Key Insights

The Italian online accommodation market is projected to reach $10.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8%. This robust growth is driven by increasing online travel bookings, particularly among younger demographics, Italy's strong tourism appeal, and expanding internet and mobile penetration. The market benefits from a diverse range of accommodation options, including vacation rentals and boutique stays, facilitated by platforms like Airbnb. While seasonal fluctuations and evolving regulations present challenges, the overall outlook remains positive, supported by dynamic market segmentation across mobile applications, websites, and direct/third-party booking channels.

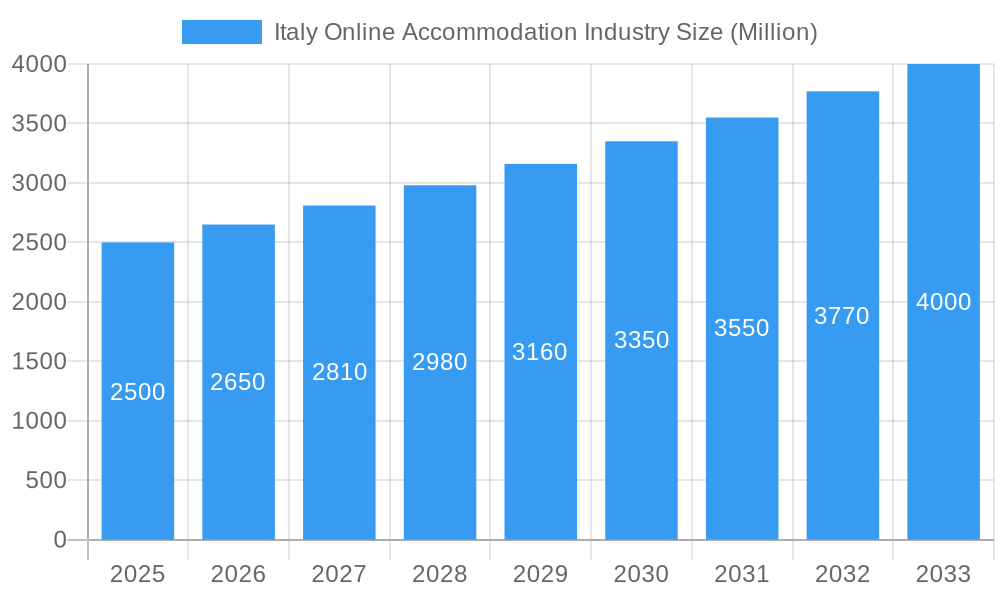

Italy Online Accommodation Industry Market Size (In Billion)

Key players, including global giants like Booking Holdings, Expedia, and Airbnb, alongside local specialists, compete through user experience, competitive pricing, and targeted marketing. Future growth will be shaped by technological advancements, innovative business models, and evolving consumer demand for personalized travel. Historical data from 2019-2024 indicates consistent market expansion, with forecasts for 2025-2033 anticipating a continuation of this trend, influenced by the factors outlined. The base year for this analysis is 2024.

Italy Online Accommodation Industry Company Market Share

Italy Online Accommodation Industry: Market Analysis & Forecast 2019-2033

This report offers a comprehensive analysis of the Italian online accommodation market from 2019 to 2033, with a specific focus on 2025. It explores market dynamics, growth trends, key participants, and emerging opportunities within the broader Italian travel and tourism sector and the online travel booking sub-market. This analysis is crucial for industry professionals, investors, and stakeholders seeking a detailed understanding of this evolving sector.

Italy Online Accommodation Industry Market Dynamics & Structure

The Italian online accommodation market exhibits a moderately concentrated structure, dominated by major players such as Booking Holdings, Expedia, and Airbnb, collectively holding a significant market share (estimated at [Insert Updated Percentage]% in 2025). However, a vibrant competitive landscape exists, fueled by smaller, specialized platforms like Italy Heaven and Plum Guide that cater to niche segments and unique traveler preferences. This competition is further intensified by technological innovation, particularly advancements in mobile applications, AI-driven personalized recommendations, and the integration of virtual reality (VR) and augmented reality (AR) experiences. The regulatory environment, notably the impact of GDPR (General Data Protection Regulation) and other tourism-specific regulations, significantly influences operational strategies and necessitates ongoing compliance efforts. Furthermore, the market faces competition from traditional booking methods, peer-to-peer rentals operating outside established online platforms, and direct bookings made through hotel websites. End-user demographics reveal a strong preference for online booking among younger travelers (18-40 years old) and those prioritizing convenience and cost-effectiveness. Mergers and acquisitions (M&A) activity within the sector has shown moderate levels ([Insert Updated Number] deals in the period [Insert Date Range]), with larger players strategically consolidating their market presence through acquisitions of smaller, more specialized platforms.

- Market Concentration: Moderately concentrated, with the top 3 players holding [Insert Updated Percentage]% market share (2025).

- Technological Innovation: Mobile app adoption, AI-driven recommendations, VR/AR experiences, and seamless integration with other travel services are key drivers of growth and market differentiation.

- Regulatory Framework: GDPR compliance, taxation policies, and other tourism regulations present ongoing operational challenges and necessitate strategic adaptation.

- Competitive Substitutes: Traditional booking agencies, local rental platforms, direct hotel bookings, and peer-to-peer platforms outside the major players constitute a significant competitive landscape.

- End-User Demographics: Young travelers (18-40) and budget-conscious consumers represent key target segments, while luxury travelers also constitute a substantial sector.

- M&A Trends: Moderate activity ([Insert Updated Number] deals, [Insert Updated Date Range]), driven by consolidation, expansion into new markets, and the acquisition of specialized platforms.

Italy Online Accommodation Industry Growth Trends & Insights

The Italian online accommodation market exhibited robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Market size is projected to reach €xx Million in 2025 and €xx Million by 2033, driven by increasing internet penetration, smartphone adoption, and a rising preference for online booking among tourists. Technological disruptions, such as the introduction of innovative booking platforms and personalized travel planning tools, significantly influence consumer behavior. The increasing adoption of mobile applications for booking demonstrates the shift towards convenience and on-the-go travel planning. Market penetration is estimated at xx% in 2025 and is expected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Italy Online Accommodation Industry

The Italian online accommodation market shows significant regional variations. Northern Italy (regions like Lombardy and Veneto) accounts for the largest market share (estimated at xx% in 2025), driven by strong tourism activity and well-developed infrastructure. Rome and Milan are key urban centers dominating the market.

Regarding booking modes, Third-Party Online Portals (e.g., Booking.com, Expedia) currently dominate, holding an estimated xx% market share in 2025. However, Direct/Captive portals are experiencing growth, particularly among established hotel chains, leveraging loyalty programs and direct marketing. Mobile applications are rapidly gaining traction, with an increasing number of bookings originating from mobile devices.

- Key Drivers (Northern Italy): Strong tourism, developed infrastructure, major cities (Milan, Rome).

- Key Drivers (Third-Party Portals): Wide reach, established brand recognition, competitive pricing.

- Key Drivers (Mobile Applications): Convenience, on-the-go booking, personalized experiences.

Italy Online Accommodation Industry Product Landscape

The online accommodation sector provides a diverse range of offerings, encompassing budget-friendly hostels to luxurious villas, all readily accessible through various platforms. Key product innovations driving market growth include AI-powered personalized recommendations, customized travel itineraries incorporating local experiences, immersive virtual tours, and streamlined integration with complementary travel services such as flights and transportation. Performance metrics central to the industry include conversion rates, customer satisfaction scores (CSAT), Net Promoter Score (NPS), and average booking value (ABV). Unique selling propositions (USPs) that foster competition and innovation include exclusive deals, loyalty programs, flexible cancellation policies, and seamless user experiences that prioritize convenience and personalization.

Key Drivers, Barriers & Challenges in Italy Online Accommodation Industry

Key Drivers:

- The robust and sustained growth of tourism in Italy.

- The continued increase in smartphone penetration and internet access.

- The rising consumer preference for online travel booking, driven by convenience and cost-effectiveness.

- Ongoing technological advancements enhancing booking platform functionalities and user experience.

- The emergence of sustainable and eco-conscious travel as a key market segment.

Challenges:

- Intense competition among numerous platforms, necessitating strategic differentiation.

- Vulnerability to fluctuations in tourism demand influenced by economic downturns and global events.

- The complexity of navigating regulatory changes and ensuring ongoing compliance with data privacy, taxation, and other relevant regulations.

- Effective management of potential supply chain disruptions impacting accommodation availability and pricing.

- The need for robust cybersecurity measures to protect sensitive customer data.

Emerging Opportunities in Italy Online Accommodation Industry

Untapped markets include eco-tourism, wellness tourism, and niche experiences. Opportunities exist in developing personalized travel packages tailored to specific interests and budgets. Evolving consumer preferences for sustainable and authentic travel experiences create new opportunities for platforms that emphasize local businesses and responsible tourism. The integration of virtual and augmented reality technologies can enhance the booking experience, creating immersive previews of accommodations.

Growth Accelerators in the Italy Online Accommodation Industry Industry

Strategic partnerships between online platforms and local businesses can boost market growth. Investment in innovative technologies like AI-powered recommendations and personalized travel planning tools can enhance customer experience and drive bookings. Expanding into underserved regions of Italy and targeting niche tourism segments can unlock significant growth potential. The increasing use of data analytics to understand consumer behavior will further refine strategies.

Key Players Shaping the Italy Online Accommodation Industry Market

- Italy Heaven

- AirBnB

- agoda

- Bookings for you

- Initalia

- Trip advisor

- Booking Holdings

- Expedia

- Plum guide

- Vrbo

Notable Milestones in Italy Online Accommodation Industry Sector

- June 01, 2021: Trip.com and TripAdvisor expand their strategic partnership to include TripAdvisor Plus.

- July 20, 2021: TripAdvisor partners with leading hotel technology providers to expand TripAdvisor Plus.

- September 13, 2021: TripAdvisor partners with Audible for enhanced travel audio entertainment.

In-Depth Italy Online Accommodation Industry Market Outlook

The Italian online accommodation market is projected to experience continued growth, fueled by technological advancements, strategic partnerships, and the enduring popularity of online travel booking. Strategic investments in personalized experiences, sustainable travel options, and innovative marketing strategies will be crucial for success in this competitive environment. The market is likely to witness further consolidation, with larger players acquiring smaller platforms to expand their reach, offerings, and market share. The long-term potential for growth remains substantial, presenting significant opportunities for established players and new entrants alike to capitalize on the growing demand for online travel services in Italy. A focus on delivering exceptional customer service, personalized experiences, and a commitment to sustainable practices will be critical differentiators in the years to come.

Italy Online Accommodation Industry Segmentation

-

1. Platform type

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking type

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive portals

Italy Online Accommodation Industry Segmentation By Geography

- 1. Italy

Italy Online Accommodation Industry Regional Market Share

Geographic Coverage of Italy Online Accommodation Industry

Italy Online Accommodation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration has Huge Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Online Accommodation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking type

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Italy Heaven**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AirBnB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bookings for you

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Initalia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trip advisor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Booking Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plum guide

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vrbo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Italy Heaven**List Not Exhaustive

List of Figures

- Figure 1: Italy Online Accommodation Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Online Accommodation Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 2: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 3: Italy Online Accommodation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 5: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 6: Italy Online Accommodation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Online Accommodation Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Italy Online Accommodation Industry?

Key companies in the market include Italy Heaven**List Not Exhaustive, AirBnB, agoda, Bookings for you, Initalia, Trip advisor, Booking Holdings, Expedia, Plum guide, Vrbo.

3. What are the main segments of the Italy Online Accommodation Industry?

The market segments include Platform type, Mode of Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration has Huge Impact on the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

On September 13, 2021. TripAdvisor partnered with Audible for the Ultimate Travel Audio Entertainment, it makes easy for traveller to listen their favourite audio playlists with them during their next trip with just a few taps on their mobile device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Online Accommodation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Online Accommodation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Online Accommodation Industry?

To stay informed about further developments, trends, and reports in the Italy Online Accommodation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence