Key Insights

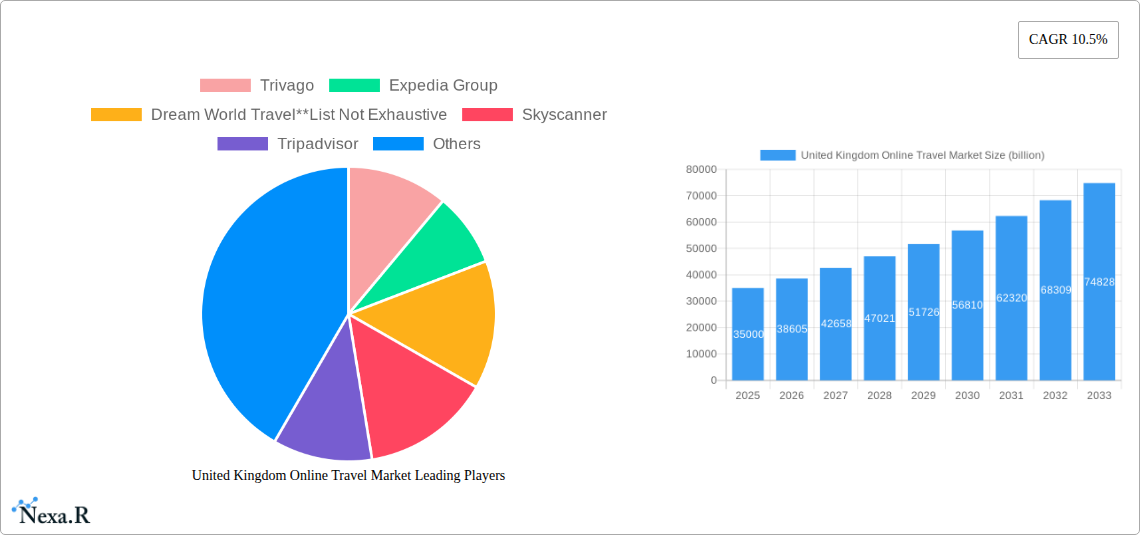

The United Kingdom's online travel market is poised for significant expansion, projecting a market size of approximately £35 billion in 2025, fueled by a robust CAGR of 10.5% through 2033. This growth is primarily driven by the increasing adoption of digital platforms for travel planning and booking, a burgeoning demand for personalized vacation experiences, and the convenience offered by online travel agencies (OTAs) and direct supplier platforms. The younger demographic, in particular, is a key driver, with a strong preference for mobile-first booking experiences and a keen interest in exploring unique accommodations and package deals. Furthermore, post-pandemic travel recovery and a renewed appetite for leisure and business trips are providing a substantial tailwind for the sector. The market is expected to witness continued innovation in user interface and customer experience, with AI-powered recommendations and seamless integration of services becoming increasingly prevalent.

United Kingdom Online Travel Market Market Size (In Billion)

However, the market is not without its challenges. Intense competition among a diverse range of players, from established OTAs like Expedia Group and Booking.com to newer disruptors like Airbnb, necessitates constant innovation and competitive pricing strategies. Economic uncertainties and potential shifts in consumer spending power could also act as a restraint, impacting discretionary travel budgets. Despite these hurdles, the underlying trend of digital transformation in the travel industry, coupled with evolving consumer preferences for flexible and tailored travel solutions, will continue to propel the UK online travel market forward. The market segments are expected to see a dynamic interplay, with vacation packages and travel accommodation likely to dominate, while the shift towards mobile bookings will further solidify the dominance of mobile platforms.

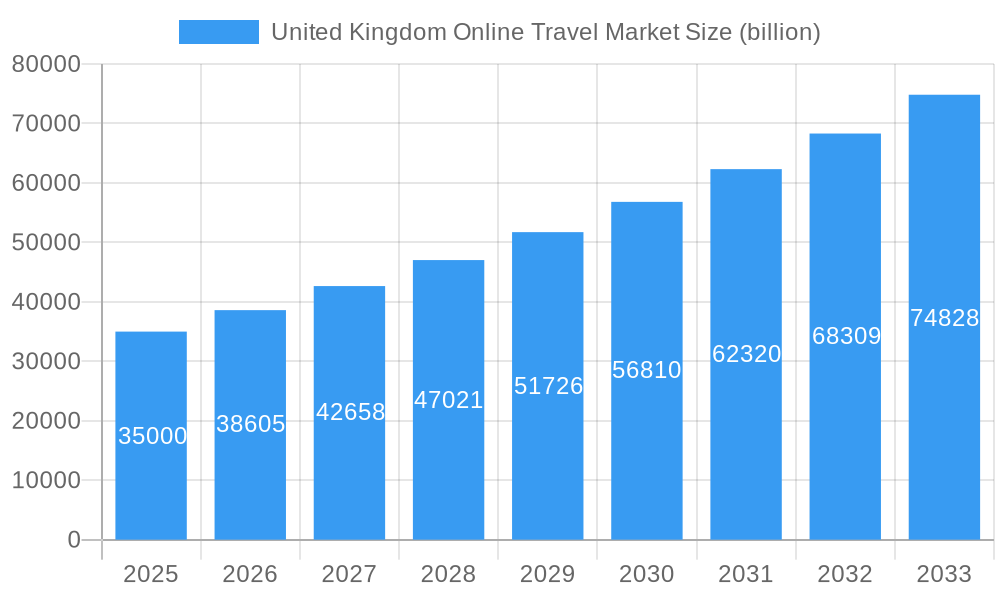

United Kingdom Online Travel Market Company Market Share

United Kingdom Online Travel Market: Comprehensive Report Description

This in-depth report provides a definitive analysis of the United Kingdom Online Travel Market, exploring its intricate dynamics, growth trajectories, and future potential. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report offers unparalleled insights for industry stakeholders. We delve into the parent and child market segments, identifying key drivers, barriers, and emerging opportunities within the broader UK travel landscape. With a focus on high-traffic keywords such as "UK online travel," "travel technology UK," "digital travel booking," and "holiday packages UK," this report is meticulously crafted for maximum search engine visibility and engagement with professionals across the travel, technology, and investment sectors. The study includes quantitative forecasts, market share analyses, and qualitative assessments of competitive strategies and regulatory impacts.

United Kingdom Online Travel Market Market Dynamics & Structure

The United Kingdom Online Travel Market is characterized by a dynamic and evolving structure, influenced by a confluence of factors including technological innovation, evolving consumer preferences, and a competitive regulatory environment. Market concentration varies across different sub-segments, with Online Travel Agencies (OTAs) holding significant sway, though direct bookings with travel suppliers are steadily gaining traction. Technological innovation, particularly in AI-driven personalization and mobile booking platforms, acts as a primary driver, enhancing user experience and expanding market reach. Regulatory frameworks, such as data privacy laws and consumer protection, shape operational strategies and market access. Competitive product substitutes, including traditional travel agents and direct airline/hotel websites, continue to present challenges, necessitating continuous differentiation and value proposition enhancement. End-user demographics are increasingly digital-native, demanding seamless, mobile-first solutions and personalized travel experiences. Merger and acquisition (M&A) trends indicate a consolidation phase, driven by a desire to achieve economies of scale, expand service offerings, and acquire innovative technologies. For instance, the recent acquisition of a leading holiday package provider by a major OTA demonstrates this trend, with an estimated X deals volume in the historical period and a projected CAGR of XX% for M&A activities in the forecast period. Innovation barriers, such as high development costs for advanced AI features and the need for robust cybersecurity measures, are also significant considerations.

- Market Concentration: Moderate to High concentration in OTA segment, increasing fragmentation in niche segments.

- Technological Innovation Drivers: AI-powered recommendations, virtual reality (VR) travel previews, blockchain for secure transactions.

- Regulatory Frameworks: GDPR compliance, ATOL protection for package holidays, competition law oversight.

- Competitive Product Substitutes: Direct airline/hotel websites, emerging niche travel platforms, meta-search engines.

- End-User Demographics: Predominantly digitally savvy millennials and Gen Z, increasing adoption by older demographics.

- M&A Trends: Strategic acquisitions for technology, market share, and service diversification. Estimated M&A value of £XX billion in the historical period.

United Kingdom Online Travel Market Growth Trends & Insights

The United Kingdom Online Travel Market is poised for robust growth, driven by a sustained shift in consumer behavior towards digital booking channels and continuous technological advancements. The market size, estimated at £XX billion in the base year 2025, is projected to expand significantly throughout the forecast period. This expansion is underpinned by increasing internet penetration and smartphone adoption, making online travel booking an increasingly convenient and preferred option. The CAGR for the online travel market in the UK is projected to be XX% from 2025 to 2033, reflecting a sustained upward trajectory. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI) for personalized recommendations, chatbots for instant customer service, and virtual reality (VR) for immersive destination previews enhancing user engagement and conversion rates. Consumer behavior shifts are evident in the growing demand for last-minute deals, bespoke travel experiences, and sustainable travel options. The rise of the "experience economy" has also fueled demand for unique and curated travel packages, further contributing to market growth. Mobile booking continues to dominate, with a projected XX% of bookings to be made via mobile devices by 2033. Adoption rates for digital travel services are high, with an estimated XX% of UK travelers utilizing online platforms for at least one stage of their travel planning and booking process. The market penetration of online travel agencies (OTAs) is expected to reach XX% by 2033, while direct bookings through supplier websites are anticipated to grow at a CAGR of XX%. The increasing reliance on user-generated content and social media for travel inspiration and decision-making also shapes market dynamics, encouraging platforms to integrate social features and influencer marketing. Furthermore, the post-pandemic resurgence in travel, coupled with evolving booking patterns, highlights the resilience and adaptability of the online travel sector in the UK. The overall market is expected to reach £XX billion by 2033.

Dominant Regions, Countries, or Segments in United Kingdom Online Travel Market

Within the United Kingdom Online Travel Market, the Travel Accommodation segment, particularly within major metropolitan areas and popular tourist destinations, stands out as a dominant force driving market growth. This segment, encompassing hotels, vacation rentals, and alternative accommodations, is projected to account for a significant XX% of the total market share in 2025. The dominance of Travel Accommodation is propelled by several key drivers. Firstly, the robust tourism infrastructure across the UK, including historical sites, cultural attractions, and vibrant city life, consistently attracts both domestic and international travelers, creating sustained demand for lodging. Economic policies supporting tourism, such as infrastructure development grants and promotional campaigns, further bolster this segment. The market share for Travel Accommodation is estimated at £XX billion in 2025, with a projected CAGR of XX% during the forecast period.

The growth potential within this segment is further amplified by the increasing adoption of online booking platforms. Online Travel Agencies (OTAs) like Booking.com and Expedia Group, along with direct suppliers such as hotel chains, have established strong online presences, offering a wide array of choices and competitive pricing that appeal to consumers. The ease of comparison and booking through these platforms significantly contributes to the dominance of Travel Accommodation.

The Mobile platform also plays a critical role in this dominance, with a substantial XX% of accommodation bookings made via smartphones and tablets. This trend reflects the convenience and on-the-go accessibility that mobile technology offers to travelers.

Key drivers for the dominance of Travel Accommodation include:

- Strong Tourism Demand: Consistent influx of domestic and international tourists to UK destinations.

- Economic Policies: Government support for tourism through infrastructure and marketing initiatives.

- Digital Infrastructure: High internet penetration and mobile adoption facilitating online bookings.

- Competitive Landscape: Proliferation of OTAs and direct booking channels offering diverse options.

- Consumer Preferences: Growing demand for personalized and flexible accommodation solutions.

While Travel Accommodation leads, other segments like Transportation (flights, trains, car rentals) and Vacation Packages also contribute significantly to the overall market, with Transportation holding an estimated XX% market share and Vacation Packages XX%. The Online Travel Agencies (OTAs) booking type continues to lead with an estimated XX% market share, though Direct Travel Suppliers are experiencing a notable growth of XX% CAGR. The Mobile platform is projected to capture XX% of the market share by 2033.

United Kingdom Online Travel Market Product Landscape

The product landscape of the United Kingdom Online Travel Market is characterized by a surge in innovative digital solutions designed to enhance the entire travel journey. From AI-powered personalized itinerary builders to augmented reality (AR) features for virtual hotel tours and destination exploration, travel technology is rapidly evolving. Unique selling propositions often lie in seamless user experience, integrated booking capabilities across multiple services (flights, accommodation, activities), and robust customer support mechanisms. Technological advancements are also focusing on sustainability initiatives, offering travelers options for eco-friendly travel and carbon offsetting. Performance metrics are increasingly tied to user engagement, conversion rates, and customer satisfaction scores, with platforms like Trivago and Skyscanner leading in user interface and comprehensive search functionalities.

Key Drivers, Barriers & Challenges in United Kingdom Online Travel Market

Key Drivers:

The United Kingdom Online Travel Market is propelled by several significant drivers. Technologically, the ubiquitous use of smartphones and the growing sophistication of AI and machine learning are enabling highly personalized travel experiences and seamless booking processes. Economically, rising disposable incomes and a strong desire for experiential travel are fueling demand. Policy-driven factors, such as government initiatives to boost tourism and investment in digital infrastructure, also provide a supportive environment for growth. The convenience and wide selection offered by online platforms are also crucial in driving adoption.

Barriers & Challenges:

Despite its growth, the market faces several barriers and challenges. Supply chain issues, particularly in the airline industry, can lead to disruptions and affect booking reliability. Regulatory hurdles, including evolving data privacy laws and consumer protection regulations, require constant adaptation from market players. Competitive pressures are intense, with a crowded marketplace leading to price wars and the need for continuous innovation to differentiate offerings. Cybersecurity threats pose a significant risk, potentially eroding consumer trust. The estimated impact of these challenges on market growth could lead to a reduction in CAGR by up to XX% if not effectively mitigated.

Emerging Opportunities in United Kingdom Online Travel Market

Emerging opportunities within the United Kingdom Online Travel Market lie in the burgeoning demand for sustainable and responsible tourism. Travelers are increasingly seeking eco-friendly options, creating a market for platforms that offer curated sustainable travel packages and carbon footprint tracking. The rise of hyper-personalization, powered by AI, presents an opportunity to move beyond generic recommendations to truly bespoke travel experiences tailored to individual preferences and past behavior. Furthermore, untapped markets within niche travel segments, such as adventure tourism, wellness retreats, and educational travel, offer significant growth potential for specialized online platforms. The integration of augmented reality (AR) for immersive destination previews and virtual tours is also an evolving frontier, enhancing booking confidence and customer engagement.

Growth Accelerators in the United Kingdom Online Travel Market Industry

Several key growth accelerators are shaping the future of the United Kingdom Online Travel Market. Technological breakthroughs, particularly in AI-driven personalization and the development of seamless mobile-first booking experiences, are fundamental to attracting and retaining customers. Strategic partnerships between online travel agencies, airlines, and accommodation providers are creating integrated travel ecosystems, offering travelers a more holistic and convenient booking process. Market expansion strategies, including the targeting of new demographic segments and the development of innovative niche travel offerings, are also crucial. The increasing adoption of loyalty programs and personalized loyalty rewards further incentivizes repeat bookings and customer retention, acting as a significant accelerator for sustained growth.

Key Players Shaping the United Kingdom Online Travel Market Market

- Trivago

- Expedia Group

- Dream World Travel

- Skyscanner

- Tripadvisor

- Jet2holidays

- Thomas Cook Group

- Airbnb

- lastminute.com

- Booking

- Hotels.com

Notable Milestones in United Kingdom Online Travel Market Sector

- 2019: Launch of enhanced AI-driven recommendation engines by major OTAs, improving personalized offers.

- 2020 (Q1): Significant impact of the COVID-19 pandemic leading to widespread travel restrictions and a surge in cancellations and refund requests, forcing a shift to flexible booking policies.

- 2020 (Q3): Emergence of "staycation" trend as domestic travel gained traction due to international travel uncertainties.

- 2021 (Q2): Introduction of digital health passports and COVID-19 testing integration by several travel platforms to facilitate re-opening of international travel.

- 2021 (Q4): Increased investment in sustainable travel options and eco-friendly booking filters on leading platforms.

- 2022 (Q1): Resurgence in international travel bookings, with a strong demand for leisure holidays and a rebound in business travel.

- 2022 (Q3): Acquisition of niche travel technology startups by larger players to enhance AI capabilities and mobile user experience.

- 2023 (Q1): Expansion of "buy now, pay later" options for travel bookings, catering to consumer demand for flexible payment solutions.

- 2023 (Q4): Increased focus on personalized vacation packages leveraging user data and AI for tailored recommendations.

- 2024 (Q2): Introduction of innovative AR/VR features for virtual destination exploration and hotel previews.

In-Depth United Kingdom Online Travel Market Market Outlook

The outlook for the United Kingdom Online Travel Market is exceptionally positive, driven by sustained consumer demand for travel and continuous technological innovation. Growth accelerators such as advanced AI for hyper-personalization, the increasing adoption of mobile booking technologies, and the strategic integration of sustainable travel options are set to fuel market expansion. The market is anticipated to witness further consolidation through strategic M&A activities, leading to more integrated and comprehensive travel solutions. The evolving preferences of digitally native consumers, coupled with the ongoing resurgence of both domestic and international tourism, create a fertile ground for new service models and product innovations, ensuring a dynamic and robust growth trajectory through 2033.

United Kingdom Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Others

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

United Kingdom Online Travel Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Online Travel Market Regional Market Share

Geographic Coverage of United Kingdom Online Travel Market

United Kingdom Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Tourism is Driving the Online Travel Market in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trivago

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expedia Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dream World Travel**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skyscanner

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tripadvisor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet2holidays

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hotels com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trivago

List of Figures

- Figure 1: United Kingdom Online Travel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: United Kingdom Online Travel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: United Kingdom Online Travel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Online Travel Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the United Kingdom Online Travel Market?

Key companies in the market include Trivago, Expedia Group, Dream World Travel**List Not Exhaustive, Skyscanner, Tripadvisor, Jet2holidays, Thomas Cook Group, Airbnb, lastminute com, Booking, Hotels com.

3. What are the main segments of the United Kingdom Online Travel Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Tourism is Driving the Online Travel Market in United Kingdom.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Online Travel Market?

To stay informed about further developments, trends, and reports in the United Kingdom Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence