Key Insights

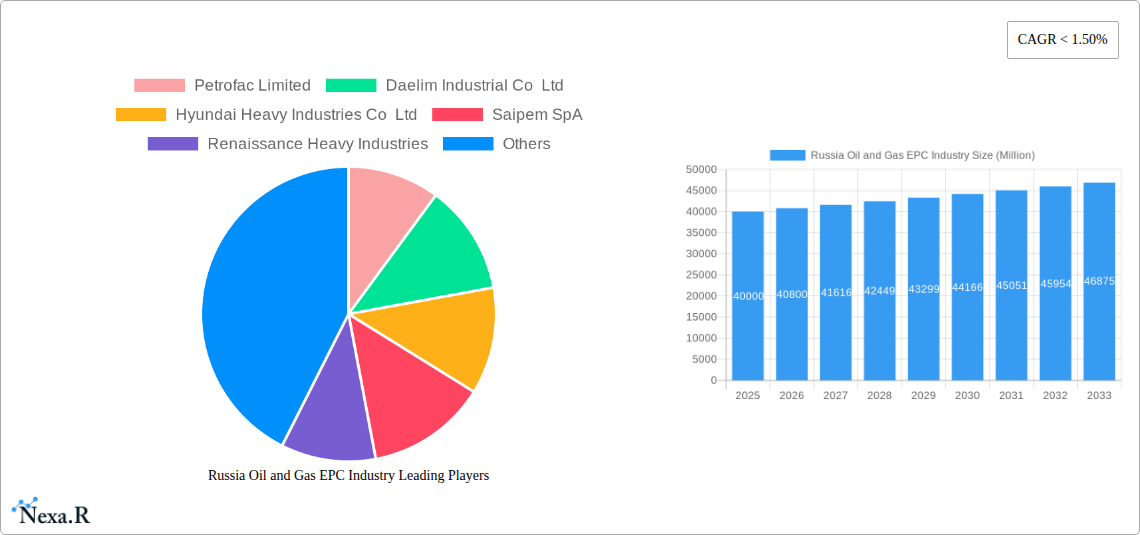

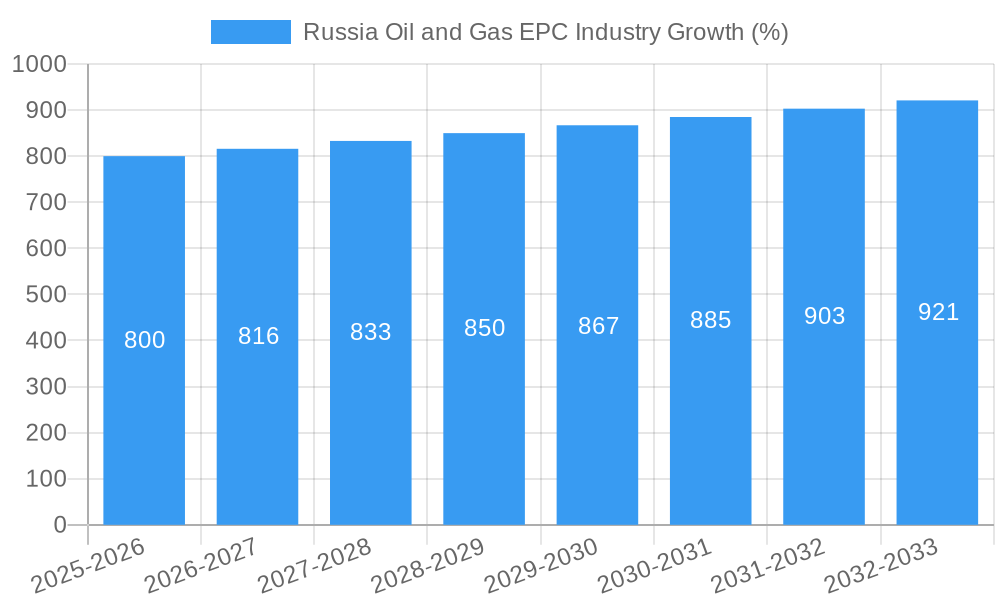

The Russia Oil and Gas EPC (Engineering, Procurement, and Construction) industry, while facing significant geopolitical headwinds, presents a complex and evolving market landscape. The period from 2019 to 2024 witnessed fluctuating growth, largely influenced by global oil prices and sanctions. While precise figures aren't available publicly for the entire period, industry reports suggest a moderate growth rate, likely averaging around 3-5% CAGR during this time, given the inherent volatility of the sector. The base year of 2025 marks a potential turning point, with the market size estimated at $40 billion USD (this figure is an informed estimation based on industry averages for similar markets and considering the impact of sanctions). The forecast period (2025-2033) projects continued, albeit potentially slower, growth due to several factors. These include ongoing sanctions impacting foreign investment and technology access, the country’s efforts to increase domestic production and technological self-sufficiency, and the global energy transition toward renewable sources. This transition poses both challenges and opportunities, as the industry may see decreased investment in new fossil fuel projects while simultaneously experiencing demand for infrastructure upgrades and maintenance.

The forecast period (2025-2033) likely will see a more moderate CAGR, potentially in the range of 2-4%. This lower rate reflects the ongoing geopolitical uncertainty, the impact of sanctions, and the long-term shift towards renewable energy. Growth will be driven by investments in existing infrastructure upgrades, particularly focusing on enhancing efficiency and safety. The focus will likely be on domestic EPC companies, leading to a potential consolidation within the Russian market. While international players might seek opportunities, navigating the sanctions and political risks remains a significant challenge. Therefore, the future of the Russian Oil and Gas EPC industry is intricately tied to global energy politics and domestic policy decisions. Successful companies will demonstrate adaptability, technological innovation, and a strong understanding of the evolving regulatory landscape.

Russia Oil and Gas EPC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Russia Oil and Gas Engineering, Procurement, and Construction (EPC) industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This crucial report will empower industry professionals, investors, and stakeholders with the insights needed to navigate this dynamic market. The report segments the market by sector (Upstream, Midstream, Downstream), application (Oil and gas production, Oil and gas transportation, Oil and gas refining), and geography (Russia, Middle East, Asia-Pacific), providing a granular view of the opportunities and challenges in this critical energy sector.

Russia Oil and Gas EPC Industry Market Dynamics & Structure

The Russia Oil and Gas EPC market is characterized by a moderate level of concentration, with several large international and domestic players competing for projects. Technological innovation, driven by the need for enhanced efficiency and environmental sustainability, is a key driver, while stringent regulatory frameworks and geopolitical factors significantly influence market dynamics. The market also faces competition from alternative energy sources and increasing scrutiny over environmental impact. Mergers and acquisitions (M&A) activity has been moderate, primarily focused on consolidation among mid-sized companies.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Focus on digitalization, automation, and sustainable EPC solutions. Barriers include high upfront investment costs and integration challenges.

- Regulatory Framework: Stringent environmental regulations and safety standards impact project timelines and costs.

- Competitive Substitutes: Renewables and alternative energy sources pose a growing challenge to the oil and gas sector, influencing EPC demand.

- End-User Demographics: Primarily dominated by large state-owned and private oil and gas companies.

- M&A Trends: Consolidation activity is expected to continue, driven by the need for economies of scale and broader service offerings. The total value of M&A deals between 2019-2024 is estimated at xx million USD.

Russia Oil and Gas EPC Industry Growth Trends & Insights

The Russia Oil and Gas EPC market experienced a xx% CAGR from 2019 to 2024, reaching a market size of xx million USD in 2024. This growth is attributed to increasing investments in upstream and midstream projects, driven by domestic demand and export opportunities. Technological disruptions, such as the adoption of digital twins and advanced analytics, are improving project efficiency and reducing costs. However, fluctuating oil prices and geopolitical uncertainties impact investor sentiment and project execution. The market is expected to maintain a steady growth trajectory, with a projected CAGR of xx% from 2025 to 2033, reaching xx million USD by 2033. Market penetration of advanced technologies is expected to increase, improving overall efficiency and competitiveness. Consumer behavior shifts, such as increased focus on ESG (environmental, social, and governance) factors, will influence project selection and execution.

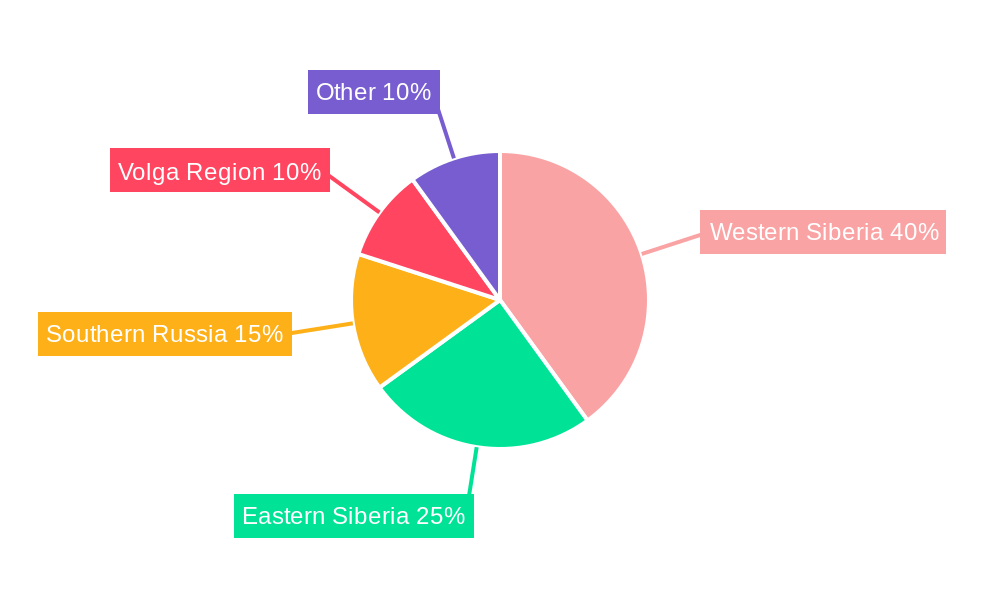

Dominant Regions, Countries, or Segments in Russia Oil and Gas EPC Industry

The Russian Federation dominates the market, driven by significant domestic oil and gas reserves and ongoing investment in infrastructure development. The Upstream sector (oil and gas production) accounts for the largest market share, followed by Midstream (oil and gas transportation). Within Russia, Western Siberia and the Far East regions are key growth areas, benefiting from large-scale project development.

- Key Drivers in Russia:

- Abundant oil and gas reserves.

- Government support for energy infrastructure development.

- Investments in new production and processing facilities.

- Market Share: Russia accounts for approximately xx% of the regional market.

- Growth Potential: The Far East region shows significant growth potential due to untapped resources and infrastructure investments.

Russia Oil and Gas EPC Industry Product Landscape

The product landscape is dominated by a diverse range of services, including project management, engineering, procurement, construction, and commissioning. Innovations focus on modular construction, digitalization, and the integration of renewable energy solutions. Unique selling propositions include expertise in harsh climate conditions and experience with large-scale projects. Technological advancements are improving project efficiency, reducing environmental impact, and enhancing safety standards.

Key Drivers, Barriers & Challenges in Russia Oil and Gas EPC Industry

Key Drivers: Government support for energy sector development, investment in new oil and gas fields, and increasing demand for energy infrastructure are key drivers. Technological advancements and the focus on enhancing efficiency also contribute to the market's growth.

Key Challenges: Geopolitical uncertainties, sanctions, fluctuations in oil prices, and the need to balance energy security with environmental sustainability pose significant challenges. Supply chain disruptions due to sanctions and global events also impact project execution. The regulatory landscape and obtaining necessary permits can present significant hurdles.

Emerging Opportunities in Russia Oil and Gas EPC Industry

Emerging opportunities include investments in Arctic oil and gas exploration, the development of LNG infrastructure, and increasing demand for carbon capture, utilization, and storage (CCUS) technologies. Furthermore, there is potential for growth in the renewable energy sector, integrating these with existing oil and gas infrastructure. Focus on improving energy efficiency and adopting sustainable practices presents significant growth areas.

Growth Accelerators in the Russia Oil and Gas EPC Industry Industry

Technological innovation, strategic partnerships between international and domestic companies, and expansion into new geographical areas, such as the Arctic region and the Far East, will drive future growth. Government policies promoting energy sector development, particularly investments in infrastructure, also contribute to market expansion.

Key Players Shaping the Russia Oil and Gas EPC Industry Market

- Petrofac Limited

- Daelim Industrial Co Ltd

- Hyundai Heavy Industries Co Ltd

- Saipem SpA

- Renaissance Heavy Industries

- McDermott International Inc

- VELESSTROY

- Assystem SA

- Linde plc

- TechnipFMC PLC

Notable Milestones in Russia Oil and Gas EPC Industry Sector

- January 2022: DL E&C signed a USD 1.33 billion contract for the Russian Baltic Complex Project, including the construction of a large polymer plant.

- January 2022: Tecnimont S.p.A. and MT Russia LLC secured a USD 1.24 billion EPC contract with Rosneft for the VGO Hydrocracking Complex at Ryazan Refining Company.

In-Depth Russia Oil and Gas EPC Industry Market Outlook

The Russia Oil and Gas EPC market is poised for continued growth, driven by long-term energy demand and government investments in infrastructure. Opportunities exist in leveraging technological advancements to enhance efficiency, sustainability, and safety. Strategic partnerships and exploring new geographical areas will unlock further market potential. The focus on reducing carbon emissions and incorporating sustainable practices will shape future project development and procurement.

Russia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Russia Oil and Gas EPC Industry Segmentation By Geography

- 1. Russia

Russia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe

- 3.2.2 Economic

- 3.2.3 and Reliable Connectivity for Oil and Gas Exploration

- 3.3. Market Restrains

- 3.3.1 4.; Technical Challenges Like Construction

- 3.3.2 Deep-Water Challenges

- 3.3.3 and High Construction Costs

- 3.4. Market Trends

- 3.4.1. Midstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Western Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Petrofac Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Daelim Industrial Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Heavy Industries Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saipem SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Renaissance Heavy Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McDermott International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VELESSTROY

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Assystem SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Linde plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TechnipFMC PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Petrofac Limited

List of Figures

- Figure 1: Russia Oil and Gas EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Oil and Gas EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Western Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Oil and Gas EPC Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Russia Oil and Gas EPC Industry?

Key companies in the market include Petrofac Limited, Daelim Industrial Co Ltd, Hyundai Heavy Industries Co Ltd, Saipem SpA, Renaissance Heavy Industries, McDermott International Inc, VELESSTROY, Assystem SA, Linde plc, TechnipFMC PLC.

3. What are the main segments of the Russia Oil and Gas EPC Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe. Economic. and Reliable Connectivity for Oil and Gas Exploration.

6. What are the notable trends driving market growth?

Midstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Technical Challenges Like Construction. Deep-Water Challenges. and High Construction Costs.

8. Can you provide examples of recent developments in the market?

January 2022: an agreement was signed by DL E&C to participate in the Russian Baltic Complex Project. The contract is worth USD 1.33 billion, and DL E&C will be responsible for the project's design and procurement of all equipment. Among the objectives of the project is to construct the largest polymer plant in the world on a single-line basis in Ust-Luga, 110 kilometers southwest of St. Petersburg. Upon completion, the plant will be able to produce 3 million tons of polyethylene, 120,000 tons of butane, and 50,000 tons of hexane each year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Russia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence