Key Insights

The South American membrane water treatment chemicals market is experiencing robust growth, fueled by increasing industrialization, stringent environmental regulations, and a growing demand for clean water across various sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2019 to 2024 indicates a significant upward trajectory. This growth is primarily driven by the expansion of water-intensive industries like food and beverage processing, pharmaceuticals, and power generation, all of which necessitate efficient and reliable water treatment solutions. Furthermore, government initiatives promoting water conservation and improved sanitation infrastructure are contributing to the market's expansion. The rising adoption of membrane technologies, such as reverse osmosis (RO) and ultrafiltration (UF), for water purification further boosts demand for specialized chemicals used in these processes. Key players like Danaher (ChemTreat Inc.), Dow, Ecolab, and Kurita Water Industries Ltd. are strategically investing in research and development to offer innovative and sustainable chemical solutions, catering to the specific needs of the South American market.

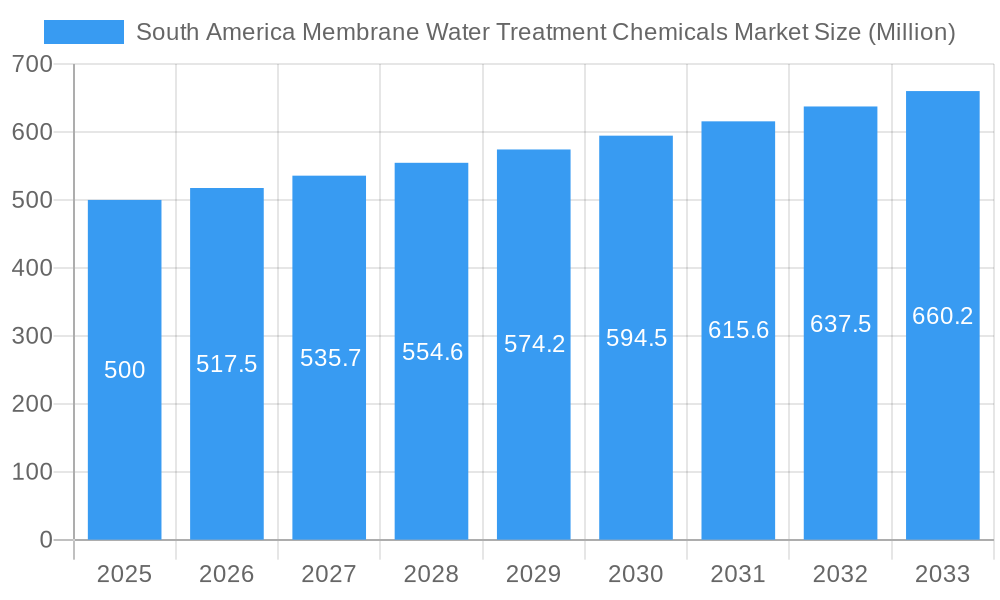

South America Membrane Water Treatment Chemicals Market Market Size (In Million)

Challenges to market expansion include economic fluctuations in certain South American nations, which can impact capital expenditure on water treatment infrastructure. Additionally, the market faces competitive pressures from both domestic and international players, necessitating a strong focus on pricing strategies and product differentiation. Despite these restraints, the long-term outlook for the South American membrane water treatment chemicals market remains positive, driven by increasing urbanization, population growth, and a growing awareness of water scarcity and its implications. The market is expected to witness considerable expansion throughout the forecast period (2025-2033), with specific segments like anti-scalants and cleaning agents experiencing particularly strong growth due to their critical role in optimizing membrane performance and lifespan.

South America Membrane Water Treatment Chemicals Market Company Market Share

South America Membrane Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the South America Membrane Water Treatment Chemicals market, providing critical insights for businesses and investors seeking to understand this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by [Insert Specific Segmentation Here, e.g., chemical type, application, end-use industry], offering a granular view of growth opportunities within the parent market of Water Treatment Chemicals and the child market of Membrane Water Treatment Chemicals. The estimated market size in 2025 is XX Million, projected to reach XX Million by 2033.

South America Membrane Water Treatment Chemicals Market Dynamics & Structure

The South American Membrane Water Treatment Chemicals market is characterized by [Level of Concentration: e.g., moderate concentration] with key players holding [Market Share Percentage] of the market share. Technological innovation, driven by the need for more efficient and sustainable water treatment solutions, is a major driver. Stringent regulatory frameworks regarding water quality and environmental protection further shape market dynamics. The market also faces competition from alternative water treatment technologies, such as [Specific Examples]. End-user demographics, primarily concentrated in [Specific End-User Sectors e.g., industrial, municipal], influence market demand. M&A activity in the sector has been [Level of Activity: e.g., moderate], with approximately XX deals recorded between 2019 and 2024, mainly focused on [Type of M&A Activity e.g., expanding product portfolios and geographic reach].

- Market Concentration: [Specific Data, e.g., Top 5 players hold 60% market share]

- Technological Innovation: Focus on [Specific Technologies e.g., nanofiltration membranes, advanced oxidation processes].

- Regulatory Landscape: Compliance with [Specific Regulations e.g., environmental standards] is crucial.

- Competitive Substitutes: [Specific Examples e.g., reverse osmosis, ion exchange] present competitive pressures.

- End-User Demographics: [Specific Examples e.g., Growth driven by industrial expansion in Brazil and Chile].

- M&A Trends: [Specific Examples e.g., acquisitions focused on strengthening technological capabilities and market penetration].

South America Membrane Water Treatment Chemicals Market Growth Trends & Insights

The South American Membrane Water Treatment Chemicals market has witnessed [Growth Pattern e.g., steady growth] over the historical period (2019-2024), driven by [Key Factors e.g., increasing industrialization, stringent water quality regulations, and growing awareness of water scarcity]. The market size expanded from XX Million in 2019 to XX Million in 2024, registering a CAGR of XX%. This growth is further expected to accelerate during the forecast period (2025-2033), with a projected CAGR of XX%, reaching XX Million by 2033. Technological disruptions, particularly the introduction of [Specific Examples e.g., energy-efficient membranes and AI-powered water treatment systems], are reshaping market dynamics. Shifting consumer behavior towards sustainable and environmentally friendly solutions also significantly impacts market growth. Market penetration remains relatively low in some segments, indicating significant untapped potential.

Dominant Regions, Countries, or Segments in South America Membrane Water Treatment Chemicals Market

[Country/Region A, e.g., Brazil] is the dominant market within South America, accounting for approximately XX% of the total market share in 2025. Its dominance is attributed to [Key Drivers e.g., robust industrial sector, significant investments in water infrastructure, and supportive government policies]. [Country/Region B, e.g., Chile] and [Country/Region C, e.g., Colombia] also show significant growth potential due to [Specific Factors e.g., increasing mining activities, expanding urbanization, and rising demand for clean water in various sectors].

- Brazil: Strong industrial base, large population, and government initiatives driving market growth.

- Chile: Growth driven by the mining industry and increasing water scarcity.

- Colombia: Expanding urban infrastructure and improved water treatment investment driving demand.

- Argentina: [Specific factors driving market growth in Argentina].

- Peru: [Specific factors driving market growth in Peru].

South America Membrane Water Treatment Chemicals Market Product Landscape

The South American membrane water treatment chemicals market is characterized by a robust and evolving product portfolio designed to address diverse water quality challenges and membrane technologies. Key product categories include advanced anti-scalants to prevent mineral deposition, effective biocides to control microbial growth, potent cleaning agents for membrane restoration, and specialized dispersants to maintain particle suspension. These chemicals are meticulously formulated to be compatible with a wide array of membrane types, such as reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF), and are tailored for specific applications in industrial, municipal, and commercial sectors.

Product innovation is a central focus, driven by the imperative to enhance operational efficiency, minimize environmental footprints, and significantly improve key performance metrics. Manufacturers are striving to develop formulations that extend membrane lifespan, thereby reducing replacement costs, and optimize water recovery rates, crucial for water-scarce regions. Unique selling propositions that are gaining traction include the development of inherently eco-friendly formulations derived from sustainable sources, superior cleaning efficacy that restores membrane performance with minimal downtime, and demonstrable cost-effectiveness through optimized dosing and extended product life.

Technological advancements are playing a pivotal role in product differentiation. The integration of intelligent dosing systems that utilize real-time sensor data for precise chemical application is becoming more prevalent. Furthermore, breakthroughs in advanced polymer chemistries are leading to the creation of novel anti-scalants and antiscalants with improved performance profiles and greater biodegradability. These innovations enable water treatment facilities to operate more sustainably and economically.

Key Drivers, Barriers & Challenges in South America Membrane Water Treatment Chemicals Market

Key Drivers:

The market is driven by factors such as increasing industrialization and urbanization, stringent environmental regulations, growing water scarcity, and rising investments in water infrastructure projects. Technological advancements in membrane technology and the development of advanced chemicals are also significant drivers.

Key Barriers & Challenges:

High initial investment costs associated with membrane water treatment systems can hinder market penetration. Regulatory hurdles and complex permitting processes can also pose challenges. Supply chain disruptions and fluctuations in raw material prices impact market stability. Intense competition among established players and emerging market entrants adds further complexity.

Emerging Opportunities in South America Membrane Water Treatment Chemicals Market

Untapped opportunities exist in smaller municipalities and rural areas with limited access to clean water. The growing demand for desalination and wastewater treatment creates further market opportunities. Innovative applications, such as the use of membrane technology in agricultural irrigation and industrial process water treatment, are emerging as key areas for growth. Evolving consumer preferences towards sustainable and environmentally friendly solutions open new avenues for market expansion.

Growth Accelerators in the South America Membrane Water Treatment Chemicals Market Industry

The South American membrane water treatment chemicals market is poised for substantial long-term growth, propelled by a confluence of technological advancements, strategic market initiatives, and supportive governmental policies. Foremost among the growth drivers are the continuous technological breakthroughs in chemical formulations and application technologies. These innovations are yielding more efficient, potent, and environmentally benign water treatment solutions, which are essential for meeting the region's increasing demand for clean water and for addressing the challenges posed by complex water sources.

The landscape of the industry is also being shaped by an increasing emphasis on strategic partnerships and collaborations. These alliances between leading chemical manufacturers and water treatment equipment providers are crucial for enhancing market penetration, facilitating the co-development of integrated solutions, and improving customer support and technical service across the vast and varied South American territories.

Market expansion into new geographical areas and untapped market segments is another significant growth avenue. As industrialization and urbanization continue across South America, there is a burgeoning demand for advanced water treatment in nascent sectors and regions previously underserved. This presents considerable opportunities for market players to extend their reach and introduce their innovative product portfolios.

Crucially, government support through favorable policies and substantial investments in water infrastructure serves as a powerful catalyst for market development. Initiatives aimed at improving water quality, ensuring water security, and promoting sustainable water management practices are directly stimulating the demand for sophisticated membrane water treatment solutions, including the essential chemicals that underpin their efficacy.

Key Players Shaping the South America Membrane Water Treatment Chemicals Market Market

- Danaher (ChemTreat Inc)

- Dow

- Ecolab

- Genesys International Ltd

- Italmatch Chemicals S p A

- Kemira

- King Lee Technologies

- Kurita Water Industries Ltd

- Suez

- Veolia Water Technologies

- Other notable contributors include: Solenis, Cortec Corporation, Accenta, and Graver Water Systems, among others.

*List is not exhaustive and represents key entities influencing the market.

Notable Milestones in South America Membrane Water Treatment Chemicals Market Sector

- 2021 (Q3): ChemTreat Inc (Danaher) launched a new generation of high-performance biocide formulations, significantly enhancing membrane system efficiency and reducing operational downtime for industrial clients in Brazil.

- 2022 (Q1): Dow and Ecolab announced a strategic partnership to co-develop and market integrated water treatment solutions, focusing on optimizing membrane performance and sustainability for the growing food and beverage sector in Argentina and Chile.

- 2023 (Q4): Italmatch Chemicals S p A introduced an innovative anti-scalant technology utilizing advanced polymer chemistry, reportedly reducing membrane fouling and maintenance costs by up to 20% in large-scale desalination plants in Peru.

- 2024 (Q2): Veolia Water Technologies expanded its service network across Colombia, offering enhanced technical support and tailored chemical treatment programs for municipal water reuse applications, aiming to bolster regional water security.

- 2024 (Q3): Kemira reported significant advancements in its line of biodegradable cleaning agents, demonstrating superior efficacy in removing organic foulants from membranes used in the mining industry in Chile and other mineral-rich South American countries.

- [Add further milestones with specific dates and details as available to capture ongoing market developments]

In-Depth South America Membrane Water Treatment Chemicals Market Market Outlook

The South America Membrane Water Treatment Chemicals market presents a significant growth opportunity, driven by long-term factors such as increasing water scarcity, expanding industrialization, and stricter environmental regulations. Strategic investments in research and development, along with strategic partnerships and expansion into underserved markets, will be crucial for players seeking to capitalize on this potential. The market is expected to experience considerable growth in the coming years, presenting a lucrative avenue for both established players and new entrants alike.

South America Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Types

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of South America Membrane Water Treatment Chemicals Market

South America Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The growing demand for freshwater in South America; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; The growing demand for freshwater in South America; Other Drivers

- 3.4. Market Trends

- 3.4.1. Pre-treatment chemicals to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Brazil South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Argentina South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Colombia South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Chile South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Pre-treatment

- 9.1.2. Biological Controllers

- 9.1.3. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage Processing

- 9.2.2. Healthcare

- 9.2.3. Municipal

- 9.2.4. Chemicals

- 9.2.5. Power

- 9.2.6. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Rest of South America South America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Pre-treatment

- 10.1.2. Biological Controllers

- 10.1.3. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage Processing

- 10.2.2. Healthcare

- 10.2.3. Municipal

- 10.2.4. Chemicals

- 10.2.5. Power

- 10.2.6. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danaher (ChemTreat Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dow

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ecolab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genesys International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Italmatch Chemicals S p A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemira

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 King Lee Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kurita Water Industries Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suez

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Veolia Water Technologies*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Danaher (ChemTreat Inc )

List of Figures

- Figure 1: Global South America Membrane Water Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Brazil South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: Brazil South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: Brazil South America Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Brazil South America Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Brazil South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Brazil South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Brazil South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: Argentina South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: Argentina South America Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: Argentina South America Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Argentina South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Argentina South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Argentina South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Colombia South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 19: Colombia South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: Colombia South America Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Colombia South America Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Colombia South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Colombia South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Colombia South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Colombia South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Chile South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 27: Chile South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: Chile South America Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Chile South America Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Chile South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Chile South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Chile South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Chile South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 35: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of South America South America Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global South America Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the South America Membrane Water Treatment Chemicals Market?

Key companies in the market include Danaher (ChemTreat Inc ), Dow, Ecolab, Genesys International Ltd, Italmatch Chemicals S p A, Kemira, King Lee Technologies, Kurita Water Industries Ltd, Suez, Veolia Water Technologies*List Not Exhaustive.

3. What are the main segments of the South America Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; The growing demand for freshwater in South America; Other Drivers.

6. What are the notable trends driving market growth?

Pre-treatment chemicals to dominate the Market.

7. Are there any restraints impacting market growth?

; The growing demand for freshwater in South America; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the South America Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence