Key Insights

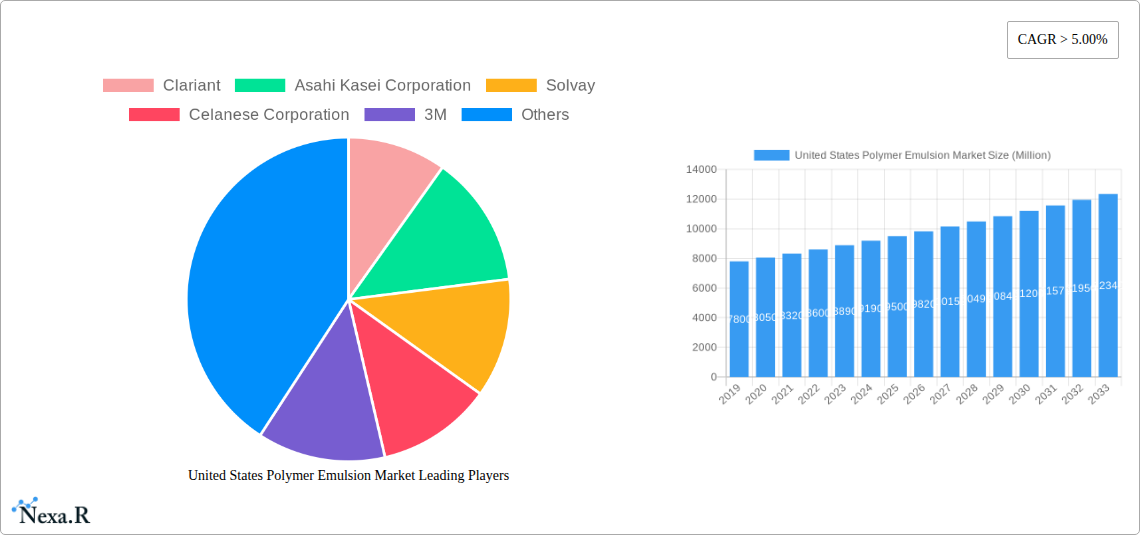

The United States polymer emulsion market is poised for significant growth, projected to exceed $XX million by 2025 and maintain a Compound Annual Growth Rate (CAGR) of over 5.00% through 2033. This robust expansion is primarily fueled by the increasing demand from key application sectors such as adhesives & carpet backing, paper & paperboard coatings, and paints & coatings. The versatility of polymer emulsions, offering properties like enhanced durability, adhesion, and environmental friendliness, makes them indispensable in these industries. Acrylics and polyurethane (PU) dispersions are expected to dominate the product type segment due to their superior performance characteristics and growing adoption in premium applications. The sustained economic activity within the US, coupled with a strong focus on infrastructure development and the production of consumer goods, provides a fertile ground for the continued uptake of polymer emulsions. Innovations in product formulations, leading to more sustainable and high-performance offerings, will further bolster market penetration.

United States Polymer Emulsion Market Market Size (In Billion)

Several factors are expected to drive this upward trajectory. The burgeoning construction industry, propelled by both new residential projects and commercial real estate development, directly translates to increased demand for paints, coatings, and adhesives, all of which heavily rely on polymer emulsions. Furthermore, the packaging sector continues to evolve, with a growing preference for eco-friendly and high-barrier coatings for paper and paperboard, where vinyl acetate and styrene butadiene (SB) latex play crucial roles. While the market enjoys strong drivers, potential restraints such as fluctuating raw material prices, particularly those linked to petrochemical feedstocks, and stringent environmental regulations could present challenges. However, the industry's proactive approach in developing bio-based and low-VOC (Volatile Organic Compound) alternatives is likely to mitigate these concerns and foster continued market expansion. Companies like BASF SE, Dow, and Clariant are at the forefront, investing in research and development to introduce next-generation polymer emulsions that meet evolving market demands.

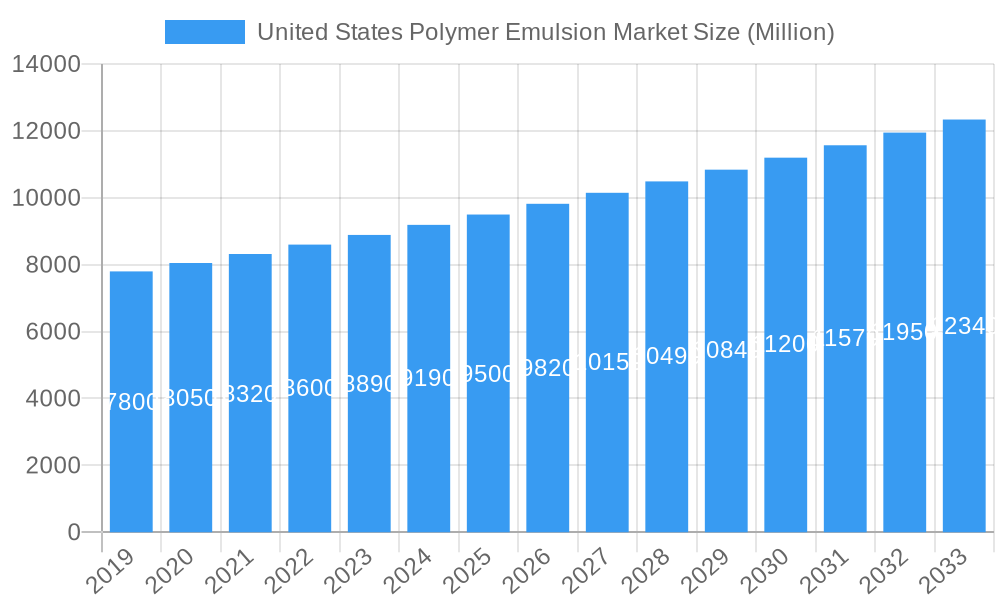

United States Polymer Emulsion Market Company Market Share

This comprehensive report offers an in-depth analysis of the United States Polymer Emulsion Market, a vital sector underpinning numerous industrial and consumer applications. Leveraging cutting-edge market research, we delve into market dynamics, growth trends, competitive landscapes, and emerging opportunities, providing actionable insights for stakeholders. The study encompasses the historical period (2019-2024), base year (2025), estimated year (2025), and an extensive forecast period (2025-2033), projecting a robust Compound Annual Growth Rate (CAGR) of XX%. Values are presented in Million units where applicable.

United States Polymer Emulsion Market Market Dynamics & Structure

The United States Polymer Emulsion Market exhibits a moderately concentrated structure, with key players like BASF SE, Dow, and Celanese Corporation holding significant market shares. Technological innovation is a primary driver, particularly in the development of advanced polymer chemistries for enhanced performance in coatings, adhesives, and textiles. Regulatory frameworks, such as those governing VOC emissions, are shaping product development towards more sustainable and environmentally friendly formulations. While competitive product substitutes exist, such as solvent-based systems, polymer emulsions offer distinct advantages in terms of ease of use, safety, and reduced environmental impact. End-user demographics, including the construction and automotive sectors, are crucial determinants of market demand. Mergers and acquisitions (M&A) remain an active trend, with companies strategically acquiring smaller players or complementary technologies to expand their product portfolios and market reach. For instance, the past five years have seen XX M&A deals, collectively valued at approximately $XXX million, aimed at consolidating market position and fostering innovation. Barriers to innovation include the high cost of R&D for novel emulsion technologies and the lengthy product development cycles required to meet stringent industry standards.

- Market Concentration: Moderately concentrated, with top XX companies accounting for approximately XX% of the market share.

- Technological Innovation Drivers: Development of low-VOC, high-performance, and bio-based polymer emulsions; advancements in particle size control and emulsion stability.

- Regulatory Frameworks: Stringent environmental regulations (e.g., EPA standards) promoting the adoption of water-based polymer emulsions.

- Competitive Product Substitutes: Solvent-based coatings and adhesives, though facing increasing pressure from environmental concerns.

- End-User Demographics: Strong demand from construction (architectural coatings, adhesives), automotive (coatings, sealants), and packaging industries.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand geographical presence.

United States Polymer Emulsion Market Growth Trends & Insights

The United States Polymer Emulsion Market is poised for significant expansion, driven by the increasing demand for sustainable and high-performance materials across diverse applications. The market size is projected to grow from an estimated $XXXX million in 2025 to $XXXX million by 2033, exhibiting a strong CAGR of XX% over the forecast period. This growth trajectory is underpinned by a growing awareness and preference for water-based formulations, which offer a reduced environmental footprint compared to traditional solvent-based alternatives. Technological advancements in emulsion polymerization have led to the development of novel polymer chemistries with enhanced properties, such as improved durability, flexibility, and adhesion, further accelerating adoption rates. Consumer behavior shifts towards eco-friendly products and stringent government regulations mandating lower volatile organic compound (VOC) emissions are pivotal in driving this market transformation. The paints and coatings segment, a major consumer of polymer emulsions, is experiencing robust growth due to increased construction activities and renovation projects, both residential and commercial. Similarly, the adhesives sector, particularly for packaging and label applications, is benefiting from the burgeoning e-commerce industry. The adoption rates of polymer emulsions in niche applications, such as textiles and nonwovens, are also on an upward trend, indicating a broadening market penetration. Disruptions from emerging technologies, while present, are largely focused on enhancing the performance and sustainability of existing polymer emulsion types rather than replacing them entirely. For instance, research into biodegradable polymer emulsions and those derived from renewable resources is gaining traction, signaling a future where sustainability will be paramount. The market penetration of acrylic emulsions, a dominant product type, is already high but continues to grow with new formulations addressing specific performance needs. Polyurethane dispersions (PUDs) are witnessing rapid growth due to their excellent mechanical properties and resistance, finding applications in demanding coatings and adhesives. The overall market evolution is characterized by a steady increase in demand, a continuous drive for innovation, and a clear shift towards environmentally conscious solutions.

Dominant Regions, Countries, or Segments in United States Polymer Emulsion Market

Within the United States Polymer Emulsion Market, the Paints & Coatings segment stands out as the dominant force, consistently driving market growth and volume. This dominance is attributable to several interconnected factors, including the sheer scale of the construction industry, the ubiquitous need for protective and decorative finishes, and the ongoing trend towards sustainable building materials. The United States boasts a highly developed construction sector, encompassing both new builds and extensive renovation and refurbishment projects across residential, commercial, and industrial landscapes. Polymer emulsions, particularly acrylics and vinyl acetates, are indispensable components in architectural paints, industrial coatings, and automotive finishes, providing essential properties like adhesion, durability, water resistance, and aesthetic appeal.

Acrylics as a product type are a significant contributor to the dominance of the Paints & Coatings segment. Their versatility, cost-effectiveness, and ability to be formulated for a wide range of performance characteristics make them the preferred choice for many coating applications. The ability to tailor acrylic emulsions for specific properties such as UV resistance, stain repellency, and low-temperature application further fuels their demand.

Economically, the robust performance of the US economy, coupled with government initiatives focused on infrastructure development and green building standards, directly translates into increased demand for paints and coatings, and consequently, polymer emulsions. The shift away from solvent-borne coatings, driven by stricter environmental regulations and a growing consumer preference for low-VOC products, has further propelled the adoption of water-based polymer emulsions in this segment.

Dominant Segment: Paints & Coatings

- Key Drivers: Extensive construction activity (residential, commercial, industrial), renovation and refurbishment projects, increasing demand for architectural and industrial coatings, growing preference for low-VOC and sustainable coating solutions.

- Market Share: Accounts for approximately XX% of the total United States Polymer Emulsion Market by volume.

- Growth Potential: Continual growth driven by infrastructure spending, stringent environmental regulations, and demand for high-performance, durable coatings.

Dominant Product Type: Acrylics

- Key Drivers: Versatility in formulations for diverse coating and adhesive applications, excellent performance characteristics (durability, adhesion, water resistance), cost-effectiveness, and adaptability to environmental regulations.

- Market Share: Holds an estimated XX% share within the United States Polymer Emulsion Market.

- Growth Potential: Steady growth expected with ongoing innovation in enhanced functionalities and bio-based alternatives.

Dominant Application (within Paints & Coatings): Architectural Coatings

- Key Drivers: Growing housing market, increasing disposable incomes leading to home improvement, demand for aesthetically pleasing and protective interior and exterior paints.

United States Polymer Emulsion Market Product Landscape

The United States Polymer Emulsion Market is characterized by a diverse and evolving product landscape, driven by innovation and specialized application needs. Acrylic emulsions remain the workhorse, offering a broad spectrum of performance characteristics from flexibility to hardness, making them ideal for architectural paints, adhesives, and paper coatings. Polyurethane dispersions (PUDs) are gaining significant traction due to their exceptional durability, abrasion resistance, and chemical resistance, finding applications in high-performance coatings for wood, metal, and textiles. Styrene Butadiene (SB) latex continues to be a key player in carpet backing and paper saturation, offering cost-effectiveness and good binding properties. Vinyl acetate emulsions provide good adhesion and are often blended to enhance performance in paints and adhesives. The continuous development of low-VOC, high-solids, and bio-based polymer emulsions is a testament to the industry's commitment to sustainability.

Key Drivers, Barriers & Challenges in United States Polymer Emulsion Market

Key Drivers:

- Growing Demand for Sustainable Solutions: Increasing environmental regulations and consumer preference for low-VOC, water-based products are major growth accelerators.

- Expansion of End-Use Industries: Robust growth in construction, automotive, packaging, and textile sectors directly fuels demand for polymer emulsions.

- Technological Advancements: Development of high-performance, specialized emulsions with enhanced durability, flexibility, and adhesion properties.

- Infrastructure Development: Government investments in infrastructure projects stimulate demand for paints, coatings, and adhesives.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of petrochemical-based raw materials can impact production costs and profitability.

- Intense Competition: The market is characterized by the presence of numerous global and regional players, leading to price pressures.

- Stringent Regulatory Compliance: Adhering to evolving environmental and safety regulations can require significant investment in R&D and manufacturing processes.

- Supply Chain Disruptions: Global supply chain issues and logistical challenges can affect the availability and cost of raw materials and finished products.

Emerging Opportunities in United States Polymer Emulsion Market

Emerging opportunities within the United States Polymer Emulsion Market lie in the development of novel bio-based and biodegradable polymer emulsions derived from renewable resources, catering to the increasing demand for eco-friendly products. The expansion of the electric vehicle (EV) market presents new avenues for specialized polymer emulsions used in battery components, lightweight materials, and advanced coatings. Furthermore, the growing trend of smart textiles and wearable electronics opens up opportunities for conductive and functional polymer emulsions. Untapped markets in specialized industrial applications requiring high-performance emulsions with unique properties, such as extreme temperature resistance or flame retardancy, also represent significant growth potential.

Growth Accelerators in the United States Polymer Emulsion Market Industry

Several catalysts are accelerating the growth of the United States Polymer Emulsion Market. Technological breakthroughs in emulsion polymerization are enabling the creation of emulsions with superior performance characteristics and reduced environmental impact. Strategic partnerships between raw material suppliers, emulsion manufacturers, and end-users are fostering collaborative innovation and market penetration. Furthermore, the increasing focus on sustainability and circular economy principles is driving the development of recyclable and biodegradable polymer emulsions, creating new market segments. Market expansion strategies, including the development of new applications and entry into underserved geographical regions within the US, are also contributing significantly to overall market growth.

Key Players Shaping the United States Polymer Emulsion Market Market

- Clariant

- Asahi Kasei Corporation

- Solvay

- Celanese Corporation

- 3M

- BASF SE

- Arkema Group

- ALLNEX NETHERLANDS B V

- Akzo Nobel N V

- Dow

- The Lubrizol Corporation

- Eni SpA

- DIC CORPORATION

- Wacker Chemie AG

- Reichhold LLC

Notable Milestones in United States Polymer Emulsion Market Sector

- 2023: BASF SE launches a new line of sustainable acrylic emulsions with enhanced bio-based content, responding to increasing market demand for eco-friendly solutions.

- 2023: Dow announces a strategic partnership to develop advanced polymer emulsions for the growing electric vehicle battery market.

- 2022: Arkema Group expands its polyurethane dispersions (PUDs) capacity to meet the rising demand from the coatings and adhesives industries.

- 2022: Solvay introduces innovative styrene-butadiene latex with improved performance for paper and packaging applications.

- 2021: Celanese Corporation acquires a leading producer of vinyl acetate monomer, strengthening its integrated supply chain for vinyl acetate emulsions.

- 2021: Akzo Nobel N V invests in R&D for low-VOC architectural coatings utilizing advanced polymer emulsion technologies.

- 2020: The Lubrizol Corporation expands its portfolio of specialty polymer emulsions for demanding industrial applications.

- 2019: The US Environmental Protection Agency (EPA) announces stricter regulations on VOC emissions, accelerating the shift towards water-based polymer emulsions.

In-Depth United States Polymer Emulsion Market Market Outlook

The United States Polymer Emulsion Market is set for a dynamic and expansive future, fueled by a confluence of sustainable innovation, expanding industrial applications, and evolving consumer preferences. Growth accelerators such as the continuous development of high-performance, eco-friendly formulations, strategic collaborations among industry leaders, and the increasing adoption of circular economy principles will shape market trajectories. The market's outlook is characterized by a sustained upward trend, with significant opportunities emerging from the demand for specialized emulsions in sectors like electric vehicles and smart textiles. Strategic investments in research and development, coupled with a proactive approach to regulatory landscapes, will be crucial for companies to capitalize on the burgeoning potential and maintain a competitive edge in this vital market.

United States Polymer Emulsion Market Segmentation

-

1. Product Type

- 1.1. Acrylics

- 1.2. Polyurethane (PU) Dispersions

- 1.3. Styrene Butadiene (SB) Latex

- 1.4. Vinyl Acetate

- 1.5. Other Product Types

-

2. Application

- 2.1. Adhesives & Carpet Backing

- 2.2. Paper & Paperboard Coatings

- 2.3. Paints & Coatings

- 2.4. Other Applications

United States Polymer Emulsion Market Segmentation By Geography

- 1. United States

United States Polymer Emulsion Market Regional Market Share

Geographic Coverage of United States Polymer Emulsion Market

United States Polymer Emulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Awareness with Regard to Volatile Organic Compound (VOCs); Rising Construction Industry in the United States

- 3.3. Market Restrains

- 3.3.1. ; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Vinyl Acetate - the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Acrylics

- 5.1.2. Polyurethane (PU) Dispersions

- 5.1.3. Styrene Butadiene (SB) Latex

- 5.1.4. Vinyl Acetate

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Adhesives & Carpet Backing

- 5.2.2. Paper & Paperboard Coatings

- 5.2.3. Paints & Coatings

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clariant

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Asahi Kasei Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solvay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celanese Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3M

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arkema Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALLNEX NETHERLANDS B V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Akzo Nobel N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dow

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Lubrizol Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Eni SpA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DIC CORPORATION

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Wacker Chemie AG*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Reichhold LLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Clariant

List of Figures

- Figure 1: United States Polymer Emulsion Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Polymer Emulsion Market Share (%) by Company 2025

List of Tables

- Table 1: United States Polymer Emulsion Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Polymer Emulsion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Polymer Emulsion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Polymer Emulsion Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: United States Polymer Emulsion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United States Polymer Emulsion Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Polymer Emulsion Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the United States Polymer Emulsion Market?

Key companies in the market include Clariant, Asahi Kasei Corporation, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, ALLNEX NETHERLANDS B V, Akzo Nobel N V, Dow, The Lubrizol Corporation, Eni SpA, DIC CORPORATION, Wacker Chemie AG*List Not Exhaustive, Reichhold LLC.

3. What are the main segments of the United States Polymer Emulsion Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Awareness with Regard to Volatile Organic Compound (VOCs); Rising Construction Industry in the United States.

6. What are the notable trends driving market growth?

Vinyl Acetate - the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Polymer Emulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Polymer Emulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Polymer Emulsion Market?

To stay informed about further developments, trends, and reports in the United States Polymer Emulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence