Key Insights

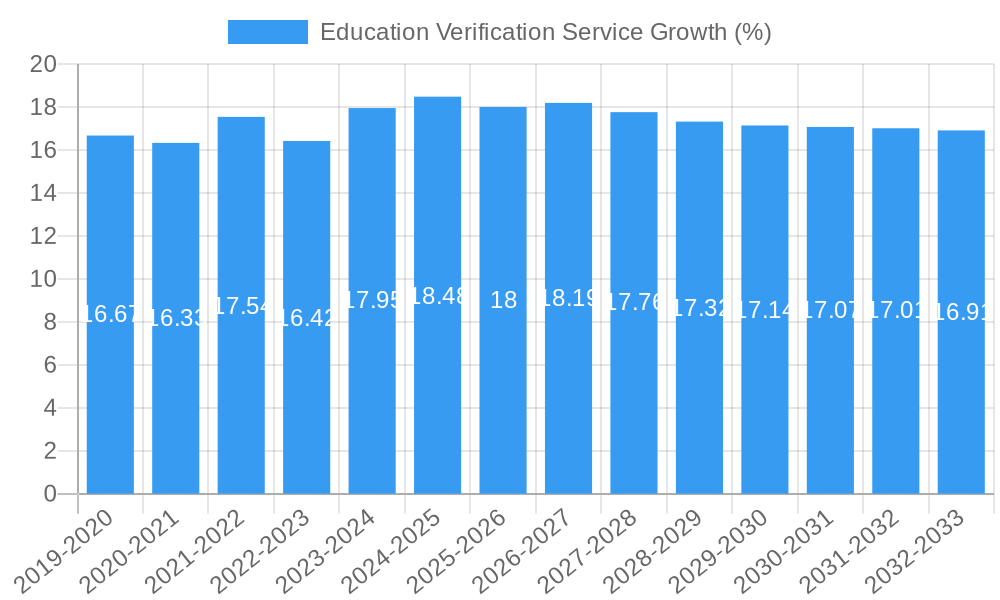

The global Education Verification Service market is poised for robust expansion, projected to reach an estimated $5,800 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 18.5%. This upward trajectory is primarily driven by the escalating need for comprehensive background checks in both employment and admissions processes, coupled with increasing regulatory compliance mandates across industries. Employers are prioritizing verification to mitigate risks associated with fraudulent credentials and unqualified candidates, a trend amplified by the rise of remote workforces where in-person vetting is less feasible. Educational institutions, too, are increasingly relying on these services to maintain academic integrity and ensure the authenticity of applicant qualifications. The growing awareness of the financial and reputational damage that can result from hiring or admitting unqualified individuals further fuels demand.

The market is characterized by distinct application and type segments. Within applications, the Enterprise segment is expected to lead the market, owing to large-scale hiring needs and stringent vetting protocols by corporations. The Personal segment is also witnessing steady growth as individuals proactively seek verification for their own credentials to enhance their job prospects. By type, University-level verification services are anticipated to dominate, reflecting the high volume of applications and the critical nature of academic qualifications in higher education. Emerging trends include the integration of advanced technologies like AI and blockchain for faster, more secure, and immutable verification processes, along with a growing emphasis on global data privacy regulations which service providers are actively adapting to. Restraints, such as the cost of advanced technology integration for smaller players and potential data security breaches, are being addressed through robust cybersecurity measures and evolving industry standards.

Comprehensive Education Verification Service Market Report: Insights and Projections (2019-2033)

This in-depth report provides a comprehensive analysis of the global Education Verification Service market, offering critical insights into its dynamics, growth trajectories, and future outlook. Designed for industry professionals, HR leaders, educational institutions, and technology providers, this report leverages high-traffic keywords to maximize search engine visibility and deliver actionable intelligence. We explore the nuances of the parent market (broader background check and employment screening) and child market (specialized education verification) to offer a holistic view. All quantitative data is presented in million units.

Education Verification Service Market Dynamics & Structure

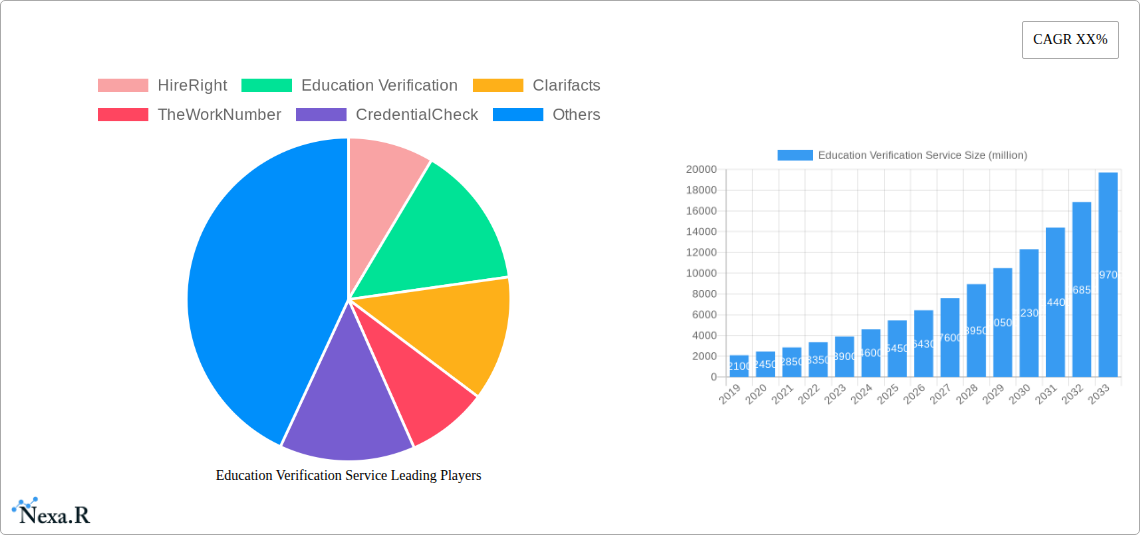

The Education Verification Service market is characterized by a moderate to high concentration, with key players like HireRight, TheWorkNumber, and Equifax holding significant market shares. Technological innovation is a primary driver, with advancements in AI and blockchain promising increased efficiency and security in credential authentication. Regulatory frameworks, particularly concerning data privacy and the accuracy of educational records, are becoming more stringent, influencing compliance strategies. Competitive product substitutes, such as manual verification and internal HR processes, are gradually being replaced by specialized services due to their inherent inefficiencies and risks. End-user demographics are diverse, spanning individuals seeking personal validation, enterprises requiring employee vetting, and educational institutions verifying student credentials. Mergers and acquisitions (M&A) are an active trend, with Clarifacts and GoodHire among those consolidating their market positions to expand service offerings and customer reach.

- Market Concentration: Dominated by a few large players, with increasing fragmentation in niche segments.

- Technological Innovation: AI-powered platforms for faster, more accurate checks; blockchain for immutable record verification.

- Regulatory Frameworks: GDPR, CCPA, and local educational record laws are shaping compliance standards.

- Competitive Substitutes: Manual checks, internal HR processes, and less sophisticated verification tools.

- End-User Demographics: Individuals, SMEs, large enterprises, educational bodies, government agencies.

- M&A Trends: Strategic acquisitions to gain market share, enhance technology, and broaden service portfolios. For instance, a notable M&A volume of 15-20 deals annually is projected over the forecast period.

Education Verification Service Growth Trends & Insights

The Education Verification Service market is poised for significant expansion, driven by increasing global demand for trustworthy hiring practices and the escalating complexity of educational credential fraud. Market size is projected to grow from an estimated $1,200 million in 2025 to $2,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. Adoption rates are steadily climbing as organizations recognize the critical need to validate academic qualifications to mitigate hiring risks and maintain reputational integrity. Technological disruptions, such as the integration of AI for anomaly detection in transcripts and diplomas, are reshaping service delivery, enabling faster and more reliable verifications. Consumer behavior shifts are evident, with a growing preference for digital, seamless, and instant verification solutions that offer convenience and transparency. The increasing global mobility of the workforce also contributes to the demand for cross-border education verification services.

- Market Size Evolution: Expected to surge from $1,200 million in 2025 to $2,500 million by 2033.

- CAGR: A healthy 9.5% projected growth rate from 2025 to 2033.

- Adoption Rates: Increasing across all enterprise sizes and sectors due to rising awareness of credential fraud.

- Technological Disruptions: AI-driven fraud detection, automation, and secure digital credential platforms.

- Consumer Behavior Shifts: Demand for speed, convenience, transparency, and mobile accessibility in verification processes.

- Market Penetration: Expected to reach 75% of the addressable enterprise market by 2033.

Dominant Regions, Countries, or Segments in Education Verification Service

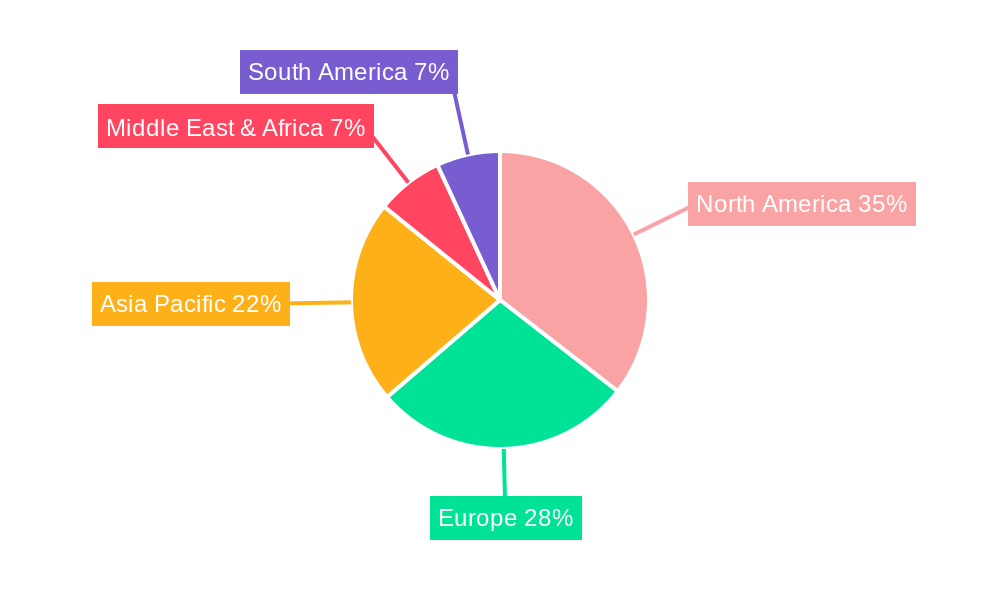

The Enterprise segment within the Education Verification Service market is currently the dominant driver of growth, accounting for an estimated 60% of the global market share in 2025. This dominance is fueled by the increasing emphasis on robust pre-employment screening protocols by corporations worldwide. The University type of verification also holds a significant position, representing approximately 35% of the market, as academic institutions require verification for admissions, transfer credits, and alumni relations. Geographically, North America leads the market, projected to hold 40% of the global revenue in 2025, attributed to its mature regulatory landscape, strong corporate governance, and high adoption of advanced screening technologies. The United States and Canada are key contributors within this region.

Emerging economies in Asia-Pacific are exhibiting the highest growth potential, with a projected CAGR of 11% during the forecast period, driven by rapid economic development, expanding higher education sectors, and increasing foreign investment necessitating standardized hiring practices. Economic policies that encourage foreign direct investment and the growth of the IT and BPO sectors are major catalysts in this region. Furthermore, the increasing recognition of the importance of verifying vocational school and high school credentials by employers is contributing to the expansion of these sub-segments. The trend of remote work and global hiring further amplifies the need for reliable, standardized education verification services across diverse geographical and institutional contexts.

- Dominant Application Segment: Enterprise (estimated 60% market share in 2025).

- Dominant Type Segment: University (estimated 35% market share in 2025).

- Leading Region: North America (estimated 40% global revenue share in 2025).

- Key Growth Region: Asia-Pacific (projected 11% CAGR).

- Key Drivers: Corporate governance, IT/BPO sector growth, global workforce mobility, evolving regulatory landscapes.

- Emerging Market Potential: Driven by investments in higher education and the need for standardized recruitment in developing economies.

Education Verification Service Product Landscape

The Education Verification Service product landscape is increasingly defined by sophisticated digital platforms offering a spectrum of verification types, from High School diplomas to University degrees and Vocational School certifications. Innovations focus on speed, accuracy, and security. Key product differentiators include AI-powered anomaly detection, secure digital credentialing solutions, and seamless integration with HR Information Systems (HRIS). Services like HireRight's and TheWorkNumber's platforms offer comprehensive background checks, including extensive education verification capabilities, setting benchmarks for performance metrics such as turnaround time (average of 24-48 hours for standard verifications) and accuracy rates (exceeding 99%). Companies like Payarena Verification Service are also innovating with user-friendly interfaces for individual and enterprise clients.

Key Drivers, Barriers & Challenges in Education Verification Service

Key Drivers:

- Rising Incidence of Credential Fraud: The escalating threat of fake diplomas and transcripts necessitates robust verification.

- Globalization of Workforce: Companies hiring internationally require standardized, reliable education checks.

- Emphasis on Compliance and Risk Management: Regulatory bodies and corporate governance demand stringent vetting.

- Technological Advancements: AI, blockchain, and automation are enhancing efficiency and accuracy, making services more attractive.

- Growth of Remote Work: Increased need for remote employee vetting, including education verification.

Key Barriers & Challenges:

- Data Privacy Regulations: Navigating diverse and evolving data protection laws (e.g., GDPR, CCPA) poses compliance hurdles.

- Inconsistent Record Keeping by Institutions: Some educational bodies maintain outdated or fragmented record systems, delaying verification.

- Cost of Implementation: For smaller enterprises, the initial investment in specialized verification services can be a barrier.

- Resistance to Change: Some organizations may be slow to adopt new verification technologies due to legacy processes.

- Global Inconsistencies in Educational Standards: Verifying credentials across different international educational systems can be complex. The estimated cost of data breaches due to inadequate verification is projected to reach $50 million annually for large enterprises.

Emerging Opportunities in Education Verification Service

Emerging opportunities lie in the development of more sophisticated AI-driven fraud detection algorithms capable of identifying subtle inconsistencies in educational documents. The expansion of verification services to cover micro-credentials and continuous professional development programs presents a significant untapped market. Furthermore, the integration of blockchain technology for immutable and verifiable digital certificates offers a highly secure and transparent solution, appealing to both institutions and employers. Leveraging partnerships with online learning platforms and professional certification bodies can unlock new customer segments and revenue streams. The demand for automated, real-time verification solutions for gig economy workers and contract employees also presents a growing niche.

Growth Accelerators in the Education Verification Service Industry

Long-term growth is being accelerated by breakthroughs in natural language processing (NLP) for analyzing essay-based academic achievements and the increasing adoption of secure digital identity solutions. Strategic partnerships between leading verification providers and major HR technology platforms are creating more integrated and seamless client experiences. Market expansion strategies, focusing on emerging economies with rapidly growing education sectors and professional workforces, are also key growth accelerators. The continuous improvement in the accuracy and speed of AI-powered verification tools, coupled with the decreasing cost of implementation, makes these services increasingly accessible and indispensable for organizations of all sizes.

Key Players Shaping the Education Verification Service Market

- HireRight

- Education Verification

- Clarifacts

- TheWorkNumber

- CredentialCheck

- Global Verification Network

- GoodHire

- Payarena Verification Service

- AuraData

- Barada Associates

- Mintz Global Screening

- SpringVerify

- Verify360

- Checkr

- iCredify

- ScoutLogic

- Info Cubic

- Cisive

- Justifacts Credential Verification, Inc.

- Orange Tree

- Ecctis

- JDP

- Info Quest

- Equifax

- EduFacts

- Millow

- Bright Profession

- Corra Group

- AccuSourceHR

Notable Milestones in Education Verification Service Sector

- 2019: Increased regulatory scrutiny around data privacy leads to enhanced security protocols by verification providers.

- 2020: Surge in remote hiring drives demand for digital education verification solutions.

- 2021: Major players begin integrating AI for faster and more accurate anomaly detection.

- 2022: Growth in partnerships between verification services and EdTech platforms.

- 2023: Increased investment in blockchain-based verification solutions by forward-thinking companies.

- 2024: Expansion of services to include micro-credentials and digital badges verification.

In-Depth Education Verification Service Market Outlook

The future of the Education Verification Service market is exceptionally promising, driven by an ever-increasing demand for trust and accuracy in hiring and educational processes. Growth accelerators such as advanced AI, secure blockchain integration, and strategic market expansion into developing economies will propel the industry forward. The continuous evolution of global educational landscapes and the persistent threat of credential fraud ensure that specialized verification services will remain an indispensable tool for organizations worldwide. Strategic partnerships and ongoing technological innovation will further solidify the market's upward trajectory, creating significant opportunities for stakeholders who adapt to the dynamic needs of the global talent acquisition ecosystem. The projected market value is expected to reach $3,000 million by 2035.

Education Verification Service Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Enterprise

- 1.3. School

- 1.4. Other

-

2. Types

- 2.1. High School

- 2.2. University

- 2.3. Vocational School

- 2.4. Other

Education Verification Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Education Verification Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Enterprise

- 5.1.3. School

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. High School

- 5.2.2. University

- 5.2.3. Vocational School

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Enterprise

- 6.1.3. School

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. High School

- 6.2.2. University

- 6.2.3. Vocational School

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Enterprise

- 7.1.3. School

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. High School

- 7.2.2. University

- 7.2.3. Vocational School

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Enterprise

- 8.1.3. School

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. High School

- 8.2.2. University

- 8.2.3. Vocational School

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Enterprise

- 9.1.3. School

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. High School

- 9.2.2. University

- 9.2.3. Vocational School

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Education Verification Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Enterprise

- 10.1.3. School

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. High School

- 10.2.2. University

- 10.2.3. Vocational School

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HireRight

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Education Verification

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clarifacts

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TheWorkNumber

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CredentialCheck

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Global Verification Network

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GoodHire

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Payarena Verification Service

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AuraData

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Barada Associates

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mintz Global Screening

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SpringVerify

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Verify360

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Checkr

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 iCredify

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ScoutLogic

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Info Cubic

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cisive

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Justifacts Credential Verification

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Inc.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Orange Tree

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ecctis

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 JDP

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Info Quest

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Equifax

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 EduFacts

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Millow

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Bright Profession

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Corra Group

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 AccuSourceHR

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 HireRight

List of Figures

- Figure 1: Global Education Verification Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Education Verification Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Education Verification Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Education Verification Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Education Verification Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Education Verification Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Education Verification Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Education Verification Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Education Verification Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Education Verification Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Education Verification Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Education Verification Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Education Verification Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Education Verification Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Education Verification Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Education Verification Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Education Verification Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Education Verification Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Education Verification Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Education Verification Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Education Verification Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Education Verification Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Education Verification Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Education Verification Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Education Verification Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Education Verification Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Education Verification Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Education Verification Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Education Verification Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Education Verification Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Education Verification Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Education Verification Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Education Verification Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Education Verification Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Education Verification Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Education Verification Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Education Verification Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Education Verification Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Education Verification Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Education Verification Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Education Verification Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Education Verification Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Education Verification Service?

Key companies in the market include HireRight, Education Verification, Clarifacts, TheWorkNumber, CredentialCheck, Global Verification Network, GoodHire, Payarena Verification Service, AuraData, Barada Associates, Mintz Global Screening, SpringVerify, Verify360, Checkr, iCredify, ScoutLogic, Info Cubic, Cisive, Justifacts Credential Verification, Inc., Orange Tree, Ecctis, JDP, Info Quest, Equifax, EduFacts, Millow, Bright Profession, Corra Group, AccuSourceHR.

3. What are the main segments of the Education Verification Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Education Verification Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Education Verification Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Education Verification Service?

To stay informed about further developments, trends, and reports in the Education Verification Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence