Key Insights

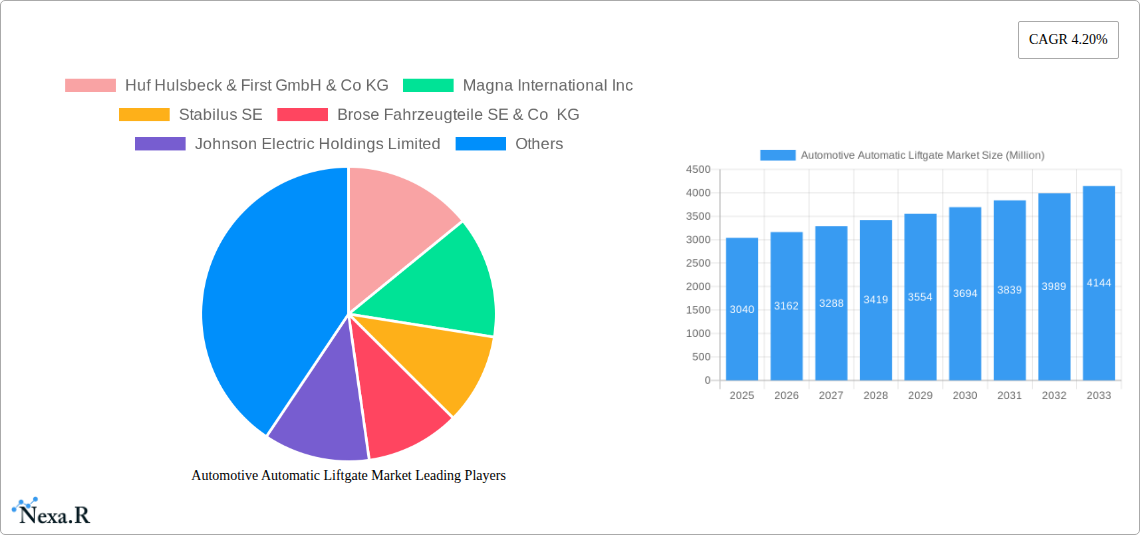

The global automotive automatic liftgate market is experiencing robust growth, projected to reach a market size of $3.04 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.20% from 2019 to 2033. This expansion is driven by several key factors. Increasing consumer preference for enhanced convenience and safety features in vehicles is a primary driver. Automatic liftgates offer hands-free operation, particularly beneficial for individuals carrying groceries, children, or dealing with luggage, boosting their appeal amongst consumers. Furthermore, the rising adoption of advanced driver-assistance systems (ADAS) and the integration of smart technologies in vehicles contribute to the market's growth. The increasing demand for SUVs and hatchbacks, vehicle types which frequently incorporate this feature, is further fueling market expansion. Technological advancements leading to more affordable and reliable systems are also playing a significant role. Segmentation analysis reveals that the OEM (Original Equipment Manufacturers) sales channel currently dominates, but the aftermarket segment presents considerable growth potential as consumers seek to retrofit this feature into older vehicles. Metal remains the leading material type due to its durability, but the adoption of lightweight composite materials is expected to increase driven by automotive industry trends towards improved fuel efficiency and reduced vehicle weight. Geographically, North America and Europe are currently leading market segments, but the Asia-Pacific region is poised for substantial growth driven by rising vehicle sales and increasing disposable incomes within key markets like China and India.

Automotive Automatic Liftgate Market Market Size (In Billion)

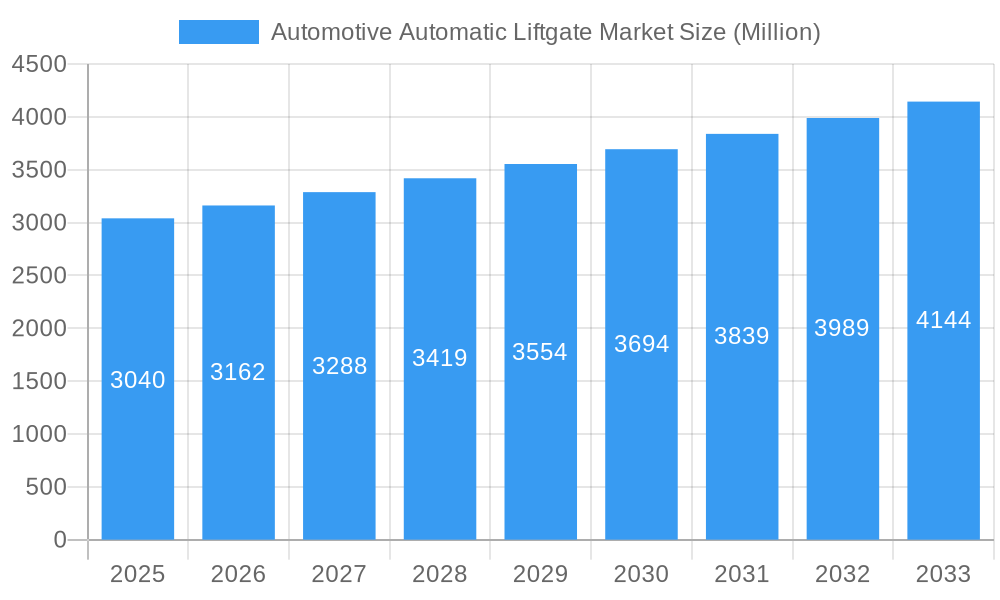

The market's future trajectory is influenced by several trends. The ongoing development of innovative features such as gesture control and smartphone integration is enhancing the user experience and driving demand. The increasing focus on electrification and autonomous driving is expected to integrate seamlessly with automatic liftgate systems. However, the market faces some restraints including the relatively higher cost of automatic liftgates compared to manual systems and concerns about the potential for system malfunctions or failures. Nevertheless, the ongoing technological advancements and the expanding luxury vehicle segment are expected to overcome these restraints, ensuring continued growth of the automotive automatic liftgate market throughout the forecast period (2025-2033). Competition is intense, with key players like Huf Hulsbeck, Magna International, Stabilus, and Brose actively innovating and expanding their product portfolios to meet diverse customer needs and market demands.

Automotive Automatic Liftgate Market Company Market Share

Automotive Automatic Liftgate Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Automotive Automatic Liftgate Market, encompassing its parent market (Automotive Aftermarket) and child markets (Hatchback, SUV, Sedan liftgates). The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis provides invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The report projects a market size of xx Million units by 2033, driven by factors detailed below.

Automotive Automatic Liftgate Market Dynamics & Structure

The Automotive Automatic Liftgate Market exhibits a moderately concentrated structure, with key players like Magna International Inc., Continental AG, and Brose Fahrzeugteile SE & Co KG holding significant market share. Technological innovation, particularly in sensor technology and actuator systems, is a crucial driver. Stringent safety and emission regulations influence market dynamics, while rising consumer demand for convenience features and the availability of advanced electronic systems are further boosting the sector's growth. The market experiences competitive pressure from manual liftgates and alternative opening mechanisms, albeit limited. Mergers and acquisitions (M&A) activity is moderately active, with xx M&A deals recorded in the last five years. End-user demographics lean towards younger and affluent consumers valuing convenience.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Advancements in sensor technology, actuator systems, and power management systems are key drivers.

- Regulatory Landscape: Stringent safety and emission norms impact product design and manufacturing processes.

- Competitive Substitutes: Limited competition from manual liftgates, though alternative opening mechanisms present a developing threat.

- M&A Activity: xx deals recorded in the past 5 years, indicating moderate consolidation.

- Innovation Barriers: High R&D investment, complex integration with vehicle systems, and regulatory compliance are key barriers to innovation.

Automotive Automatic Liftgate Market Growth Trends & Insights

The Automotive Automatic Liftgate Market witnessed substantial growth during the historical period (2019-2024), registering a CAGR of xx%. This growth is primarily attributed to rising vehicle sales, increasing consumer preference for convenience features, and technological advancements leading to lower production costs and improved performance. The adoption rate of automatic liftgates has increased significantly, especially in premium vehicle segments. Technological disruptions, such as the introduction of hands-free operation and improved safety features, are further accelerating market growth. Consumer behavior shifts towards enhanced vehicle personalization and technological sophistication are driving demand. We project a CAGR of xx% during the forecast period (2025-2033), with the market size expected to reach xx Million units by 2033. Market penetration is projected to reach xx% by 2033.

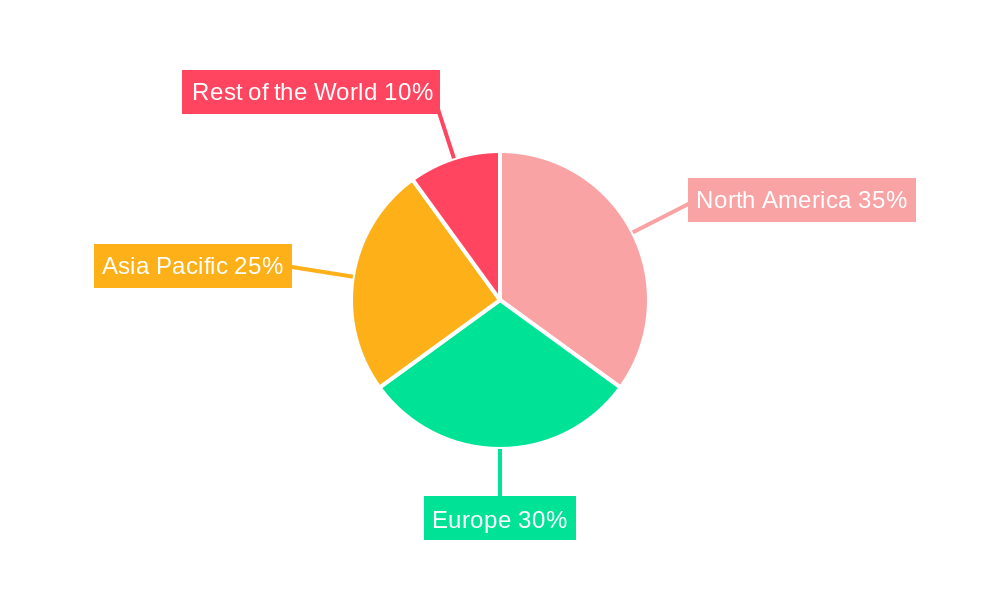

Dominant Regions, Countries, or Segments in Automotive Automatic Liftgate Market

North America currently dominates the Automotive Automatic Liftgate Market, followed by Europe and Asia Pacific. The strong presence of major vehicle manufacturers and high consumer disposable incomes contribute to the region's leading position. Within vehicle types, SUVs and hatchbacks represent the largest market segments, driven by their popularity and suitability for automatic liftgates. Metal remains the predominant material type due to its durability and cost-effectiveness. OEM sales channels still represent the largest segment, although the aftermarket is showing promising growth potential.

- Key Drivers: High vehicle production, rising consumer disposable income (especially in North America), increasing preference for convenience features.

- Dominance Factors: High vehicle sales, strong presence of major automakers, well-established automotive supply chains.

- Growth Potential: Asia Pacific presents the highest growth potential driven by rapid urbanization, rising vehicle ownership, and growing demand for comfort features. The aftermarket segment also holds significant potential for growth.

Automotive Automatic Liftgate Market Product Landscape

Automatic liftgates are evolving from simple electrically powered systems to sophisticated units integrating advanced sensor technologies, intelligent control systems, and safety features like obstacle detection. Key performance indicators include lift speed, payload capacity, and ease of operation. Unique selling propositions focus on improved convenience, enhanced safety, and customizable features. Technological advancements are driving miniaturization, cost reduction, and improved reliability.

Key Drivers, Barriers & Challenges in Automotive Automatic Liftgate Market

Key Drivers:

- Increasing consumer demand for convenience and comfort features in vehicles.

- Technological advancements leading to improved performance and lower costs.

- Growing adoption of advanced driver-assistance systems (ADAS).

Challenges and Restraints:

- High initial investment costs for manufacturers and consumers.

- Potential for malfunctions and safety concerns.

- Intense competition from established players and emerging technologies.

Emerging Opportunities in Automotive Automatic Liftgate Market

Emerging opportunities exist in the development of innovative features such as hands-free operation, smartphone integration, and improved obstacle detection systems. Untapped markets in developing economies, particularly in Asia Pacific and South America, present significant growth potential. Evolving consumer preferences towards eco-friendly materials will drive demand for sustainable composite liftgate solutions.

Growth Accelerators in the Automotive Automatic Liftgate Market Industry

Strategic partnerships between liftgate manufacturers and automotive OEMs will play a vital role in accelerating market growth. Technological breakthroughs in areas such as lighter materials, more energy-efficient actuators, and improved sensor technology are key growth accelerators. Market expansion into emerging markets through strategic alliances and local manufacturing will significantly contribute to the sector's overall growth.

Key Players Shaping the Automotive Automatic Liftgate Market Market

Notable Milestones in Automotive Automatic Liftgate Market Sector

- November 2023: Hyundai Motor Company introduced the Santa Fe with a significantly wider liftgate opening, showcasing design innovation.

- October 2023: Honda Motor Co. Ltd launched the Honda Passport SUV featuring a remote-controlled power liftgate, highlighting the increasing demand for convenience features.

In-Depth Automotive Automatic Liftgate Market Market Outlook

The Automotive Automatic Liftgate Market is poised for sustained growth driven by technological advancements, increasing consumer demand, and expansion into new markets. Strategic partnerships, investments in R&D, and the development of innovative features will be crucial for capturing significant market share. The long-term outlook remains positive, with significant opportunities for growth and innovation in this dynamic sector.

Automotive Automatic Liftgate Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sports Utility vehicle

- 1.3. Sedan

- 1.4. Other Vehicle Types

-

2. Material Type

- 2.1. Metal

- 2.2. Composite

-

3. Sales Channel Type

- 3.1. Original Equipment Manufacturers (OEM)

- 3.2. Aftermarket

Automotive Automatic Liftgate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Automatic Liftgate Market Regional Market Share

Geographic Coverage of Automotive Automatic Liftgate Market

Automotive Automatic Liftgate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sale of Luxury Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With the System

- 3.4. Market Trends

- 3.4.1. SUV Will Fuel The Growth Of The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sports Utility vehicle

- 5.1.3. Sedan

- 5.1.4. Other Vehicle Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Composite

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. Original Equipment Manufacturers (OEM)

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchback

- 6.1.2. Sports Utility vehicle

- 6.1.3. Sedan

- 6.1.4. Other Vehicle Types

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Metal

- 6.2.2. Composite

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 6.3.1. Original Equipment Manufacturers (OEM)

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchback

- 7.1.2. Sports Utility vehicle

- 7.1.3. Sedan

- 7.1.4. Other Vehicle Types

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Metal

- 7.2.2. Composite

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 7.3.1. Original Equipment Manufacturers (OEM)

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchback

- 8.1.2. Sports Utility vehicle

- 8.1.3. Sedan

- 8.1.4. Other Vehicle Types

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Metal

- 8.2.2. Composite

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 8.3.1. Original Equipment Manufacturers (OEM)

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchback

- 9.1.2. Sports Utility vehicle

- 9.1.3. Sedan

- 9.1.4. Other Vehicle Types

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Metal

- 9.2.2. Composite

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 9.3.1. Original Equipment Manufacturers (OEM)

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Huf Hulsbeck & First GmbH & Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Magna International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stabilus SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Brose Fahrzeugteile SE & Co KG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson Electric Holdings Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aisin Seiki Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Continental AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Plastic Omnium SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Autoease Technology

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Faurecia SE

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Huf Hulsbeck & First GmbH & Co KG

List of Figures

- Figure 1: Global Automotive Automatic Liftgate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 7: North America Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 8: North America Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 15: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 16: Europe Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 31: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 32: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 14: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 15: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 24: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 32: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 33: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Automatic Liftgate Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Automotive Automatic Liftgate Market?

Key companies in the market include Huf Hulsbeck & First GmbH & Co KG, Magna International Inc, Stabilus SE, Brose Fahrzeugteile SE & Co KG, Johnson Electric Holdings Limited, STMicroelectronics N V, Aisin Seiki Co Ltd, Continental AG, Plastic Omnium SE, Autoease Technology, Faurecia SE.

3. What are the main segments of the Automotive Automatic Liftgate Market?

The market segments include Vehicle Type, Material Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sale of Luxury Vehicles.

6. What are the notable trends driving market growth?

SUV Will Fuel The Growth Of The Market.

7. Are there any restraints impacting market growth?

High Costs Associated With the System.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Motor Company introduced Santa Fe with a development concept centered around its new liftgate opening that is six inches wider than the previous generation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Automatic Liftgate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Automatic Liftgate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Automatic Liftgate Market?

To stay informed about further developments, trends, and reports in the Automotive Automatic Liftgate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence