Key Insights

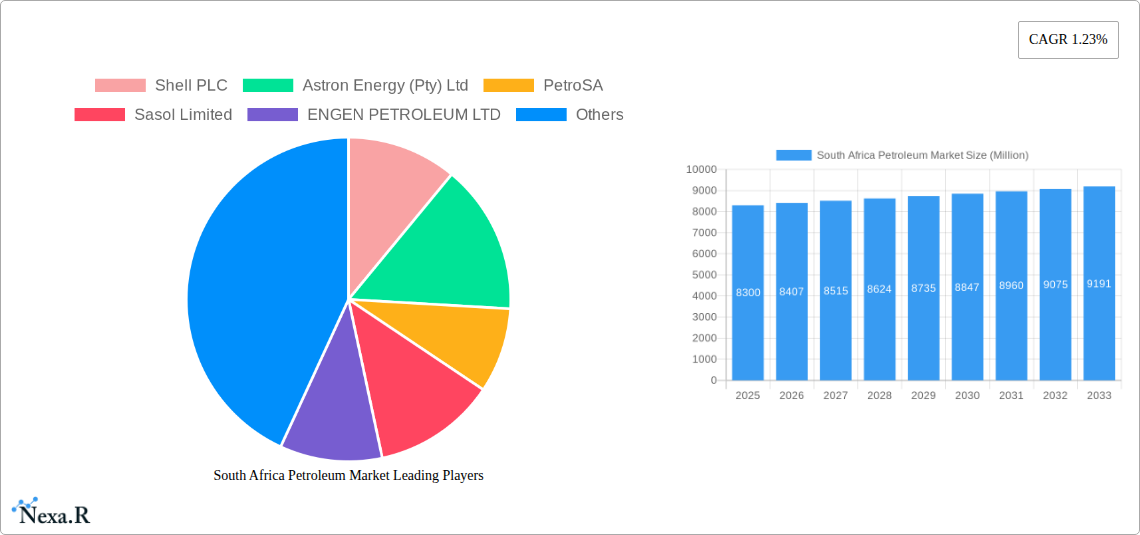

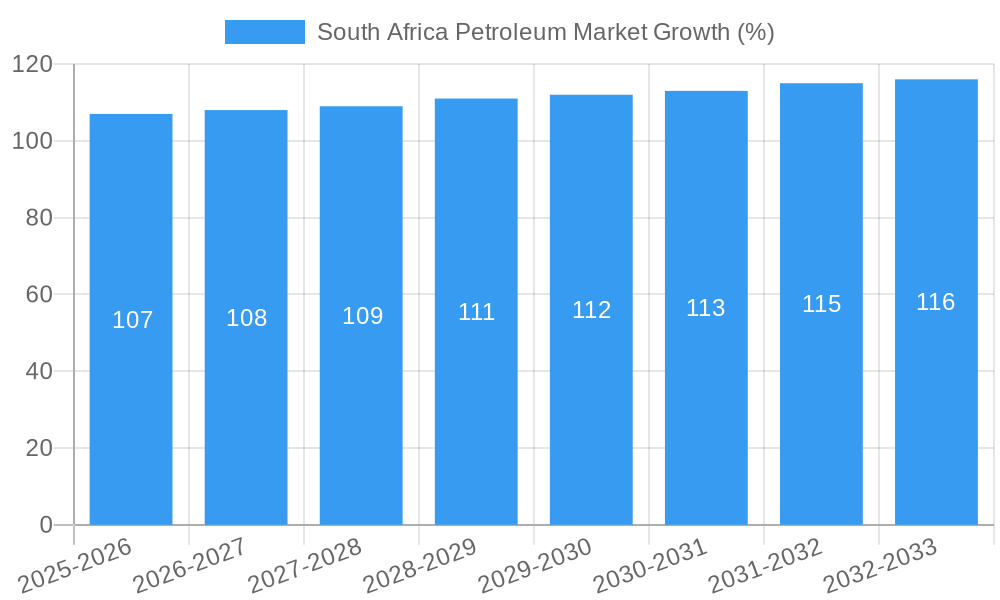

The South African petroleum market, valued at $8.3 billion in 2025, is projected to experience steady growth, albeit at a moderate CAGR of 1.23% from 2025 to 2033. This relatively low growth rate reflects a combination of factors. Increased fuel efficiency standards for vehicles and a growing adoption of renewable energy sources are putting downward pressure on overall demand. However, the continued reliance on petroleum-based products in transportation and various industrial sectors provides a stable base for the market. Key segments like Automotive Gas Oil (AGO)/Diesel and Premium Motor Spirit (PMS) continue to dominate market share, driven by the country's substantial transportation sector and relatively low vehicle electrification rates. Growth in the LPG segment is anticipated due to its increasing use as a cleaner alternative fuel, particularly in domestic applications. The market is highly consolidated, with major international players like Shell, TotalEnergies, and BP, alongside significant local players such as Sasol and Engen, dominating the landscape. Competition amongst these players is fierce, impacting pricing and market strategies. Government regulations regarding fuel quality and environmental standards also exert a significant influence on market dynamics, encouraging investment in cleaner technologies and potentially impacting profitability.

Looking ahead to 2033, the South African petroleum market will likely see a gradual increase in value, largely influenced by economic growth and population increase. While the transition towards renewable energy sources is expected to gradually diminish the dependence on petroleum products in the long term, significant short-to-medium term growth remains unlikely due to the aforementioned factors. The market's resilience is anchored in its essential role in supporting the nation's transportation, industrial processes, and energy needs. However, companies operating within this market must adapt to evolving regulatory frameworks and consumer preferences to maintain their market share and profitability. Strategic investments in refining capabilities and exploration activities will be crucial for sustained growth in the face of these challenges. Furthermore, diversification into cleaner energy solutions may become essential for long-term sustainability in this evolving market.

South Africa Petroleum Market: 2019-2033 Outlook

This comprehensive report delivers an in-depth analysis of the South Africa petroleum market, covering the period 2019-2033. It provides crucial insights for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic sector. The report segments the market into refined products (Illuminating Paraffin, Fuel Oil, Automotive Gas Oil (AGO)/Diesel, Premium Motor Spirit (PMS), Liquefied Petroleum Gas (LPG), and Other Refined Products), offering a granular view of market dynamics, growth trends, and future prospects. Key players such as Shell PLC, Astron Energy (Pty) Ltd, PetroSA, Sasol Limited, ENGEN PETROLEUM LTD, TotalEnergies SE, Chevron Corporation, and BP Southern Africa (Pty) Ltd are analyzed to understand their market share and strategic initiatives. The study period is 2019-2033, with 2025 as the base and estimated year.

South Africa Petroleum Market Dynamics & Structure

The South African petroleum market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Technological innovation is driven by efficiency improvements in refining processes and the adoption of cleaner fuels. Stringent regulatory frameworks influence product specifications and environmental standards. The market experiences competitive pressure from alternative energy sources, although petroleum products maintain dominant positions in transportation and industrial sectors. End-user demographics reveal a strong correlation between economic growth and petroleum consumption. M&A activity has been relatively modest in recent years, but strategic partnerships and collaborations are gaining traction.

- Market Concentration: The top 5 players control approximately xx% of the market (2025).

- Technological Innovation: Focus on improving refining efficiency and reducing emissions.

- Regulatory Framework: Stringent environmental regulations impact fuel quality and emissions.

- Competitive Substitutes: Growing adoption of renewable energy sources and electric vehicles.

- M&A Activity: Moderate activity observed with a focus on strategic partnerships (xx deals in the last 5 years).

- End-user Demographics: Strong link between economic growth and petroleum demand.

South Africa Petroleum Market Growth Trends & Insights

The South African petroleum market exhibited a CAGR of xx% during 2019-2024. Market size is projected to reach xx million units by 2025 and xx million units by 2033, driven by factors such as economic growth, infrastructure development, and increasing vehicle ownership. Technological disruptions, particularly the rise of electric vehicles, pose a challenge, although the adoption rate remains relatively low. Consumer behavior continues to be influenced by fuel prices, and demand remains strong despite alternative energy solutions. Growth is further shaped by shifts in government policies and investment in infrastructure projects. Market penetration remains high, with slight decreases projected due to the introduction of electric vehicles, indicating continuous relevance in the energy landscape.

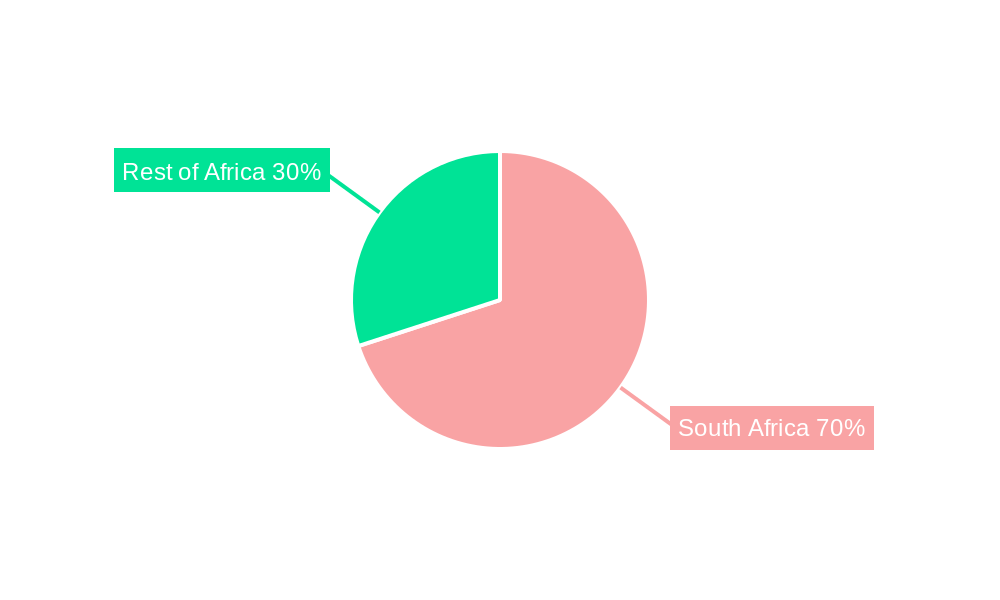

Dominant Regions, Countries, or Segments in South Africa Petroleum Market

The Automotive Gas Oil (AGO)/Diesel segment dominates the South African petroleum market, driven by the country's reliance on road transport. Premium Motor Spirit (PMS) holds a significant share reflecting a large car ownership base and increasing urbanization. Gauteng province demonstrates the highest consumption due to its industrial activity and dense population.

- Key Drivers: Strong economic activity, increased urbanization, and robust road transportation infrastructure.

- Dominance Factors: High vehicle ownership, industrial energy needs and robust road network.

- Growth Potential: Continued economic growth and infrastructure development will fuel further expansion. A shift in the energy mix toward renewable energy sources in the long-term will affect this segment.

South Africa Petroleum Market Product Landscape

The South African petroleum market offers a range of refined products, characterized by compliance with stringent quality standards. Innovation focuses on improving fuel efficiency and reducing environmental impact. Blends of fuels are tailored to different vehicle types. Premium grades, with enhanced performance and cleanliness, target high-end vehicles. The market sees the introduction of low-sulfur fuels and biofuel blends, reflecting the regulatory environment.

Key Drivers, Barriers & Challenges in South Africa Petroleum Market

Key Drivers:

- Economic growth and infrastructure development.

- Increasing vehicle ownership and urbanization.

- Government policies supporting economic development.

Key Challenges and Restraints:

- Fluctuating global crude oil prices.

- Regulatory pressures for cleaner fuels and emissions reduction. (xx% increase in compliance costs in last 5 years).

- Competition from alternative energy sources (e.g., renewables).

- Potential supply chain disruptions and infrastructure constraints.

Emerging Opportunities in South Africa Petroleum Market

- Expansion into renewable energy and biofuel blends.

- Investment in infrastructure to support growth.

- Exploring opportunities in the petrochemical industry.

- Enhancing energy efficiency in transportation and industrial sectors.

Growth Accelerators in the South Africa Petroleum Market Industry

Long-term growth in the South African petroleum market will be accelerated by strategic investments in refinery modernization and expansion. Technological advancements, particularly in refining technologies that reduce emissions and enhance efficiency, will be crucial. Moreover, government policies supporting infrastructure development and promoting energy security will play a critical role. Collaboration between market players to develop sustainable and efficient fuel solutions will drive sustainable growth.

Key Players Shaping the South Africa Petroleum Market Market

- Shell PLC

- Astron Energy (Pty) Ltd

- PetroSA

- Sasol Limited

- ENGEN PETROLEUM LTD

- TotalEnergies SE

- Chevron Corporation

- BP Southern Africa (Pty) Ltd

Notable Milestones in South Africa Petroleum Market Sector

- February 2023: Astron Energy announces plans to reopen the Cape Town oil refinery.

- November 2022: South Africa explores collaboration with Saudi Aramco for a new East Coast refinery (projected capacity: 300,000 barrels/day; estimated cost: USD 10 billion, operational by 2028).

In-Depth South Africa Petroleum Market Market Outlook

The South African petroleum market is poised for continued growth, albeit at a moderated pace due to the increasing adoption of alternative energy sources. Strategic investments in refinery upgrades, the development of sustainable fuel options, and robust infrastructure will be crucial for long-term success. Opportunities exist in expanding into new market segments and leveraging technological advancements to enhance efficiency and reduce environmental impact. The balance between meeting the energy demands of a growing economy and transitioning toward a more sustainable energy future will shape the market's trajectory in the coming years.

South Africa Petroleum Market Segmentation

-

1. Refined Products

- 1.1. Illuminating Paraffin

- 1.2. Fuel Oil

- 1.3. Automotive Gas Oil (AGO)/Diesel

- 1.4. Premium Motor Spirit (PMS)

- 1.5. Liquefied Petroleum Gas (LPG)

- 1.6. Other Refined Products

South Africa Petroleum Market Segmentation By Geography

- 1. South Africa

South Africa Petroleum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption Of Petroleum Products

- 3.3. Market Restrains

- 3.3.1 Fluctuating Crude Oil Prices

- 3.3.2 Adoption of Cleaner Alternatives In Transportation

- 3.4. Market Trends

- 3.4.1. Automotive Gas Oil (AGO) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refined Products

- 5.1.1. Illuminating Paraffin

- 5.1.2. Fuel Oil

- 5.1.3. Automotive Gas Oil (AGO)/Diesel

- 5.1.4. Premium Motor Spirit (PMS)

- 5.1.5. Liquefied Petroleum Gas (LPG)

- 5.1.6. Other Refined Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Refined Products

- 6. South Africa South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Petroleum Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Shell PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Astron Energy (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PetroSA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sasol Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ENGEN PETROLEUM LTD

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 TotalEnergies SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Chevron Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BP Southern Africa (Pty) Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Shell PLC

List of Figures

- Figure 1: South Africa Petroleum Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Petroleum Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Petroleum Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Petroleum Market Revenue Million Forecast, by Refined Products 2019 & 2032

- Table 3: South Africa Petroleum Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South Africa Petroleum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa South Africa Petroleum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Petroleum Market Revenue Million Forecast, by Refined Products 2019 & 2032

- Table 12: South Africa Petroleum Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Petroleum Market?

The projected CAGR is approximately 1.23%.

2. Which companies are prominent players in the South Africa Petroleum Market?

Key companies in the market include Shell PLC, Astron Energy (Pty) Ltd, PetroSA, Sasol Limited, ENGEN PETROLEUM LTD, TotalEnergies SE, Chevron Corporation, BP Southern Africa (Pty) Ltd.

3. What are the main segments of the South Africa Petroleum Market?

The market segments include Refined Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption Of Petroleum Products.

6. What are the notable trends driving market growth?

Automotive Gas Oil (AGO) to Dominate the Market.

7. Are there any restraints impacting market growth?

Fluctuating Crude Oil Prices. Adoption of Cleaner Alternatives In Transportation.

8. Can you provide examples of recent developments in the market?

February 2023: Astron Energy, a subsidiary of Glencore, has announced plans to reopen the Cape Town oil refinery based on a compelling commercial rationale. The company is fully dedicated to restarting the refinery and is progressing with the required work to achieve this objective.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Petroleum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Petroleum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Petroleum Market?

To stay informed about further developments, trends, and reports in the South Africa Petroleum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence