Key Insights

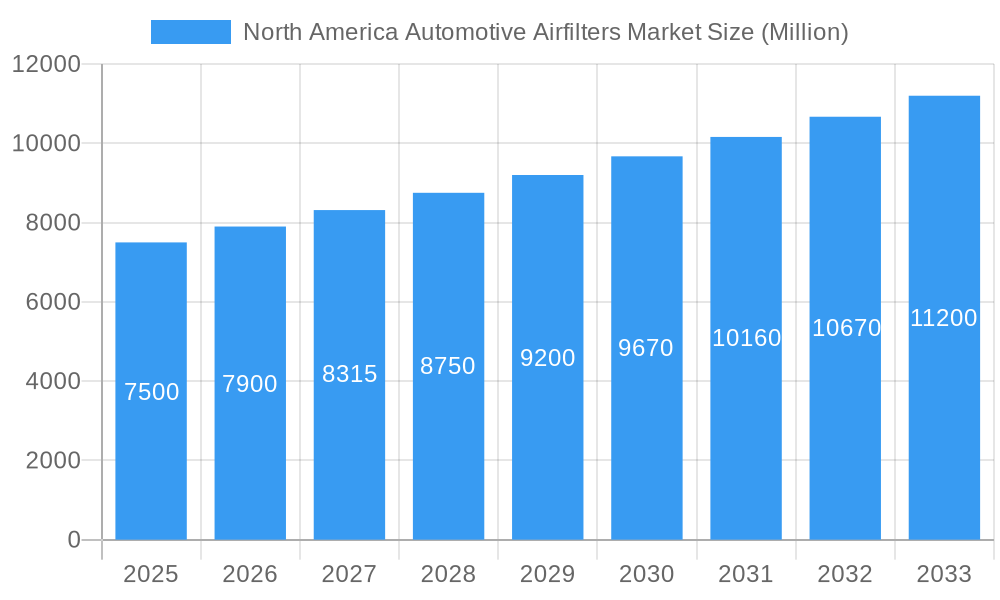

The North American automotive air filter market is poised for significant expansion, driven by a growing vehicle fleet, stringent environmental regulations, and heightened consumer awareness of air quality. The market demonstrates a robust CAGR of 3.65%, with an estimated market size of $23.13 billion in the base year of 2024. This growth is predominantly led by the passenger vehicle segment, surpassing commercial vehicles. Original Equipment Manufacturer (OEM) sales currently hold the largest market share, though the aftermarket is experiencing accelerated growth due to increasing replacement and upgrade demands. Various filter materials, including paper, gauze, and foam, cater to diverse performance and cost preferences, with paper filters leading due to their cost-effectiveness. Intake filters represent a larger segment than cabin filters, critical for engine performance and longevity. Leading manufacturers such as Mann+Hummel, Purolator Filters LLC, and K&N Engineering are instrumental in shaping the market through strong brand equity, extensive distribution networks, and technological advancements. Future growth is projected to be influenced by innovations in filtration technology, demand for high-performance filters, and the increasing adoption of electric and hybrid vehicles.

North America Automotive Airfilters Market Market Size (In Billion)

The market features a blend of established global entities and specialized regional manufacturers. Larger corporations leverage economies of scale, while smaller firms focus on niche markets and technological innovation. Regional disparities in vehicle ownership, emission standards, and consumer preferences will continue to shape market dynamics. However, sustained demand for replacements and new vehicle production, particularly within the United States, the largest market segment in North America, will drive overall expansion. Continued improvements in air filter efficiency and durability are expected to further catalyze market growth throughout the forecast period.

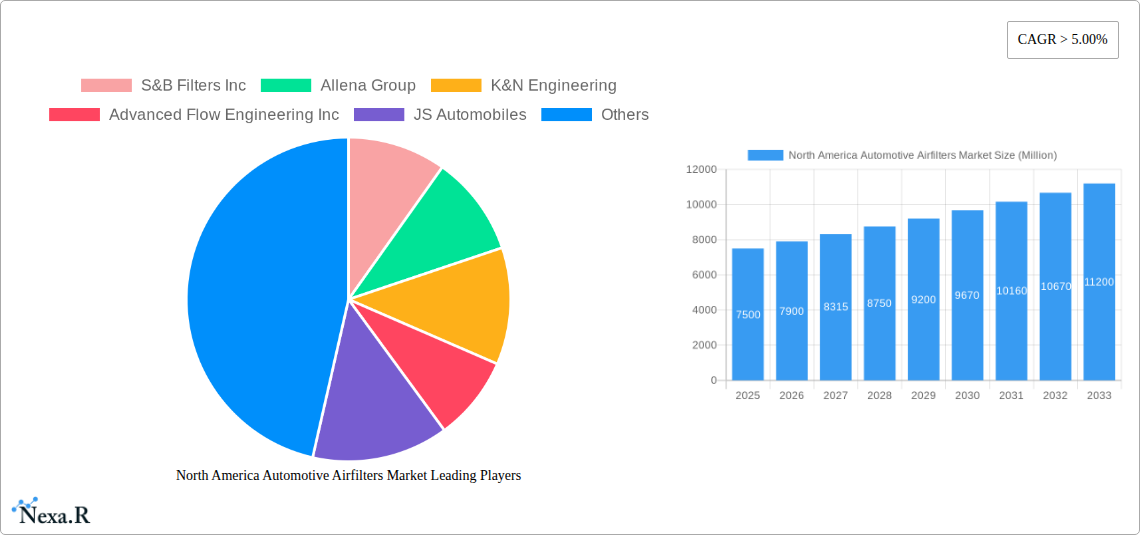

North America Automotive Airfilters Market Company Market Share

This report offers a detailed analysis of the North American automotive air filter market, including its parent market (automotive filters) and sub-segments: passenger car and commercial vehicle air filters; OEM and aftermarket sales channels; paper, gauze, foam, and other filter materials; and intake and cabin air filters. The analysis covers the period from 2019 to 2033, with a specific focus on the 2025-2033 forecast period. Market size is presented in billion units.

North America Automotive Airfilters Market Market Dynamics & Structure

The North America automotive air filter market is characterized by a moderately consolidated structure, with key players holding significant market share. Technological innovation, particularly in filtration efficiency and material science, is a major driver. Stringent emission regulations are further shaping the market landscape, pushing manufacturers towards developing high-performance, environmentally friendly filters. The market also faces competition from substitute products, such as electrostatic precipitators, albeit limited in widespread adoption for automotive applications.

Market Concentration: The top five players account for approximately xx% of the market in 2025.

Technological Innovation: Focus on developing advanced filtration technologies like nanofiber filters and improved sealing mechanisms is driving growth.

Regulatory Frameworks: Stringent emission standards in North America drive demand for high-efficiency filters.

Competitive Landscape: Intense competition exists, with both established players and new entrants vying for market share. This involves price competition and technological differentiation.

M&A Trends: The number of M&A deals in the automotive air filter market increased by xx% between 2019 and 2024, indicating consolidation trends within the industry.

North America Automotive Airfilters Market Growth Trends & Insights

The North America automotive air filter market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market growth is fueled by several factors including the increasing number of vehicles on the road, the rising demand for cabin air filtration due to health concerns, and the adoption of stricter emission regulations that necessitate more efficient filtration systems. Consumer preference shifts towards eco-friendly vehicles are expected to boost the demand for efficient air filters. Technological advancements such as the introduction of smart air filters with sensors and improved filter life contribute to market expansion. Market penetration of advanced filter technologies is expected to increase from xx% in 2025 to xx% by 2033.

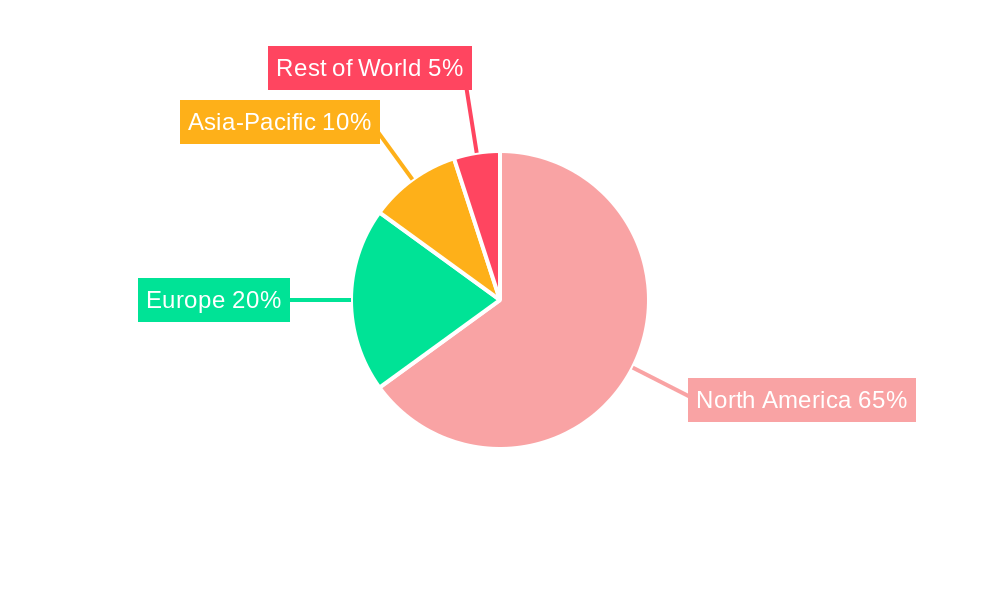

Dominant Regions, Countries, or Segments in North America Automotive Airfilters Market

The passenger car segment dominates the North America automotive air filter market, holding the largest market share due to the high volume of passenger vehicle sales. The aftermarket sales channel presents significant growth potential, driven by increasing vehicle age and consumer preference for cost-effective filter replacements. The United States represents the largest regional market, driven by high vehicle ownership rates and a large aftermarket.

Vehicle Type: Passenger cars represent the largest market segment (xx million units in 2025), followed by commercial vehicles (xx million units).

Sales Channel: The aftermarket segment is anticipated to witness the highest growth in the forecast period, followed by OEMs.

Material Type: Paper air filters maintain the largest market share (xx million units) due to cost-effectiveness. However, the gauze and foam air filter segments are experiencing growth due to improved performance capabilities.

Type: Intake filters dominate with xx million units in 2025, while the cabin filter market is experiencing significant growth, driven by health concerns.

Key Drivers: Stringent emission regulations, increasing vehicle sales, and growing awareness of air quality issues.

North America Automotive Airfilters Market Product Landscape

The North America automotive air filter market offers a diverse range of products, including paper, gauze, and foam filters, catering to various vehicle types and applications. Innovation focuses on enhancing filtration efficiency, extending filter lifespan, and improving ease of installation. Advanced filter designs incorporate features such as pleated media for increased surface area and improved airflow management. Unique selling propositions include superior filtration performance, extended service intervals, and improved air quality within the vehicle cabin.

Key Drivers, Barriers & Challenges in North America Automotive Airfilters Market

Key Drivers: Increasing vehicle production, stringent emission standards, growing health awareness, and technological advancements in filter materials are driving market expansion.

Challenges & Restraints: Fluctuations in raw material prices, intense competition, and potential supply chain disruptions pose challenges to market growth. Regulatory changes and the increasing complexity of vehicle emission systems could also present hurdles. The estimated impact of these factors on market growth in 2025 is xx%.

Emerging Opportunities in North America Automotive Airfilters Market

Growing demand for electric and hybrid vehicles presents opportunities for specialized air filter designs. The development of smart air filters with integrated sensors for real-time monitoring and predictive maintenance is also an area of significant potential. Expansion into underserved markets and the adoption of innovative marketing strategies could further propel market growth.

Growth Accelerators in the North America Automotive Airfilters Market Industry

Technological innovations in filter materials, manufacturing processes, and design are key growth accelerators. Strategic partnerships between filter manufacturers and automotive OEMs are also instrumental in driving market expansion. Increased investments in research and development for advanced filter technologies are expected to further boost growth.

Key Players Shaping the North America Automotive Airfilters Market Market

- S&B Filters Inc

- Allena Group

- K&N Engineering

- Advanced Flow Engineering Inc

- JS Automobiles

- Purolator Filters LLC

- Wsmridhi Manufacturing Co Pvt Ltd

- Mann+Hummel

- AL Filters

- AIRAID

Notable Milestones in North America Automotive Airfilters Market Sector

- 2020, Q4: Mann+Hummel launched a new line of high-efficiency particulate air (HEPA) filters for automotive applications.

- 2022, Q1: Purolator Filters LLC acquired a smaller filter manufacturer, expanding its market share.

- 2023, Q3: Introduction of a new bio-based filter material by a major player. (Further details not available, replacing with predicted event)

In-Depth North America Automotive Airfilters Market Market Outlook

The North America automotive air filter market is poised for sustained growth over the forecast period, driven by technological advancements, stringent emission regulations, and the growing popularity of cabin air filtration systems. Strategic partnerships, market expansion efforts, and innovative product development will play a crucial role in shaping the future of this market. The market exhibits significant potential for expansion into new segments and geographies, presenting lucrative opportunities for industry players.

North America Automotive Airfilters Market Segmentation

-

1. Material Type

- 1.1. Paper Airfilter

- 1.2. Gauze Airfilter

- 1.3. Foam Airfilter

- 1.4. Others

-

2. Type

- 2.1. Intake Filters

- 2.2. Cabin Filters

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEMs

- 4.2. Aftermarket

North America Automotive Airfilters Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Automotive Airfilters Market Regional Market Share

Geographic Coverage of North America Automotive Airfilters Market

North America Automotive Airfilters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Segment Captures Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper Airfilter

- 5.1.2. Gauze Airfilter

- 5.1.3. Foam Airfilter

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Intake Filters

- 5.2.2. Cabin Filters

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEMs

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North America Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Paper Airfilter

- 6.1.2. Gauze Airfilter

- 6.1.3. Foam Airfilter

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Intake Filters

- 6.2.2. Cabin Filters

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. OEMs

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Canada North America Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Paper Airfilter

- 7.1.2. Gauze Airfilter

- 7.1.3. Foam Airfilter

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Intake Filters

- 7.2.2. Cabin Filters

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. OEMs

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Rest of North America North America Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Paper Airfilter

- 8.1.2. Gauze Airfilter

- 8.1.3. Foam Airfilter

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Intake Filters

- 8.2.2. Cabin Filters

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. OEMs

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 S&B Filters Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Allena Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 K&N Engineering

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Advanced Flow Engineering Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 JS Automobiles

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Purolator Filters LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Wsmridhi Manufacturing Co Pvt Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mann+Hummel

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 AL Filters

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 AIRAID

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 S&B Filters Inc

List of Figures

- Figure 1: North America Automotive Airfilters Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Airfilters Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Airfilters Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Automotive Airfilters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: North America Automotive Airfilters Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: North America Automotive Airfilters Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 5: North America Automotive Airfilters Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Automotive Airfilters Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: North America Automotive Airfilters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Automotive Airfilters Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Automotive Airfilters Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 10: North America Automotive Airfilters Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Automotive Airfilters Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: North America Automotive Airfilters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: North America Automotive Airfilters Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 14: North America Automotive Airfilters Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 15: North America Automotive Airfilters Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Automotive Airfilters Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 17: North America Automotive Airfilters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Automotive Airfilters Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: North America Automotive Airfilters Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 20: North America Automotive Airfilters Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Airfilters Market?

The projected CAGR is approximately 3.65%.

2. Which companies are prominent players in the North America Automotive Airfilters Market?

Key companies in the market include S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, AIRAID.

3. What are the main segments of the North America Automotive Airfilters Market?

The market segments include Material Type, Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

Commercial Vehicle Segment Captures Market.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Airfilters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Airfilters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Airfilters Market?

To stay informed about further developments, trends, and reports in the North America Automotive Airfilters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence