Key Insights

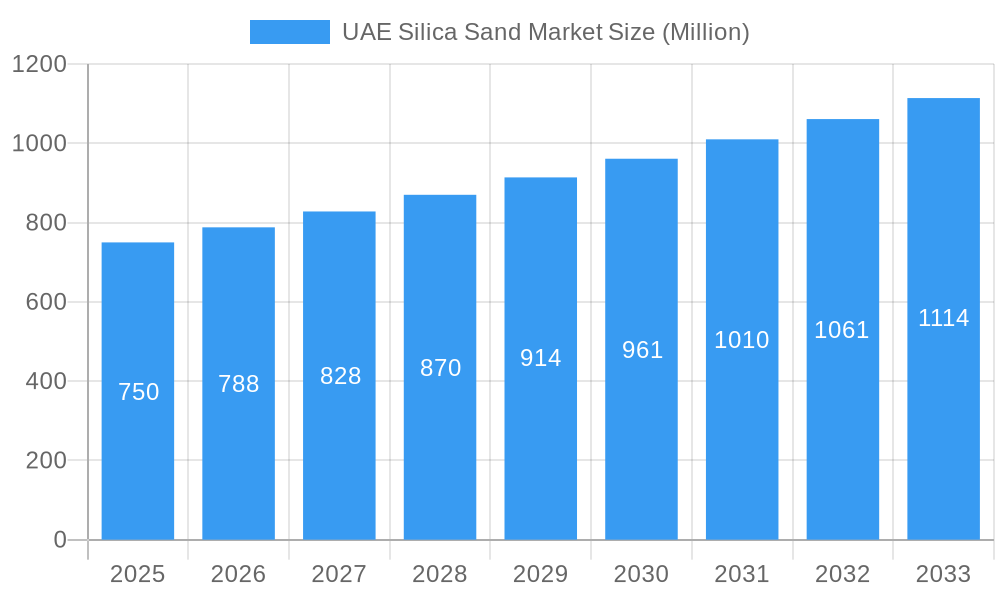

The UAE Silica Sand Market is poised for robust growth, projected to exceed USD 750 million in market size by 2025, with a Compound Annual Growth Rate (CAGR) of over 5.00% anticipated through 2033. This expansion is primarily fueled by the region's burgeoning construction sector, driven by ambitious infrastructure projects and a strong focus on tourism and real estate development. The increasing demand for high-quality silica sand in the manufacturing of glass for construction, automotive, and consumer goods, as well as its essential role in foundry operations for metal casting, are significant growth catalysts. Furthermore, the Paints and Coatings industry is witnessing a steady rise in silica sand consumption as a functional filler, enhancing durability and performance. The strategic location of the UAE and its proactive economic diversification policies are further bolstering the market by attracting investments and fostering industrial development across various end-user segments.

UAE Silica Sand Market Market Size (In Million)

The market's upward trajectory is further supported by emerging trends such as the growing adoption of advanced filtration technologies in water treatment and industrial processes, where silica sand plays a crucial role. Innovations in mining and processing techniques are also contributing to higher purity grades of silica sand, meeting the stringent requirements of specialized applications like electronics and solar energy. While the market benefits from strong demand drivers, potential restraints include fluctuating raw material costs and the implementation of stringent environmental regulations concerning mining activities. However, the continuous development of new applications and the sustained demand from core industries, coupled with the government's commitment to infrastructure enhancement, are expected to outweigh these challenges, ensuring a dynamic and growing UAE Silica Sand Market in the coming years.

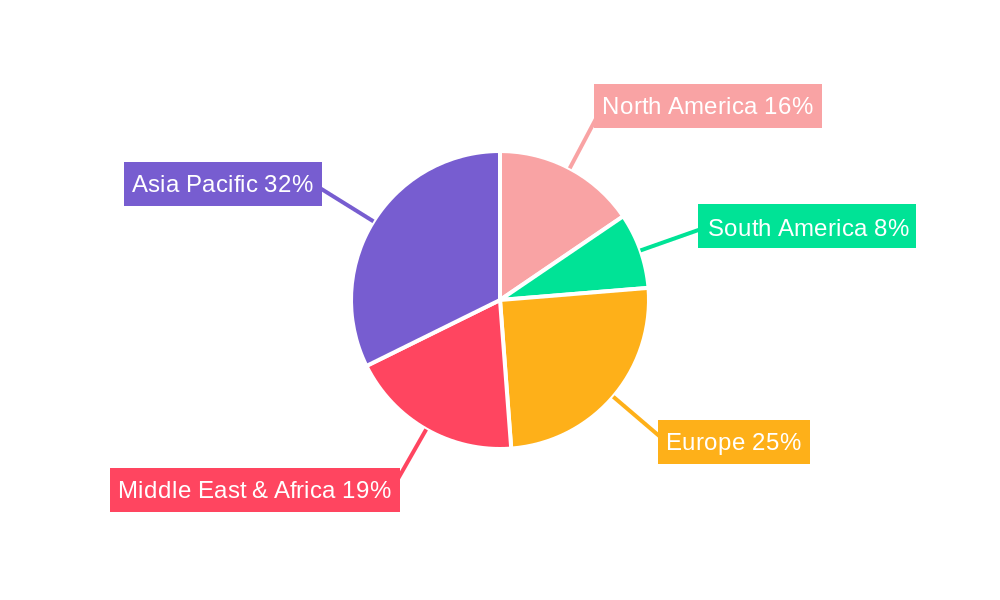

UAE Silica Sand Market Company Market Share

UAE Silica Sand Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the UAE Silica Sand Market, encompassing its current dynamics, growth trajectory, and future potential. Leveraging high-traffic keywords such as "UAE silica sand," "silica sand market UAE," "construction silica sand," "glass manufacturing silica sand," and "foundry silica sand," this report aims to be the definitive resource for industry professionals seeking strategic insights. We delve into both the parent market and child markets, offering a granular view of the competitive landscape, technological advancements, and key growth drivers. All values are presented in millions, with a base year of 2025 and a forecast period extending to 2033.

UAE Silica Sand Market Market Dynamics & Structure

The UAE Silica Sand Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is primarily driven by advancements in processing techniques, leading to higher purity silica sand for specialized applications. Regulatory frameworks are evolving to promote sustainable extraction practices and environmental compliance. While direct substitutes for high-purity silica sand are limited, the market faces indirect competition from alternative materials in certain low-grade applications. End-user demographics reveal a strong reliance on the construction and industrial sectors, with growing demand from emerging industries. Mergers and acquisitions (M&A) activity is present, driven by a desire for vertical integration and expanded market reach.

- Market Concentration: Moderate, with key players like Mitsubishi Corporation, Rawasy Group, and Delmon Co Ltd leading extraction and supply.

- Technological Innovation: Focus on beneficiation and purification technologies to meet stringent industry standards.

- Regulatory Frameworks: Emphasis on environmental impact assessments and responsible mining practices.

- Competitive Substitutes: Limited for high-purity grades; some competition from alternative aggregates in less demanding construction applications.

- End-User Demographics: Predominantly driven by construction (XX% market share), followed by glass manufacturing (XX% market share) and foundry operations (XX% market share).

- M&A Trends: Strategic acquisitions aimed at securing supply chains and expanding product portfolios.

UAE Silica Sand Market Growth Trends & Insights

The UAE Silica Sand Market is poised for robust growth, projected to expand significantly from its current valuation of USD XXX Million in the base year 2025. This expansion is fueled by sustained demand from key sectors and the UAE's ambitious development projects. The adoption rate of high-quality silica sand is steadily increasing, driven by stricter quality standards in industries like glass manufacturing and advanced construction materials. Technological disruptions are primarily centered around improving extraction efficiency, reducing environmental impact, and developing specialized silica sand grades for niche applications. Consumer behavior shifts are observed in a growing preference for sustainably sourced and high-purity silica sand, especially among environmentally conscious industries. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is an impressive XX%. This growth trajectory is further supported by substantial investments in infrastructure development and the burgeoning real estate sector within the UAE. The historical period (2019-2024) indicates a steady upward trend, laying a strong foundation for future expansion. The market penetration of specialized silica sand products is anticipated to rise as industries seek enhanced performance and efficiency in their end products. The increasing urbanization and industrialization in the UAE are also significant contributors to this sustained market growth, creating a consistent demand for silica sand across various applications.

Dominant Regions, Countries, or Segments in UAE Silica Sand Market

Within the UAE Silica Sand Market, the Construction segment emerges as the dominant force, driving significant growth and demand. This dominance is attributed to the UAE's continuous and large-scale infrastructure development, urban expansion, and the thriving real estate sector. Government initiatives promoting diversification of the economy and the development of smart cities further bolster the demand for construction materials, where silica sand plays a crucial role as an aggregate and component in concrete, asphalt, and other building materials. The robust pipeline of construction projects, including residential, commercial, and industrial developments, ensures a sustained and substantial requirement for silica sand.

- Construction Segment Dominance: Accounts for approximately XX% of the total UAE silica sand market share.

- Key Drivers:

- Mega-infrastructure Projects: Ongoing development of cities, transportation networks, and iconic landmarks.

- Real Estate Boom: High demand for residential and commercial properties.

- Government Spending: Significant investment in public works and urban development.

- Urbanization: Continuous migration to urban centers necessitates expansion and new construction.

- Growth Potential: High and sustained due to long-term development plans and a favorable economic climate.

- Key Drivers:

The Glass Manufacturing segment represents the second-largest contributor, with an estimated market share of XX%. The UAE's growing manufacturing base, particularly in areas like flat glass for construction and packaging, fuels this demand. Advancements in glass technology requiring higher purity silica sand further support this segment.

- Glass Manufacturing Segment: Estimated at XX% market share.

- Key Drivers:

- Automotive Industry Growth: Increasing demand for automotive glass.

- Packaging Industry Expansion: Rise in demand for glass containers.

- Construction Sector Support: Demand for architectural and decorative glass.

- Key Drivers:

The Foundry segment, holding an estimated XX% market share, is crucial for the manufacturing of metal castings. The UAE's burgeoning industrial sector, including metal fabrication and heavy machinery production, contributes to the demand for foundry-grade silica sand.

- Foundry Segment: Estimated at XX% market share.

- Key Drivers:

- Industrial Manufacturing Expansion: Growth in metal casting for various industries.

- Automotive and Aerospace Support: Demand for precision metal components.

- Key Drivers:

Other significant segments include Chemical Production, Paints and Coatings, and Filtration, each contributing to the overall market dynamics with their specific purity and particle size requirements for silica sand. The Oil and Gas sector also utilizes silica sand for well stimulation and filtration applications.

UAE Silica Sand Market Product Landscape

The UAE Silica Sand Market product landscape is evolving to meet increasingly stringent industry demands. Innovations are focused on delivering higher purity silica sand (often exceeding 99% SiO2) for applications in advanced glass manufacturing, specialty chemicals, and high-performance coatings. Particle size distribution and uniformity are critical performance metrics, with manufacturers offering a range of grades tailored to specific end-user needs, from fine powders for ceramics to granular sizes for filtration. Technological advancements in beneficiation and processing techniques are enabling the production of silica sand with controlled levels of impurities, enhancing its functional properties. Unique selling propositions often revolve around the consistency of product quality, reliable supply chains, and the ability to customize product specifications.

Key Drivers, Barriers & Challenges in UAE Silica Sand Market

Key Drivers:

- Infrastructure Development: Continuous government investment in large-scale construction projects remains the primary growth engine.

- Industrialization: Expansion of manufacturing sectors requiring silica sand for various processes.

- Economic Diversification: UAE's strategic focus on developing non-oil sectors boosts industrial output.

- Technological Advancements: Innovations in processing and beneficiation leading to higher quality products.

- Growing Population: Increased demand for housing and associated construction materials.

Barriers & Challenges:

- Environmental Regulations: Stringent regulations on mining and extraction can increase operational costs and complexity.

- Logistics and Transportation: Efficient transportation of bulk materials across the UAE can be challenging and costly.

- Competition from Imports: Availability of competitively priced imported silica sand can pressure domestic producers.

- Water Scarcity: Water-intensive processing methods face challenges in a water-scarce region.

- Fluctuations in Construction Demand: The cyclical nature of the construction industry can lead to demand volatility.

Emerging Opportunities in UAE Silica Sand Market

Emerging opportunities within the UAE Silica Sand Market lie in catering to the growing demand for specialized, high-purity silica sand. The development of advanced materials for solar energy applications and the burgeoning electronics industry present untapped markets. Furthermore, the increasing focus on sustainability offers opportunities for companies offering environmentally friendly extraction and processing methods. The potential for developing silica-based composites for lightweight construction materials also represents a promising avenue for innovation and market expansion, catering to evolving consumer preferences for eco-friendly and high-performance products.

Growth Accelerators in the UAE Silica Sand Market Industry

Several catalysts are accelerating the long-term growth of the UAE Silica Sand Market. Technological breakthroughs in beneficiation and purification processes are enabling the production of exceptionally pure silica sand, opening doors to high-value niche markets. Strategic partnerships between mining companies and end-users are fostering innovation and ensuring a consistent supply of tailored products. Market expansion strategies, including the exploration of new deposit sites and the optimization of existing operations, are crucial for meeting projected demand. Furthermore, the UAE's strategic location and its ambition to become a global hub for manufacturing and trade provide a conducive environment for sustained market growth and export potential.

Key Players Shaping the UAE Silica Sand Market Market

- Mitsubishi Corporation

- Rawasy Group

- Delmon Co Ltd

- Chem Source Egypt

- National Ready Mix Concrete Co LLC

- Adwan Chemical Industries Co Ltd

- Cairo Minerals

- Speciality Industries LLC

- Gulf Minerals

- Majd Al Muayad

Notable Milestones in UAE Silica Sand Market Sector

- 2022: Increased investment in advanced beneficiation technologies by leading players.

- 2021: Implementation of stricter environmental regulations for sand mining operations.

- 2020: Significant growth in silica sand demand driven by construction for Expo 2020 Dubai.

- 2019: Expansion of specialized silica sand production for niche industrial applications.

In-Depth UAE Silica Sand Market Market Outlook

The future outlook for the UAE Silica Sand Market is exceptionally promising, driven by sustained economic growth and ambitious national development plans. Growth accelerators such as ongoing infrastructure projects, industrial diversification, and technological advancements will continue to propel the market forward. Strategic opportunities lie in capitalizing on the increasing demand for high-purity silica sand in emerging sectors like renewable energy and electronics, alongside the continued dominance of the construction and manufacturing industries. Companies that focus on sustainable practices and innovative product development are well-positioned to capture significant market share and contribute to the UAE's continued economic prosperity.

UAE Silica Sand Market Segmentation

-

1. End-user Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas

- 1.9. Other End-user Industries

UAE Silica Sand Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Silica Sand Market Regional Market Share

Geographic Coverage of UAE Silica Sand Market

UAE Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Land Reclamation Projects Across the Region

- 3.3. Market Restrains

- 3.3.1. Competition from Various Substitutes; Development of Sand-Free Construction Products

- 3.4. Market Trends

- 3.4.1. Growing Land Reclamation to Drive Demand for Silica Sand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas

- 5.1.9. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Glass Manufacturing

- 6.1.2. Foundry

- 6.1.3. Chemical Production

- 6.1.4. Construction

- 6.1.5. Paints and Coatings

- 6.1.6. Ceramics and Refractories

- 6.1.7. Filtration

- 6.1.8. Oil and Gas

- 6.1.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Glass Manufacturing

- 7.1.2. Foundry

- 7.1.3. Chemical Production

- 7.1.4. Construction

- 7.1.5. Paints and Coatings

- 7.1.6. Ceramics and Refractories

- 7.1.7. Filtration

- 7.1.8. Oil and Gas

- 7.1.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Glass Manufacturing

- 8.1.2. Foundry

- 8.1.3. Chemical Production

- 8.1.4. Construction

- 8.1.5. Paints and Coatings

- 8.1.6. Ceramics and Refractories

- 8.1.7. Filtration

- 8.1.8. Oil and Gas

- 8.1.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Glass Manufacturing

- 9.1.2. Foundry

- 9.1.3. Chemical Production

- 9.1.4. Construction

- 9.1.5. Paints and Coatings

- 9.1.6. Ceramics and Refractories

- 9.1.7. Filtration

- 9.1.8. Oil and Gas

- 9.1.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific UAE Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Glass Manufacturing

- 10.1.2. Foundry

- 10.1.3. Chemical Production

- 10.1.4. Construction

- 10.1.5. Paints and Coatings

- 10.1.6. Ceramics and Refractories

- 10.1.7. Filtration

- 10.1.8. Oil and Gas

- 10.1.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mitsubishi Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rawasy Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delmon Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chem Source Egypt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 National Ready Mix Concrete Co LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adwan Chemical Industries Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cairo Minerals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Speciality Industries LLC*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gulf Minerals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Majd Al Muayad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global UAE Silica Sand Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UAE Silica Sand Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: North America UAE Silica Sand Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America UAE Silica Sand Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America UAE Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE Silica Sand Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: South America UAE Silica Sand Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: South America UAE Silica Sand Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America UAE Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE Silica Sand Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe UAE Silica Sand Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe UAE Silica Sand Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe UAE Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE Silica Sand Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Middle East & Africa UAE Silica Sand Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Middle East & Africa UAE Silica Sand Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE Silica Sand Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 19: Asia Pacific UAE Silica Sand Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Asia Pacific UAE Silica Sand Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE Silica Sand Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global UAE Silica Sand Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global UAE Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global UAE Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global UAE Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 25: Global UAE Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Silica Sand Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 33: Global UAE Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE Silica Sand Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Silica Sand Market?

The projected CAGR is approximately 4.44%.

2. Which companies are prominent players in the UAE Silica Sand Market?

Key companies in the market include Mitsubishi Corporation, Rawasy Group, Delmon Co Ltd, Chem Source Egypt, National Ready Mix Concrete Co LLC, Adwan Chemical Industries Co Ltd, Cairo Minerals, Speciality Industries LLC*List Not Exhaustive, Gulf Minerals, Majd Al Muayad.

3. What are the main segments of the UAE Silica Sand Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Land Reclamation Projects Across the Region.

6. What are the notable trends driving market growth?

Growing Land Reclamation to Drive Demand for Silica Sand.

7. Are there any restraints impacting market growth?

Competition from Various Substitutes; Development of Sand-Free Construction Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Silica Sand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Silica Sand Market?

To stay informed about further developments, trends, and reports in the UAE Silica Sand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence