Key Insights

The Latin American online travel market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). The market's expansion is fueled by several key factors. Rising disposable incomes across major economies like Brazil, Mexico, and Argentina are empowering a burgeoning middle class with increased spending power for leisure travel. Furthermore, the widespread adoption of smartphones and increased internet penetration are making online booking platforms increasingly accessible, driving the shift away from traditional travel agencies. The preference for convenient, self-service booking options and the allure of competitive pricing offered by online platforms are further propelling market growth. While challenges remain, such as economic volatility in some regions and concerns about data security, the overall market outlook remains positive. Segmentation analysis reveals significant opportunities within accommodation booking, particularly for budget-friendly options and unique experiences catering to the evolving preferences of Latin American travelers. Mobile booking platforms dominate the market, indicating a strong need for responsive and user-friendly mobile applications.

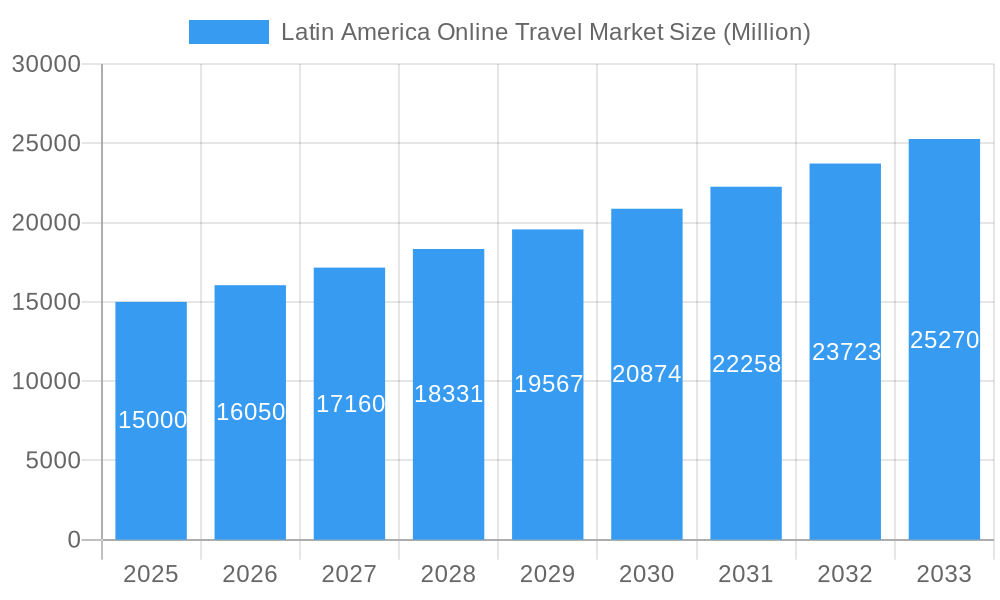

Latin America Online Travel Market Market Size (In Billion)

The competitive landscape is dynamic, with both global giants like Booking Holdings and Airbnb, as well as regional players like Decolar and Despegar, vying for market share. Strategic partnerships, technological innovations (e.g., AI-powered personalization), and aggressive marketing campaigns are crucial for success. Future growth will likely be influenced by factors such as sustainable tourism initiatives, the integration of travel technology with other platforms (e.g., fintech), and the ongoing evolution of consumer preferences. Understanding these trends is crucial for businesses seeking to capitalize on the vast potential of the Latin American online travel market. A sustained CAGR of 7.00% suggests substantial growth, though localized economic conditions and infrastructure development will continue to impact regional performance.

Latin America Online Travel Market Company Market Share

Latin America Online Travel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America online travel market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market by service type (Accommodation Booking, Travel Tickets Booking, Holiday Package Booking, Other Service Types), mode of booking (Direct Booking, Travel Agents), and booking platform (Desktop, Mobile/Tablet). Market size is presented in Millions.

Latin America Online Travel Market Market Dynamics & Structure

The Latin American online travel market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is relatively high, with major players like Booking Holdings, Despegar, and CVC Corp holding significant shares. However, the market also features a thriving ecosystem of smaller, specialized agencies and innovative startups. Technological innovation, particularly in mobile booking platforms and personalized travel recommendations, is a key driver. Regulatory frameworks vary across countries, impacting market access and operational efficiency. The market faces competition from traditional travel agents and offline booking channels, but the ongoing shift towards digital platforms presents significant growth opportunities. M&A activity, as evidenced by recent acquisitions like Despegar's purchase of Viajanet, signals consolidation and expansion efforts among key players. End-user demographics are evolving, with increasing penetration among younger, tech-savvy travelers.

- Market Concentration: Highly concentrated with top 5 players holding xx% market share in 2024.

- Technological Innovation: Strong driver, fueled by mobile app development and AI-powered personalization.

- Regulatory Landscape: Varies significantly across Latin American countries.

- Competitive Substitutes: Traditional travel agencies and offline booking channels.

- M&A Activity: High, reflecting consolidation and expansion strategies. xx deals closed in 2024.

- End-User Demographics: Growth driven by increasing internet penetration and smartphone adoption among younger demographics.

Latin America Online Travel Market Growth Trends & Insights

The Latin American online travel market has experienced significant growth over the historical period (2019-2024), driven by factors such as rising disposable incomes, increased internet and smartphone penetration, and a growing preference for convenient online booking platforms. The market is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of mobile booking, personalized travel recommendations, and the integration of travel-related services into broader platforms, are accelerating market growth and reshaping consumer behavior. Consumers are increasingly seeking personalized experiences and value-added services, influencing the evolution of product offerings and competitive strategies within the industry. Market penetration is still relatively low compared to developed markets, leaving significant room for growth.

Dominant Regions, Countries, or Segments in Latin America Online Travel Market

Brazil and Mexico are the dominant markets, accounting for xx% and xx% of the total market value in 2024, respectively, due to higher population density, increased internet penetration, and a robust middle class. Within the service types, Accommodation Booking holds the largest share, followed by Travel Tickets Booking and Holiday Package Booking. Mobile/Tablet is the leading booking platform, driven by high smartphone penetration and user preference.

- Leading Regions: Brazil and Mexico.

- Dominant Service Type: Accommodation Booking.

- Preferred Booking Platform: Mobile/Tablet.

- Key Drivers: Rising disposable incomes, increased internet and smartphone penetration.

Latin America Online Travel Market Product Landscape

The online travel market is characterized by a diverse range of products and services, including accommodation bookings, flight tickets, holiday packages, and ancillary services such as travel insurance and car rentals. Product innovation focuses on enhancing user experience through personalized recommendations, seamless booking processes, and mobile-optimized platforms. Key performance metrics include booking conversion rates, customer satisfaction scores, and average revenue per booking. Unique selling propositions often center on competitive pricing, exclusive deals, and superior customer service.

Key Drivers, Barriers & Challenges in Latin America Online Travel Market

Key Drivers:

- Increasing smartphone and internet penetration.

- Rising disposable incomes among the middle class.

- Growing preference for online booking convenience.

- Government initiatives promoting tourism.

Challenges:

- Payment infrastructure limitations in some regions.

- Competition from traditional travel agencies and offline channels.

- Fluctuations in currency exchange rates.

- Cybersecurity concerns and data privacy issues.

Emerging Opportunities in Latin America Online Travel Market

- Growth of sustainable and responsible tourism.

- Rise of niche travel experiences.

- Increasing demand for personalized travel itineraries.

- Expansion into underserved regions.

Growth Accelerators in the Latin America Online Travel Market Industry

Technological advancements, such as AI-powered personalization and virtual reality travel experiences, are poised to significantly accelerate market growth. Strategic partnerships between online travel agencies and local tourism businesses can enhance product offerings and expand market reach. Expansion into new markets within Latin America and the adoption of innovative marketing strategies will further fuel market expansion.

Key Players Shaping the Latin America Online Travel Market Market

- Hotel Urbano

- Trivago

- Carlson Wagonlit

- Flutouviagens

- Hoteis

- CVC Corp

- Airbnb

- Booking Holdings

- Decolar

- Pricetravel

- Despegar

Notable Milestones in Latin America Online Travel Market Sector

- May 2022: Despegar acquires Viajanet for approximately US$15 million, strengthening its position in the Brazilian market.

- November 2022: The European Commission opens an investigation into Booking Holdings' acquisition of Etraveli, raising concerns about market competition.

In-Depth Latin America Online Travel Market Market Outlook

The Latin American online travel market is poised for continued robust growth, driven by technological innovation, increasing smartphone penetration, and rising disposable incomes. Strategic partnerships, targeted marketing initiatives, and expansion into underserved markets will unlock significant future potential. The market's evolution will be shaped by the ongoing adoption of mobile technologies, the development of personalized travel experiences, and the increasing integration of travel services within broader digital platforms.

Latin America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Service Types

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

Latin America Online Travel Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Online Travel Market Regional Market Share

Geographic Coverage of Latin America Online Travel Market

Latin America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growing Tourism Sector is Helping the Market to Grow Further

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Mexico Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Brazil Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Argentina Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Accommodation Booking

- 8.1.2. Travel Tickets Booking

- 8.1.3. Holiday Package Booking

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Direct Booking

- 8.2.2. Travel Agents

- 8.3. Market Analysis, Insights and Forecast - by Booking Platform

- 8.3.1. Desktop

- 8.3.2. Mobile/Tablet

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Latin America Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Accommodation Booking

- 9.1.2. Travel Tickets Booking

- 9.1.3. Holiday Package Booking

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Direct Booking

- 9.2.2. Travel Agents

- 9.3. Market Analysis, Insights and Forecast - by Booking Platform

- 9.3.1. Desktop

- 9.3.2. Mobile/Tablet

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hotel Urbano

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivago

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Carlson Wagonlit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutouviagens

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hoteis

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CVC Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Airbnb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Booking Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Decolar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pricetravel**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Despegar

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hotel Urbano

List of Figures

- Figure 1: Latin America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 19: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 23: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 24: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Online Travel Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Online Travel Market?

Key companies in the market include Hotel Urbano, Trivago, Carlson Wagonlit, Flutouviagens, Hoteis, CVC Corp, Airbnb, Booking Holdings, Decolar, Pricetravel**List Not Exhaustive, Despegar.

3. What are the main segments of the Latin America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growing Tourism Sector is Helping the Market to Grow Further.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In November 2022, The European Commission has opened an investigation into the proposed acquisition of Sweden's Flugo Group Holdings AB which operates as Etraveli by Booking Holdings Inc.. The proposed transaction would allow Booking to strengthen its position in the market for online travel agencies, and increase the barrier to entry and expansion for rivals

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Online Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence