Key Insights

The global Ultra-High Strength Steel (UHSS) market is projected for significant expansion, anticipating a market size of $19.5 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 7.39% during the forecast period of 2024-2033. This growth is driven by escalating demand for lightweight, durable, and high-performance materials across vital industries. The automotive sector is a key contributor, utilizing UHSS to improve fuel efficiency and safety through lighter vehicle construction. The aerospace and defense industries benefit from UHSS's superior strength-to-weight ratio for advanced aircraft and equipment. Furthermore, the construction sector employs UHSS in structural elements to enhance seismic resilience and facilitate innovative architectural designs.

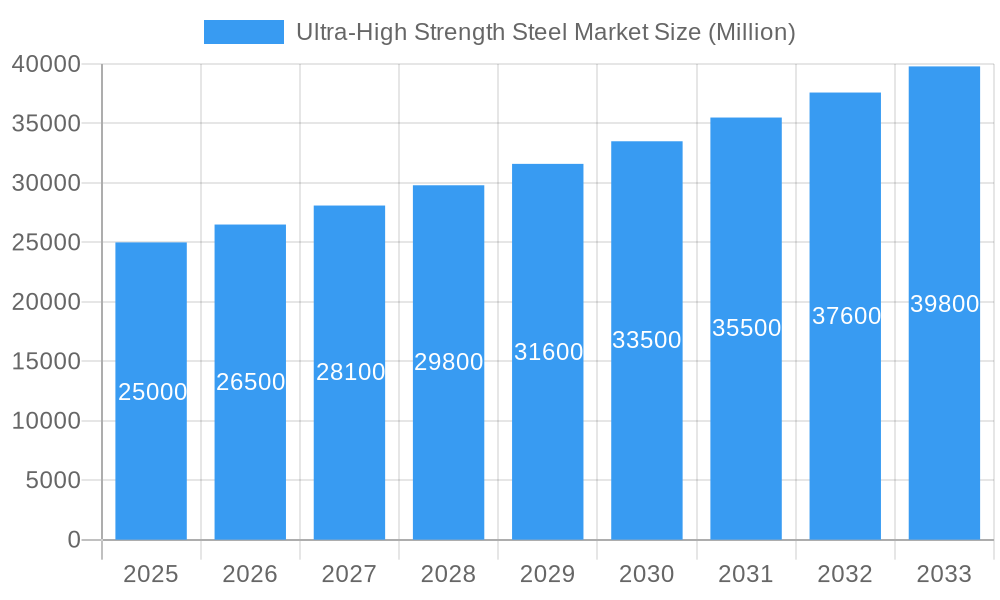

Ultra-High Strength Steel Market Market Size (In Billion)

Technological advancements in steel production are also bolstering the UHSS market, enabling specialized grades such as Dual Phase, Complex Phase, and Martensitic steels, each designed for specific performance needs. Emerging trends include the broader adoption of Advanced High-Strength Steels (AHSS) in mass-produced vehicles and a growing commitment to sustainable manufacturing. Challenges such as higher production and processing costs compared to conventional steels, and the requirement for specialized fabrication techniques, persist. Nevertheless, the continuous drive for enhanced performance, safety, and efficiency across various industrial applications points to a dynamic and growing future for the Ultra-High Strength Steel market.

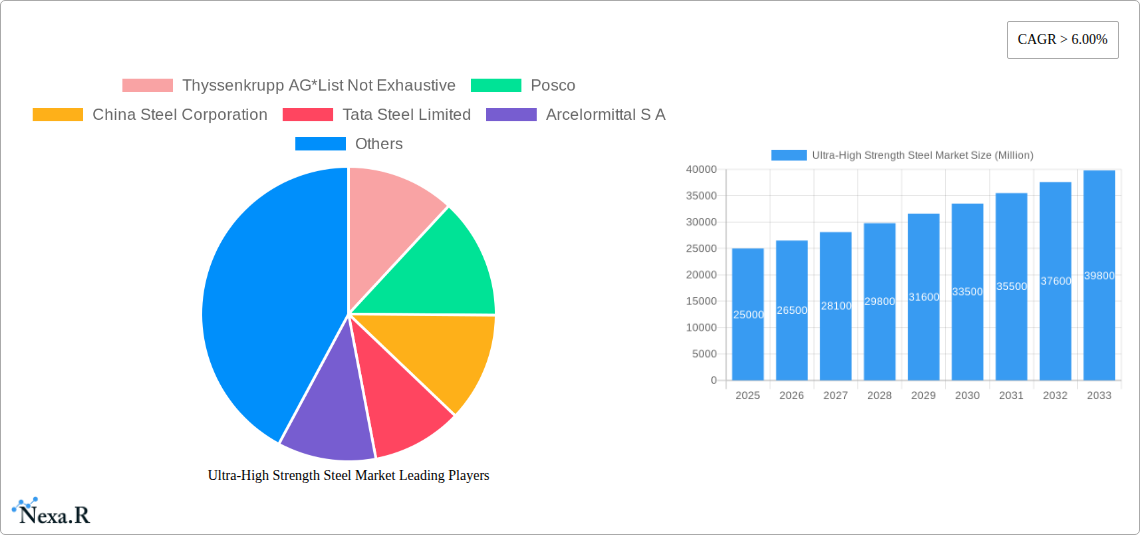

Ultra-High Strength Steel Market Company Market Share

Ultra-High Strength Steel Market Report: Driving Innovation in Automotive, Construction, and Aerospace

This comprehensive Ultra-High Strength Steel (UHSS) market report provides an in-depth analysis of the global market landscape, covering key segments, growth drivers, challenges, and future opportunities. With a study period from 2019 to 2033, the report offers crucial insights for industry stakeholders, including manufacturers, suppliers, investors, and end-users. The analysis leverages extensive data from the base year 2025 and forecasts significant expansion through 2033. Our parent market analysis delves into the broader steel industry, while child market insights pinpoint the specialized dynamics of UHSS. This report is meticulously optimized with high-traffic keywords such as "UHSS market," "advanced high-strength steel," "steel market size," "automotive steel," "construction steel," "aerospace steel," and "steel industry trends" to ensure maximum search engine visibility and engagement with industry professionals.

Ultra-High Strength Steel Market Market Dynamics & Structure

The Ultra-High Strength Steel (UHSS) market is characterized by a moderately concentrated competitive landscape, driven by significant technological innovation and substantial capital investment requirements. Key players are investing heavily in research and development to enhance steel properties, leading to advanced grades that meet increasingly stringent performance demands across various industries. Regulatory frameworks, particularly concerning vehicle safety standards and building codes, act as significant drivers for UHSS adoption. The automotive sector, in particular, is a primary consumer, pushing for lightweighting and improved crashworthiness.

- Market Concentration: Dominated by a few large, integrated steel producers and specialized UHSS manufacturers.

- Technological Innovation Drivers: Focus on developing higher strength-to-weight ratios, improved formability, and enhanced corrosion resistance.

- Regulatory Frameworks: Stringent safety regulations in automotive and building construction necessitate the use of advanced materials like UHSS.

- Competitive Product Substitutes: While UHSS offers superior performance, traditional steels, aluminum alloys, and advanced composites present ongoing competition, particularly in price-sensitive applications.

- End-user Demographics: A growing demand for fuel-efficient vehicles and safer infrastructure fuels UHSS consumption.

- M&A Trends: Strategic acquisitions and joint ventures are observed as companies seek to expand their product portfolios, gain market access, and secure raw material supply chains. For instance, a projected XX merger & acquisition deals in the forecast period are expected to reshape the competitive landscape.

Ultra-High Strength Steel Market Growth Trends & Insights

The global Ultra-High Strength Steel (UHSS) market is poised for robust growth, projected to witness a compound annual growth rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by an escalating demand for lightweight yet high-performance materials across critical sectors, most notably the automotive industry, which is actively pursuing fuel efficiency and enhanced safety standards through vehicle weight reduction. The increasing stringency of global safety regulations, compelling manufacturers to adopt materials that can better withstand impact and provide superior structural integrity, acts as a significant catalyst. Furthermore, advancements in steel manufacturing technologies, including novel alloying techniques and advanced processing methods, are enabling the production of UHSS grades with superior mechanical properties, thereby broadening their application scope.

Consumer behavior is also playing a pivotal role, with a rising preference for vehicles that offer improved environmental performance and advanced safety features, directly translating into higher demand for UHSS. The adoption rate of UHSS in new vehicle platforms is steadily increasing, with manufacturers integrating these advanced steels into chassis, body-in-white components, and structural elements. Beyond automotive, the building and construction sector is witnessing a gradual but significant uptake of UHSS for high-rise buildings, bridges, and seismic-resistant structures, owing to its exceptional load-bearing capacity and durability, contributing to reduced material usage and enhanced structural longevity. The aerospace industry, while a smaller but high-value segment, continues to explore and adopt UHSS for its critical structural components, where the unparalleled strength-to-weight ratio is paramount for optimizing aircraft performance and fuel economy.

Technological disruptions are continuously reshaping the UHSS market. Innovations in metallurgy, such as the development of advanced high-strength steels (AHSS) and ultra-high strength steels (UHSS), are leading to materials that are not only stronger but also more formable and weldable, addressing historical limitations. The integration of digital technologies in manufacturing processes, including AI-driven quality control and advanced simulation tools for material design, is further enhancing the efficiency and precision in UHSS production. Market penetration is expected to deepen as manufacturing costs gradually decrease with scale and technological advancements, making UHSS more accessible for a wider range of applications. The estimated market size for UHSS in 2025 is projected to be around $XX million, with significant upward trajectory anticipated throughout the forecast period. This growth trajectory is indicative of a dynamic market responding effectively to evolving industrial demands and technological frontiers.

Dominant Regions, Countries, or Segments in Ultra-High Strength Steel Market

The Automotive industry stands as the dominant end-user segment driving growth within the global Ultra-High Strength Steel (UHSS) market. This dominance is primarily attributed to the relentless pursuit of lightweighting for enhanced fuel efficiency and compliance with stringent emission regulations worldwide. Manufacturers are increasingly incorporating UHSS grades such as Dual Phase, Complex Phase, and Hot Formed steels into critical structural components, chassis, and body panels to reduce vehicle weight without compromising safety. The market share of UHSS in automotive applications is estimated to be around XX% in 2025, with projections indicating a further increase as electric vehicle (EV) development accelerates, demanding optimized battery enclosure designs and lightweight body structures for extended range.

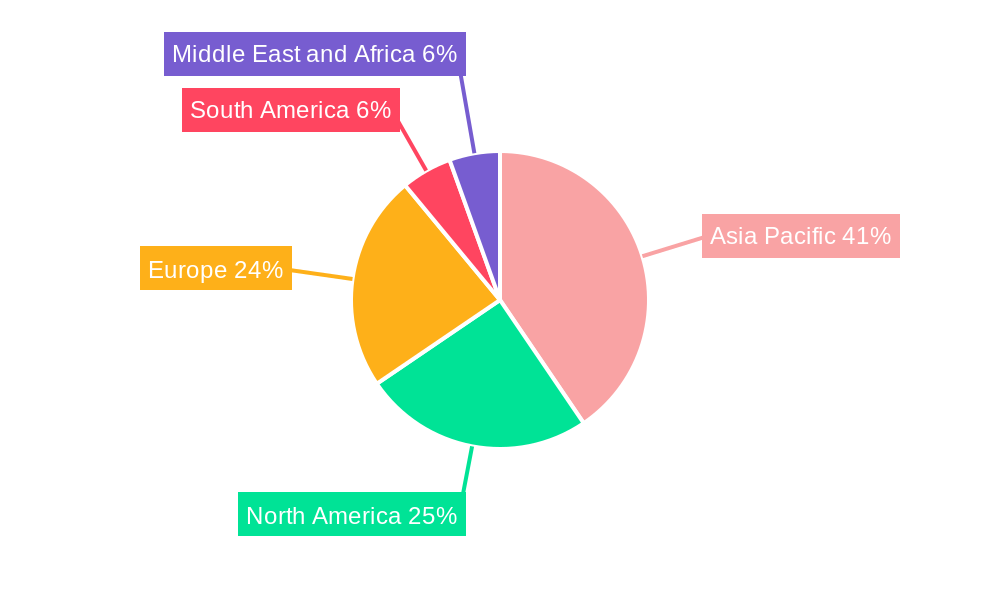

Geographically, Asia-Pacific is emerging as the most dominant region in the UHSS market. This leadership is propelled by the region's robust automotive manufacturing base, particularly in China, Japan, and South Korea, coupled with significant investments in infrastructure development and a growing construction sector. China, as the world's largest automotive producer and consumer, plays a pivotal role in this regional dominance. Government initiatives promoting advanced manufacturing and supportive industrial policies further bolster UHSS adoption. The region's projected market share is expected to reach XX% by 2025, driven by a substantial volume of production and consumption across both automotive and construction sectors.

Within the Type segmentation, Hot Formed steels are gaining considerable traction due to their exceptional formability and strength, making them ideal for complex automotive components like A-pillars, B-pillars, and bumper beams that require intricate shaping and high impact resistance. The market share for Hot Formed UHSS is estimated at XX% in 2025. Martensitic steels also hold a significant position, especially for applications demanding extreme strength and hardness, such as certain safety components and specialized structural parts. The Ferritic-Bainitic and Complex Phase categories are also vital, offering a balance of strength, formability, and cost-effectiveness for a broader range of applications.

The Building and Construction sector, while secondary to automotive, represents a substantial growth opportunity. The increasing demand for high-rise buildings, longer-span bridges, and seismically resilient infrastructure in rapidly urbanizing economies necessitates the use of high-strength materials. UHSS offers superior load-bearing capacity, enabling more slender designs, reduced foundation requirements, and enhanced structural integrity, particularly in earthquake-prone regions. The Aerospace and Defense sector, though smaller in volume, is a high-value market for UHSS, where the critical need for lightweighting and extreme strength for aircraft frames, wings, and defense equipment drives innovation and adoption.

Ultra-High Strength Steel Market Product Landscape

The Ultra-High Strength Steel (UHSS) product landscape is defined by continuous innovation in material science, yielding steels with unparalleled strength-to-weight ratios and enhanced performance characteristics. Key product types include Dual Phase, Complex Phase, Martensitic, Ferritic-Bainitic, and Hot Formed steels, each tailored for specific applications. For instance, Hot Formed steels offer exceptional formability for complex automotive safety components, while Martensitic steels provide extreme hardness for demanding structural integrity. The unique selling propositions of UHSS lie in their ability to enable significant lightweighting, improve crashworthiness in vehicles, and enhance the durability and efficiency of infrastructure, leading to reduced material consumption and a smaller environmental footprint over the product lifecycle. Technological advancements are focused on improving weldability, corrosion resistance, and cost-effectiveness, further broadening the application scope of these advanced steel grades.

Key Drivers, Barriers & Challenges in Ultra-High Strength Steel Market

Key Drivers:

- Automotive Lightweighting: Mandates for fuel efficiency and reduced emissions are driving demand for UHSS in vehicle manufacturing, enhancing safety and performance.

- Infrastructure Development: Global investments in modernizing and expanding infrastructure, particularly in emerging economies, require high-strength materials for durable and resilient structures.

- Technological Advancements: Continuous innovation in steel metallurgy is creating new UHSS grades with improved properties, expanding their application spectrum.

- Safety Regulations: Increasingly stringent safety standards in automotive and construction sectors necessitate the use of advanced, high-strength materials.

Key Barriers & Challenges:

- Manufacturing Costs: The production of UHSS is complex and often more expensive than traditional steels, limiting its adoption in price-sensitive markets. Estimated cost premium is around XX-XX%.

- Forming and Welding Complexity: Achieving optimal formability and weldability in UHSS can be challenging, requiring specialized equipment and expertise.

- Supply Chain Volatility: Fluctuations in raw material prices and availability can impact production costs and lead times, posing supply chain risks.

- Competition from Alternatives: Advanced aluminum alloys and composite materials offer lightweight alternatives, presenting a competitive challenge in certain applications. The market share of aluminum in automotive lightweighting is estimated at XX% in 2025.

Emerging Opportunities in Ultra-High Strength Steel Market

Emerging opportunities in the UHSS market are largely driven by evolving industrial needs and technological advancements. The burgeoning electric vehicle (EV) sector presents a significant avenue for growth, as UHSS can be utilized in battery enclosures, chassis, and lightweight body structures to optimize range and safety. Furthermore, the growing emphasis on sustainable construction practices creates opportunities for UHSS in high-performance buildings and infrastructure projects that require enhanced durability and reduced material usage. Innovative applications in renewable energy infrastructure, such as wind turbine towers and advanced solar panel mounting systems, also offer untapped potential. The development of smart steels with integrated sensing capabilities could further expand the application horizons in critical infrastructure monitoring.

Growth Accelerators in the Ultra-High Strength Steel Market Industry

Several key factors are accelerating the growth of the Ultra-High Strength Steel (UHSS) industry. Foremost among these is the continuous technological innovation in steelmaking processes and material science, leading to the development of even stronger, more formable, and cost-effective UHSS grades. Strategic partnerships between steel manufacturers and end-users, particularly in the automotive sector, are crucial for co-developing bespoke solutions that meet specific performance requirements. Market expansion strategies, including the penetration into new geographical regions and emerging application sectors like renewable energy and advanced defense systems, are also significant growth catalysts. Furthermore, supportive government policies and investments in advanced manufacturing infrastructure are fostering an environment conducive to UHSS adoption and innovation.

Key Players Shaping the Ultra-High Strength Steel Market Market

- Thyssenkrupp AG

- Posco

- China Steel Corporation

- Tata Steel Limited

- Arcelormittal S A

- Baosteel Group

- Nippon Steel & Sumitomo Metal Corporation

- AK Steel Holding Corporation

- Nucor Corporation

- Saab Group

Notable Milestones in Ultra-High Strength Steel Market Sector

- 2019/2020: Increased adoption of advanced high-strength steels (AHSS) in passenger vehicles, driven by stricter fuel economy standards.

- 2021/2022: Launch of new grades of hot-formed UHSS with enhanced crash performance for automotive applications.

- 2023: Significant investment in R&D for new martensitic steel grades offering exceptional strength and impact resistance.

- 2024: Growing interest in UHSS for critical infrastructure projects, including longer-span bridges and high-rise buildings, due to its superior load-bearing capacity.

- 2025 (Est.): Expected increased demand from the electric vehicle (EV) sector for lightweight structural components and battery enclosures.

In-Depth Ultra-High Strength Steel Market Market Outlook

The future outlook for the Ultra-High Strength Steel (UHSS) market is exceptionally promising, driven by persistent global megatrends and continuous technological evolution. Growth accelerators such as advancements in automotive lightweighting, the global push for sustainable infrastructure, and the burgeoning electric vehicle market will continue to fuel demand. Strategic collaborations between material providers and end-users will be instrumental in tailoring UHSS solutions for increasingly complex applications. Emerging opportunities in areas like advanced energy storage and next-generation defense systems further underscore the long-term growth potential. The market is poised for sustained expansion, cementing UHSS's role as a critical material for innovation and progress across diverse industrial sectors.

Ultra-High Strength Steel Market Segmentation

-

1. Type

- 1.1. Dual Phase

- 1.2. Complex Phase

- 1.3. Martensitic

- 1.4. Ferritic-Bainitic

- 1.5. Hot Formed

- 1.6. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Building and Construction

- 2.3. Aerospace and Defense

- 2.4. Other End-user Industries

Ultra-High Strength Steel Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Nordic Countries

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Ultra-High Strength Steel Market Regional Market Share

Geographic Coverage of Ultra-High Strength Steel Market

Ultra-High Strength Steel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Applications for Automobiles; Growing Demand from Construction Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Production; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Automobile Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dual Phase

- 5.1.2. Complex Phase

- 5.1.3. Martensitic

- 5.1.4. Ferritic-Bainitic

- 5.1.5. Hot Formed

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Building and Construction

- 5.2.3. Aerospace and Defense

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dual Phase

- 6.1.2. Complex Phase

- 6.1.3. Martensitic

- 6.1.4. Ferritic-Bainitic

- 6.1.5. Hot Formed

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Building and Construction

- 6.2.3. Aerospace and Defense

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dual Phase

- 7.1.2. Complex Phase

- 7.1.3. Martensitic

- 7.1.4. Ferritic-Bainitic

- 7.1.5. Hot Formed

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Building and Construction

- 7.2.3. Aerospace and Defense

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dual Phase

- 8.1.2. Complex Phase

- 8.1.3. Martensitic

- 8.1.4. Ferritic-Bainitic

- 8.1.5. Hot Formed

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Building and Construction

- 8.2.3. Aerospace and Defense

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dual Phase

- 9.1.2. Complex Phase

- 9.1.3. Martensitic

- 9.1.4. Ferritic-Bainitic

- 9.1.5. Hot Formed

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Building and Construction

- 9.2.3. Aerospace and Defense

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Ultra-High Strength Steel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dual Phase

- 10.1.2. Complex Phase

- 10.1.3. Martensitic

- 10.1.4. Ferritic-Bainitic

- 10.1.5. Hot Formed

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Building and Construction

- 10.2.3. Aerospace and Defense

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thyssenkrupp AG*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Posco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Steel Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tata Steel Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arcelormittal S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baosteel Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Steel & Sumitomo Metal Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AK Steel Holding Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nucor Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saab Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Thyssenkrupp AG*List Not Exhaustive

List of Figures

- Figure 1: Global Ultra-High Strength Steel Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Ultra-High Strength Steel Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Ultra-High Strength Steel Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Ultra-High Strength Steel Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Ultra-High Strength Steel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Ultra-High Strength Steel Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Ultra-High Strength Steel Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Ultra-High Strength Steel Market Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Ultra-High Strength Steel Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Ultra-High Strength Steel Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Ultra-High Strength Steel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Ultra-High Strength Steel Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Ultra-High Strength Steel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Ultra-High Strength Steel Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Ultra-High Strength Steel Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Ultra-High Strength Steel Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Ultra-High Strength Steel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Ultra-High Strength Steel Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Ultra-High Strength Steel Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Ultra-High Strength Steel Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Ultra-High Strength Steel Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Ultra-High Strength Steel Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Ultra-High Strength Steel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Ultra-High Strength Steel Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Ultra-High Strength Steel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Ultra-High Strength Steel Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Ultra-High Strength Steel Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Ultra-High Strength Steel Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Ultra-High Strength Steel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Ultra-High Strength Steel Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Ultra-High Strength Steel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Nordic Countries Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Ultra-High Strength Steel Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Ultra-High Strength Steel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Ultra-High Strength Steel Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-High Strength Steel Market?

The projected CAGR is approximately 7.39%.

2. Which companies are prominent players in the Ultra-High Strength Steel Market?

Key companies in the market include Thyssenkrupp AG*List Not Exhaustive, Posco, China Steel Corporation, Tata Steel Limited, Arcelormittal S A, Baosteel Group, Nippon Steel & Sumitomo Metal Corporation, AK Steel Holding Corporation, Nucor Corporation, Saab Group.

3. What are the main segments of the Ultra-High Strength Steel Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.5 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Applications for Automobiles; Growing Demand from Construction Industry.

6. What are the notable trends driving market growth?

Growing Demand from Automobile Sector.

7. Are there any restraints impacting market growth?

; High Cost of Production; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra-High Strength Steel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra-High Strength Steel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra-High Strength Steel Market?

To stay informed about further developments, trends, and reports in the Ultra-High Strength Steel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence