Key Insights

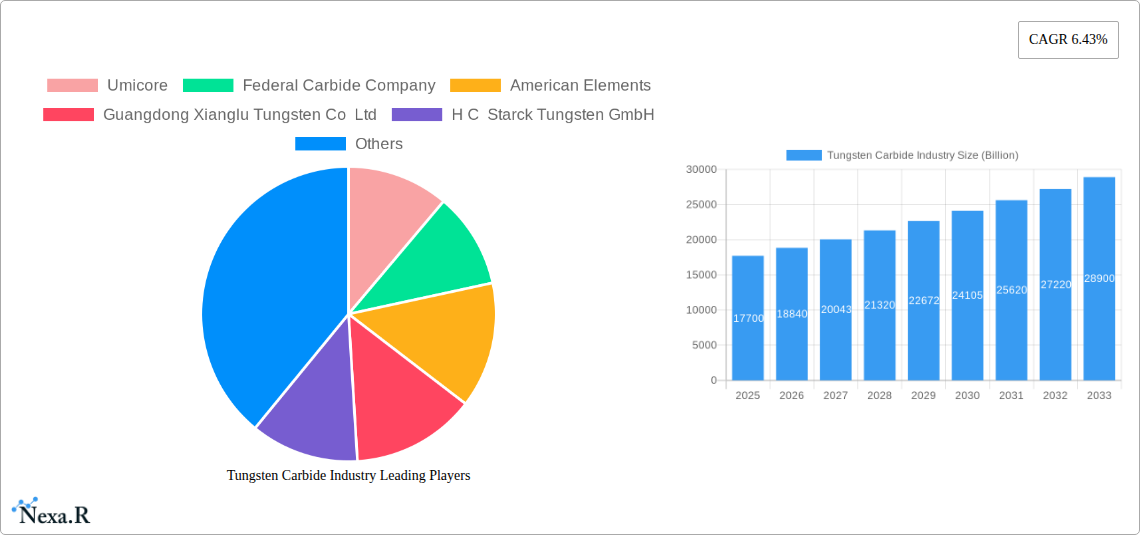

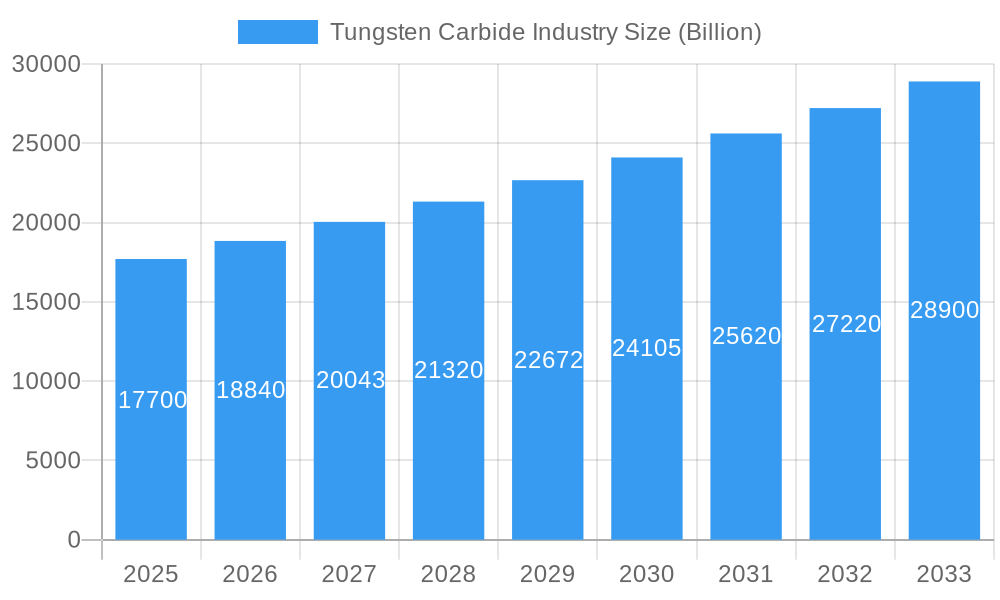

The global tungsten carbide market, valued at $17.70 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.43% from 2025 to 2033. This expansion is fueled by increasing demand across diverse sectors. The aerospace and defense industry relies heavily on tungsten carbide's exceptional hardness and wear resistance for critical components, while the automotive sector utilizes it in cutting tools and wear-resistant parts. The mining and construction industries benefit from its durability in drilling and cutting applications. Furthermore, the electronics industry's growing need for high-precision components and the burgeoning medical device sector's demand for biocompatible materials contribute to market growth. Significant advancements in material science and manufacturing techniques are continuously improving tungsten carbide's properties, expanding its applications in specialized areas like sports equipment and advanced tools. Geographic expansion, particularly in developing economies experiencing rapid industrialization, further accelerates market growth. While raw material price fluctuations and environmental concerns related to tungsten mining pose some challenges, the overall market outlook remains positive due to the material's unique properties and its irreplaceable role in diverse high-performance applications.

Tungsten Carbide Industry Market Size (In Billion)

The competitive landscape is marked by both established players and emerging manufacturers. Major companies like Umicore, Kennametal, and Sandvik hold significant market shares due to their strong technological capabilities and extensive distribution networks. However, smaller companies are making inroads, particularly in niche applications, through focused innovation and cost-effective production methods. The market is witnessing a trend towards consolidation, with larger companies acquiring smaller players to expand their product portfolios and geographic reach. The future success of companies in this market hinges on their ability to innovate, adapt to changing regulations related to environmental sustainability, and cater to evolving customer needs in terms of both product quality and delivery speed. Regional variations in growth rates reflect differences in industrial development and infrastructure, with Asia-Pacific expected to show robust growth driven by industrial expansion in China and India.

Tungsten Carbide Industry Company Market Share

Tungsten Carbide Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Tungsten Carbide industry, covering market dynamics, growth trends, regional insights, product landscape, and key players. With a focus on the parent market (Tungsten) and child markets (Cemented Carbide, Coatings, Alloys), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base year and an estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The total market size in 2025 is estimated to be xx Billion.

Tungsten Carbide Industry Market Dynamics & Structure

The global tungsten carbide market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, particularly in material science and manufacturing processes, is a key driver, constantly pushing the boundaries of performance and applications. Stringent environmental regulations concerning tungsten extraction and processing influence production costs and sustainability practices. Competitive substitutes, such as ceramics and advanced polymers, exist in specific niche applications, but tungsten carbide retains a strong competitive edge due to its exceptional hardness and wear resistance. End-user demographics are diverse, spanning various sectors with varying growth trajectories. M&A activity, as illustrated by recent acquisitions by CERATIZIT S.A., highlights the strategic importance of consolidating market share and accessing specialized technologies.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on improving hardness, wear resistance, and machinability.

- Regulatory Framework: Stringent environmental regulations impacting production costs.

- Competitive Substitutes: Ceramics and advanced polymers pose niche competition.

- End-User Demographics: Diverse, with significant presence across multiple sectors.

- M&A Trends: Active consolidation through acquisitions and mergers, driving growth and innovation.

Tungsten Carbide Industry Growth Trends & Insights

The global tungsten carbide market experienced significant growth from 2019 to 2024, driven primarily by robust demand from the automotive, aerospace & defense, and mining & construction industries. The market size is projected to reach xx Billion by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by increasing adoption of tungsten carbide in high-performance applications, technological advancements leading to enhanced product performance, and expansion into new and emerging markets. However, fluctuating tungsten prices and supply chain disruptions pose challenges to consistent market growth. Consumer behavior shifts toward sustainable and environmentally friendly products are also influencing industry practices.

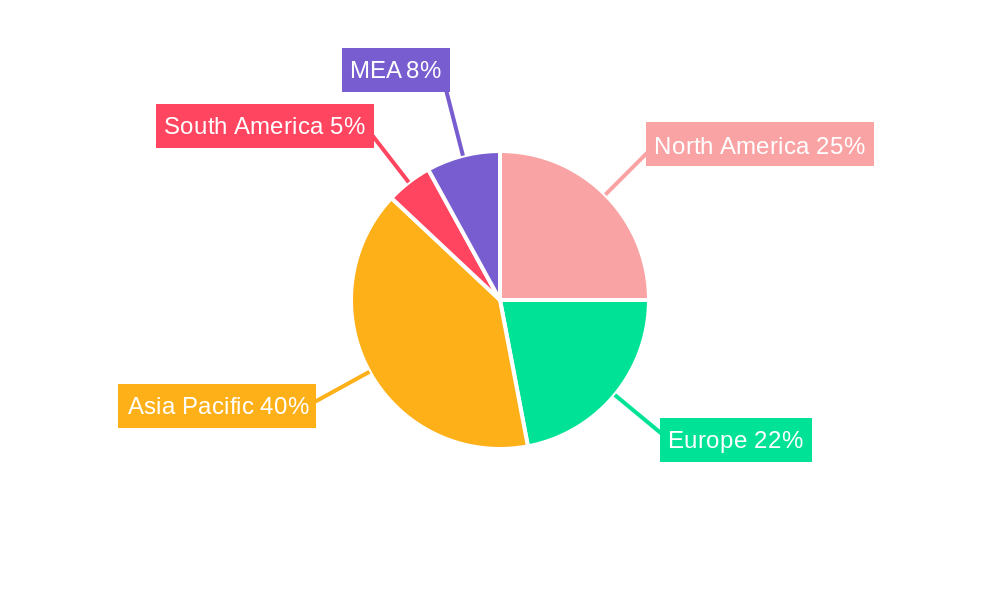

Dominant Regions, Countries, or Segments in Tungsten Carbide Industry

The global tungsten carbide industry is significantly shaped by regional strengths and key application segments. The Asia-Pacific region, with China at its forefront, stands as the undisputed leader. This dominance is fueled by China's vast and sophisticated manufacturing capabilities, coupled with its substantial demand from critical end-use industries such as automotive, construction, and mining. Following closely, North America and Europe represent substantial market shares, driven by their advanced industrial infrastructure and high consumption of specialized tungsten carbide products. Within the application landscape, Cemented Carbide commands the largest market share, owing to its widespread use in cutting tools, wear parts, and structural components. This is followed by the significant contributions of Coatings and Alloys, which enhance the performance and durability of various materials. In terms of end-user industries, the Automotive and Mining & Construction sectors are the primary consumers, leveraging tungsten carbide's exceptional hardness and wear resistance. Notably, the Aerospace & Defense industry is exhibiting robust growth potential, driven by the increasing demand for high-performance materials in critical applications.

- Key Drivers: Sustained industrial expansion in Asia-Pacific, escalating demand from the automotive and construction sectors, continuous technological advancements in material science and manufacturing processes, and increasing adoption in specialized industrial applications.

- Dominance Factors: China's unparalleled manufacturing capacity and cost-competitiveness, well-established and integrated supply chains for tungsten raw materials, and supportive government policies promoting industrial development and innovation.

- Growth Potential: Significant untapped potential lies within the Aerospace & Defense sector due to stringent material requirements, burgeoning opportunities in the Electronics industry for advanced components, and the rapid expansion of emerging markets seeking industrial modernization.

Tungsten Carbide Industry Product Landscape

Tungsten carbide products are characterized by their exceptional hardness, wear resistance, and high density. Continuous innovations focus on optimizing these properties for specific applications, with advancements in powder metallurgy, coating technologies, and grain size control enhancing product performance and longevity. Unique selling propositions often include superior durability, enhanced machinability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Tungsten Carbide Industry

Key Drivers:

- Growing demand from automotive and aerospace sectors for lightweight yet high-strength materials.

- Increasing adoption in mining and construction for improved tool life and efficiency.

- Technological advancements leading to enhanced performance and wider applications.

Key Challenges:

- Fluctuations in tungsten prices due to supply chain vulnerabilities and geopolitical factors. This has impacted profitability by xx% in some years.

- Stringent environmental regulations impacting manufacturing processes and waste disposal.

- Intense competition from other advanced materials.

Emerging Opportunities in Tungsten Carbide Industry

- Advancements in Electronics: Expanding applications in the semiconductor manufacturing and packaging sectors, where high precision and wear resistance are paramount for microchip production. This includes its use in wire bonding tools, etching equipment, and various micro-machining applications.

- Biomedical Innovations: Growth in medical applications, particularly for biocompatible and wear-resistant implants, such as artificial joints, dental prosthetics, and advanced surgical instruments. The unique properties of tungsten carbide make it ideal for demanding medical environments.

- High-Performance Composites: Development and commercialization of advanced tungsten carbide composites engineered with enhanced properties. This includes improvements in fracture toughness, thermal conductivity, and tailored microstructures for specialized industrial challenges, leading to lighter and stronger materials.

- Energy Sector Applications: Growing utilization in renewable energy technologies, such as wind turbine components requiring extreme wear resistance, and in the oil and gas industry for drill bits and downhole tools operating under harsh conditions.

Growth Accelerators in the Tungsten Carbide Industry Industry

The tungsten carbide industry's growth is propelled by a confluence of strategic initiatives and technological leaps. Strategic partnerships and collaborative ventures, especially between innovative material science companies and key end-user industries, are instrumental in the development and rapid adoption of customized tungsten carbide solutions tailored to specific performance requirements. Furthermore, technological breakthroughs in powder metallurgy and advanced coating techniques are continuously refining product performance, leading to enhanced durability, precision, and efficiency, thereby widening market penetration across various sectors. The strategic expansion into emerging markets, coupled with the dedicated development of specialized applications for niche industries, are further solidifying and accelerating the industry's growth trajectory.

Key Players Shaping the Tungsten Carbide Industry Market

- Umicore

- Federal Carbide Company

- American Elements

- Guangdong Xianglu Tungsten Co Ltd

- H C Starck Tungsten GmbH

- Sandvik AB

- Kennametal Inc

- CERATIZIT S.A

- Jiangxi Yaosheng Tungsten Co Ltd

- China Tungsten

- Extramet Products LLC

- CY Carbide Mfg Co Ltd

- Buffalo Tungsten Inc

- Sumitomo Electric Industries Ltd

- Carmet (part of Sumitomo Electric)

- Walter AG (part of Sandvik)

Notable Milestones in Tungsten Carbide Industry Sector

- September 2022: CERATIZIT S.A.'s strategic acquisition of AgriCarb SAS significantly expanded its market reach and product portfolio into the crucial agricultural wear parts sector, demonstrating a commitment to diversification and growth.

- June 2022: A groundbreaking collaboration between ZSW (Centre for Solar Energy and Hydrogen Research Baden-Württemberg) and H.C. Starck Tungsten GmbH on developing advanced tungsten-based cathode coatings for lithium-ion batteries marked a pivotal advancement in enhancing the performance and longevity of electric vehicle battery technology.

- February 2022: CERATIZIT S.A.'s full acquisition of Stadler Mettale strengthened its vertical integration by securing a reliable and sustainable supply of secondary raw materials, bolstering its commitment to circular economy principles and supply chain resilience.

- October 2023: Kennametal Inc. announced the launch of its new line of advanced tungsten carbide cutting tools engineered for extreme durability and precision in the aerospace industry, targeting critical applications in difficult-to-machine materials.

- April 2023: Sandvik Coromant unveiled a novel tungsten carbide grade designed for enhanced performance in high-temperature machining applications, offering improved tool life and productivity for industries dealing with superalloys.

In-Depth Tungsten Carbide Industry Market Outlook

The tungsten carbide market is poised for sustained growth, driven by increasing demand from diverse sectors, technological advancements, and strategic partnerships. The focus on sustainability and the development of innovative applications will shape the industry's future. Opportunities exist in expanding into new markets, developing specialized products, and creating sustainable manufacturing processes. The continued growth in the automotive and renewable energy sectors, particularly the rise of electric vehicles, is expected to drive further demand for high-performance tungsten carbide components.

Tungsten Carbide Industry Segmentation

-

1. Application

- 1.1. Cemented carbide

- 1.2. Coatings

- 1.3. Alloys

-

2. End-user

- 2.1. Aerospace & Defense

- 2.2. Automotive

- 2.3. Mining & Construction

- 2.4. Electronics

- 2.5. Others (Medical, Sports, etc.)

Tungsten Carbide Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Tungsten Carbide Industry Regional Market Share

Geographic Coverage of Tungsten Carbide Industry

Tungsten Carbide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Tungsten Carbide in Various End-user Industries; Recylable Property of Tungsten carbide

- 3.3. Market Restrains

- 3.3.1. Toxicity of Tungsten carbide; Other Restraints

- 3.4. Market Trends

- 3.4.1. Cement Carbide to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tungsten Carbide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cemented carbide

- 5.1.2. Coatings

- 5.1.3. Alloys

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Aerospace & Defense

- 5.2.2. Automotive

- 5.2.3. Mining & Construction

- 5.2.4. Electronics

- 5.2.5. Others (Medical, Sports, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Tungsten Carbide Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cemented carbide

- 6.1.2. Coatings

- 6.1.3. Alloys

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Aerospace & Defense

- 6.2.2. Automotive

- 6.2.3. Mining & Construction

- 6.2.4. Electronics

- 6.2.5. Others (Medical, Sports, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Tungsten Carbide Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cemented carbide

- 7.1.2. Coatings

- 7.1.3. Alloys

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Aerospace & Defense

- 7.2.2. Automotive

- 7.2.3. Mining & Construction

- 7.2.4. Electronics

- 7.2.5. Others (Medical, Sports, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tungsten Carbide Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cemented carbide

- 8.1.2. Coatings

- 8.1.3. Alloys

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Aerospace & Defense

- 8.2.2. Automotive

- 8.2.3. Mining & Construction

- 8.2.4. Electronics

- 8.2.5. Others (Medical, Sports, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Tungsten Carbide Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cemented carbide

- 9.1.2. Coatings

- 9.1.3. Alloys

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Aerospace & Defense

- 9.2.2. Automotive

- 9.2.3. Mining & Construction

- 9.2.4. Electronics

- 9.2.5. Others (Medical, Sports, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Umicore

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Federal Carbide Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 American Elements

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Guangdong Xianglu Tungsten Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 H C Starck Tungsten GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sandvik AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kennametal Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CERATIZIT S A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jiangxi Yaosheng Tungsten Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 China Tungsten

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Extramet Products LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 CY Carbide Mfg Co Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Buffalo Tungsten Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Sumitomo Electric Industries Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Umicore

List of Figures

- Figure 1: Global Tungsten Carbide Industry Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Tungsten Carbide Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Tungsten Carbide Industry Revenue (Billion), by Application 2025 & 2033

- Figure 4: Asia Pacific Tungsten Carbide Industry Volume (K Tons), by Application 2025 & 2033

- Figure 5: Asia Pacific Tungsten Carbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Tungsten Carbide Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific Tungsten Carbide Industry Revenue (Billion), by End-user 2025 & 2033

- Figure 8: Asia Pacific Tungsten Carbide Industry Volume (K Tons), by End-user 2025 & 2033

- Figure 9: Asia Pacific Tungsten Carbide Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Asia Pacific Tungsten Carbide Industry Volume Share (%), by End-user 2025 & 2033

- Figure 11: Asia Pacific Tungsten Carbide Industry Revenue (Billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Tungsten Carbide Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Tungsten Carbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Tungsten Carbide Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Tungsten Carbide Industry Revenue (Billion), by Application 2025 & 2033

- Figure 16: North America Tungsten Carbide Industry Volume (K Tons), by Application 2025 & 2033

- Figure 17: North America Tungsten Carbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Tungsten Carbide Industry Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Tungsten Carbide Industry Revenue (Billion), by End-user 2025 & 2033

- Figure 20: North America Tungsten Carbide Industry Volume (K Tons), by End-user 2025 & 2033

- Figure 21: North America Tungsten Carbide Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 22: North America Tungsten Carbide Industry Volume Share (%), by End-user 2025 & 2033

- Figure 23: North America Tungsten Carbide Industry Revenue (Billion), by Country 2025 & 2033

- Figure 24: North America Tungsten Carbide Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Tungsten Carbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Tungsten Carbide Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Tungsten Carbide Industry Revenue (Billion), by Application 2025 & 2033

- Figure 28: Europe Tungsten Carbide Industry Volume (K Tons), by Application 2025 & 2033

- Figure 29: Europe Tungsten Carbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Tungsten Carbide Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Tungsten Carbide Industry Revenue (Billion), by End-user 2025 & 2033

- Figure 32: Europe Tungsten Carbide Industry Volume (K Tons), by End-user 2025 & 2033

- Figure 33: Europe Tungsten Carbide Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Europe Tungsten Carbide Industry Volume Share (%), by End-user 2025 & 2033

- Figure 35: Europe Tungsten Carbide Industry Revenue (Billion), by Country 2025 & 2033

- Figure 36: Europe Tungsten Carbide Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Tungsten Carbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Tungsten Carbide Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Tungsten Carbide Industry Revenue (Billion), by Application 2025 & 2033

- Figure 40: Rest of the World Tungsten Carbide Industry Volume (K Tons), by Application 2025 & 2033

- Figure 41: Rest of the World Tungsten Carbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Rest of the World Tungsten Carbide Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Rest of the World Tungsten Carbide Industry Revenue (Billion), by End-user 2025 & 2033

- Figure 44: Rest of the World Tungsten Carbide Industry Volume (K Tons), by End-user 2025 & 2033

- Figure 45: Rest of the World Tungsten Carbide Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Rest of the World Tungsten Carbide Industry Volume Share (%), by End-user 2025 & 2033

- Figure 47: Rest of the World Tungsten Carbide Industry Revenue (Billion), by Country 2025 & 2033

- Figure 48: Rest of the World Tungsten Carbide Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Rest of the World Tungsten Carbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Tungsten Carbide Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tungsten Carbide Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 2: Global Tungsten Carbide Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Global Tungsten Carbide Industry Revenue Billion Forecast, by End-user 2020 & 2033

- Table 4: Global Tungsten Carbide Industry Volume K Tons Forecast, by End-user 2020 & 2033

- Table 5: Global Tungsten Carbide Industry Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Tungsten Carbide Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Tungsten Carbide Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 8: Global Tungsten Carbide Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Global Tungsten Carbide Industry Revenue Billion Forecast, by End-user 2020 & 2033

- Table 10: Global Tungsten Carbide Industry Volume K Tons Forecast, by End-user 2020 & 2033

- Table 11: Global Tungsten Carbide Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: Global Tungsten Carbide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: China Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: India Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Tungsten Carbide Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 24: Global Tungsten Carbide Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 25: Global Tungsten Carbide Industry Revenue Billion Forecast, by End-user 2020 & 2033

- Table 26: Global Tungsten Carbide Industry Volume K Tons Forecast, by End-user 2020 & 2033

- Table 27: Global Tungsten Carbide Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 28: Global Tungsten Carbide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 30: United States Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: Canada Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: Mexico Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Tungsten Carbide Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 36: Global Tungsten Carbide Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Global Tungsten Carbide Industry Revenue Billion Forecast, by End-user 2020 & 2033

- Table 38: Global Tungsten Carbide Industry Volume K Tons Forecast, by End-user 2020 & 2033

- Table 39: Global Tungsten Carbide Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 40: Global Tungsten Carbide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: Germany Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 46: Italy Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 48: France Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Tungsten Carbide Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 52: Global Tungsten Carbide Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 53: Global Tungsten Carbide Industry Revenue Billion Forecast, by End-user 2020 & 2033

- Table 54: Global Tungsten Carbide Industry Volume K Tons Forecast, by End-user 2020 & 2033

- Table 55: Global Tungsten Carbide Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 56: Global Tungsten Carbide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: South America Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 58: South America Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Middle East Tungsten Carbide Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 60: Middle East Tungsten Carbide Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tungsten Carbide Industry?

The projected CAGR is approximately 6.43%.

2. Which companies are prominent players in the Tungsten Carbide Industry?

Key companies in the market include Umicore, Federal Carbide Company, American Elements, Guangdong Xianglu Tungsten Co Ltd, H C Starck Tungsten GmbH, Sandvik AB, Kennametal Inc, CERATIZIT S A, Jiangxi Yaosheng Tungsten Co Ltd, China Tungsten, Extramet Products LLC, CY Carbide Mfg Co Ltd, Buffalo Tungsten Inc, Sumitomo Electric Industries Ltd.

3. What are the main segments of the Tungsten Carbide Industry?

The market segments include Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.70 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Tungsten Carbide in Various End-user Industries; Recylable Property of Tungsten carbide.

6. What are the notable trends driving market growth?

Cement Carbide to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Toxicity of Tungsten carbide; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: CERATIZIT S.A. announced the acquisition of all the shares of AgriCarb SAS, a global leader in tungsten carbide agricultural wear parts for over 35 years. This acquisition will help the company enter new markets. with the help of a high degree of added value and expertise in the field of hybrid tools made of steel and tungsten carbide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tungsten Carbide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tungsten Carbide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tungsten Carbide Industry?

To stay informed about further developments, trends, and reports in the Tungsten Carbide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence