Key Insights

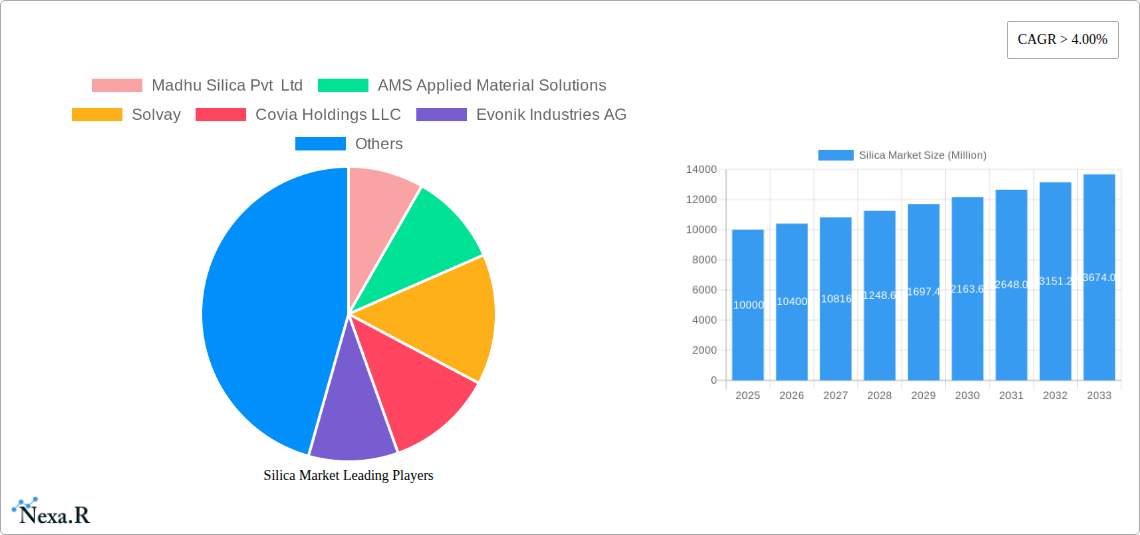

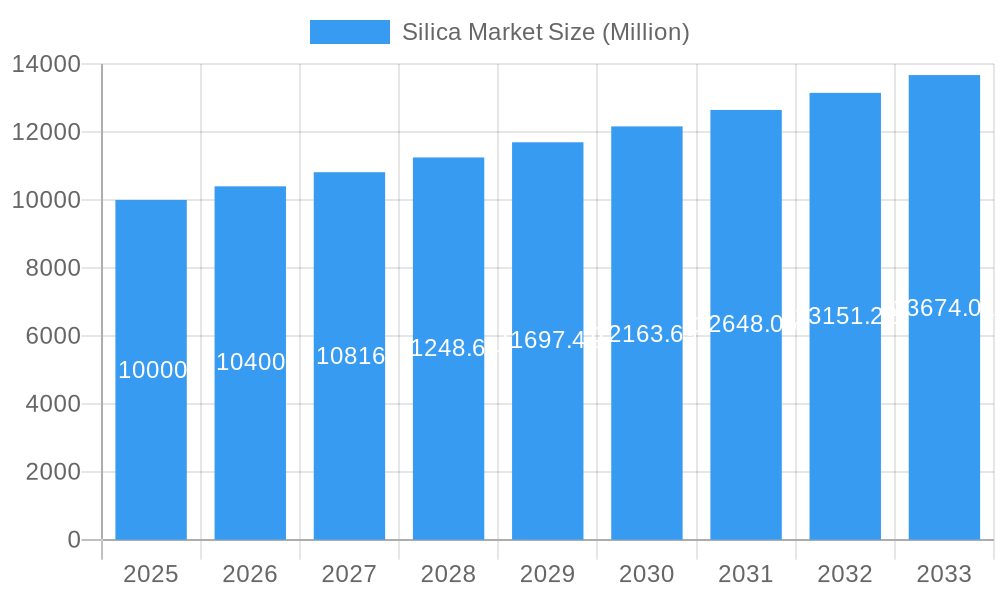

The global silica market, currently valued at approximately $XX million (estimated based on the provided CAGR and market size), is projected to experience robust growth, exceeding a 4% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning demand from the construction and automotive industries, particularly in emerging economies like China and India, is a significant contributor. Increasing use of silica in high-performance tires, coatings, and electronics further propels market growth. Technological advancements leading to the development of novel silica-based materials with enhanced properties, such as improved strength and durability, are also contributing factors. The market is segmented by end-user industry, with agriculture, cosmetics, automotive, and electronics representing major segments. While the growth trajectory is positive, certain restraints exist, including price volatility of raw materials and environmental concerns related to silica production and disposal. However, ongoing research and development efforts focused on sustainable manufacturing practices are expected to mitigate these challenges. Competition in the market is intense, with established players like Solvay, Evonik Industries AG, and PPG Industries Inc., alongside emerging companies like Madhu Silica Pvt Ltd and Anten Chemical Co Ltd., vying for market share. Regional analysis indicates a significant presence in the Asia-Pacific region, driven primarily by China and India's high consumption rates. North America and Europe also constitute substantial markets, with growth anticipated across all key regions throughout the forecast period.

Silica Market Market Size (In Billion)

The future of the silica market appears promising, particularly given the continued expansion of industries relying on its unique properties. Strategic partnerships, acquisitions, and technological innovations will be crucial for companies seeking to maintain a competitive edge. Furthermore, a focus on sustainable practices and environmentally friendly production methods will increasingly become a key differentiator in this dynamic and expanding market. The forecast period of 2025-2033 holds significant opportunities for growth, driven by sustained demand from diverse sectors and ongoing technological advancements in silica-based applications. Companies focusing on innovation, cost optimization, and sustainable production are poised to benefit most from this evolving landscape.

Silica Market Company Market Share

Silica Market: A Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a comprehensive analysis of the Silica Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market.

Silica Market Dynamics & Structure

The global silica market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, driven by the demand for high-performance materials across various end-user industries, is a key driver. Stringent regulatory frameworks concerning environmental impact and product safety influence manufacturing processes and product formulations. Competitive substitutes, such as alternative fillers and reinforcing agents, exert pressure on market pricing and adoption. End-user demographics, particularly in rapidly growing economies, significantly influence market demand. M&A activity in the sector is relatively active, reflecting consolidation and strategic expansion efforts.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on developing high-performance silica with enhanced properties like improved dispersibility, reinforcement, and sustainability.

- Regulatory Landscape: Stringent environmental regulations impacting production methods and waste management.

- Competitive Substitutes: Growing competition from alternative fillers and reinforcing agents.

- M&A Activity: xx significant M&A deals observed between 2019-2024, valued at approximately $xx million.

Silica Market Growth Trends & Insights

The global silica market is experiencing a dynamic expansion, propelled by an ever-increasing demand across a wide spectrum of end-user industries. In 2024, the market size was valued at approximately $XX million and is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This upward trajectory is expected to culminate in a market valuation of $XX million by 2033. Key drivers underpinning this robust growth include the burgeoning automotive sector, the rapidly expanding electronics industry, and a sustained surge in demand for advanced, high-performance tires. Furthermore, continuous technological advancements in silica production techniques and processing methodologies are acting as significant catalysts for market expansion. A discernible shift in consumer behavior towards prioritizing environmentally conscious products is also fostering innovation, steering the development of more sustainable silica solutions. The market is anticipated to witness a significant increase in penetration within developing economies, presenting ample opportunities for growth.

Dominant Regions, Countries, or Segments in Silica Market

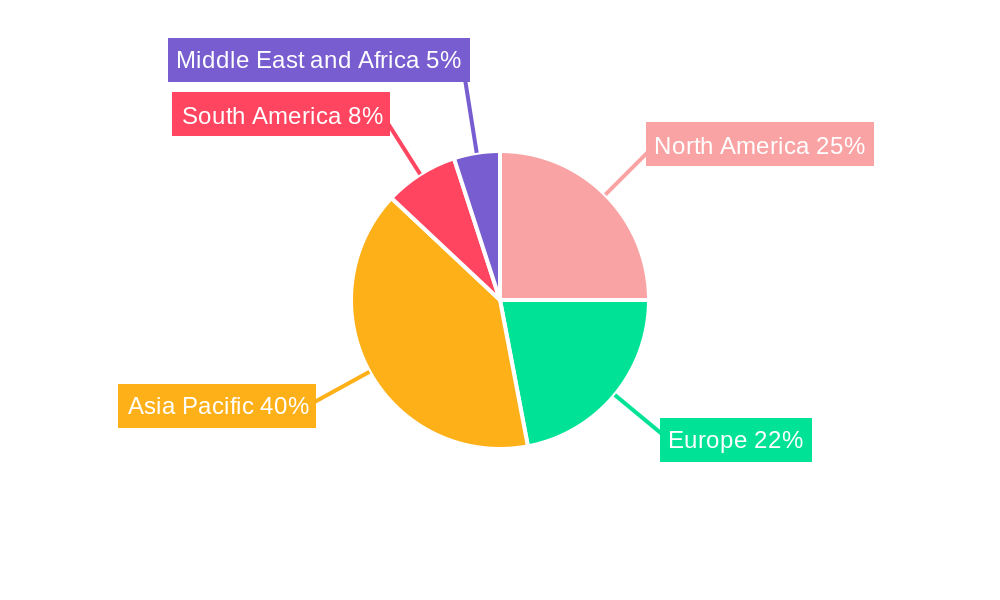

The Asia-Pacific region stands as the dominant force in the global silica market, primarily attributed to its vigorous economic expansion, accelerating industrialization, and a vast consumer base. China and India are pivotal contributors to this regional dominance, with other Southeast Asian nations also playing a significant role. The automotive and tire manufacturing industries are particularly influential in driving demand within this region. North America and Europe also command substantial market shares, bolstered by their well-established manufacturing infrastructures and a strong focus on technological innovation.

- Asia-Pacific: Exhibits exceptionally strong growth, fueled by the thriving automotive, tire, and electronics sectors. Its estimated market share in 2024 was approximately XX%.

- North America: Demonstrates stable and consistent growth, driven by continuous technological innovation and a robust industrial ecosystem. The estimated market share in 2024 was around XX%.

- Europe: Experiences moderate but steady growth, influenced by stringent environmental regulations and a rising demand for high-performance silica across various sophisticated applications. The estimated market share in 2024 stood at approximately XX%.

- Automotive Segment: Possesses the highest growth potential among all end-user industries, directly correlated with increasing vehicle production volumes and the escalating demand for tires offering enhanced performance and durability.

- Electronics Segment: Shows consistent and reliable growth, a direct consequence of the increasing global requirement for high-purity and high-quality silica in the manufacturing of sophisticated electronic components.

Silica Market Product Landscape

The silica market is characterized by an extensive and diverse range of products, meticulously engineered and classified based on critical attributes such as particle size, specific surface area, and tailored functional modifications. These precisely controlled variations are fundamental in optimizing the material's performance for an array of specific applications, thereby enhancing efficacy across a multitude of industries. Recent advancements in product development are heavily focused on improving silica's dispersibility characteristics, augmenting its reinforcing capabilities in composite materials, and enhancing its overall environmental compatibility. The unique selling propositions of advanced silica products include superior rheological control, significantly improved mechanical strength and durability, and custom-tailored surface modifications designed to impart specific functionalities for niche applications.

Key Drivers, Barriers & Challenges in Silica Market

Key Drivers: Rapid industrialization, particularly in developing economies; increasing demand from automotive, tire, and electronics industries; technological advancements leading to enhanced silica properties; supportive government policies promoting industrial growth.

Challenges & Restraints: Fluctuations in raw material prices; stringent environmental regulations; intense competition from alternative fillers; potential supply chain disruptions. The impact of these restraints is estimated to reduce market growth by approximately xx% by 2033.

Emerging Opportunities in Silica Market

The increasing focus on sustainability offers significant opportunities for developing eco-friendly silica production methods and applications. Untapped markets in emerging economies present potential for market expansion. Innovative applications in advanced materials, biomedicine, and specialized coatings also promise significant growth avenues. Evolving consumer preferences towards high-performance, environmentally friendly products fuel innovation and create new market segments.

Growth Accelerators in the Silica Market Industry

The silica market's growth trajectory is being significantly accelerated by strategic collaborations and partnerships forged between leading silica manufacturers and key end-users. These alliances foster a deeper understanding of market needs and drive the development of tailored solutions. Concurrently, groundbreaking technological advancements in silica synthesis methodologies and sophisticated modification techniques are continuously enhancing product properties, thereby expanding the scope of applications. Furthermore, aggressive market expansion strategies, with a keen focus on tapping into the potential of emerging economies and identifying novel application areas, are collectively fueling the overall expansion of the silica market.

Key Players Shaping the Silica Market Market

- Madhu Silica Pvt Ltd

- AMS Applied Material Solutions

- Solvay

- Covia Holdings LLC

- Evonik Industries AG

- PPG Industries Inc

- QUECHEN

- W R Grace & Co -Conn

- Denka Company Limited

- Tosoh Silica Corporation

- Anten Chemical Co Ltd

Notable Milestones in Silica Market Sector

- October 2021: PPG Industries Inc. partnered with Oriental Silicas Corporation (OSC) to expand its presence in the Asia-Pacific tire market.

- May 2021: Evonik Industries launched Ultrasil 4000 GR, a new active filler enhancing winter tire traction.

- March 2021: Bridgestone, ARLANXEO, and Solvay launched TECHSYN, a new tire technology platform.

In-Depth Silica Market Market Outlook

The future of the silica market appears promising, with continued growth driven by technological advancements and expanding applications across diverse industries. Strategic partnerships and focus on sustainability will be critical for long-term success. The market presents significant opportunities for innovative players to capitalize on emerging trends and untapped markets, driving substantial growth in the coming years.

Silica Market Segmentation

-

1. End-user Industry

- 1.1. Agriculture

- 1.2. Cosmetics

- 1.3. Automotive

- 1.4. Electronics

- 1.5. Other End-user Industries

Silica Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silica Market Regional Market Share

Geographic Coverage of Silica Market

Silica Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Automotive Industry; Others

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automobile Industry is Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silica Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Agriculture

- 5.1.2. Cosmetics

- 5.1.3. Automotive

- 5.1.4. Electronics

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Silica Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Agriculture

- 6.1.2. Cosmetics

- 6.1.3. Automotive

- 6.1.4. Electronics

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Silica Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Agriculture

- 7.1.2. Cosmetics

- 7.1.3. Automotive

- 7.1.4. Electronics

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Silica Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Agriculture

- 8.1.2. Cosmetics

- 8.1.3. Automotive

- 8.1.4. Electronics

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Silica Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Agriculture

- 9.1.2. Cosmetics

- 9.1.3. Automotive

- 9.1.4. Electronics

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Silica Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Agriculture

- 10.1.2. Cosmetics

- 10.1.3. Automotive

- 10.1.4. Electronics

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Madhu Silica Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMS Applied Material Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Covia Holdings LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PPG Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 QUECHEN

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 W R Grace & Co -Conn *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Denka Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tosoh Silica Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Anten Chemical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Madhu Silica Pvt Ltd

List of Figures

- Figure 1: Global Silica Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Silica Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Silica Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silica Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Silica Market?

Key companies in the market include Madhu Silica Pvt Ltd, AMS Applied Material Solutions, Solvay, Covia Holdings LLC, Evonik Industries AG, PPG Industries Inc, QUECHEN, W R Grace & Co -Conn *List Not Exhaustive, Denka Company Limited, Tosoh Silica Corporation, Anten Chemical Co Ltd.

3. What are the main segments of the Silica Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Automotive Industry; Others.

6. What are the notable trends driving market growth?

Automobile Industry is Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

In October 2021, PPG Industries Inc. entered into a strategic agreement with Oriental Silicas Corporation (OSC). OSC of Greater China is the sales representative for select grades of PPG silica products used by tire manufacturers in the Asia-Pacific region. This helped the company to expand service capabilities and introduce innovative products in the Asia-Pacific market for new and existing tire customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silica Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silica Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silica Market?

To stay informed about further developments, trends, and reports in the Silica Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence