Key Insights

The South America Thermoplastic Elastomers (TPE) market is projected for significant expansion, reaching an estimated $30.83 billion by 2025 and maintaining a Compound Annual Growth Rate (CAGR) of 4.8% from 2025 to 2033. This growth is driven by increasing demand in the automotive sector for lightweight components, seals, and under-hood applications, as well as in building and construction for durable, weather-resistant materials like window profiles, roofing membranes, and flooring. The footwear industry's adoption of TPEs for sustainable soles and the electricals & electronics sector's use in cable insulation and device casings are also key contributors.

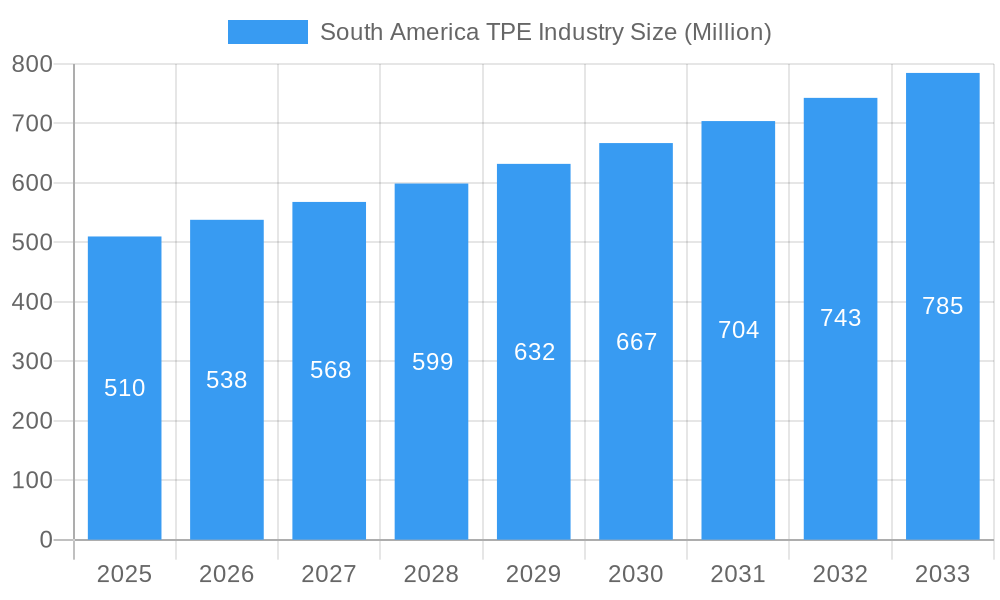

South America TPE Industry Market Size (In Billion)

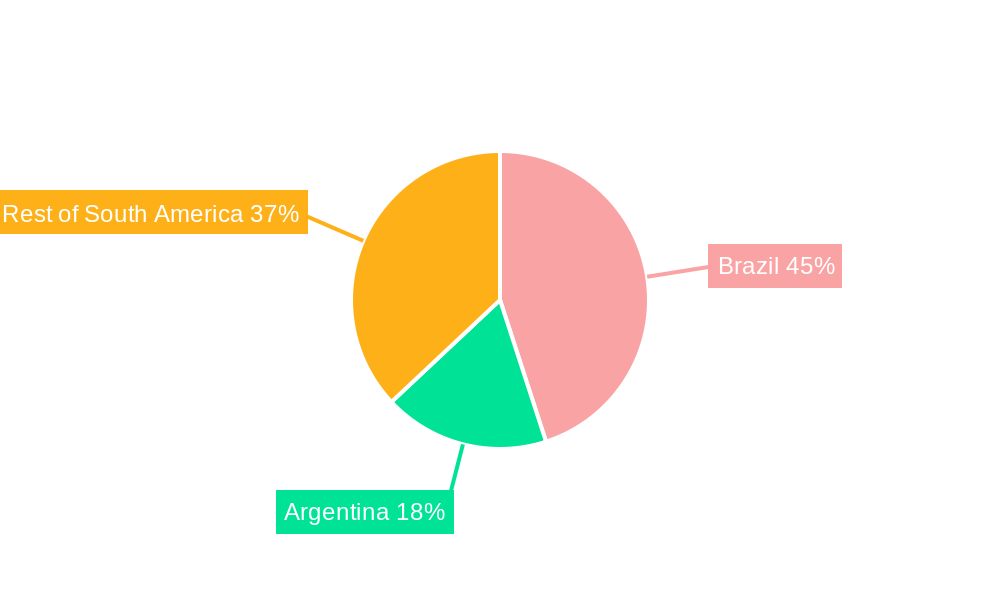

Evolving consumer demand for sustainable and high-performance materials fuels innovation in TPE product portfolios. Key segments like Thermoplastic Olefins (TPE-O) and Styrenic Block Copolymers (TPE-S) are expected to see substantial uptake due to their cost-effectiveness and versatility. While fluctuating raw material prices and competition from conventional materials present challenges, the ongoing pursuit of enhanced product performance, recyclability, and ergonomic designs will propel sustained market growth. Brazil is anticipated to lead the South America TPE market, followed by other South American nations and Argentina.

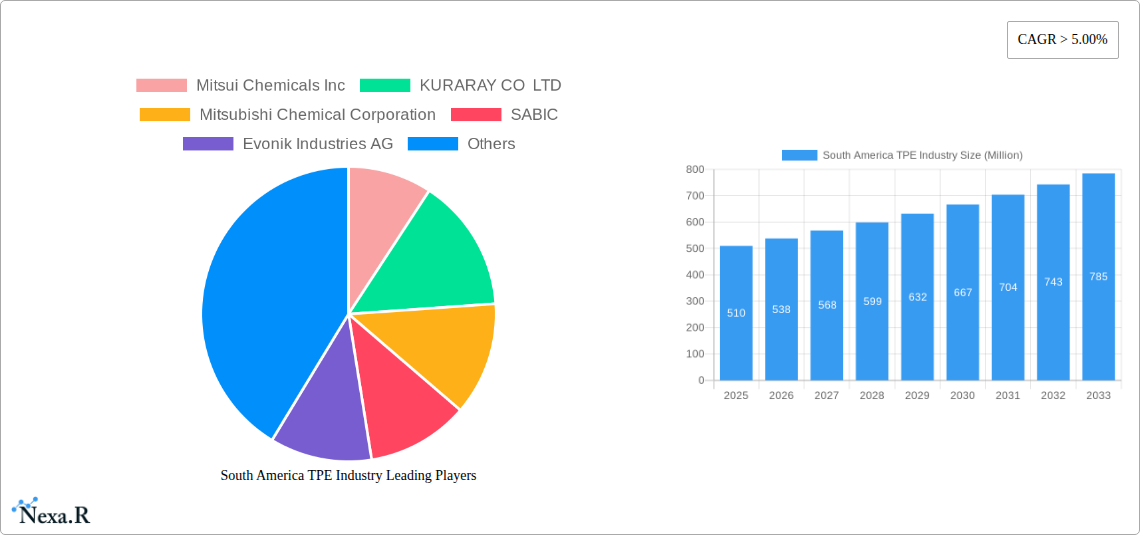

South America TPE Industry Company Market Share

This SEO-optimized report provides a comprehensive analysis of the South America TPE industry, including market size, growth, and forecasts.

South America TPE Industry Market Dynamics & Structure

The South America Thermoplastic Elastomer (TPE) industry is characterized by a moderately concentrated market, with key global players like Mitsui Chemicals Inc., KURARAY CO LTD, Mitsubishi Chemical Corporation, SABIC, Evonik Industries AG, BASF SE, Arkema Group, Huntsman International LLC, LG Chem, DuPont, and KRATON CORPORATION holding significant influence. Technological innovation is a primary driver, with ongoing advancements in TPE-S (Styrenic Block Copolymer), TPE-O (Thermoplastic Olefin), TPE-V/TPV (Elastomeric Alloy), TPU (Thermoplastic Polyurethane), Thermoplastic Copolyester, and Thermoplastic Polyamide materials enhancing performance and expanding application scope. Regulatory frameworks, while evolving, are generally supportive of material innovation and sustainability initiatives. Competitive product substitutes, primarily traditional thermoset rubbers and other plastics, are present but increasingly challenged by TPEs' unique blend of elasticity and processability. End-user demographics are shifting, with a growing demand for lightweight, durable, and sustainable materials across various sectors. Mergers & Acquisitions (M&A) trends, though not extensively documented in public records for this specific region, are anticipated to play a role in market consolidation and strategic expansion.

- Market Concentration: Moderate, with a few dominant global manufacturers.

- Innovation Drivers: Enhanced material properties, cost-effectiveness, and sustainability.

- Regulatory Landscape: Evolving to support material innovation and environmental standards.

- Competitive Landscape: TPEs are displacing traditional materials due to performance advantages.

- End-User Demographics: Increasing demand for high-performance and eco-friendly solutions.

- M&A Trends: Potential for consolidation and strategic partnerships.

South America TPE Industry Growth Trends & Insights

The South America TPE industry is poised for significant expansion, driven by a confluence of robust market size evolution, increasing adoption rates across diverse applications, and transformative technological disruptions. The market is projected to grow from an estimated 1,200 Million units in the Base Year of 2025 to 2,500 Million units by the end of the Forecast Period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5%. This impressive trajectory is fueled by the inherent advantages of TPEs, including their design flexibility, ease of processing, recyclability, and superior performance characteristics compared to traditional materials. The adoption rates are accelerating, particularly within the Automotive & Transportation sector, where lightweighting initiatives and stringent emission standards necessitate advanced material solutions. Similarly, the Building & Construction industry is witnessing increased TPE usage for sealing, insulation, and durable components, responding to demands for energy efficiency and longevity.

Consumer behavior shifts are also playing a pivotal role. A growing awareness of sustainability and a preference for durable, long-lasting products are driving demand for TPEs in Footwear, Household Appliances, and Electricals & Electronics. The medical sector's demand for biocompatible and sterilizable TPE materials is also a key growth driver. Technological disruptions, such as advancements in compounding, additive manufacturing (3D printing) with TPEs, and the development of bio-based TPE alternatives, are further enhancing their appeal and opening up new market segments. The penetration of TPEs is deepening as manufacturers recognize their potential to reduce manufacturing costs, improve product performance, and meet increasingly stringent environmental regulations. The market is moving beyond basic applications to more specialized and high-value uses, reflecting a maturation of both the industry and its customer base. The historical period (2019-2024) laid the groundwork, with steady growth driven by industrialization and infrastructure development. The forecast period (2025-2033) promises an accelerated expansion, propelled by innovation and evolving market needs.

Dominant Regions, Countries, or Segments in South America TPE Industry

Within the dynamic South America TPE industry, Brazil emerges as the dominant country, spearheading market growth and consumption. Its substantial industrial base, significant manufacturing output across key sectors like automotive, construction, and consumer goods, and a relatively well-established infrastructure provide fertile ground for TPE adoption. Economic policies that encourage domestic manufacturing and foreign investment further bolster Brazil's leading position. The country’s large population and expanding middle class translate into robust demand for products that increasingly incorporate advanced TPE materials for enhanced performance, aesthetics, and durability.

Among product types, Styrenic Block Copolymer (TPE-S) and Thermoplastic Polyurethane (TPU) are particularly dominant. TPE-S, known for its rubber-like elasticity and processability, finds extensive application in footwear, adhesives, sealants, and consumer goods, sectors that are thriving in Brazil and other parts of South America. TPU, with its exceptional abrasion resistance, chemical resistance, and flexibility, is a critical material for the automotive industry (e.g., interior components, seals), as well as in medical devices and high-performance applications, all of which are experiencing significant growth.

In terms of applications, Automotive & Transportation is the foremost segment driving TPE demand. Brazil's position as a major automotive manufacturing hub in South America means a constant and growing need for TPEs in vehicle interiors, exteriors, and under-the-hood components. The push for lightweight vehicles, fuel efficiency, and enhanced passenger comfort directly translates to increased TPE utilization. The Building & Construction segment also plays a crucial role, driven by urbanization, infrastructure development, and a growing demand for energy-efficient buildings, leading to increased use of TPEs in sealants, gaskets, and insulation.

- Dominant Country: Brazil, due to its large industrial base and strong manufacturing sector.

- Key Product Segments: TPE-S (Footwear, Adhesives) and TPU (Automotive, Medical) are leading growth.

- Dominant Application: Automotive & Transportation, driven by manufacturing and lightweighting trends.

- Secondary Growth Application: Building & Construction, fueled by infrastructure and energy efficiency demands.

- Geographical Drivers: Economic policies promoting manufacturing and robust consumer demand in Brazil and key neighboring economies.

South America TPE Industry Product Landscape

The South America TPE industry showcases a vibrant product landscape characterized by continuous innovation and diverse applications. Styrenic Block Copolymers (TPE-S) lead with excellent elasticity and processability, finding extensive use in footwear, adhesives, and consumer goods. Thermoplastic Polyurethane (TPU) offers superior abrasion resistance and chemical stability, making it vital for automotive parts, medical devices, and performance textiles. Thermoplastic Olefins (TPE-O) provide a cost-effective balance of flexibility and strength, prevalent in automotive interiors and household appliances. Elastomeric Alloys (TPE-V or TPV) deliver enhanced temperature and chemical resistance, crucial for demanding sealing applications in automotive and industrial settings. Thermoplastic Copolyesters and Polyamides offer specialized properties like high-temperature resistance and chemical inertness, catering to niche but growing applications in demanding environments. These materials enable product differentiation through improved aesthetics, tactile feel, and functional performance, directly impacting end-user satisfaction.

Key Drivers, Barriers & Challenges in South America TPE Industry

Key Drivers:

- Technological Advancements: Development of TPEs with enhanced properties like higher temperature resistance, improved chemical resistance, and better UV stability.

- Economic Growth & Industrialization: Expansion of manufacturing sectors like automotive, construction, and consumer goods fuels demand for versatile TPE materials.

- Sustainability Focus: Growing preference for recyclable and lightweight materials, aligning with global environmental initiatives and consumer demand.

- Cost-Effectiveness: TPEs offer a viable alternative to traditional rubber, often with lower processing costs and greater design freedom.

- Growing Automotive Sector: Demand for lightweight components and improved interior aesthetics and functionality in vehicles.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in petrochemical feedstock prices can impact TPE production costs and competitiveness.

- Competition from Traditional Materials: Established use and lower initial costs of some thermoset rubbers and other plastics present persistent competition.

- Regulatory Hurdles: Evolving environmental regulations and compliance requirements for material usage, especially in medical and food-contact applications.

- Supply Chain Disruptions: Geopolitical factors, logistics challenges, and dependence on imported raw materials can affect availability and lead times.

- Technical Expertise: Need for specialized knowledge in processing and application development for certain high-performance TPE grades.

Emerging Opportunities in South America TPE Industry

Emerging opportunities in the South America TPE industry lie in the burgeoning demand for sustainable and bio-based TPE alternatives, responding to increasing environmental consciousness. The expansion of the medical device sector, particularly in Brazil and Argentina, presents a significant opportunity for high-purity, biocompatible TPEs for implants, tubing, and drug delivery systems. Furthermore, the growing adoption of additive manufacturing (3D printing) for prototyping and low-volume production opens new avenues for specialized TPEs with unique printing characteristics. The increasing focus on urban mobility and electric vehicles will also drive demand for lightweight, high-performance TPE components for battery insulation, charging ports, and interior applications.

Growth Accelerators in the South America TPE Industry Industry

Long-term growth in the South America TPE industry is being accelerated by ongoing technological breakthroughs in material science, leading to TPEs with enhanced functionalities and broader application ranges. Strategic partnerships between global TPE manufacturers and local South American companies are crucial for expanding market reach, improving distribution networks, and providing tailored technical support. Market expansion strategies focused on underserved segments within the building and construction, electricals, and electronics industries, coupled with the development of customized TPE solutions for evolving consumer preferences, are also significant growth accelerators. The increasing focus on circular economy principles and the development of TPE recycling technologies will further solidify their position as sustainable material choices.

Key Players Shaping the South America TPE Industry Market

- Mitsui Chemicals Inc.

- KURARAY CO LTD

- Mitsubishi Chemical Corporation

- SABIC

- Evonik Industries AG

- BASF SE

- Arkema Group

- Huntsman International LLC

- LG Chem

- DuPont

- KRATON CORPORATION

Notable Milestones in South America TPE Industry Sector

- 2022: Launch of new TPE grades with enhanced UV resistance for outdoor applications in Building & Construction.

- 2023: Increased investment in R&D for bio-based TPE formulations by key players.

- 2024: Expansion of distribution networks for TPEs in emerging markets within the "Rest of South America" region.

- 2024: Strategic collaborations to develop TPE solutions for the growing electric vehicle (EV) market.

- 2025: Introduction of advanced TPE compounds for medical device manufacturing meeting stringent regulatory standards.

In-Depth South America TPE Industry Market Outlook

The South America TPE industry presents a robust outlook, driven by continuous material innovation and a strong demand for high-performance, sustainable solutions. Growth accelerators include advancements in TPE formulations for extreme temperature and chemical resistance, catering to specialized industrial applications, and the expanding use of TPEs in additive manufacturing for rapid prototyping and customized product development. Strategic alliances between material suppliers and end-users are expected to foster innovation and market penetration. The increasing adoption of electric vehicles and renewable energy infrastructure will create new avenues for TPEs in electrical insulation and sealing applications. Overall, the market is positioned for sustained growth, fueled by its versatility, cost-effectiveness, and alignment with global sustainability trends.

South America TPE Industry Segmentation

-

1. Product Type

- 1.1. Styrenic Block Copolymer (TPE-S)

- 1.2. Thermoplastic Olefin (TPE-O)

- 1.3. Elastomeric Alloy (TPE-V or TPV)

- 1.4. Thermoplastic Polyurethane (TPU)

- 1.5. Thermoplastic Copolyester

- 1.6. Thermoplastic Polyamide

-

2. Application

- 2.1. Automotive & Transportation

- 2.2. Building & Construction

- 2.3. Footwear

- 2.4. Electricals & Electronics

- 2.5. Medical

- 2.6. Household Appliances

- 2.7. HVAC

- 2.8. Adhesive, Sealant & Coating

- 2.9. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America TPE Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America TPE Industry Regional Market Share

Geographic Coverage of South America TPE Industry

South America TPE Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand from Building and Construction Industry; Growing Demand from Medical Sector

- 3.3. Market Restrains

- 3.3.1. ; Government Regulations on the Commercial Use of TPE

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Automotive and Transportation Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America TPE Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Styrenic Block Copolymer (TPE-S)

- 5.1.2. Thermoplastic Olefin (TPE-O)

- 5.1.3. Elastomeric Alloy (TPE-V or TPV)

- 5.1.4. Thermoplastic Polyurethane (TPU)

- 5.1.5. Thermoplastic Copolyester

- 5.1.6. Thermoplastic Polyamide

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive & Transportation

- 5.2.2. Building & Construction

- 5.2.3. Footwear

- 5.2.4. Electricals & Electronics

- 5.2.5. Medical

- 5.2.6. Household Appliances

- 5.2.7. HVAC

- 5.2.8. Adhesive, Sealant & Coating

- 5.2.9. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America TPE Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Styrenic Block Copolymer (TPE-S)

- 6.1.2. Thermoplastic Olefin (TPE-O)

- 6.1.3. Elastomeric Alloy (TPE-V or TPV)

- 6.1.4. Thermoplastic Polyurethane (TPU)

- 6.1.5. Thermoplastic Copolyester

- 6.1.6. Thermoplastic Polyamide

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive & Transportation

- 6.2.2. Building & Construction

- 6.2.3. Footwear

- 6.2.4. Electricals & Electronics

- 6.2.5. Medical

- 6.2.6. Household Appliances

- 6.2.7. HVAC

- 6.2.8. Adhesive, Sealant & Coating

- 6.2.9. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America TPE Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Styrenic Block Copolymer (TPE-S)

- 7.1.2. Thermoplastic Olefin (TPE-O)

- 7.1.3. Elastomeric Alloy (TPE-V or TPV)

- 7.1.4. Thermoplastic Polyurethane (TPU)

- 7.1.5. Thermoplastic Copolyester

- 7.1.6. Thermoplastic Polyamide

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive & Transportation

- 7.2.2. Building & Construction

- 7.2.3. Footwear

- 7.2.4. Electricals & Electronics

- 7.2.5. Medical

- 7.2.6. Household Appliances

- 7.2.7. HVAC

- 7.2.8. Adhesive, Sealant & Coating

- 7.2.9. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America TPE Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Styrenic Block Copolymer (TPE-S)

- 8.1.2. Thermoplastic Olefin (TPE-O)

- 8.1.3. Elastomeric Alloy (TPE-V or TPV)

- 8.1.4. Thermoplastic Polyurethane (TPU)

- 8.1.5. Thermoplastic Copolyester

- 8.1.6. Thermoplastic Polyamide

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive & Transportation

- 8.2.2. Building & Construction

- 8.2.3. Footwear

- 8.2.4. Electricals & Electronics

- 8.2.5. Medical

- 8.2.6. Household Appliances

- 8.2.7. HVAC

- 8.2.8. Adhesive, Sealant & Coating

- 8.2.9. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Mitsui Chemicals Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 KURARAY CO LTD

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Mitsubishi Chemical Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 SABIC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Evonik Industries AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Arkema Group

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Huntsman International LLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 LG Chem

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 DuPont

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 KRATON CORPORATION

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Mitsui Chemicals Inc

List of Figures

- Figure 1: South America TPE Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America TPE Industry Share (%) by Company 2025

List of Tables

- Table 1: South America TPE Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America TPE Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: South America TPE Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: South America TPE Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: South America TPE Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America TPE Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: South America TPE Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America TPE Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: South America TPE Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America TPE Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: South America TPE Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: South America TPE Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: South America TPE Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America TPE Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: South America TPE Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America TPE Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: South America TPE Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America TPE Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: South America TPE Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: South America TPE Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: South America TPE Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America TPE Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: South America TPE Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America TPE Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: South America TPE Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: South America TPE Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: South America TPE Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: South America TPE Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: South America TPE Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America TPE Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: South America TPE Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America TPE Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America TPE Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the South America TPE Industry?

Key companies in the market include Mitsui Chemicals Inc, KURARAY CO LTD, Mitsubishi Chemical Corporation, SABIC, Evonik Industries AG, BASF SE, Arkema Group, Huntsman International LLC, LG Chem, DuPont, KRATON CORPORATION.

3. What are the main segments of the South America TPE Industry?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.83 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand from Building and Construction Industry; Growing Demand from Medical Sector.

6. What are the notable trends driving market growth?

Increasing Usage in the Automotive and Transportation Applications.

7. Are there any restraints impacting market growth?

; Government Regulations on the Commercial Use of TPE.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America TPE Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America TPE Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America TPE Industry?

To stay informed about further developments, trends, and reports in the South America TPE Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence