Key Insights

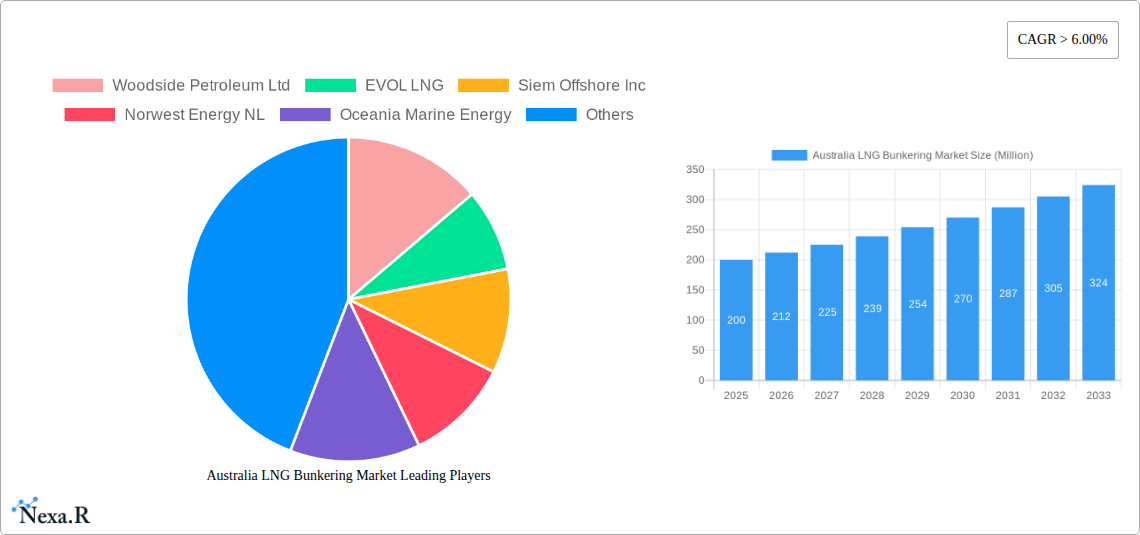

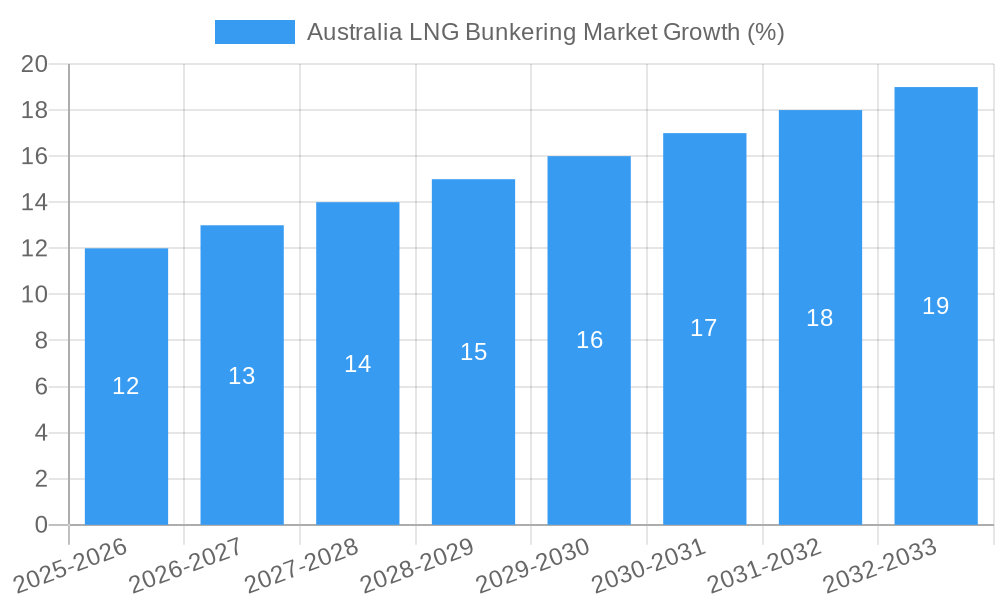

The Australian LNG bunkering market is poised for substantial growth, driven by increasing adoption of LNG as a marine fuel to meet stringent environmental regulations and reduce carbon emissions. The market, currently valued at an estimated AUD 200 million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the expanding tanker, container, and ferry fleets within Australia are creating heightened demand for LNG bunkering services. Secondly, government initiatives promoting cleaner maritime transportation and incentives for LNG adoption are accelerating market expansion. The segments driving this growth are medium-scale and large-scale LNG bunkering, catering to the needs of larger vessels. Companies like Woodside Petroleum Ltd, EVOL LNG, and Siem Offshore Inc are key players, actively investing in infrastructure and services to capitalize on this burgeoning market. However, challenges remain, including the high initial investment costs associated with LNG bunkering infrastructure and the limited availability of LNG bunkering ports along major shipping routes. Despite these constraints, the long-term outlook for the Australian LNG bunkering market remains positive, with continued growth anticipated throughout the forecast period due to the escalating need for environmentally friendly shipping solutions.

The geographical concentration of the market within Australia presents both opportunities and limitations. While the domestic market offers a solid foundation for growth, expansion plans should consider strategic partnerships and infrastructure development to overcome logistical challenges and serve a wider range of vessels. Further market segmentation analysis considering the specific energy needs of different vessel types will be critical for optimizing service offerings and attracting a diverse client base. Future success depends on overcoming the current infrastructural limitations, securing regulatory support, and fostering collaboration among stakeholders to ensure the seamless integration of LNG bunkering into Australia's maritime operations. Continuous innovation in LNG bunkering technologies, alongside strategic investments, will be crucial to achieving the projected growth trajectory.

Australia LNG Bunkering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian LNG bunkering market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this burgeoning market. The report examines both the parent market (Australian LNG Market) and the child market (LNG Bunkering) for a holistic perspective. Market values are presented in Millions of Units (MU).

Australia LNG Bunkering Market Dynamics & Structure

The Australian LNG bunkering market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, primarily in liquefaction and storage technologies, is a significant growth driver. Regulatory frameworks, particularly concerning emissions standards and safety regulations, are shaping market dynamics. The emergence of cleaner alternatives like bio-LNG presents a competitive threat, while end-user demographics—primarily the shipping industry—are evolving towards LNG-fuelled vessels. M&A activity, though not prolific, reflects strategic consolidation within the sector.

- Market Concentration: xx% (2024), predicted to decrease to xx% by 2033 due to new entrants.

- Technological Innovation: Focus on reducing LNG boil-off rates and improving bunkering infrastructure.

- Regulatory Landscape: Stringent emission regulations driving adoption of LNG as a marine fuel.

- Competitive Substitutes: Bio-LNG and other alternative fuels posing a competitive challenge.

- M&A Activity: xx deals in the historical period (2019-2024), with an estimated xx deals predicted for 2025-2033.

Australia LNG Bunkering Market Growth Trends & Insights

The Australian LNG bunkering market exhibited a CAGR of xx% during 2019-2024. Driven by increased adoption of LNG as a marine fuel, this growth is expected to continue with a projected CAGR of xx% from 2025 to 2033, reaching a market size of xx MU by 2033. This expansion is attributed to several factors, including stringent environmental regulations, decreasing LNG prices, and advancements in bunkering infrastructure. The market penetration rate for LNG-fuelled vessels is steadily increasing, reflecting a shift towards environmentally friendly shipping practices. Technological advancements are further enhancing efficiency and reducing operational costs, thereby accelerating market adoption.

Dominant Regions, Countries, or Segments in Australia LNG Bunkering Market

The major growth drivers are located in the Western Australia region, fueled by the significant iron ore and other commodity exports. Within the market segments, large-scale LNG bunkering is currently the dominant segment, primarily serving the tanker fleet. However, medium-scale LNG is anticipated to exhibit high growth in the forecast period.

- Leading Region: Western Australia, driven by port infrastructure and shipping activity.

- Dominant Segment (Type): Large-scale LNG (xx% market share in 2024), followed by medium-scale LNG (xx%).

- Dominant Segment (End-User): Tanker fleet (xx% market share in 2024), with growing contribution from bulk & general cargo fleets.

- Key Drivers: Government policies promoting LNG adoption, significant investments in port infrastructure.

Australia LNG Bunkering Market Product Landscape

The market is characterized by a range of LNG bunkering solutions, encompassing small, medium, and large-scale vessels designed for efficient and safe LNG transfer. Technological advancements focus on reducing boil-off gas (BOG) rates, improving safety systems, and enhancing overall operational efficiency. The unique selling propositions include optimized vessel designs, advanced automation, and remote monitoring capabilities.

Key Drivers, Barriers & Challenges in Australia LNG Bunkering Market

Key Drivers:

- Increasing environmental regulations aimed at reducing emissions from maritime transport.

- Growing demand for LNG as a cleaner alternative fuel in the shipping industry.

- Significant investments in port infrastructure to support LNG bunkering operations.

Key Challenges:

- High initial investment costs associated with LNG bunkering infrastructure and vessel modifications.

- Limited availability of LNG bunkering infrastructure in certain ports, creating supply chain bottlenecks.

- Competition from alternative marine fuels.

- xx% increase in insurance costs due to the nature of LNG handling.

Emerging Opportunities in Australia LNG Bunkering Market

- Expansion into smaller ports and coastal regions to cater to a wider range of vessels.

- Development of innovative bunkering technologies to improve efficiency and reduce costs.

- Exploration of alternative LNG sources like bio-LNG to further enhance sustainability.

- Growing demand from the container fleet and other segments, potentially increasing market size by xx% by 2033.

Growth Accelerators in the Australia LNG Bunkering Market Industry

The long-term growth of the Australian LNG bunkering market is projected to be driven by strategic partnerships between LNG producers, shipping companies, and infrastructure developers. Technological advancements in LNG bunkering technology will further reduce costs and improve efficiency. The expansion of LNG bunkering infrastructure to new ports and regions will open up new markets and enhance accessibility.

Key Players Shaping the Australia LNG Bunkering Market Market

- Woodside Petroleum Ltd

- EVOL LNG

- Siem Offshore Inc

- Norwest Energy NL

- Oceania Marine Energy

- Gas Energy Australia

- Kanfer Shipping

- List Not Exhaustive

Notable Milestones in Australia LNG Bunkering Market Sector

- September 2022: Norwest Energy Ltd. acquires a 20% stake in Pilbara Clean Fuels, advancing eLNG development.

- February 2022: BHP introduces the world's first LNG-fuelled Newcastlemax bulk carrier, significantly boosting LNG adoption in the shipping industry.

In-Depth Australia LNG Bunkering Market Market Outlook

The Australian LNG bunkering market is poised for significant growth in the coming years. Strategic partnerships, technological advancements, and expanding infrastructure will drive market expansion and create lucrative opportunities for both established players and new entrants. The increasing adoption of LNG as a cleaner fuel, coupled with supportive government policies, will further accelerate this growth trajectory. The market is expected to reach xx MU by 2033.

Australia LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk & General Cargo Fleet

- 1.4. Ferries & OSV

- 1.5. Others

Australia LNG Bunkering Market Segmentation By Geography

- 1. Australia

Australia LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Ferries and OSV to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk & General Cargo Fleet

- 5.1.4. Ferries & OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Woodside Petroleum Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EVOL LNG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siem Offshore Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Norwest Energy NL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oceania Marine Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gas Energy Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kanfer Shipping *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Woodside Petroleum Ltd

List of Figures

- Figure 1: Australia LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: Australia LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Australia LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Australia LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia LNG Bunkering Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Australia LNG Bunkering Market?

Key companies in the market include Woodside Petroleum Ltd, EVOL LNG, Siem Offshore Inc, Norwest Energy NL, Oceania Marine Energy, Gas Energy Australia, Kanfer Shipping *List Not Exhaustive.

3. What are the main segments of the Australia LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Ferries and OSV to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

In September 2022, Norwest Energy Ltd., Perth, acquired a 20% interest in Pilbara Clean Fuels Pty Ltd. (PCF), a company developing an electrified LNG (eLNG) plant at Port Hedland. The company is expected to invest AUD 300,000 to fund an initial 6-month assessment program designed to progress the project. PCF has entered a development partnership with Technip Energies and selected Air Products Inc. as the preferred liquefaction technology licensor and core equipment supplier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the Australia LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence