Key Insights

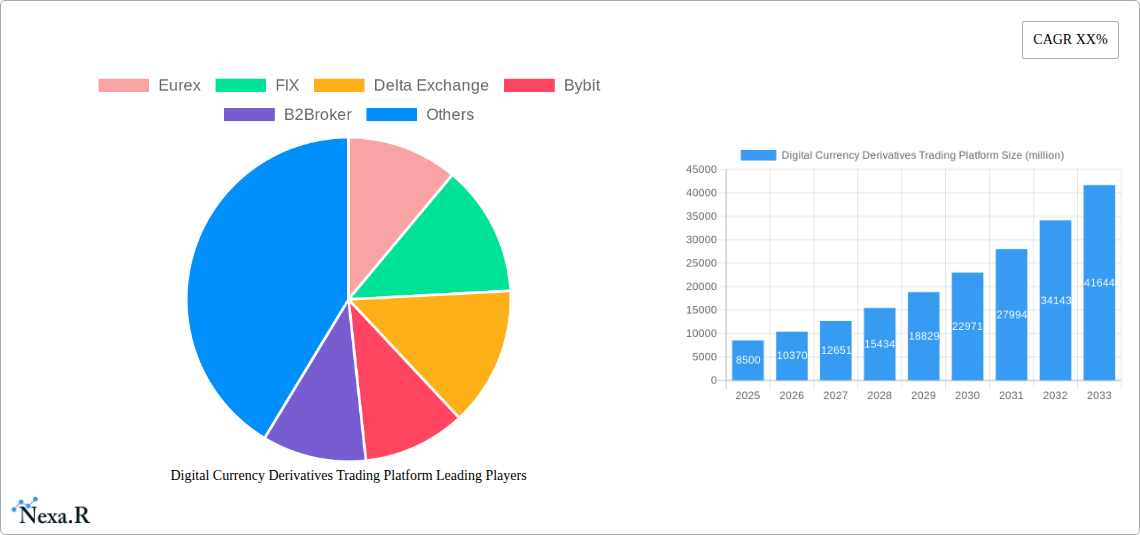

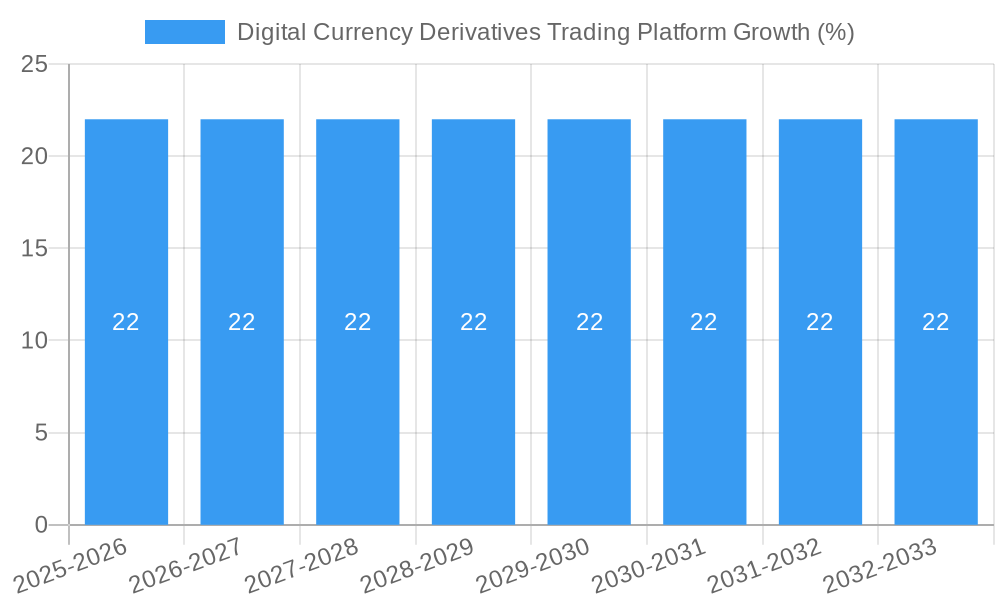

The global Digital Currency Derivatives Trading Platform market is experiencing robust expansion, projected to reach an estimated USD 8,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 22% through 2033. This significant growth is propelled by an increasing appetite for sophisticated trading instruments among both retail and professional investors. Retail investors are actively seeking avenues to hedge against the inherent volatility of digital assets and to leverage their positions for amplified returns, while professional investors are drawn to the efficiency and risk management capabilities offered by derivatives. The increasing sophistication of trading platforms, characterized by enhanced user interfaces, advanced analytical tools, and secure trading environments, further fuels adoption. Key drivers include the growing institutional acceptance of cryptocurrencies, the development of regulatory frameworks that lend legitimacy to digital asset trading, and the continuous innovation in derivative products such as futures, options, and perpetual swaps tailored for the unique characteristics of digital currencies. The market is poised for substantial value creation, with significant potential for innovation and market penetration across various investor segments.

The landscape of digital currency derivatives trading is being shaped by dynamic trends, including the rise of decentralized finance (DeFi) platforms and a burgeoning demand for regionalized trading solutions that cater to specific market needs and regulatory environments. While global platforms continue to dominate, regional platforms are gaining traction by offering localized support, tailored product offerings, and compliance with distinct jurisdictional regulations. The market is not without its challenges, however. Regulatory uncertainty across different jurisdictions remains a significant restraint, creating complexities for platform operators and investors alike. Furthermore, the inherent volatility and security risks associated with digital assets necessitate robust risk management protocols and investor education initiatives. Despite these hurdles, the continuous evolution of technology, including advancements in blockchain and trading infrastructure, alongside the increasing integration of digital currency derivatives into mainstream financial markets, signals a bright future for this rapidly evolving sector. Key players like Binance, Deribit, and Coinbase are actively expanding their offerings and geographical reach, intensifying competition and driving innovation.

Absolutely! Here is a compelling, SEO-optimized report description for your "Digital Currency Derivatives Trading Platform" report, meticulously crafted for maximum visibility and industry engagement.

Digital Currency Derivatives Trading Platform Market Dynamics & Structure

The global digital currency derivatives trading platform market is characterized by dynamic evolution and increasing sophistication, driven by technological innovation and evolving investor demand. Market concentration is moderate, with leading global platforms holding significant sway, while regional players carve out niche markets. Technological advancements, particularly in blockchain infrastructure and AI-powered trading tools, are pivotal drivers, enabling enhanced security, faster transaction speeds, and more complex derivative products. Regulatory frameworks, though still developing, are crucial in shaping market access and investor protection, with varying approaches across jurisdictions influencing platform strategies. Competitive product substitutes include traditional financial derivatives and evolving DeFi solutions, pushing platforms to continuously innovate. End-user demographics are diversifying, encompassing both retail investors seeking accessible trading avenues and professional investors demanding sophisticated tools and high liquidity. Mergers and acquisitions (M&A) activity is a key feature, as larger platforms seek to expand their offerings, market reach, and technological capabilities. For instance, the sector has seen a surge in strategic alliances and acquisitions aimed at consolidating market share and acquiring innovative technologies.

- Market Concentration: Moderate, with dominance by a few global platforms and a growing number of specialized regional players.

- Technological Innovation: Driven by blockchain advancements, AI integration, and the development of new derivative instruments.

- Regulatory Landscape: Fragmented, with ongoing efforts to establish clearer guidelines impacting platform operations and product offerings.

- Competitive Substitutes: Traditional financial derivatives, decentralized finance (DeFi) protocols, and evolving alternative investment products.

- End-User Demographics: Expanding to include both retail traders and institutional investors.

- M&A Trends: Increasing activity as established players acquire innovative startups and expand service portfolios.

Digital Currency Derivatives Trading Platform Growth Trends & Insights

The digital currency derivatives trading platform market is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately 18.5% from 2025 to 2033. The estimated market size for 2025 is valued at $150 million, with expectations to reach $400 million by the end of the forecast period. This significant growth is underpinned by several key trends: the escalating adoption of digital assets as a recognized asset class, increased demand for hedging and speculative trading opportunities, and the maturation of the underlying blockchain technology, offering enhanced security and efficiency. Market penetration, particularly among retail investors, is rapidly accelerating due to the user-friendliness of modern trading platforms and the allure of high-yield potential. Technological disruptions, such as the integration of sophisticated trading algorithms, lightning-fast execution speeds, and the development of novel derivative products like perpetual futures and options on a wider array of cryptocurrencies, are further fueling this growth. Consumer behavior is shifting towards a greater acceptance of digital asset trading, driven by growing awareness, educational resources, and the increasing accessibility of these platforms. The average trading volume is expected to see a consistent upward trajectory, influenced by market volatility and the introduction of new trading instruments. Furthermore, the growing institutional interest in crypto derivatives, seeking diversification and risk management strategies, is a significant contributor to market expansion. The development of more intuitive interfaces and comprehensive analytical tools is also widening the appeal to a broader investor base, including those with less prior experience in financial markets.

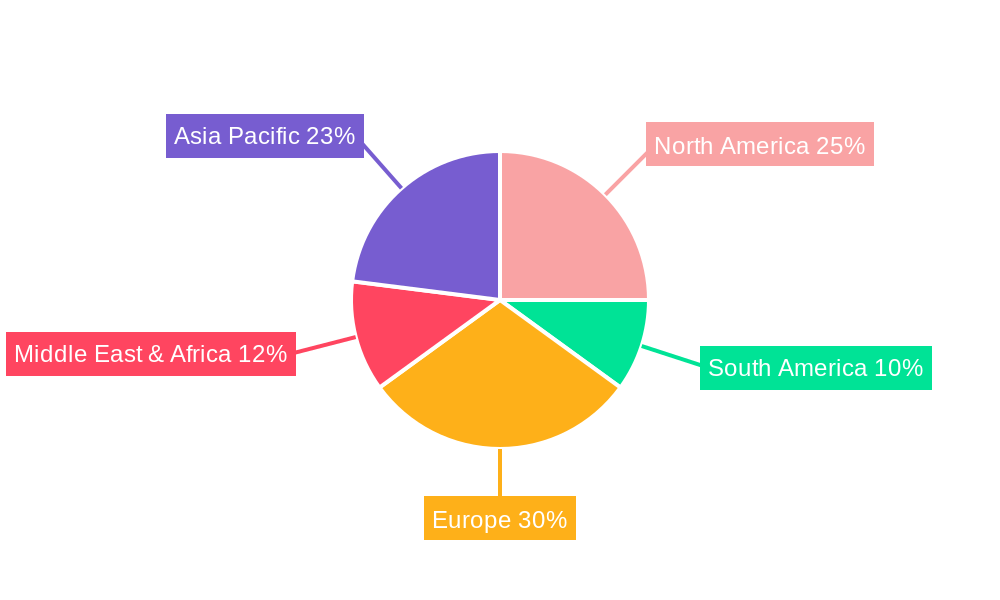

Dominant Regions, Countries, or Segments in Digital Currency Derivatives Trading Platform

The digital currency derivatives trading platform market exhibits distinct regional strengths and segment dominance, with Global Platforms and Professional Investors emerging as the primary growth engines. The global nature of cryptocurrency markets allows platforms that offer broad accessibility and a comprehensive suite of products to capture a significant share of the market. These global platforms, such as Binance and Bybit, are characterized by their extensive liquidity, diverse derivative offerings, and regulatory compliance in key markets, enabling them to attract a vast user base. The growth in this segment is propelled by the inherent interconnectedness of the digital asset ecosystem, where cross-border trading is the norm.

Professional Investors represent a crucial segment driving market expansion. This group, including hedge funds, proprietary trading firms, and institutional asset managers, demands high liquidity, advanced trading tools, robust risk management features, and institutional-grade security. Platforms like Deribit and Eurex, which cater specifically to this sophisticated clientele, are witnessing substantial growth due to their ability to meet these stringent requirements. The increasing acceptance of digital assets by traditional financial institutions further bolsters the demand from this segment. The total value of derivatives traded by professional investors is projected to reach over $300 million by 2025, a substantial portion of the overall market.

Key drivers for the dominance of global platforms and professional investors include:

- High Liquidity: Essential for professional traders to execute large orders without significant price slippage, with global platforms often offering the deepest liquidity pools.

- Advanced Trading Tools: Sophisticated charting, algorithmic trading capabilities, and API access are crucial for professional investors.

- Regulatory Clarity (in key jurisdictions): Platforms operating in regions with clearer regulatory frameworks tend to attract more institutional capital.

- Product Innovation: The continuous introduction of new and complex derivative instruments, such as options on futures and leveraged tokens, appeals to the sophisticated needs of professional investors.

- Risk Management Features: Robust margin systems, liquidation protocols, and insurance funds are paramount for professional traders.

While regional platforms cater to specific market needs and regulatory environments, the overarching trend favors global accessibility and the specialized demands of institutional and experienced traders. The market share for global platforms is estimated to be around 70% in terms of trading volume, with professional investors accounting for approximately 60% of the total derivative contract value traded. The growth potential for these dominant segments remains exceptionally high as the digital asset space matures and gains wider institutional acceptance.

Digital Currency Derivatives Trading Platform Product Landscape

The digital currency derivatives trading platform product landscape is evolving rapidly with innovations focused on enhancing trading efficiency, accessibility, and product diversity. Key product developments include the expansion of perpetual futures and options contracts across a wider range of cryptocurrencies, offering investors flexible hedging and speculative opportunities. Leveraged tokens and structured products are also gaining traction, providing tailored risk-reward profiles for different investor appetites. Platforms like Deribit and Bybit are at the forefront, offering highly sophisticated trading interfaces with advanced charting tools and order types. Innovations in smart contract-based derivatives, exemplified by protocols like dFuture and Hegic, are enabling decentralized and transparent trading experiences. Performance metrics like low latency execution, high uptime, and robust security infrastructure are crucial differentiators, with platforms striving to achieve millisecond-level trade execution.

Key Drivers, Barriers & Challenges in Digital Currency Derivatives Trading Platform

Key Drivers:

The digital currency derivatives trading platform market is propelled by several key drivers, including the increasing demand for hedging against cryptocurrency price volatility, the growing acceptance of digital assets as a legitimate investment class, and the pursuit of higher returns through leverage. Technological advancements in blockchain, enabling faster settlement and more complex financial instruments, also play a significant role. Furthermore, the expanding user base of cryptocurrencies globally, encompassing both retail and professional investors, creates a larger addressable market.

Barriers & Challenges:

Despite strong growth, the market faces significant barriers and challenges. Regulatory uncertainty and fragmentation across different jurisdictions remain a major hurdle, impacting platform operations and investor confidence. The inherent volatility of underlying digital assets poses substantial risks to traders. Moreover, the need for robust cybersecurity measures to protect against hacks and fraud requires continuous investment. Intense competition among platforms, coupled with the high costs associated with compliance and technological development, also presents ongoing challenges.

Emerging Opportunities in Digital Currency Derivatives Trading Platform

Emerging opportunities lie in the development of more sophisticated and regulated derivatives products that cater to institutional demand, such as tokenized real-world asset derivatives. The expansion into emerging markets with less developed financial infrastructure, where digital assets can offer a more accessible alternative, presents a significant growth avenue. Innovations in decentralized finance (DeFi) derivatives, offering greater transparency and reduced reliance on intermediaries, are poised to capture a growing market share. Furthermore, the integration of artificial intelligence for enhanced risk management and personalized trading strategies offers a competitive edge.

Growth Accelerators in the Digital Currency Derivatives Trading Platform Industry

Growth in the digital currency derivatives trading platform industry is significantly accelerated by technological breakthroughs, strategic partnerships, and aggressive market expansion strategies. The ongoing development of Layer 2 scaling solutions for blockchain networks dramatically improves transaction speeds and reduces costs, making derivatives trading more viable and attractive. Strategic partnerships between established financial institutions and crypto derivative platforms, such as potential collaborations involving exchanges like Binance and traditional financial players, are crucial for onboarding institutional capital and enhancing credibility. Market expansion efforts, including targeting underserved regions and offering localized trading experiences, are also critical catalysts for sustained growth.

Key Players Shaping the Digital Currency Derivatives Trading Platform Market

- Eurex

- FIX

- Delta Exchange

- Bybit

- B2Broker

- StormGain

- Bingbon

- Phemex

- CoinTiger

- Binance

- Deribit

- Coinbase

- Lever Network

- dFuture

- Hegic

- Deri Protocol

- Perpetual

Notable Milestones in Digital Currency Derivatives Trading Platform Sector

- 2019: Launch of enhanced perpetual futures contracts by platforms like BitMEX, setting a new standard for crypto derivatives.

- 2020: Increased institutional interest in crypto derivatives, leading to higher trading volumes on exchanges like CME and Deribit.

- 2021: Significant growth in options trading volume, with platforms like Deribit experiencing record-breaking activity.

- 2022: Emergence of more robust regulatory discussions and frameworks impacting platform operations globally.

- 2023: Introduction of new derivative products beyond traditional futures and options, including leveraged tokens and structured products.

- 2024: Continued focus on security enhancements and user experience improvements across major platforms.

In-Depth Digital Currency Derivatives Trading Platform Market Outlook

The future outlook for the digital currency derivatives trading platform market is exceptionally bright, driven by ongoing technological innovation, increasing institutional adoption, and a growing demand for sophisticated financial instruments. Key growth accelerators include the maturation of blockchain technology, offering greater scalability and efficiency, and the development of more user-friendly interfaces that appeal to a broader retail investor base. Strategic partnerships between traditional finance and crypto entities will unlock significant institutional capital, further legitimizing the asset class. The market is expected to witness continued expansion into new geographies and the introduction of novel derivative products, solidifying its position as a vital component of the global financial landscape. The projected market value reaching $400 million by 2033 underscores the immense growth potential and strategic opportunities within this dynamic sector.

Digital Currency Derivatives Trading Platform Segmentation

-

1. Application

- 1.1. Retail Investor

- 1.2. Professional Investor

-

2. Types

- 2.1. Regional Platforms

- 2.2. Global Platforms

Digital Currency Derivatives Trading Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Currency Derivatives Trading Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Retail Investor

- 5.1.2. Professional Investor

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Regional Platforms

- 5.2.2. Global Platforms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Retail Investor

- 6.1.2. Professional Investor

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Regional Platforms

- 6.2.2. Global Platforms

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Retail Investor

- 7.1.2. Professional Investor

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Regional Platforms

- 7.2.2. Global Platforms

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Retail Investor

- 8.1.2. Professional Investor

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Regional Platforms

- 8.2.2. Global Platforms

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Retail Investor

- 9.1.2. Professional Investor

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Regional Platforms

- 9.2.2. Global Platforms

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Currency Derivatives Trading Platform Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Retail Investor

- 10.1.2. Professional Investor

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Regional Platforms

- 10.2.2. Global Platforms

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Eurex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FIX

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Exchange

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bybit

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B2Broker

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 StormGain

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bingbon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phemex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CoinTiger

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Binance

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deribit

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Coinbase

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lever Network

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 dFuture

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hegic

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Deri Protocol

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Perpetual

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Eurex

List of Figures

- Figure 1: Global Digital Currency Derivatives Trading Platform Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Currency Derivatives Trading Platform Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Currency Derivatives Trading Platform Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Currency Derivatives Trading Platform Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Currency Derivatives Trading Platform Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Currency Derivatives Trading Platform Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Currency Derivatives Trading Platform Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Currency Derivatives Trading Platform Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Currency Derivatives Trading Platform Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Currency Derivatives Trading Platform Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Currency Derivatives Trading Platform Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Currency Derivatives Trading Platform Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Currency Derivatives Trading Platform Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Currency Derivatives Trading Platform Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Currency Derivatives Trading Platform Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Currency Derivatives Trading Platform Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Currency Derivatives Trading Platform Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Currency Derivatives Trading Platform Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Currency Derivatives Trading Platform Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Currency Derivatives Trading Platform Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Currency Derivatives Trading Platform Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Currency Derivatives Trading Platform Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Currency Derivatives Trading Platform Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Currency Derivatives Trading Platform Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Currency Derivatives Trading Platform Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Currency Derivatives Trading Platform Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Currency Derivatives Trading Platform Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Currency Derivatives Trading Platform Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Currency Derivatives Trading Platform?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital Currency Derivatives Trading Platform?

Key companies in the market include Eurex, FIX, Delta Exchange, Bybit, B2Broker, StormGain, Bingbon, Phemex, CoinTiger, Binance, Deribit, Coinbase, Lever Network, dFuture, Hegic, Deri Protocol, Perpetual.

3. What are the main segments of the Digital Currency Derivatives Trading Platform?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Currency Derivatives Trading Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Currency Derivatives Trading Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Currency Derivatives Trading Platform?

To stay informed about further developments, trends, and reports in the Digital Currency Derivatives Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence