Key Insights

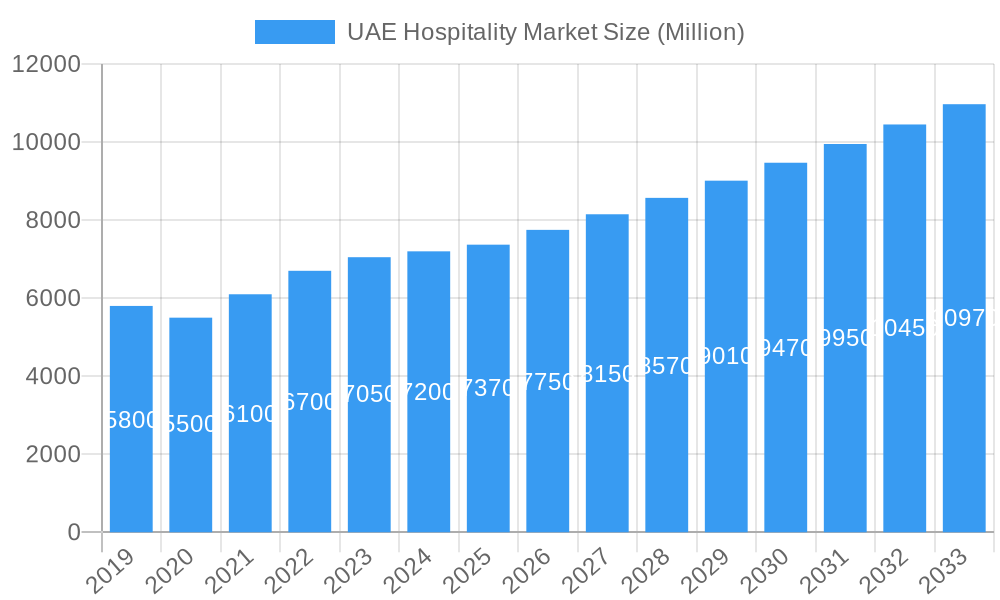

The UAE hospitality market is poised for significant expansion, projected to reach $7.37 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.12% through 2033. This growth is primarily propelled by a strategic focus on tourism diversification, major infrastructure developments, and large-scale events like the Dubai Expo and the ongoing expansion of tourism offerings across the Emirates. The market's dynamism is further fueled by a growing demand for diverse accommodation options, ranging from luxury resorts to budget-friendly stays, catering to a broad spectrum of international and domestic travelers. Investment in world-class hospitality infrastructure, coupled with enhanced visa policies and direct flight connectivity, creates a conducive environment for sustained market penetration and revenue generation.

UAE Hospitality Market Market Size (In Billion)

Key drivers shaping the UAE hospitality landscape include the government's ambitious tourism strategies aimed at attracting a record number of visitors, alongside the consistent influx of business travelers due to the UAE's status as a global commercial hub. Trends such as the increasing popularity of experiential travel, a rising preference for sustainable and eco-friendly accommodations, and the growing adoption of technology to enhance guest experiences are defining the sector's evolution. While the market benefits from strong government support and a well-developed tourism ecosystem, potential restraints include geopolitical uncertainties and intense competition. The market's segmentation into various hotel types and price points reflects a mature industry capable of meeting diverse consumer needs and preferences, with major players actively engaging in loyalty programs to foster customer retention and market leadership.

UAE Hospitality Market Company Market Share

UAE Hospitality Market Report: Growth, Trends, and Competitive Landscape (2019-2033)

This comprehensive report offers an in-depth analysis of the UAE hospitality market, a dynamic sector poised for significant expansion. Delving into market dynamics, growth trends, and the competitive landscape, this report provides actionable insights for stakeholders, investors, and industry professionals. With a study period spanning from 2019 to 2033, including a base year of 2025, the analysis covers historical performance, current estimations, and future projections. The report meticulously examines various market segments, including chain hotels, service apartments, and independent hotels, alongside budget and economy hotels, mid and upper mid-scale hotels, and luxury hotels. Discover the strategies and innovations that are shaping the future of Dubai hospitality, Abu Dhabi tourism, and the broader GCC hotel industry.

UAE Hospitality Market Market Dynamics & Structure

The UAE hospitality market is characterized by a moderate to high level of concentration, with major international and regional players dominating. Technological innovation is a key driver, with increasing adoption of smart hotel technologies, AI-powered guest services, and advanced booking platforms. Regulatory frameworks, while generally supportive of tourism, present evolving compliance requirements. Competitive product substitutes, such as short-term rental platforms, exert pressure on traditional hotel offerings. End-user demographics are diverse, encompassing leisure tourists, business travelers, and expatriates, each with distinct preferences and spending habits. Mergers and acquisitions (M&A) trends indicate consolidation, with larger entities acquiring smaller players to expand their portfolios and market reach.

- Market Concentration: Dominated by a few key international and regional hotel brands.

- Technological Innovation: Driven by smart room technologies, AI, and digital guest experiences.

- Regulatory Frameworks: Evolving compliance for licensing, sustainability, and operational standards.

- Competitive Substitutes: Growing influence of alternative accommodation platforms.

- End-User Demographics: Diverse mix of leisure, business, and long-stay guests.

- M&A Trends: Strategic acquisitions to enhance market share and service offerings.

UAE Hospitality Market Growth Trends & Insights

The UAE hospitality market has demonstrated robust growth, fueled by strategic government initiatives promoting tourism and diversified economic development. The market size has evolved significantly, with increasing adoption rates of modern hospitality solutions and a growing preference for personalized guest experiences. Technological disruptions, such as the integration of the Internet of Things (IoT) in hotels and the rise of contactless services, are reshaping operational efficiency and guest satisfaction. Consumer behavior shifts, including a growing demand for sustainable tourism, wellness offerings, and unique experiential stays, are influencing hotel development and service design. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, driven by a steady influx of international visitors and a thriving business environment. The penetration of branded hotels, especially in the mid-scale and luxury segments, continues to expand, reflecting the discerning tastes of travelers to the region.

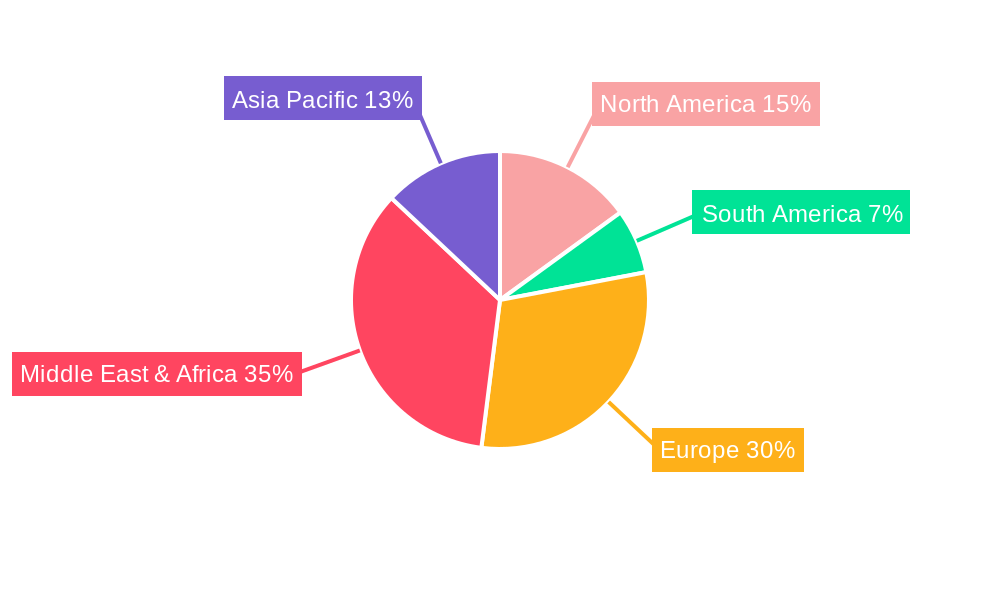

Dominant Regions, Countries, or Segments in UAE Hospitality Market

Dubai consistently emerges as the dominant emirate within the UAE hospitality market, driven by its status as a global tourism and business hub. The emirate's strategic location, world-class infrastructure, and consistent pipeline of mega-events attract a significant volume of international visitors.

Dominant Type: Chain Hotels

- Drivers: Brand recognition, standardized service quality, extensive loyalty programs, and integrated marketing efforts by major global hotel corporations. These chains often offer a wider range of amenities and services catering to diverse traveler needs.

- Market Share: Chain hotels represent a substantial portion of the overall hotel inventory, estimated at over xx% of total rooms in key tourist destinations.

- Growth Potential: Continuous expansion and rebranding efforts by major players, focusing on diversified offerings and niche markets.

Dominant Segment: Luxury Hotels

- Drivers: High disposable income of international tourists, demand for premium experiences, iconic architecture and design, and exclusive services. The UAE is renowned for its ultra-luxury hospitality offerings that cater to an affluent clientele.

- Market Share: While representing a smaller percentage of total room inventory compared to mid-scale, luxury hotels command higher Average Daily Rates (ADR) and RevPAR, significantly contributing to market revenue.

- Growth Potential: Ongoing development of new luxury properties and the introduction of ultra-luxury brands, further solidifying the UAE's position as a premier luxury destination.

The sustained investment in infrastructure, including airports and transportation networks, coupled with proactive government policies aimed at boosting tourism arrivals and encouraging foreign investment, further cements the dominance of these segments and regions. The development of new leisure and entertainment destinations also plays a crucial role in attracting and retaining visitors, contributing to the sustained growth trajectory of the UAE hospitality sector.

UAE Hospitality Market Product Landscape

The UAE hospitality market is distinguished by a landscape rich in product innovation and diverse applications. Hotels are increasingly integrating smart technologies, offering guests personalized experiences through AI-driven services, smart room controls, and customized digital concierge platforms. Applications range from seamless check-in/check-out processes to personalized dining recommendations and in-room entertainment systems. Performance metrics are evolving to encompass guest satisfaction scores, operational efficiency gains through automation, and the adoption of sustainable practices, such as energy-efficient systems and waste reduction initiatives. Unique selling propositions often revolve around exceptional guest service, unique F&B concepts, and the integration of local culture with international standards, ensuring a memorable and differentiated stay for every traveler.

Key Drivers, Barriers & Challenges in UAE Hospitality Market

Key Drivers:

- Government Support & Vision: Proactive government initiatives to boost tourism, diversify the economy, and attract foreign investment, exemplified by long-term tourism strategies and visa facilitation.

- Infrastructure Development: World-class airports, transportation networks, and the continuous expansion of leisure and entertainment facilities.

- Global Events & Exhibitions: Hosting major international events, conferences, and sporting tournaments that drive significant visitor influx.

- Diverse Attractions: A broad spectrum of attractions, from cultural heritage sites to futuristic entertainment complexes, catering to a wide range of traveler interests.

Barriers & Challenges:

- Global Economic Volatility: Potential impact of global economic downturns on international travel spending and demand.

- Intense Competition: A highly competitive market with a significant number of established and emerging players vying for market share.

- Talent Acquisition & Retention: Challenges in attracting and retaining skilled hospitality professionals in a growing and demanding industry.

- Geopolitical Instability: Potential impact of regional or global geopolitical events on traveler confidence and inbound tourism.

- Sustainability Demands: Increasing pressure to adopt and implement sustainable practices across operations, requiring significant investment and operational adjustments.

Emerging Opportunities in the UAE Hospitality Market Industry

Emerging opportunities in the UAE hospitality market are centered on niche segments and evolving consumer preferences. The rise of wellness tourism presents a significant avenue for growth, with demand for spa treatments, healthy culinary options, and holistic experiences. The "bleisure" trend, blending business and leisure travel, offers opportunities for hotels to cater to remote workers with co-working spaces and extended stay packages. Furthermore, the increasing popularity of experiential travel, focusing on authentic cultural immersion and unique adventure activities, opens doors for boutique hotels and specialized tour operators. The growing expat population also presents a consistent demand for serviced apartments and extended-stay accommodations, creating a stable revenue stream for providers in this segment.

Growth Accelerators in the UAE Hospitality Market Industry

Several catalysts are accelerating growth in the UAE hospitality market. Technological breakthroughs, such as the pervasive integration of AI for personalized guest services and the adoption of big data analytics for enhanced operational efficiency, are significantly improving guest experiences and profitability. Strategic partnerships between hotel groups, airlines, and tourism boards are crucial for joint marketing campaigns and package deals, expanding reach and attracting new markets. Market expansion strategies, including the development of new hotel brands catering to specific demographics and the entry into emerging tourist source markets, are further fueling growth. The continuous diversification of the UAE's tourism offerings, moving beyond traditional attractions to encompass cultural tourism, adventure sports, and MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, is also a major growth accelerator.

Key Players Shaping the UAE Hospitality Market Market

- Accor S A

- Danat Hotels & Resorts

- Majid Al Futtaim

- Al Habtoor Group

- Marriott International

- Rotana Hotels

- Hilton Worldwide Holdings

- DAMAC Group

- Jumeirah Hotels & Resort

- Abu Dhabi National Hotels

- Hyatt Hotel Corporation

- Emaar Hospitality Group

Notable Milestones in UAE Hospitality Market Sector

- April 2023: Dubai-based Hospitality Management Holding (HMH) Group announced plans to launch 18 new hotels during the Arabian Travel Market (ATM-2023). The group aimed to showcase its regional projects, sign new partnerships, and reveal future strategies and international expansion plans. HMH currently manages 13 hotels and resorts with an inventory of 2,032 rooms.

- March 2023: IHG Hotels & Resorts opened Voco Dubai The Palm, a new beachfront hotel on Palm Jumeirah. This hotel features 138 rooms and two dining options, including Maison Mathis (European restaurant) and Frenia (rooftop pool bar).

In-Depth UAE Hospitality Market Market Outlook

The UAE hospitality market is poised for sustained and robust growth, driven by a forward-thinking vision and continuous investment in its tourism infrastructure and offerings. Future market potential lies in further diversifying tourist experiences, with a growing emphasis on cultural tourism, eco-tourism, and niche luxury segments. Strategic opportunities will emerge from leveraging technology to create hyper-personalized guest journeys and enhancing operational sustainability. The market will continue to benefit from strong governmental support for tourism and a commitment to attracting both leisure and business travelers. Expansion into emerging source markets and the development of unique, value-driven propositions will be key to maintaining its competitive edge and solidifying its position as a premier global hospitality destination.

UAE Hospitality Market Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Service Apartments

- 1.3. Independent Hotels

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper mid scale Hotels

- 2.3. Luxury Hotels

UAE Hospitality Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Hospitality Market Regional Market Share

Geographic Coverage of UAE Hospitality Market

UAE Hospitality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector

- 3.3. Market Restrains

- 3.3.1. High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector

- 3.4. Market Trends

- 3.4.1. Rising Tourism in the United Arab Emirates Bolsters the Growth Hospitality Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Service Apartments

- 5.1.3. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper mid scale Hotels

- 5.2.3. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Service Apartments

- 6.1.3. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Budget and Economy Hotels

- 6.2.2. Mid and Upper mid scale Hotels

- 6.2.3. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Service Apartments

- 7.1.3. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Budget and Economy Hotels

- 7.2.2. Mid and Upper mid scale Hotels

- 7.2.3. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Service Apartments

- 8.1.3. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Budget and Economy Hotels

- 8.2.2. Mid and Upper mid scale Hotels

- 8.2.3. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Service Apartments

- 9.1.3. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Budget and Economy Hotels

- 9.2.2. Mid and Upper mid scale Hotels

- 9.2.3. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Service Apartments

- 10.1.3. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Budget and Economy Hotels

- 10.2.2. Mid and Upper mid scale Hotels

- 10.2.3. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accor S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danat Hotels & Resorts*List Not Exhaustive 6 3 Loyalty Programs Offered By Major Hotel Brand

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Majid Al Futtaim

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Habtoor Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marriott International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rotana Hotels

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hilton Worldwide Holdings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAMAC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jumeirah Hotels & Resort

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Abu Dhabi National Hotels

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hyatt Hotel Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Emaar Hospitality Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Accor S A

List of Figures

- Figure 1: Global UAE Hospitality Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Hospitality Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UAE Hospitality Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Hospitality Market Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America UAE Hospitality Market Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America UAE Hospitality Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAE Hospitality Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Hospitality Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America UAE Hospitality Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UAE Hospitality Market Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America UAE Hospitality Market Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America UAE Hospitality Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UAE Hospitality Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Hospitality Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe UAE Hospitality Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UAE Hospitality Market Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe UAE Hospitality Market Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe UAE Hospitality Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UAE Hospitality Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Hospitality Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UAE Hospitality Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UAE Hospitality Market Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa UAE Hospitality Market Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa UAE Hospitality Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Hospitality Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Hospitality Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific UAE Hospitality Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UAE Hospitality Market Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific UAE Hospitality Market Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific UAE Hospitality Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Hospitality Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global UAE Hospitality Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global UAE Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global UAE Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global UAE Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global UAE Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UAE Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global UAE Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Hospitality Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Hospitality Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the UAE Hospitality Market?

Key companies in the market include Accor S A, Danat Hotels & Resorts*List Not Exhaustive 6 3 Loyalty Programs Offered By Major Hotel Brand, Majid Al Futtaim, Al Habtoor Group, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles, Marriott International, Rotana Hotels, Hilton Worldwide Holdings, DAMAC Group, Jumeirah Hotels & Resort, Abu Dhabi National Hotels, Hyatt Hotel Corporation, Emaar Hospitality Group.

3. What are the main segments of the UAE Hospitality Market?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector.

6. What are the notable trends driving market growth?

Rising Tourism in the United Arab Emirates Bolsters the Growth Hospitality Sector.

7. Are there any restraints impacting market growth?

High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector.

8. Can you provide examples of recent developments in the market?

April 2023: Dubai-based Hospitality Management Holding (HMH) Group set to launch 18 new hotels in the Arabian Travel Market, During its participation in the ATM-2023, the Group will showcase its projects in the hospitality sector across the region and sign new partnership agreements. The Group will utilize the platform to show its future strategies and expansion plans into foreign markets. The HMH Group manages 13 hotels and resorts in and outside the UAE market, with a total inventory of 2032 rooms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Hospitality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Hospitality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Hospitality Market?

To stay informed about further developments, trends, and reports in the UAE Hospitality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence