Key Insights

The wood-based modal fiber market is projected for significant expansion, fueled by robust demand from the apparel and textile sectors, alongside a growing preference for sustainable and eco-friendly materials. The market is anticipated to achieve a compound annual growth rate (CAGR) of 7%, with a projected market size of $1162 million by 2025. Key growth drivers include modal fiber's superior softness, drape, and moisture-wicking properties compared to conventional cotton, making it ideal for premium apparel. Growing environmental consciousness and the adoption of sustainable manufacturing processes further boost demand for this renewable fiber. Emerging applications in healthcare and personal care, utilizing its softness and hypoallergenic qualities, also contribute to market growth. While viscose remains the dominant segment, lyocell and modal are gaining traction due to enhanced production and sustainability. Asia Pacific leads the market, driven by textile manufacturing hubs, while North America and Europe represent established markets for high-quality, sustainable textiles. Major players include Lenzing and Asahi Kasei Corporation. Challenges include raw material price volatility and competition from synthetic fibers, yet the market outlook remains positive due to sustained apparel industry growth and increasing consumer demand for eco-conscious options.

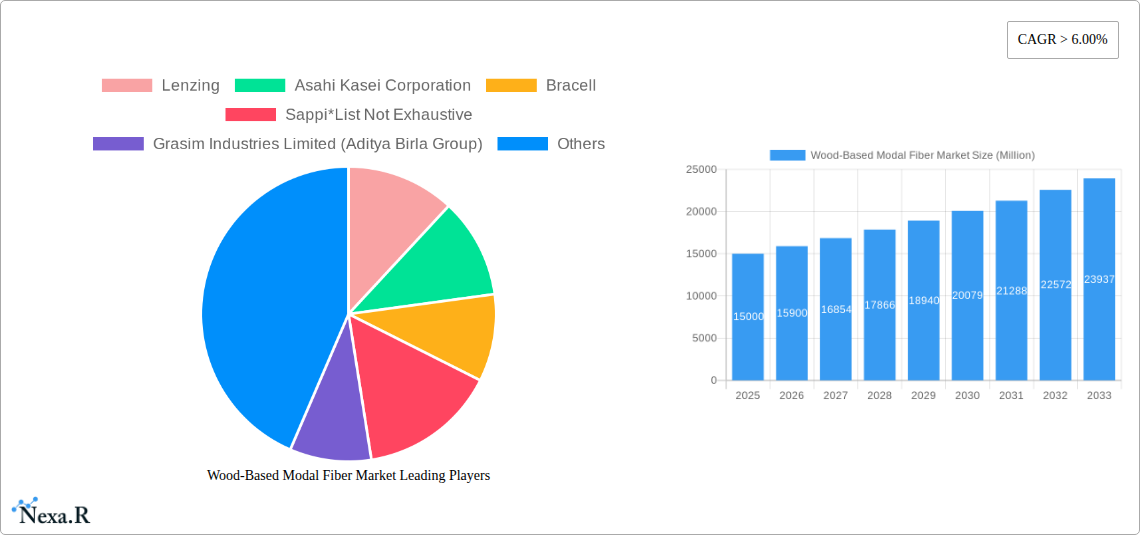

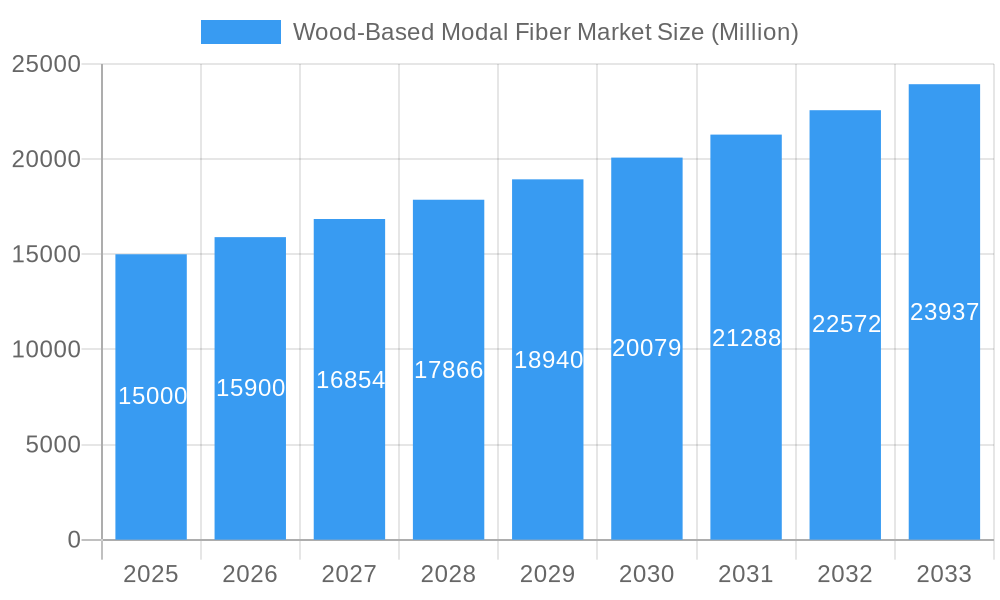

Wood-Based Modal Fiber Market Market Size (In Billion)

Future market expansion will be propelled by technological advancements in modal fiber production, enhancing efficiency and sustainability. Innovations in fiber modification, improving durability and wrinkle resistance, will drive broader adoption. Supply chain transparency and traceability are becoming increasingly critical, with brands prioritizing ethically sourced, sustainable modal fiber. This trend necessitates investment in sustainable practices and certifications. Opportunities for growth lie in new applications, such as advanced hygiene products and automotive interiors. Developing economies in Asia and South America are expected to witness faster growth rates than mature markets. Strategic partnerships between fiber producers and textile manufacturers will foster innovation and market expansion. Efficient supply chain management and the exploration of alternative sustainable raw material sources are crucial for navigating raw material price fluctuations.

Wood-Based Modal Fiber Market Company Market Share

Wood-Based Modal Fiber Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Wood-Based Modal Fiber market, encompassing its parent market (Cellulosic Fibers) and child markets (Apparel & Textile, Healthcare, Automotive). The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. Market size is presented in Million units.

Value Proposition: This report offers a detailed analysis of market dynamics, growth trends, regional dominance, product landscape, key drivers and barriers, emerging opportunities, and key players, enabling informed strategic planning and investment decisions.

Wood-Based Modal Fiber Market Market Dynamics & Structure

The global Wood-Based Modal Fiber market is characterized by a moderately concentrated yet dynamic structure. While established global leaders such as Lenzing, Asahi Kasei Corporation, Bracell, Sappi, Grasim Industries Limited (Aditya Birla Group), Aoyang Technology, Sandong Yamei, and Rayonier Advanced Materials command a significant market share, the landscape also fosters the growth of innovative smaller regional players. This balance creates a competitive environment where technological advancement is paramount.

Key growth drivers include relentless technological innovation, particularly in optimizing fiber production processes for enhanced sustainability and improved fiber properties like superior softness, enhanced drape, and increased durability. The increasing global emphasis on environmental stewardship and circular economy principles is a significant market shaper. Stringent environmental regulations worldwide are not only pushing manufacturers towards sustainable sourcing of wood pulp and eco-friendly production methods but also creating a distinct advantage for companies that have already integrated these practices into their core operations.

However, the market faces ongoing challenges from competitive product substitutes, including established synthetic fibers like polyester, which often offer lower price points and a wide range of functional properties. Despite these challenges, the sector is witnessing a strategic increase in mergers and acquisitions (M&A) activity. This trend is fueled by companies seeking to expand their geographical reach, diversify their product portfolios, and achieve economies of scale in production and research and development.

- Market Concentration: Moderately concentrated, with top players collectively holding an estimated xx% market share by 2025. This indicates a stable yet competitive market.

- Technological Innovation: A continuous focus on improving intrinsic fiber properties (e.g., unparalleled softness, exceptional drape, increased strength), optimizing production efficiency to reduce costs, and further enhancing the sustainability profile of modal fibers through closed-loop systems and bio-based chemical inputs.

- Regulatory Framework: The market is increasingly influenced by stringent environmental regulations, encompassing sustainable forestry practices, responsible water management in production, and chemical usage, driving a shift towards certified and traceable raw material sourcing.

- Competitive Substitutes: While polyester and other conventional synthetic fibers remain significant competitors, the unique natural feel and eco-credentials of modal fibers are carving out distinct market niches.

- End-User Demographics: A substantial and growing demand segment comprises fashion-conscious consumers who prioritize both aesthetics and ethical production, alongside environmentally conscious brands actively seeking sustainable material solutions to align with their corporate social responsibility goals.

- M&A Trends: Approximately xx strategic M&A deals have been observed within the past five years, underscoring a clear trend towards market consolidation, strategic partnerships, and expansion into new product categories or geographical markets. Innovation barriers remain considerable, stemming from high R&D expenditure required for novel production techniques and the inherent complexity in scaling up sustainable manufacturing processes while maintaining cost-competitiveness.

Wood-Based Modal Fiber Market Growth Trends & Insights

The Wood-Based Modal Fiber market experienced a CAGR of xx% during the historical period (2019-2024), driven by increasing consumer demand for sustainable and high-performance textiles. The market is projected to maintain robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising adoption rates across diverse applications, including apparel and textile, healthcare, and automotive. Technological advancements, particularly in improved fiber production techniques and functional enhancements, are contributing to higher adoption. Consumer preference shifts towards eco-friendly and sustainable products are also acting as a significant growth catalyst. Market penetration in developing economies is expected to accelerate in the coming years.

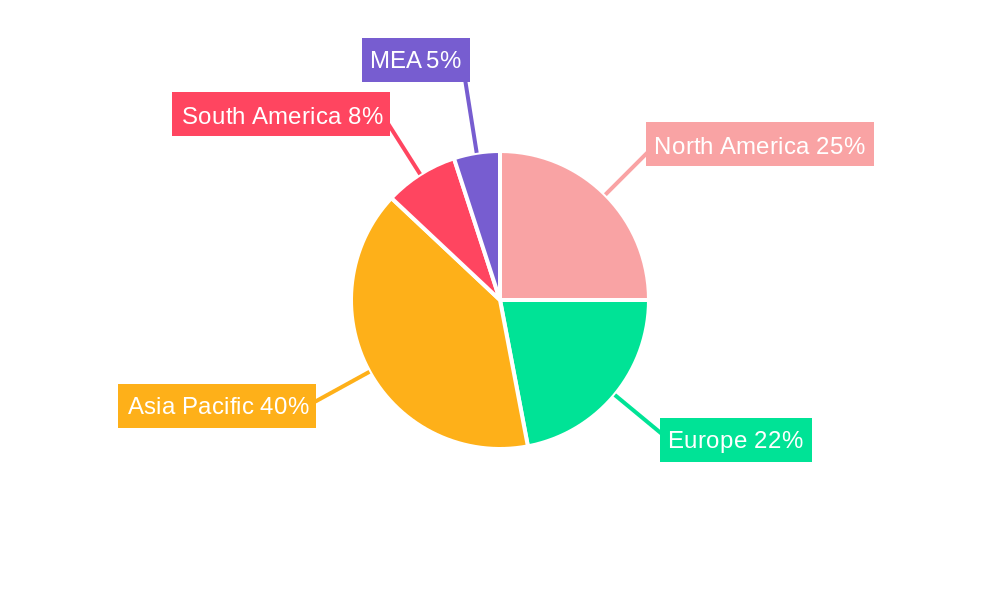

Dominant Regions, Countries, or Segments in Wood-Based Modal Fiber Market

The Asia-Pacific region currently dominates the Wood-Based Modal Fiber market, driven by robust growth in the apparel and textile industries, along with favorable government policies promoting sustainable manufacturing. China and India are key contributors within this region. Within the segments, Apparel & Textile accounts for the largest market share, followed by Healthcare (including Personal Care). Modal fiber holds the largest market share among the fiber types.

Asia-Pacific: High demand from the apparel and textile sector, coupled with economic growth.

Europe: Growing focus on sustainability and eco-friendly materials.

North America: Increasing adoption in the healthcare and automotive sectors.

Apparel & Textile: High demand from fast fashion and high-end brands.

Healthcare: Use in hygiene products and medical textiles.

Automotive: Application in interior components and seat covers.

Modal: Dominates due to superior softness, drape, and moisture absorption.

Viscose: Large-scale production and cost-effectiveness.

Lyocell: Growing demand driven by its eco-friendly production.

Wood-Based Modal Fiber Market Product Landscape

The Wood-Based Modal Fiber market showcases a variety of products with diverse properties and applications. Innovations focus on enhanced softness, drape, and moisture management capabilities. The industry is witnessing the introduction of functionalized modal fibers with added features like antimicrobial properties or enhanced durability. These advancements cater to the growing demand for high-performance and specialized textiles across various sectors. Unique selling propositions include superior comfort, eco-friendly production, and tailored functionalities for specific applications.

Key Drivers, Barriers & Challenges in Wood-Based Modal Fiber Market

Key Drivers: Growing demand for sustainable and comfortable textiles; increasing disposable incomes in developing economies; technological advancements improving fiber quality and production efficiency. Government incentives for sustainable manufacturing also play a role.

Key Challenges: Fluctuations in raw material prices (wood pulp); competition from synthetic fibers; stringent environmental regulations demanding high compliance costs; supply chain disruptions impacting production and delivery. The intensity of these challenges varies across regions, with some emerging markets facing more significant hurdles in regulatory compliance.

Emerging Opportunities in Wood-Based Modal Fiber Market

The Wood-Based Modal Fiber market is ripe with burgeoning opportunities, particularly in underserved or developing geographical regions that represent significant untapped growth potential. Beyond traditional textile applications, innovative uses in high-performance sectors such as advanced medical textiles (e.g., wound dressings, surgical gowns), specialized hygiene products (e.g., biodegradable wipes), and the development of lightweight, sustainable composites for various industries are presenting exciting new avenues for market expansion.

Furthermore, the persistent evolution of consumer preferences, with a pronounced shift towards sustainable sourcing, ethical manufacturing, and high-performance apparel that doesn't compromise on comfort or style, is acting as a powerful catalyst for innovation. This growing demand for eco-conscious and premium textile solutions is directly driving both product development and broader market expansion for wood-based modal fibers.

Growth Accelerators in the Wood-Based Modal Fiber Market Industry

Technological breakthroughs in fiber production, increasing strategic partnerships between fiber producers and textile manufacturers, and market expansion strategies targeting emerging economies are key growth catalysts. Focus on sustainable production methods will continue to propel growth.

Key Players Shaping the Wood-Based Modal Fiber Market Market

- Lenzing: A pioneer and global leader, known for its innovative TENCEL™ Modal fibers.

- Asahi Kasei Corporation: A key player with a strong focus on advanced materials and sustainable solutions.

- Bracell: A significant producer of dissolving pulp, a key raw material for modal fiber production.

- Sappi: A global leader in dissolving wood pulp and specialty cellulose, crucial for modal fiber manufacturing.

- Grasim Industries Limited (Aditya Birla Group): A diversified conglomerate with a strong presence in the textile and pulp sector.

- Aoyang Technology: A notable Chinese manufacturer contributing to the global modal fiber supply.

- Sandong Yamei: Another significant player in the Chinese modal fiber production landscape.

- Rayonier Advanced Materials: A leading producer of high-purity cellulose, a precursor for various regenerated fibers.

Notable Milestones in Wood-Based Modal Fiber Market Sector

- 2022: Lenzing launched a new generation of TENCEL™ Modal fibers, setting new benchmarks for sustainability and performance through innovative production processes and material enhancements.

- 2021: Asahi Kasei Corporation made significant strategic investments to expand its modal fiber production capacity, signaling a commitment to meeting growing global demand and enhancing its market position.

- 2020: A significant merger between two smaller, regional modal fiber producers was successfully executed, demonstrating a trend towards industry consolidation and the creation of more robust market entities (specific details often remain proprietary, hence represented by 'xx').

- Ongoing: Continuous research and development across the industry are leading to advancements in closed-loop production systems, reducing water and chemical usage, and exploring new wood sources for enhanced sustainability.

In-Depth Wood-Based Modal Fiber Market Market Outlook

The Wood-Based Modal Fiber market is strategically positioned for robust and sustained growth in the coming years. This positive outlook is primarily underpinned by a confluence of two powerful trends: the escalating global demand for eco-friendly and bio-based materials, and the continuous advancements in material science and production technologies that are enhancing the performance and appeal of modal fibers.

Companies that strategically focus on optimizing sustainable production methods, investing in groundbreaking innovation to further refine fiber properties, and actively pursuing expansion into underserved or emerging markets are poised to capitalize on significant growth opportunities. The market landscape offers considerable potential for both established global players looking to solidify their leadership and agile new entrants keen on disrupting the market with differentiated offerings, a strong commitment to sustainability, and innovative business models.

Wood-Based Modal Fiber Market Segmentation

-

1. Type

- 1.1. Viscose

- 1.2. Modal

- 1.3. Lyocell

- 1.4. Cupro

- 1.5. Other Types

-

2. Application

- 2.1. Apparel & Textile

- 2.2. Healthcare (Including Personal Care)

- 2.3. Automotive & Transportation

- 2.4. Other Applications

Wood-Based Modal Fiber Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Wood-Based Modal Fiber Market Regional Market Share

Geographic Coverage of Wood-Based Modal Fiber Market

Wood-Based Modal Fiber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Usage from Textile Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1 ; Availability of Substitutes like Synthetic Fibers

- 3.3.2 Cotton

- 3.3.3 and Wool; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Textile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wood-Based Modal Fiber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Viscose

- 5.1.2. Modal

- 5.1.3. Lyocell

- 5.1.4. Cupro

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Apparel & Textile

- 5.2.2. Healthcare (Including Personal Care)

- 5.2.3. Automotive & Transportation

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Wood-Based Modal Fiber Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Viscose

- 6.1.2. Modal

- 6.1.3. Lyocell

- 6.1.4. Cupro

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Apparel & Textile

- 6.2.2. Healthcare (Including Personal Care)

- 6.2.3. Automotive & Transportation

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Wood-Based Modal Fiber Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Viscose

- 7.1.2. Modal

- 7.1.3. Lyocell

- 7.1.4. Cupro

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Apparel & Textile

- 7.2.2. Healthcare (Including Personal Care)

- 7.2.3. Automotive & Transportation

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Wood-Based Modal Fiber Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Viscose

- 8.1.2. Modal

- 8.1.3. Lyocell

- 8.1.4. Cupro

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Apparel & Textile

- 8.2.2. Healthcare (Including Personal Care)

- 8.2.3. Automotive & Transportation

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Wood-Based Modal Fiber Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Viscose

- 9.1.2. Modal

- 9.1.3. Lyocell

- 9.1.4. Cupro

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Apparel & Textile

- 9.2.2. Healthcare (Including Personal Care)

- 9.2.3. Automotive & Transportation

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lenzing

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Asahi Kasei Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bracell

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sappi*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Grasim Industries Limited (Aditya Birla Group)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aoyang Technology

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sandong Yamei

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rayonier Advanced Materials

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Lenzing

List of Figures

- Figure 1: Global Wood-Based Modal Fiber Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Wood-Based Modal Fiber Market Revenue (million), by Type 2025 & 2033

- Figure 3: Asia Pacific Wood-Based Modal Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Wood-Based Modal Fiber Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Wood-Based Modal Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Wood-Based Modal Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Wood-Based Modal Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Wood-Based Modal Fiber Market Revenue (million), by Type 2025 & 2033

- Figure 9: North America Wood-Based Modal Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Wood-Based Modal Fiber Market Revenue (million), by Application 2025 & 2033

- Figure 11: North America Wood-Based Modal Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Wood-Based Modal Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Wood-Based Modal Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Wood-Based Modal Fiber Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Wood-Based Modal Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Wood-Based Modal Fiber Market Revenue (million), by Application 2025 & 2033

- Figure 17: Europe Wood-Based Modal Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Wood-Based Modal Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Wood-Based Modal Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Wood-Based Modal Fiber Market Revenue (million), by Type 2025 & 2033

- Figure 21: Rest of the World Wood-Based Modal Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Wood-Based Modal Fiber Market Revenue (million), by Application 2025 & 2033

- Figure 23: Rest of the World Wood-Based Modal Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Wood-Based Modal Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 25: Rest of the World Wood-Based Modal Fiber Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Type 2020 & 2033

- Table 19: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: France Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Italy Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Type 2020 & 2033

- Table 27: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Wood-Based Modal Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: South America Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Wood-Based Modal Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wood-Based Modal Fiber Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Wood-Based Modal Fiber Market?

Key companies in the market include Lenzing, Asahi Kasei Corporation, Bracell, Sappi*List Not Exhaustive, Grasim Industries Limited (Aditya Birla Group), Aoyang Technology, Sandong Yamei, Rayonier Advanced Materials.

3. What are the main segments of the Wood-Based Modal Fiber Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1162 million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Usage from Textile Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from Textile Industry.

7. Are there any restraints impacting market growth?

; Availability of Substitutes like Synthetic Fibers. Cotton. and Wool; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wood-Based Modal Fiber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wood-Based Modal Fiber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wood-Based Modal Fiber Market?

To stay informed about further developments, trends, and reports in the Wood-Based Modal Fiber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence