Key Insights

The global surface treatment chemicals market is experiencing robust expansion, fueled by significant growth in the automotive, electronics, and construction industries. Projected to achieve a Compound Annual Growth Rate (CAGR) of 5.9%, the market is on a strong upward trajectory. This growth is driven by escalating demand for enhanced corrosion resistance, improved aesthetics, and superior functionality across various base materials. The automotive sector, in particular, is a key contributor, with the imperative for durable, lightweight vehicles stimulating the adoption of advanced surface treatment techniques. Similarly, the electronics industry's pursuit of miniaturization and enhanced performance relies heavily on sophisticated surface treatments. While plating chemicals currently hold a dominant market share due to their broad industrial applicability, the environmentally friendly conversion coatings segment is rapidly growing, propelled by stringent environmental regulations and a heightened focus on sustainable manufacturing. Geographically, Asia Pacific, led by China and India, presents substantial growth potential due to its extensive manufacturing base and expanding infrastructure. North America and Europe maintain significant market positions, driven by mature industrial sectors and continuous technological innovation. The competitive landscape is intense, characterized by vigorous competition from established multinational corporations and specialized chemical providers, fostering innovation in both product development and eco-conscious production methods. Key challenges include fluctuating raw material prices and potential regulatory shifts concerning specific chemical compounds. Nevertheless, the outlook for the surface treatment chemicals market remains highly positive, indicating considerable investment and expansion opportunities.

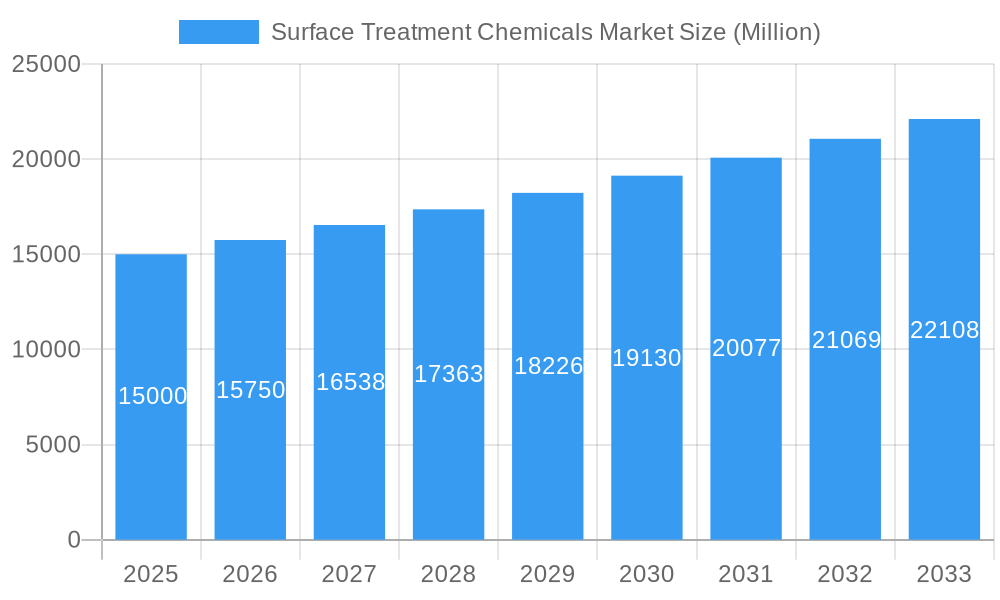

Surface Treatment Chemicals Market Market Size (In Billion)

Market segmentation reveals critical dynamics. Although metals remain the primary substrate, plastics are gaining traction, driven by industry-wide lightweighting initiatives. The 'Other Chemical Types' segment, including coolants and paint strippers, is anticipated to experience steady growth, responding to diverse industrial needs. Regional analysis highlights growth opportunities in emerging economies, complemented by the established presence of key players in developed markets. Leading companies are significantly investing in Research & Development to create novel products tailored to specific requirements, further accelerating market expansion. The overarching theme of sustainability is profoundly influencing future growth, with eco-friendly solutions gaining prominence and companies prioritizing the development and marketing of products compliant with increasingly rigorous environmental standards. Strategic collaborations, mergers, and acquisitions are expected to further consolidate the market landscape in the coming years.

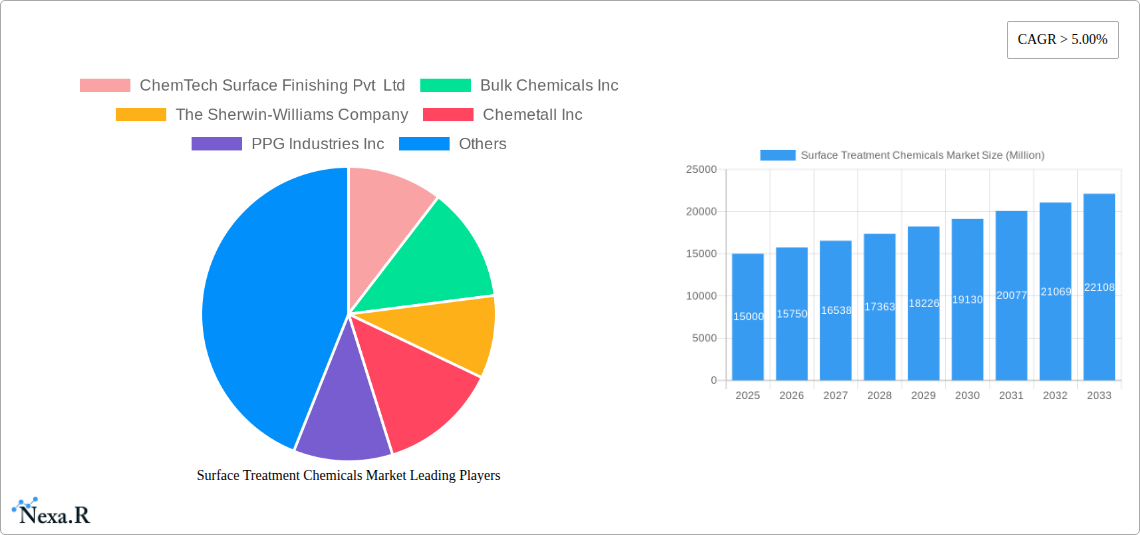

Surface Treatment Chemicals Market Company Market Share

This comprehensive report offers an in-depth analysis of the Surface Treatment Chemicals market, covering market dynamics, growth trends, regional segmentation, product offerings, key players, and future projections. The study period extends from 2019 to 2033, with 2025 designated as the base and estimated year. This analysis provides invaluable insights for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market. The estimated market size is projected to reach 15.82 billion by 2033.

Surface Treatment Chemicals Market Market Dynamics & Structure

The Surface Treatment Chemicals market, a parent market encompassing diverse sub-segments like plating chemicals, cleaners, and conversion coatings, is characterized by moderate concentration with several key players holding significant market share. The market exhibits considerable dynamism driven by technological innovations in materials science and surface engineering. Stringent environmental regulations are shaping the demand for eco-friendly solutions, while the automotive, electronics, and construction industries remain major end-users.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Ongoing R&D focuses on improving coating efficiency, durability, and environmental impact. Innovations include nanotechnology-based coatings, water-based alternatives to solvent-based chemicals, and advanced surface treatment processes.

- Regulatory Framework: Environmental regulations, particularly those related to VOC emissions and hazardous waste disposal, significantly influence market dynamics. Compliance costs and the adoption of sustainable technologies are key considerations.

- Competitive Product Substitutes: The emergence of alternative surface treatment methods, such as laser surface modification, competes with traditional chemical treatments.

- End-User Demographics: The automotive, electronics, and construction industries are major consumers, with the growth of electric vehicles and advanced electronics driving demand for specialized surface treatments.

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&As) in recent years, primarily driven by strategic expansion and portfolio diversification. An estimated xx M&A deals were closed between 2019 and 2024.

Surface Treatment Chemicals Market Growth Trends & Insights

The Surface Treatment Chemicals market has demonstrated robust and consistent growth throughout the historical period (2019-2024). This expansion has been propelled by a confluence of factors including escalating industrialization across various sectors, significant advancements in materials science leading to novel applications, and a sustained surge in demand from critical end-user industries such as automotive, aerospace, electronics, and construction. Projections indicate that this healthy growth trajectory will persist, with the market anticipated to achieve a Compound Annual Growth Rate (CAGR) of approximately **[Insert Specific CAGR Here]**% during the forecast period (2025-2033), ultimately reaching an estimated market valuation of **[Insert Specific Market Value]** Million by 2033. This upward trend is further substantiated by the increasing adoption of sophisticated surface treatment technologies, the continuous expansion of the automotive and electronics industries, and a pronounced global emphasis on developing and implementing sustainable and environmentally responsible solutions. Emerging technological disruptions, including the pioneering introduction of bio-based coatings and the increasing integration of automation within surface treatment processes, are acting as significant catalysts, further accelerating market expansion. Evolving consumer preferences and a growing consciousness towards environmentally benign products are directly influencing and steering the demand towards greener and more sustainable surface treatment chemical formulations. Furthermore, the market penetration of advanced functional coatings, renowned for their enhanced properties such as superior corrosion resistance, improved thermal conductivity, and extended durability, is expected to experience substantial growth in the coming years.

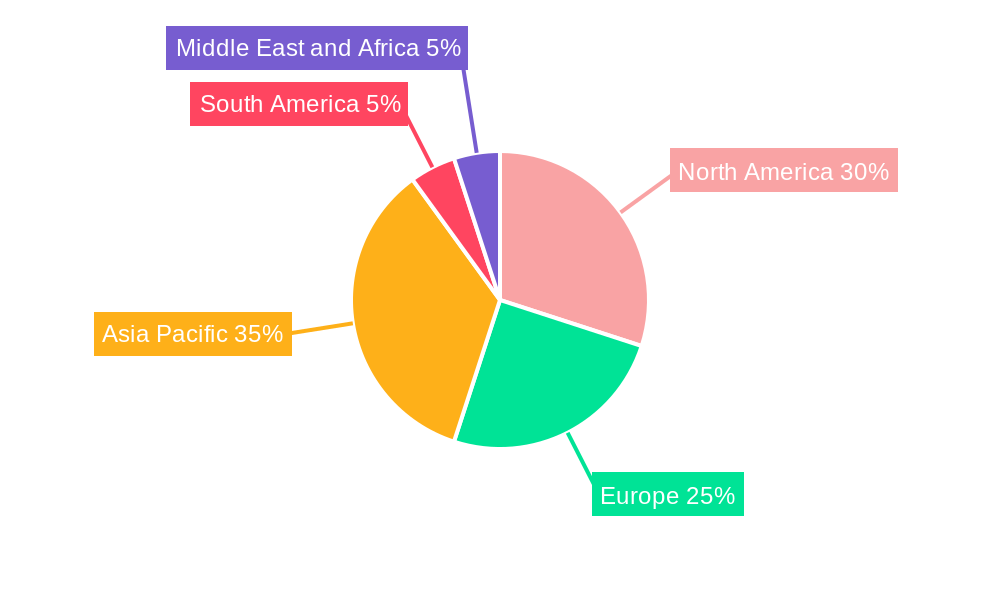

Dominant Regions, Countries, or Segments in Surface Treatment Chemicals Market

The automotive and transportation sector stands as the preeminent end-user industry, playing a pivotal role in driving market demand. This is closely followed by the burgeoning electronics industry and the expansive construction sector, both of which contribute significantly to the overall market dynamics. In terms of chemical types, plating chemicals and conversion coatings currently command substantial market shares, reflecting their widespread application and essential role in various manufacturing processes. Geographically, North America and Europe have historically been the leading markets, largely attributable to their well-established automotive and electronics industries and robust manufacturing bases. However, the Asia-Pacific region is poised to emerge as the fastest-growing market during the forecast period, fueled by rapid industrialization, expanding manufacturing capabilities, and increasing investments in infrastructure development.

- Key Drivers:

- Sustained and robust growth observed in the global automotive and electronics industries.

- Increasing infrastructure development and urbanization, particularly in emerging economies.

- Supportive government policies, regulatory frameworks, and financial incentives aimed at promoting industrial growth and technological innovation.

- Growing demand for enhanced product lifespan and aesthetic appeal across various consumer and industrial goods.

- Dominance Factors: The established industrial base, continuous technological advancements, and high consumer spending power contribute significantly to the current market dominance of North America and Europe. The Asia-Pacific region, on the other hand, presents immense growth potential due to its rapid industrialization, escalating manufacturing capacity, and a large, growing consumer base. Within the base materials segment, the Metals category continues to lead due to its pervasive use across a multitude of industries, from automotive and aerospace to construction and general manufacturing.

Surface Treatment Chemicals Market Product Landscape

The surface treatment chemicals market is characterized by a remarkably diverse and innovative product landscape, meticulously designed to cater to a wide spectrum of applications and a variety of base materials. Continuous innovation efforts are strategically focused on augmenting key performance characteristics, including but not limited to, superior corrosion resistance, enhanced wear resistance, improved adhesion, and superior aesthetic appeal. Product differentiation is actively pursued through the delivery of chemicals offering exceptional performance, the development of environmentally benign formulations with reduced VOCs and hazardous substances, and the creation of specialized solutions tailored for niche applications. Recent significant advancements include the widespread development and adoption of water-based and bio-based coatings. These innovative formulations not only offer substantial improvements in environmental sustainability and worker safety but also maintain or even enhance high-performance standards previously achieved by traditional solvent-based alternatives.

Key Drivers, Barriers & Challenges in Surface Treatment Chemicals Market

Key Drivers:

- The ever-increasing demand from critical sectors like automotive, aerospace, and electronics, driven by innovation and product evolution.

- A growing global awareness and emphasis on surface protection strategies to mitigate corrosion, wear, and environmental degradation, thereby extending product lifecycles.

- Continuous research and development leading to the creation and implementation of advanced coating technologies that offer enhanced performance and new functionalities.

- The rising trend of lightweighting in automotive and aerospace industries, necessitating advanced surface treatments for composite materials and new alloys.

Challenges & Restraints:

- The implementation of increasingly stringent environmental regulations and compliance requirements globally, which can lead to higher production costs and necessitate investment in cleaner technologies.

- Volatility and fluctuations in the prices of key raw materials, impacting manufacturing costs and profitability.

- Intense competition among established market players and emerging new entrants, which can exert downward pressure on pricing and profit margins. This competitive landscape is projected to potentially reduce average profit margins by an estimated **[Insert Specific Percentage Here]**% by 2033.

- The need for significant capital investment in research and development and advanced manufacturing facilities to keep pace with technological advancements and sustainability mandates.

Emerging Opportunities in Surface Treatment Chemicals Market

Emerging opportunities lie in the development of sustainable and eco-friendly surface treatment solutions, catering to the growing demand for green technologies. Untapped markets in developing economies offer significant growth potential. Innovations in nanotechnology and bio-based coatings are creating new avenues for product differentiation. The expansion of the electric vehicle market and renewable energy sectors presents significant opportunities for specialized surface treatments.

Growth Accelerators in the Surface Treatment Chemicals Market Industry

Significant technological breakthroughs stemming from advancements in materials science and sophisticated surface engineering are acting as powerful engines for long-term market growth. Strategic partnerships and collaborative ventures forged between leading chemical manufacturers and key end-user industries are proving instrumental in accelerating the pace of innovation, enhancing product development cycles, and facilitating broader market penetration of new solutions. Market expansion strategies that are strategically focused on untapped emerging economies and the development of specialized, high-value applications are also playing a crucial role in driving overall market growth. Moreover, the undeniable and increasing global focus on sustainability and circular economy principles is powerfully driving the adoption of eco-friendly and sustainable surface treatment solutions, thereby acting as a significant accelerator for the entire industry.

Key Players Shaping the Surface Treatment Chemicals Market Market

- ChemTech Surface Finishing Pvt Ltd

- Bulk Chemicals Inc

- The Sherwin-Williams Company

- Chemetall Inc

- PPG Industries Inc

- Atotech Deutschland GmbH

- OC Oerlikon Management AG

- Nippon Paint Holdings Co Ltd

- DOW

- Henkel AG & Co Ltd

- Atotech

- YUKEN Surface Technology S A de C V

- ALANOD GmbH & Co KG

- Aalberts Surface Technologies

- IONICS

- Quaker Chemical Corporation

Notable Milestones in Surface Treatment Chemicals Market Sector

- September 2021: Henkel presented innovative coating methods for EV battery manufacture and aluminum pre-treatment at SURCAR 2021, highlighting advancements in sustainable and high-performance coatings for the automotive industry.

- October 2021: Aalberts Surface Technologies partnered with Hoeller Electrolyzer GmbH to develop highly effective electrolyzer surface treatments, contributing to the advancement of green hydrogen technologies.

- February 2022: PPG's acquisition of Arsonsisi's powder coatings branch significantly expanded its powder coatings portfolio in Europe, the Middle East, and Africa, strengthening its market position and offering a broader range of solutions.

In-Depth Surface Treatment Chemicals Market Market Outlook

The future of the Surface Treatment Chemicals market looks promising, fueled by technological advancements, increasing industrialization, and the growing demand for sustainable solutions. Strategic partnerships, focused R&D, and market expansion into emerging economies are poised to further propel market growth. The focus on environmentally friendly formulations and advanced coating technologies will continue to shape the market landscape, presenting significant opportunities for innovation and growth.

Surface Treatment Chemicals Market Segmentation

-

1. Chemicals Type

- 1.1. Plating Chemicals

- 1.2. Cleaners

- 1.3. Conversion Coatings

- 1.4. Other Chemical Types (Coolants, Paint Strippers)

-

2. Base Material

- 2.1. Metals

- 2.2. Plastics

- 2.3. Other Base Materials (Glass, Alloys, Wood)

-

3. End-User Industry

- 3.1. Automotive and Transportation

- 3.2. Construction

- 3.3. Electronics

- 3.4. Industrial Machinery

- 3.5. Others (

Surface Treatment Chemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Surface Treatment Chemicals Market Regional Market Share

Geographic Coverage of Surface Treatment Chemicals Market

Surface Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Automotive Industry; The Use of Surface Treatment Chemicals to Reduce the Impact of Infections

- 3.3. Market Restrains

- 3.3.1. Shift from Chemicals to Bio-based (Green) Products; Strict Environmental Regulations for the Emission of Hazardous Chromium Components

- 3.4. Market Trends

- 3.4.1. The Automotive and Transport Segment is Anticipated to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 5.1.1. Plating Chemicals

- 5.1.2. Cleaners

- 5.1.3. Conversion Coatings

- 5.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 5.2. Market Analysis, Insights and Forecast - by Base Material

- 5.2.1. Metals

- 5.2.2. Plastics

- 5.2.3. Other Base Materials (Glass, Alloys, Wood)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive and Transportation

- 5.3.2. Construction

- 5.3.3. Electronics

- 5.3.4. Industrial Machinery

- 5.3.5. Others (

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 6. Asia Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 6.1.1. Plating Chemicals

- 6.1.2. Cleaners

- 6.1.3. Conversion Coatings

- 6.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 6.2. Market Analysis, Insights and Forecast - by Base Material

- 6.2.1. Metals

- 6.2.2. Plastics

- 6.2.3. Other Base Materials (Glass, Alloys, Wood)

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Automotive and Transportation

- 6.3.2. Construction

- 6.3.3. Electronics

- 6.3.4. Industrial Machinery

- 6.3.5. Others (

- 6.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 7. North America Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 7.1.1. Plating Chemicals

- 7.1.2. Cleaners

- 7.1.3. Conversion Coatings

- 7.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 7.2. Market Analysis, Insights and Forecast - by Base Material

- 7.2.1. Metals

- 7.2.2. Plastics

- 7.2.3. Other Base Materials (Glass, Alloys, Wood)

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Automotive and Transportation

- 7.3.2. Construction

- 7.3.3. Electronics

- 7.3.4. Industrial Machinery

- 7.3.5. Others (

- 7.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 8. Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 8.1.1. Plating Chemicals

- 8.1.2. Cleaners

- 8.1.3. Conversion Coatings

- 8.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 8.2. Market Analysis, Insights and Forecast - by Base Material

- 8.2.1. Metals

- 8.2.2. Plastics

- 8.2.3. Other Base Materials (Glass, Alloys, Wood)

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Automotive and Transportation

- 8.3.2. Construction

- 8.3.3. Electronics

- 8.3.4. Industrial Machinery

- 8.3.5. Others (

- 8.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 9. South America Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 9.1.1. Plating Chemicals

- 9.1.2. Cleaners

- 9.1.3. Conversion Coatings

- 9.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 9.2. Market Analysis, Insights and Forecast - by Base Material

- 9.2.1. Metals

- 9.2.2. Plastics

- 9.2.3. Other Base Materials (Glass, Alloys, Wood)

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Automotive and Transportation

- 9.3.2. Construction

- 9.3.3. Electronics

- 9.3.4. Industrial Machinery

- 9.3.5. Others (

- 9.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 10. Middle East and Africa Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 10.1.1. Plating Chemicals

- 10.1.2. Cleaners

- 10.1.3. Conversion Coatings

- 10.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 10.2. Market Analysis, Insights and Forecast - by Base Material

- 10.2.1. Metals

- 10.2.2. Plastics

- 10.2.3. Other Base Materials (Glass, Alloys, Wood)

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Automotive and Transportation

- 10.3.2. Construction

- 10.3.3. Electronics

- 10.3.4. Industrial Machinery

- 10.3.5. Others (

- 10.1. Market Analysis, Insights and Forecast - by Chemicals Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ChemTech Surface Finishing Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bulk Chemicals Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Sherwin-Williams Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chemetall Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PPG Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atotech Deutschland GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OC Oerlikon Management AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nippon Paint Holdings Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DOW

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henkel AG & Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Atotech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 YUKEN Surface Technology S A de C V *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ALANOD GmbH & Co KG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Aalberts Surface Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IONICS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Quaker Chemical Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 ChemTech Surface Finishing Pvt Ltd

List of Figures

- Figure 1: Global Surface Treatment Chemicals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Surface Treatment Chemicals Market Revenue (billion), by Chemicals Type 2025 & 2033

- Figure 3: Asia Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemicals Type 2025 & 2033

- Figure 4: Asia Pacific Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 5: Asia Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 6: Asia Pacific Surface Treatment Chemicals Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 7: Asia Pacific Surface Treatment Chemicals Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: Asia Pacific Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Surface Treatment Chemicals Market Revenue (billion), by Chemicals Type 2025 & 2033

- Figure 11: North America Surface Treatment Chemicals Market Revenue Share (%), by Chemicals Type 2025 & 2033

- Figure 12: North America Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 13: North America Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 14: North America Surface Treatment Chemicals Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 15: North America Surface Treatment Chemicals Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: North America Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Surface Treatment Chemicals Market Revenue (billion), by Chemicals Type 2025 & 2033

- Figure 19: Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemicals Type 2025 & 2033

- Figure 20: Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 21: Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 22: Europe Surface Treatment Chemicals Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 23: Europe Surface Treatment Chemicals Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Surface Treatment Chemicals Market Revenue (billion), by Chemicals Type 2025 & 2033

- Figure 27: South America Surface Treatment Chemicals Market Revenue Share (%), by Chemicals Type 2025 & 2033

- Figure 28: South America Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 29: South America Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 30: South America Surface Treatment Chemicals Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 31: South America Surface Treatment Chemicals Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: South America Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Surface Treatment Chemicals Market Revenue (billion), by Chemicals Type 2025 & 2033

- Figure 35: Middle East and Africa Surface Treatment Chemicals Market Revenue Share (%), by Chemicals Type 2025 & 2033

- Figure 36: Middle East and Africa Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 37: Middle East and Africa Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 38: Middle East and Africa Surface Treatment Chemicals Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Surface Treatment Chemicals Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 2: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 3: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 6: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 7: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 15: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 16: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United States Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Mexico Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 22: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 23: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 32: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 33: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Brazil Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Argentina Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Chemicals Type 2020 & 2033

- Table 39: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 40: Global Surface Treatment Chemicals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 41: Global Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: South Africa Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Surface Treatment Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surface Treatment Chemicals Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Surface Treatment Chemicals Market?

Key companies in the market include ChemTech Surface Finishing Pvt Ltd, Bulk Chemicals Inc, The Sherwin-Williams Company, Chemetall Inc, PPG Industries Inc, Atotech Deutschland GmbH, OC Oerlikon Management AG, Nippon Paint Holdings Co Ltd, DOW, Henkel AG & Co Ltd, Atotech, YUKEN Surface Technology S A de C V *List Not Exhaustive, ALANOD GmbH & Co KG, Aalberts Surface Technologies, IONICS, Quaker Chemical Corporation.

3. What are the main segments of the Surface Treatment Chemicals Market?

The market segments include Chemicals Type, Base Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Automotive Industry; The Use of Surface Treatment Chemicals to Reduce the Impact of Infections.

6. What are the notable trends driving market growth?

The Automotive and Transport Segment is Anticipated to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Shift from Chemicals to Bio-based (Green) Products; Strict Environmental Regulations for the Emission of Hazardous Chromium Components.

8. Can you provide examples of recent developments in the market?

February 2022: PPG announced the acquisition of Arsonsisi's powder coatings branch. Arsonsisi is a well-known exporter of specialist powder coatings for residential and commercial use. PPG will be able to expand its powder coatings portfolio throughout Europe, the Middle East, and Africa due to the acquisition. It also contains metallic bonding, one of the fastest growing sectors for powder coatings, which are widely used in specific treatments for automobiles, homes, and general industrial usage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Surface Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Surface Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Surface Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Surface Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence