Key Insights

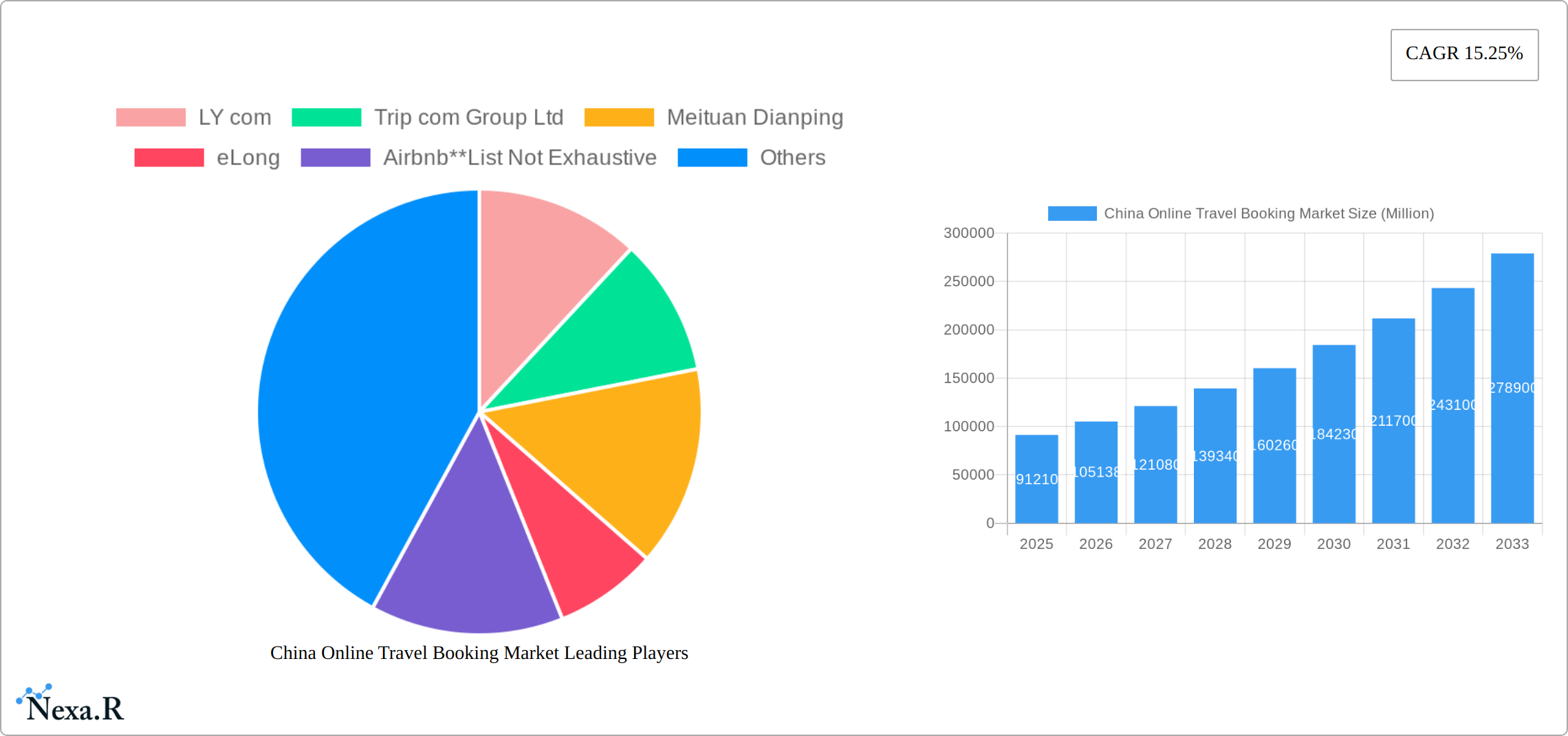

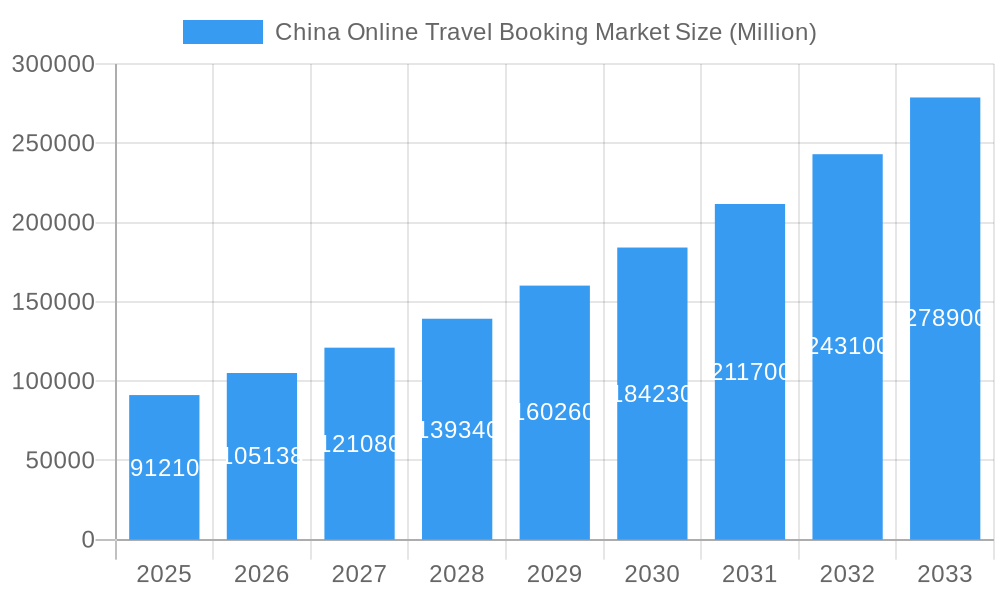

The China online travel booking market, a dynamic and rapidly expanding sector, is projected to reach a substantial size driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient online booking platforms. The market's Compound Annual Growth Rate (CAGR) of 15.25% from 2019 to 2024 indicates significant growth momentum. This robust growth is fueled by several key drivers: a burgeoning middle class with increased travel budgets, the expanding popularity of mobile travel apps, and the continuous improvement of online travel platforms offering diverse and competitive travel packages. The market is segmented by booking mode (direct booking vs. travel agents), platform (desktop vs. mobile/tablet), and service type (accommodation, tickets, holiday packages, and other services). While direct bookings are gaining traction, travel agents continue to hold a significant market share, particularly for complex or customized travel arrangements. Mobile booking is rapidly overtaking desktop booking, reflecting the pervasive use of smartphones in China. Accommodation and holiday package bookings are the largest segments, showcasing the importance of integrated travel planning and booking. Leading players like LY.com, Trip.com Group, and Meituan Dianping, along with other significant companies like Airbnb (though it may have a smaller market share compared to domestic players), are competing intensely in this market, striving for dominance through technological innovation, extensive product offerings, and aggressive marketing strategies.

China Online Travel Booking Market Market Size (In Billion)

Looking forward, the market's sustained growth is expected to be moderated somewhat by factors such as intensifying competition, economic fluctuations, and the potential impact of government regulations. However, the underlying factors driving the market, such as increased consumer spending and technological advancements, remain strong. The continued focus on user experience, personalized travel recommendations, and seamless booking processes will be crucial for companies seeking to maintain a competitive edge. The diversification of travel services offered online will also play a significant role in future market expansion. The forecast period of 2025-2033 suggests a continued trajectory of growth, though the CAGR might slightly adjust based on macroeconomic conditions and specific market developments. The market's segmentation offers ample opportunities for specialized players to cater to specific niches and gain market share.

China Online Travel Booking Market Company Market Share

China Online Travel Booking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic China online travel booking market, encompassing market size, growth trends, competitive landscape, and future outlook. With a focus on key players like LY.com, Trip.com Group Ltd, Meituan Dianping, eLong, Airbnb, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, and Lvmama (list not exhaustive), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year.

China Online Travel Booking Market Market Dynamics & Structure

This section provides a comprehensive analysis of the dynamic structure of China's online travel booking market. We examine key aspects including market concentration, technological innovation, regulatory influences, competitive forces, and mergers & acquisitions (M&A) activity, supported by robust quantitative and qualitative data. The analysis encompasses both the broader online travel market and the specific nuances of the Chinese online travel booking sector. We will present market share data, M&A deal volumes (in millions of units where applicable), and a detailed examination of the factors driving market evolution.

- Market Concentration and Competitive Landscape: A detailed analysis of market share held by key players, identifying dominant firms and evaluating the intensity of competition. We will quantify the market share controlled by the top 5 players in 2024, examining their strategies and competitive advantages. Porter's Five Forces framework will be applied to understand the competitive dynamics.

- Technological Innovation and Disruption: We explore the transformative impact of technological advancements, including AI-powered recommendation engines, VR/AR experiences, personalized travel planning tools, and blockchain for secure transactions. We will analyze innovation barriers and the crucial role of fintech in shaping the market landscape, highlighting specific examples of innovative technologies adopted by leading players.

- Regulatory Framework and Policy Impacts: A thorough assessment of government regulations impacting market growth, including licensing requirements, data privacy regulations, cybersecurity standards, and consumer protection laws. We will analyze the impact of these regulations on market participants and their strategies.

- Competitive Substitutes and Market Threats: Identification and analysis of substitute products or services, such as offline travel agencies, niche online platforms, and direct-to-consumer offerings from hotels and airlines. We assess the competitive pressure from these substitutes and their potential impact on market share.

- End-User Demographics and Travel Behavior: A deep dive into the demographics of Chinese online travel bookers, including age, income, location, travel preferences, booking behaviors, and motivations. We will segment the market based on these factors, identifying key user segments and their impact on market demand.

- Mergers & Acquisitions (M&A) Activity: A comprehensive review of recent M&A activity in the Chinese online travel booking market, including deal values, strategic rationale, and implications for market consolidation. We will present data on the number and value of M&A deals recorded between 2019 and 2024, analyzing their impact on the competitive landscape.

China Online Travel Booking Market Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, leveraging proprietary data and industry benchmarks. It examines market size evolution (in Millions of units), adoption rates, technological disruptions, and shifts in consumer behavior, offering specific metrics such as compound annual growth rate (CAGR) and market penetration. This analysis will cover the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The total market size is projected to reach xx Million units by 2033.

Dominant Regions, Countries, or Segments in China Online Travel Booking Market

This section identifies the leading regions, countries, or segments within the Chinese online travel booking market, analyzing growth drivers and future potential. Segmentation will be based on booking mode, platform, and service type, providing a granular understanding of market dynamics.

- By Mode of Booking: A detailed comparison of direct booking and bookings through travel agents, highlighting the growth trajectory of each segment, including the influence of technological advancements and consumer preferences.

- By Platform: A comprehensive analysis of market share and growth rates for desktop and mobile/tablet platforms. We will project the future dominance of mobile booking, providing a quantified estimate of market share by 2033, supported by relevant data and analysis.

- By Service Type: An in-depth assessment of the relative importance and growth rates of accommodation, travel tickets, holiday packages, and other services, identifying the fastest-growing segments and the factors driving their success.

China Online Travel Booking Market Product Landscape

This section examines product innovations, applications, and performance metrics within the market. We will highlight unique selling propositions (USPs) and technological advancements that are shaping the competitive landscape. The focus will be on features such as personalized recommendations, seamless booking processes, and innovative payment options.

Key Drivers, Barriers & Challenges in China Online Travel Booking Market

This section analyzes the key factors driving market growth, including technological advancements (e.g., AI, big data), economic factors (e.g., rising disposable income, changing travel patterns), and supportive government policies. Conversely, we will examine significant challenges and restraints, such as supply chain disruptions, intensified competition, cybersecurity threats, regulatory hurdles, and evolving consumer expectations. We will quantify the impact of these challenges on market growth.

Emerging Opportunities in China Online Travel Booking Market

This section explores emerging trends and opportunities, such as untapped markets (e.g., niche tourism segments), innovative applications (e.g., personalized travel itineraries), and evolving consumer preferences (e.g., sustainable travel).

Growth Accelerators in the China Online Travel Booking Market Industry

This section explores factors poised to accelerate long-term growth within the industry, including technological breakthroughs (e.g., personalized AI-driven travel recommendations, seamless integration with other platforms), strategic partnerships (e.g., collaborations between OTAs and airlines, hotels, and other travel service providers), and expansion strategies into underserved markets (e.g., targeting niche travel segments or exploring new geographical regions).

Key Players Shaping the China Online Travel Booking Market Market

- LY.com

- Trip.com Group Ltd

- Meituan Dianping

- eLong

- Airbnb

- Fliggy

- Tuniu

- Didi Chuxing

- Qunar

- Mafengwo

- Lvmama

Notable Milestones in China Online Travel Booking Market Sector

- July 2021: Trip.com became the first OTA to offer Eurail and Interrail passes via its app, significantly expanding its international reach and product offerings.

- February 2022: CWT launched myCWT, a business travel platform in China, highlighting the increasing demand for tailored business travel solutions within the market.

- [Add more recent milestones here with brief descriptions and analysis of their impact]

In-Depth China Online Travel Booking Market Market Outlook

This section summarizes the key growth accelerators and offers a concise outlook on the future market potential, including strategic opportunities for businesses to capitalize on emerging trends and evolving consumer demands. The report concludes with a discussion of the potential for continued strong growth in the coming years, driven by factors such as increasing smartphone penetration, rising disposable incomes, and the government’s ongoing support for the tourism sector.

China Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

China Online Travel Booking Market Segmentation By Geography

- 1. China

China Online Travel Booking Market Regional Market Share

Geographic Coverage of China Online Travel Booking Market

China Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in China is Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LY com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trip com Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan Dianping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eLong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbnb**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fliggy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tuniu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Didi Chuxing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qunar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mafengwo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lvmama

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LY com

List of Figures

- Figure 1: China Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: China Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 7: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: China Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Travel Booking Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the China Online Travel Booking Market?

Key companies in the market include LY com, Trip com Group Ltd, Meituan Dianping, eLong, Airbnb**List Not Exhaustive, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, Lvmama.

3. What are the main segments of the China Online Travel Booking Market?

The market segments include Service Type, Mode of Booking, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in China is Helping in Market Expansion.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: CWT launched myCWT, a flagship platform in China aimed at simplifying business travel for companies and employees. CWT is a global B2B4E travel management specialist based in the United States. The myCWT platform offers extensive international and domestic travel content, including rail, flights, hotels, and ground transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the China Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence