Key Insights

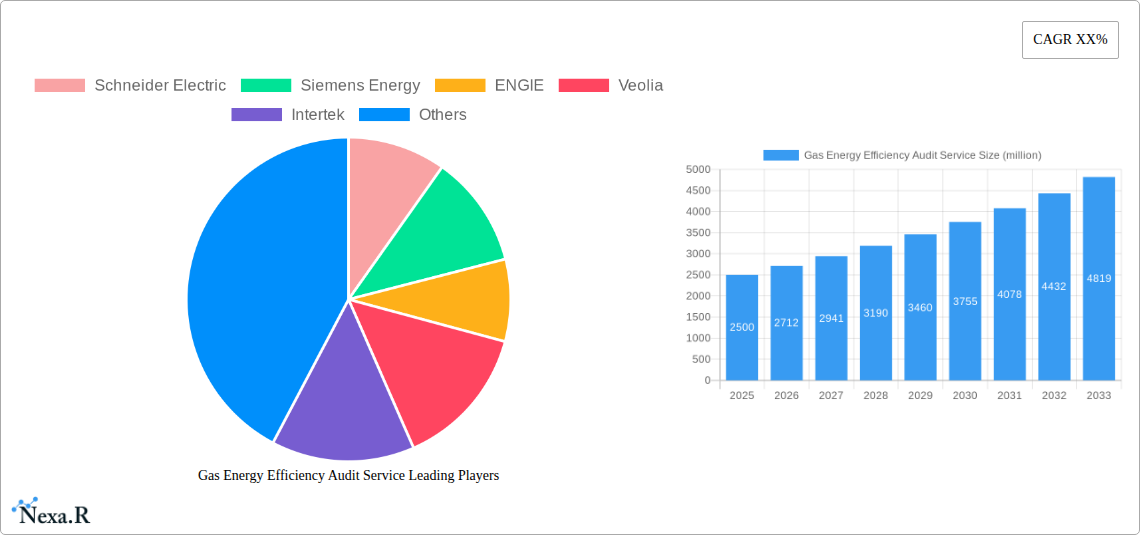

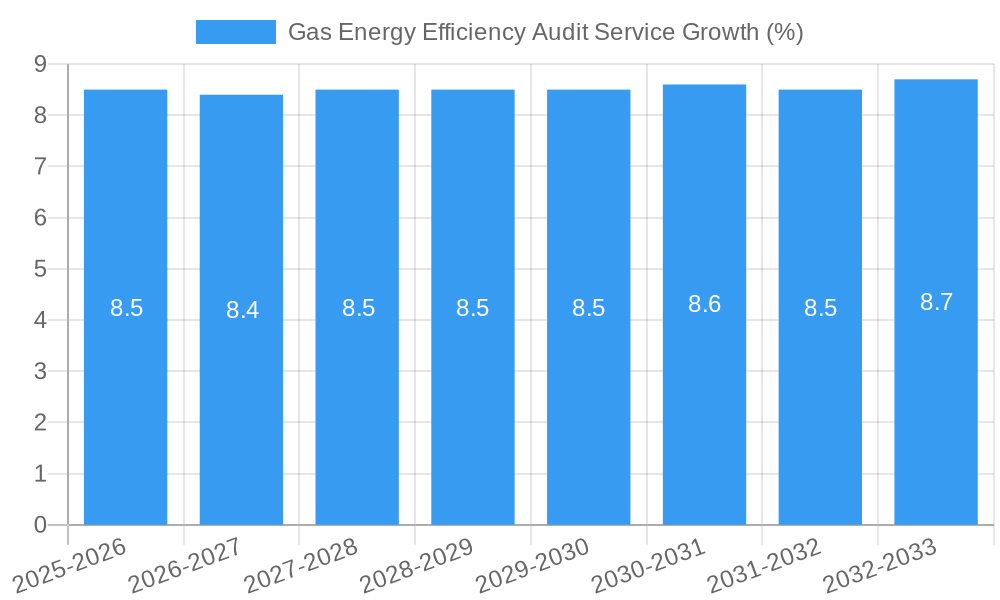

The global Gas Energy Efficiency Audit Service market is poised for significant expansion, projected to reach an estimated market size of approximately $2,500 million by 2025. This robust growth is underpinned by a compound annual growth rate (CAGR) of around 8.5% throughout the forecast period of 2025-2033. The escalating demand for energy efficiency solutions, driven by stringent environmental regulations and the increasing cost of energy, is a primary catalyst. Businesses across commercial services, industrial production, and energy supply sectors are actively seeking audits to identify and rectify energy wastage, thereby reducing operational expenses and their carbon footprint. The "Natural Gas Products" and "Liquefied Petroleum Gas (LPG) Products" segments are expected to dominate this market, reflecting the widespread reliance on these fuels. Key market players like Schneider Electric, Siemens Energy, and ENGIE are actively investing in advanced auditing technologies and expanding their service portfolios to cater to this burgeoning demand.

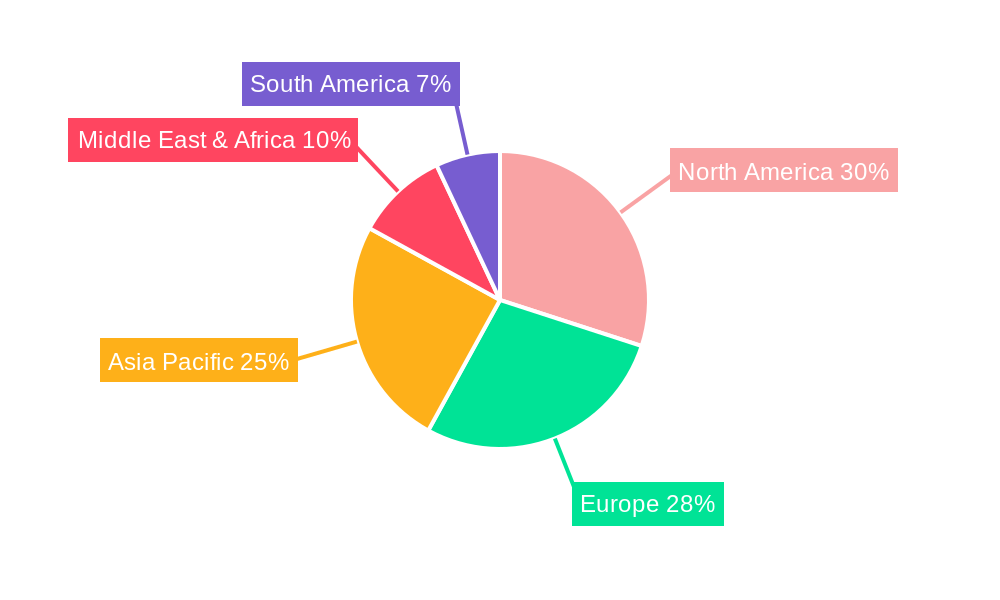

Further propelling market growth are evolving trends such as the integration of smart technologies and IoT devices for real-time energy monitoring, and the increasing adoption of data analytics for predictive energy management. These advancements enable more precise and actionable insights, enhancing the value proposition of energy efficiency audits. However, the market faces certain restraints, including the initial capital investment required for implementing audit recommendations and a potential shortage of skilled professionals in specialized energy auditing. Geographically, North America and Europe currently hold significant market shares due to established industrial bases and proactive environmental policies. Asia Pacific, however, is anticipated to exhibit the fastest growth, fueled by rapid industrialization and a growing awareness of energy conservation. The continued focus on sustainability and cost optimization will ensure a sustained upward trajectory for the Gas Energy Efficiency Audit Service market.

Gas Energy Efficiency Audit Service Market Dynamics & Structure

The global Gas Energy Efficiency Audit Service market is characterized by a moderate concentration, with a few key players like Schneider Electric, Siemens Energy, ENGIE, Veolia, Intertek, Honeywell, Johnson Controls, DNV GL, TÜV Rheinland, and Bureau Veritas holding significant influence. Technological innovation is a primary driver, fueled by the increasing demand for cost reduction and compliance with stringent environmental regulations. The regulatory framework, encompassing energy efficiency mandates and carbon emission targets, plays a pivotal role in shaping market trajectory. Competitive product substitutes, such as renewable energy audits and broader energy management systems, are present but often complement rather than fully replace specialized gas energy efficiency services. End-user demographics span commercial services, industrial production, energy supply, and transportation sectors, each with unique energy consumption patterns and audit requirements. Mergers and acquisitions (M&A) trends, while not at peak levels, indicate strategic consolidation as larger entities seek to broaden their service portfolios and expand their geographic reach.

- Market Concentration: Moderate, with a blend of large multinational corporations and specialized service providers.

- Technological Innovation Drivers: Advanced analytics, IoT integration for real-time monitoring, and predictive maintenance solutions.

- Regulatory Frameworks: Growing emphasis on carbon neutrality, energy efficiency standards, and emission reduction targets globally.

- Competitive Product Substitutes: Renewable energy feasibility studies, comprehensive energy management software, and demand-side management services.

- End-User Demographics: Diversified across sectors requiring significant natural gas and LPG consumption.

- M&A Trends: Strategic acquisitions for service portfolio expansion and market penetration.

Gas Energy Efficiency Audit Service Growth Trends & Insights

The global Gas Energy Efficiency Audit Service market is projected for robust growth, driven by escalating energy costs and a growing imperative for sustainability across industries. The market size, estimated at approximately $6.8 billion in 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033, reaching an estimated $13.1 billion by the end of the forecast period. This growth is underpinned by increasing adoption rates of sophisticated auditing tools and methodologies, particularly within the industrial production and energy supply segments. Technological disruptions, including the integration of artificial intelligence (AI) and machine learning (ML) in data analysis for identifying inefficiencies, are revolutionizing how audits are conducted, leading to more precise and actionable recommendations. Consumer behavior shifts are also a significant factor, with businesses increasingly prioritizing energy-efficient operations not only for cost savings but also for enhanced corporate social responsibility and brand reputation.

The historical period from 2019 to 2024 witnessed a steady increase in demand for gas energy efficiency audits, driven by initial regulatory pressures and rising energy prices post-pandemic. The base year of 2025 serves as a crucial inflection point, with accelerated adoption expected as more organizations realize the tangible financial and environmental benefits. The market penetration of these specialized audit services, while varying by region and sector, is expanding as awareness grows and the return on investment (ROI) becomes more apparent. The increasing complexity of natural gas and LPG supply chains, coupled with the need to optimize consumption in diverse applications ranging from manufacturing processes to transportation fleets, further fuels this demand. The development of more granular diagnostic tools and real-time monitoring systems allows for continuous improvement, moving beyond one-off audits to integrated energy management strategies.

Dominant Regions, Countries, or Segments in Gas Energy Efficiency Audit Service

The Industrial Production segment, utilizing natural gas and LPG products extensively for manufacturing processes and energy generation, is emerging as the dominant force driving the growth of the Gas Energy Efficiency Audit Service market. This segment's dominance is evident in its substantial market share, estimated to be around 35% of the total market value in 2025, projected to grow at a CAGR of 9.2% through 2033. Key drivers within this segment include the high energy intensity of manufacturing operations, the direct impact of energy costs on profit margins, and the stringent emission reduction targets imposed on industrial facilities globally.

- Industrial Production Dominance:

- High Energy Consumption: Manufacturing processes such as smelting, heating, and chemical reactions are highly reliant on natural gas and LPG.

- Cost Sensitivity: Fluctuations in energy prices directly impact production costs, making efficiency audits a critical tool for cost management.

- Regulatory Compliance: Industrial facilities are often subject to stricter environmental regulations and carbon pricing mechanisms, necessitating energy efficiency improvements.

- Technological Advancements: Adoption of advanced manufacturing techniques and automation requires optimized energy inputs.

North America, particularly the United States, stands out as a dominant country within this segment, primarily due to its robust industrial base, significant natural gas production, and proactive regulatory environment encouraging energy efficiency. The presence of major manufacturing hubs and a strong emphasis on industrial competitiveness contribute to a high demand for these audit services. Asia Pacific is also exhibiting rapid growth, driven by the burgeoning industrial sectors in countries like China and India, and increasing investments in energy-saving technologies.

- Key Drivers in North America:

- Abundant and affordable natural gas supply.

- Government incentives for industrial energy efficiency.

- Presence of large-scale industrial operations across various sub-sectors.

- Growing adoption of smart manufacturing and Industry 4.0 technologies.

Gas Energy Efficiency Audit Service Product Landscape

The product landscape for gas energy efficiency audit services is evolving with innovative offerings designed for precision and comprehensive analysis. These services now integrate advanced digital tools, including IoT sensors for real-time data acquisition on gas flow, pressure, and consumption, alongside sophisticated software platforms for data analytics and predictive modeling. Performance metrics focus on quantifiable reductions in gas consumption, emission mitigation, and operational cost savings. Unique selling propositions lie in customized audit protocols tailored to specific industrial processes, from petrochemical plants to food processing units, and the provision of actionable, data-driven recommendations for equipment upgrades and operational adjustments. Technological advancements also extend to specialized audits for Liquefied Petroleum Gas (LPG) products, addressing unique storage and handling efficiencies.

Key Drivers, Barriers & Challenges in Gas Energy Efficiency Audit Service

The gas energy efficiency audit service market is propelled by several key drivers. The escalating global energy prices are a primary catalyst, compelling businesses to seek cost-saving measures. Stringent environmental regulations and carbon emission reduction targets set by governments worldwide are also forcing industries to invest in efficiency. Technological advancements in data analytics and monitoring systems enable more accurate and effective audits.

- Key Drivers:

- Rising energy costs and volatility.

- Government mandates for energy efficiency and emissions reduction.

- Corporate sustainability goals and ESG initiatives.

- Advancements in auditing technologies and AI.

However, the market faces significant barriers and challenges. High upfront costs for implementing audit recommendations can deter smaller businesses. A lack of awareness or understanding of the long-term benefits of energy efficiency audits among certain industry players poses a challenge. Supply chain disruptions impacting the availability of specialized audit equipment or components can also create hurdles.

- Key Barriers & Challenges:

- High initial investment for implementing audit recommendations.

- Limited awareness and perceived complexity of audit processes.

- Supply chain volatility for advanced monitoring equipment.

- Skilled labor shortage for conducting specialized audits.

- Resistance to change in established operational practices.

Emerging Opportunities in Gas Energy Efficiency Audit Service

Emerging opportunities in the gas energy efficiency audit service sector are abundant. The increasing focus on decarbonization and the transition to cleaner energy sources present a significant avenue for specialized audits that optimize the use of natural gas as a transitional fuel. The growth of smart cities and industrial IoT (IIoT) ecosystems creates a demand for integrated energy management solutions that incorporate gas efficiency. Furthermore, the expanding use of hydrogen blends with natural gas in existing infrastructure presents new audit requirements for ensuring compatibility and efficiency. Untapped markets in developing economies with rapidly industrializing sectors also offer substantial growth potential.

Growth Accelerators in the Gas Energy Efficiency Audit Service Industry

Several catalysts are accelerating long-term growth in the gas energy efficiency audit industry. Technological breakthroughs, such as the development of advanced AI algorithms for anomaly detection in gas consumption and predictive maintenance of gas infrastructure, are significantly enhancing the value proposition of these services. Strategic partnerships between audit service providers and technology firms, as well as equipment manufacturers, are fostering innovation and offering integrated solutions to clients. Market expansion strategies, including targeting new industry verticals and geographical regions previously underserved, are also contributing to sustained growth. The increasing emphasis on corporate ESG (Environmental, Social, and Governance) reporting is further driving demand for quantifiable energy efficiency data.

Key Players Shaping the Gas Energy Efficiency Audit Service Market

- Schneider Electric

- Siemens Energy

- ENGIE

- Veolia

- Intertek

- Honeywell

- Johnson Controls

- DNV GL

- TÜV Rheinland

- Bureau Veritas

Notable Milestones in Gas Energy Efficiency Audit Service Sector

- 2019: Increased regulatory focus on industrial emissions drives demand for advanced gas efficiency diagnostics.

- 2020: COVID-19 pandemic highlights the importance of operational cost reduction, boosting interest in energy efficiency audits.

- 2021: Introduction of AI-powered analytics platforms for real-time gas consumption monitoring and anomaly detection.

- 2022: Growing corporate commitment to sustainability and ESG reporting leads to higher adoption of comprehensive energy audits.

- 2023: Expansion of audit services to include assessment of hydrogen blending in natural gas infrastructure.

- 2024: Major energy companies begin investing in digital twins for gas network optimization and efficiency.

In-Depth Gas Energy Efficiency Audit Service Market Outlook

The future market outlook for gas energy efficiency audit services is exceptionally promising, driven by a confluence of economic, environmental, and technological forces. The ongoing push for energy independence and the volatility of global energy markets will continue to position efficiency as a critical strategy for cost containment and operational resilience. Furthermore, the accelerating global transition towards net-zero emissions will necessitate rigorous auditing of existing gas infrastructure to maximize efficiency and minimize environmental impact, particularly as natural gas serves as a crucial transitional fuel. The integration of advanced digital technologies, including predictive analytics and IoT, will further enhance the precision and value of these services. Strategic collaborations and the development of innovative, data-driven solutions will be pivotal in unlocking new market segments and addressing the evolving needs of a diverse industrial landscape, solidifying the indispensable role of gas energy efficiency audits in a sustainable future.

Gas Energy Efficiency Audit Service Segmentation

-

1. Application

- 1.1. Commercial Services

- 1.2. Industrial Production

- 1.3. Energy Supply

- 1.4. Transportation

- 1.5. Other

-

2. Types

- 2.1. Natural Gas Products

- 2.2. Liquefied Petroleum Gas (LPG) Products

- 2.3. Other

Gas Energy Efficiency Audit Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gas Energy Efficiency Audit Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Services

- 5.1.2. Industrial Production

- 5.1.3. Energy Supply

- 5.1.4. Transportation

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Natural Gas Products

- 5.2.2. Liquefied Petroleum Gas (LPG) Products

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Services

- 6.1.2. Industrial Production

- 6.1.3. Energy Supply

- 6.1.4. Transportation

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Natural Gas Products

- 6.2.2. Liquefied Petroleum Gas (LPG) Products

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Services

- 7.1.2. Industrial Production

- 7.1.3. Energy Supply

- 7.1.4. Transportation

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Natural Gas Products

- 7.2.2. Liquefied Petroleum Gas (LPG) Products

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Services

- 8.1.2. Industrial Production

- 8.1.3. Energy Supply

- 8.1.4. Transportation

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Natural Gas Products

- 8.2.2. Liquefied Petroleum Gas (LPG) Products

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Services

- 9.1.2. Industrial Production

- 9.1.3. Energy Supply

- 9.1.4. Transportation

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Natural Gas Products

- 9.2.2. Liquefied Petroleum Gas (LPG) Products

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gas Energy Efficiency Audit Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Services

- 10.1.2. Industrial Production

- 10.1.3. Energy Supply

- 10.1.4. Transportation

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Natural Gas Products

- 10.2.2. Liquefied Petroleum Gas (LPG) Products

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Schneider Electric

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens Energy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ENGIE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veolia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intertek

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Honeywell

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson Controls

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DNV GL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TÜV Rheinland

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bureau Veritas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Schneider Electric

List of Figures

- Figure 1: Global Gas Energy Efficiency Audit Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gas Energy Efficiency Audit Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gas Energy Efficiency Audit Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gas Energy Efficiency Audit Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Gas Energy Efficiency Audit Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Gas Energy Efficiency Audit Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gas Energy Efficiency Audit Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gas Energy Efficiency Audit Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gas Energy Efficiency Audit Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gas Energy Efficiency Audit Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Gas Energy Efficiency Audit Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Gas Energy Efficiency Audit Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gas Energy Efficiency Audit Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gas Energy Efficiency Audit Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gas Energy Efficiency Audit Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gas Energy Efficiency Audit Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Gas Energy Efficiency Audit Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Gas Energy Efficiency Audit Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gas Energy Efficiency Audit Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gas Energy Efficiency Audit Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gas Energy Efficiency Audit Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gas Energy Efficiency Audit Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Gas Energy Efficiency Audit Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Gas Energy Efficiency Audit Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gas Energy Efficiency Audit Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gas Energy Efficiency Audit Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gas Energy Efficiency Audit Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gas Energy Efficiency Audit Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Gas Energy Efficiency Audit Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Gas Energy Efficiency Audit Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gas Energy Efficiency Audit Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Gas Energy Efficiency Audit Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gas Energy Efficiency Audit Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Energy Efficiency Audit Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Gas Energy Efficiency Audit Service?

Key companies in the market include Schneider Electric, Siemens Energy, ENGIE, Veolia, Intertek, Honeywell, Johnson Controls, DNV GL, TÜV Rheinland, Bureau Veritas.

3. What are the main segments of the Gas Energy Efficiency Audit Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Energy Efficiency Audit Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Energy Efficiency Audit Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Energy Efficiency Audit Service?

To stay informed about further developments, trends, and reports in the Gas Energy Efficiency Audit Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence