Key Insights

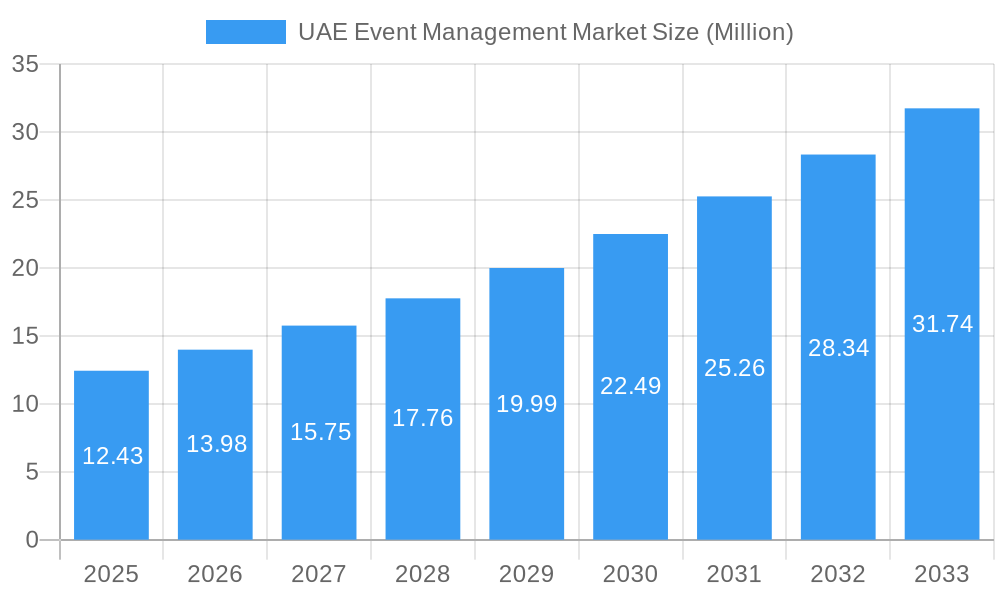

The UAE event management market, valued at $12.43 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 12.45% from 2025 to 2033. This expansion is fueled by several key factors. The UAE's strategic location, world-class infrastructure, and proactive government initiatives promoting tourism and business events contribute significantly to the market's dynamism. Increasing disposable incomes among residents and a growing influx of tourists create a substantial demand for diverse events, ranging from large-scale music concerts and festivals to corporate conferences and exhibitions. Furthermore, the burgeoning popularity of experiential marketing and the increasing use of technology to enhance event experiences are driving innovation and market expansion. The segment breakdown reveals a diverse market, with corporate events, music concerts, and festivals holding significant shares. Revenue streams are similarly diversified, encompassing ticket sales, sponsorships, advertising, and broadcasting rights, showcasing the market's resilience and adaptability. Key players like Artes, Plan3Media, TEC, and others are capitalizing on these opportunities, further contributing to the market's growth trajectory.

UAE Event Management Market Market Size (In Million)

The sustained growth in the UAE event management market hinges on several factors. Continued investment in infrastructure and technology will remain crucial. The ability of event management companies to adapt to changing consumer preferences, embrace sustainable practices, and leverage data analytics for effective marketing and event planning will be key differentiators. Maintaining a balance between large-scale events and niche offerings to cater to diverse demographics is also essential for sustainable growth. Potential challenges include regulatory changes, economic fluctuations, and competition from regional markets. However, the UAE's commitment to innovation and its status as a global hub for business and tourism position the event management sector for continued success in the long term. The forecast period of 2025-2033 presents significant opportunities for established players and new entrants alike.

UAE Event Management Market Company Market Share

UAE Event Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE event management market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025, this study meticulously examines market dynamics, growth trends, key players, and future opportunities within this dynamic sector. The report segments the market by end-user (corporate, individual, public), event type (music concerts, festivals, sports, exhibitions & conferences, corporate events & seminars, others), and revenue source (tickets, sponsorships, advertising, broadcasting, others). The market size is valued in millions of units.

UAE Event Management Market Dynamics & Structure

The UAE event management market exhibits a moderately concentrated structure, with several key players vying for market share. Technological innovation, particularly in event technology and digital marketing, is a significant growth driver. The regulatory framework, while generally supportive, presents certain challenges related to permits and licensing. Competitive product substitutes, such as virtual events, are gaining traction, influencing market dynamics. End-user demographics showcase a diverse landscape, with a significant proportion of corporate and public sector events. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on event tech, virtual reality (VR), augmented reality (AR), and data analytics for enhanced event experiences and ROI.

- Regulatory Framework: Generally supportive but requires streamlining of licensing procedures and permit acquisition.

- Competitive Substitutes: Growth of virtual and hybrid events poses a competitive threat, necessitating adaptation strategies.

- End-User Demographics: Corporate events dominate, followed by public events and an increasing contribution from individual events.

- M&A Activity: xx deals concluded between 2019 and 2024, indicating consolidation trends within the sector.

UAE Event Management Market Growth Trends & Insights

The UAE event management market has experienced robust growth over the historical period (2019-2024), driven by a thriving tourism sector, increasing government investments in infrastructure, and rising disposable incomes. The market size in 2024 is estimated at xx million, with a CAGR of xx% during this period. Technological disruptions, such as the rise of virtual and hybrid events, have impacted adoption rates, while consumer behavior shifts toward personalized experiences are influencing event planning strategies. The forecast period (2025-2033) projects continued expansion, driven by factors outlined in subsequent sections. Market penetration remains relatively high within urban areas but offers growth opportunities in untapped regional markets.

Dominant Regions, Countries, or Segments in UAE Event Management Market

Dubai and Abu Dhabi continue to be the undisputed leaders in the UAE event management market, collectively accounting for a substantial estimated 75-80% of the total market size in 2024. This dominance is propelled by their status as global business and tourism hubs. The corporate end-user segment is the powerhouse, contributing an estimated 45-50% of the market share. This is a direct result of intense business activity, a steady influx of multinational corporations, and a strong demand for professional events that foster networking, brand building, and employee engagement. Within event types, exhibitions and conferences stand out as the most significant revenue generators, reflecting the UAE's ambition as a center for international trade and knowledge exchange. Corporate events and seminars follow closely, underscoring the importance of business-focused gatherings. While ticket sales remain a primary revenue stream, representing an estimated 40-45% in 2024, the contributions from sponsorship and advertising are steadily gaining momentum, offering lucrative opportunities for event organizers and brands alike.

- Key Drivers: A robust and continuously expanding tourism sector, unwavering strong government support and strategic vision for the MICE (Meetings, Incentives, Conferences, and Exhibitions) industry, and the ongoing development and enhancement of world-class infrastructure, including state-of-the-art venues and transportation networks.

- Dominance Factors: The unparalleled concentration of business activity and a thriving cosmopolitan atmosphere in Dubai and Abu Dhabi, coupled with an escalating and sophisticated demand for high-caliber corporate events, including product launches, team-building activities, and annual general meetings.

- Growth Potential: Significant untapped potential exists in emerging regional markets beyond the main hubs, as well as substantial growth opportunities in niche event types such as sustainable events, wellness retreats, and highly personalized experiential gatherings.

UAE Event Management Market Product Landscape

The UAE event management market presents a dynamic and sophisticated product landscape, evolving from foundational event planning services to intricately integrated, cutting-edge solutions that harness the power of advanced technology. Innovation is heavily geared towards creating immersive and memorable attendee experiences. This is achieved through the strategic deployment of digital platforms for seamless registration and engagement, personalized content delivery tailored to individual preferences, and the utilization of robust data analytics to derive actionable insights. Unique selling propositions are increasingly centered on delivering flawlessly executed, unforgettable events that not only meet but exceed client expectations and deliver measurable return on investment. Emerging technological advancements, such as the transformative potential of virtual reality (VR) and augmented reality (AR) in creating engaging event environments, alongside the strategic application of big data analytics for optimizing event planning, attendee flow, and post-event impact, are defining the market's product offerings.

Key Drivers, Barriers & Challenges in UAE Event Management Market

Key Drivers:

- Strong government support and investment in infrastructure.

- Growing tourism and business activity.

- Increasing disposable incomes and consumer spending.

- Technological advancements in event planning and management.

Challenges and Restraints:

- Intense competition and price pressures within the market.

- Regulatory compliance and licensing requirements.

- Dependence on external factors such as tourism and economic conditions.

- Supply chain disruptions impacting event logistics.

Emerging Opportunities in UAE Event Management Market

- Niche Event Segments: Growing demand for specialized events (e.g., experiential marketing, virtual reality events).

- Sustainable Events: Increased focus on eco-friendly practices and sustainable event solutions.

- Technology Integration: Advancements in AR/VR and AI-powered event management tools.

- Expansion into Regional Markets: Growing opportunities outside of major urban centers.

Growth Accelerators in the UAE Event Management Market Industry

The long-term trajectory of the UAE event management market is poised for accelerated growth, significantly propelled by the formation of strategic alliances and synergistic partnerships between leading event management companies and pioneering technology providers. These collaborations are instrumental in the development and rollout of truly innovative and transformative event solutions. Furthermore, proactive and visionary government initiatives, specifically those focused on bolstering tourism and actively promoting the UAE as a premier destination for business events, will continue to be a critical catalyst. The strategic expansion into underserved regional markets, alongside the astute leveraging of emerging technologies such as AI-driven personalization to craft highly bespoke attendee journeys, are set to further amplify the industry's growth momentum and solidify the UAE's position as a global leader in event management.

Key Players Shaping the UAE Event Management Market Market

- Artes

- Plan3Media

- TEC

- The event company

- SkyHigh

- Great Wall Events

- GM Events

- M&N

- CWE

- Emerald

Notable Milestones in UAE Event Management Market Sector

- May 2023: Identity, a UK-based event agency, expands to the UAE, indicating increased foreign investment.

- December 2022: Dubai Chamber of Commerce launches an Events Business Group to support the sector's growth, reflecting government support.

In-Depth UAE Event Management Market Outlook

The UAE event management market is poised for continued expansion over the forecast period (2025-2033), driven by sustained economic growth, government initiatives, and technological innovation. Strategic partnerships, leveraging emerging technologies, and expanding into new markets will be critical success factors for players in this dynamic sector. The market is projected to reach xx million by 2033, presenting significant opportunities for both established and emerging companies.

UAE Event Management Market Segmentation

-

1. Type

- 1.1. Music Concerts

- 1.2. Festivals

- 1.3. Sports

- 1.4. Exhibitions and Conferences

- 1.5. Corporate Events and Seminars

- 1.6. Other Types

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Sponsorships

- 2.3. Advertising

- 2.4. Broadcasting

- 2.5. Other Sources of Revenue

-

3. End User

- 3.1. Corporate

- 3.2. Individual

- 3.3. Public

UAE Event Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Event Management Market Regional Market Share

Geographic Coverage of UAE Event Management Market

UAE Event Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Expanding Hospitality Industry is Booming the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Music Concerts

- 5.1.2. Festivals

- 5.1.3. Sports

- 5.1.4. Exhibitions and Conferences

- 5.1.5. Corporate Events and Seminars

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Sponsorships

- 5.2.3. Advertising

- 5.2.4. Broadcasting

- 5.2.5. Other Sources of Revenue

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.3.3. Public

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Music Concerts

- 6.1.2. Festivals

- 6.1.3. Sports

- 6.1.4. Exhibitions and Conferences

- 6.1.5. Corporate Events and Seminars

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.2.1. Tickets

- 6.2.2. Sponsorships

- 6.2.3. Advertising

- 6.2.4. Broadcasting

- 6.2.5. Other Sources of Revenue

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Corporate

- 6.3.2. Individual

- 6.3.3. Public

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Music Concerts

- 7.1.2. Festivals

- 7.1.3. Sports

- 7.1.4. Exhibitions and Conferences

- 7.1.5. Corporate Events and Seminars

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.2.1. Tickets

- 7.2.2. Sponsorships

- 7.2.3. Advertising

- 7.2.4. Broadcasting

- 7.2.5. Other Sources of Revenue

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Corporate

- 7.3.2. Individual

- 7.3.3. Public

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Music Concerts

- 8.1.2. Festivals

- 8.1.3. Sports

- 8.1.4. Exhibitions and Conferences

- 8.1.5. Corporate Events and Seminars

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.2.1. Tickets

- 8.2.2. Sponsorships

- 8.2.3. Advertising

- 8.2.4. Broadcasting

- 8.2.5. Other Sources of Revenue

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Corporate

- 8.3.2. Individual

- 8.3.3. Public

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Music Concerts

- 9.1.2. Festivals

- 9.1.3. Sports

- 9.1.4. Exhibitions and Conferences

- 9.1.5. Corporate Events and Seminars

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.2.1. Tickets

- 9.2.2. Sponsorships

- 9.2.3. Advertising

- 9.2.4. Broadcasting

- 9.2.5. Other Sources of Revenue

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Corporate

- 9.3.2. Individual

- 9.3.3. Public

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Music Concerts

- 10.1.2. Festivals

- 10.1.3. Sports

- 10.1.4. Exhibitions and Conferences

- 10.1.5. Corporate Events and Seminars

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 10.2.1. Tickets

- 10.2.2. Sponsorships

- 10.2.3. Advertising

- 10.2.4. Broadcasting

- 10.2.5. Other Sources of Revenue

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Corporate

- 10.3.2. Individual

- 10.3.3. Public

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Artes**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plan3Media

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TEC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The event company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SkyHigh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Great Wall Events

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GM Events

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 M&N

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CWE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emerald

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Artes**List Not Exhaustive

List of Figures

- Figure 1: Global UAE Event Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 5: North America UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North America UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 13: South America UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 14: South America UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 15: South America UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 21: Europe UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: Europe UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 29: Middle East & Africa UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: Middle East & Africa UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 37: Asia Pacific UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 38: Asia Pacific UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global UAE Event Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 34: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 44: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Event Management Market?

The projected CAGR is approximately 12.45%.

2. Which companies are prominent players in the UAE Event Management Market?

Key companies in the market include Artes**List Not Exhaustive, Plan3Media, TEC, The event company, SkyHigh, Great Wall Events, GM Events, M&N, CWE, Emerald.

3. What are the main segments of the UAE Event Management Market?

The market segments include Type, Source of Revenue, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Expanding Hospitality Industry is Booming the Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Identity, one of the UK’s leading full-service events agencies, announced the expansion of its business to the Middle East with the opening of two new offices in the United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Event Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Event Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Event Management Market?

To stay informed about further developments, trends, and reports in the UAE Event Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence