Key Insights

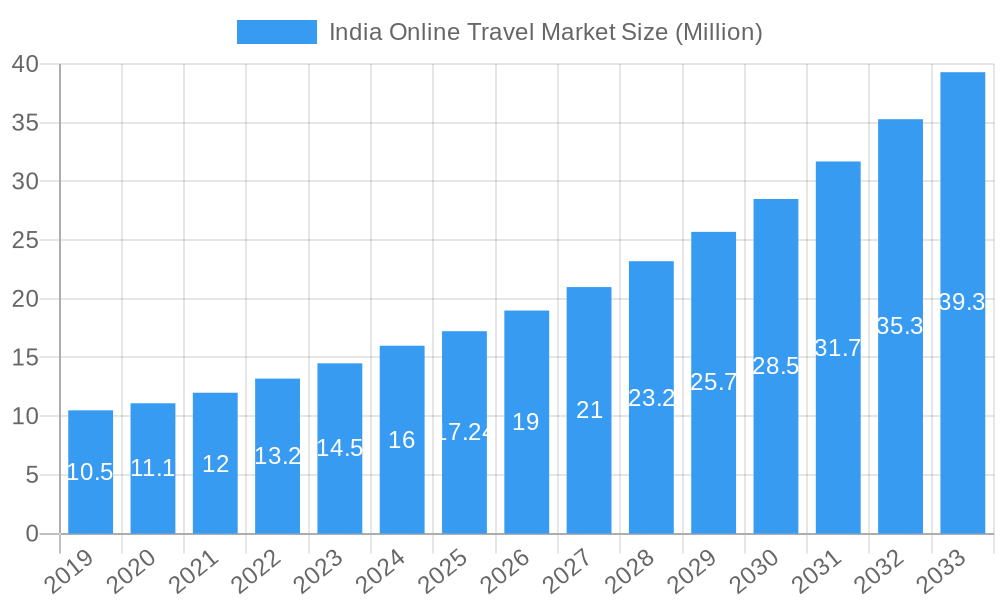

The Indian Online Travel Market is poised for robust expansion, projected to reach a substantial USD 17.24 million by 2025. This impressive growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.50% throughout the forecast period of 2025-2033. This surge is primarily driven by a confluence of factors including the increasing internet and smartphone penetration across India, a burgeoning middle class with greater disposable incomes, and a growing propensity for digital-first booking experiences. The evolving travel landscape, characterized by a demand for personalized itineraries and competitive pricing, further fuels this upward trajectory. Furthermore, the convenience and accessibility offered by online platforms are transforming how Indians plan and book their journeys, from domestic getaways to international explorations.

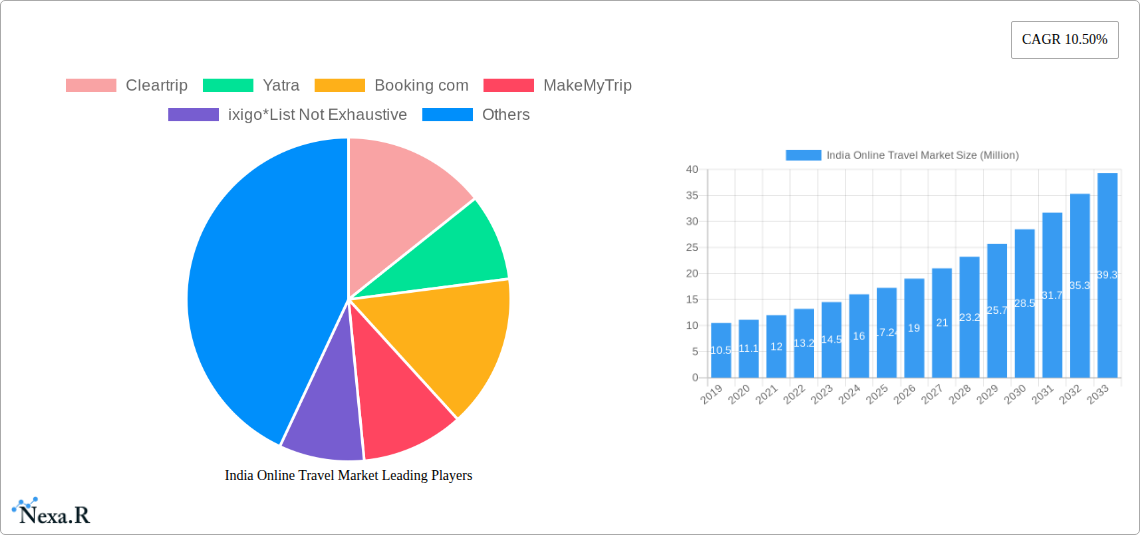

India Online Travel Market Market Size (In Million)

Key trends shaping this dynamic market include the significant rise of Online Travel Agencies (OTAs) and direct bookings through supplier websites, indicating a preference for streamlined booking processes. The platform shift towards mobile devices is paramount, reflecting the ubiquitous nature of smartphones in daily life. The market is segmented by service types, with Transportation and Travel Accommodation emerging as dominant categories, followed by Vacation Packages and Other Service Types. Tour Group and Package Traveller segments highlight a strong inclination towards organized travel experiences. The competitive landscape features prominent players like MakeMyTrip, Yatra, Cleartrip, and Booking.com, alongside emerging disruptors such as OYO Rooms, all vying for market share through innovative offerings and strategic partnerships. Despite immense growth potential, challenges such as fluctuating fuel prices and evolving regulatory landscapes present moderate restraints that industry players must adeptly navigate.

India Online Travel Market Company Market Share

India Online Travel Market: Comprehensive Report Description

Unlock the Lucrative Potential of India's Digital Travel Landscape. This in-depth report offers a definitive analysis of the India Online Travel Market, meticulously examining its current state and forecasting its trajectory through 2033. Delve into critical market dynamics, growth trends, regional dominance, and a comprehensive product landscape, equipping industry professionals with actionable insights for strategic decision-making. The report covers the expansive online travel market from 2019-2033, with a deep dive into the parent market and its various child markets.

Keywords: India Online Travel Market, Online Travel Agencies India, Travel Technology India, Digital Travel India, OTA India, Travel Accommodation India, Transportation Booking India, Vacation Packages India, Mobile Travel Booking India, India Tourism Market, MakeMyTrip, ixigo, Cleartrip, Yatra, Booking.com, EaseMyTrip, OYO Rooms, Expedia, Thomas Cook India, Cox & Kings India, Via.com, Travel Analytics India, CAGR India Travel, Tourism Policy India.

India Online Travel Market Market Dynamics & Structure

The India Online Travel Market is characterized by a dynamic and evolving structure, driven by increasing internet penetration, smartphone adoption, and a growing digitally-savvy consumer base. Market concentration is moderately high, with a few dominant Online Travel Agencies (OTAs) holding significant market share, but a healthy competitive landscape exists with emerging players and specialized niche providers. Technological innovation is a key driver, with advancements in AI-powered personalization, data analytics for dynamic pricing, and seamless mobile booking experiences constantly reshaping consumer expectations. Regulatory frameworks, while evolving, aim to foster a more organized and transparent travel ecosystem, impacting operational strategies for both online travel agencies and direct travel suppliers. Competitive product substitutes are abundant, ranging from traditional travel agents to alternative accommodation platforms and car-sharing services, forcing online players to continually innovate and offer superior value propositions. End-user demographics are increasingly diverse, encompassing millennials and Gen Z seeking flexible and personalized travel experiences, as well as older generations embracing the convenience of online booking. Merger and Acquisition (M&A) trends are indicative of market consolidation and strategic expansion, with larger players acquiring smaller competitors to enhance their service portfolios and customer reach.

- Market Concentration: Dominated by key players but with room for niche specialization.

- Technological Innovation: AI, personalization engines, and mobile-first solutions are paramount.

- Regulatory Landscape: Focused on consumer protection, data security, and fair competition.

- Competitive Substitutes: A wide array of options necessitates continuous value creation.

- End-User Demographics: Catering to a broad spectrum of age groups and travel preferences.

- M&A Trends: Driven by market consolidation and strategic growth initiatives.

India Online Travel Market Growth Trends & Insights

The India Online Travel Market is poised for substantial growth, fueled by a confluence of robust economic development, a burgeoning middle class, and an accelerated shift towards digital channels for all consumer transactions, including travel. The market size evolution is projected to be significant, with the online travel market expected to witness a Compound Annual Growth Rate (CAGR) that outpaces general economic growth. Adoption rates for online travel booking platforms are soaring, driven by increasing digital literacy and the undeniable convenience offered by these services. Technological disruptions, such as the integration of Augmented Reality (AR) for virtual destination exploration and sophisticated machine learning algorithms for hyper-personalized travel recommendations, are further accelerating adoption and enhancing user experience. Consumer behavior shifts are clearly evident, with a growing preference for self-service booking, flexible travel options, and a demand for end-to-end travel solutions delivered seamlessly through mobile devices. The market penetration of online travel services is rapidly expanding beyond Tier 1 cities into Tier 2 and Tier 3 cities, indicating a widening reach and a democratizing effect on travel planning.

The study period spanning from 2019 to 2033, with a base and estimated year of 2025, provides a comprehensive outlook on this dynamic sector. The historical period of 2019-2024 showcases the initial rapid growth and resilience of the online travel market in India. Looking ahead, the forecast period of 2025-2033 anticipates sustained expansion driven by a combination of factors including increasing disposable incomes, a growing propensity for leisure travel, and the continued digital transformation of the Indian economy. Online Travel Agencies (OTAs) are expected to remain the dominant channel, offering a wide array of services from flight and hotel bookings to holiday packages and activity reservations. However, direct travel suppliers are also increasing their digital presence, aiming to capture a larger share of the market by offering exclusive deals and loyalty programs. The platform segment will see mobile dominance continue to grow exponentially, with a decline in desktop bookings as smartphone penetration becomes ubiquitous. The service type segment will witness continued strength in Transportation and Travel Accommodation, with Vacation Packages also showing significant growth as consumers seek curated and hassle-free travel experiences. Other Service Types, encompassing activities, tours, and local experiences, are expected to emerge as key growth areas.

Dominant Regions, Countries, or Segments in India Online Travel Market

The India Online Travel Market's dominance is multi-faceted, with specific regions, segments, and booking types playing pivotal roles in driving its expansive growth. Geographically, while metropolitan hubs like Mumbai, Delhi, and Bengaluru consistently lead in online travel bookings due to their higher disposable incomes and digital connectivity, a significant surge is now being observed in Tier 2 and Tier 3 cities. This expansion is driven by increased internet accessibility, a growing young demographic with a propensity for travel, and the expansion of budget-friendly online travel options. The economic policies promoting tourism and infrastructure development in these emerging regions are critical enablers of this shift.

Within the Service Type segment, Transportation and Travel Accommodation continue to be the bedrock of the online travel market. The sheer volume of domestic and international air travel, coupled with the widespread adoption of online hotel booking platforms, solidifies their leading positions. However, Vacation Packages are rapidly gaining traction, reflecting a consumer desire for curated, all-inclusive travel experiences that simplify planning and offer better value. The market share of vacation packages is projected to grow significantly as more Indians embrace leisure travel and seek to explore diverse destinations.

The Booking Type segment is overwhelmingly dominated by Online Travel Agencies (OTAs). Players like MakeMyTrip, ixigo, and Cleartrip have established strong brand recognition and extensive networks, offering a one-stop solution for a wide range of travel needs. While Direct Travel Suppliers are increasing their online presence, the convenience and comparative shopping offered by OTAs maintain their market leadership.

In terms of Platform, Mobile is the undisputed champion, with the vast majority of online travel bookings now initiated and completed via smartphones. This trend is fueled by the ubiquitous nature of mobile devices in India and the development of user-friendly mobile applications by travel companies. The growth potential for mobile travel booking is immense, as it democratizes access to travel planning for a larger segment of the population.

The Tour Type segment sees Package Traveller contributing significantly to the market's growth, as consumers increasingly opt for bundled deals that include flights, accommodation, and activities. This segment benefits from the convenience and perceived cost savings. While Tour Group travel is also present, the individualistic nature of online booking platforms caters more directly to the independent package traveler. Key drivers for dominance across these segments include robust digital infrastructure, a young and tech-savvy population, growing disposable incomes, and strategic marketing efforts by major online travel players.

India Online Travel Market Product Landscape

The India Online Travel Market's product landscape is characterized by a dynamic array of digital solutions designed to cater to every facet of the travel journey. Innovations are centered around enhancing user experience, streamlining booking processes, and offering personalized recommendations. Online Travel Agencies (OTAs) are continuously refining their platforms to offer comprehensive services, including flight and train bookings, hotel reservations, bus ticketing, and car rentals, under one roof. Unique selling propositions often revolve around competitive pricing, exclusive deals, and loyalty programs. Technological advancements such as AI-powered chatbots for instant customer support, dynamic pricing algorithms for optimal fare discovery, and integrated payment gateways are standard features. The performance metrics for these products are closely monitored, with user engagement, conversion rates, and customer satisfaction being key indicators of success. The evolving product landscape also includes specialized offerings like curated vacation packages, experiential tours, and ancillary services such as travel insurance and visa assistance, all delivered through intuitive and accessible digital interfaces.

Key Drivers, Barriers & Challenges in India Online Travel Market

The India Online Travel Market is propelled by several key drivers. Increasing internet penetration and smartphone adoption provide the fundamental infrastructure for digital travel transactions. A growing middle class with rising disposable incomes fuels a greater propensity for leisure and business travel. The convenience and time-saving benefits of online booking platforms are highly appealing to a busy population. Furthermore, government initiatives promoting tourism and digital India create a favorable ecosystem. Technological advancements, such as personalized recommendations and seamless mobile experiences, further enhance the attractiveness of online travel.

However, the market faces significant barriers and challenges. Limited digital literacy in certain demographics can hinder adoption. Concerns regarding data security and privacy can create hesitation among some consumers. Intense competition among players can lead to price wars, impacting profitability. Infrastructure limitations in remote areas can affect service delivery. Regulatory complexities and evolving policies can pose compliance challenges for businesses. Supply chain issues, particularly in peak travel seasons, can lead to service disruptions. The impact of these challenges can manifest in lower customer acquisition costs, reduced customer retention, and a slower pace of market expansion.

Emerging Opportunities in India Online Travel Market

Emerging opportunities in the India Online Travel Market lie in untapped segments and evolving consumer preferences. The vast potential of Tier 2 and Tier 3 cities represents a significant growth frontier, with a growing demand for affordable and accessible travel options. The increasing interest in experiential and niche tourism, such as adventure travel, wellness retreats, and cultural immersions, presents opportunities for specialized tour operators and aggregators. The integration of sustainable and eco-friendly travel options is a growing consumer concern, offering avenues for businesses to differentiate themselves. Furthermore, the expansion of corporate travel booking platforms and the development of personalized loyalty programs catering to frequent travelers are key areas for innovation and growth.

Growth Accelerators in the India Online Travel Market Industry

Several catalysts are accelerating long-term growth in the India Online Travel Market. Continuous technological breakthroughs, including the adoption of Artificial Intelligence for hyper-personalization and the exploration of Blockchain for secure transactions, are enhancing efficiency and customer engagement. Strategic partnerships between OTAs, airlines, hotels, and local experience providers are creating more comprehensive and appealing travel packages. Market expansion strategies, particularly targeting emerging demographic segments and geographical regions, are broadening the customer base. The increasing focus on domestic tourism, driven by evolving travel trends and government support, is a significant growth accelerator. Furthermore, innovative marketing campaigns and influencer collaborations are effectively reaching and influencing a wider audience, driving bookings and brand loyalty.

Key Players Shaping the India Online Travel Market Market

- Cleartrip

- Yatra

- Booking com

- MakeMyTrip

- ixigo

- EaseMyTrip

- Thomas Cook Ltd

- Oyo Rooms

- Expedia

- Cox & Kings Ltd

- Via com

Notable Milestones in India Online Travel Market Sector

- August 2023: Skyscanner launched its Hindi language experience across all its products and services to penetrate deeper into the Indian market. Skyscanner acts as a one-stop solution for travelers looking to compare ticket fares, hotel tariffs, and intra-city commutes by curating data from its partner Online Travel Agent (OTA) sites.

- August 2023: MakeMyTrip, along with the Ministry of Tourism, launched a unique Travellers' Map of India that showcases 600 plus destinations beyond the popular travel spots in the country.

In-Depth India Online Travel Market Market Outlook

The India Online Travel Market Outlook is exceptionally promising, driven by sustained economic growth, a young and aspirational population, and the irreversible digital transformation of the Indian economy. The market is poised to witness significant expansion, fueled by continued innovation in technology and evolving consumer preferences for seamless, personalized, and convenient travel experiences. Strategic opportunities abound for players who can effectively leverage data analytics to understand and cater to the nuanced needs of various traveler segments, particularly in emerging regions and for niche travel interests. The continued dominance of mobile bookings, coupled with the increasing adoption of advanced features like AI-powered recommendations and augmented reality experiences, will shape the future of online travel in India. Investment in sustainable tourism and the development of integrated travel ecosystems will further accelerate growth and solidify India's position as a leading global online travel market.

India Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

-

4. Tour Type

- 4.1. Tour Group

- 4.2. Package Traveller

India Online Travel Market Segmentation By Geography

- 1. India

India Online Travel Market Regional Market Share

Geographic Coverage of India Online Travel Market

India Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Winter Sports and Outdoor Recreation

- 3.3. Market Restrains

- 3.3.1. Unpredictable Weather Conditions

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Tour Type

- 5.4.1. Tour Group

- 5.4.2. Package Traveller

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yatra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MakeMyTrip

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ixigo*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EaseMyTrip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oyo Rooms

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expedia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cox & Kings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Via com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 5: India Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 10: India Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Online Travel Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the India Online Travel Market?

Key companies in the market include Cleartrip, Yatra, Booking com, MakeMyTrip, ixigo*List Not Exhaustive, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, Via com.

3. What are the main segments of the India Online Travel Market?

The market segments include Service Type, Booking Type, Platform, Tour Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Winter Sports and Outdoor Recreation.

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in India is Driving the Market.

7. Are there any restraints impacting market growth?

Unpredictable Weather Conditions.

8. Can you provide examples of recent developments in the market?

August 2023: Skyscanner launched its Hindi language experience across all its products and services to penetrate deeper into the Indian market. Skyscanner acts as a one-stop solution for travelers looking to compare ticket fares, hotel tariffs, and intra-city commutes by curating data from its partner Online Travel Agent (OTA) sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Online Travel Market?

To stay informed about further developments, trends, and reports in the India Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence