Key Insights

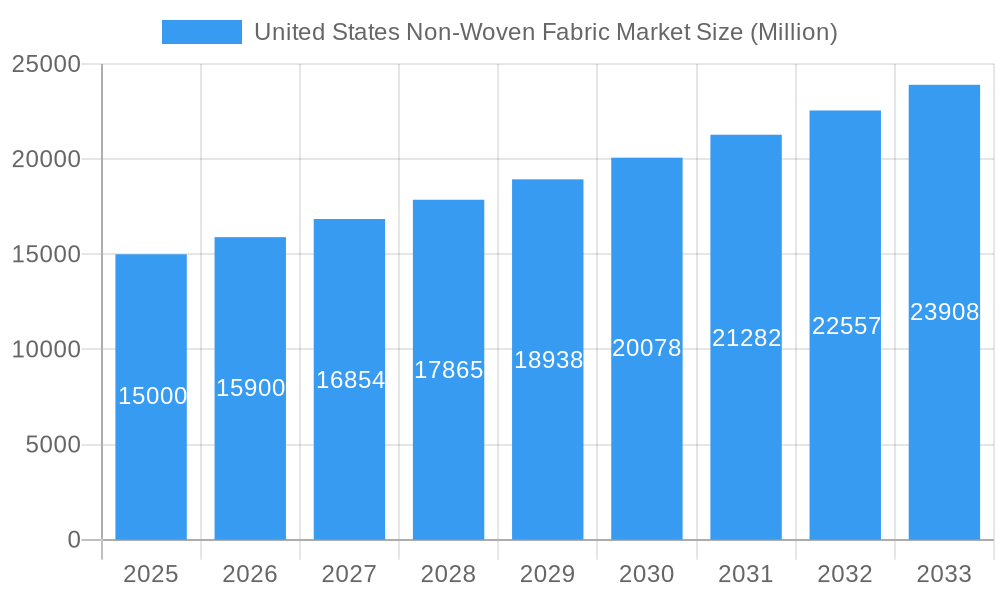

The United States non-woven fabric market is experiencing robust growth, projected to maintain a CAGR exceeding 6% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning construction industry, demanding high-performance insulation and filtration materials, significantly contributes to market demand. Simultaneously, the healthcare sector's reliance on disposable medical garments and hygiene products further boosts consumption. Technological advancements in spunbond, meltblown, and other non-woven production methods are enhancing material properties like strength, breathability, and biodegradability, opening new application avenues across diverse sectors like automotive and textiles. The increasing preference for eco-friendly materials is driving innovation in sustainable non-woven fabrics made from recycled polymers and plant-based sources. However, fluctuations in raw material prices and stringent environmental regulations pose potential challenges to market growth. Regional variations exist within the US market, with the Northeast and West Coast potentially exhibiting higher growth rates due to concentrated industrial activity and population density. Competition among established players like KCWW, Ahlstrom-Munksjö, and 3M is intensifying, prompting investments in R&D and expansion of product portfolios. This dynamic market presents opportunities for companies focusing on specialized applications and sustainable solutions.

United States Non-Woven Fabric Market Market Size (In Billion)

The segmentation analysis reveals a diversified market. Polyester and polypropylene remain dominant materials due to their cost-effectiveness and versatility. However, increasing demand for bio-based and recycled alternatives is anticipated to drive growth in segments like rayon and fluff pulp-based non-wovens. Within the technology segment, spunbond and meltblown non-wovens hold significant market share, catering to diverse applications. The construction sector’s demand for insulation and geotextiles, the healthcare sector's need for hygiene products, and the automotive industry's reliance on filtration media are key end-user drivers. The market’s future trajectory hinges on successfully navigating the balance between cost optimization, sustainability concerns, and technological innovation to satisfy evolving consumer demands and regulatory compliance. Market projections suggest continued growth, particularly in segments catering to environmentally conscious consumers and industries embracing sustainable practices.

United States Non-Woven Fabric Market Company Market Share

United States Non-Woven Fabric Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States non-woven fabric market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of industrial textiles and the child market of non-woven fabrics, this report offers valuable insights for industry professionals, investors, and strategists. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Market values are presented in million units.

United States Non-Woven Fabric Market Dynamics & Structure

The US non-woven fabric market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, driven by demand for sustainable and high-performance materials, is a key driver. Stringent environmental regulations and increasing consumer awareness of sustainability are influencing product development and manufacturing processes. Competitive pressures from substitute materials, like natural fibers, exist, but non-wovens maintain their dominance due to superior performance characteristics in many applications. The market is also shaped by end-user demographics, with significant demand from the healthcare, automotive, and construction sectors. M&A activity has been moderate, with consolidation primarily focused on enhancing production capabilities and expanding product portfolios. Approximately xx% of the market is controlled by the top 5 players. The number of M&A deals in the last 5 years totaled approximately xx.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Driven by demand for sustainable and high-performance materials.

- Regulatory Framework: Stringent environmental regulations are influencing manufacturing processes.

- Competitive Substitutes: Natural fibers pose some competition, but non-wovens maintain dominance.

- End-User Demographics: Significant demand from healthcare, automotive, and construction sectors.

- M&A Trends: Moderate activity, focused on expansion and enhanced production capabilities.

United States Non-Woven Fabric Market Growth Trends & Insights

The United States non-woven fabric market has demonstrated robust growth, historically expanding at a Compound Annual Growth Rate (CAGR) of approximately XX% between 2019 and 2024, achieving a significant market size of XX million units in 2024. This upward trajectory is anticipated to persist, with projections indicating a continued CAGR of XX% throughout the forecast period (2025-2033). Several key drivers are fueling this expansion. Increasing consumer purchasing power, coupled with a heightened demand for hygiene and personal care products, forms a foundational pillar of growth. Furthermore, robust performance in the construction and automotive sectors continues to create substantial demand for non-woven materials. Innovations in advanced manufacturing techniques, particularly in spunbond and meltblown technologies, are instrumental in enhancing product performance and expanding application possibilities. The market is also witnessing a significant increase in the adoption of sophisticated non-woven materials across a widening array of applications. A notable shift in consumer preferences towards environmentally conscious and sustainable products is creating a fertile ground for manufacturers prioritizing biodegradable and recycled non-woven alternatives. It is estimated that the market penetration of sustainable non-woven fabrics will reach an impressive XX% by 2033. The unwavering focus on hygiene and public health globally further bolsters the market, as non-woven fabrics are fundamental components in a vast range of essential products.

Dominant Regions, Countries, or Segments in United States Non-Woven Fabric Market

The Southeast region of the United States exhibits the strongest growth within the non-woven fabric market, driven by factors such as a large manufacturing base and high demand from key end-user industries like automotive and textiles. Within the segments, Spunbond technology dominates, holding approximately xx% of the market share due to its versatility and cost-effectiveness. Similarly, Polypropylene is the leading material, primarily due to its cost-effectiveness and suitability for various applications. The Healthcare end-user industry presents a rapidly growing market segment owing to increased demand for medical and personal protective equipment (PPE).

- Leading Region: Southeast United States (strong manufacturing base & high demand)

- Leading Technology: Spunbond (versatile and cost-effective)

- Leading Material: Polypropylene (cost-effective & versatile)

- Fastest Growing End-User Industry: Healthcare (increased demand for PPE and medical products)

United States Non-Woven Fabric Market Product Landscape

The non-woven fabric market in the United States is characterized by a rich and evolving product portfolio, distinguished by continuous innovation in material composition, advanced manufacturing methodologies, and tailored functional properties. Each product is meticulously engineered to meet the stringent demands of specific applications, offering optimized variations in tensile strength, breathability, absorbency, and hydrophilicity. Recent groundbreaking developments include the creation of spunbond fabrics with persistent hydrophilic properties and an exceptionally soft texture, thereby significantly broadening their utility in high-performance hygiene applications. Manufacturers are consistently striving to elevate performance metrics while simultaneously emphasizing environmental stewardship and minimizing ecological impact. This commitment translates into the development and widespread availability of non-woven fabrics made from biodegradable and recycled materials, catering to the growing demand for sustainable solutions.

Key Drivers, Barriers & Challenges in United States Non-Woven Fabric Market

Key Drivers: Growing demand from key industries (healthcare, automotive, construction), technological advancements (spunbond, meltblown), and increased consumer preference for sustainable products.

Challenges: Fluctuations in raw material prices, intense competition, stringent regulatory compliance, and supply chain disruptions caused by geopolitical events. These disruptions could lead to price increases of up to xx% in specific product lines.

Emerging Opportunities in United States Non-Woven Fabric Market

Emerging opportunities lie in the growing demand for sustainable and biodegradable non-wovens, particularly in applications such as agricultural textiles and filtration systems. Innovative applications in areas like smart textiles and advanced medical devices also hold significant potential. The increasing focus on personalized healthcare and hygiene solutions presents opportunities for customized non-woven products.

Growth Accelerators in the United States Non-Woven Fabric Market Industry

The United States non-woven fabric industry is experiencing accelerated growth driven by a confluence of factors. Pioneering technological advancements in material science and sophisticated manufacturing processes are at the forefront, enabling the creation of high-performance, environmentally responsible materials. Strategic partnerships and collaborative efforts between leading non-woven manufacturers and key end-users are proving invaluable in fostering the development of innovative solutions precisely tailored to meet the unique and evolving requirements of diverse applications. Furthermore, the strategic expansion into new and emerging geographical markets, coupled with the diversification into novel and rapidly growing application sectors, are poised to further propel the industry's growth trajectory.

Key Players Shaping the United States Non-Woven Fabric Market Market

- KCWW

- Glatfelter Corporation

- Lydall Inc

- Ahlstrom-Munksjo

- Freudenberg Performance Materials

- 3M

- Fybon Nonwovens Inc

- Jasztex Inc

- PFNonwovens Holding SRO

- Suominen Corporation

- DuPont

- Johns Manville

- Berry Global Inc

Notable Milestones in United States Non-Woven Fabric Market Sector

- September 2022: Toray Industries, Inc. unveiled a revolutionary spunbond nonwoven fabric engineered for sanitary applications, featuring persistent hydrophilic properties and an exceptionally soft touch.

- June 2022: Berry Global's US-based nonwoven manufacturing facilities achieved ISCC PLUS certification, underscoring their commitment to sustainable sourcing and production practices.

In-Depth United States Non-Woven Fabric Market Market Outlook

The US non-woven fabric market is poised for robust growth, driven by technological advancements, increasing demand from various sectors, and the rising emphasis on sustainability. Strategic partnerships, investments in R&D, and expansion into high-growth markets present significant opportunities for market players. The market's future is bright, with strong potential for innovation and expansion in diverse applications.

United States Non-Woven Fabric Market Segmentation

-

1. Technology

- 1.1. Spunbond

- 1.2. Wet-laid

- 1.3. Dry-laid

- 1.4. Other Technologies

-

2. Material

-

2.1. Polyester

- 2.1.1. Polyester Staple Fiber

- 2.1.2. Polyester Resin (Bottle Grade)

-

2.2. Polypropylene

- 2.2.1. Polypropylene Resin

- 2.2.2. Polypropylene Staple Fiber

- 2.3. Polyethylene

- 2.4. Rayon

- 2.5. Fluff Pulp

- 2.6. Other Materials

-

2.1. Polyester

-

3. End-User Industry

- 3.1. Construction

- 3.2. Textiles

- 3.3. Healthcare

- 3.4. Automotive

- 3.5. Other End-User Industries

United States Non-Woven Fabric Market Segmentation By Geography

- 1. United States

United States Non-Woven Fabric Market Regional Market Share

Geographic Coverage of United States Non-Woven Fabric Market

United States Non-Woven Fabric Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond

- 3.3. Market Restrains

- 3.3.1. Low Durability and Strength of the Fabric; Other Restraints

- 3.4. Market Trends

- 3.4.1. The Healthcare Industry Promotes the Demand for Non-Woven Fabric

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Non-Woven Fabric Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Spunbond

- 5.1.2. Wet-laid

- 5.1.3. Dry-laid

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyester

- 5.2.1.1. Polyester Staple Fiber

- 5.2.1.2. Polyester Resin (Bottle Grade)

- 5.2.2. Polypropylene

- 5.2.2.1. Polypropylene Resin

- 5.2.2.2. Polypropylene Staple Fiber

- 5.2.3. Polyethylene

- 5.2.4. Rayon

- 5.2.5. Fluff Pulp

- 5.2.6. Other Materials

- 5.2.1. Polyester

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Construction

- 5.3.2. Textiles

- 5.3.3. Healthcare

- 5.3.4. Automotive

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KCWW

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glatfelter Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lydall Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ahlstrom-Munksjo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Freudenberg Performance Materials

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3M

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fybon Nonwovens Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jasztex Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PFNonwovens Holding SRO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suominen Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DuPont

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johns Manville

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Berry Global Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KCWW

List of Figures

- Figure 1: United States Non-Woven Fabric Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Non-Woven Fabric Market Share (%) by Company 2025

List of Tables

- Table 1: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: United States Non-Woven Fabric Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: United States Non-Woven Fabric Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Non-Woven Fabric Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Non-Woven Fabric Market?

Key companies in the market include KCWW, Glatfelter Corporation, Lydall Inc, Ahlstrom-Munksjo, Freudenberg Performance Materials, 3M, Fybon Nonwovens Inc, Jasztex Inc, PFNonwovens Holding SRO, Suominen Corporation*List Not Exhaustive, DuPont, Johns Manville, Berry Global Inc.

3. What are the main segments of the United States Non-Woven Fabric Market?

The market segments include Technology, Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond.

6. What are the notable trends driving market growth?

The Healthcare Industry Promotes the Demand for Non-Woven Fabric.

7. Are there any restraints impacting market growth?

Low Durability and Strength of the Fabric; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Toray Industries, Inc. developed a spunbond nonwoven fabric that is both persistently hydrophilic and soft on the skin. This fabric can be used to make disposable diapers, masks, feminine hygiene products, and other sanitary items. When the production technology is fully established, the company intends to begin full-scale production. Polypropylene, which is softer than polyester, is commonly used in spunbond nonwoven materials for sanitary applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Non-Woven Fabric Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Non-Woven Fabric Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Non-Woven Fabric Market?

To stay informed about further developments, trends, and reports in the United States Non-Woven Fabric Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence