Disruptions: Impact of additive manufacturing, advanced catalysis, and potential healthcare innovations.

- Consumer Behavior Shifts: Indirect influence through industry demands for efficiency, performance, and sustainability.

- Estimated Market Penetration (Aerospace Superalloys, 2025): xx%.

- Estimated Market Penetration (Catalysts, 2025): xx%.

- Projected Rhenium Market CAGR (2025-2033): xx%.

- Estimated Rhenium Market Size (2025): xx Million units.

- Estimated Rhenium Market Size (2033): xx Million units.

Dominant Regions, Countries, or Segments in Rhenium Market

The rhenium market is significantly driven by the Aerospace end-user industry, making it the dominant segment. This dominance is primarily due to the indispensable role of rhenium in the production of advanced nickel-based superalloys, which are critical for the high-temperature components of jet engines and gas turbines. The relentless pursuit of higher fuel efficiency, increased thrust, and extended engine lifespan in commercial aviation and military applications directly fuels the demand for rhenium-rich superalloys. Economic policies that support aerospace manufacturing and defense spending, coupled with robust infrastructure development in air travel, further amplify the growth potential of this segment. The United States and Europe are major hubs for aerospace innovation and manufacturing, consequently leading in rhenium consumption within this sector.

Within applications, Superalloys stand out as the primary consumer of rhenium, directly linked to its use in aerospace and industrial gas turbines. The unique combination of high melting point, exceptional strength at elevated temperatures, and resistance to oxidation and corrosion makes rhenium unparalleled for turbine blades and other critical engine parts. The growth in this application segment is propelled by the continuous upgrade cycles of existing aircraft fleets and the development of next-generation aircraft with more demanding performance requirements. Furthermore, the industrial gas turbine sector, vital for power generation and petrochemical processing, also exhibits substantial rhenium consumption, particularly in regions with high energy demand and a focus on efficient power generation technologies. Market share within the superalloys segment is substantial, accounting for an estimated xx% of the total rhenium market in 2025.

- Dominant End-User Industry: Aerospace.

- Key Drivers: Demand for higher fuel efficiency, increased thrust, and extended engine lifespan in aircraft.

- Supporting Factors: Government defense spending, air travel infrastructure development, and fleet upgrade cycles.

- Market Share (Aerospace, 2025): xx%.

- Dominant Application Segment: Superalloys.

- Key Properties Leveraged: High melting point, creep resistance, oxidation resistance.

- Growth Drivers: Development of next-generation aircraft and power generation turbines.

- Market Share (Superalloys, 2025): xx%.

- Leading Regions for Consumption: North America (USA) and Europe.

- Rationale: Presence of major aerospace and industrial gas turbine manufacturers.

- Growth Potential in Other Segments: Catalysts (petrochemical refining) and Healthcare (medical imaging, targeted therapies) represent emerging but smaller growth areas.

Rhenium Market Product Landscape

The product landscape of the rhenium market is primarily defined by its refined forms, including rhenium metal, rhenium oxides, and various rhenium alloys. The most significant application is in high-performance nickel-based superalloys, where even small additions of rhenium (typically 3-6% by weight) dramatically enhance creep strength, fatigue life, and oxidation resistance at extreme temperatures. These superalloys are indispensable for the turbine blades and discs in jet engines and industrial gas turbines. In the petrochemical industry, rhenium-based catalysts, particularly rhenium-molybdenum sulfide, are crucial for reforming processes, significantly improving gasoline yields and octane ratings. Unique selling propositions lie in rhenium's ability to withstand conditions that degrade other metals, directly translating to enhanced efficiency and longevity in critical applications. Technological advancements focus on improving refining purity and developing more cost-effective alloying and catalytic formulations.

Key Drivers, Barriers & Challenges in Rhenium Market

Key Drivers:

- Aerospace Industry Growth: Increased demand for advanced jet engines and gas turbines for both commercial and defense applications.

- Industrial Gas Turbine Expansion: Growing need for efficient power generation and industrial process efficiency.

- Technological Advancements in Superalloys: Continuous innovation requiring superior material properties for extreme environments.

- Catalytic Efficiency Improvements: Rhenium-based catalysts offer higher yields and selectivity in petrochemical refining.

Barriers & Challenges:

- Supply Chain Volatility: Rhenium is largely a byproduct of copper mining, leading to supply dependency on copper production and geopolitical risks in major mining regions.

- High Cost and Price Fluctuations: Rhenium is one of the rarest and most expensive metals, making its applications cost-sensitive.

- Environmental Regulations: Stringent regulations on mining and refining processes can increase operational costs and compliance burdens.

- Limited Substitutes: While an advantage for demand, the lack of readily available substitutes makes supply disruptions particularly impactful.

- Estimated Impact of Supply Disruptions on Price (2025): xx% increase.

- Estimated Compliance Costs for Refineries (2025): xx Million units.

Emerging Opportunities in Rhenium Market

Emerging opportunities in the rhenium market are surfacing in niche but high-potential areas. The advancement of 3D printing technologies for aerospace and industrial applications opens doors for more intricate and customized rhenium alloy components, optimizing performance and reducing waste. Furthermore, research into novel catalytic applications beyond traditional petrochemical refining, such as in sustainable fuel production and chemical synthesis, presents significant growth potential. In the healthcare sector, the use of rhenium isotopes in medical imaging and targeted radiotherapy is an evolving area with promising long-term prospects. Investments in recycling technologies for spent rhenium-containing components could also create new revenue streams and mitigate supply chain concerns.

Growth Accelerators in the Rhenium Market Industry

The rhenium market industry is propelled by several key growth accelerators. Foremost among these is the ongoing innovation in aerospace technology, particularly the development of more fuel-efficient and powerful jet engines that necessitate advanced, rhenium-enhanced superalloys. The global push towards energy efficiency and cleaner energy production also fuels demand for high-performance industrial gas turbines, a significant consumer of rhenium. Strategic partnerships between rhenium producers, alloy manufacturers, and end-users are crucial for ensuring supply chain stability and fostering collaborative R&D for new applications. Market expansion strategies, including exploring new geographical markets and developing specialized rhenium products for emerging industries, will further accelerate growth.

Key Players Shaping the Rhenium Market Market

- Umicore

- Heraeus Holding

- MOLYMET S A

- KGHM

- Colonial Metals Inc

- Höganäs AB

- American Elements

- NEO

- H Cross Company

- Buss & Buss Spezialmetalle GmbH

- Rhenium Alloys Inc

Notable Milestones in Rhenium Market Sector

- 2019: Increased investment in research for rhenium recycling technologies.

- 2020: Introduction of new rhenium alloy formulations for enhanced turbine performance.

- 2021: Strategic partnerships formed to secure rhenium concentrate supply.

- 2022: Significant advancements in rhenium-based catalysts for petrochemical processes.

- 2023: Growing exploration of rhenium isotopes for advanced medical applications.

- 2024: xx Million unit acquisition of a key rhenium processing facility.

- 2025 (Estimated): Launch of a new generation of rhenium-enhanced superalloys for aerospace.

In-Depth Rhenium Market Market Outlook

The rhenium market is set for robust expansion, driven by an insatiable demand for high-performance materials in aerospace and industrial gas turbines. Future growth will be significantly augmented by advancements in additive manufacturing, enabling more complex and efficient rhenium alloy components. The ongoing transition towards sustainable energy solutions will further bolster the demand for efficient industrial gas turbines. Emerging applications in catalysis and healthcare represent substantial untapped potential, promising diversified revenue streams and market penetration. Strategic investments in supply chain resilience, including enhanced recycling initiatives and exploration for new primary sources, will be critical for sustained growth and market stability. The overall outlook for the rhenium market is exceptionally positive, marked by technological innovation and increasing strategic importance.

Rhenium Market Segmentation

-

1. Application

- 1.1. Superalloys

- 1.2. Catalysts

- 1.3. Other Applications

-

2. End-User Industry

- 2.1. Aerospace

- 2.2. Industrial Gas Turbines

- 2.3. Automotive

- 2.4. Healthcare

- 2.5. Other End-user Industries

Rhenium Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rhenium Market Regional Market Share

Geographic Coverage of Rhenium Market

Rhenium Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in the Production of Aircraft; Increasing Demand from the Power Industry; Mounting Prominence in Catalyst Applications

- 3.3. Market Restrains

- 3.3.1. ; Growing Usage of Substitutes; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Aerospace to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Superalloys

- 5.1.2. Catalysts

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace

- 5.2.2. Industrial Gas Turbines

- 5.2.3. Automotive

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Superalloys

- 6.1.2. Catalysts

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Aerospace

- 6.2.2. Industrial Gas Turbines

- 6.2.3. Automotive

- 6.2.4. Healthcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Superalloys

- 7.1.2. Catalysts

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Aerospace

- 7.2.2. Industrial Gas Turbines

- 7.2.3. Automotive

- 7.2.4. Healthcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Superalloys

- 8.1.2. Catalysts

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Aerospace

- 8.2.2. Industrial Gas Turbines

- 8.2.3. Automotive

- 8.2.4. Healthcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Superalloys

- 9.1.2. Catalysts

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Aerospace

- 9.2.2. Industrial Gas Turbines

- 9.2.3. Automotive

- 9.2.4. Healthcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Rhenium Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Superalloys

- 10.1.2. Catalysts

- 10.1.3. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Aerospace

- 10.2.2. Industrial Gas Turbines

- 10.2.3. Automotive

- 10.2.4. Healthcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Umicore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heraeus Holding

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MOLYMET S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KGHM

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colonial Metals Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Höganäs AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 American Elements

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NEO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 H Cross Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Buss & Buss Spezialmetalle GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rhenium Alloys Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Umicore

List of Figures

- Figure 1: Global Rhenium Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Rhenium Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Rhenium Market Revenue (Million), by Application 2025 & 2033

- Figure 4: Asia Pacific Rhenium Market Volume (K Tons), by Application 2025 & 2033

- Figure 5: Asia Pacific Rhenium Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Rhenium Market Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific Rhenium Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 8: Asia Pacific Rhenium Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 9: Asia Pacific Rhenium Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: Asia Pacific Rhenium Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 11: Asia Pacific Rhenium Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Rhenium Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Rhenium Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Rhenium Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Rhenium Market Revenue (Million), by Application 2025 & 2033

- Figure 16: North America Rhenium Market Volume (K Tons), by Application 2025 & 2033

- Figure 17: North America Rhenium Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Rhenium Market Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Rhenium Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 20: North America Rhenium Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 21: North America Rhenium Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: North America Rhenium Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 23: North America Rhenium Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Rhenium Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Rhenium Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Rhenium Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Rhenium Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Rhenium Market Volume (K Tons), by Application 2025 & 2033

- Figure 29: Europe Rhenium Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Rhenium Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Rhenium Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 32: Europe Rhenium Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 33: Europe Rhenium Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 34: Europe Rhenium Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 35: Europe Rhenium Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Rhenium Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Rhenium Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Rhenium Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Rhenium Market Revenue (Million), by Application 2025 & 2033

- Figure 40: South America Rhenium Market Volume (K Tons), by Application 2025 & 2033

- Figure 41: South America Rhenium Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: South America Rhenium Market Volume Share (%), by Application 2025 & 2033

- Figure 43: South America Rhenium Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 44: South America Rhenium Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 45: South America Rhenium Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: South America Rhenium Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: South America Rhenium Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Rhenium Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Rhenium Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Rhenium Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Rhenium Market Revenue (Million), by Application 2025 & 2033

- Figure 52: Middle East and Africa Rhenium Market Volume (K Tons), by Application 2025 & 2033

- Figure 53: Middle East and Africa Rhenium Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East and Africa Rhenium Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East and Africa Rhenium Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 56: Middle East and Africa Rhenium Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 57: Middle East and Africa Rhenium Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 58: Middle East and Africa Rhenium Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 59: Middle East and Africa Rhenium Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Rhenium Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Rhenium Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Rhenium Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Rhenium Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Rhenium Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Rhenium Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Rhenium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 25: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 26: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 27: Global Rhenium Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Rhenium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 38: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 39: Global Rhenium Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Rhenium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: France Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 53: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 54: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 55: Global Rhenium Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Rhenium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Rhenium Market Revenue Million Forecast, by Application 2020 & 2033

- Table 64: Global Rhenium Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Rhenium Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 66: Global Rhenium Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 67: Global Rhenium Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Rhenium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Rhenium Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Rhenium Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rhenium Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Rhenium Market?

Key companies in the market include Umicore, Heraeus Holding, MOLYMET S A, KGHM, Colonial Metals Inc, Höganäs AB, American Elements, NEO, H Cross Company, Buss & Buss Spezialmetalle GmbH, Rhenium Alloys Inc.

3. What are the main segments of the Rhenium Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 168.9 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in the Production of Aircraft; Increasing Demand from the Power Industry; Mounting Prominence in Catalyst Applications.

6. What are the notable trends driving market growth?

Aerospace to Dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Usage of Substitutes; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rhenium Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rhenium Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rhenium Market?

To stay informed about further developments, trends, and reports in the Rhenium Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence