Key Insights

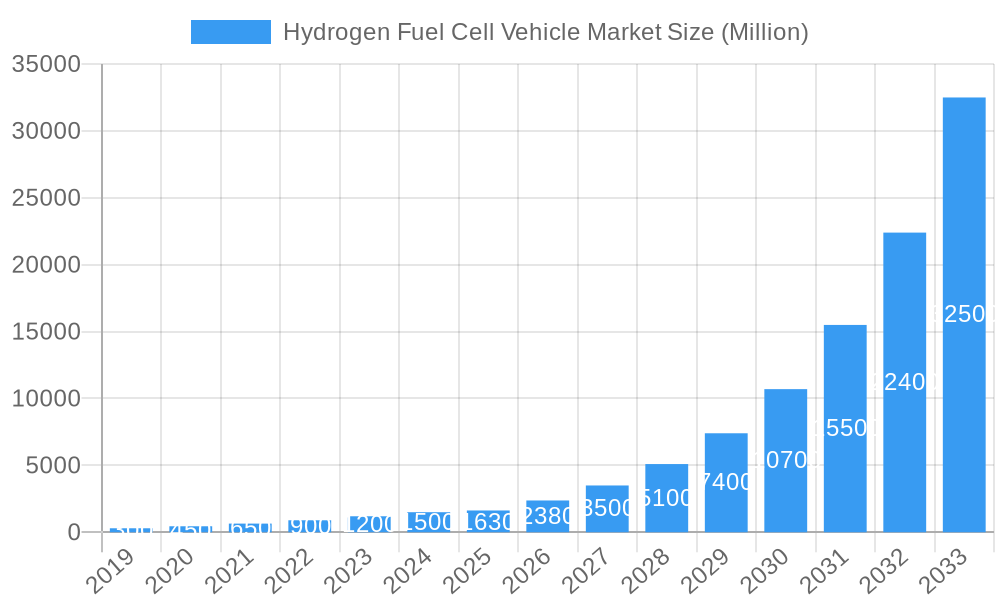

The global Hydrogen Fuel Cell Vehicle (HFCV) market is poised for explosive growth, projecting a remarkable market size of USD 1.63 billion and an astounding Compound Annual Growth Rate (CAGR) of 47.50% from 2019 to 2033. This meteoric rise is driven by a confluence of potent factors, chief among them being stringent government regulations aimed at reducing tailpipe emissions and fostering sustainable transportation. The increasing demand for zero-emission vehicles, coupled with advancements in fuel cell technology that enhance efficiency and reduce costs, are further fueling this expansion. Major automotive manufacturers are heavily investing in HFCV research and development, introducing innovative models across passenger cars and commercial vehicles. The Proton Exchange Membrane (PEM) fuel cell technology is leading this charge due to its high power density and rapid startup times, making it ideal for a wide range of applications.

Hydrogen Fuel Cell Vehicle Market Market Size (In Million)

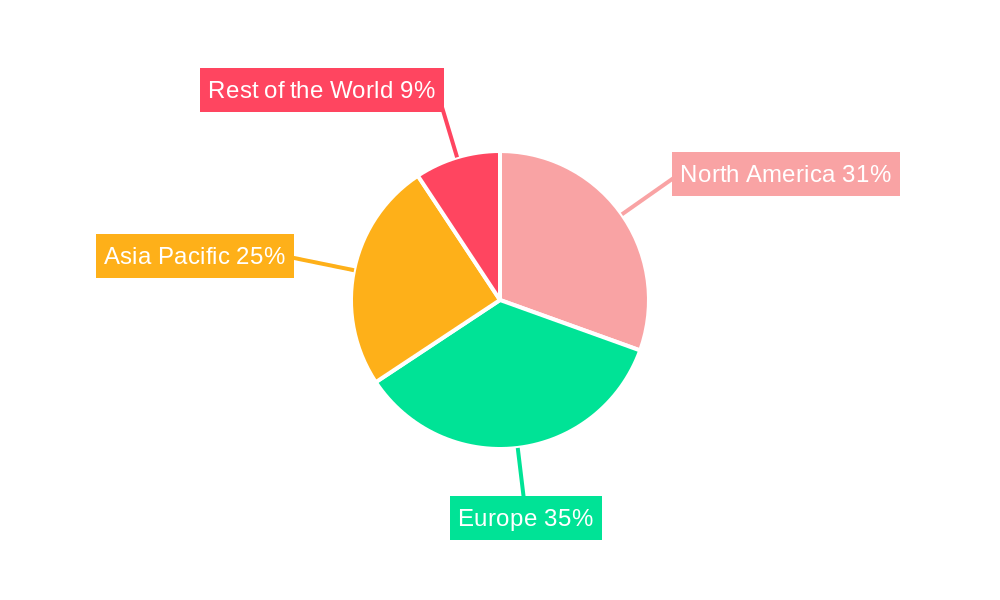

While the market is characterized by significant drivers, certain restraints require careful consideration. The high initial cost of HFCVs and the limited availability of hydrogen refueling infrastructure remain significant hurdles to widespread adoption. However, ongoing efforts to expand the hydrogen refueling network and advancements in manufacturing processes are expected to mitigate these challenges over the forecast period. Emerging trends like the development of solid oxide fuel cells (SOFCs) for heavy-duty applications and the integration of hydrogen fuel cells with renewable energy sources for on-site hydrogen production are shaping the future landscape. Geographically, North America and Europe are expected to lead the market due to supportive government policies and substantial investments, with Asia Pacific also showing promising growth driven by countries like China and South Korea. Companies such as Toyota, Hyundai, and Ballard Power Systems are at the forefront, innovating and expanding their HFCV offerings.

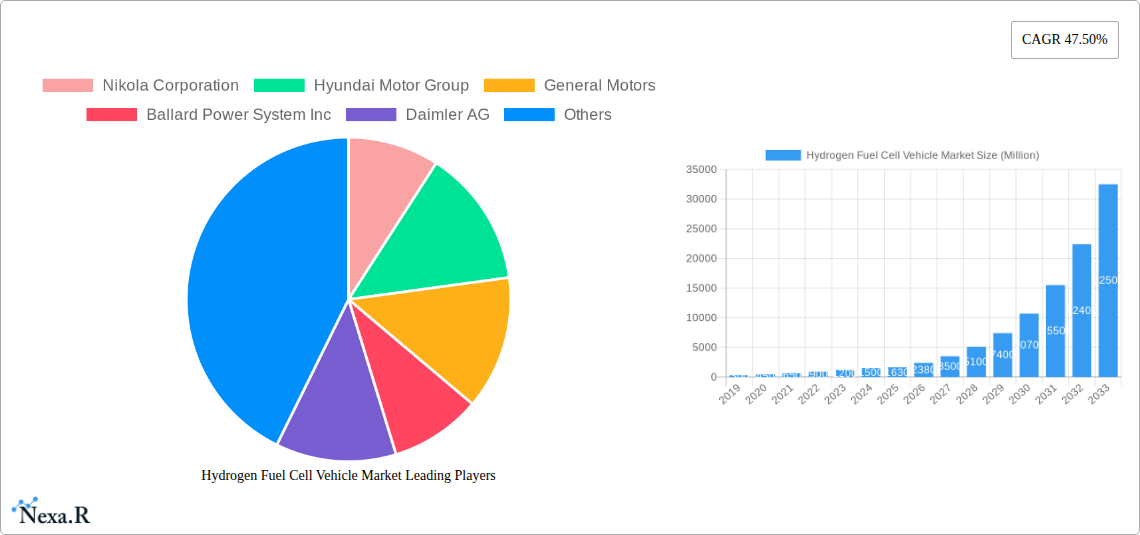

Hydrogen Fuel Cell Vehicle Market Company Market Share

Unveiling the Future of Sustainable Mobility: Hydrogen Fuel Cell Vehicle Market Report

This comprehensive report provides an in-depth analysis of the global Hydrogen Fuel Cell Vehicle (HFCV) market, offering strategic insights and actionable intelligence for industry stakeholders. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, regional dominance, product landscapes, and key players. Leveraging high-traffic keywords such as "hydrogen car," "fuel cell truck," "green hydrogen mobility," and "zero-emission vehicles," this report is optimized for maximum search engine visibility, attracting a broad audience from industry professionals to investors. Discover the transformative potential of hydrogen technology in shaping the future of transportation.

Hydrogen Fuel Cell Vehicle Market Dynamics & Structure

The Hydrogen Fuel Cell Vehicle (HFCV) market is characterized by dynamic shifts driven by escalating environmental concerns and governmental mandates for emission reduction. Market concentration is currently moderate, with a few key players dominating innovation and production. Technological innovation is primarily propelled by advancements in Proton Exchange Membrane (PEM) fuel cells, which offer higher power density and efficiency, crucial for both passenger and commercial applications. However, the widespread adoption of Phosphoric Acid Fuel Cells (PAFCs) in specific heavy-duty applications also presents a significant niche. Regulatory frameworks globally are increasingly favoring zero-emission vehicles, with subsidies, tax credits, and stricter emission standards acting as potent adoption drivers. Competitive product substitutes include battery electric vehicles (BEVs), which currently hold a larger market share due to established infrastructure and lower upfront costs. End-user demographics are gradually expanding from early adopters and fleet operators to a broader consumer base seeking sustainable alternatives. Mergers and acquisitions (M&A) are on the rise as companies seek to consolidate expertise, secure supply chains, and accelerate market entry. For instance, strategic alliances and technology partnerships are becoming more prevalent than outright acquisitions, reflecting the complex ecosystem of HFCV development.

Hydrogen Fuel Cell Vehicle Market Growth Trends & Insights

The Hydrogen Fuel Cell Vehicle market is poised for robust expansion, projected to witness significant growth in market size and adoption rates over the forecast period. This growth is underpinned by a convergence of factors including evolving consumer preferences towards sustainable transportation, a push for decarbonization in logistics, and continuous technological disruptions in fuel cell efficiency and hydrogen production. The global hydrogen car market is experiencing increasing interest, fueled by improvements in driving range and refueling times that address key consumer pain points compared to earlier iterations. In parallel, the fuel cell truck market is emerging as a critical growth engine, driven by the demand for zero-emission solutions in heavy-duty transport and long-haul logistics, where the rapid refueling capabilities of HFCVs offer a distinct advantage over battery-electric alternatives.

The increasing investment in green hydrogen infrastructure, including refueling stations, is a significant enabler of market penetration. As the cost of hydrogen production decreases and the availability of refueling points expands, the economic viability and practical appeal of HFCVs will further escalate. Consumer behavior shifts are becoming more pronounced, with growing awareness of the environmental impact of internal combustion engines and a rising demand for cleaner mobility solutions. This is reflected in increasing search volumes for "hydrogen vehicle advantages" and "next-gen fuel cell technology." The market is also witnessing a surge in hydrogen-powered public transport, such as buses, which are ideal candidates for fuel cell technology due to their predictable routes and refueling schedules. The continuous refinement of fuel cell stack technology, leading to increased durability and reduced manufacturing costs, is also a critical factor contributing to higher adoption rates. Furthermore, government incentives and ambitious climate targets are acting as powerful catalysts, pushing manufacturers to accelerate the development and deployment of their hydrogen vehicle portfolios. The overall market penetration of HFCVs is expected to grow substantially, driven by a combination of technological maturity, infrastructure development, and evolving consumer and regulatory demands for sustainable transportation solutions.

Dominant Regions, Countries, or Segments in Hydrogen Fuel Cell Vehicle Market

The Proton Exchange Membrane Fuel Cell (PEMFC) segment, particularly within Commercial Vehicles, is emerging as a dominant force driving the global Hydrogen Fuel Cell Vehicle (HFCV) market. This dominance stems from the inherent advantages of PEMFC technology, including its high power density, fast response time, and efficient operation across a wide temperature range, making it ideal for the demanding requirements of heavy-duty applications. Within the commercial vehicle segment, long-haul trucking and delivery fleets are at the forefront of HFCV adoption. The superior range and rapid refueling capabilities of fuel cell trucks directly address the operational needs of logistics companies, mitigating range anxiety and minimizing downtime, which are critical factors in this sector.

Several regions are exhibiting significant traction in the HFCV market, with Asia-Pacific, particularly South Korea and Japan, leading the charge. These nations have aggressive government initiatives, substantial investments in hydrogen infrastructure, and proactive automotive manufacturers committed to fuel cell technology. Their dominance is further amplified by strong domestic demand for both passenger cars and commercial vehicles powered by hydrogen.

Asia-Pacific (South Korea & Japan):

- Market Share: High concentration of HFCV production and sales, driven by national hydrogen strategies and leading automotive players.

- Growth Potential: Significant due to ongoing infrastructure build-out and government incentives for hydrogen mobility.

- Key Drivers: Strong government support for green hydrogen, advanced fuel cell research and development, and established automotive manufacturing capabilities.

Europe:

- Market Share: Growing rapidly, especially in countries like Germany and France, with a focus on commercial vehicles and public transport.

- Growth Potential: Robust, supported by the European Green Deal and ambitious emissions reduction targets.

- Key Drivers: Increasing investment in hydrogen refueling infrastructure, stringent emission regulations for commercial vehicles, and pilot projects for fuel cell buses and trucks.

North America (United States & Canada):

- Market Share: Emerging market, with increasing government funding for hydrogen projects and growing interest from commercial vehicle manufacturers.

- Growth Potential: Strong, particularly in the commercial sector, supported by federal and state-level initiatives.

- Key Drivers: Federal funding for hydrogen research and infrastructure, growing adoption by fleet operators, and advancements in fuel cell technology.

The Passenger Cars segment, while also important, is currently trailing the commercial vehicle segment in terms of adoption rate and market penetration, primarily due to the more established infrastructure for battery electric vehicles and the higher upfront cost of HFCVs for individual consumers. However, ongoing technological improvements and cost reductions in fuel cell systems are expected to boost passenger car adoption in the coming years. The Proton Exchange Membrane Fuel Cell technology is overwhelmingly favored across both segments due to its efficiency and power-to-weight ratio.

Hydrogen Fuel Cell Vehicle Market Product Landscape

The Hydrogen Fuel Cell Vehicle (HFCV) market is witnessing a wave of innovative product development focused on enhancing performance, efficiency, and user experience. Key product innovations include lighter and more durable fuel cell stacks with increased power output, advanced hydrogen storage solutions offering greater capacity and safety, and integrated powertrain systems designed for seamless integration into various vehicle platforms. Applications are diversifying beyond passenger cars to encompass a wide range of commercial vehicles, including heavy-duty trucks, buses, and vans, where the extended range and quick refueling capabilities of HFCVs offer significant operational advantages. Performance metrics are steadily improving, with advancements in fuel cell durability, energy efficiency, and overall vehicle range, pushing the boundaries of what is achievable with hydrogen propulsion. Unique selling propositions often revolve around zero tailpipe emissions, longer driving ranges compared to battery-electric counterparts, and rapid refueling times, making HFCVs a compelling sustainable mobility solution for diverse needs.

Key Drivers, Barriers & Challenges in Hydrogen Fuel Cell Vehicle Market

The Hydrogen Fuel Cell Vehicle (HFCV) market is propelled by several key drivers. A primary force is the global imperative to reduce greenhouse gas emissions and combat climate change, driving government support and incentives for zero-emission technologies. Advances in fuel cell technology, leading to improved efficiency, durability, and reduced costs, are also significant drivers. The increasing demand for long-range and fast-refueling zero-emission solutions, particularly in the commercial vehicle sector, creates a strong market pull. Furthermore, the growing availability of renewable hydrogen production methods is enhancing the sustainability appeal of HFCVs.

However, the market faces significant challenges. The lack of widespread and accessible hydrogen refueling infrastructure remains a major barrier to adoption. The high upfront cost of HFCVs, coupled with the higher price of hydrogen fuel compared to gasoline or electricity in many regions, presents an economic hurdle for consumers and fleet operators. Supply chain complexities and the need for specialized manufacturing processes also contribute to the cost. Regulatory inconsistencies and a lack of standardization across different regions can hinder global market expansion. Competition from established battery electric vehicle technology, which benefits from a more developed charging infrastructure and a longer history of mass production, also presents a competitive pressure.

Emerging Opportunities in Hydrogen Fuel Cell Vehicle Market

Emerging opportunities in the Hydrogen Fuel Cell Vehicle (HFCV) market are abundant and span across various sectors. The significant growth in green hydrogen production technologies, such as electrolysis powered by renewable energy, is creating a more sustainable and cost-effective fuel supply. This opens avenues for mass adoption and potential cost parity with fossil fuels. The expansion of hydrogen refueling infrastructure networks, supported by government initiatives and private investment, is a crucial opportunity to address current limitations. Untapped markets in regions with ambitious decarbonization goals and limited charging infrastructure for BEVs present considerable growth potential. Innovative applications, such as hydrogen-powered heavy-duty trucks, buses for public transportation, and specialized industrial vehicles, are gaining traction. Furthermore, evolving consumer preferences towards eco-friendly transportation and increasing corporate sustainability mandates are creating demand for HFCVs as a viable alternative to traditional internal combustion engines and even battery-electric vehicles for certain use cases.

Growth Accelerators in the Hydrogen Fuel Cell Vehicle Market Industry

Several factors are acting as powerful growth accelerators for the Hydrogen Fuel Cell Vehicle (HFCV) industry. Technological breakthroughs in fuel cell efficiency, durability, and manufacturing cost reduction are pivotal. Strategic partnerships and collaborations between automotive manufacturers, fuel cell technology providers, and energy companies are accelerating product development and market penetration. Government policies, including subsidies, tax incentives, and stringent emission regulations, are creating a supportive ecosystem for HFCV deployment. The expansion of hydrogen production capacity, particularly through renewable sources, and the concurrent build-out of refueling infrastructure are critical enablers of broader market adoption. Furthermore, pilot projects and fleet deployments in key sectors like logistics and public transportation are demonstrating the viability and benefits of HFCVs, building confidence and driving further investment and demand.

Key Players Shaping the Hydrogen Fuel Cell Vehicle Market Market

- Nikola Corporation

- Hyundai Motor Group

- General Motors

- Ballard Power System Inc

- Daimler AG

- BMW AG

- AUDI AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

- AB Volvo

Notable Milestones in Hydrogen Fuel Cell Vehicle Market Sector

- Mid-2024: BMW is gearing up to launch the BMW iX5 Hydrogen, part of the trio of hydrogen-powered vehicles hitting BMW dealerships.

- March 2024: The Ministry of New and Renewable Energy (MNRE) in India planned to convene discussions with relevant stakeholders to address challenges related to high-pressure storage cylinders for green hydrogen, a move following concerns raised by manufacturers of commercial vehicles.

- March 2024: Viritech introduces the 60kW VPT60N Ready to Run Vehicle Powertrain, a comprehensive powertrain solution for OEMs, Tier-1s, and research bodies, facilitating the swift deployment of hydrogen fuel cell electric vehicles.

- March 2024: General Motors embarked on a hydrogen fuel-cell project for medium-duty commercial vehicles, supported by federal government funding.

- January 2024: Stellantis Pro One expanded its hydrogen fuel cell offering by initiating in-house production for mid-size and large vans in Europe.

In-Depth Hydrogen Fuel Cell Vehicle Market Market Outlook

The Hydrogen Fuel Cell Vehicle (HFCV) market is set for an accelerated growth trajectory, driven by a confluence of technological advancements and increasing global commitment to decarbonization. Key growth accelerators include the continuous improvement in fuel cell performance and longevity, coupled with a significant reduction in manufacturing costs. Strategic alliances between major automotive players and technology developers are streamlining the path to mass production and wider market acceptance. Furthermore, supportive government policies, such as substantial subsidies for vehicle purchase and infrastructure development, alongside increasingly stringent emissions regulations, are creating a fertile ground for HFCV expansion. The future outlook is particularly strong for commercial vehicles, where the demand for zero-emission, long-range, and fast-refueling solutions is paramount. Investments in green hydrogen production and the expansion of refueling networks are critical for unlocking the full market potential and solidifying HFCVs as a cornerstone of sustainable mobility.

Hydrogen Fuel Cell Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology

- 2.1. Proton Exchange Membrane Fuel Cell

- 2.2. Phosphoric Acid Fuel Cell

Hydrogen Fuel Cell Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Hydrogen Fuel Cell Vehicle Market Regional Market Share

Geographic Coverage of Hydrogen Fuel Cell Vehicle Market

Hydrogen Fuel Cell Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Small Boats; Expanding Recreational Boating Opportunities

- 3.3. Market Restrains

- 3.3.1. Strict Emission Norms for Recreation Boats Likely to Have Negative Impact

- 3.4. Market Trends

- 3.4.1. Passenger Cars to Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Proton Exchange Membrane Fuel Cell

- 5.2.2. Phosphoric Acid Fuel Cell

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Proton Exchange Membrane Fuel Cell

- 6.2.2. Phosphoric Acid Fuel Cell

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Proton Exchange Membrane Fuel Cell

- 7.2.2. Phosphoric Acid Fuel Cell

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Proton Exchange Membrane Fuel Cell

- 8.2.2. Phosphoric Acid Fuel Cell

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Proton Exchange Membrane Fuel Cell

- 9.2.2. Phosphoric Acid Fuel Cell

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nikola Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyundai Motor Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Motors

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ballard Power System Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daimler AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BMW AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AUDI AG*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toyota Motor Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honda Motor Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AB Volvo

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nikola Corporation

List of Figures

- Figure 1: Global Hydrogen Fuel Cell Vehicle Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Hydrogen Fuel Cell Vehicle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 29: Global Hydrogen Fuel Cell Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Hydrogen Fuel Cell Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Fuel Cell Vehicle Market?

The projected CAGR is approximately 47.50%.

2. Which companies are prominent players in the Hydrogen Fuel Cell Vehicle Market?

Key companies in the market include Nikola Corporation, Hyundai Motor Group, General Motors, Ballard Power System Inc, Daimler AG, BMW AG, AUDI AG*List Not Exhaustive, Toyota Motor Corporation, Honda Motor Co Ltd, AB Volvo.

3. What are the main segments of the Hydrogen Fuel Cell Vehicle Market?

The market segments include Vehicle Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Small Boats; Expanding Recreational Boating Opportunities.

6. What are the notable trends driving market growth?

Passenger Cars to Lead the Market.

7. Are there any restraints impacting market growth?

Strict Emission Norms for Recreation Boats Likely to Have Negative Impact.

8. Can you provide examples of recent developments in the market?

BMW is gearing up to launch the BMW iX5 Hydrogen, part of the trio of hydrogen-powered vehicles hitting BMW dealerships in mid-2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydrogen Fuel Cell Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydrogen Fuel Cell Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydrogen Fuel Cell Vehicle Market?

To stay informed about further developments, trends, and reports in the Hydrogen Fuel Cell Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence