Key Insights

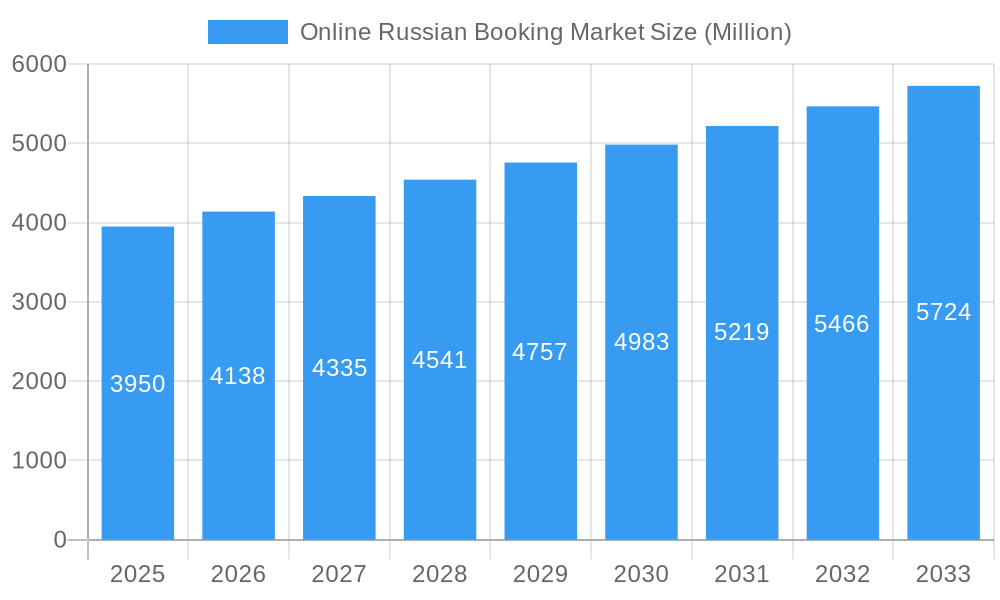

The Russian online booking market, valued at $3.95 billion in 2025, is projected to experience robust growth, exceeding a 4% Compound Annual Growth Rate (CAGR) through 2033. This expansion is fueled by several key factors. Increasing internet and smartphone penetration across Russia, particularly in younger demographics, is driving a surge in online travel bookings. The convenience and competitive pricing offered by online platforms like Tutu.ru, Tripadvisor, Booking.com, and others are significantly impacting consumer behavior, shifting preferences away from traditional travel agencies. Furthermore, the development of sophisticated mobile applications tailored to the Russian market, with features such as localized payment options and customer support in Russian, has further accelerated market growth. The rise of domestic tourism within Russia also plays a significant role, as online booking platforms provide easy access to diverse accommodations and travel options across the country's diverse regions.

Online Russian Booking Market Market Size (In Billion)

However, challenges remain. Economic fluctuations within Russia can influence travel spending, potentially impacting market growth in certain periods. Competition among established players and the emergence of new entrants necessitate continuous innovation and adaptation to maintain market share. Addressing concerns regarding data privacy and security within the online booking sector is also critical to maintaining consumer trust and confidence. The market segmentation by booking mode (third-party platforms vs. direct bookings) and platform type (mobile vs. website) highlights the importance of a multi-channel approach for businesses seeking success within this dynamic market. Regional variations in market penetration exist, with western Russia likely demonstrating higher adoption rates compared to more remote eastern regions. Successful players are likely those who adapt to these regional differences and leverage the increasing popularity of mobile booking across all regions.

Online Russian Booking Market Company Market Share

Online Russian Booking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Online Russian Booking Market, covering the historical period (2019-2024), the base year (2025), and projecting the forecast period (2025-2033). The study delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals and strategic investors. The parent market is the broader Russian travel and tourism sector, while the child market focuses specifically on online booking platforms for accommodations, flights, and other travel services. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Online Russian Booking Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Russian online booking sector. The market is characterized by a mix of large global players and established local companies, resulting in a dynamic competitive environment.

- Market Concentration: The market exhibits moderate concentration, with key players like Booking.com, TripAdvisor, and Ostrovok holding significant market share, but numerous smaller players and niche providers also compete. We estimate the top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Technological advancements, such as AI-powered recommendations and personalized travel planning tools, drive innovation. However, barriers include infrastructure limitations in certain regions and varying levels of digital literacy among consumers.

- Regulatory Framework: Government regulations on data privacy, consumer protection, and taxation influence market operations. Changes in these regulations can significantly impact market players.

- Competitive Product Substitutes: Traditional travel agencies and direct bookings from hotels pose competition to online booking platforms.

- End-User Demographics: The market caters to a wide range of demographics, with significant growth potential in younger age groups and increasing use among older populations.

- M&A Trends: The acquisition of Bronevik Group by MTS in 2022 illustrates the ongoing consolidation and strategic investment in the sector. The total value of M&A deals in the market during 2019-2024 was estimated at xx Million.

Online Russian Booking Market Growth Trends & Insights

This section examines the evolution of the Russian online booking market size, adoption rates, technological disruptions, and consumer behavior shifts. Using robust data analytics (XXX), we project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is currently at xx%, with significant room for growth driven by increasing smartphone penetration, improved internet infrastructure, and a growing preference for online travel planning among Russian consumers. Key factors influencing growth include rising disposable incomes, a growing middle class, and the increasing popularity of domestic and international travel. The impact of geopolitical events and economic sanctions is also thoroughly analyzed, revealing both challenges and unexpected growth opportunities.

Dominant Regions, Countries, or Segments in Online Russian Booking Market

This section pinpoints the key regions, countries, and segments within the online Russian booking market driving overall growth. Analysis covers both "By Mode of Booking" (Third-Party Online Platforms vs. Direct/Captive Portals) and "By Platform Type" (Mobile Applications vs. Websites).

By Mode of Booking: Third-party online travel agencies (OTAs) currently dominate the market, accounting for approximately xx% of bookings in 2025. This dominance stems from their wider reach, comprehensive offerings, and comparative pricing features. However, direct bookings through hotel or airline websites are also gradually increasing.

By Platform Type: Mobile applications are experiencing rapid growth, with a projected xx% share in 2025, surpassing website bookings. This shift reflects the increasing smartphone penetration and consumer preference for mobile-friendly interfaces.

Regional Dominance: Major metropolitan areas like Moscow and Saint Petersburg drive a significant portion of market activity, followed by other large cities and popular tourist destinations across Russia. Growth in less-developed regions is driven by improving infrastructure and increased internet access.

Online Russian Booking Market Product Landscape

The Russian online booking market is a dynamic and evolving ecosystem offering a comprehensive suite of travel solutions. Beyond traditional flight and hotel bookings, it encompasses package tours, car rentals, and crucial travel insurance options. A significant trend is the integration of cutting-edge technologies. AI-powered personalized recommendations are becoming standard, tailoring travel suggestions to individual preferences. The allure of virtual reality travel experiences is also growing, offering immersive previews of destinations. Furthermore, platforms are prioritizing seamless integration with a variety of payment gateways, ensuring secure and convenient transactions for users. To capture and retain customers, companies are strategically focusing on enhanced user experience through intuitive interfaces and streamlined booking processes, offering competitive pricing strategies, and developing robust loyalty programs. The undeniable dominance of mobile-first design is a key differentiator, with leading platforms prioritizing mobile accessibility and functionality.

Key Drivers, Barriers & Challenges in Online Russian Booking Market

Key Drivers:

Several potent forces are fueling the growth of the Russian online booking market. A primary driver is the steady increase in rising disposable incomes among the population, empowering more individuals to invest in travel. Simultaneously, the continuous expansion of internet access, particularly in remote regions, broadens the potential customer base. There's a palpable shift in consumer behavior towards online travel planning, with users increasingly preferring the convenience and breadth of options available online. Supportive government initiatives promoting domestic and international tourism are also playing a crucial role in market development. Advancements in mobile technology are making travel booking more accessible than ever, and the increasing affordability of international travel, when possible, further stimulates demand.

Key Barriers and Challenges:

Despite the positive momentum, the market faces significant headwinds. Geopolitical instability and the impact of economic sanctions are profound challenges that create uncertainty and can disrupt travel flows. Fluctuations in the ruble directly affect the cost of international travel and can impact consumer spending power. The imposition of international travel restrictions further complicates planning and limits destination choices. The market is characterized by intense competition among numerous players, leading to price wars and the need for constant innovation. Additionally, persistent concerns regarding data security and the risk of online fraud necessitate robust protective measures and can erode consumer trust. These interconnected factors are meticulously quantified and analyzed in the comprehensive industry report.

Emerging Opportunities in Online Russian Booking Market

Untapped opportunities exist in expanding services to smaller cities and less-developed regions, focusing on niche travel segments (e.g., eco-tourism, adventure travel), and leveraging data analytics for more effective marketing. Developing innovative products like virtual tours and AI-powered travel assistants offers significant growth potential. Addressing concerns related to data privacy and security is also crucial.

Growth Accelerators in the Online Russian Booking Market Industry

Long-term growth will be driven by strategic partnerships between OTAs and local tourism businesses, investment in technological advancements to enhance user experience, and expansion into new markets. Government support for the tourism sector and increasing focus on domestic tourism also contribute to this positive outlook.

Key Players Shaping the Online Russian Booking Market Market

- Tutu.ru - A leading platform for booking train and air tickets, as well as bus tickets and travel packages.

- Trivago - A popular metasearch engine for hotel prices, allowing users to compare offers from various booking sites.

- Aviasales - A prominent flight aggregator known for its user-friendly interface and extensive flight search capabilities.

- Bronevik.com - A significant player specializing in hotel bookings within Russia and the CIS countries.

- TripAdvisor - A global platform offering reviews, ratings, and booking options for hotels, restaurants, and attractions.

- Booking.com - A widely recognized international platform for accommodation bookings, with a strong presence in the Russian market.

- Skyscanner - Another major metasearch engine for flights, hotels, and car hire, known for its comprehensive search options.

- Ostrovok - A leading Russian online travel agency (OTA) focusing primarily on hotel and apartment bookings.

- Airbnb - A global marketplace for unique accommodations and experiences, though its operations have been affected by recent geopolitical events.

- Hotels.com - Part of the Expedia Group, offering a wide range of hotel bookings with a focus on loyalty rewards.

Notable Milestones in Online Russian Booking Market Sector

- July 2022: Mobile TeleSystems (MTS), a major telecommunications operator, strategically acquired a 100% stake in Bronevik Group. This acquisition signifies substantial consolidation within the Russian online booking sector and signals potential for expanded service offerings and cross-platform integration by MTS.

- March 2022: In response to escalating geopolitical tensions, Airbnb made the decision to suspend all operations within Russia and Belarus. This pivotal move underscores the profound and immediate impact of external political and economic factors on the operational landscape of global online booking platforms active in the region.

In-Depth Online Russian Booking Market Market Outlook

The future of the Russian online booking market is promising, despite the challenges. Strategic investments in technology, expansion into underserved markets, and focus on enhancing user experience will drive growth. Opportunities for partnerships and collaborations within the tourism ecosystem will contribute to long-term success and profitability. The market is expected to witness a significant increase in the adoption of innovative technologies, boosting overall market growth.

Online Russian Booking Market Segmentation

-

1. Platform Type

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third Party Online Platforms

- 2.2. Direct/Captive Portals

Online Russian Booking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Russian Booking Market Regional Market Share

Geographic Coverage of Online Russian Booking Market

Online Russian Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Increase in the Tourism in Russia is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform Type

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third Party Online Platforms

- 5.2.2. Direct/Captive Portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform Type

- 6. North America Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform Type

- 6.1.1. Mobile Application

- 6.1.2. Website

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Third Party Online Platforms

- 6.2.2. Direct/Captive Portals

- 6.1. Market Analysis, Insights and Forecast - by Platform Type

- 7. South America Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform Type

- 7.1.1. Mobile Application

- 7.1.2. Website

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Third Party Online Platforms

- 7.2.2. Direct/Captive Portals

- 7.1. Market Analysis, Insights and Forecast - by Platform Type

- 8. Europe Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform Type

- 8.1.1. Mobile Application

- 8.1.2. Website

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Third Party Online Platforms

- 8.2.2. Direct/Captive Portals

- 8.1. Market Analysis, Insights and Forecast - by Platform Type

- 9. Middle East & Africa Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform Type

- 9.1.1. Mobile Application

- 9.1.2. Website

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Third Party Online Platforms

- 9.2.2. Direct/Captive Portals

- 9.1. Market Analysis, Insights and Forecast - by Platform Type

- 10. Asia Pacific Online Russian Booking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform Type

- 10.1.1. Mobile Application

- 10.1.2. Website

- 10.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 10.2.1. Third Party Online Platforms

- 10.2.2. Direct/Captive Portals

- 10.1. Market Analysis, Insights and Forecast - by Platform Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tutu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trivago

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 aviasales

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BRONEVIK com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TripAdvisor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Booking com

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Skyscanner**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ostrovok

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Airbnb

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hotels com

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tutu

List of Figures

- Figure 1: Global Online Russian Booking Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Russian Booking Market Revenue (Million), by Platform Type 2025 & 2033

- Figure 3: North America Online Russian Booking Market Revenue Share (%), by Platform Type 2025 & 2033

- Figure 4: North America Online Russian Booking Market Revenue (Million), by Mode of Booking 2025 & 2033

- Figure 5: North America Online Russian Booking Market Revenue Share (%), by Mode of Booking 2025 & 2033

- Figure 6: North America Online Russian Booking Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Russian Booking Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Online Russian Booking Market Revenue (Million), by Platform Type 2025 & 2033

- Figure 9: South America Online Russian Booking Market Revenue Share (%), by Platform Type 2025 & 2033

- Figure 10: South America Online Russian Booking Market Revenue (Million), by Mode of Booking 2025 & 2033

- Figure 11: South America Online Russian Booking Market Revenue Share (%), by Mode of Booking 2025 & 2033

- Figure 12: South America Online Russian Booking Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Online Russian Booking Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Online Russian Booking Market Revenue (Million), by Platform Type 2025 & 2033

- Figure 15: Europe Online Russian Booking Market Revenue Share (%), by Platform Type 2025 & 2033

- Figure 16: Europe Online Russian Booking Market Revenue (Million), by Mode of Booking 2025 & 2033

- Figure 17: Europe Online Russian Booking Market Revenue Share (%), by Mode of Booking 2025 & 2033

- Figure 18: Europe Online Russian Booking Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Online Russian Booking Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Online Russian Booking Market Revenue (Million), by Platform Type 2025 & 2033

- Figure 21: Middle East & Africa Online Russian Booking Market Revenue Share (%), by Platform Type 2025 & 2033

- Figure 22: Middle East & Africa Online Russian Booking Market Revenue (Million), by Mode of Booking 2025 & 2033

- Figure 23: Middle East & Africa Online Russian Booking Market Revenue Share (%), by Mode of Booking 2025 & 2033

- Figure 24: Middle East & Africa Online Russian Booking Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Online Russian Booking Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Online Russian Booking Market Revenue (Million), by Platform Type 2025 & 2033

- Figure 27: Asia Pacific Online Russian Booking Market Revenue Share (%), by Platform Type 2025 & 2033

- Figure 28: Asia Pacific Online Russian Booking Market Revenue (Million), by Mode of Booking 2025 & 2033

- Figure 29: Asia Pacific Online Russian Booking Market Revenue Share (%), by Mode of Booking 2025 & 2033

- Figure 30: Asia Pacific Online Russian Booking Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Online Russian Booking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 2: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Global Online Russian Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 5: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: Global Online Russian Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 11: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 12: Global Online Russian Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 17: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Global Online Russian Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 29: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 30: Global Online Russian Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Online Russian Booking Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 38: Global Online Russian Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 39: Global Online Russian Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Online Russian Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Russian Booking Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Online Russian Booking Market?

Key companies in the market include Tutu, Trivago, aviasales, BRONEVIK com, TripAdvisor, Booking com, Skyscanner**List Not Exhaustive, Ostrovok, Airbnb, Hotels com.

3. What are the main segments of the Online Russian Booking Market?

The market segments include Platform Type, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Increase in the Tourism in Russia is Driving the Market.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

July 2022: Mobile TeleSystems (MTS) acquired a 100% stake in Bronevik Online and Bronevik Company (Bronevik Group, one of the market leaders in online hotel booking). The acquisition is aimed at developing a new business line, MTS Travel, in the tourism industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Russian Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Russian Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Russian Booking Market?

To stay informed about further developments, trends, and reports in the Online Russian Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence