Key Insights

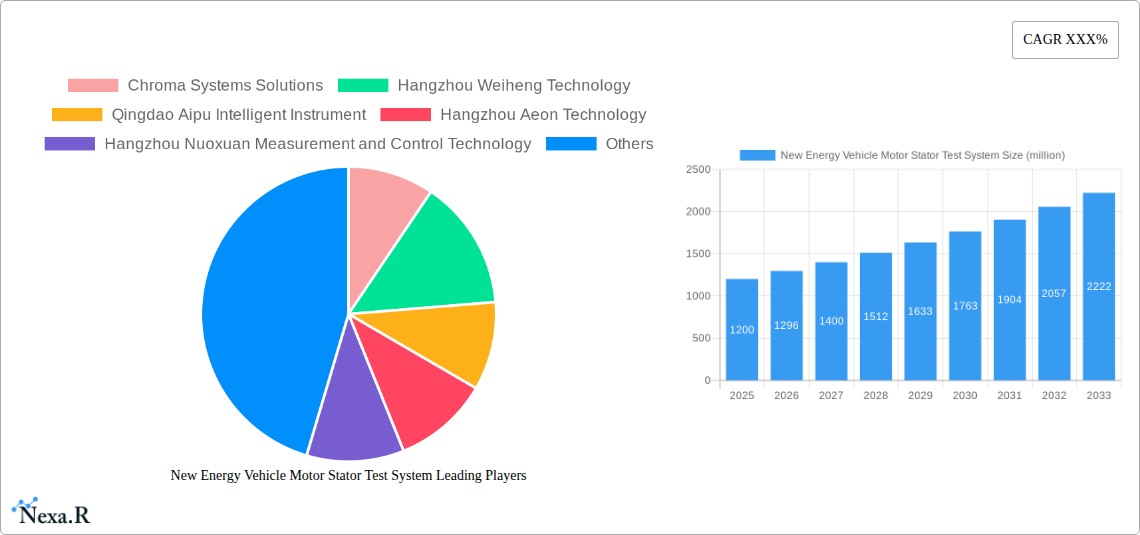

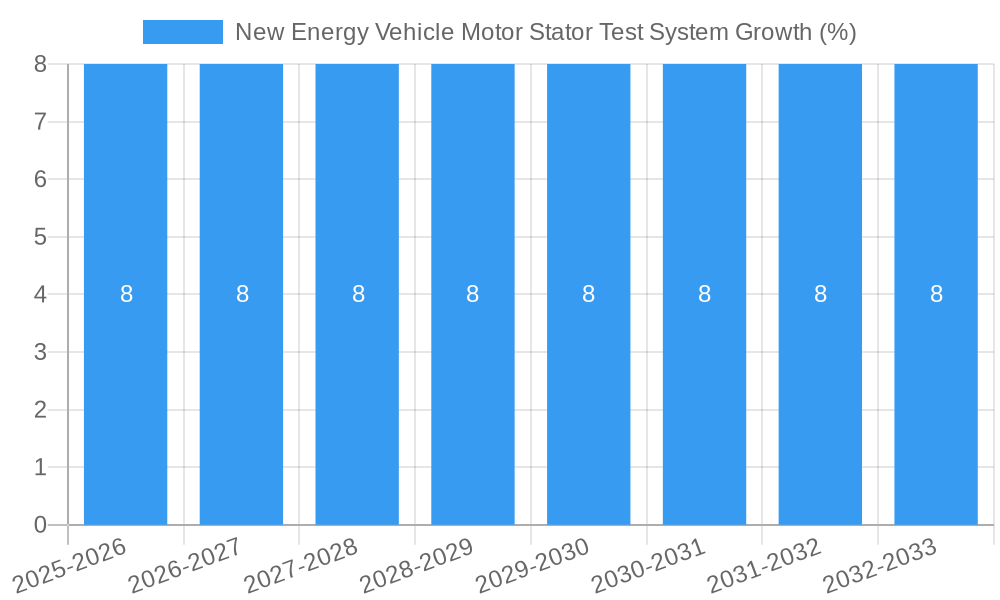

The New Energy Vehicle (NEV) Motor Stator Test System market is poised for significant expansion, driven by the accelerating global adoption of electric vehicles. With an estimated market size of approximately USD 1.2 billion in 2025, the sector is projected to witness robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of around 8.5% over the forecast period of 2025-2033. This surge is fundamentally propelled by increasing government regulations mandating stricter emissions standards and promoting EV incentives, alongside a growing consumer preference for sustainable transportation solutions. The inherent need for stringent quality control and performance validation of electric vehicle powertrains, particularly the intricate motor stator, underpins the demand for advanced testing systems. This ensures the reliability, efficiency, and safety of NEVs, critical factors for widespread market acceptance and continued technological innovation in the electric mobility space.

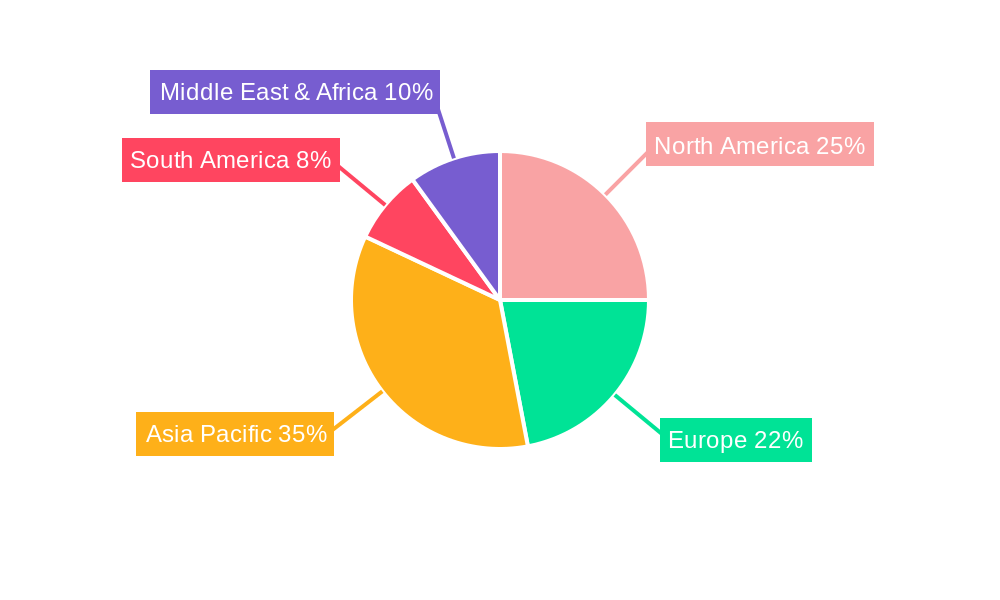

The market is segmented by application into Commercial Cars and Passenger Cars, with the latter currently dominating due to higher production volumes. However, the commercial vehicle segment is expected to witness a faster growth rate as electrification gains traction in trucking and logistics. In terms of testing types, AC Asynchronous Motor Stator Tests and PM Motor Stator Tests represent the core of the market, catering to the predominant motor technologies in NEVs. Emerging trends include the integration of artificial intelligence and machine learning for predictive maintenance and enhanced diagnostic capabilities, as well as the development of automated and scalable testing solutions to meet the burgeoning production demands. Restraints include the high initial investment costs for sophisticated testing equipment and the evolving nature of motor technologies, which requires continuous R&D and adaptation of testing methodologies. Geographically, Asia Pacific, led by China, is the largest market, followed by North America and Europe, all demonstrating strong growth trajectories driven by their respective EV market expansions and manufacturing capabilities.

This comprehensive report provides an in-depth analysis of the New Energy Vehicle (NEV) Motor Stator Test System market. It forecasts market growth, identifies key trends, and explores the competitive landscape for the period 2019–2033, with a base year of 2025 and a forecast period from 2025–2033. Leveraging advanced analytics and market intelligence, this report offers actionable insights for stakeholders in the rapidly evolving electric vehicle industry.

New Energy Vehicle Motor Stator Test System Market Dynamics & Structure

The NEV motor stator test system market is characterized by a moderate concentration, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by the escalating demand for higher motor efficiency, increased power density, and enhanced reliability in electric vehicles. Regulatory frameworks, such as stringent emission standards and government incentives for NEV adoption, are indirectly boosting the demand for advanced testing solutions. Competitive product substitutes, while present in the form of manual testing methods, are increasingly being phased out in favor of automated and sophisticated test systems. End-user demographics are shifting towards environmentally conscious consumers and fleet operators seeking to reduce operational costs and carbon footprints. Mergers and acquisitions (M&A) trends are emerging as companies aim to consolidate their market position, expand their product portfolios, and gain access to new technologies and geographical markets. For instance, several smaller players are being acquired by larger entities seeking to integrate advanced testing capabilities into their EV component manufacturing or supply chains. Barriers to innovation are primarily related to the high cost of R&D for sophisticated testing equipment and the need for specialized expertise to develop and operate these systems. However, the continuous evolution of NEV technology necessitates ongoing investment in cutting-edge testing solutions.

- Market Concentration: Moderate, with key players dominating significant portions of the market.

- Technological Innovation Drivers: Demand for increased motor efficiency (e.g., >95%), higher power density (e.g., kW/kg), and improved reliability (e.g., MTBF > 50,000 hours).

- Regulatory Frameworks: Emissions standards (e.g., Euro 7), government subsidies for NEVs, and safety regulations for EV components.

- Competitive Product Substitutes: Manual winding inspection, basic resistance testing, limited use of oscilloscopes.

- End-User Demographics: Growing segment of eco-conscious consumers, commercial fleet operators, public transportation agencies.

- M&A Trends: Consolidation to enhance capabilities and market reach. An estimated volume of 5-10 significant M&A deals in the last three years.

- Innovation Barriers: High R&D expenditure, specialized workforce requirements.

New Energy Vehicle Motor Stator Test System Growth Trends & Insights

The NEV motor stator test system market is experiencing robust growth, projected to expand significantly from an estimated $XXX million in 2025 to reach $YYY million by 2033. This expansion is driven by the surging global adoption of New Energy Vehicles, which in turn necessitates a parallel growth in the sophisticated testing infrastructure required to ensure the quality, performance, and safety of their critical electric motor components. The market size evolution is directly correlated with the increasing production volumes of electric cars, commercial vehicles, and other electrified transport solutions. Adoption rates of advanced stator testing systems are accelerating as manufacturers recognize the indispensable role these systems play in quality control, fault detection, and performance optimization. Technological disruptions, such as the integration of AI and machine learning for predictive maintenance in testing equipment, and the development of non-destructive testing (NDT) methods for stator insulation integrity, are further shaping market dynamics. Consumer behavior shifts towards demanding longer battery ranges, faster charging, and more reliable electric powertrains are compelling automakers to invest heavily in the underlying technologies, including efficient and durable electric motors, thus amplifying the need for stringent stator testing. The Compound Annual Growth Rate (CAGR) for this market is estimated to be in the range of XX-XX% during the forecast period. Market penetration of automated stator test systems is projected to increase from approximately 60% in 2025 to over 85% by 2033, signifying a definitive industry-wide shift. The increasing complexity of motor designs, including advancements in Permanent Magnet (PM) motors and AC asynchronous motors, demands highly specialized testing protocols to validate their performance under various operational conditions. This growing complexity directly fuels the demand for more advanced and versatile stator test systems. Furthermore, the increasing focus on supply chain resilience and localized manufacturing of EV components is driving investments in testing infrastructure across different regions. The evolving landscape of EV battery technology and charging infrastructure also indirectly influences motor design and testing requirements, as automakers strive for integrated system efficiency and performance. The escalating competition among NEV manufacturers to differentiate their products on performance and reliability also acts as a significant catalyst for enhanced testing capabilities.

Dominant Regions, Countries, or Segments in New Energy Vehicle Motor Stator Test System

The Passenger Car application segment, and specifically PM Motor Stator Test type, is currently the most dominant force driving growth in the New Energy Vehicle Motor Stator Test System market. This dominance is fueled by several interwoven factors, including substantial government incentives, a rapidly expanding consumer base, and a concentrated push for electrification by major automotive manufacturers.

Application: Passenger Car: This segment is leading due to the sheer volume of passenger EVs being produced globally. The high demand for personal mobility, coupled with stricter emissions regulations and evolving consumer preferences for sustainable transportation, has made passenger cars the primary vehicle for NEV adoption. For example, in 2025, it is estimated that passenger cars will account for over 70% of all NEV sales, directly translating to a similar proportion of demand for their respective stator test systems. The market share for passenger car stator testing systems is projected to remain strong throughout the forecast period.

Type: PM Motor Stator Test: Permanent Magnet (PM) motors are widely favored in passenger EVs due to their high efficiency, compact size, and excellent power density, all crucial for achieving desirable range and performance. The complex winding configurations and stringent performance requirements of PM motors necessitate highly specialized and accurate testing systems. The global market share for PM motor stator testing systems is estimated to be around 65% in 2025, with significant growth potential driven by continuous advancements in PM motor technology.

Dominant Regions:

- Asia Pacific: This region, particularly China, is the undisputed leader in both NEV production and sales, hence driving the demand for stator test systems. Supportive government policies, massive manufacturing capabilities, and a burgeoning domestic market contribute to its dominance. China’s market share in NEV production is estimated at over 50%, making it a critical hub for testing system suppliers.

- Europe: With ambitious emission reduction targets and strong governmental support for electrification, Europe is another significant market. Countries like Germany, France, and the UK are witnessing substantial growth in NEV adoption and consequently, the demand for advanced testing solutions. The European market is expected to contribute approximately 20% of the global demand for stator test systems by 2025.

- North America: The United States, with its growing NEV market and increasing investments in domestic EV manufacturing, represents a key growth region. Initiatives aimed at boosting EV production and infrastructure are accelerating the demand for reliable testing equipment.

Key Drivers:

- Government Subsidies and Tax Credits: Encouraging NEV adoption and manufacturing.

- Strict Emission Regulations: Pushing automakers towards electrification.

- Technological Advancements in Motors: Driving the need for sophisticated testing.

- Cost Reduction in Battery Technology: Making EVs more accessible.

- Growing Environmental Consciousness: Influencing consumer purchasing decisions.

- Infrastructure Development: Expansion of charging networks.

The forecast period anticipates continued growth in these dominant segments and regions, with potential for emerging markets to gain traction as NEV adoption spreads globally. The synergy between application types and motor technologies will continue to shape the demand for specialized stator test systems.

New Energy Vehicle Motor Stator Test System Product Landscape

The NEV motor stator test system product landscape is characterized by a strong emphasis on automation, precision, and versatility. Manufacturers are developing systems capable of performing a wide array of tests, including resistance, insulation, winding inductance, surge testing, and performance validation under simulated operating conditions. Key product innovations include the integration of high-speed data acquisition systems for real-time analysis, advanced algorithms for anomaly detection, and modular designs that allow for easy configuration to test different motor types and sizes. Some systems offer end-to-end testing solutions, covering everything from raw material inspection to final product validation, ensuring comprehensive quality control. Unique selling propositions often revolve around reduced test cycle times, improved accuracy (e.g., resistance measurement accuracy of +/- 0.01%), and enhanced data management capabilities for traceability and compliance. Technological advancements are also focused on miniaturization and portability of some test units, catering to in-line production testing requirements and facilitating on-site diagnostics.

Key Drivers, Barriers & Challenges in New Energy Vehicle Motor Stator Test System

Key Drivers:

- Rapid NEV Market Expansion: The exponential growth in global NEV production is the primary driver, directly increasing the demand for stator testing systems.

- Increasing Motor Complexity and Performance Demands: Higher efficiency, power density, and reliability requirements for EV motors necessitate advanced testing.

- Stringent Quality Control Standards: Automotive manufacturers and regulatory bodies demand rigorous testing to ensure safety and performance.

- Technological Advancements in Testing Equipment: AI integration, high-speed data processing, and automation enhance testing capabilities.

- Government Incentives and Regulations: Policies promoting NEV adoption indirectly boost the demand for testing infrastructure.

Key Barriers & Challenges:

- High Initial Investment Costs: Sophisticated test systems represent a significant capital expenditure for manufacturers.

- Need for Specialized Expertise: Operating and maintaining advanced test systems requires skilled technicians and engineers.

- Supply Chain Disruptions: The global supply chain challenges can impact the availability of critical components for test system manufacturing.

- Rapid Technological Obsolescence: The fast-evolving NEV technology can lead to testing equipment becoming outdated quickly.

- Standardization Issues: Lack of universal testing standards across different regions and manufacturers can pose integration challenges.

- Competitive Pressures: Intense competition among test system manufacturers can lead to price erosion.

- Global Economic Volatility: Fluctuations in the global economy can affect automotive production and, consequently, demand for testing equipment.

- Regulatory Hurdles in Emerging Markets: Navigating diverse regulatory landscapes in different countries can be challenging for global suppliers.

Emerging Opportunities in New Energy Vehicle Motor Stator Test System

Emerging opportunities lie in the development of portable and modular test solutions for on-site diagnostics and repair facilities, catering to the growing after-sales service market for EVs. The integration of AI and machine learning for predictive maintenance of the testing equipment itself, as well as for advanced fault prediction in motor stators, presents a significant growth avenue. Furthermore, the expanding use of electric powertrains in diverse applications beyond passenger cars, such as e-bikes, electric scooters, and industrial machinery, opens up new market segments. There is also a growing demand for specialized test systems for high-voltage and high-performance motors used in racing and performance EVs. Collaboration with NEV manufacturers to develop customized testing solutions tailored to their specific motor designs and production lines offers lucrative partnership opportunities.

Growth Accelerators in the New Energy Vehicle Motor Stator Test System Industry

Several factors are acting as significant growth accelerators for the NEV motor stator test system industry. The relentless pursuit of higher energy efficiency and extended range in electric vehicles by all major automakers is a primary catalyst. This is directly pushing the boundaries of motor design, necessitating increasingly sophisticated and precise testing methodologies. Furthermore, the global push towards decarbonization and net-zero emission targets by various governments is creating a sustained, long-term demand for EVs, thereby ensuring a continuous need for their underlying components and the testing systems required to validate them. Strategic partnerships between NEV manufacturers and test system providers are accelerating the development and adoption of cutting-edge testing technologies. Market expansion strategies by leading test system manufacturers into emerging NEV markets in developing economies are also contributing to overall industry growth.

Key Players Shaping the New Energy Vehicle Motor Stator Test System Market

- Chroma Systems Solutions

- Hangzhou Weiheng Technology

- Qingdao Aipu Intelligent Instrument

- Hangzhou Aeon Technology

- Hangzhou Nuoxuan Measurement and Control Technology

- Dean Electric Group

- Qingdao Ainuo Intelligent Instrument

- Suzhou Zhuoyan Electromechanical Equipment

- Hangzhou Weion Technology

- Jiaxing Boyuan Electronic Technology

- Hangzhou Weige Electronic Technology

Notable Milestones in New Energy Vehicle Motor Stator Test System Sector

- 2019: Introduction of AI-powered anomaly detection in stator winding tests.

- 2020: Launch of highly automated, integrated stator testing solutions for mass production lines.

- 2021: Development of non-destructive testing (NDT) methods for improved insulation integrity assessment.

- 2022: Increased adoption of cloud-based data management and analytics for test results.

- 2023: Emergence of portable stator diagnostic tools for maintenance and repair.

- 2024 (Q1-Q4): Growing emphasis on testing systems for advanced motor designs like axial flux motors.

In-Depth New Energy Vehicle Motor Stator Test System Market Outlook

- 2019: Introduction of AI-powered anomaly detection in stator winding tests.

- 2020: Launch of highly automated, integrated stator testing solutions for mass production lines.

- 2021: Development of non-destructive testing (NDT) methods for improved insulation integrity assessment.

- 2022: Increased adoption of cloud-based data management and analytics for test results.

- 2023: Emergence of portable stator diagnostic tools for maintenance and repair.

- 2024 (Q1-Q4): Growing emphasis on testing systems for advanced motor designs like axial flux motors.

In-Depth New Energy Vehicle Motor Stator Test System Market Outlook

The future outlook for the NEV motor stator test system market is exceptionally positive, driven by sustained global investment in electric mobility. Key growth accelerators include the unwavering commitment to electrification by leading automotive OEMs, coupled with increasingly stringent government regulations mandating cleaner transportation. The continuous technological evolution of electric motors, pushing for higher performance metrics and greater reliability, directly translates to a sustained demand for advanced and specialized testing solutions. Strategic collaborations between test system manufacturers and EV producers will further refine and accelerate innovation. The expansion of NEV adoption into new geographical markets and commercial vehicle segments presents significant untapped potential. Overall, the market is poised for robust and sustained growth, offering substantial opportunities for stakeholders who can adapt to evolving technological demands and cater to the burgeoning global NEV industry.

New Energy Vehicle Motor Stator Test System Segmentation

-

1. Application

- 1.1. Commercial Car

- 1.2. Passenger Car

-

2. Type

- 2.1. AC Asynchronous Motor Stator Test

- 2.2. PM Motor Stator Test

- 2.3. Others

New Energy Vehicle Motor Stator Test System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

New Energy Vehicle Motor Stator Test System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Car

- 5.1.2. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. AC Asynchronous Motor Stator Test

- 5.2.2. PM Motor Stator Test

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Car

- 6.1.2. Passenger Car

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. AC Asynchronous Motor Stator Test

- 6.2.2. PM Motor Stator Test

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Car

- 7.1.2. Passenger Car

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. AC Asynchronous Motor Stator Test

- 7.2.2. PM Motor Stator Test

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Car

- 8.1.2. Passenger Car

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. AC Asynchronous Motor Stator Test

- 8.2.2. PM Motor Stator Test

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Car

- 9.1.2. Passenger Car

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. AC Asynchronous Motor Stator Test

- 9.2.2. PM Motor Stator Test

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific New Energy Vehicle Motor Stator Test System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Car

- 10.1.2. Passenger Car

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. AC Asynchronous Motor Stator Test

- 10.2.2. PM Motor Stator Test

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chroma Systems Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hangzhou Weiheng Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qingdao Aipu Intelligent Instrument

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hangzhou Aeon Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hangzhou Nuoxuan Measurement and Control Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dean Electric Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Ainuo Intelligent Instrument

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzhou Zhuoyan Electromechanical Equipment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hangzhou Weion Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jiaxing Boyuan Electronic Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hangzhou Weige Electronic Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Chroma Systems Solutions

List of Figures

- Figure 1: Global New Energy Vehicle Motor Stator Test System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America New Energy Vehicle Motor Stator Test System Revenue (million), by Application 2024 & 2032

- Figure 3: North America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America New Energy Vehicle Motor Stator Test System Revenue (million), by Type 2024 & 2032

- Figure 5: North America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America New Energy Vehicle Motor Stator Test System Revenue (million), by Country 2024 & 2032

- Figure 7: North America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America New Energy Vehicle Motor Stator Test System Revenue (million), by Application 2024 & 2032

- Figure 9: South America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America New Energy Vehicle Motor Stator Test System Revenue (million), by Type 2024 & 2032

- Figure 11: South America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America New Energy Vehicle Motor Stator Test System Revenue (million), by Country 2024 & 2032

- Figure 13: South America New Energy Vehicle Motor Stator Test System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe New Energy Vehicle Motor Stator Test System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe New Energy Vehicle Motor Stator Test System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe New Energy Vehicle Motor Stator Test System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe New Energy Vehicle Motor Stator Test System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe New Energy Vehicle Motor Stator Test System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe New Energy Vehicle Motor Stator Test System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific New Energy Vehicle Motor Stator Test System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global New Energy Vehicle Motor Stator Test System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific New Energy Vehicle Motor Stator Test System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Energy Vehicle Motor Stator Test System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the New Energy Vehicle Motor Stator Test System?

Key companies in the market include Chroma Systems Solutions, Hangzhou Weiheng Technology, Qingdao Aipu Intelligent Instrument, Hangzhou Aeon Technology, Hangzhou Nuoxuan Measurement and Control Technology, Dean Electric Group, Qingdao Ainuo Intelligent Instrument, Suzhou Zhuoyan Electromechanical Equipment, Hangzhou Weion Technology, Jiaxing Boyuan Electronic Technology, Hangzhou Weige Electronic Technology.

3. What are the main segments of the New Energy Vehicle Motor Stator Test System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Energy Vehicle Motor Stator Test System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Energy Vehicle Motor Stator Test System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Energy Vehicle Motor Stator Test System?

To stay informed about further developments, trends, and reports in the New Energy Vehicle Motor Stator Test System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence