Key Insights

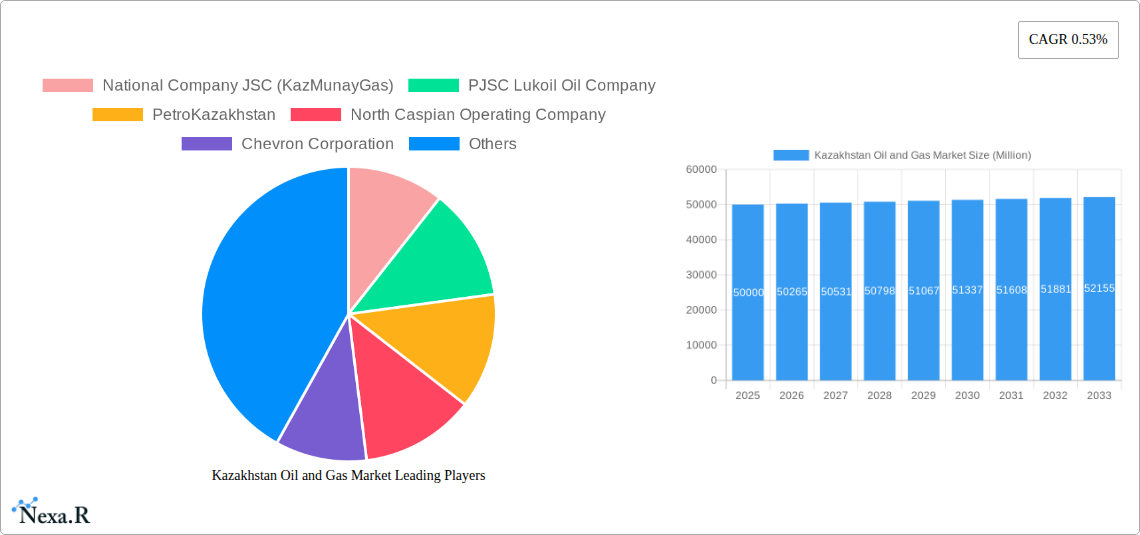

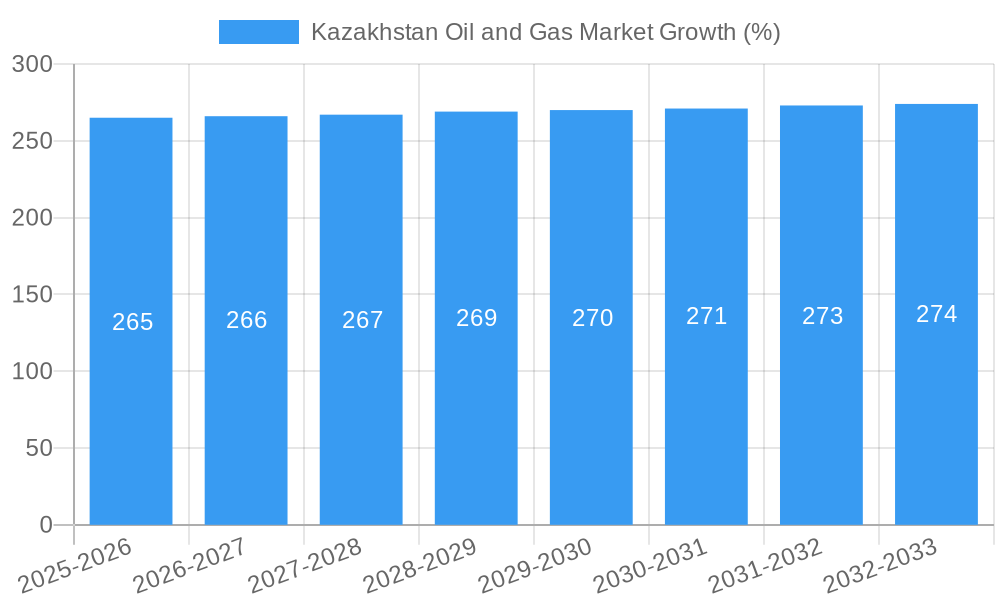

The Kazakhstan oil and gas market, while exhibiting a moderate CAGR of 0.53%, presents a complex landscape shaped by several interacting factors. The market's size in 2025 is estimated at $XX million (assuming a reasonable market size based on comparable economies and oil production data, a figure needs to be inserted here). Key drivers include the nation's substantial oil and gas reserves, ongoing exploration and production activities, and strategic partnerships with international energy companies like Chevron and Lukoil. Growth is further fueled by increasing domestic energy demand and the expansion of pipeline infrastructure, particularly for export to key Asian markets. However, the market faces challenges. Geopolitical instability and fluctuating global oil prices pose significant restraints. Furthermore, the need for modernization of existing infrastructure and the transition towards cleaner energy sources represent long-term headwinds. The market is segmented by upstream, midstream, and downstream activities, with onshore operations currently dominating. Significant growth potential exists in the development of offshore reserves and the expansion of LNG terminal capacity. The major players, including KazMunayGas, Lukoil, and PetroKazakhstan, are strategically focusing on diversifying their operations and enhancing production efficiency to navigate these market dynamics.

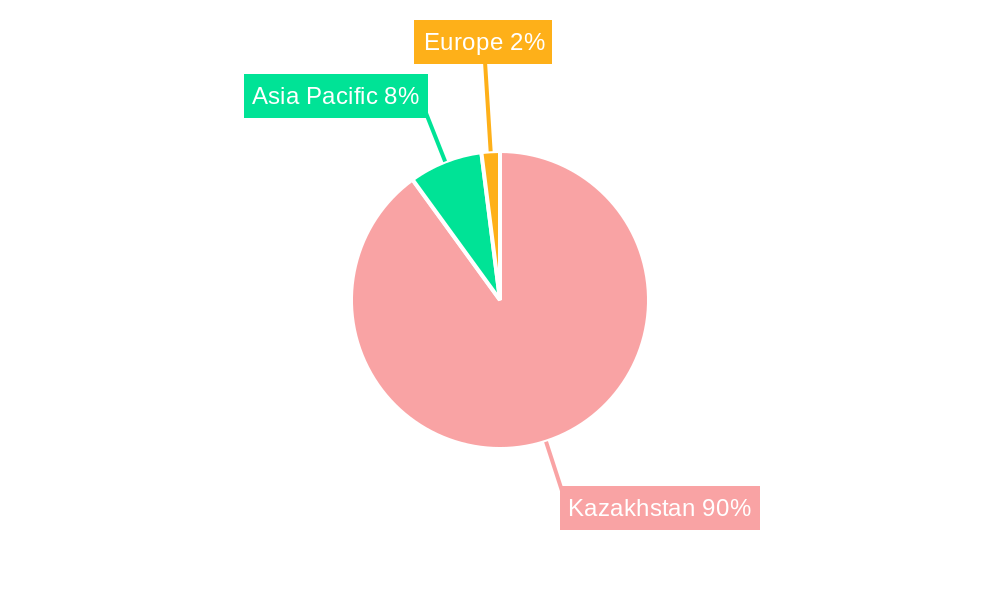

The regional distribution reveals a strong concentration within Kazakhstan itself, with export-oriented strategies primarily targeting Asian markets like China, Japan, and India. While the Asia-Pacific region is a significant export market, the growth trajectory is dependent on global energy demand and the competitive dynamics of the international oil and gas market. Future projections for the 2025-2033 forecast period suggest continued growth, albeit at a moderate pace. This growth will be shaped by successful exploration efforts, strategic investments in infrastructure, and the ability to manage geopolitical risks effectively. The focus on optimizing existing resources and tapping into untapped reserves will be crucial for realizing the full potential of the Kazakhstan oil and gas market.

Kazakhstan Oil & Gas Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Kazakhstan oil and gas market, encompassing upstream, midstream, and downstream segments, from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and policymakers seeking to navigate this dynamic market. The report leverages extensive data analysis to forecast market size, identify key growth drivers and challenges, and highlight promising opportunities within the onshore and offshore sectors. With a focus on key players like KazMunayGas, Lukoil, and Chevron, this report is an essential resource for understanding the current landscape and future trajectory of Kazakhstan's energy sector.

Keywords: Kazakhstan oil and gas market, upstream, midstream, downstream, KazMunayGas, Lukoil, Chevron, PetroKazakhstan, Gazprom, oil production, gas production, pipeline infrastructure, LNG terminals, OPEC, Sinopec, energy market, market analysis, market forecast, energy sector, Kazakhstan energy, Atyrau region, petrochemical complex, M&A activity.

Kazakhstan Oil and Gas Market Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within Kazakhstan's oil and gas industry. The analysis covers the period from 2019 to 2024.

The Kazakhstani oil and gas sector exhibits a mixed market structure, with significant state influence through National Company JSC (KazMunayGas) alongside substantial private sector participation from international energy giants like Lukoil and Chevron. Market concentration is moderate, with a few dominant players controlling a large portion of production and refining.

Market Concentration: KazMunayGas holds a significant market share in upstream operations, while other players compete intensely in downstream and midstream activities. XX% of upstream production is controlled by the top 5 players in 2024.

Technological Innovation: The adoption of advanced technologies, such as enhanced oil recovery (EOR) techniques and digitalization in exploration and production, is increasing but faces challenges related to infrastructure development and expertise.

Regulatory Framework: Government regulations play a crucial role, impacting exploration licenses, production quotas, and environmental compliance. Recent regulatory changes have aimed to attract foreign investment and enhance operational efficiency. These regulations are expected to evolve in line with global climate goals, potentially influencing upstream operations.

Competitive Product Substitutes: The market faces some pressure from renewable energy sources, although their penetration rate remains comparatively low at present. Natural gas plays a considerable role in energy mix, competing with oil.

End-User Demographics: Kazakhstan’s energy demand is largely domestic, with exports playing a major role in revenue generation. The industrial sector consumes a significant portion of energy, while the residential and transportation sectors are also crucial drivers.

M&A Trends: The number of M&A deals within the sector varied throughout the 2019-2024 period, averaging xx deals annually, with deals largely focused on consolidation in specific segments of the value chain.

Kazakhstan Oil and Gas Market Growth Trends & Insights

This section details the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the Kazakhstan oil and gas industry from 2019 to 2033.

The Kazakhstan oil and gas market experienced a period of growth between 2019 and 2024. However, global events like the COVID-19 pandemic and geopolitical factors such as the war in Ukraine have influenced demand and prices, affecting production and investment decisions. The market is projected to witness moderate growth during the forecast period (2025-2033), driven by ongoing investment in exploration and production, expansion of pipeline infrastructure, and increased domestic consumption.

The CAGR for the overall market during the forecast period is estimated at xx%. This growth is attributed to factors such as growing energy demand within Kazakhstan, new projects, and government initiatives.

Technological advancements like automation and digitalization are influencing operational efficiency and resource optimization. However, high initial investment costs and the need for skilled workforce limit the widespread adoption of some cutting-edge technologies. Furthermore, evolving global energy policy is influencing investment decisions, necessitating diversification strategies by both state-owned and privately owned entities. The refining sector is undergoing modernization through planned investments aimed at improving efficiency. The downstream sector’s growth is largely connected to overall production levels and the domestic market’s expansion.

Dominant Regions, Countries, or Segments in Kazakhstan Oil and Gas Market

The West Kazakhstan region dominates the oil and gas sector due to its substantial reserves and established infrastructure. The Atyrau region plays a particularly significant role, being a hub for exploration, production, and refining activities.

Upstream: The Caspian Sea's offshore fields, particularly the North Caspian Project, are major contributors to upstream production.

Midstream: Pipeline infrastructure, primarily connecting production sites to refineries and export terminals, serves as a key element of midstream operations, with future focus on optimizing existing capacity and potentially developing new pipelines.

Downstream: Refineries primarily situated in Atyrau and Pavlodar play a critical role in processing crude oil into petroleum products for domestic consumption and export.

Onshore/Offshore: Onshore activities account for a larger share of the production currently. Offshore production from Caspian Sea fields is important and likely to see growth in the future, as exploration efforts continue.

Transportation: Pipeline infrastructure is the dominant mode of transportation for crude oil and natural gas, connecting production areas to refineries, storage facilities, and export terminals. Key routes and capacities are frequently updated to accommodate changing production levels and export demands. Further development of pipeline capacity is projected to support industry growth.

Storage: Kazakhstan possesses considerable storage capacity for crude oil and refined products, strategic locations ensuring uninterrupted supply and aiding flexibility during times of fluctuating demand and production.

LNG Terminals: The current market share for LNG terminals is relatively low. Future development will depend on increased domestic demand and the exploration of potential export opportunities. Several infrastructure projects might be considered in the next decade.

Kazakhstan Oil and Gas Market Product Landscape

The Kazakhstan oil and gas market primarily focuses on crude oil, natural gas, and refined petroleum products. Ongoing efforts toward value-added product development are pushing innovation in the petrochemical sector. Investments in upgrading refineries, aimed at producing higher-value products and cleaner fuels, are enhancing product quality and competitiveness. Technological advancements, such as enhanced oil recovery techniques and improved refining processes, are driving efficiency gains and production optimization across the product lifecycle.

Key Drivers, Barriers & Challenges in Kazakhstan Oil and Gas Market

Key Drivers:

- Abundant Reserves: Kazakhstan possesses significant hydrocarbon reserves, forming a strong foundation for continued production.

- Government Support: Government initiatives focused on attracting foreign investment and streamlining regulatory processes are driving investment and growth.

- Growing Domestic Demand: The expanding economy and population lead to higher energy consumption.

- Export Opportunities: Kazakhstan exports oil and gas to regional and international markets, contributing significantly to revenue generation.

Challenges and Restraints:

- Geopolitical Risks: Regional instability and fluctuating global energy prices present significant uncertainties.

- Infrastructure Limitations: While the pipeline network is extensive, there remain limitations and ongoing need for upgrades and new routes.

- Environmental Concerns: Environmental regulations and growing awareness of climate change impact investment and operational practices. Sustainable practices and emissions reduction are becoming increasingly important to maintain operations.

- Competition: The highly competitive global energy market requires ongoing efficiency improvements and strategic partnerships to maintain profitability.

Emerging Opportunities in Kazakhstan Oil and Gas Market

- Petrochemical Industry Development: Growth in the petrochemical sector presents significant opportunities for value-added product diversification.

- Renewable Energy Integration: Exploration of integrating renewable energy sources with oil and gas operations is an area of emerging opportunity.

- Gas Exports: Expansion of gas export capabilities is another potential area of future expansion.

- Technological Advancement: The implementation of new technological capabilities in enhanced oil recovery can greatly influence long-term projections.

Growth Accelerators in the Kazakhstan Oil and Gas Market Industry

Long-term growth in the Kazakhstan oil and gas market will be accelerated by continuous investment in exploration and production, strategic partnerships with international energy companies, and government support for infrastructure development. Advancements in oil and gas extraction technologies, along with a focus on optimizing existing resources, will further fuel expansion. Furthermore, the development of gas processing and petrochemical industries provides promising avenues for value chain diversification.

Key Players Shaping the Kazakhstan Oil and Gas Market Market

- National Company JSC (KazMunayGas)

- PJSC Lukoil Oil Company

- PetroKazakhstan

- North Caspian Operating Company

- Chevron Corporation

- PJSC Gazprom

- Karachaganak Petroleum Operating BV

- Nostrum Oil & Gas PLC

Notable Milestones in Kazakhstan Oil and Gas Market Sector

June 2023: The Ministry of Energy announced the continuation of oil production reduction by 78,000 barrels per day until the end of 2024, aligning with the OPEC+ agreement. This decision impacts production output and revenue streams.

May 2023: Sinopec and KazMunayGaz announced agreements to construct a gas-based petrochemical complex in Atyrau, signaling significant investment in downstream activities and potential growth in the petrochemical sector. This development will shape the downstream sector in the long term.

In-Depth Kazakhstan Oil and Gas Market Market Outlook

The future of the Kazakhstan oil and gas market appears promising, driven by its significant reserves, strategic location, and ongoing investments in infrastructure. While challenges persist, including geopolitical risks and environmental considerations, strategic partnerships, technological advancements, and government support will shape the market's continued growth. Opportunities in the downstream sector, particularly in petrochemicals and gas exports, will be crucial in driving long-term expansion. The market’s potential for diversification will influence its long-term trajectory.

Kazakhstan Oil and Gas Market Segmentation

-

1. Upstream

-

1.1. Location of Deployment

-

1.1.1. Onshore

-

1.1.1.1. Overview

- 1.1.1.1.1. Existing Projects

- 1.1.1.1.2. Projects in Pipeline

- 1.1.1.1.3. Upcoming Projects

-

1.1.1.1. Overview

- 1.1.2. Offshore

-

1.1.1. Onshore

-

1.1. Location of Deployment

-

2. Midstream

-

2.1. Transportation

-

2.1.1. Overview

- 2.1.1.1. Existing Infrastructure

- 2.1.1.2. Projects in Pipeline

- 2.1.1.3. Upcoming Projects

-

2.1.1. Overview

- 2.2. Storage

- 2.3. LNG Terminals

-

2.1. Transportation

-

3. Downstream

-

3.1. Refineries

-

3.1.1. Overview

- 3.1.1.1. Existing Infrastructure

- 3.1.1.2. Projects in Pipeline

- 3.1.1.3. Upcoming Projects

-

3.1.1. Overview

- 3.2. Petrochemicals Plants

-

3.1. Refineries

Kazakhstan Oil and Gas Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.1.1. Location of Deployment

- 5.1.1.1. Onshore

- 5.1.1.1.1. Overview

- 5.1.1.1.1.1. Existing Projects

- 5.1.1.1.1.2. Projects in Pipeline

- 5.1.1.1.1.3. Upcoming Projects

- 5.1.1.1.1. Overview

- 5.1.1.2. Offshore

- 5.1.1.1. Onshore

- 5.1.1. Location of Deployment

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.2.1. Transportation

- 5.2.1.1. Overview

- 5.2.1.1.1. Existing Infrastructure

- 5.2.1.1.2. Projects in Pipeline

- 5.2.1.1.3. Upcoming Projects

- 5.2.1.1. Overview

- 5.2.2. Storage

- 5.2.3. LNG Terminals

- 5.2.1. Transportation

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.3.1. Refineries

- 5.3.1.1. Overview

- 5.3.1.1.1. Existing Infrastructure

- 5.3.1.1.2. Projects in Pipeline

- 5.3.1.1.3. Upcoming Projects

- 5.3.1.1. Overview

- 5.3.2. Petrochemicals Plants

- 5.3.1. Refineries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. China Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 8. India Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 12. Indonesia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 13. Phillipes Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 14. Singapore Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 15. Thailandc Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia Pacific Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 National Company JSC (KazMunayGas)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PJSC Lukoil Oil Company

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 PetroKazakhstan

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 North Caspian Operating Company

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Chevron Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PJSC Gazprom

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Karachaganak Petroleum Operating BV

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Nostrum Oil & Gas PLC

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 National Company JSC (KazMunayGas)

List of Figures

- Figure 1: Kazakhstan Oil and Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kazakhstan Oil and Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kazakhstan Oil and Gas Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2019 & 2032

- Table 5: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2019 & 2032

- Table 7: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2019 & 2032

- Table 9: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kazakhstan Oil and Gas Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kazakhstan Oil and Gas Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: China Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: India Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Southeast Asia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Southeast Asia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Indonesia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Thailandc Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 36: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2019 & 2032

- Table 37: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 38: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2019 & 2032

- Table 39: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 40: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2019 & 2032

- Table 41: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Kazakhstan Oil and Gas Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Oil and Gas Market?

The projected CAGR is approximately 0.53%.

2. Which companies are prominent players in the Kazakhstan Oil and Gas Market?

Key companies in the market include National Company JSC (KazMunayGas), PJSC Lukoil Oil Company, PetroKazakhstan, North Caspian Operating Company, Chevron Corporation, PJSC Gazprom, Karachaganak Petroleum Operating BV, Nostrum Oil & Gas PLC.

3. What are the main segments of the Kazakhstan Oil and Gas Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

June 2023: The Ministry of Energy in Kazakhstan has announced that the country will maintain its reduction of oil production by 78,000 barrels per day until the end of 2024. This decision aligns with the agreement reached by the Organization of the Petroleum Exporting Countries (OPEC) in June 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence