Key Insights

The Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) business tourism market is poised for significant expansion. This growth is propelled by escalating business activities, substantial infrastructure investments, and an expanding middle class with increased discretionary spending. The region's economic diversity and rich cultural tapestry serve as compelling draws for both international and regional MICE events. While historical data (2019-2024) is not explicitly detailed, market projections indicate consistent growth aligned with global MICE trends and regional economic performance. The base year, 2025, is anticipated to mark a strong post-pandemic recovery, highlighting the sector's inherent resilience and future potential. The forecast period (2025-2033) predicts sustained expansion, driven by technological innovations in event planning and management, enhanced government support for tourism, and a growing adoption of hybrid and virtual event solutions. Key contributors to this growth include China, India, Japan, South Korea, and Australia. The market features intense competition among hotels, convention centers, event management firms, and destination marketing organizations. Future market success will be contingent on adapting to evolving attendee preferences, prioritizing sustainable practices, and leveraging technology to elevate the MICE experience.

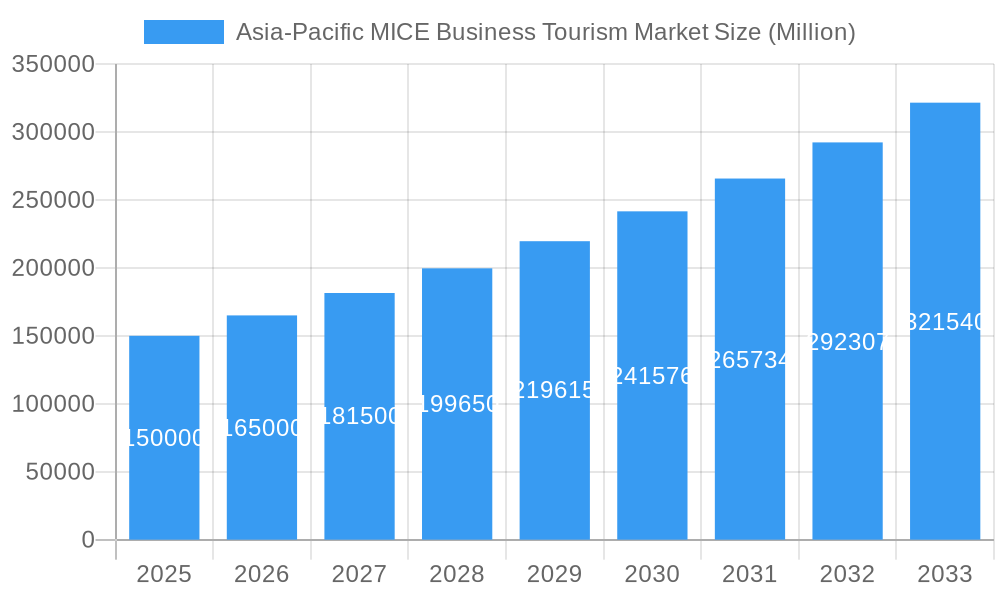

Asia-Pacific MICE Business Tourism Market Market Size (In Million)

Sustained growth in the Asia-Pacific MICE market will be influenced by strategic investments in cutting-edge event technologies, including virtual and augmented reality solutions, to support hybrid event formats. Furthermore, an emphasis on sustainability and responsible tourism practices will resonate with environmentally conscious organizations and participants. Government-led initiatives promoting tourism and infrastructure development are critical enablers of market expansion. The competitive landscape will be shaped by the ability of regional stakeholders to effectively rival established global MICE destinations. This necessitates a strategic focus on branding, marketing, and accentuating the distinctive cultural and experiential offerings characteristic of the Asia-Pacific region.

Asia-Pacific MICE Business Tourism Market Company Market Share

Asia-Pacific MICE Business Tourism Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific MICE (Meetings, Incentives, Conferences, Exhibitions) business tourism market, offering invaluable insights for industry professionals, investors, and strategic planners. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is segmented by event type (Meetings, Incentives, Conventions, Exhibitions) and key players include CWT Meetings & Events, Interpublic Group of Companies Inc, Conference Care Ltd, IBTM Events, The Freeman Company, BCD Meetings and Events, Questex LLC, Cievents, and ATPI Ltd (list not exhaustive). The total market value is projected to reach xx Million by 2033.

Asia-Pacific MICE Business Tourism Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and influencing factors. The Asia-Pacific MICE market exhibits a moderately concentrated structure, with several large players holding significant market share. However, the market also accommodates numerous smaller, specialized firms.

Market Concentration & Competitive Dynamics:

- The top 5 players hold an estimated xx% market share in 2025.

- Significant M&A activity has been observed in recent years, with xx deals recorded between 2019 and 2024. This consolidation trend is expected to continue.

- Competition is intense, driven by factors like pricing strategies, service quality, and technological offerings.

Technological Innovation Drivers:

- Adoption of virtual and hybrid event platforms is accelerating market growth.

- AI-powered tools for event planning and management are gaining traction.

- Data analytics is increasingly used to personalize attendee experiences and optimize event outcomes.

Regulatory Frameworks & Compliance:

- Government regulations regarding event safety and sustainability are influencing market dynamics.

- Visa and travel policies significantly impact international MICE events.

- Varying tax regulations across different countries within the region create complexities.

End-User Demographics & Trends:

- The business tourism market is driven by a diverse range of industries, including technology, finance, pharmaceuticals, and education.

- Growth in corporate spending on MICE events is a key factor in market expansion.

- Growing demand for sustainable and responsible MICE practices is shaping the industry landscape.

Competitive Substitutes & Innovation Barriers:

- Online webinars and virtual conferences pose a competitive threat to traditional in-person events.

- High initial investment costs and technological complexity are barriers to innovation.

- The integration of new technologies requires substantial investment and expertise.

Asia-Pacific MICE Business Tourism Market Growth Trends & Insights

The Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) market demonstrated robust growth from 2019 to 2024, experiencing a temporary setback due to the global pandemic. However, a significant recovery is underway, fueled by pent-up demand and a resurgence in business travel. Market projections indicate a substantial value of [Insert Updated Market Size in Millions] by 2025, with a projected compound annual growth rate (CAGR) of [Insert Updated CAGR]% from 2025 to 2033. This expansion is driven by several key factors: a rise in disposable incomes across the region, increased business activity, supportive government policies promoting tourism, and a growing focus on fostering regional and international collaborations.

Technological advancements have profoundly reshaped the market landscape. The widespread adoption of virtual and hybrid event formats has broadened the market's reach and accessibility, facilitating participation from a wider geographical area and diverse audiences. While offering significant opportunities, this shift has also introduced challenges related to maintaining attendee engagement and ensuring inclusivity across different technological platforms. Furthermore, a growing consumer preference for sustainable and responsible travel has prompted a significant shift in industry practices. MICE businesses are increasingly adopting eco-friendly event planning and management strategies, integrating sustainability metrics into their key performance indicators (KPIs).

Dominant Regions, Countries, or Segments in Asia-Pacific MICE Business Tourism Market

China and Singapore currently dominate the Asia-Pacific MICE market, contributing xx% and xx% of total market value respectively in 2025. Strong economic growth, advanced infrastructure, and government initiatives promoting tourism have solidified their leadership positions. The Meetings segment represents the largest share within the overall market, followed by Conventions and Exhibitions. Incentives travel, though smaller, has shown consistent growth potential.

Key Drivers of Growth:

- China: Robust economic growth, expanding middle class, and strategic investment in infrastructure have contributed significantly to MICE growth.

- Singapore: Well-developed infrastructure, government support for the MICE sector, and its strategic location make it a prominent hub.

- Meetings Segment: High demand for business meetings across various industries drives this segment's dominance. Effective communication and collaboration needs of business are constantly growing.

Dominance Factors:

- Infrastructure: Availability of world-class venues, excellent connectivity, and advanced technology infrastructure are essential for attracting large-scale events.

- Government Support: Favorable policies, tax incentives, and government-backed initiatives significantly impact market growth.

- Business Environment: A stable political and economic environment, coupled with a skilled workforce, is crucial for attracting both domestic and international MICE events.

Asia-Pacific MICE Business Tourism Market Product Landscape

The Asia-Pacific MICE market offers a diverse and rapidly evolving range of products and services. This includes comprehensive venue management solutions, sophisticated event planning services, cutting-edge technology solutions designed to enhance attendee engagement and streamline logistics, and targeted marketing strategies for maximizing event impact. Recent product innovations prioritize enhanced attendee engagement through personalized experiences, streamlined logistics using AI-powered solutions, and the incorporation of sustainable sourcing practices throughout the event lifecycle. Key performance indicators (KPIs) for MICE businesses are evolving to encompass a broader range of metrics, including attendee satisfaction, return on investment (ROI), environmental impact assessment, and measurable contributions to the local economy.

Key Drivers, Barriers & Challenges in Asia-Pacific MICE Business Tourism Market

Key Drivers:

- A surge in business travel and increased corporate spending on events and incentives.

- Government support and investment in tourism infrastructure and marketing initiatives focused on attracting MICE events.

- Technological advancements that simplify event planning, improve communication, and enhance the overall attendee experience.

- The expansion of the middle class and a subsequent rise in disposable income, fueling demand for experiential travel and high-quality events.

- Growing emphasis on regional and international collaborations, creating opportunities for cross-border MICE events.

Key Barriers & Challenges:

- Geopolitical instability and economic uncertainty impacting travel budgets and investment decisions.

- Intense competition from other regions offering attractive MICE destinations and sophisticated infrastructure.

- Supply chain disruptions and logistical challenges that can affect event planning and execution.

- The increasing importance of sustainability concerns, necessitating the adoption of eco-friendly practices which can lead to higher costs and complex operational adjustments.

- The need for skilled professionals and workforce development to meet the growing demands of the industry.

Emerging Opportunities in Asia-Pacific MICE Business Tourism Market

- Expansion into untapped markets within the region, such as emerging economies in Southeast Asia.

- Growth of niche MICE events focusing on specific industries or themes.

- Increased adoption of virtual and hybrid event formats, expanding reach and accessibility.

- Development of sustainable and responsible MICE practices to meet growing consumer demand.

Growth Accelerators in the Asia-Pacific MICE Business Tourism Market Industry

Long-term growth will be accelerated by strategic partnerships between event organizers, technology providers, and government agencies. Technological breakthroughs in virtual reality (VR) and augmented reality (AR) will enhance attendee engagement. Furthermore, the expansion of MICE infrastructure, particularly in secondary cities and developing economies, will further accelerate growth. The focus on sustainable practices will position the industry for long-term success.

Key Players Shaping the Asia-Pacific MICE Business Tourism Market Market

- CWT Meetings & Events

- Interpublic Group of Companies Inc

- Conference Care Ltd

- IBTM Events

- The Freeman Company

- BCD Meetings and Events

- Questex LLC

- Cievents

- ATPI Ltd

Notable Milestones in Asia-Pacific MICE Business Tourism Market Sector

- October 2021: SITE Thailand Chapter partnered with the Thailand Convention and Exhibition Bureau (TCEB) to launch the SITE Thailand M&I Sustainability Advocate Project, promoting sustainable practices within the meetings and incentives industry.

- 2022: IBTM chose Singapore as the new home for IBTM Asia Pacific, concurrently launching the inaugural Singapore MICE Forum (SMF) X IBTM APAC event, highlighting the region's growing importance in the global MICE landscape.

- [Add other relevant milestones with dates and brief descriptions]

In-Depth Asia-Pacific MICE Business Tourism Market Market Outlook

The Asia-Pacific MICE market exhibits substantial future potential, driven by ongoing economic growth, infrastructure development, and technological advancements. Strategic partnerships, focusing on sustainability and innovation, will be crucial for navigating the competitive landscape. The market's long-term growth trajectory is positive, with opportunities for both established players and new entrants to capitalize on emerging trends and untapped markets.

Asia-Pacific MICE Business Tourism Market Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentive

- 1.3. Conventions

- 1.4. Exhibitions

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Singapore

- 2.4. Thailand

- 2.5. Hong Kong

- 2.6. Malaysia

- 2.7. Japan

- 2.8. Rest of AP

Asia-Pacific MICE Business Tourism Market Segmentation By Geography

- 1. India

- 2. China

- 3. Singapore

- 4. Thailand

- 5. Hong Kong

- 6. Malaysia

- 7. Japan

- 8. Rest of AP

Asia-Pacific MICE Business Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific MICE Business Tourism Market

Asia-Pacific MICE Business Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels

- 3.3. Market Restrains

- 3.3.1. Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market

- 3.4. Market Trends

- 3.4.1. Hybrid events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentive

- 5.1.3. Conventions

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Singapore

- 5.2.4. Thailand

- 5.2.5. Hong Kong

- 5.2.6. Malaysia

- 5.2.7. Japan

- 5.2.8. Rest of AP

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Singapore

- 5.3.4. Thailand

- 5.3.5. Hong Kong

- 5.3.6. Malaysia

- 5.3.7. Japan

- 5.3.8. Rest of AP

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. India Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Event

- 6.1.1. Meeting

- 6.1.2. Incentive

- 6.1.3. Conventions

- 6.1.4. Exhibitions

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Singapore

- 6.2.4. Thailand

- 6.2.5. Hong Kong

- 6.2.6. Malaysia

- 6.2.7. Japan

- 6.2.8. Rest of AP

- 6.1. Market Analysis, Insights and Forecast - by Event

- 7. China Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Event

- 7.1.1. Meeting

- 7.1.2. Incentive

- 7.1.3. Conventions

- 7.1.4. Exhibitions

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Singapore

- 7.2.4. Thailand

- 7.2.5. Hong Kong

- 7.2.6. Malaysia

- 7.2.7. Japan

- 7.2.8. Rest of AP

- 7.1. Market Analysis, Insights and Forecast - by Event

- 8. Singapore Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Event

- 8.1.1. Meeting

- 8.1.2. Incentive

- 8.1.3. Conventions

- 8.1.4. Exhibitions

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Singapore

- 8.2.4. Thailand

- 8.2.5. Hong Kong

- 8.2.6. Malaysia

- 8.2.7. Japan

- 8.2.8. Rest of AP

- 8.1. Market Analysis, Insights and Forecast - by Event

- 9. Thailand Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Event

- 9.1.1. Meeting

- 9.1.2. Incentive

- 9.1.3. Conventions

- 9.1.4. Exhibitions

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Singapore

- 9.2.4. Thailand

- 9.2.5. Hong Kong

- 9.2.6. Malaysia

- 9.2.7. Japan

- 9.2.8. Rest of AP

- 9.1. Market Analysis, Insights and Forecast - by Event

- 10. Hong Kong Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Event

- 10.1.1. Meeting

- 10.1.2. Incentive

- 10.1.3. Conventions

- 10.1.4. Exhibitions

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. India

- 10.2.2. China

- 10.2.3. Singapore

- 10.2.4. Thailand

- 10.2.5. Hong Kong

- 10.2.6. Malaysia

- 10.2.7. Japan

- 10.2.8. Rest of AP

- 10.1. Market Analysis, Insights and Forecast - by Event

- 11. Malaysia Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Event

- 11.1.1. Meeting

- 11.1.2. Incentive

- 11.1.3. Conventions

- 11.1.4. Exhibitions

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. India

- 11.2.2. China

- 11.2.3. Singapore

- 11.2.4. Thailand

- 11.2.5. Hong Kong

- 11.2.6. Malaysia

- 11.2.7. Japan

- 11.2.8. Rest of AP

- 11.1. Market Analysis, Insights and Forecast - by Event

- 12. Japan Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Event

- 12.1.1. Meeting

- 12.1.2. Incentive

- 12.1.3. Conventions

- 12.1.4. Exhibitions

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. India

- 12.2.2. China

- 12.2.3. Singapore

- 12.2.4. Thailand

- 12.2.5. Hong Kong

- 12.2.6. Malaysia

- 12.2.7. Japan

- 12.2.8. Rest of AP

- 12.1. Market Analysis, Insights and Forecast - by Event

- 13. Rest of AP Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Event

- 13.1.1. Meeting

- 13.1.2. Incentive

- 13.1.3. Conventions

- 13.1.4. Exhibitions

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. India

- 13.2.2. China

- 13.2.3. Singapore

- 13.2.4. Thailand

- 13.2.5. Hong Kong

- 13.2.6. Malaysia

- 13.2.7. Japan

- 13.2.8. Rest of AP

- 13.1. Market Analysis, Insights and Forecast - by Event

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 CWT MEETINGS & EVENTS

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 INTERPUBLIC GROUP OF COMPANIES INC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 CONFERENCE CARE LTD

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 IBTM EVENTS

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 THE FREEMAN COMPANY**List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 BCD MEETINGS AND EVENTS

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 QUESTEX LLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 CIEVENTS

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 ATPI LTD

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 CWT MEETINGS & EVENTS

List of Figures

- Figure 1: Asia-Pacific MICE Business Tourism Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific MICE Business Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 2: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 5: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 8: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 11: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 14: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 17: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 20: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 23: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 26: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 27: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific MICE Business Tourism Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Asia-Pacific MICE Business Tourism Market?

Key companies in the market include CWT MEETINGS & EVENTS, INTERPUBLIC GROUP OF COMPANIES INC, CONFERENCE CARE LTD, IBTM EVENTS, THE FREEMAN COMPANY**List Not Exhaustive, BCD MEETINGS AND EVENTS, QUESTEX LLC, CIEVENTS, ATPI LTD.

3. What are the main segments of the Asia-Pacific MICE Business Tourism Market?

The market segments include Event, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1226.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels.

6. What are the notable trends driving market growth?

Hybrid events.

7. Are there any restraints impacting market growth?

Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market.

8. Can you provide examples of recent developments in the market?

In 2022, IBTM has selected Singapore to be the home of IBTM Asia Pacific.It will be coupled with the first edition of Singapore MICE Forum (SMF) X IBTM APAC, in partnership with Singapore Association of Convention & Exhibition Organisers & Suppliers (SACEOS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific MICE Business Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific MICE Business Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific MICE Business Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific MICE Business Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence