Key Insights

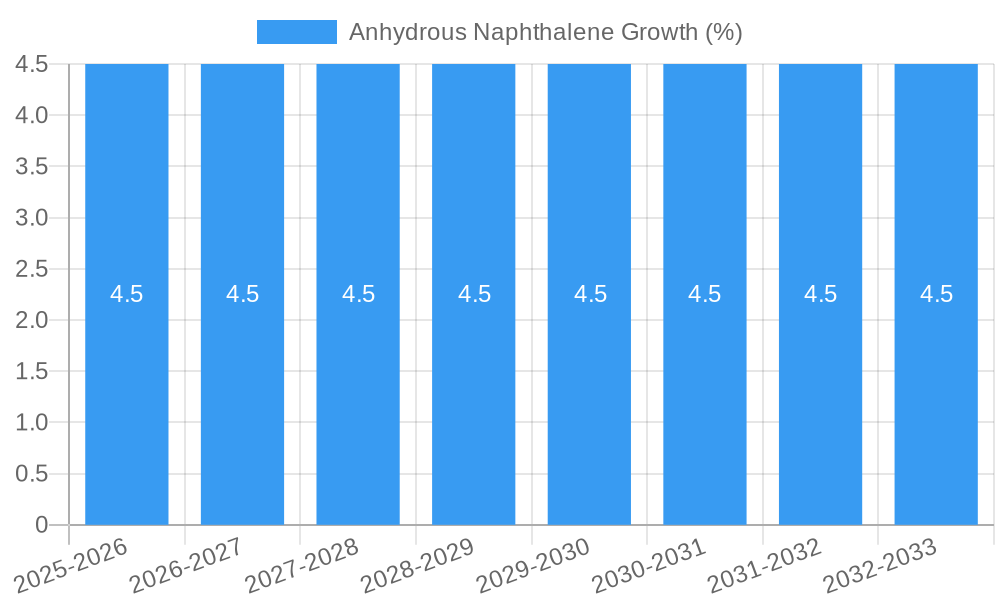

The global Anhydrous Naphthalene market is poised for robust growth, projected to reach a significant valuation by 2033, driven by a consistent Compound Annual Growth Rate (CAGR) of 4.5%. This expansion is primarily fueled by the increasing demand from critical end-use industries, most notably the Chemical Industry, where anhydrous naphthalene serves as a vital intermediate for the production of phthalic anhydride, a key component in plasticizers, resins, and dyes. The Semiconductor Industry also presents a substantial growth avenue, with anhydrous naphthalene finding applications in etching and cleaning processes. Furthermore, its use in the Pharmaceutical Industry as a precursor for various medicinal compounds contributes to its market ascent. The market’s trajectory is further bolstered by the growing adoption of higher purity grades, such as Electronic Grade, catering to the stringent requirements of advanced technological applications.

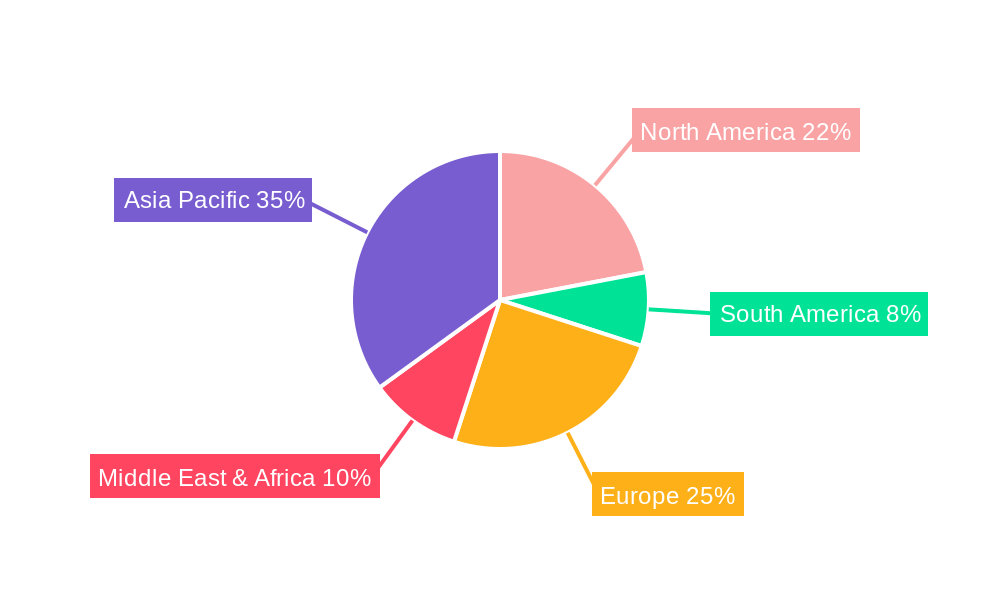

The market's expansion is supported by several key drivers, including ongoing technological advancements that enhance production efficiency and purity of anhydrous naphthalene, alongside increasing industrialization and urbanization in developing economies, particularly in the Asia Pacific region. Emerging trends like the development of sustainable production methods and the exploration of new applications are also shaping the market landscape. However, certain factors could temper this growth. Fluctuations in raw material prices, particularly crude oil derivatives, and stringent environmental regulations concerning naphthalene production and handling may pose challenges. Additionally, the availability of substitutes in some niche applications could influence market dynamics. Despite these restraints, the overall outlook for the Anhydrous Naphthalene market remains positive, with significant opportunities for innovation and expansion across its diverse application segments and types.

Anhydrous Naphthalene Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Anhydrous Naphthalene market, offering unparalleled insights into its dynamics, growth trajectory, and future potential. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period from 2025-2033, this study leverages advanced analytical tools and extensive primary and secondary research. We explore parent and child market interdependencies, providing a holistic view of the industry. This report is crucial for stakeholders seeking to understand market concentration, technological innovation, regulatory landscapes, competitive forces, and emerging opportunities within the Anhydrous Naphthalene sector.

Anhydrous Naphthalene Market Dynamics & Structure

The Anhydrous Naphthalene market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Technological innovation is primarily driven by the increasing demand for high-purity Anhydrous Naphthalene in specialized applications, particularly within the semiconductor and pharmaceutical industries. Regulatory frameworks, while generally supportive of industrial growth, are increasingly focusing on environmental sustainability and the safe handling of chemical compounds, which can influence production processes and costs. Competitive product substitutes are limited for Anhydrous Naphthalene's specific applications, but advancements in alternative synthesis methods or materials for certain downstream products could pose indirect competition.

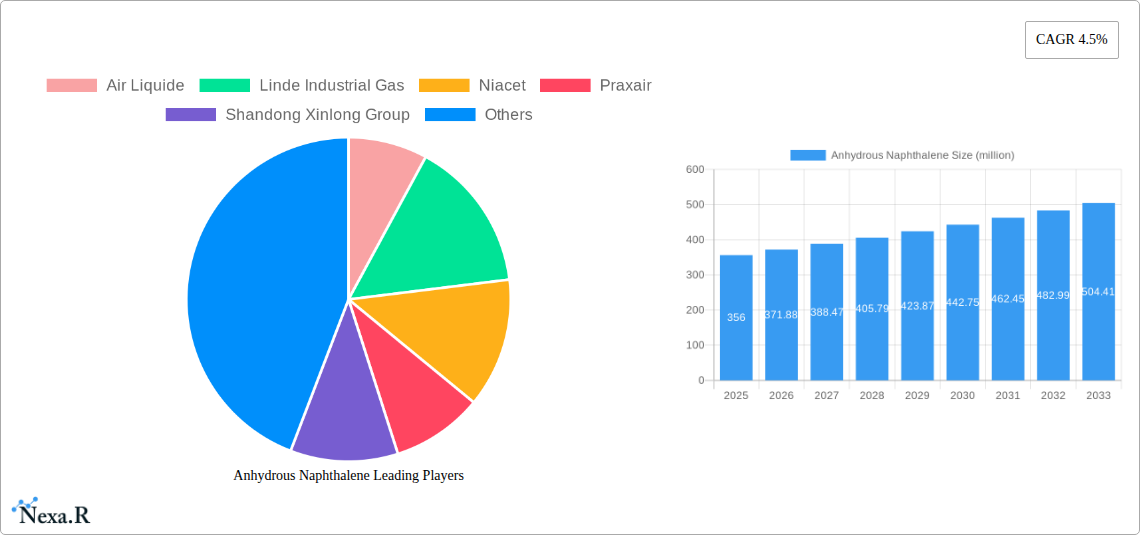

- Market Concentration: Dominated by a mix of large chemical conglomerates and specialized gas manufacturers.

- Technological Innovation: Focus on purification techniques, energy-efficient production, and novel application development.

- Regulatory Frameworks: Stringent quality control, environmental compliance (e.g., emissions standards), and safety regulations.

- Competitive Product Substitutes: Limited direct substitutes for core applications, but innovation in downstream industries can impact demand.

- End-User Demographics: Primarily B2B, with key end-users in the chemical, semiconductor, and pharmaceutical sectors.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding product portfolios, market reach, and technological capabilities. For instance, a significant M&A activity in 2023 saw a major industrial gas provider acquire a specialized chemical producer, consolidating their position in high-purity gas markets.

Anhydrous Naphthalene Growth Trends & Insights

The global Anhydrous Naphthalene market is projected for substantial growth, driven by the expanding applications in high-growth sectors. The market size is expected to evolve from an estimated $XXX million in the base year 2025 to $XXX million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X%. This growth is fueled by increasing adoption rates of Anhydrous Naphthalene in advanced manufacturing processes and a continuous demand for high-purity chemicals. Technological disruptions are playing a pivotal role, with advancements in synthesis and purification methods enabling the production of electronic-grade Anhydrous Naphthalene with exceptional purity levels, critical for the fabrication of semiconductors and advanced electronic components.

Consumer behavior shifts, particularly within the end-user industries, are also influencing market dynamics. The semiconductor industry's insatiable demand for materials enabling miniaturization and enhanced performance directly translates into a higher requirement for precision chemicals like Anhydrous Naphthalene. Similarly, the pharmaceutical sector's quest for more efficient drug synthesis and formulation processes is boosting the demand for Anhydrous Naphthalene as a key intermediate. The overall market penetration of Anhydrous Naphthalene is on an upward trajectory, reflecting its indispensable role in these critical industries. Emerging economies are also contributing significantly to this growth, as their industrial bases expand and their adoption of advanced technologies accelerates. The increasing focus on sustainable manufacturing practices will also drive innovation in Anhydrous Naphthalene production and application, further solidifying its market position.

Dominant Regions, Countries, or Segments in Anhydrous Naphthalene

The Chemical Industry segment, accounting for an estimated XX.X% of the global Anhydrous Naphthalene market in 2025, stands as the dominant force driving market growth. This dominance is attributed to Anhydrous Naphthalene's extensive use as a versatile intermediate in the synthesis of a wide array of chemicals, including dyes, pigments, plasticizers, and agrochemicals. The robust growth of the global chemical manufacturing sector, particularly in emerging economies, directly fuels the demand for Anhydrous Naphthalene. Furthermore, the pharmaceutical industry, a significant child market, is experiencing sustained growth, driven by an aging global population, increasing healthcare expenditure, and the development of novel therapeutics. Anhydrous Naphthalene plays a crucial role as a precursor and reagent in the synthesis of various active pharmaceutical ingredients (APIs) and fine chemicals.

The Semiconductor Industry is another pivotal segment, characterized by its rapid technological advancements and the ever-increasing demand for high-purity materials. The production of advanced microchips and electronic components necessitates ultra-pure chemicals like Electronic Grade Anhydrous Naphthalene, driving its adoption. Countries with strong semiconductor manufacturing bases, such as the United States, Taiwan, South Korea, and China, are key demand centers for this grade. Economic policies that promote domestic manufacturing and R&D in the electronics sector further bolster this demand. Infrastructure development in these regions, facilitating efficient logistics and supply chains for specialty chemicals, also contributes to the dominance of these segments.

- Key Drivers in the Chemical Industry:

- Growth in downstream chemical manufacturing (dyes, pigments, agrochemicals).

- Demand for plasticizers and resins.

- Industrialization and economic development in emerging markets.

- Key Drivers in the Pharmaceutical Industry:

- Development of new drugs and APIs.

- Increasing healthcare expenditure globally.

- Demand for fine chemicals in drug synthesis.

- Key Drivers in the Semiconductor Industry:

- Miniaturization and increasing complexity of microchips.

- Demand for high-purity chemicals in fabrication processes.

- Growth of the global electronics market.

Anhydrous Naphthalene Product Landscape

The Anhydrous Naphthalene product landscape is defined by continuous innovation aimed at enhancing purity and tailoring properties for specific high-tech applications. Beyond its traditional use as a chemical intermediate, advancements have led to the development of Electronic Grade Anhydrous Naphthalene, boasting purity levels exceeding 99.99%, crucial for the semiconductor industry's stringent requirements in photolithography and etching processes. Technical Grade Anhydrous Naphthalene continues to serve the broader chemical industry, with manufacturers focusing on cost-effectiveness and consistent quality. Unique selling propositions often revolve around exceptionally low impurity profiles, stable supply chains, and customized packaging solutions for sensitive applications. Technological advancements in purification techniques, such as advanced distillation and crystallization methods, are key differentiators.

Key Drivers, Barriers & Challenges in Anhydrous Naphthalene

Key Drivers: The Anhydrous Naphthalene market is propelled by the relentless demand from its core applications in the chemical and pharmaceutical industries. Technological advancements, particularly the development of high-purity Electronic Grade Anhydrous Naphthalene, are creating new avenues for growth in the booming semiconductor sector. Economic growth in developing nations, leading to increased industrial activity and consumer spending, also acts as a significant driver. Furthermore, government initiatives supporting domestic manufacturing and R&D in key end-user industries contribute to market expansion.

Key Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, pose a significant challenge. Fluctuations in raw material prices, primarily derived from coal tar or petroleum, can impact production costs and market pricing. Stringent environmental regulations regarding the production and handling of naphthalene derivatives can increase operational expenses and necessitate investment in cleaner technologies. The competitive landscape, while moderate, can lead to price pressures, especially for Technical Grade Anhydrous Naphthalene. Maintaining consistent quality and high purity levels, particularly for Electronic Grade, requires substantial investment in advanced manufacturing and quality control processes. The estimated impact of supply chain volatility on market growth is projected to be around XX.X% over the forecast period.

Emerging Opportunities in Anhydrous Naphthalene

Emerging opportunities in the Anhydrous Naphthalene market lie in the burgeoning demand for sustainable chemical processes and the exploration of novel applications. The development of bio-based naphthalene derivatives or more energy-efficient production methods presents a significant opportunity for environmentally conscious manufacturers. Untapped markets in regions with developing industrial bases and growing high-tech sectors offer substantial growth potential. Furthermore, the exploration of Anhydrous Naphthalene in advanced materials research, such as in the development of organic semiconductors or specialized polymers, could open up entirely new application frontiers. Evolving consumer preferences for eco-friendly products may also indirectly drive demand for Anhydrous Naphthalene used in the production of such goods.

Growth Accelerators in the Anhydrous Naphthalene Industry

Long-term growth in the Anhydrous Naphthalene industry is being significantly accelerated by transformative technological breakthroughs in purification and synthesis. Strategic partnerships between chemical manufacturers and semiconductor equipment providers are fostering innovation and ensuring the availability of ultra-high-purity Anhydrous Naphthalene for next-generation electronics. Market expansion strategies, focusing on catering to the specific needs of the pharmaceutical industry for intermediates and reagents, are also proving highly effective. Investments in research and development for novel applications, particularly in areas like advanced materials and specialty chemicals, are crucial catalysts. The increasing global focus on self-sufficiency in critical material supply chains is also encouraging investment and production capacity expansion in key regions.

Key Players Shaping the Anhydrous Naphthalene Market

- Air Liquide

- Linde Industrial Gas

- Niacet

- Praxair

- Shandong Xinlong Group

- BASF

- Chinalco

- Gas Innovations

- Juhua Group

- Versum Materials

- Wandali Special Gas

Notable Milestones in Anhydrous Naphthalene Sector

- 2019: Launch of a new, highly efficient purification technology by a leading chemical company, significantly improving the purity of Electronic Grade Anhydrous Naphthalene.

- 2020: A major industrial gas provider acquires a specialty chemical producer, expanding its portfolio in high-purity gases and chemicals for the semiconductor industry.

- 2021: Increased investment in R&D by multiple players for developing sustainable production methods for Anhydrous Naphthalene.

- 2022: Significant surge in demand from the pharmaceutical sector for Anhydrous Naphthalene as a key intermediate for novel drug synthesis.

- 2023: Strategic collaboration between a Chinese chemical conglomerate and a European electronics manufacturer to secure supply chains for high-purity Anhydrous Naphthalene.

- 2024 (Early): Introduction of advanced packaging solutions for ultra-pure Anhydrous Naphthalene, minimizing contamination risks during transportation and handling.

In-Depth Anhydrous Naphthalene Market Outlook

The future market outlook for Anhydrous Naphthalene is exceptionally positive, driven by a confluence of accelerating growth factors. Technological breakthroughs in enhancing purity and developing novel applications in advanced materials are set to unlock new market segments. Strategic partnerships and collaborations, particularly between raw material suppliers and high-tech end-users, will solidify supply chains and foster innovation. Aggressive market expansion strategies targeting emerging economies and specialized niche applications will further propel growth. The increasing demand for high-performance materials in sectors like electronics and pharmaceuticals, coupled with a global push for advanced manufacturing capabilities, positions Anhydrous Naphthalene for sustained and robust expansion in the coming years. The projected market growth rate indicates significant opportunities for stakeholders to capitalize on the evolving landscape.

Anhydrous Naphthalene Segmentation

-

1. Application

- 1.1. Chemical Industry

- 1.2. Semiconductor Industry

- 1.3. Pharmaceutical Industry

- 1.4. Others

-

2. Types

- 2.1. Technical Grade

- 2.2. Electronic Grade

Anhydrous Naphthalene Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Anhydrous Naphthalene REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemical Industry

- 5.1.2. Semiconductor Industry

- 5.1.3. Pharmaceutical Industry

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Technical Grade

- 5.2.2. Electronic Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemical Industry

- 6.1.2. Semiconductor Industry

- 6.1.3. Pharmaceutical Industry

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Technical Grade

- 6.2.2. Electronic Grade

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemical Industry

- 7.1.2. Semiconductor Industry

- 7.1.3. Pharmaceutical Industry

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Technical Grade

- 7.2.2. Electronic Grade

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemical Industry

- 8.1.2. Semiconductor Industry

- 8.1.3. Pharmaceutical Industry

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Technical Grade

- 8.2.2. Electronic Grade

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemical Industry

- 9.1.2. Semiconductor Industry

- 9.1.3. Pharmaceutical Industry

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Technical Grade

- 9.2.2. Electronic Grade

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Anhydrous Naphthalene Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemical Industry

- 10.1.2. Semiconductor Industry

- 10.1.3. Pharmaceutical Industry

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Technical Grade

- 10.2.2. Electronic Grade

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Air Liquide

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Linde Industrial Gas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niacet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Praxair

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shandong Xinlong Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chinalco

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gas Innovations

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Juhua Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Versum Materials

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wandali Special Gas

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Air Liquide

List of Figures

- Figure 1: Global Anhydrous Naphthalene Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Anhydrous Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 3: North America Anhydrous Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Anhydrous Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 5: North America Anhydrous Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Anhydrous Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 7: North America Anhydrous Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Anhydrous Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 9: South America Anhydrous Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Anhydrous Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 11: South America Anhydrous Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Anhydrous Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 13: South America Anhydrous Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Anhydrous Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Anhydrous Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Anhydrous Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Anhydrous Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Anhydrous Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Anhydrous Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Anhydrous Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Anhydrous Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Anhydrous Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Anhydrous Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Anhydrous Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Anhydrous Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Anhydrous Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Anhydrous Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Anhydrous Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Anhydrous Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Anhydrous Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Anhydrous Naphthalene Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anhydrous Naphthalene Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Anhydrous Naphthalene Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Anhydrous Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Anhydrous Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Anhydrous Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Anhydrous Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Anhydrous Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Anhydrous Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Anhydrous Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Anhydrous Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anhydrous Naphthalene?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Anhydrous Naphthalene?

Key companies in the market include Air Liquide, Linde Industrial Gas, Niacet, Praxair, Shandong Xinlong Group, BASF, Chinalco, Gas Innovations, Juhua Group, Versum Materials, Wandali Special Gas.

3. What are the main segments of the Anhydrous Naphthalene?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 356 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anhydrous Naphthalene," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anhydrous Naphthalene report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anhydrous Naphthalene?

To stay informed about further developments, trends, and reports in the Anhydrous Naphthalene, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence