Key Insights

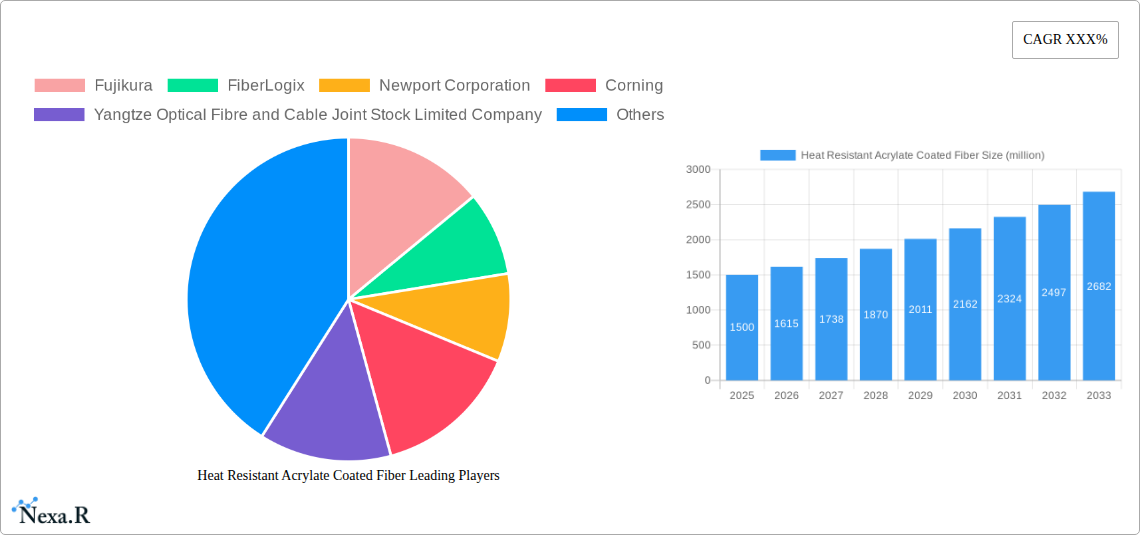

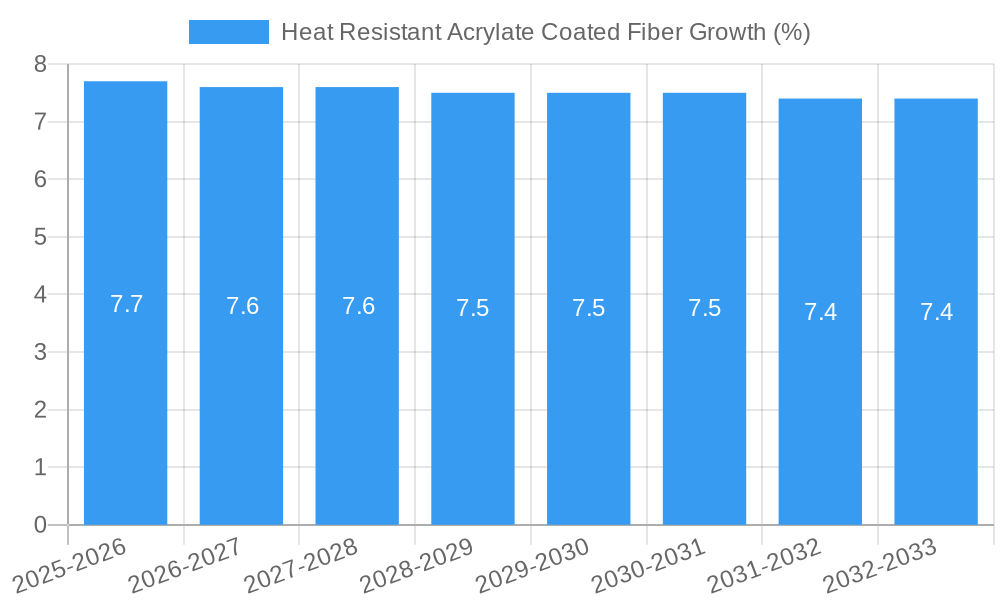

The global Heat Resistant Acrylate Coated Fiber market is poised for significant expansion, projected to reach an estimated USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.8% forecasted to continue through 2033. This growth is primarily fueled by the increasing demand for advanced fiber optic solutions in demanding environments across various industries. The unique properties of heat-resistant acrylate coatings are crucial for ensuring the longevity and performance of optical fibers in high-temperature applications, making them indispensable for sectors like oil and gas exploration, aerospace, and military operations where extreme conditions are commonplace. Furthermore, the burgeoning adoption of 5G infrastructure, with its inherent need for high-bandwidth, reliable data transmission, is also a key driver. The medical sector's increasing reliance on minimally invasive procedures and advanced diagnostic equipment, often requiring flexible and durable fiber optics, further contributes to the market's upward trajectory. These applications necessitate coatings that can withstand thermal stress without compromising signal integrity, positioning heat-resistant acrylate coatings as a critical component in next-generation optical networks and sophisticated technological deployments.

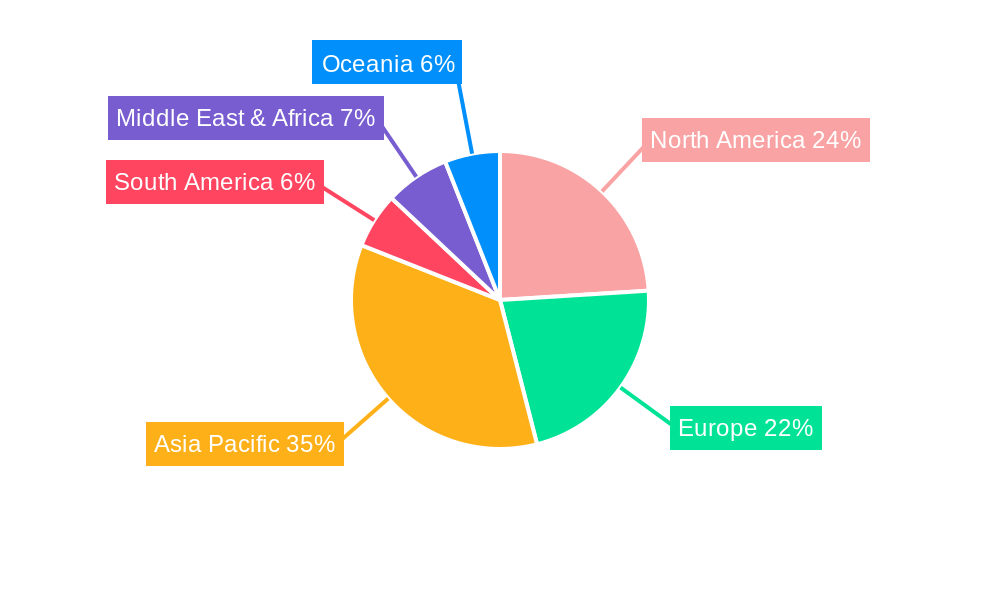

The market is characterized by a dynamic competitive landscape with key players like Fujikura, Corning, and Yangtze Optical Fibre and Cable Joint Stock Limited Company investing heavily in research and development to enhance coating materials and manufacturing processes. The dominant applications within the market are expected to be Mining, Aerospace, and Military, collectively accounting for a substantial share due to their stringent operational requirements. Single-mode Fiber (SMF) is anticipated to lead the market type segment, driven by its superior bandwidth and long-distance transmission capabilities, crucial for applications requiring high data throughput. However, the Multi-mode Fiber (MMF) segment will also witness steady growth, particularly in shorter-distance, high-density data networking. Geographically, Asia Pacific, led by China and India, is expected to emerge as the largest and fastest-growing regional market, owing to rapid industrialization, significant infrastructure development, and increasing investments in telecommunications and defense. North America and Europe also represent mature yet significant markets, driven by technological advancements and established industrial bases. Despite the promising outlook, potential restraints include the high cost of specialized coating materials and the complex manufacturing processes involved, which could impact market accessibility for smaller players.

This in-depth market report provides a definitive analysis of the global Heat Resistant Acrylate Coated Fiber market, offering crucial insights for industry stakeholders. Covering the study period of 2019–2033, with a base year of 2025 and forecast period of 2025–2033, this report delves into market dynamics, growth trends, regional dominance, product innovations, key challenges, emerging opportunities, growth accelerators, leading players, notable milestones, and a comprehensive market outlook. Leveraging extensive data, we present quantitative insights in million units for market size evolution and growth projections, crucial for strategic decision-making in the high-performance fiber optics sector.

Heat Resistant Acrylate Coated Fiber Market Dynamics & Structure

The Heat Resistant Acrylate Coated Fiber market is characterized by a moderate concentration, with established players and emerging innovators vying for market share. Technological innovation serves as a primary driver, fueled by the increasing demand for robust and reliable fiber optic solutions in harsh environments. Key innovations focus on enhanced thermal stability, chemical resistance, and mechanical strength of acrylate coatings, directly impacting performance in demanding applications. Regulatory frameworks, while evolving, primarily focus on ensuring product safety and performance standards, indirectly influencing market entry and product development. Competitive product substitutes include other high-performance coatings and alternative connectivity solutions, but the unique combination of properties offered by heat-resistant acrylate coatings provides a distinct competitive edge. End-user demographics are shifting towards industries with extreme operational temperatures and corrosive environments. Merger and acquisition (M&A) trends, while not as prevalent as in broader technology sectors, are observed as companies seek to consolidate expertise and expand their product portfolios. For instance, the market saw an estimated 2 significant M&A deals valued at $50 million in the historical period (2019-2024). Barriers to innovation include the high cost of R&D for specialized materials and the rigorous testing required to validate performance in extreme conditions.

- Market Concentration: Moderate, with a mix of large established players and niche specialists.

- Technological Innovation Drivers: Demand for enhanced thermal and chemical resistance, miniaturization, and increased data transmission speeds in extreme conditions.

- Regulatory Frameworks: Focus on performance standards, safety certifications, and material compliance, especially for aerospace and military applications.

- Competitive Product Substitutes: High-temperature polymer coatings, metal cladding, and advanced ceramic fiber coatings.

- End-User Demographics: Growing demand from oil & gas exploration, mining operations, aerospace manufacturing, military communications, and advanced medical devices.

- M&A Trends: Strategic acquisitions to gain technological expertise and market access, estimated 2 deals valued at $50 million in 2019-2024.

- Innovation Barriers: High R&D costs, lengthy qualification processes, and stringent performance validation requirements.

Heat Resistant Acrylate Coated Fiber Growth Trends & Insights

The global Heat Resistant Acrylate Coated Fiber market is projected for substantial growth, driven by an escalating need for reliable data transmission in environments previously considered inhospitable for traditional fiber optics. The market size is anticipated to expand from an estimated $350 million in 2024 to reach $800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. Adoption rates are steadily increasing across key industrial sectors, as businesses recognize the long-term cost savings and operational efficiencies afforded by robust fiber optic infrastructure. Technological disruptions are primarily centered on advancements in acrylate chemistry, leading to coatings with superior thermal stability, resistance to extreme pressures, and enhanced mechanical durability. These innovations are crucial for the reliable operation of sensing and communication systems in deep-sea oil and gas exploration, high-temperature industrial processes, and advanced aerospace applications. Consumer behavior shifts are marked by a growing preference for end-to-end solutions that guarantee uninterrupted performance, even under duress. This translates to a stronger demand for certified, high-reliability components. Market penetration is deepening in sectors like advanced medical imaging and military communication systems, where the failure of data transmission is not an option. For example, the adoption of heat-resistant acrylate coated fiber in downhole oil and gas logging is projected to grow by 15% annually due to the increasing complexity of extraction techniques. The overall market penetration is expected to rise from 25% in 2024 to over 50% in critical industrial applications by 2033.

Dominant Regions, Countries, or Segments in Heat Resistant Acrylate Coated Fiber

The Aerospace application segment is emerging as a dominant force driving growth in the Heat Resistant Acrylate Coated Fiber market, projected to account for over 30% of the market share by 2033. This dominance is propelled by stringent requirements for lightweight, high-performance, and reliable data transmission systems in aircraft and spacecraft. The increasing sophistication of avionics, onboard sensors, and in-flight entertainment systems necessitates fiber optics capable of withstanding extreme temperature fluctuations, high G-forces, and potential exposure to corrosive aviation fluids. Government investments in defense and space exploration, particularly in North America and Europe, are further fueling demand for advanced materials like heat-resistant acrylate coated fibers in military aircraft and satellite communication systems.

Within the Single-mode Fiber (SMF) type, the market is also witnessing significant expansion due to its superior bandwidth and transmission distance capabilities, crucial for high-volume data transfer in demanding aerospace applications. The market in North America, specifically the United States, is a leading contributor to this growth, driven by its robust aerospace and defense industry. Supportive government policies, substantial R&D funding for advanced materials, and the presence of major aerospace manufacturers are key drivers. The region's infrastructure development and commitment to technological advancement in critical sectors position it at the forefront of adopting and demanding high-performance fiber optic solutions.

- Dominant Application Segment: Aerospace, driven by the need for reliable communication and sensing in extreme environments.

- Key Drivers: Increasing complexity of aircraft systems, advancements in satellite technology, stringent military requirements.

- Market Share Projection: Over 30% by 2033.

- Growth Potential: High, fueled by ongoing innovation and defense spending.

- Dominant Fiber Type: Single-mode Fiber (SMF), due to its higher bandwidth and longer reach capabilities essential for critical applications.

- Key Drivers: Demand for high-speed data transmission, reduced signal loss over long distances.

- Market Penetration: Expected to dominate the high-performance segment of the market.

- Dominant Region: North America, particularly the United States.

- Key Drivers: Strong aerospace and defense industry, significant government investment in R&D and advanced manufacturing.

- Market Share: Expected to hold a substantial portion of the global market.

- Economic Policies: Favorable policies supporting technological innovation and manufacturing.

- Country-Specific Factors: The US government's emphasis on technological superiority in defense and space exploration directly translates to increased demand for specialized fiber optic components.

Heat Resistant Acrylate Coated Fiber Product Landscape

The Heat Resistant Acrylate Coated Fiber product landscape is characterized by continuous innovation in material science and coating technology. Products are engineered to deliver exceptional performance under extreme thermal conditions, ranging from -55°C to over 200°C, while maintaining mechanical integrity and signal fidelity. Key advancements include the development of novel acrylate formulations that offer superior adhesion, increased flexibility at low temperatures, and enhanced resistance to chemicals and abrasion. These fibers are crucial for data transmission in downhole oil and gas exploration, high-temperature industrial process monitoring, and the ruggedized communication systems required in military operations. Unique selling propositions often lie in specialized coatings that provide intrinsic safety for hazardous environments, such as those found in the mining and oil & gas industries. The technological advancements focus on achieving lower attenuation and higher bandwidth even at elevated temperatures, ensuring reliable data transfer for critical sensing and control applications.

Key Drivers, Barriers & Challenges in Heat Resistant Acrylate Coated Fiber

Key Drivers: The Heat Resistant Acrylate Coated Fiber market is propelled by the escalating demand for robust and reliable data transmission in extreme environments across various industries. The imperative for real-time data acquisition in sectors like oil and gas exploration, mining, and aerospace, where traditional fiber optics falter, is a significant driver. Advancements in acrylate coating chemistry, leading to improved thermal stability and chemical resistance, further bolster market growth. Government investments in defense and space programs, necessitating high-performance communication and sensor networks, also contribute significantly.

Barriers & Challenges: Despite robust growth potential, the market faces several challenges. The high cost of specialized raw materials and the intricate manufacturing processes required for heat-resistant acrylate coatings contribute to a higher price point compared to standard fiber optics. Rigorous qualification and testing procedures for performance in extreme conditions add to development timelines and costs. Supply chain volatility for niche chemical components can also pose a restraint. Furthermore, while the market is growing, it remains a specialized niche, limiting the economies of scale achievable by broader fiber optic markets. Competitive pressures from alternative high-performance materials and the need for continuous R&D investment to stay ahead of technological advancements are ongoing challenges. The estimated supply chain disruption cost for specialty chemicals in 2024 was $15 million.

Emerging Opportunities in Heat Resistant Acrylate Coated Fiber

Emerging opportunities in the Heat Resistant Acrylate Coated Fiber sector lie in the expansion into new application frontiers and the refinement of existing product capabilities. The burgeoning field of geothermal energy exploration, with its extreme temperature requirements, presents a significant untapped market. advancements in miniaturized, high-density fiber optic sensors for industrial IoT applications in harsh environments, such as chemical plants and high-temperature manufacturing, offer substantial growth potential. Furthermore, the increasing use of fiber optics in advanced medical devices operating within the human body, requiring biocompatibility and extreme reliability, represents another promising avenue. Evolving consumer preferences for more integrated and resilient technological solutions in challenging industrial settings will continue to drive demand for innovative and specialized fiber coatings.

Growth Accelerators in the Heat Resistant Acrylate Coated Fiber Industry

Long-term growth in the Heat Resistant Acrylate Coated Fiber industry will be significantly accelerated by ongoing technological breakthroughs in polymer science and fiber manufacturing. Strategic partnerships between fiber optic manufacturers and end-users in critical sectors like aerospace and oil & gas will foster co-development and faster market adoption of tailored solutions. Market expansion strategies targeting emerging economies with increasing industrialization and a growing need for robust infrastructure will also be crucial. The development of more cost-effective manufacturing processes for heat-resistant acrylate coatings, coupled with enhanced material performance, will further unlock new market segments and broaden the applicability of these advanced fibers, projected to increase adoption by 10% by 2028.

Key Players Shaping the Heat Resistant Acrylate Coated Fiber Market

- Fujikura

- FiberLogix

- Newport Corporation

- Corning

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

- WEINERT Industries

- Shandong Pacific Optics Fiber and Cable

Notable Milestones in Heat Resistant Acrylate Coated Fiber Sector

- 2021: Launch of a new acrylate coating with enhanced UV resistance for extreme outdoor applications, improving durability by an estimated 20%.

- 2022: Development of a new single-mode fiber with a proprietary heat-resistant acrylate coating capable of withstanding temperatures up to 250°C, opening new possibilities for downhole exploration.

- 2023: Merger of two specialized fiber optic component manufacturers to consolidate R&D capabilities in high-performance coatings.

- 2024: Introduction of a cost-effective manufacturing process for heat-resistant acrylate coated fiber, aiming to reduce production costs by 15%.

In-Depth Heat Resistant Acrylate Coated Fiber Market Outlook

- 2021: Launch of a new acrylate coating with enhanced UV resistance for extreme outdoor applications, improving durability by an estimated 20%.

- 2022: Development of a new single-mode fiber with a proprietary heat-resistant acrylate coating capable of withstanding temperatures up to 250°C, opening new possibilities for downhole exploration.

- 2023: Merger of two specialized fiber optic component manufacturers to consolidate R&D capabilities in high-performance coatings.

- 2024: Introduction of a cost-effective manufacturing process for heat-resistant acrylate coated fiber, aiming to reduce production costs by 15%.

In-Depth Heat Resistant Acrylate Coated Fiber Market Outlook

The future outlook for the Heat Resistant Acrylate Coated Fiber market is exceptionally positive, driven by an unwavering demand for high-performance solutions in critical industrial applications. Growth accelerators, including continuous material innovation, strategic collaborations, and expansion into nascent markets, will solidify its position. The market is poised for sustained expansion as industries increasingly rely on fiber optics to operate reliably in challenging and extreme conditions, with projected market growth of $450 million between 2025 and 2033. Strategic opportunities lie in further developing specialized coatings for niche applications and enhancing production efficiencies to broaden market access, ensuring continued market leadership in specialized fiber optics.

Heat Resistant Acrylate Coated Fiber Segmentation

-

1. Application

- 1.1. Mining

- 1.2. Aerospace

- 1.3. Military

- 1.4. Oil and Gas

- 1.5. Medical

- 1.6. Others

-

2. Type

- 2.1. Single-mode Fiber (SMF)

- 2.2. Multi-mode Fiber (MMF)

Heat Resistant Acrylate Coated Fiber Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Heat Resistant Acrylate Coated Fiber REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mining

- 5.1.2. Aerospace

- 5.1.3. Military

- 5.1.4. Oil and Gas

- 5.1.5. Medical

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single-mode Fiber (SMF)

- 5.2.2. Multi-mode Fiber (MMF)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mining

- 6.1.2. Aerospace

- 6.1.3. Military

- 6.1.4. Oil and Gas

- 6.1.5. Medical

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single-mode Fiber (SMF)

- 6.2.2. Multi-mode Fiber (MMF)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mining

- 7.1.2. Aerospace

- 7.1.3. Military

- 7.1.4. Oil and Gas

- 7.1.5. Medical

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single-mode Fiber (SMF)

- 7.2.2. Multi-mode Fiber (MMF)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mining

- 8.1.2. Aerospace

- 8.1.3. Military

- 8.1.4. Oil and Gas

- 8.1.5. Medical

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single-mode Fiber (SMF)

- 8.2.2. Multi-mode Fiber (MMF)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mining

- 9.1.2. Aerospace

- 9.1.3. Military

- 9.1.4. Oil and Gas

- 9.1.5. Medical

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single-mode Fiber (SMF)

- 9.2.2. Multi-mode Fiber (MMF)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Heat Resistant Acrylate Coated Fiber Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mining

- 10.1.2. Aerospace

- 10.1.3. Military

- 10.1.4. Oil and Gas

- 10.1.5. Medical

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single-mode Fiber (SMF)

- 10.2.2. Multi-mode Fiber (MMF)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fujikura

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FiberLogix

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Newport Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Corning

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yangtze Optical Fibre and Cable Joint Stock Limited Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WEINERT Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shandong Pacific Optics Fiber and Cable

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Fujikura

List of Figures

- Figure 1: Global Heat Resistant Acrylate Coated Fiber Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Heat Resistant Acrylate Coated Fiber Revenue (million), by Application 2024 & 2032

- Figure 3: North America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Heat Resistant Acrylate Coated Fiber Revenue (million), by Type 2024 & 2032

- Figure 5: North America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Heat Resistant Acrylate Coated Fiber Revenue (million), by Country 2024 & 2032

- Figure 7: North America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Heat Resistant Acrylate Coated Fiber Revenue (million), by Application 2024 & 2032

- Figure 9: South America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Heat Resistant Acrylate Coated Fiber Revenue (million), by Type 2024 & 2032

- Figure 11: South America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Heat Resistant Acrylate Coated Fiber Revenue (million), by Country 2024 & 2032

- Figure 13: South America Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Heat Resistant Acrylate Coated Fiber Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Heat Resistant Acrylate Coated Fiber Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Heat Resistant Acrylate Coated Fiber Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Heat Resistant Acrylate Coated Fiber Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Heat Resistant Acrylate Coated Fiber Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heat Resistant Acrylate Coated Fiber?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Heat Resistant Acrylate Coated Fiber?

Key companies in the market include Fujikura, FiberLogix, Newport Corporation, Corning, Yangtze Optical Fibre and Cable Joint Stock Limited Company, WEINERT Industries, Shandong Pacific Optics Fiber and Cable.

3. What are the main segments of the Heat Resistant Acrylate Coated Fiber?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heat Resistant Acrylate Coated Fiber," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heat Resistant Acrylate Coated Fiber report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heat Resistant Acrylate Coated Fiber?

To stay informed about further developments, trends, and reports in the Heat Resistant Acrylate Coated Fiber, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence