Key Insights

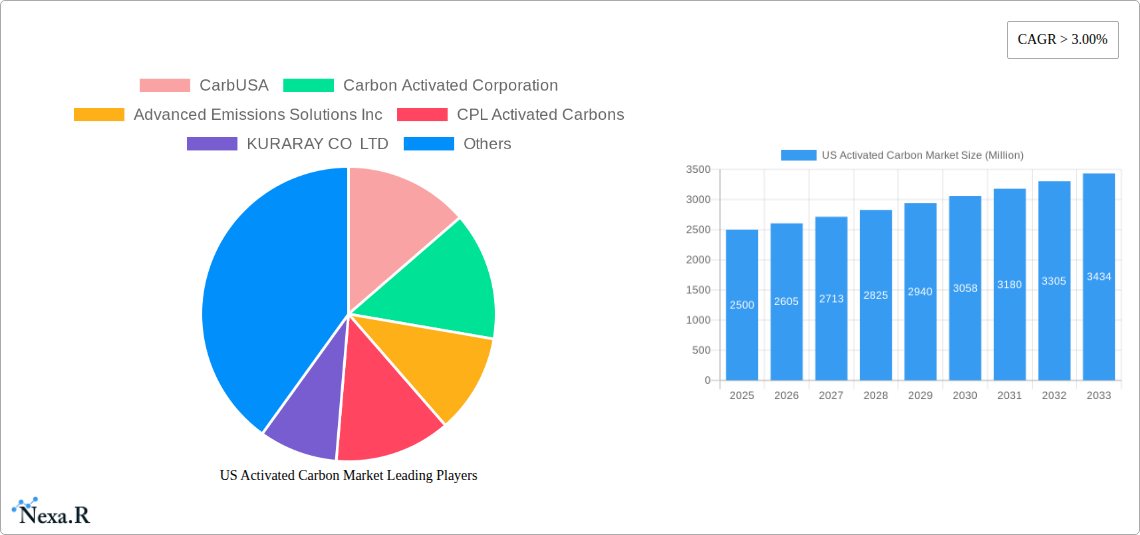

The US Activated Carbon market is poised for substantial growth, projected to expand significantly within the forecast period of 2025-2033. Driven by increasing stringent environmental regulations and a growing emphasis on public health, the demand for activated carbon in water purification and gas purification applications is escalating rapidly. The market’s trajectory is further bolstered by the booming industrial processing sector, where activated carbon plays a crucial role in various manufacturing processes, including metal extraction and chemical purification. Innovations in production technologies and the development of specialized activated carbon grades tailored for specific contaminant removal are also contributing to market expansion. The increasing awareness regarding the health benefits associated with purified air and water, coupled with the food and beverage industry's adoption of activated carbon for decolorization and deodorization, further solidifies its market position. Furthermore, the healthcare sector’s reliance on activated carbon for medical applications, such as detoxification, presents a consistent demand stream.

US Activated Carbon Market Market Size (In Billion)

The market's growth will likely be characterized by a steady CAGR exceeding 3.00%, indicating a robust and sustained expansion. While the broad adoption across diverse applications provides a strong foundation, the market also faces certain restraints. These include the fluctuating raw material costs, particularly for coal and wood, which are primary feedstocks for activated carbon production. Additionally, the energy-intensive nature of the manufacturing process and the logistical challenges associated with the disposal and regeneration of spent activated carbon could pose hurdles. Despite these challenges, the continued technological advancements, coupled with the unwavering need for efficient purification solutions, are expected to drive the US activated carbon market towards a promising future. Key players are actively investing in research and development to enhance product efficacy and explore sustainable production methods, ensuring the market's long-term viability and growth.

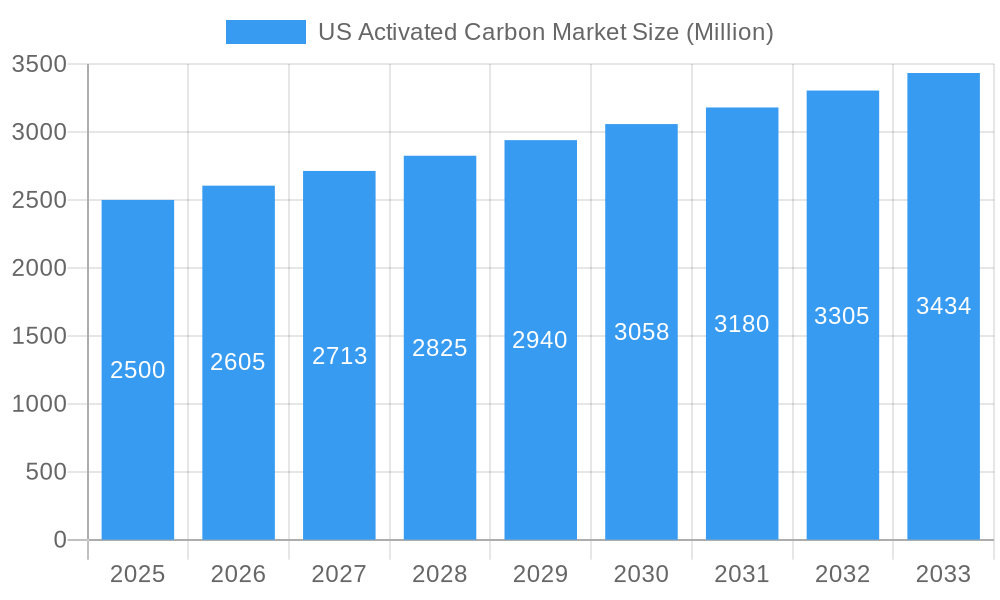

US Activated Carbon Market Company Market Share

US Activated Carbon Market Report: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a strategic analysis of the US Activated Carbon Market, offering unparalleled insights into its current state, growth trajectory, and future potential. We meticulously examine market dynamics, key drivers, emerging trends, and competitive landscapes, empowering industry stakeholders to make informed decisions. Our analysis spans the historical period of 2019-2024, with a base year of 2025 and a comprehensive forecast extending to 2033. The US Activated Carbon Market is projected to reach XX Million units by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

US Activated Carbon Market Market Dynamics & Structure

The US Activated Carbon Market is characterized by a moderately concentrated structure, with a few key players holding significant market share, particularly in specialized applications. Technological innovation remains a primary driver, with continuous advancements in production methods, surface modification, and pore structure control enhancing activated carbon’s adsorption capabilities. Regulatory frameworks, particularly those concerning environmental protection and water quality standards, play a crucial role in shaping market demand, especially for applications in gas and water purification. The presence of competitive product substitutes, such as zeolites and ion-exchange resins, necessitates ongoing innovation and cost-efficiency from activated carbon manufacturers. End-user demographics are shifting towards industries with stricter environmental compliance and higher purity requirements. Merger and acquisition (M&A) trends are notable, with larger players acquiring smaller, innovative companies to expand their product portfolios and geographical reach. For instance, in 20XX, XX M&A deals were recorded, indicating a consolidation drive within the market.

- Market Concentration: Dominated by a few leading manufacturers, with increasing M&A activity.

- Technological Innovation: Focus on enhanced adsorption capacity, regeneration efficiency, and novel material development.

- Regulatory Influence: Stringent environmental regulations for air and water quality are key demand drivers.

- Competitive Landscape: Intense competition from activated carbon variants and alternative adsorption technologies.

- End-User Sophistication: Growing demand for customized solutions for specific purification needs.

- M&A Activity: Strategic acquisitions to gain market share, technology, and customer base.

US Activated Carbon Market Growth Trends & Insights

The US Activated Carbon Market has demonstrated consistent growth driven by escalating environmental concerns and an increasing demand for purified substances across various sectors. The market size evolution is a testament to the growing adoption of activated carbon in applications beyond traditional purification, such as in the food and beverage industry for decolorization and in the healthcare sector for pharmaceutical purification. Technological disruptions have led to the development of highly engineered activated carbons with tailored pore structures and surface chemistries, significantly improving their efficiency and broadening their application scope. For example, the development of nanoporous activated carbons has opened new avenues in high-performance gas separation and catalysis. Consumer behavior shifts are also influencing the market, with a growing preference for sustainably sourced and produced materials, prompting manufacturers to explore eco-friendly raw materials and production processes. The penetration of activated carbon in industrial wastewater treatment is expected to reach XX% by 2025, up from XX% in 2019. The CAGR for the overall market is projected to be XX% from 2025 to 2033, fueled by these dynamic trends.

The expansion of water treatment infrastructure, driven by government initiatives and increasing public awareness regarding water scarcity and quality, is a primary growth catalyst. In the gas purification segment, the demand for activated carbon is surging due to stricter air emission standards for industrial facilities, including power plants and chemical manufacturing units. The automotive industry’s focus on reducing vehicle emissions also presents a significant opportunity for activated carbon in canister systems and cabin air filters. Furthermore, the burgeoning pharmaceutical industry's requirement for high-purity excipients and active pharmaceutical ingredients (APIs) is driving the demand for pharmaceutical-grade activated carbons. The adoption of activated carbon in food and beverage processing for removing impurities, colors, and odors is also on an upward trajectory, contributing to market expansion. The market is witnessing a surge in demand for regenerated activated carbon as sustainability becomes a paramount concern, leading to a circular economy approach. The estimated market size for US Activated Carbon by the end of the forecast period is XX Million units.

Dominant Regions, Countries, or Segments in US Activated Carbon Market

The Water Treatment end-user industry stands as a dominant force within the US Activated Carbon Market. This segment's ascendancy is underpinned by a confluence of factors, including stringent federal and state regulations mandating high water quality standards, increasing population density, aging water infrastructure, and a growing public consciousness about waterborne contaminants. The demand for both municipal and industrial water purification solutions is substantial and continuously expanding.

- Water Treatment Dominance: The increasing need for potable water, wastewater treatment, and industrial process water purification is a primary driver.

- Market Share: Water Treatment accounts for an estimated XX% of the total US Activated Carbon Market by application.

- Regulatory Push: EPA regulations (e.g., Safe Drinking Water Act) are critical in driving demand.

- Infrastructure Investment: Significant government and private investment in upgrading and expanding water treatment facilities.

- Contaminant Concerns: Growing awareness and detection of emerging contaminants like PFAS, pharmaceuticals, and microplastics.

Within Product Type, Granular Activated Carbon (GAC) holds a prominent position. Its larger particle size makes it easier to handle and regenerate, making it a cost-effective and efficient choice for large-scale water and gas purification systems. The ease of use and established infrastructure for GAC systems contribute to its widespread adoption.

- Granular Activated Carbon (GAC) Leadership:

- Ease of Handling & Regeneration: Preferred for large-scale industrial and municipal applications.

- Cost-Effectiveness: Often more economical for continuous filtration processes.

- Versatile Applications: Widely used in adsorption beds for water and air purification.

- Infrastructure Compatibility: Integrates seamlessly into existing filtration systems.

In terms of Application, Water Purification naturally aligns with the dominant end-user industry. This encompasses a broad spectrum, from municipal drinking water treatment plants to industrial wastewater management and specialized applications like groundwater remediation. The sheer volume and critical necessity of clean water ensure a robust and sustained demand for activated carbon.

- Water Purification Application:

- Municipal Drinking Water: Removal of chlorine, disinfection byproducts, taste, and odor.

- Industrial Wastewater: Treatment of chemical effluent, heavy metals, and organic pollutants.

- Groundwater Remediation: Cleaning contaminated aquifers.

- Desalination Pre-treatment: Enhancing the efficiency of desalination processes.

Key drivers for this dominance include supportive economic policies aimed at environmental protection, substantial infrastructure development projects focused on water management, and evolving consumer preferences for safe and clean water. The market share for GAC in water purification applications is estimated to be XX%.

US Activated Carbon Market Product Landscape

The US Activated Carbon Market showcases a dynamic product landscape driven by continuous innovation and diverse application needs. Powdered Activated Carbon (PAC), with its high surface area and rapid adsorption kinetics, is gaining traction in batch processes and applications requiring quick contaminant removal, such as in the food and beverage industry for decolorization and in potable water treatment for taste and odor control. Granular Activated Carbon (GAC) remains a workhorse, favored for its ease of handling and regeneration in large-scale water and gas purification systems. Innovations in GAC include improved pore size distribution and surface functionalization for enhanced selectivity. Extruded or Pelletized Activated Carbon offers superior mechanical strength and attrition resistance, making it ideal for demanding industrial applications like gas phase catalytic converters and solvent recovery, where durability and consistent performance are paramount. The development of impregnated activated carbons further expands their capabilities, enabling targeted removal of specific pollutants like mercury or ammonia.

Key Drivers, Barriers & Challenges in US Activated Carbon Market

The US Activated Carbon Market is propelled by several key drivers. Stringent environmental regulations, particularly concerning air and water quality, are a major impetus for demand. Growing awareness of health and safety, coupled with the need for higher purity in industries like food, beverage, and pharmaceuticals, also fuels market growth. Technological advancements leading to more efficient and specialized activated carbons are expanding application possibilities. The increasing focus on sustainability and circular economy principles is driving demand for regenerated activated carbon.

- Key Drivers:

- Environmental Regulations (Clean Air Act, Clean Water Act)

- Demand for High-Purity Products (Food & Beverage, Healthcare)

- Technological Innovations (Engineered Carbons, Impregnated Carbons)

- Sustainability Initiatives & Regeneration of Carbon

- Growth in Industrial Processes and Emissions Control

However, the market faces several barriers and challenges. High initial investment costs for advanced production facilities can be a restraint. The fluctuating prices of raw materials like coal and coconut shells can impact profitability. The availability of competitive substitutes such as zeolites and ion-exchange resins poses a constant challenge. Furthermore, disposal and regeneration complexities for spent activated carbon can be an operational hurdle for some end-users.

- Barriers & Challenges:

- Raw Material Price Volatility

- Competition from Substitute Adsorbents

- Complexity of Spent Carbon Disposal and Regeneration

- Need for Customized Solutions for Niche Applications

- Energy Consumption in Production Processes

Emerging Opportunities in US Activated Carbon Market

Emerging opportunities in the US Activated Carbon Market are significant and varied. The increasing focus on indoor air quality presents a substantial opportunity for activated carbon in HVAC systems, air purifiers, and personal protective equipment. The burgeoning field of carbon capture and utilization (CCU), aimed at mitigating greenhouse gas emissions, is a high-potential area for advanced activated carbon materials. Furthermore, the growing demand for sustainable and bio-based activated carbons derived from agricultural waste offers a niche but expanding market segment. The application of activated carbon in battery technology and supercapacitors for energy storage is also an area of active research and development, promising future growth.

- Emerging Opportunities:

- Indoor Air Purification Solutions

- Carbon Capture and Utilization (CCU) Technologies

- Bio-based and Sustainable Activated Carbon

- Energy Storage Applications (Batteries, Supercapacitors)

- Advanced Filtration for Emerging Contaminants (PFAS, Microplastics)

Growth Accelerators in the US Activated Carbon Market Industry

Several catalysts are accelerating the long-term growth of the US Activated Carbon Market. Continued advancements in material science and nanotechnology are enabling the development of activated carbons with unprecedented adsorption capacities and selectivity, opening up new high-value applications. Strategic partnerships and collaborations between activated carbon manufacturers and end-users are crucial for co-developing tailored solutions that meet specific industry needs. Government incentives and funding for environmental protection and sustainable technology development further boost market expansion. The increasing global demand for clean water and air, coupled with a growing emphasis on industrial efficiency, will continue to drive the need for effective purification solutions.

- Growth Accelerators:

- Breakthroughs in Material Science and Nanotechnology

- Strategic Partnerships and Co-development with End-Users

- Government Initiatives and Funding for Environmental Technologies

- Increasing Global Demand for Purification Solutions

- Focus on Circular Economy and Sustainable Manufacturing Practices

Key Players Shaping the US Activated Carbon Market Market

- CarbUSA

- Carbon Activated Corporation

- Advanced Emissions Solutions Inc

- CPL Activated Carbons

- KURARAY CO LTD

- JACOBI CARBONS GROUP

- Evoqua Water Technologies LLC

- Cabot Corporation

- Prominent Systems Inc

- Calgon Carbon Corporation

- Ingevity

- KUREHA CORPORATION

- Veolia

- Donau Chemie AG

- Albemarle Corporation

- PURAGEN ACTIVATED CARBONS

Notable Milestones in US Activated Carbon Market Sector

- 20XX: Launch of a new generation of highly porous activated carbon for enhanced mercury removal in power plants.

- 20XX: Acquisition of a leading bio-char producer by a major activated carbon manufacturer, strengthening its sustainable product offerings.

- 20XX: Development of a novel regeneration process for spent activated carbon, significantly reducing energy consumption and environmental impact.

- 20XX: Introduction of advanced activated carbon filters for the removal of Per- and Polyfluoroalkyl Substances (PFAS) in drinking water, addressing critical public health concerns.

- 20XX: Significant investment in R&D for activated carbon in battery applications, signaling a move towards energy storage solutions.

In-Depth US Activated Carbon Market Market Outlook

The US Activated Carbon Market is poised for sustained growth, driven by an unwavering demand for purification solutions across critical sectors. The market's outlook is exceptionally strong due to the synergistic effect of escalating environmental regulations and continuous technological innovation. Growth accelerators like advancements in material science, the pursuit of sustainable practices, and strategic collaborations will further fortify its trajectory. Emerging opportunities in areas such as indoor air quality and carbon capture present significant untapped potential, promising to diversify and expand the market's reach. The inherent versatility and proven efficacy of activated carbon ensure its indispensable role in addressing environmental challenges and meeting the increasing purity demands of a sophisticated industrial landscape. The overall market is projected to continue its robust expansion, presenting lucrative avenues for stakeholders.

US Activated Carbon Market Segmentation

-

1. Product Type

- 1.1. Powdered Activated Carbon

- 1.2. Granular Activated Carbon

- 1.3. Extruded or Pelletized Activated Carbon

-

2. Application

- 2.1. Gas Purification

- 2.2. Water Purification

- 2.3. Metal Extraction

- 2.4. Medicine

- 2.5. Other Applications

-

3. End-user Industry

- 3.1. Water Treatment

- 3.2. Food & Beverage

- 3.3. Healthcare

- 3.4. Automotive

- 3.5. Industrial Processing

- 3.6. Other End-user Industries

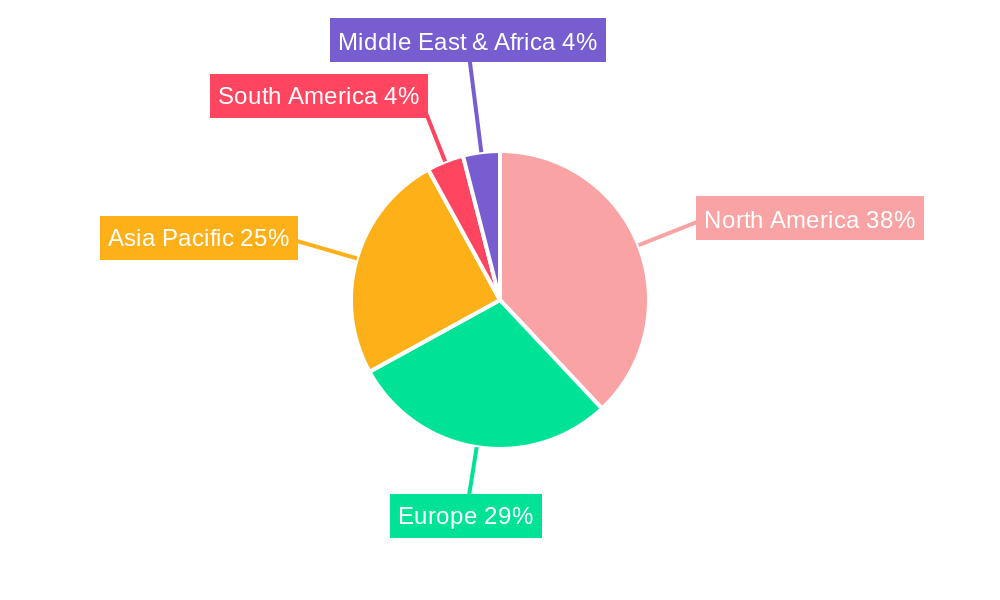

US Activated Carbon Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Activated Carbon Market Regional Market Share

Geographic Coverage of US Activated Carbon Market

US Activated Carbon Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Conformance to Stringent Environmental Regulations In Water Treatment Applications; Augmenting Prominence for Air Pollution Control (Especially Mercury Removal)

- 3.3. Market Restrains

- 3.3.1. ; Narrower Markets Due to Increased Costs of Some Grades of Activated Carbon; Threat of Substitutes Like Silica Gel and Supersand

- 3.4. Market Trends

- 3.4.1. Emerging Applications in the Medical and Pharmaceutical Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Powdered Activated Carbon

- 5.1.2. Granular Activated Carbon

- 5.1.3. Extruded or Pelletized Activated Carbon

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gas Purification

- 5.2.2. Water Purification

- 5.2.3. Metal Extraction

- 5.2.4. Medicine

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Water Treatment

- 5.3.2. Food & Beverage

- 5.3.3. Healthcare

- 5.3.4. Automotive

- 5.3.5. Industrial Processing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Powdered Activated Carbon

- 6.1.2. Granular Activated Carbon

- 6.1.3. Extruded or Pelletized Activated Carbon

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gas Purification

- 6.2.2. Water Purification

- 6.2.3. Metal Extraction

- 6.2.4. Medicine

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Water Treatment

- 6.3.2. Food & Beverage

- 6.3.3. Healthcare

- 6.3.4. Automotive

- 6.3.5. Industrial Processing

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Powdered Activated Carbon

- 7.1.2. Granular Activated Carbon

- 7.1.3. Extruded or Pelletized Activated Carbon

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gas Purification

- 7.2.2. Water Purification

- 7.2.3. Metal Extraction

- 7.2.4. Medicine

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Water Treatment

- 7.3.2. Food & Beverage

- 7.3.3. Healthcare

- 7.3.4. Automotive

- 7.3.5. Industrial Processing

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Powdered Activated Carbon

- 8.1.2. Granular Activated Carbon

- 8.1.3. Extruded or Pelletized Activated Carbon

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gas Purification

- 8.2.2. Water Purification

- 8.2.3. Metal Extraction

- 8.2.4. Medicine

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Water Treatment

- 8.3.2. Food & Beverage

- 8.3.3. Healthcare

- 8.3.4. Automotive

- 8.3.5. Industrial Processing

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Powdered Activated Carbon

- 9.1.2. Granular Activated Carbon

- 9.1.3. Extruded or Pelletized Activated Carbon

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gas Purification

- 9.2.2. Water Purification

- 9.2.3. Metal Extraction

- 9.2.4. Medicine

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Water Treatment

- 9.3.2. Food & Beverage

- 9.3.3. Healthcare

- 9.3.4. Automotive

- 9.3.5. Industrial Processing

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Activated Carbon Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Powdered Activated Carbon

- 10.1.2. Granular Activated Carbon

- 10.1.3. Extruded or Pelletized Activated Carbon

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gas Purification

- 10.2.2. Water Purification

- 10.2.3. Metal Extraction

- 10.2.4. Medicine

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Water Treatment

- 10.3.2. Food & Beverage

- 10.3.3. Healthcare

- 10.3.4. Automotive

- 10.3.5. Industrial Processing

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CarbUSA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carbon Activated Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advanced Emissions Solutions Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CPL Activated Carbons

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KURARAY CO LTD

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JACOBI CARBONS GROUP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evoqua Water Technologies LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cabot Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prominent Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Calgon Carbon Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ingevity

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KUREHA CORPORATION

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Veolia*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Donau Chemie AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Albemarle Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 PURAGEN ACTIVATED CARBONS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 CarbUSA

List of Figures

- Figure 1: Global US Activated Carbon Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Activated Carbon Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America US Activated Carbon Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America US Activated Carbon Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Activated Carbon Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Activated Carbon Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America US Activated Carbon Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America US Activated Carbon Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Activated Carbon Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Activated Carbon Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America US Activated Carbon Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America US Activated Carbon Market Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Activated Carbon Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Activated Carbon Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America US Activated Carbon Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America US Activated Carbon Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Activated Carbon Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Activated Carbon Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe US Activated Carbon Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe US Activated Carbon Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Activated Carbon Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Activated Carbon Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe US Activated Carbon Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe US Activated Carbon Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Activated Carbon Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Activated Carbon Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa US Activated Carbon Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa US Activated Carbon Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Activated Carbon Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Activated Carbon Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa US Activated Carbon Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa US Activated Carbon Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Activated Carbon Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Activated Carbon Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific US Activated Carbon Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific US Activated Carbon Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Activated Carbon Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Activated Carbon Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific US Activated Carbon Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific US Activated Carbon Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Activated Carbon Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global US Activated Carbon Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global US Activated Carbon Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global US Activated Carbon Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global US Activated Carbon Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global US Activated Carbon Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Activated Carbon Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global US Activated Carbon Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Activated Carbon Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global US Activated Carbon Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Activated Carbon Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Activated Carbon Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the US Activated Carbon Market?

Key companies in the market include CarbUSA, Carbon Activated Corporation, Advanced Emissions Solutions Inc, CPL Activated Carbons, KURARAY CO LTD, JACOBI CARBONS GROUP, Evoqua Water Technologies LLC, Cabot Corporation, Prominent Systems Inc, Calgon Carbon Corporation, Ingevity, KUREHA CORPORATION, Veolia*List Not Exhaustive, Donau Chemie AG, Albemarle Corporation, PURAGEN ACTIVATED CARBONS.

3. What are the main segments of the US Activated Carbon Market?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Conformance to Stringent Environmental Regulations In Water Treatment Applications; Augmenting Prominence for Air Pollution Control (Especially Mercury Removal).

6. What are the notable trends driving market growth?

Emerging Applications in the Medical and Pharmaceutical Sector.

7. Are there any restraints impacting market growth?

; Narrower Markets Due to Increased Costs of Some Grades of Activated Carbon; Threat of Substitutes Like Silica Gel and Supersand.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Activated Carbon Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Activated Carbon Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Activated Carbon Market?

To stay informed about further developments, trends, and reports in the US Activated Carbon Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence