Key Insights

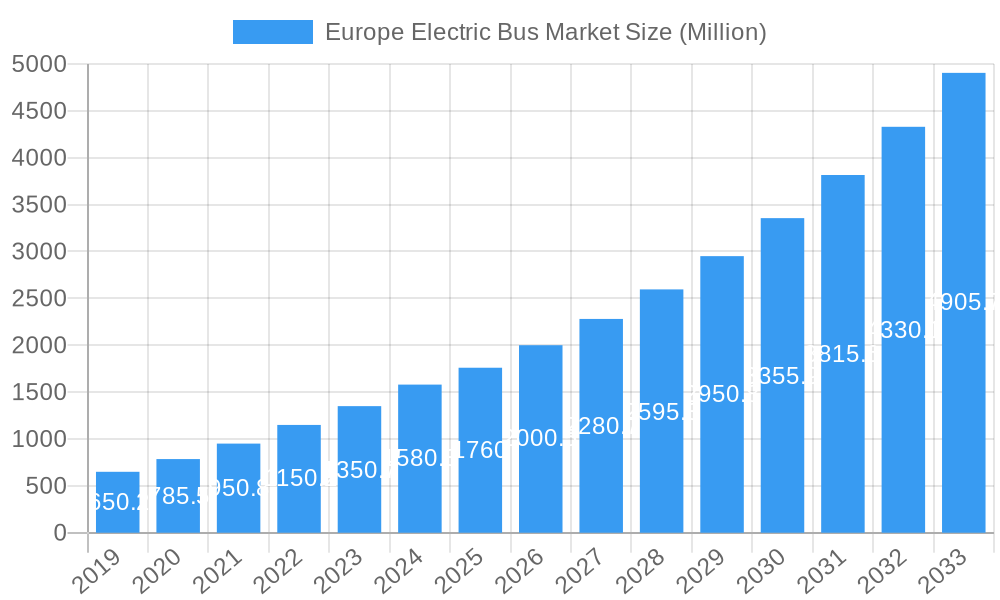

The Europe Electric Bus Market is poised for substantial expansion, projected to reach approximately USD 1.76 billion in market size. This impressive growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 14.56%, indicating a dynamic and rapidly evolving sector. This surge is primarily driven by a confluence of strong government initiatives, escalating environmental consciousness, and the imperative for sustainable urban mobility solutions. Policies promoting zero-emission transport, coupled with increasing investments in charging infrastructure and the development of advanced battery technologies, are key catalysts for this upward trajectory. The market is segmented across various propulsion types, including Battery Electric Buses (BEBs), Plug-in Hybrid Electric Buses (PHEBs), and Fuel Cell Electric Buses (FCEBs), with BEBs currently dominating due to their established technology and improving range capabilities. Lithium-ion batteries are the predominant choice for energy storage, benefiting from advancements in energy density and cost reduction.

Europe Electric Bus Market Market Size (In Million)

Further fueling this growth are the consistent efforts by fleet operators and government entities to electrify their public transportation fleets. This transition is motivated by the long-term operational cost savings associated with electric buses, including reduced fuel and maintenance expenses, as well as the desire to meet stringent emission regulations. Key players such as BYD Auto, Mercedes-Benz Group AG, and AB Volvo are at the forefront, investing heavily in research and development and expanding their product portfolios to cater to the diverse needs of the European market. Europe, with its forward-thinking environmental policies and significant investments in electric mobility, is expected to remain a dominant region, with countries like the United Kingdom, Germany, France, and the Netherlands leading the adoption. The study period, encompassing historical data from 2019-2024 and a forecast to 2033, highlights a sustained and significant expansion, solidifying the electric bus as a cornerstone of future urban transit.

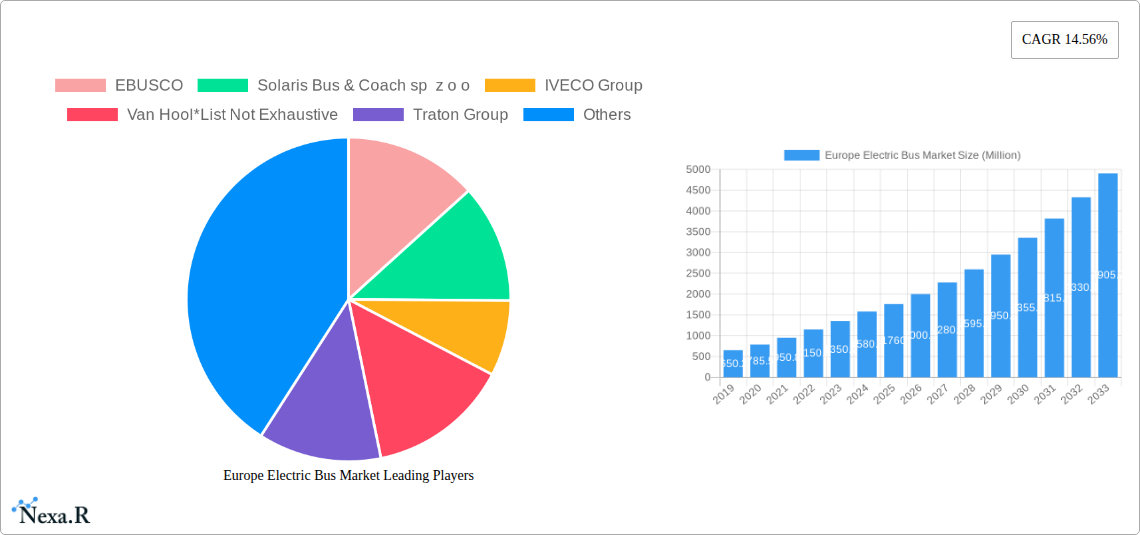

Europe Electric Bus Market Company Market Share

This in-depth report provides a definitive analysis of the Europe electric bus market, encompassing a detailed historical overview (2019-2024), a robust base year analysis (2025), and a comprehensive forecast period (2025-2033). We delve into critical market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, challenges, emerging opportunities, growth accelerators, key players, notable milestones, and a future market outlook, all designed to equip industry professionals with actionable intelligence for strategic decision-making. The report covers a wide array of segments, including Propulsion Types (Battery Electric Bus, Plug-in Hybrid Electric Bus, Fuel Cell Electric Bus), Battery Types (Lithium-ion, Nickel-Metal Hydride Battery (NiMH), Others), and Consumer Types (Government, Fleet Operators). All quantitative data is presented in million units.

Europe Electric Bus Market Market Dynamics & Structure

The Europe electric bus market is characterized by dynamic evolution, driven by a strong push for decarbonization and sustainable urban mobility. Market concentration is moderately fragmented, with established players continuously innovating to capture market share. Technological innovation is a primary driver, with ongoing advancements in battery technology, charging infrastructure, and powertrain efficiency. Regulatory frameworks, particularly stringent emissions standards and government incentives for zero-emission vehicles, are significantly shaping market direction. Competitive product substitutes, such as internal combustion engine (ICE) buses, are gradually being displaced by electric alternatives due to growing environmental awareness and operational cost benefits. End-user demographics are increasingly dominated by government bodies and public transport authorities, alongside a growing interest from private fleet operators seeking to reduce their carbon footprint and operational expenses. Merger and acquisition (M&A) trends are indicative of consolidation efforts and strategic partnerships aimed at scaling up production and expanding market reach.

- Market Concentration: Moderately fragmented with key players investing heavily in R&D and manufacturing capacity.

- Technological Innovation Drivers: Advancements in battery energy density, faster charging capabilities, and the development of hydrogen fuel cell technology.

- Regulatory Frameworks: European Union directives on emissions reduction and national government subsidies are critical market enablers.

- Competitive Product Substitutes: ICE buses are facing increasing pressure from electric and hybrid alternatives due to environmental regulations and total cost of ownership.

- End-User Demographics: Predominantly public sector (government agencies and transit authorities), with a rising segment of private fleet operators.

- M&A Trends: Strategic alliances and acquisitions are observed as companies seek to gain technological expertise and expand their geographical presence.

Europe Electric Bus Market Growth Trends & Insights

The Europe electric bus market is poised for significant growth, projected to witness a substantial expansion in adoption rates throughout the forecast period. This surge is underpinned by a confluence of factors including escalating environmental concerns, supportive government policies, and advancements in electric vehicle (EV) technology. We estimate the market size to evolve significantly from an estimated XXX million units in 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) during the forecast period of 2025-2033. Consumer behavior is shifting demonstrably towards sustainable transportation solutions, with a growing preference for electric buses driven by lower operating costs, reduced noise pollution, and a commitment to cleaner air in urban environments. Technological disruptions, such as the development of solid-state batteries and improved charging infrastructure, are further accelerating the market's trajectory by addressing key adoption barriers like range anxiety and charging times. The increasing investment in smart city initiatives and the push for electrification of public transport fleets across major European nations are also key contributors to these upward trends. The market penetration of electric buses is set to increase dramatically as more cities commit to phasing out diesel buses and electrifying their transit systems.

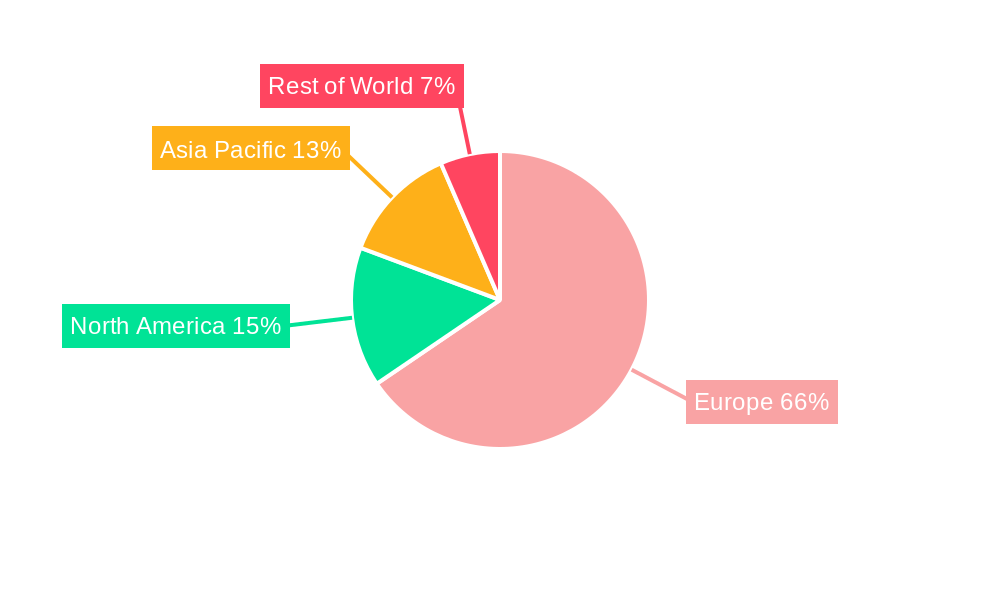

Dominant Regions, Countries, or Segments in Europe Electric Bus Market

The Europe electric bus market is witnessing dominant growth driven by specific regions, countries, and product segments. Battery Electric Buses (BEBs) stand out as the leading propulsion type, accounting for a substantial majority of market share due to their established technology, improving range, and widespread charging infrastructure development. Within the battery technology segment, Lithium-ion batteries are the undisputed leader, benefiting from their high energy density, long lifespan, and declining manufacturing costs. The primary consumer type driving this expansion is the Government, which through public procurement, emission reduction targets, and infrastructure investments, is the largest purchaser of electric buses for public transportation networks.

Several countries are spearheading this transition. For instance, Germany, with its strong industrial base and ambitious climate goals, is a significant market for electric buses. Similarly, the United Kingdom, driven by its net-zero targets and extensive decarbonization plans for public transport, shows robust demand. France, with its commitment to sustainable urban mobility and investments in charging infrastructure, is another key player.

- Dominant Propulsion Type: Battery Electric Bus (BEB) leads due to technological maturity and cost-effectiveness.

- Dominant Battery Type: Lithium-ion batteries are favored for their performance and cost advantages.

- Dominant Consumer Type: Government entities are the primary drivers through public tenders and emission mandates.

- Key Leading Countries: Germany, United Kingdom, and France are at the forefront of electric bus adoption, supported by favorable policies and infrastructure development.

- Infrastructure Development: Investments in charging stations and grid upgrades are crucial enablers for widespread adoption.

- Economic Policies: Government subsidies, tax incentives, and grants for electric bus procurement are critical growth factors.

- Growth Potential: These dominant segments and regions are expected to continue leading market expansion due to ongoing policy support and technological advancements.

Europe Electric Bus Market Product Landscape

The Europe electric bus market's product landscape is defined by continuous innovation aimed at enhancing performance, reliability, and sustainability. Manufacturers are focusing on developing electric buses with extended range capabilities, faster charging times, and improved passenger comfort. Key product innovations include advanced battery management systems for optimized energy utilization and a growing array of charging solutions, from overnight depot charging to opportunity charging at terminals. The performance metrics that are gaining prominence include energy efficiency (kWh per km), battery longevity, and the availability of advanced driver-assistance systems (ADAS) for enhanced safety. The unique selling propositions of these modern electric buses revolve around zero tailpipe emissions, significantly reduced operational noise, and a lower total cost of ownership compared to traditional diesel buses, making them increasingly attractive for fleet operators and public transport authorities across Europe.

Key Drivers, Barriers & Challenges in Europe Electric Bus Market

Key Drivers:

- Stringent Environmental Regulations: EU directives and national targets for CO2 emission reductions are compelling transit authorities to adopt zero-emission vehicles.

- Government Subsidies and Incentives: Financial support for electric bus procurement and infrastructure development significantly lowers the initial investment barrier.

- Decreasing Battery Costs: Technological advancements and economies of scale are making battery electric buses more cost-competitive.

- Growing Public Awareness: Increased demand for sustainable transportation solutions from citizens is pushing authorities to electrify fleets.

- Technological Advancements: Improvements in battery technology, charging speed, and vehicle efficiency are addressing earlier limitations.

Barriers & Challenges:

- High Upfront Purchase Costs: Electric buses generally have a higher initial purchase price compared to diesel buses, despite lower operating costs.

- Charging Infrastructure Development: The availability and widespread deployment of robust charging infrastructure remain a significant hurdle, especially for intercity routes.

- Battery Lifespan and Replacement Costs: Concerns about battery degradation and the high cost of battery replacement can impact long-term operational planning.

- Grid Capacity and Stability: The increased demand from widespread electric bus charging could strain existing power grids in some regions.

- Range Anxiety and Charging Times: While improving, range limitations and charging durations can still be a concern for certain operational needs.

- Supply Chain Constraints: Potential disruptions in the supply of critical battery components and raw materials can impact production volumes.

Emerging Opportunities in Europe Electric Bus Market

Emerging opportunities in the Europe electric bus market lie in the expansion of hydrogen fuel cell electric buses as a complementary zero-emission solution, particularly for longer routes and heavier duty applications. The development of innovative charging solutions, such as wireless charging and dynamic charging systems integrated into bus routes, presents significant potential. Furthermore, untapped markets within Eastern European countries are beginning to show increased interest and investment in electric mobility. Evolving consumer preferences for on-demand and shared mobility services also create opportunities for tailored electric bus solutions. The growing focus on circular economy principles within the automotive sector also presents opportunities for battery recycling and second-life applications, enhancing the overall sustainability of electric bus fleets.

Growth Accelerators in the Europe Electric Bus Market Industry

Several catalysts are accelerating the growth of the Europe electric bus market. Technological breakthroughs in battery energy density and charging speeds are continuously improving the practicality and appeal of electric buses. Strategic partnerships between bus manufacturers, battery suppliers, and charging infrastructure providers are crucial for creating comprehensive ecosystem solutions. Market expansion strategies, including the electrification of rural and suburban bus routes in addition to urban networks, are broadening the market's reach. Increased collaboration between public transport authorities and private sector entities to pilot and scale up electric bus deployments further fuels growth. The development of smart charging solutions that integrate with renewable energy sources also contributes to making electric bus operations more efficient and sustainable, acting as a significant growth accelerator.

Key Players Shaping the Europe Electric Bus Market Market

- EBUSCO

- Solaris Bus & Coach sp z o o

- IVECO Group

- Van Hool

- Traton Group

- VDL Bus & Coach BV

- Otokar Otomotiv Ve Savunma Sanayi AS

- BYD Auto Co Ltd

- Mercedes-Benz Group AG

- AB Volvo

Notable Milestones in Europe Electric Bus Market Sector

- June 2022: Van Hool Introduced its new A-Series range of zero-emission public buses at the European Mobility Expo in Paris, offering battery-electric and fuel cell (hydrogen) powertrain options across various lengths (12m, 13m, 18m, and 24m).

- April 2022: Switch Mobility showcased its new Metrocity electric bus at BUS2BUS in Berlin.

- June 2022: Switch Mobility launched its new 12-meter bus at the European Mobility Expo in Paris.

- August 2021: Alexander Dennis Limited (ADL), a subsidiary of NFI Group Inc. (NFI), was selected by the Liverpool City Region Combined Authority to supply 20 zero-emission hydrogen double-deck buses, with the buses set to operate on the 10A route, supporting Liverpool City Region's goal of achieving net-zero carbon emissions by 2040.

- July 2021: Toyota announced a co-branding partnership with Portuguese bus manufacturer Caetano Bus, featuring the battery-electric city bus, the e-City Gold, and the fuel cell electric bus, the H2.City Gold.

In-Depth Europe Electric Bus Market Market Outlook

The Europe electric bus market is set for sustained and robust growth, driven by a powerful combination of policy support, technological innovation, and increasing demand for sustainable urban transportation. Key growth accelerators include the ongoing decline in battery costs, the expansion of charging infrastructure, and the continuous development of more efficient and longer-range electric bus models. Future market potential is significant, with numerous cities across Europe committed to electrifying their entire public transport fleets. Strategic opportunities lie in developing hydrogen fuel cell buses for specific applications, enhancing charging solutions, and expanding into less developed but emerging electric bus markets within the continent. The market's trajectory indicates a strong shift away from traditional internal combustion engine buses towards cleaner, greener alternatives, positioning the electric bus sector for a dominant future in European public transportation.

Europe Electric Bus Market Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Bus

- 1.2. Plug-in Hybrid Electric Bus

- 1.3. Fuel Cell Electric Bus

-

2. Battery Type

- 2.1. Lithium-ion

- 2.2. Nickel-Metal Hydride Battery (NiMH),

- 2.3. Others

-

3. Consumer Type

- 3.1. Government

- 3.2. Fleet Operators

Europe Electric Bus Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Bus Market Regional Market Share

Geographic Coverage of Europe Electric Bus Market

Europe Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Transitions Of Urban Bus Fleet To Electric Power

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Bus

- 5.1.2. Plug-in Hybrid Electric Bus

- 5.1.3. Fuel Cell Electric Bus

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lithium-ion

- 5.2.2. Nickel-Metal Hydride Battery (NiMH),

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Consumer Type

- 5.3.1. Government

- 5.3.2. Fleet Operators

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EBUSCO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solaris Bus & Coach sp z o o

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IVECO Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Van Hool*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Traton Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VDL Bus & Coach BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otokar Otomotiv Ve Savunma Sanayi AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Auto Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercedes-Benz Group AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AB Volvo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EBUSCO

List of Figures

- Figure 1: Europe Electric Bus Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Electric Bus Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electric Bus Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Europe Electric Bus Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 3: Europe Electric Bus Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 4: Europe Electric Bus Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Electric Bus Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Europe Electric Bus Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 7: Europe Electric Bus Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 8: Europe Electric Bus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Electric Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Bus Market?

The projected CAGR is approximately 14.56%.

2. Which companies are prominent players in the Europe Electric Bus Market?

Key companies in the market include EBUSCO, Solaris Bus & Coach sp z o o, IVECO Group, Van Hool*List Not Exhaustive, Traton Group, VDL Bus & Coach BV, Otokar Otomotiv Ve Savunma Sanayi AS, BYD Auto Co Ltd, Mercedes-Benz Group AG, AB Volvo.

3. What are the main segments of the Europe Electric Bus Market?

The market segments include Propulsion Type, Battery Type, Consumer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Rising Transitions Of Urban Bus Fleet To Electric Power.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In June 2022, Van Hool Introduced a new range of zero-emission public buses A-Series, at the European Mobility Expo in Paris. The A-series of zero-emission buses will feature options of a battery-electric and fuel cell (hydrogen) powertrain. There will also be four different lengths (12m, 13m, 18m, and 24m), each having two to five passenger doors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Bus Market?

To stay informed about further developments, trends, and reports in the Europe Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence