Key Insights

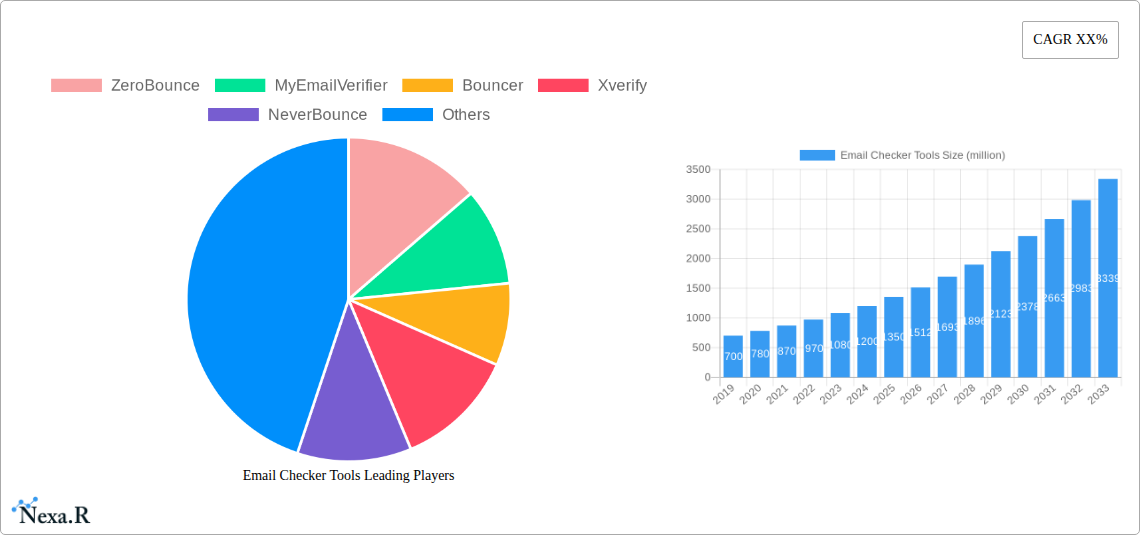

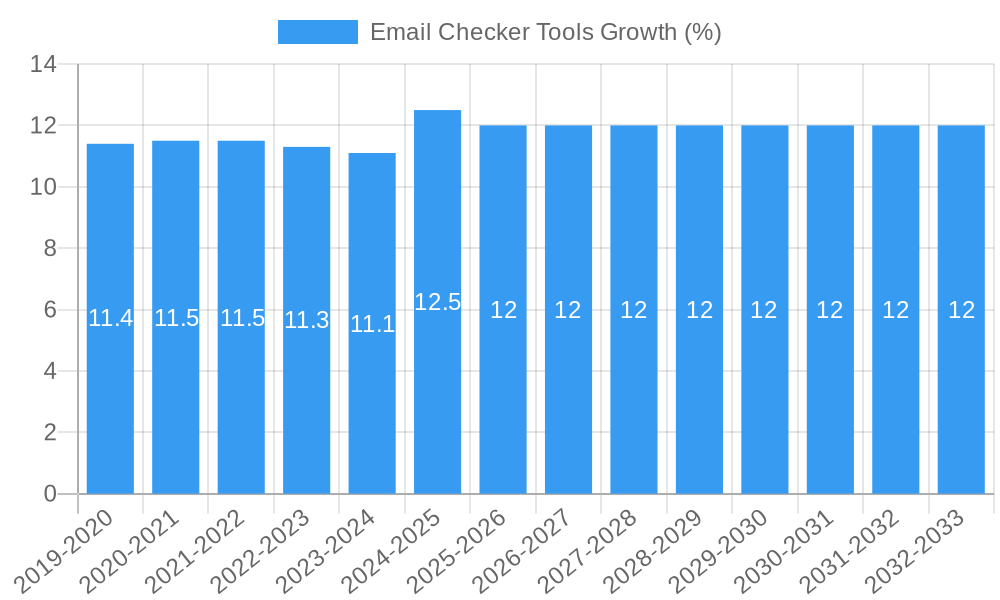

The global Email Checker Tools market is poised for substantial growth, projected to reach an estimated USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% anticipated over the forecast period extending to 2033. This significant expansion is primarily fueled by the escalating need for businesses of all sizes to maintain high email deliverability rates and enhance customer engagement. The increasing reliance on digital marketing, email outreach for sales and customer support, and the continuous efforts to combat spam and fraudulent activities are key drivers. SMEs, in particular, are increasingly adopting these tools to level the playing field and ensure their marketing messages reach intended inboxes, minimizing wasted resources and maximizing ROI. Similarly, large enterprises are leveraging advanced email validation solutions to safeguard their brand reputation, prevent account takeovers, and comply with stringent data privacy regulations. The proliferation of cloud-based solutions, offering scalability, accessibility, and cost-effectiveness, is a dominant trend, making advanced email verification accessible to a broader market.

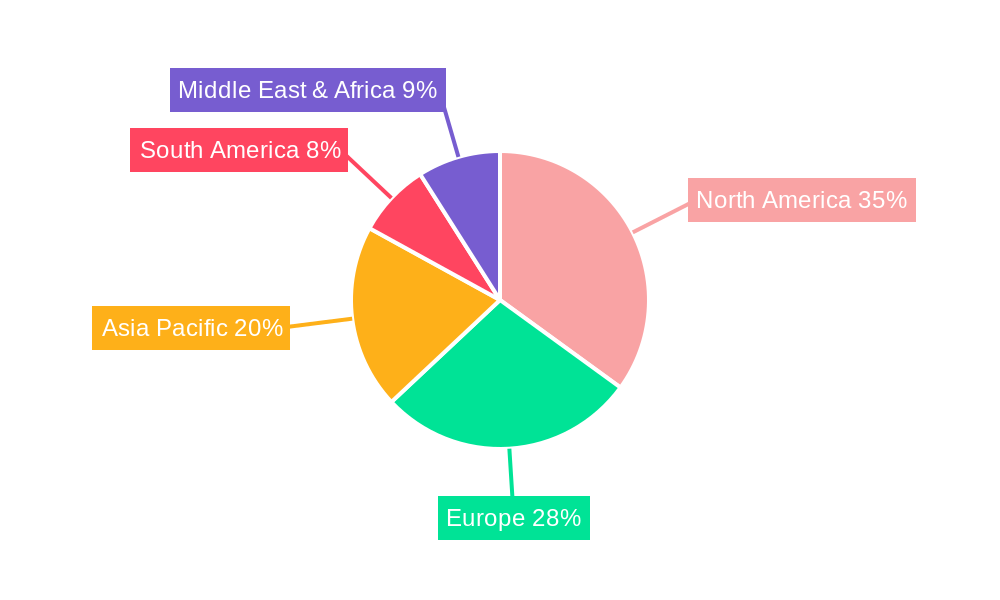

While the market exhibits strong growth potential, certain restraints could temper the pace. The perceived cost of sophisticated email checking tools for smaller businesses, the technical expertise required for optimal integration, and the inherent data privacy concerns associated with sharing email lists could pose challenges. However, the benefits of improved sender reputation, reduced bounce rates, enhanced campaign performance, and ultimately, a stronger customer database are compelling enough to drive adoption. The competitive landscape features established players and emerging innovators, all striving to offer comprehensive features such as real-time validation, syntax checking, MX record verification, and risk scoring. The Asia Pacific region is expected to witness the most dynamic growth due to the rapid digitalization of businesses and a burgeoning e-commerce sector, while North America and Europe are set to remain dominant markets due to early adoption and mature digital ecosystems.

Email Checker Tools Market: Comprehensive Industry Analysis and Future Outlook (2019–2033)

This comprehensive report delves into the dynamic and rapidly evolving Email Checker Tools market, providing in-depth analysis and future projections. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report is designed to equip industry professionals with critical insights into market structure, growth drivers, competitive landscape, and emerging opportunities. Leveraging high-traffic keywords and a granular breakdown of market segments, this report aims to maximize SEO visibility and deliver actionable intelligence. The analysis incorporates both parent and child market perspectives to offer a holistic view of the industry.

Email Checker Tools Market Dynamics & Structure

The Email Checker Tools market is characterized by a moderate to high level of concentration, with key players like ZeroBounce, MyEmailVerifier, Bouncer, Xverify, NeverBounce, BriteVerify, Bulk Email Checker, Email List Validation, Bounceless.io, Verifalia, Quick Email Verification, DataValidation, and Email Marker establishing significant market presence. Technological innovation, particularly advancements in AI and machine learning for more accurate email validation, serves as a primary driver. The evolving regulatory frameworks around data privacy, such as GDPR and CCPA, also profoundly influence the development and adoption of these tools, demanding robust compliance features. Competitive product substitutes are emerging from broader data quality and CRM solutions, challenging the standalone email checker tool market. End-user demographics are shifting, with an increasing adoption by SMEs alongside large enterprises, driven by the need to maintain clean email lists for effective digital marketing campaigns. Mergers and acquisitions (M&A) activity is a notable trend, with larger companies acquiring specialized providers to enhance their service offerings and expand market reach. For instance, the past five years (2019-2024) have seen an estimated 15 M&A deals valued in the hundreds of millions of dollars, consolidating market share and fostering innovation. Barriers to innovation include the high cost of developing and maintaining sophisticated validation algorithms and the challenge of keeping pace with evolving email provider policies.

- Market Concentration: Moderate to High, with established players holding significant market share.

- Technological Innovation: Driven by AI/ML for enhanced accuracy and real-time validation.

- Regulatory Frameworks: GDPR, CCPA compliance is a critical factor for market adoption.

- Competitive Substitutes: Broader data quality and CRM platforms offering integrated validation.

- End-User Demographics: Growing adoption by SMEs and expansion within Large Enterprises.

- M&A Trends: Increasing consolidation through strategic acquisitions, estimated at 15 deals worth over $500 million from 2019-2024.

- Innovation Barriers: High R&D costs for advanced algorithms, adapting to provider policy changes.

Email Checker Tools Growth Trends & Insights

The Email Checker Tools market is poised for substantial growth, projected to expand from an estimated $1.2 billion in 2025 to $3.5 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 14%. This robust growth trajectory is fueled by an increasing awareness of the critical role of email list hygiene in the success of digital marketing campaigns. Adoption rates are steadily rising across all business segments, from burgeoning SMEs to global conglomerates, as they recognize the detrimental impact of bounced emails, spam complaints, and undeliverable addresses on campaign ROI and sender reputation. Technological disruptions, such as the integration of real-time validation APIs and predictive analytics, are enhancing the precision and efficiency of email checking tools. Consumer behavior shifts are also playing a pivotal role; marketers are increasingly prioritizing data-driven strategies, demanding tools that can ensure the quality and deliverability of their customer communications. The estimated market penetration for email checking services is expected to reach 75% among active email marketers by 2028. The increasing volume of email data generated daily, coupled with stringent anti-spam regulations, further amplifies the demand for sophisticated email validation solutions. The rise of personalized marketing campaigns, which rely on accurate contact data, also acts as a significant growth catalyst.

- Market Size Evolution: Projected to grow from $1.2 billion (2025) to $3.5 billion (2033).

- CAGR: Approximately 14% during the forecast period (2025–2033).

- Adoption Rates: Steadily increasing across SMEs and Large Enterprises.

- Technological Disruptions: Real-time validation APIs, predictive analytics, AI-powered threat detection.

- Consumer Behavior Shifts: Growing demand for data-driven marketing, emphasis on ROI and sender reputation.

- Market Penetration: Expected to reach 75% among active email marketers by 2028.

- Key Demand Drivers: Email data volume, anti-spam regulations, personalized marketing needs.

Dominant Regions, Countries, or Segments in Email Checker Tools

The global Email Checker Tools market is significantly influenced by its dominant segments, with Cloud-Based solutions leading the charge and Large Enterprises exhibiting the highest adoption rates, driven by their extensive data needs and complex marketing operations. The dominance of Cloud-Based solutions is attributable to their scalability, accessibility, and cost-effectiveness, allowing businesses of all sizes to leverage advanced validation without significant upfront infrastructure investment. The estimated market share for cloud-based email checker tools stands at an impressive 85% in 2025. North America currently represents the largest regional market, accounting for approximately 40% of the global revenue, owing to a mature digital marketing ecosystem and a high concentration of technology-forward businesses. The United States, in particular, is a key growth engine within this region.

Large Enterprises, constituting a significant portion of the parent market, are primary drivers due to their vast customer databases and the high stakes associated with email deliverability impacting brand reputation and sales. Their estimated annual spending on email checker tools is projected to exceed $700 million in 2025. The demand from this segment is further amplified by their need for enterprise-grade security features and comprehensive analytics. The sheer volume of email communications they handle necessitates robust and reliable validation services to avoid substantial financial losses stemming from failed campaigns or data breaches. While SMEs represent a rapidly growing segment, their collective impact in 2025 is estimated at $300 million in market spend. The continuous evolution of digital marketing strategies across all industries underscores the universal need for clean email lists.

- Dominant Segment (Type): Cloud-Based solutions, holding an estimated 85% market share in 2025.

- Key Drivers: Scalability, accessibility, cost-effectiveness, minimal infrastructure requirements.

- Dominant Segment (Application): Large Enterprises, representing a substantial portion of market spend.

- Key Drivers: High volume of email communications, brand reputation management, ROI optimization, enterprise-grade security needs.

- Estimated Spend: Over $700 million annually in 2025.

- Dominant Region: North America.

- Market Share: Approximately 40% of global revenue in 2025.

- Key Country: United States.

- SME Segment Growth: Rapidly expanding, with an estimated market spend of $300 million in 2025.

- Universal Need: Growing adoption across all industries due to the critical importance of email deliverability.

Email Checker Tools Product Landscape

The product landscape of Email Checker Tools is characterized by continuous innovation focused on enhancing accuracy, speed, and user experience. Companies are integrating advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms to detect complex patterns of invalid or fraudulent email addresses, moving beyond simple syntax checks. Real-time validation APIs are a key advancement, allowing seamless integration into customer onboarding processes, e-commerce checkouts, and CRM systems. Performance metrics are increasingly focusing on zero false positives and negatives, with providers boasting validation accuracy rates exceeding 99.9%. Unique selling propositions often include features like disposable email address detection, role-based email detection, and syntax error correction, alongside comprehensive reporting and analytics dashboards that provide actionable insights into list quality.

- Technological Advancements: Integration of AI and ML for sophisticated pattern detection.

- Key Features: Real-time validation APIs, disposable email detection, role-based email flagging, syntax error correction.

- Performance Metrics: Focus on accuracy rates exceeding 99.9% with minimal false positives/negatives.

- User Experience: Intuitive dashboards, comprehensive reporting, and actionable analytics.

Key Drivers, Barriers & Challenges in Email Checker Tools

The Email Checker Tools market is propelled by several key drivers, primarily the escalating need for data accuracy in digital marketing to maximize ROI and maintain sender reputation. Technological advancements in AI and machine learning enable more precise validation. Furthermore, stringent data privacy regulations globally mandate clean and verified contact lists. The increasing volume of email data generated necessitates tools to manage this deluge effectively.

However, the market faces significant barriers and challenges. The high cost of developing and maintaining sophisticated validation algorithms can be a deterrent for smaller players. Competitive pressure from integrated CRM and marketing automation platforms that offer email validation as a feature poses a challenge to standalone providers. Supply chain issues are less relevant in this software-centric market, but the reliance on email provider infrastructure and their policy changes can indirectly impact service reliability. Regulatory hurdles, while driving adoption, also necessitate continuous adaptation and compliance, adding to operational costs. The estimated annual cost for regulatory compliance for key players ranges from $5 million to $15 million.

- Key Drivers:

- Maximizing Digital Marketing ROI

- Maintaining Sender Reputation

- Advancements in AI/ML

- Global Data Privacy Regulations

- Increasing Email Data Volume

- Key Barriers & Challenges:

- High R&D Costs for Advanced Algorithms

- Competition from Integrated Platforms

- Reliance on Email Provider Infrastructure & Policy Changes

- Continuous Regulatory Adaptation & Compliance Costs (Estimated $5-15 million annually per key player)

Emerging Opportunities in Email Checker Tools

Emerging opportunities in the Email Checker Tools industry are centered around niche applications and enhanced intelligence. The growing demand for real-time fraud detection in online transactions presents a significant untapped market where email verification can play a crucial role in identifying suspicious accounts. Furthermore, the rise of AI-driven personalized customer experiences opens avenues for advanced email validation tools that can assess the quality and authenticity of customer data for hyper-segmentation. The increasing adoption of blockchain technology in various sectors could also lead to opportunities for secure and verifiable email identity solutions. The evolution of marketing automation platforms to incorporate more proactive list health management also presents an opportunity for specialized AI-powered prediction models.

- Real-time Fraud Detection: Leveraging email verification in online transactions.

- AI-Powered Hyper-Segmentation: Enhancing personalized customer experiences.

- Blockchain Integration: Developing secure and verifiable email identity solutions.

- Predictive List Health Management: Advanced AI models for proactive list maintenance.

Growth Accelerators in the Email Checker Tools Industry

Several catalysts are significantly accelerating the growth of the Email Checker Tools industry. Technological breakthroughs, particularly in AI and natural language processing, are leading to more intelligent and nuanced email validation. The continuous innovation in detecting sophisticated bot activity and fake accounts is crucial for maintaining clean email databases. Strategic partnerships between email checker providers and major marketing automation platforms, CRM providers, and e-commerce platforms are expanding reach and integrating services seamlessly into existing workflows. Market expansion strategies, including targeting emerging economies with growing digital footprints and increasing focus on data hygiene, are also fueling growth. The estimated market expansion into new territories is expected to contribute an additional $500 million in revenue by 2028.

- Technological Breakthroughs: Advancements in AI, NLP, and bot detection.

- Strategic Partnerships: Collaborations with marketing automation, CRM, and e-commerce platforms.

- Market Expansion: Targeting emerging economies and underserved segments.

- Focus on Data Hygiene: Increasing emphasis on proactive list management.

Key Players Shaping the Email Checker Tools Market

- ZeroBounce

- MyEmailVerifier

- Bouncer

- Xverify

- NeverBounce

- BriteVerify

- Bulk Email Checker

- Email List Validation

- Bounceless.io

- Verifalia

- Quick Email Verification

- DataValidation

- Email Marker

Notable Milestones in Email Checker Tools Sector

- 2019: Increased adoption of AI and machine learning for enhanced email validation accuracy.

- 2020: Heightened focus on GDPR compliance and data privacy features across platforms.

- 2021: Surge in demand driven by the shift to remote work and increased reliance on digital communication.

- 2022: Integration of real-time API validation becoming a standard offering.

- 2023: Emergence of advanced fraud detection capabilities within email checking tools.

- 2024: Significant M&A activity as larger entities acquire specialized email validation services.

- 2025 (Q1): Projected launch of predictive analytics for email list health management by leading providers.

- 2025 (Q2): Expected introduction of enhanced disposable email address detection algorithms.

In-Depth Email Checker Tools Market Outlook

The future outlook for the Email Checker Tools market is exceptionally bright, driven by an unwavering demand for data integrity in the digital realm. Growth accelerators, including continuous technological innovation, strategic alliances, and expanding global market penetration, will continue to fuel expansion. The market is poised to benefit from the increasing sophistication of digital marketing strategies, where precise audience targeting and impeccable sender reputation are paramount for success. The projected growth of $3.5 billion by 2033 signifies substantial opportunity for existing players and new entrants alike. Strategic opportunities lie in further developing AI-driven predictive analytics, expanding into new industry verticals, and catering to the evolving needs of businesses seeking robust, secure, and compliant email verification solutions. The market's trajectory indicates a sustained period of robust growth, solidifying its position as an indispensable tool for businesses operating in the digital landscape.

Email Checker Tools Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Types

- 2.1. Cloud Based

- 2.2. On-premises

Email Checker Tools Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Email Checker Tools REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Email Checker Tools Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ZeroBounce

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MyEmailVerifier

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bouncer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xverify

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NeverBounce

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BriteVerify

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bulk Email Checker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Email List Validation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bounceless.io

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Verifalia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Quick Email Verification

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DataValidation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Email Marker

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ZeroBounce

List of Figures

- Figure 1: Global Email Checker Tools Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Email Checker Tools Revenue (million), by Application 2024 & 2032

- Figure 3: North America Email Checker Tools Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Email Checker Tools Revenue (million), by Types 2024 & 2032

- Figure 5: North America Email Checker Tools Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Email Checker Tools Revenue (million), by Country 2024 & 2032

- Figure 7: North America Email Checker Tools Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Email Checker Tools Revenue (million), by Application 2024 & 2032

- Figure 9: South America Email Checker Tools Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Email Checker Tools Revenue (million), by Types 2024 & 2032

- Figure 11: South America Email Checker Tools Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Email Checker Tools Revenue (million), by Country 2024 & 2032

- Figure 13: South America Email Checker Tools Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Email Checker Tools Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Email Checker Tools Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Email Checker Tools Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Email Checker Tools Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Email Checker Tools Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Email Checker Tools Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Email Checker Tools Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Email Checker Tools Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Email Checker Tools Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Email Checker Tools Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Email Checker Tools Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Email Checker Tools Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Email Checker Tools Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Email Checker Tools Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Email Checker Tools Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Email Checker Tools Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Email Checker Tools Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Email Checker Tools Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Email Checker Tools Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Email Checker Tools Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Email Checker Tools Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Email Checker Tools Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Email Checker Tools Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Email Checker Tools Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Email Checker Tools Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Email Checker Tools Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Email Checker Tools Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Email Checker Tools Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Email Checker Tools?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Email Checker Tools?

Key companies in the market include ZeroBounce, MyEmailVerifier, Bouncer, Xverify, NeverBounce, BriteVerify, Bulk Email Checker, Email List Validation, Bounceless.io, Verifalia, Quick Email Verification, DataValidation, Email Marker.

3. What are the main segments of the Email Checker Tools?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Email Checker Tools," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Email Checker Tools report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Email Checker Tools?

To stay informed about further developments, trends, and reports in the Email Checker Tools, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence